Economic Outlook

Canadians can expect to dish more dollars as the Bank of Canada forecasts another spike in inflation.

Tiff Macklem, governor at Bank of Canada, spoke to the Canadian Federation of Independent Business (CFIB) on Thursday. A transcript of this meeting reveals the anxiety-inducing forecast.

“Inflation is high sevens,” said Macklem, referring to the 7.7% spike seen in year-over-year-inflation back in June. This increase broke a 39-year-record and it looks like we’re on our way to break another.

“It’s probably going to go a little over eight,” Macklem predicted. “We know oil prices were very high in June, so I wouldn’t be surprised to see it move up.”…read more.

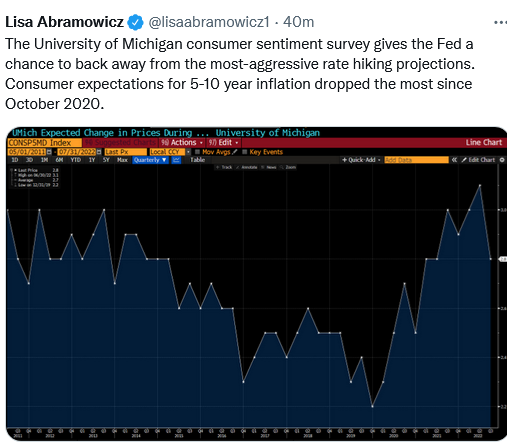

“Don’t fight the Fed,” they say, but what will the Fed do?

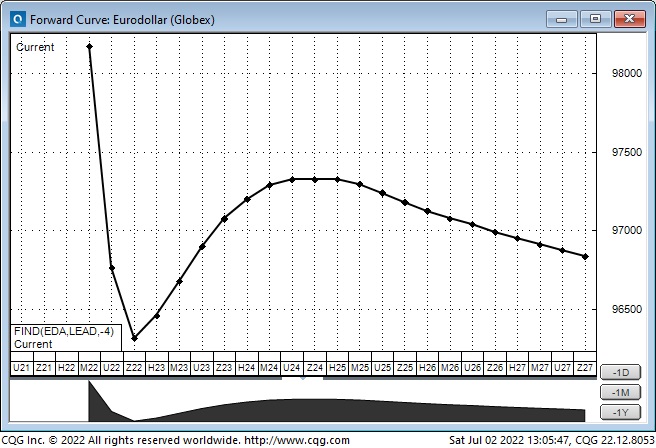

The markets understand that the Fed is determined to cool inflation by raising interest rates another ~125bps between now and December. But then what? The forward markets see the Fed beginning to cut interest rates in early 2023, likely in response to recessionary pressures. But if inflation stays high and employment remains strong, the Fed will keep raising rates.

Markets are searching for the “Peak Fed” moment

If you believe markets have “fully-priced” future Fed tightening, the Peak Fed moment was the June 15 FOMC meeting (when the Fed raised rates by 75bps) despite the Fed’s forecast for many more hikes to come.

That FOMC meeting may have been Peak Fed because the market had already priced in those increases and started reducing future rate expectations following the meeting – thinking that the path of Fed tightening would produce (or amplify) a recession.

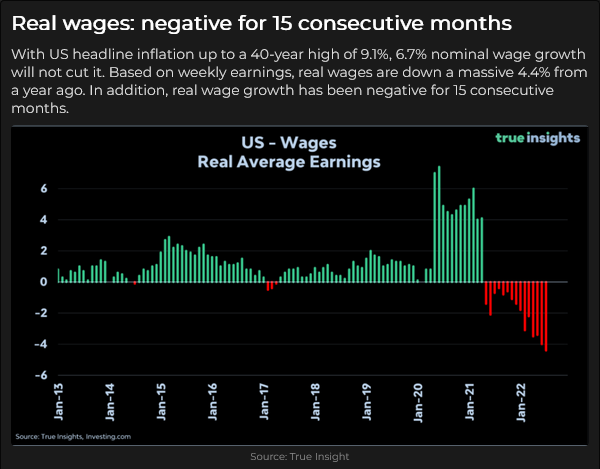

If you believe inflation will stay “higher for longer,” Peak Fed is somewhere in the future. This week’s CPI (9.1%) and last week’s strong employment report suggest inflation may be “higher for longer.” (Falling real wages may create pressure for higher wage demands.)

Markets are searching for Peak Fed – when the Fed pivots away from continually raising interest rates – because Fed policy is THE driver of price discovery across assets. If markets get the idea that Peak Fed has passed, then (all else being equal!) things that were shunned during the rising rates period will be embraced – without fighting the Fed!

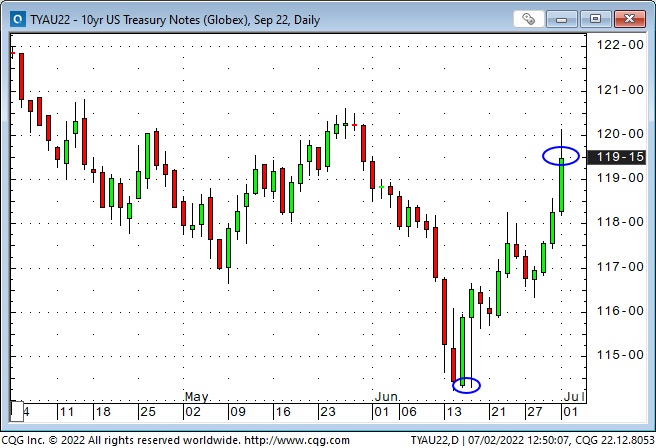

10-year T-Notes have rallied from the 12-year low made on June 15 – FOMC day

The 10-year Treasury yield hit a 12-year high (3.5%) on June 15 and has fallen since then (currently ~2.92%.) Do bonds see a recession coming, or do yields ~3% offer an excellent alternative to a soggy stock market?

Equity markets have a “dammed if you do, dammed if you don’t” problem

Rising interest rates have been a problem for stocks this year, but if interest rates start falling because the market decides a recession is coming, that’s bad news for earnings. The major stock indices have chopped up and down since the FOMC meeting.

The US Dollar hit another 20-year high this week

The prospect of an aggressive Fed has helped drive the USD higher against all major currencies, with the Euro dropping below par for the first time in 20 years – down~12% YTD. (The DXY US Dollar Index is mostly the Euro and other European currencies. The Eurozone has been struggling with geopolitical and energy issues, but all US Dollar indices show a strong USD.)

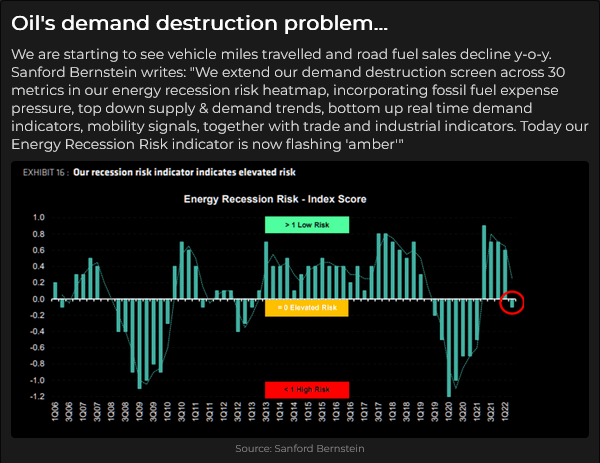

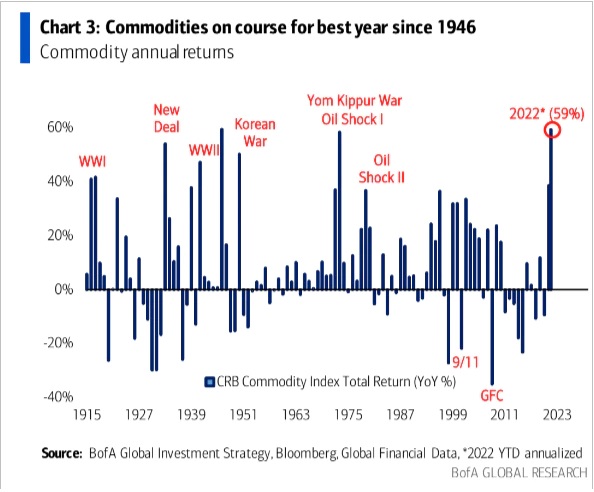

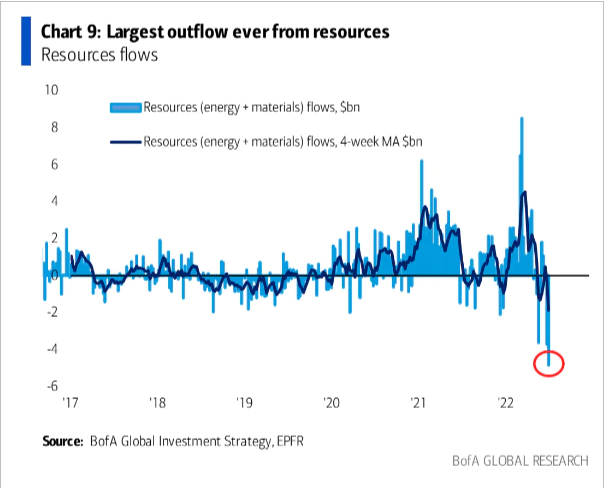

Commodity indices peaked a few days ahead of the FOMC – and have closed lower for six consecutive weeks

The prospect of the Fed tightening into a recession has not been good news for commodities – a recession would likely mean demand destruction. Commodities (especially energy) were the “hottest – most crowded” sector of the market YTD and were vulnerable to a “positioning adjustment.”

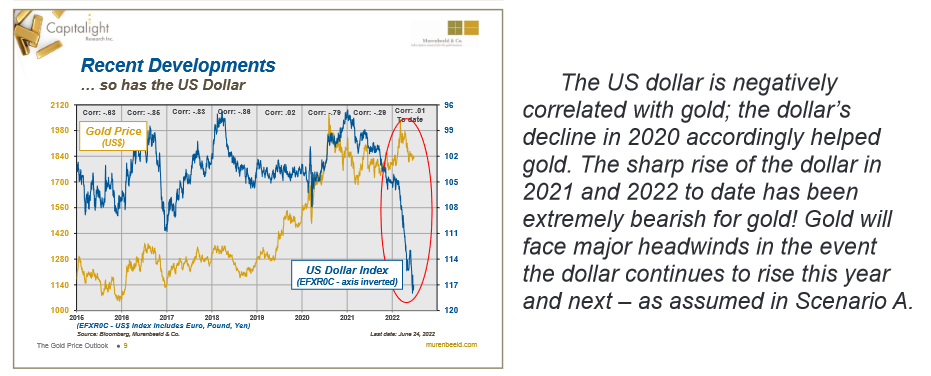

Gold has dropped as much as $385 (18%) from March All-Time Highs

Historically, gold has rallied on high inflation, but the soaring USD and rising real interest rates have been toxic for gold – in US Dollar terms. Comex gold futures have fallen for five consecutive weeks – down ~$175 from last month’s highs. This is the lowest weekly close in 16 months.

(Actually, gold has held up reasonably well. The last time real rates were at current levels, gold was ~$1,500. The last time the USDX was at current levels, gold was ~$350!)

My short-term trading

I started this week with a small S+P position I bought last Friday. I covered that for a slight loss as soon as markets opened Sunday afternoon. I bought the S+P five times Monday to Thursday, looking for a bounce. I traded small sizes with tight stops and lost money on four trades. I missed the 140-point rally from Thursday’s low to Friday’s close (the rally I had been trying to catch!)

I bought the CAD twice, breaking even once and losing a bit on the other trade.

I bought gold Wednesday when it bounced off 10-month lows and was nicely ahead on the trade at one point, but I was stopped overnight for another slight loss.

It was a frustrating week with very choppy price action. I lost money but using small size and tight stops saved me from getting destroyed as I tried to catch a turn in market sentiment. I was flat at the end of the week; my P+L was down ~0.5% on the week.

What does risk management mean – how do I apply it?

The essence of risk management is protecting your capital so that you can live to trade another day.

My friend Dennis Gartman used to say that there were two kinds of capital: the money in your account and mental capital. In his opinion, mental capital was the most important. If you lost your trading capital, you could always find some more money somewhere, but if you lost your mental capital, your willingness to keep going, you were done.

Another way to understand “protecting your capital” is to ask yourself, “What will I do when I’m wrong?”

That question implies that you clearly define what “wrong” means and have a contingency plan to protect your capital when you’re wrong.

Another question that helps identify risk management is, “Am I trying to make money or prove that I’m right?”

Many traders develop a “good” reason for taking a position in the market, and they get their ego involved in the decision-making process. They “have done their homework” and have determined that “X” must go up because of “Y.” If they have used this process before and it has produced profitable results, they will likely be determined to be proven “right” once again.

I’m willing to acknowledge that I don’t know what will happen. I “do my homework” and take risks, but I understand that there’s better than a 50/50 chance that I’m wrong on every trade, so it is “routine” for me to have a plan, and to stick with my plan, to limit losses on every transaction.

I spent decades as a commodities broker and watched 100s and 100s of people lose millions and millions of dollars. There were two main reasons; they used too much leverage, and either didn’t have a plan to limit their losses or didn’t stick with their plan. (We called that a cancel-if-close order!)

I believe every successful trader finds a “way” to trade that suits them. Some people are day-traders; others have a much longer time horizon. Some people swing for the fences; others are content to hit singles. Some of the “big names” are willing to confess that they made horrible mistakes during their early days and are grateful to have survived – but they have set rules for themselves never to make that mistake again.

I wish every trader success, whatever your style, but it truly is a marathon, not a sprint, and if you don’t conserve your capital, you won’t succeed.

Quote of the week

The British Open

It is the 150th Open this week, and Tiger missed the cut. I won’t watch it as much as I watch the Masters, but I had the pleasure of playing the Old Course several years ago in a two-club wind, and I’ll remember that experience forever.

The Barney report

Barney came to us from a lovely lady (Laurel Pickels in Pemberton, BC) who had great success breeding pure-bred Golden Retrievers for many years. But a Border Collie “jumped the fence” at the wrong time, so Barney is part Golden and part Border Collie, which means he is an amiable dog who can run like the wind (and instinctually tries to “herd” me when I take him for a walk.)

I took Barney to the beach twice this week (record low tides), and he had a great time playing in the ocean with two Goldens. He could barely walk back to the car after 30 minutes in the water and curled up in Papa’s chair for a nap as soon as we got home!

(The painting on the wall is an original watercolour of the Merc floor in 2001 – painted years ago by the wife of a long-time friend and commodity broker.)

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The July 15 podcast is available at: https://mikesmoneytalks.ca.

I did my monthly 30-minute podcast with Jim Goddard on July 9 and talked about macro markets, Dutch farmers, and risk management. You can listen to This Week In Money – A Howe Street Radio feature.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

Royal Bank of Canada is predicting this country will likely endure a “moderate and short-lived” recession next year as the economy succumbs to the pressure brought on by stubborn inflation, higher rates, and constraints in the labour market.

“This recession will be moderate and short-lived by historical standards—and can be reversed once inflation settles enough for central banks to lower rates,” economists Nathan Janzen and Claire Fan wrote in their report Thursday.

RBC’s outlook includes back-to-back annualized contractions of half a percentage point in the middle quarters of next year, before returning to growth of 0.2 per cent in the fourth quarter of 2023.

Nonetheless, Janzen and Fan warned the Bank of Canada can’t afford to take its foot off the gas in the fight against inflation.

“Though higher rates will technically push Canada toward a contraction, the Bank of Canada now has little choice but to act. … A scenario in which Canadians believe inflation will run well past the bank’s target range of one to three per cent could upend almost three decades of exceptionally effective inflation targeting policy. It could also require much larger and more damaging interest rate hikes to re-anchor prices,” they wrote…read more.

Market worries switch from “relentlessly rising inflation” to “looming recession”

The Fed raised s/t rates by 75bps two weeks ago and warned that they will continue to raise rates in an “unconditional” manner until inflation cries “Uncle.” But interest rates have DROPPED since then as the market focuses on the looming recession rather than on relentless inflation.

Credit markets

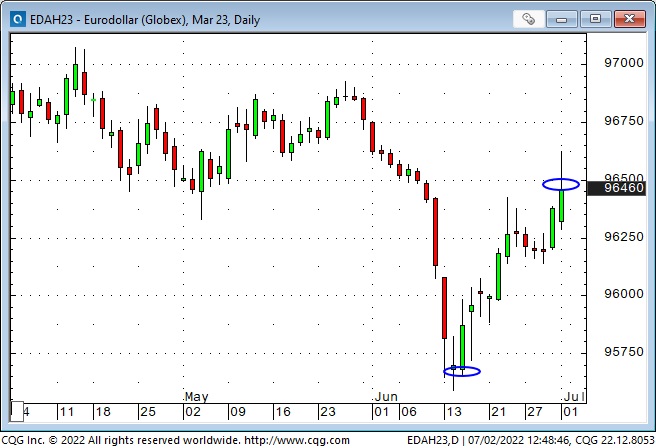

March 2023 Eurodollar futures have rallied ~100bps since the Fed raised rates, while the 10-year Treasury yield has fallen from ~3.5% to ~2.9%. (Eurodollars trade at a discount to par. Rising prices = lower yields. Bond prices rally as yields fall.)

Markets are pricing the Fed to raise rates by ~125bps between now and December 2022 and then start CUTTING rates aggressively – because “recession.”

In Canada, the March 2023 Bankers Acceptance futures have rallied ~65bps since June 14, while the 10-year yield has fallen from ~3.62% to ~3.2%. Markets are pricing the BoC to raise rates by ~125bps by December 2022 and then start cutting rates – but not as aggressively as the Fed.

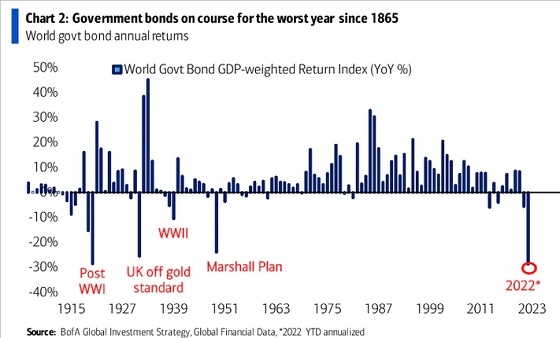

Increasing recession prospects have caused bonds to rally (after having a miserable first six months of 2022) while stocks and commodities have declined.

The energy sector of the stock market

Energy has been the hottest stock market sector YTD but has also been the worst performer in June, dropping ~17%. Historically, the energy sector was the worst performer over the past decade.

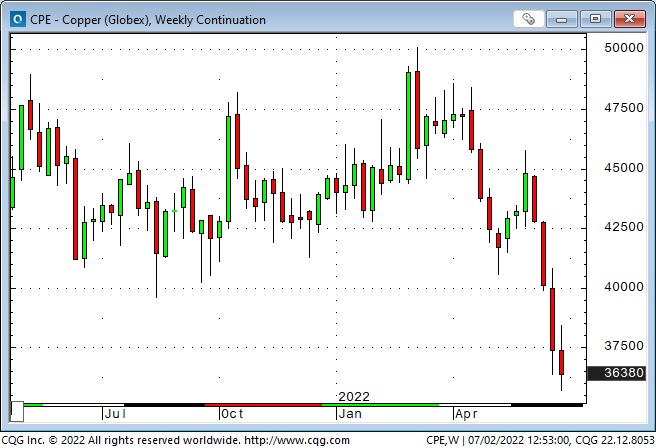

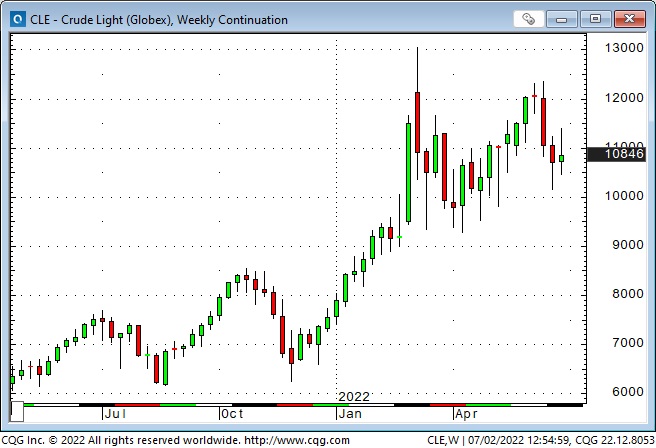

Commodities

The commodity sector is not monolithic, but the entire sector had a booming start this year. Lately, base metals and grains have been weak, as has Natgas, but crude oil and gasoline have been relatively steady.

I’ve circled the “Economist Magazine Cover” top on wheat – May 19.

Commodities had a booming start to the year.

Commodities (save crude oil and derivatives) had a booming start to the year but have fallen sharply lately – because “recession.”

Equities

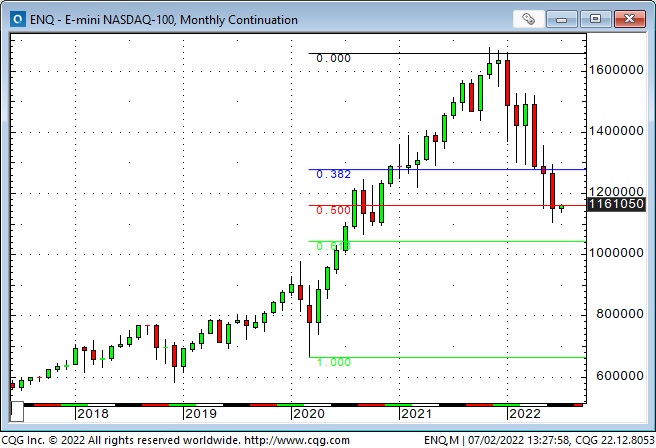

The S+P is down ~21% from its January 4th All-Time Highs. For perspective, the Feb/Mar 2020 bear market dropped ~35%, the 2007-2009 bear market dropped ~57%, while the 1987 bear market fell ~36%.

Since January 4, the S+P has “given back” ~ 40% of its gains from the March 2020 lows. The NAZ has “given back” ~50%.

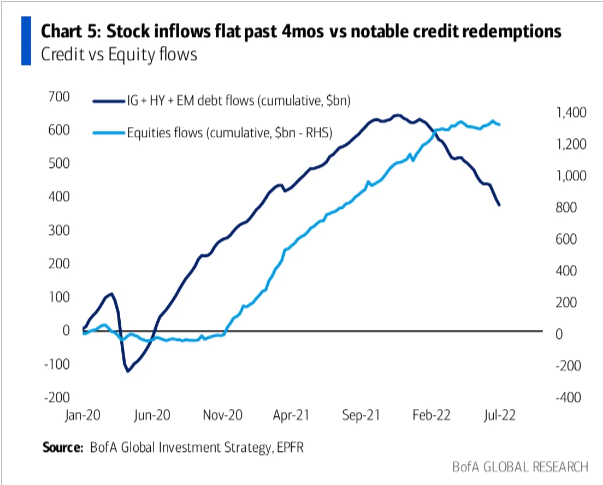

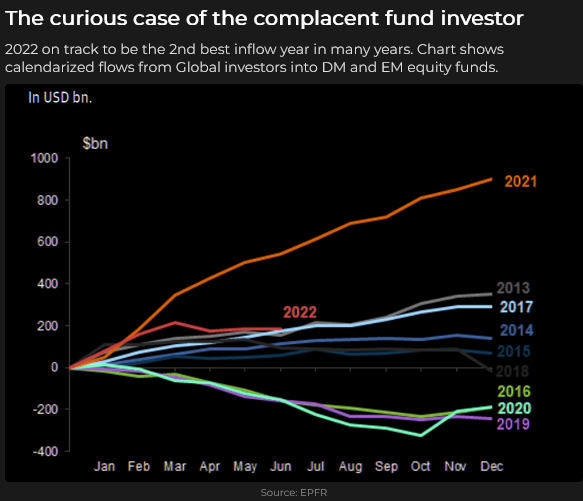

Capital has continued to flow into the stock market YTD, although it has flat-lined recently. There has been selling, but Vol metrics don’t indicate panic, and passive investors have not begun to sell.

Currencies

The US Dollar Index closed the week at a new 20-year high; the Yen is at a fresh 24-year low against the USD.

The Euro/Swiss dropped to new lows, while the EURUSD is only a hair away from 20-year lows.

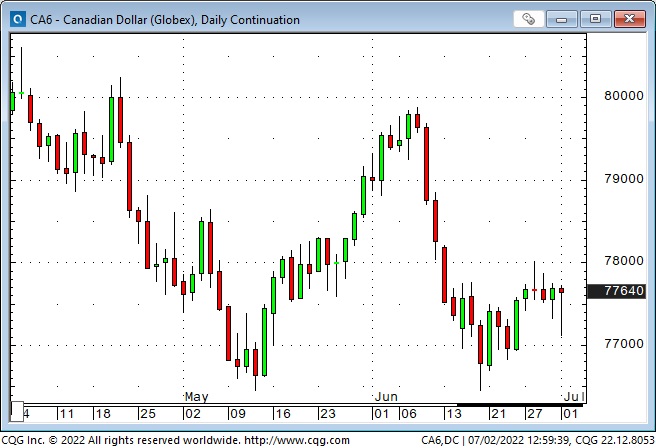

The CAD has held up well, around 77.5 cents, considering the overall strength of the USD, the weak stock market (an expression of risk-off sentiment) and the recent drop in commodities.

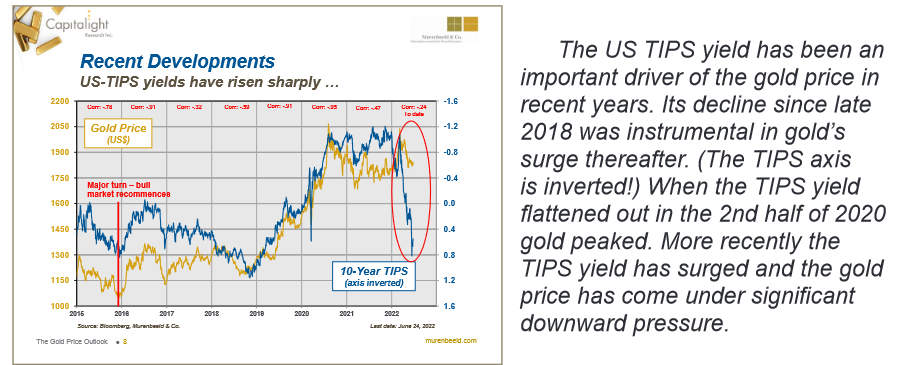

Gold

Gold dropped to a 5-month low early Friday but bounced back ~$30 by the close. Silver closed at a 1-year low.

These two charts are from the Gold Monitor, written by my good friend Martin Murenbeeld. The USD and real interest rates significantly impact the gold price.

My short-term trading

I was short the S+P this week, thinking that the bear market rally off the mid-June lows was inspired by the notion that the Fed would not be as aggressive as previously thought – but that the looming recession would overwhelm the idea of an easier Fed, and that would pressure stocks.

I was long T-Notes for much the same reason.

I was short CAD, thinking it would weaken with the USD being strong while stocks and commodities were weak. I covered the position for a small gain, thinking that it might rally if the CAD couldn’t fall in that “risk-off” environment.

I was flat going into the long weekend, and my P+L was up ~1.2% on the week.

Om my radar

I don’t enter a trade based on where I think a market could be months from now or where I think it should be relative to other markets, but I can’t help wondering about those things.

For instance, during H2 of 2021, I repeatedly told our Moneytalks listeners that I thought asset prices were “stretched,” that there was a lot of speculative froth showing up in different sectors, and that people should be careful about chasing things.

I felt a little silly doing that – like I was the buzz-killer telling the kids that if they drank too much at the party, they would wake up with a nasty hangover.

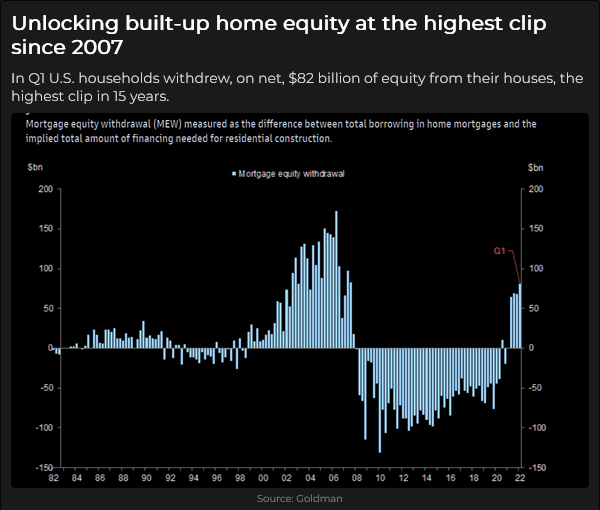

But right now, in my Big Picture view of the world, with the leading stock market indices down 20 -25%, I think the Big Risk is that we “ain’t seen nothing yet.”

We’ve had four or five bear market rallies since January, and each time those rallies ran out of steam, the market rolled over and made new lows. There has been selling but no panic. I know the Passive Investing Crowd believes that, in the long run, the stock market always goes up, but there will be “corrections,” which are good buying opportunities – a chance to lower your average buy-in cost.

I’m not “hoping” that Passive Investors start selling in a panic, and I believe that years of ultra-low interest rates “forced” a lot of people who should have been savers to become “investors.” But I think that trillions of dollars have flowed into the stock market based on some variation of the Passive theme, and if the broad indices keep trending lower, some of that money will start to exit.

Another Big Picture item is the US Dollar at 20-year highs. Many economists will argue, with good reason, that it is over-valued and “should” be lower. They may be correct, but IF the USD keeps trending higher, it will be another symptom of our world changing in unexpected ways.

I’m willing to bet that the recession is already here, and unemployment will start rising. That may be a reason for the Fed to pause, or it may be a reason for stocks to fall further, and I think those things could happen simultaneously.

This chart does nothing to dispel my concerns.

Thoughts on trading

When I see a great quote, I’m happy to steal it – but I also want to give the author full credit for his inspiration. Adam Mancini is a Canadian who actively trades stock index futures, and I recommend his Twitter feed to you. I loved this quote:

The Barney report

Barney is loving summer! This week he swam a few dog-paddle strokes for the first time! Previously, he only waded into the water, but this time he lunged for a floating stick in slightly deeper water and seemed surprised to find himself swimming! Another milestone!

When my grandmother wanted to take pictures of people, she always wanted them to stand in front of her flower garden. Taking photographs with colour film was expensive, and she tried to get the most into each photo. I’ve become my grandmother! Barney and I found a stand of poppies on one of our walks, and I positioned him in front of the flowers!

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The July 1 podcast is available at: https://mikesmoneytalks.ca.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

Thanks for taking a couple of minutes for our fun Canada poll. Mike will share the results in his special Canada Day show on July 1st.

Create your own user feedback survey