Stocks & Equities

Juniors are typically micro-cap exploration companies. Yet, GDXJ the junior ETF is comprised of companies with market caps in the $500 Million to $1 Billion range. There is nothing junior about that. We notice there is a gap in terms of terminology. If Juniors are sub- $100 Million, and large caps are over $1 Billion, then what do you call those that fit the gap?

We prefer to use the term “established juniors” or small cap. After all, small caps by definition are in market cap between $100 Million and $1 Billion. These terms are most appropriate for those in the middle of said range rather than the bottom or top. We prefer the established juniors as being established (which is open to interpretation) they have less risk than the true juniors and if successful can grow to $1 Billion or more in capitalization.

In our opinion, small caps are the area to focus on as they have a much greater likelihood of growth and leverage to Gold than the large producers. Historically, the large producers do not outperform Gold on a consistent basis. The law of numbers combined with the difficulty of the mining business explains why.

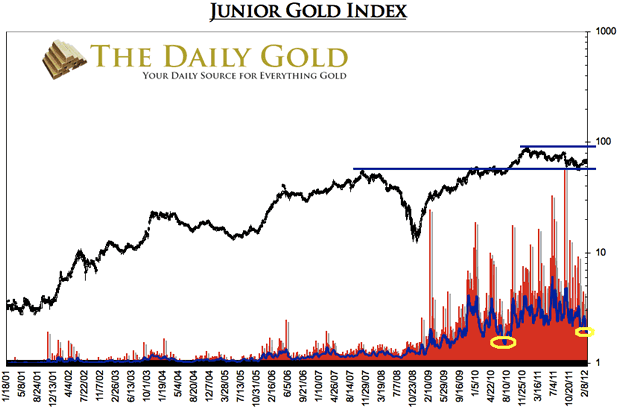

Our junior/small cap index consists of 20 stocks equally weighted with a median market cap of about 600 Million. In the second half of 2010 the market broke to new highs for the first time since 2007. With every breakout comes a retest. Heading into 2011 we predicted the retest would last into the summer. The retest lasted the entire year but appears to be successful.

Our bet is that the small caps will work their way back to the high before the end of the summer. It will take the time to overcome resistance but the trend will remain higher. If and when the market makes a new all-time high it will be very bullish for several reasons. It would be the first sustained breakout to a new all-time high since 2005-2006. It would come at a time when the bull market is starting to transition out of the wall of worry phase. Finally, it would generate significant momentum when overhead resistance is basically nil.

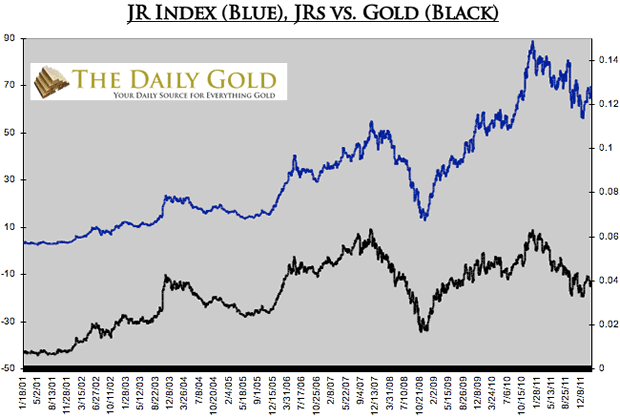

This is possible due to a combination of Gold rising and present low valuations improving. In the next chart we graph our index and the ratio of our index to Gold. Gold companies are generating record profits and the price of Gold is near its all-time high yet leveraged small caps are trading near a low relative to Gold. That, in our view is a function of market sentiment and evidence of the wall of worry stage.

f the ratio would rise back to its 2007 and 2010 highs at 0.065 and Gold would reach $2000, our small cap index would just about double. That is right, a potential 100% gain.

The bottom line is small cap gold stocks have completed a textbook breakout and retest. As we said, the market will likely have a hard slog for the next several months as it encounters supply from the 2011 correction. If and when the market nears its old high it will have built up the necessary strength and momentum to embark on an explosive breakout. Thus, now is the time to be doing your due diligence to find and research those candidates to lead the market in a potential rip roaring move into 2013.

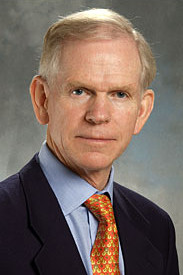

Warren Buffett has said that if you look around the poker table and you can’t spot the patsy, you’re it. In that spirit, another famed investor, Jeremy Grantham, is trying to deal investors a better hand.

Jeremy Grantham is a British investor and Co-founder and Chief Investment Strategist of Grantham Mayo Van Otterloo (GMO), a Boston-based asset management firm. GMO is one of the largest managers of such funds in the world, having more than US $107 billion in assets under management as of December 2010. Grantham is regarded as a highly knowledgeable investor in various stock, bond, and commodity markets, and is particularly noted for his prediction of various bubbles.

Grantham doesn’t mince words. In Grantham’s view, outlined in a quarterly letter published late Friday, individuals launched into the market have embarked on “dangerous investment voyages” that threaten to separate them from their money. They hear the tempting call of countless stock-market sirens — self-interested cheerleaders and barkers who promise that it’s different this time, and that you must buy now or miss the boat.

Making the journey even more perilous is that stocks around the world are either fairly priced or nearly so, he says. Investors who buy now can expect meager returns over the next seven years.

….read Grantham’s detailed version of the 10 Investment Lessons: HERE – The Longest Quarterly Letter Ever.’

Here is a summarized version of the 10 Investment Lessons:

1. Believe in history

“All bubbles break; all investment frenzies pass. The market is gloriously inefficient and wanders far from fair price, but eventually, after breaking your heart and your patience … it will go back to fair value. Your task is to survive until that happens.”

2. ‘Neither a lender nor a borrower be’

“Leverage reduces the investor’s critical asset: patience. It encourages financial aggressiveness, recklessness and greed.”

3. Don’t put all of your treasure in one boat

“The more investments you have and the more different they are, the more likely you are to survive those critical periods when your big bets move against you.”

4. Be patient and focus on the long term

“Wait for the good cards this will be your margin of safety.”

5. Recognize your advantages over the professionals

“The individual is far better positioned to wait patiently for the right pitch while paying no regard to what others are doing.”

6. Try to contain natural optimism

“Optimism is a lousy investment strategy”

7. On rare occasions, try hard to be brave

“If the numbers tell you it’s a real outlier of a mispriced market, grit your teeth and go for it.”

8. Resist the crowd; cherish numbers only

“Ignore especially the short-term news. The ebb and flow of economic and political news is irrelevant. Do your own simple measurements of value or find a reliable source.”

9. In the end it’s quite simple. really

Estimates and forecasts such as the ones GMO makes for the next seven years aren’t complicated, Grantham says – “[GMO] estimates are not about nuances or Ph.D.s. They are about ignoring the crowd, working out simple ratios and being patient.”

10. ‘This above all: To thine own self be true’

“It is utterly imperative that you know your limitations as well as your strengths and weaknesses. You must know your pain and patience thresholds accurately and not play over your head. If you cannot resist temptation, you absolutely must not manage your own money.”

Jeremy Grantham is a British investor and Co-founder and Chief Investment Strategist of Grantham Mayo Van Otterloo (GMO), a Boston-based asset management firm. GMO is one of the largest managers of such funds in the world, having more than US $107 billion in assets under management as of December 2010. Grantham is regarded as a highly knowledgeable investor in various stock, bond, and commodity markets, and is particularly noted for his prediction of various bubbles.

Estimates and forecasts such as the ones GMO makes for the next seven years aren’t complicated, Grantham says

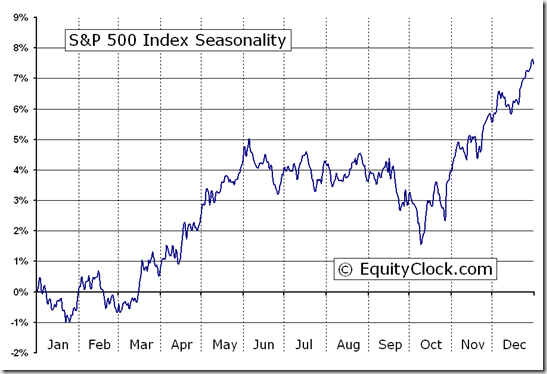

Ed Note: Dodging Overbought status, Don Vialoux’s seasonality studies aim at profiting through Historically reliable patterns (detailed definition HERE). Right now EquityClock says “Seasonal influences on equity markets turn positive in March. They tend to strength as the month progresses.” The TSE tracks the S&P 500 well. All the World’s Major indices charts and commentary are below:

Macro events will continue to influence equity markets this week. The G20 Meeting of Finance Ministers was held in Mexico over the weekend. The focus is on European sovereign debt. Germany’s Parliament discusses the Greek bailout program on Monday. The European consumer confidence and industrial confidence indices are released on Tuesday. Federal Reserve Chairman Ben Bernanke delivers the Semi-annual Monetary Report on Wednesday. China and Euro announce their February Purchasing Managers indices on Thursday. Europe’s unemployment rate is released on Thursday. Russia’s Presidential election is held next Sunday.

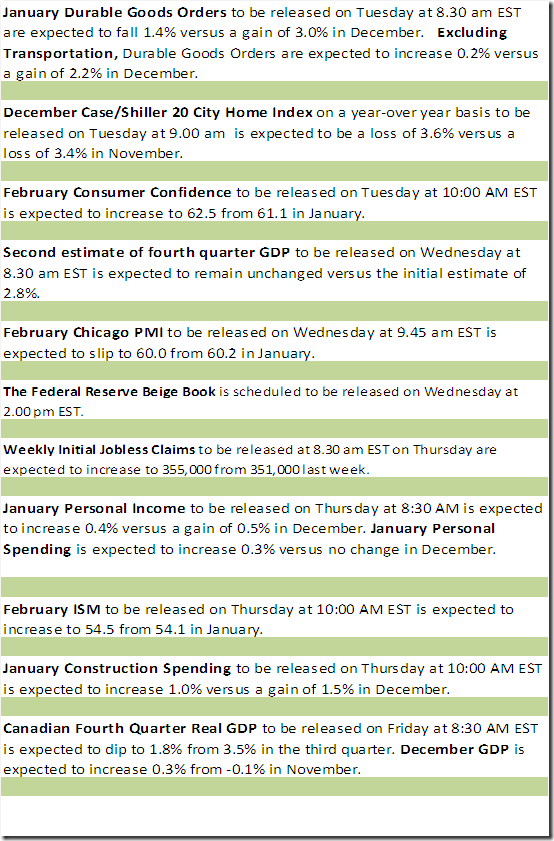

Economic news this week is expected to be mixed to slightly negative, breaking a string of economic reports that have encouraged investor confidence. Click HERE for Economic & Earnings News Schedule for this coming week.

The earnings focus this week is on Canada’s banks (scroll down HERE for the Schedule). Fourth quarter reports from the U.S. are winding down. A total of 463 S&P 500 companies have reported to date. 59% have exceeded consensus versus an average of 62% in recent quarters. A total of 104 S&P 500 companies have offered first quarter guidance with 31 companies guiding higher and 64 companies guiding lower.

Short and intermediate technical indicators remain overbought in a wide variety of equity markets and sectors. Fewer sectors are leading the advance.

Cash on the sidelines remains substantial and is unlikely to trend lower until equity markets determine who the next U.S. President will be.

Equity Trends

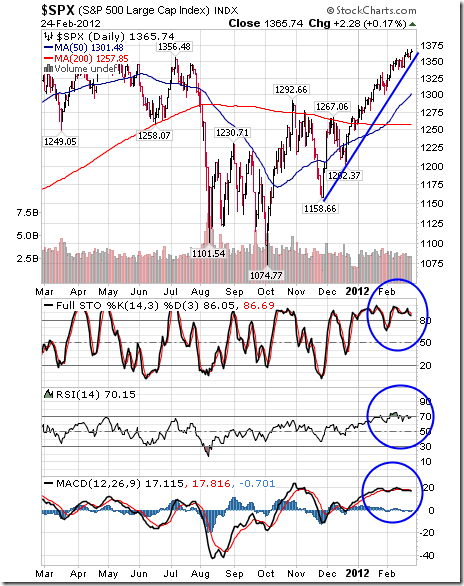

The S&P 500 Index gained 4.51 points (0.33%) last week. Intermediate trend is up. The Index remains well above its 50 and 200 day moving averages. Short term momentum indicators are overbought and showing early signs of peaking. Short term momentum indicators are not useful until the short term trend line is broken.

Percent of S&P 500 stocks trading above their 50 day moving average slipped last week from 86.60% to 83.20%. Percent is intermediate overbought and peaked three weeks ago.

The TSX Composite Index gained 267.47 points (2.15%) last week. Intermediate trend is up. The Index broke above resistance at 12,623.98. Support is at 11,420.78. The Index remains above its 50 day moving average and broke above its 200 day moving average last week. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index is turning positive. ‘Tis the season for the TSX to outperform the S&P 500 Index!

Percent of TSX Composite stocks trading above their 50 day moving average increased last week from 60.08% to 68.38%. Percent remains intermediate overbought.

The Shanghai Composite Index gained 66.45 points (2.82%) last week. Intermediate trend is down. Support is at 2,132.63 and resistance is at 2,536.78. The Index trades above its 50 day moving average, but remains below its 200 day moving average. Short term momentum indicators are overbought, but continue to trend higher. Strength relative to the S&P 500 Index remains positive. ‘Tis the season for the Index to move higher!

The Dow Jones Industrial Average added 33.08 points (0.26%) last week. Intermediate trend is up. The Average trades well above its 50 and 200 day moving averages. Short term momentum indicators are overbought and showing early signs of peaking. However, short term momentum indicators are not meaningful until short term uptrend in the Average is broken. Strength relative to the S&P 500 Index remains negative.

The Dow Jones Transportation Average fell 100.38 points (1.92%) last week. Intermediate trend is up. Support is at 4,531.79 and resistance has formed at 5,384.15. The Average has broken below a rising wedge pattern. The Average trades above its 200 day moving average, but fell below its 50 day moving average on Friday. Short term momentum indicators continue to trend down. Strength relative to the S&P 500 Index remains negative.

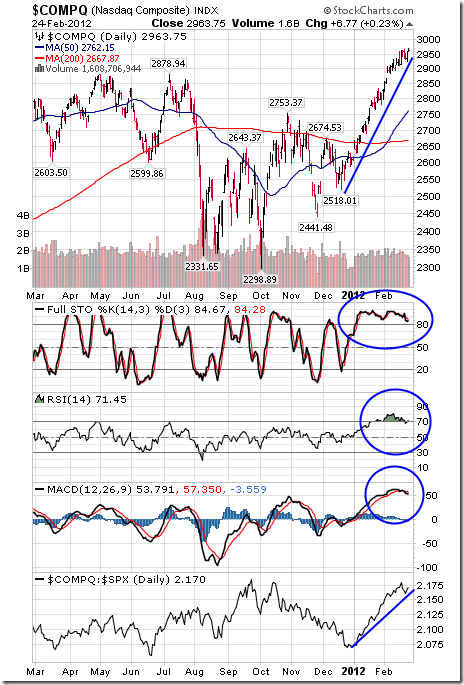

The NASDAQ Composite Index added 11.97 points (0.41%) last week. Intermediate trend is up. Support is at 2,441.48. The Index trades well above its 50 and 200 day moving averages. Short term momentum indicators are overbought and showing early signs of peaking. Significant momentum sell signals will occur when short term uptrend of the Index is broken. Strength relative to the S&P 500 Index remains positive.

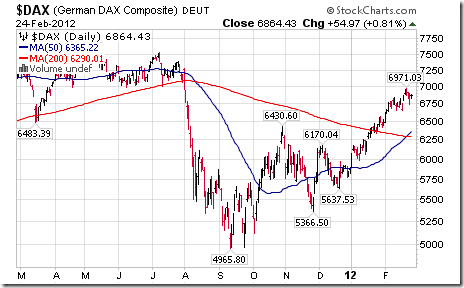

The London FT Index added 30.06 points (0.51%), the Frankfurt DAX improved 16.40 points (0.24%) and the Paris CAC Index gained 27.41 points (0.80%) last week.

The Athens Index plunged 74.57 points (9.05%) last week. Investors are skeptical that the agreement on sovereign debt will last. Resistance is forming at 843.64. Short term momentum indicators are trending down. Strength relative to the S&P 500 Index has returned negative.

The Nikkei Average gained 263.21 points (2.80%) last week. Intermediate trend is up. The Average trades well above its 50 and 200 day moving averages. Short term momentum indicators are overbought, but continue to trend higher. Strength relative to the S&P 500 Index remains positive. ‘Tis the season for the Nikkei Average to move higher!

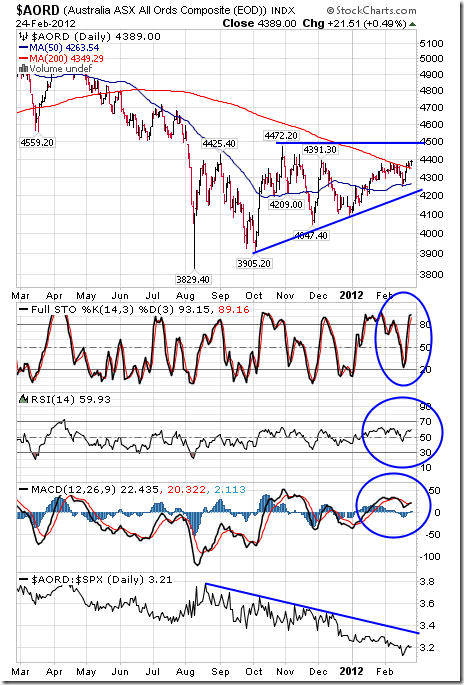

The Australia All Ordinaries Composite Index added 115.74 points (2.71%) last week. Intermediate trend is up. Support is at 3,905.20 and resistance is at 4,472.20. The Index recently bounced from its 50 day moving average and broke above its 200 day moving average last week. Short term momentum indicators continue to trend higher. Strength relative to the S&P 500 Index remains negative.

Other Factors

The VIX Index slipped 0.47 (2.64%) last week. Once again, it is testing long term support near 15.00.

…..to view 30 more Charts for Currencies, Commodities and Interest Rates go HERE. Don & Jon Vialoux’s Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Economic News This Week

Earnings Reports This Week

The record volatility, and 400 point up and down days in the DJIA of last summer seem like a lifetime ago, having been replaced by a smooth, unperturbed, 45 degree-inclined see of stock market appreciation, rising purely on the $2 trillion or so in liquidity pumped into global markets by the central printers, ever since Italy threatened to blow up the Ponzi last fall. In short – we have once again hit peak complacency. Yet with crude now matching every liquidity injection tick for tick, there is absolutely no more space for the world central banks to inject any more stock appreciation without blowing up Obama’s reelection chances (and you can be sure they know it). Suddenly the market finds itself without an explicit backstop. So what are some of the “realizations” that can pop the complacency bubble leading to a stock market plunge, and filling the liquidity-filled gap? Here are, courtesy of David Rosenberg, six distinct hurdles that loom ever closer on the horizon, and having been ignored for too long, courtesy of Bernanke et cie, will almost certainly become the market’s preoccupation all too soon.

1. The nascent task market place improvement was small a lot more than a reflection of deteriorating productiveness growth. As this kind of, businesses will reply in the spring by curbing their hiring ideas. This is exactly what happened a calendar year ago when non-public payroll gains averaged 207k from January to April and the most significant blunder the emboldened bulls did at the time was extrapolate that performance into the future. No quicker did we mention the most likely renewed corporate target on reviving productiveness growth than we noticed Proctor & Gamble announce a five,700 occupation cut or 10% of its manufacturing work power — and the stock price tag was rewarded with a $ two advance.

2. The ballyhooed housing recovery represented a climate report. January was the fourth warmest on report, skewing the data, and February seems to be to be a record for balmy temperature ranges. As this sort of, we could be in for a setback in the housing knowledge, and the most recent weekly info on house loan programs for new purchases could presently be signaling a renewed downturn in profits activity. The volume index for new purchases was down 2.9% in the week of February 17th on leading of an 8.4% slide in the prior week and it has been trending down for four of the past 5 weeks.

3. The European economic downturn is just getting started (See Recession Looms for ten Nations on webpage 2 of the FT) and the effect on Asian trade flows is previously evident in the knowledge — with Chinese export growth fully vanishing in January and producing diffusion indices flashing modest contraction in February. We are possibly one particular to two quarters absent from seeing a significant shock to the U.S. GDP data from an eroding internet international trade overall performance. To catch a glimpse of just how much reaching the Eurozone economic downturn is, have a look at Austerity in Europe Puts Stress on Drug Prices on page B6 of the NYT.

4. What upset the apple cart this time very last yr was the operate-up in oil rates, followed by a lag with a surge in fuel costs at the pump. So instead of acquiring the four.% very first quarter GDP progress number in 2011 that several pundits anticipated, we got .four% rather — correct digits but in the wrong place. The issue was electricity expenses and what that did to the GDP value deflator — it crushed genuine financial expansion (this time it is not the Arab Spring but heightened Israel-Iran tensions at perform). In 24 hours of the release of that GDP report in late April, the stock industry peaked for the yr.

Once yet again, oil costs have ratcheted up and with a lag, we can most likely count on a return to $ four for every gallon for normal gasoline at the pumps by the time spring rolls all around. The front webpage of the USA Right now can make the scenario for why $ 5 for each gallon is probably coming … that would symbolize a lot more than a $ 200 billion drag out of home funds flows. As it stands, consumers have responded by cutting again on energy usage at a pace we have not observed in fifteen years. Notice that motorists in California are currently spending north of $ four for every gallon. And Brent crude charges have strike file highs in the U.K. in sterling phrases and back to 2008 ranges in euro terms for the previously economic downturn-gripped euro location.

Not only have been January retail revenue previously weak, but we just saw two bellwethers —Gap and Kohl’s — all article reduce Q4 earnings. Kohl’s really posted its first income decline in a few years. And we have not even noticed the entire brunt of the energy value influence hit property however.

The transportation shares see what is coming, obtaining peaked on February third, and since then this group has suffered nine losses out of the past thirteen sessions, representing a 4% decline from the nearby peak. This is a bit of a problem for the bulls because the transports in no way did validate the new highs that the Dow and S&P five hundred manufactured — and the index is now at a vital juncture as it kisses the 50-day going regular on the downslope.

5. This hurdle will most likely only grow to be apparent in the 2nd fifty percent of the 12 months and it relates to tax uncertainties and the implications for growing personal and company cost savings prices.

First, the top rated marginal individual tax fee rises to 39.6% from 35% as the Bush tax cuts expire at the stop of 2012. A reduce on itemized deductions will include a even more one.two percentage details to the top rate. Second, a new .9% Medicare tax on incomes more than $ two hundred,000 will get imposed ($ 250,000 for joint filers). Moreover, the best fifteen% price on extended-term funds gains rises to twenty%. And dividends will after yet again be taxed at normal prices — 39.six% for the leading earnings earners. A new 3.eight% tax on investment income also will get launched for incomes over $ 200,000 ($ 250,000 for joint filers). The top estate tax rate goes from 35% to 55% (sixty% in some instances). The estate tax exemption falls to $ one million from $ 5 million (the present-tax exemption also drops to $ 1 million and the charge adjusts hither to 55%). In all, 41 independent tax provisions expire this yr.

6. Fiscal contagion. Just as there is a deep-seated look at of economic re-acceleration in the United States, so too is there a widespread consensus that Europe will muddle via. The ECB’s substantial liquidity infusion previous November and the forthcoming move on February 29th for what pretty much everyone hopes will be a massive LTRO (For a longer time-term Refinancing Operation) just take-up has the masses convinced that Europe is out of the woods.

Markets have dealt with Greece’s default with a shrug. But what if a CDS celebration does get activated? It is feasible. And what if Portugal decides that it desires its bail-out phrases renegotiated, as the FT hints at? Spain is undertaking furthermore as properly — see Spain Pushes Brussels to Reduce Deficit Target as Growth Hopes are Dashed on the front webpage of the FT and also have a seem at Spain Counts Social Fees of Austerity Drive on page 2 of the FT.

The lack of self-assurance is so palpable that some corporates in Portugal, like Portugal Telecom, trade at a 600 basis level price reduction to equivalent federal government bonds. Even Italy is far from out of the woods (allow on your own Spain) — the ECB’s intervention efforts may have helped drag ten-year yields down to 5.4% from the latest peak of more than seven%, but personal debt and debt-program dynamics are this kind of that fiscal sustainability can only be achieved, barring an economic boom (which is not in the cards), if yields can break decisively underneath four% and remain there.