Asset protection

Rather than attempt to re-live, re-frame or re-litigate the last two years of our upside-down world at a granular level, I’ll be as succinct as I can muster; I’ll revert to being annoyingly practical and direct – for which I’m rather infamous. We recently attended the online version of Martin Armstrong’s World Economic Conference (WEC) – my 8th consecutive edition. Each successive WEC builds upon previous conferences and Marty’s ongoing blog posts, distills critical information between familiar anecdotes, and most importantly provides “over the horizon” insights into geopolitics and economics.

Spoiler alert: there’s bad news, and good.

While some of Marty’s political views are too acerbic and cutting for some (not me), all of his forecasts are generated by his Socrates program. Over time, both his politic opinions and market forecasts have proven freakishly accurate.

First the bad news, none of which will surprise dedicated Money Talks and Armstrong blog followers. In summary, the unsustainable systems and ideologies, the incoherent solutions that exacerbate rather than repair, and the glaring conflicts of interest that seem to drive so much of the modern world…they’re all accelerating on a collision course. That’s the red pill part.

Specifically, elected western leaders are intent upon forcing “green solutions” before they can adequately replace oil, natural gas and nuclear power. Result: soaring energy and food costs, rolling blackouts, supply shortfalls and economic hardship for all but the wealthiest. My late mother’s expression warning of such folly was, “Don’t throw away your old shoes until you have new ones.”

Europe is obviously being hit the worst, and this winter will undoubtedly bring news of innocent citizens dying of cold and hunger. Here in North America, supplies of essentials will be more reliable, but wages never rise as quickly as prices during stagflation.

Sanctions on Russia’s energy exports, destruction of two submerged natural gas pipelines, unenforceable price caps and incessant bluster from EU, NATO, UK and US spokespeople have hurt the west exponentially more than Russia. In fact, they’ve driven China, Iran and North Korea closer to Russia as the power axis opposing the west. I call these boomerang sanctions.

All the while, the western MSM transcribes press releases from the relevant institutions. Gone are the days when media outlets consistently engage in acts of journalism. They stoke the tribalist impulses that escalate violence, e.g. Putin is evil and Zelensky is a hero. It’s simplistic and very effective; nuance is relegated to the dust bin. The MSM seems most concerned with staying in the good graces of the powerful, rather than informing the public, occasionally questioning obviously false official narratives…thereby supporting the continued escalation of the war in Ukraine. They care not about the death, destruction and displacement of hundreds of thousands still in Ukraine or the millions who fled the conflict early on.

And predictably, the military industrial complex (MIC) is making bank as they ramp up production of weapons to replace those sent to Ukraine. Western stockpiles are dangerously low and will take years to rebuild to minimal readiness levels. This proxy war with Russia will also provide a plausible excuse, “cover” if you will, for the accelerating collapse of UK and European bond markets…and the insolvency of public pensions throughout the region.

Governments, big finance, mainstream media and the MIC all have naked conflicts of interest. Who cares about the death of people thousands of miles away?

This is NOT a black pill situation by any means. It would be easy to descend into despair for the future, including our financial wellbeing, were it not for the fact that we can indeed see over the horizon. It’s not that the forecasts call for peace, stability and a rapid return to business as usual; they don’t. The saving grace is that we can see the problems coming and take defensive measures to minimize the damage…at least the financial damage to our nest eggs. And knowing when and where to shift for recovery will help heal the financial wounds. That’s the white pill/good news part.

In early January 2023 we’ll be presenting our next webinar, and will share some more specific insights from the WEC and other independent sources we’ve come to trust based on their consistent accuracy. Here are a few areas we’ll be addressing: equity market volatility early in 2023, the path ahead for fossil fuels and their producers, the final bottom of the precious metals markets before they enter a robust bull market in all currencies, and the future of $USD as the world’s de-facto reserve currency.

April and May 2023 appear to be the timing targets of escalation, panic cycles and directional changes in MANY of the countries and financial markets that most affect our clients. Thus, we’ll be sharing as much as we can with our Portfolio Managers in the weeks ahead. In sports and investments, “offense sells tickets but defense wins championships.”

As this will be our final broad communication of 2022, please accept our entire team’s sincere wishes for a blessed Christmas, Hanukah, or whatever occasion you might celebrate. We’re truly blessed to live here in North America, despite the many challenges we continue to experience. Re-connect as you can with family and others you hold dear…our collective souls need the refreshment and sustenance that only loving, face to face, human connection can offer.

Patience and discipline are accretive to your wealth, health and happiness – so focus on these.

Andrew H. Ruhland, CFP

Founder, Integrated Wealth Management Inc.

Nanoone CEO Dan Blondal joins Mike to share the realistic opportunities and bottlenecks that face the green revolution in the coming years.

- American gross domestic product fell 0.9% at an annualized pace for the period, according to the advance estimate.

- That follows a 1.6% decline in the first quarter and was worse than the Dow Jones estimate for a gain of 0.3%.

- The drop came from a broad swath of factors, including decreases in inventories, residential and nonresidential investment, and government spending.

The U.S. economy contracted for the second straight quarter from April to June, hitting a widely accepted rule of thumb for a recession, the Bureau of Economic Analysis reported Thursday.

Gross domestic product fell 0.9% at an annualized pace for the period, according to the advance estimate. That follows a 1.6% decline in the first quarter and was worse than the Dow Jones estimate for a gain of 0.3%.

Officially, the National Bureau of Economic Research declares recessions and expansions, and likely won’t make a judgment on the period in question for months if not longer…read more.

Is anything going right in Europe?

Germany reported a monthly trade deficit in May for the first time since 1991 (following the reunification of East and West Germany) as a direct result of soaring imported energy costs. Energy shortages across the Eurozone may result in rationing later this year, exacerbating the current economic slowdown.

The ECB raised s/t interest rates 50bps this week (to zero!) This was their first raise in 11 years as they attempt to slow inflation which is an average of ~9.5% across the Eurozone.

The Russian/Ukraine war drags on, feeding the existential fear of freezing to death in the dark this winter.

You can read the rest of this Doomberg Twitter thread here.

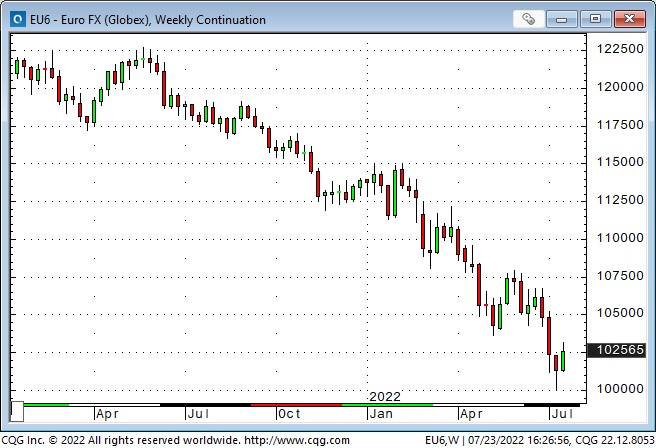

The Euro currency fell below par with the USD last week for the first time in 20 years (as the USD continued its 18-month rally against virtually all currencies.)

The Euro was ~84 when it was introduced in 2001 and rallied to its All-Time high of ~1.60 in the summer of 2008. It has trended lower since 2008, with that downtrend accelerating over the past year as markets expected the Fed to tighten monetary policy much more aggressively than the ECB. The Russian invasion of Ukraine hastened the flow of capital away from Europe to the safety of the USA.

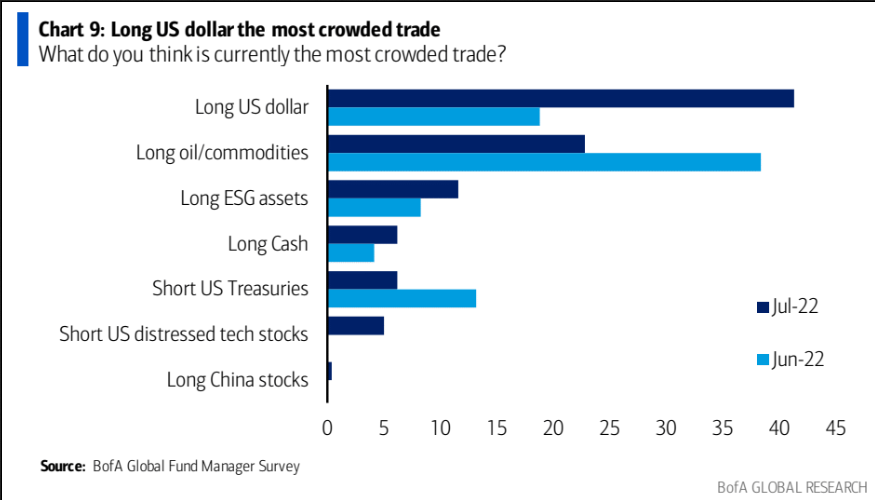

The Euro rallied ~3% this week from last week’s 20-year low. This could be a result of profit-taking on long USD positions (BoA Fund Manager survey sees Long USD as the most crowded trade) and thoughts that Peak Fed is behind us.

What is the Fed going to do?

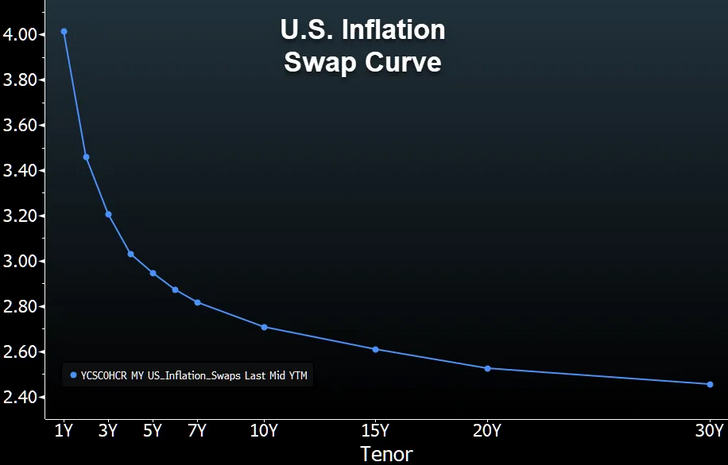

Very bright analysts with years of experience have decidedly different answers to this question. Some folks believe that a recession is already underway and will quickly get dramatically worse – causing the Fed to “back off” their tightening program. In contrast, other folks believe that a new era of persistently higher supply-shortage inflation has begun after decades of relatively low inflation – which means the Fed will be raising rates far higher and for far longer than the market is currently pricing.

My answer: I think the Fed is determined to get inflation down at all costs, which may take them longer, and require them to raise rates more than the market expects. I can imagine a steeply inverted yield curve, with long rates lower than short rates as the market prices in the future impact of higher s/t rates.

The Fed’s credibility is lost if inflation remains high and inflation expectations remain “unanchored.” Don’t fight the Fed.

What is the macro message across asset classes over the past few weeks?

Since the mid-June FOMC meeting, bonds and short rates have had a good rally, stock indices have bounced, commodity markets have been weak, and the USD has rallied to new 20-year highs but has given back ~50% of those gains in recent days. Based on this macro picture, my guess is that the market sees a recession coming and the Fed “backing off.”

The FOMC meets this coming week, and the market expects another 75bps increase.

Stock indices

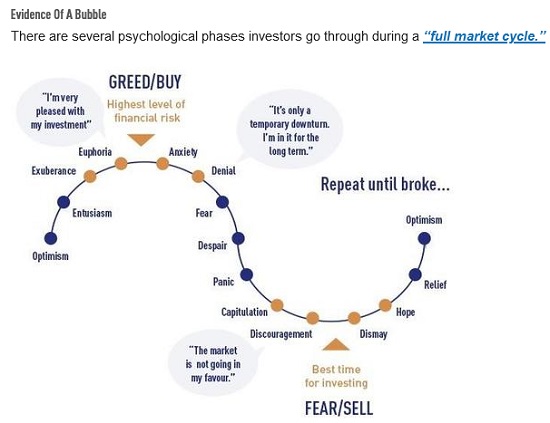

The DJIA bounced ~8% from the mid-June lows to this week’s highs. Market sentiment was extremely negative at the lows and hasn’t improved much since then. Last week I wrote that the stock market had a “damned if you do, damned if you don’t” problem. If a recession is looming, then the Fed would be less aggressive (good news), but if a recession is looming, earnings will take a hit (terrible news.)

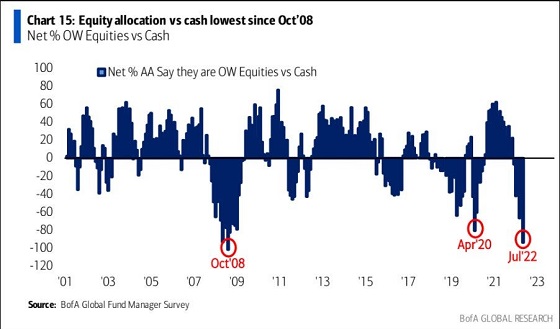

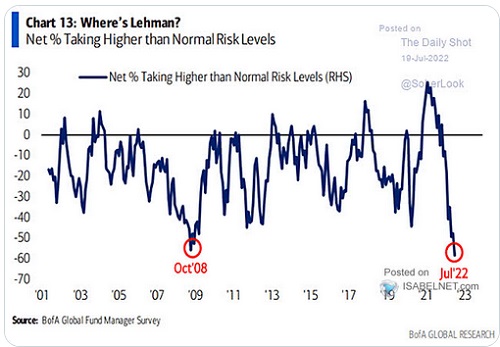

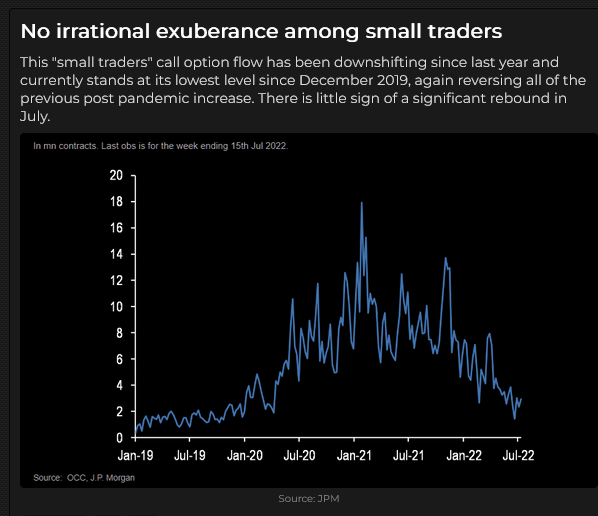

Stock market sentiment is extremely negative:

Are falling gasoline prices good news for the stock market? Yes, if you see cheaper gas as a sign of cooling inflation (the Fed won’t need to be so aggressive.) No, if you see cheaper gas as a sign of “demand destruction,” consumers are cutting back on their spending, and in an economy that is 70% driven by consumer spending, that’s not good.

I believe the bounce from the June lows has been another bear market rally. I agree with Michael Harnett, CIO at Bank of America, when he writes: “It’s unlikely that Wall Street will unwind the financial excesses of the last 13 years with a six-month, garden variety bear market.”

Concerning that 13-year time frame, I have often wondered what will happen to the Passive Investing cohort if/when the major indices fall more and stay down longer than they ever imagined. (Their thesis: The stock market always goes up over time, so keep buying at regular intervals, don’t try to time the market, buy the whole market, don’t try to pick stocks, be prepared for occasional corrections, and see them as good opportunities to lower your average costs, be patient and you will be handsomely rewarded over the long term.) I don’t believe they have begun to sell yet, but they will at some point in the cycle.

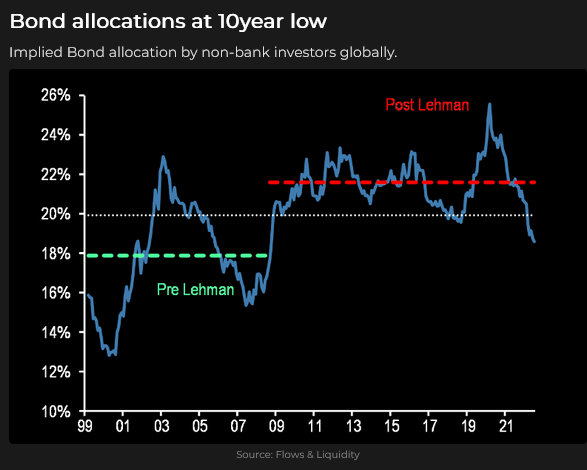

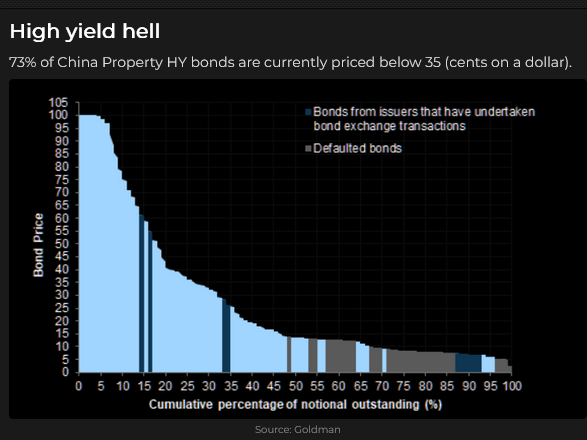

Credit markets

If the Fed is determined to get inflation down, and if that takes longer than the market expects, short rates will rise, bond prices will fall, and quality spreads will widen.

The June 2023 Eurodollar has rallied 100 points since the last FOMC meeting – the market is pricing s/t rates to be 100bps lower than what was priced a month ago. Eurodollar futures will fall if the Fed surprises the market and keeps pushing rates higher.

If the US economy does not go into recession, the Fed will push rates much higher than the market is currently pricing.

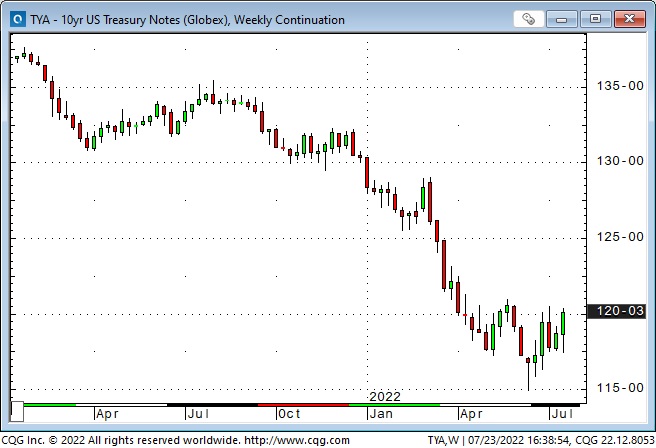

This is a chart of the 10-year T-Note futures contract. Prices have risen ~5 full points since last month’s FOMC meeting (as yields have fallen.) If the Fed surprises the market and takes rates higher for longer, prices will fall. If a recession hits harder and faster than expected, prices will rise.

Baring some exogenous events, like over-leveraged China having a severe financial meltdown, I think the only thing that would cause the Fed to “back off” would be a sustained sharp rise in the unemployment rate.

Currencies

For the past 40 years, I’ve said that capital comes to America for safety and opportunity. I’ve also repeatedly said that currency trends go “way further” than seems to make any “sense” before turning on a dime and going the other way.

I acknowledge that the USD looks “over-valued” on several metrics (primarily trade imbalances), but if the Fed is determined to cool inflation (while Europe is lurching into an existential crisis and Japan maintains a zero interest rate policy), the USD will go higher against virtually all currencies.

Commodities

The Goldman Sachs commodity index has closed lower (down ~20%) for seven consecutive weeks. Weaker fossil fuel prices have contributed to this decline, but industrial metals and Ag markets have also tumbled. (The Economist magazine cover in May – The Coming Food Catastrophe – signalled the top of the wheat market – see the May 21, 2022 TD Notes.)

Commodities, especially energy, were The Most Crowded Long trade earlier this year. The bullish narrative was a compelling supply shortage story, exacerbated by the Russian invasion.

There has been severe liquidation of speculative bullish positions in the commodities market despite the Malthusian warnings that future supply shortages will be acute and prices will soar from current “bargain” levels.

The Malthusian theory has been wrong for over 200 years. In commodity markets, the “best cure for high prices is high prices.” High prices bring forth supply – from innovation and substitution.

Instead of millions of people dying of starvation due to the world’s rising population, food innovations have delivered an adequate supply of food to a higher percentage of the world’s population than ever before.

That doesn’t mean that commodity prices won’t spike on supply shortages; they will, and that spike will bring forth more supply – from innovation and substitution. If fossil fuel prices spike over the next few years, that will be a powerful accelerant for innovators to deliver alternative energy sources, like nuclear, for instance!

Gold

Gold hit a 15-month low this week, down ~$400 (19%) from the All-Time highs ($2,080) made following the Russian invasion.

The ultra-strong USD and rising interest rates are a significant headwind for gold. Net speculative long positions on Comex appear to be around a 3-year low (the managed money category is net short ~19,000 contracts), and the gold ETF market has seen net selling for the past few months.

My long-time friend and excellent technical analyst Ross Clark (ChartsandMarkets.com) wrote a report this week, seeing major oversold extremes in the XAU, HUI and Newmont and capitulation in gold futures.

With gold in a downtrend, stories will inevitably surface as people try to explain “why” gold is falling. For instance, there has been a story that Ukraine has been selling gold. Maybe they have, I don’t know. But the best story is that Uganda has “discovered” 320,000 tonnes of gold throughout the country. (To put that “discovery” in perspective, the world currently mines ~3,000 tonnes of gold annually.) This massive discovery has depressed the gold price (so the story goes) because there will “soon” be a flood of supply hitting the market!

While the Uganda news was greeted with skepticism, it got me thinking that perhaps Africa will be the source of supply for the mountains of minerals that the world will need in the future.

My short-term trading

I’ve been in summer vacation mode for the past two weeks. I bought gold Tuesday and was quickly stopped for a slight loss. I shorted the S+P Wednesday and Thursday and was stopped promptly for small losses. I missed being short Friday when the market broke. I’m flat at the end of the week, and my P+L is down ~0.2%

On my radar

I think the S&P rally off the June lows has been a bear market rally, and I’ll be looking for price action to allow me to trade from the short side.

I’ll look for opportunities to buy the USD against CAD and EUR.

The FOMC meets Tuesday/Wednesday, so I’ll be cautious about trading into that, but I’ll watch for price action to confirm (or deny) my idea that the market has over-priced a Fed pause.

Quote of the week

The Barney report

Barney is leading the good life. He is well fed but gets so much exercise that he looks lean. He is well-loved at home; everywhere he goes, people pet him and say he is a beautiful dog.

We were at the ocean again this week, and he was swimming like he’d been doing it all his life. He loves to chase a ball, whether I throw it in the dog park or the ocean and when he comes home, he can fall asleep anywhere, without a worry in the world. Does it get any better than that?

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The July 23 podcast is available at: https://mikesmoneytalks.ca.

I did my monthly 30-minute podcast with Jim Goddard on July 9 and talked about macro markets, Dutch farmers, and risk management. You can listen to This Week In Money – A Howe Street Radio feature.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.