Stocks & Equities

While Greece has been criticized for just about everything, especially about going on a debt binge, to be fair, that is the kettle calling the pot black. Let’s be honest. ALL Western governments have been doing the same thing. Greece is merely the PRELUDE to the Decline & Fall of Western Society.

….read more HERE

MF GLOBAL Continues to Undermine the US Financial Markets and the Rule of Law

The trustee overseeing MF Global’s liquidation has come out and confirmed that the amount of customers’ funds of the failed brokerage are now expected to be at least $1.6 billion. This gap has now risen from the previous estimate of $1.2 billion. This is the biggest financial crime perhaps in history far worse than Madoff. This is the outright theft of client funds that nobody is being called to account for no less the recipients of such funds being made to return them.

About $1.2 billion previously reported as missing has been traced to customer accounts and banks.

…read more HERE

Gloom Boom Doom Report publisher Marc Faber with his latest thoughts on Greece, China, stocks, U.S. real estate, and some creative ideas for male real estate investors during these troubled times.

“It’s a symptom of a wider problem that we have over-indebted governments in the Western world and Japan, and this is just a small plate, a small appetizer to much larger problems and a much larger crisis,” Faber said about strained Greece negotiations with the EU. Sign-up for my 100% FREE Alerts

As for stocks, generally, the Swiss pony-tailed expat from Thailand believes the rally from the December lows has been too strong to jump on board, yet, especially during the seasonally weak month of February for equities. He also has been watching the weakest sectors of the economy (home builders and banks) for clues to the overall market direction for the coming weeks.

“Basically, what has happened, the market peaked out last May in 2011, then it dropped to 1,074 on October 4th on the S&P. Now we’re up 25 percent,” Faber explained. “The market is very overbought right now, and any excuse for profit taking is now being taken. And I think February is traditionally a weak seasonal month, so we’ll go down first for a while.

“I would just wait a little bit [before buying stocks] because, take for instance the home builders and the banks: the home builders, in some cases, are up 100 percent from the lows, last October [and] November; the banks are up 60 to 70 percent from the December lows. I would just wait here a little bit because, we don’t know how bad the correction will look like—could be 100 points on the S&P, could be 200 points.”

Like Peter Schiff of Euro Pacific Capital, Faber likes high-yielding foreign stocks, especially in the area of the world that which Faber is most knowledgeable and comfortable—Asia.

“Well I bought some shares in November [and] December of last year, and I’m not going to sell them because they are high dividend shares in Asia, and I quite like the Asian markets.”

Faber especially likes “Singapore REITs and real estate related companies in Thailand, because they knocked off the industrial park companies following the flooding of the Thai … some Thai industrial states,” adding, “and some shares in Hong Kong.”

Following the lows in December, globally, stocks have move up in tandem as the so-called ‘risk-on’ trade drew investors off the sidelines back into stocks, as investors anticipated a loosening of monetary policy among the world’s dominate central banks.

Moreover, India, whose currency took a mini-crash last year of approximately 20 percent within a one-month period, has rallied back from its nearly 54 rupee level low against the U.S. dollar at the end of 2011, now trading at the 49 handle, as the risk-on trade flows back more strongly into emerging markets once again.

“Actually, what is interesting, in this rally, since early January, emerging markets have done best,” Faber pointed out. “India is up 14 percent, and the currency has strengthened. So you’re up almost 20 percent, in essentially, a month’s time. So all these markets have become overbought—near term.”

Generally, Faber doesn’t like stocks in the U.S.; he likes the battered down residential real estate market, instead.

“I like real estate in the U.S… Just buy a house,” he chuckled.

In typical Faber style, he went on to share an anecdote from his most recent destination. This time, the vignette takes place in Phoenix, a city among the worst hit by the across-the-board U.S. residential real estate crash.

“I was in Phoenix the other day,” Faber began. “Then, the taxi driver took me to the hotel, nice hotel, Fairmont. And then he told me the person that I just drove before you—I drove him to a five-bedroom house. He told me he just bought it for $120,000. Where in the world can you buy a five-bedroom house for $120,000? I would buy it, live in one bedroom and rent out four bedrooms to concubines.”

But he wouldn’t rent out spare rooms to any foursome of concubines, according to Faber; the concubines must pay rent to him so that the property would throw off cash.

“If you take a very bearish view of the world, then at least—if you own property, you still own it—you pay for cash and get the cash flow as I suggested [from the concubines]. And if you are very bullish about the world, it means the demand for real estate will go up.”

Faber continued, sharing his observation from his earlier stop in Miami. There, Faber said he witnessed the ‘crane index’, firsthand.

“I was three days in Miami. Three years ago, I counted 47 cranes, building highrises,” he said. “This time around, I counted one crane, destroying a building. So, the market has cleared, actually, in Miami.”

Faber noted the frustrations that foreigners across the globe face when seeking overseas bank accounts outside their native countries—which has been a growing trend since the Asian currency of 1997-8, and magnified by the current ruse by many nations disguising capital controls with ‘fighting terrorism’.

“A lot of money has come from Latin America, from Russia because, if you want to open a bank account somewhere, they ask so many questions. But as a foreigner, you can go buy a condo,” Faber said.

Globally, Faber is less concerned with the drama playing out in Greece. His concern focuses upon the only economy primarily responsible for driving global growth (mostly from resources purchases) since the collapse of Lehman Brothers in 2008. That country, of course, is China.

“When we talk about Greece, the major issue for the world economy is China,” he explained. “And China has been slowing down. Industrial production is down; electricity consumption is down; exports were down; and cement production is down; steel production is down. So, many indicators point to a meaningful slowdown in the [world] economy.”

According to Faber, the countries of Australia and Brazil are most vulnerable to a marked decline in Chinese consumption, especially of raw materials—which has recently given rise of talk among some analysts that the Aussie dollar and Brazilian real may be due for a decline due to a China slowdown.

At the end of the interview, the two Fox Business hosts thanked Faber for his appearance and for “the information about the concubines.”

Faber replied, “Yes, yes, yes [about the concubines]. It’s most important; it’s an urgent matter.” Sign-up for my 100% FREE Alerts

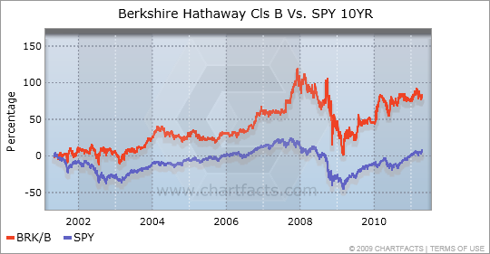

Warren Buffett and Berkshire Hathaway’s latest stock holdings were released and there were some interesting additions and deletes, as well as many internal changes of existing positions up or down.

American Express Co. (NYSE: AXP) was over 151.6 million shares, SAME AS last quarter.

Bank of New York Mellon Corp. (NYSE: BK) was 1,793,915 shares, SAME AS last quarter.

CVS Caremark Corporation (NYSE: CVS) is LARGER POSITION at 7.106 million shares after having been a new holding in a recent quarter.

Comdisco Holdings (NASDAQ: CDCO) was roughly 1.5 million shares, SAME AS BEFORE.

Coca Cola Co. (NYSE: KO) was right at 200 million shares, SAME AS BEFORE.

ConocoPhillips (NYSE: COP) is roughly 29.1 million shares, roughly the SAME AS BEFORE but it is still lower than previous quarters.

Costco Wholesale (NASDAQ: COST) 4,333,363 Shares, SAME AS last quarter after having lowered it before.

Da Vita Inc. (NYSE: DVA) is a NEW POSITION of 2.684 million shares worth $203 million.

DirecTV (NASDAQ: DTV) is a LARGER POSITION listed as 20.348 million shares worth $870 million; was a new position of 4.249 million shares one quarter earlier.

Dollar General Corporation (NYSE: DG) is that SAME SIZE as before at 4.497 million shares; was a new position and a grown position before. This one of our Top Stocks for the Next Decade.

Gannett Co. (NYSE: GCI) was 1.74 million, SAME AS BEFORE but decreased in prior quarters.

General Dynamics Corporation (NYSE: GD) is a LARGER POSITION of 3.877 million shares worth $257 million after being a new position before of 3.064 million shares.

General Electric Corp. (NYSE: GE) is 7.777 million shares; SAME AS before.

GlaxoSmithKline (NYSE: GSK) 1.51 million shares, SAME AS last quarter.

Ingersoll-Rand (NYSE: IR) was 636,600; SAME AS last quarter but still way down from prior reports.

Intel Corporation (NASDAQ: INTC) is a LARGER POSITION of 11.495 million shares worth $278 million; this was a new position of 9.333 million shares last quarter.

International Business Machines Corporation (NYSE: IBM) is now 63.905 million shares worth some $11.75 billion now after having been a new position with an average cost of about $170 per share.

Johnson & Johnson (NYSE: JNJ) was a LOWER POSITION of about 29 million shares; lower than 37.4 million last quarter and way under the peak of 62 million shares at one point in prior quarters.

Kraft Foods (NYSE: KFT) was a LOWER POSITION at about 87 million shares, down from 89.7+ million last quarter and this has continued to be lightened up since the Cadbury purchase.

Exxon Mobil Corp. (NYSE: XOM) was ELIMINATED FROM THE PORTFOLIO after having been only 421,800 shares last quarter and lowered earlier.

PAGE TWO…BUFFETT HOLDINGS ‘L to Z’ HERE

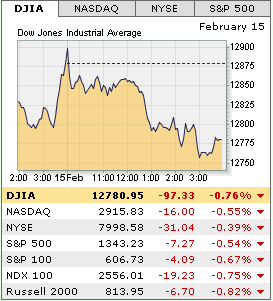

For the first time since the last week of December of 2011, the S&P 500 Index closed lower on the weekly chart. Recently I have been discussing the overbought nature of stocks based on a variety of indicators. However, the real question that should be asked is whether last week was just a short term event or if we see sustained selling in coming weeks.

For the first time since the last week of December of 2011, the S&P 500 Index closed lower on the weekly chart. Recently I have been discussing the overbought nature of stocks based on a variety of indicators. However, the real question that should be asked is whether last week was just a short term event or if we see sustained selling in coming weeks.

The issues occurring in Greece spooked the markets somewhat on Friday as Eurozone fears continue to permeate in the mindset of traders. The U.S. Dollar Index is the real driver regarding risk in the near and intermediate term future. If the Dollar is strong, market participants will likely reduce risk. However a weakening Dollar will be a risk-on type of trading event which could lead to an extended rally in equities, precious metals, and oil.

Friday marked an important day for the U.S. Dollar Index futures as for the first time in several weeks the Dollar held higher prices into a daily close. The U.S. Dollar appears to have carved out a daily swing low on the daily chart from Friday. Furthermore, the potential for a weekly swing low at the end of this week remains quite possible. The chart below illustrates how the 100 period simple moving average has offered short term support for the past few weeks.

….read more and view charts HERE

Greek parliament passes unpopular package of cuts. Stocks and the euro rose on Monday on relief over sweeping austerity measures passed by the Greek parliament, but gains looked fragile with several issues still to be resolved before the shadow of a messy debt default is lifted.

U.S. stock index futures pointed to a recovery for equities on Wall Street after delays in agreeing a new Greek bailout deal sent the S&P 500 index to its biggest daily loss of the year on Friday.

….read more HERE