Op/Ed

Central Banks dominated the markets this week

The Fed raised rates by 75bps and forecasts much more to come. The Swiss National Bank surprised markets with a 50bps raise (to minus 25bps), the BoE raised 25bps, the ECB indicated that they would likely raise by more than 25bps in July, and the BoJ stood pat. The Bank of Canada is expected to raise by 50-75bps on July 13.

Short-term price action this week in stock, credit, currency and commodity markets was wickedly choppy. The S+P is down ~24% YTD, the Dow is down ~19%, and the Vanguard Total Stock Market ETF is down ~25%.

The BIG questions about Central Banks

Have Central Banks entered a new (Volker-like) era after more than two decades of throwing money around? Is their resolve to “bring down inflation” strong enough to keep raising rates (and otherwise tighten monetary policy) as “stuff” breaks? Will they continue raising rates into a recession? If they have found “religion,” what will cause them to “back off”? (A stock market down 50%? A crash in real estate prices? Soaring credit spreads? Sharply higher unemployment rates?) Given that they were woefully late in abandoning their “transitory” views, will their timing be any better when markets cry “Uncle?”

The BIG questions for markets

Are Central Banks the driving force in markets or only the catalyst for an overdue “shakeout?” If Central Banks have found “religion,” does that mean that most of the metrics (especially valuation metrics) that have worked over the past two decades are now worse than useless? If Central Banks have entered a “new era” (think of Fed Chair William Martin and his notion of “taking away the punch bowl…”) will people (retail and institutional) who bought into Passive Investing start selling?

Has a recession already started?

It all depends on your time frame

For short-term traders, the cacophony of negative wailing is a temptation to BUY. For longer-term investors, the markdown in various assets has been a sobering reminder that they were not nearly as rich as they thought. Reality (Mister Market) is catching up to unsustainability (over-leveraged speculative excesses), and TINA has gone out of style.

Equities

The major indices have round-tripped to just above where they were when Biden’s election and the Pfizer vaccine announcement in November 2020 ignited the run-for-the-roses final rally in the 12-year bull market.

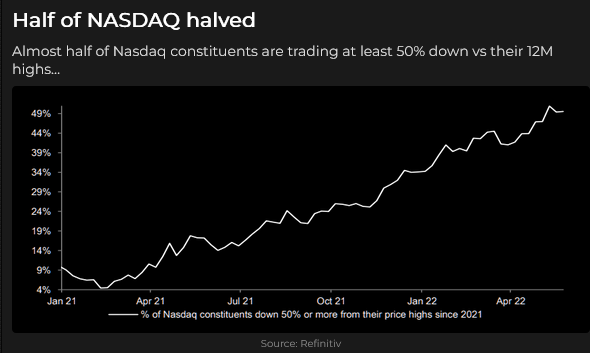

More speculative issues have had a more dramatic rise and fall.

The S+P futures fell ~13% (top to bottom) in the ten trading days from June 3 to June 16. This sharp decline has only happened on three different occasions in the last eleven years, and each time it was followed by a substantial rally. (But if we are in a new era of Central Bank behaviour, past performance is no guide to future performance.)

Credit

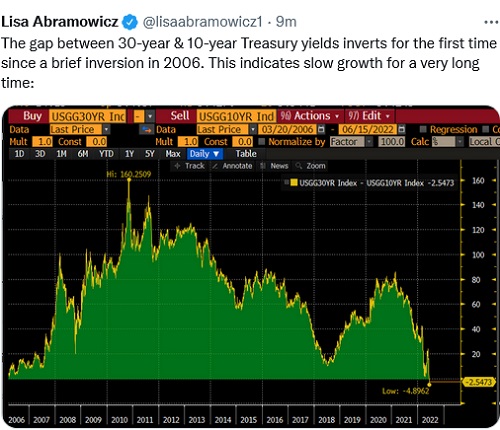

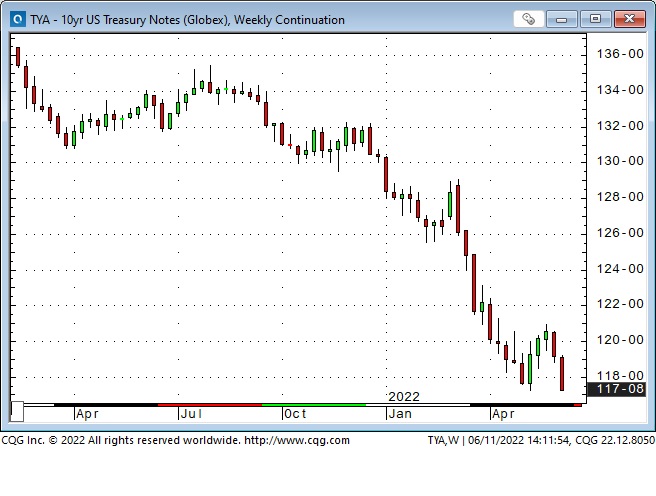

The US 10-Year TNote briefly traded at a record low 0.50% yield in August 2020. This week it briefly traded at a 3.5% yield, an eleven-year high.

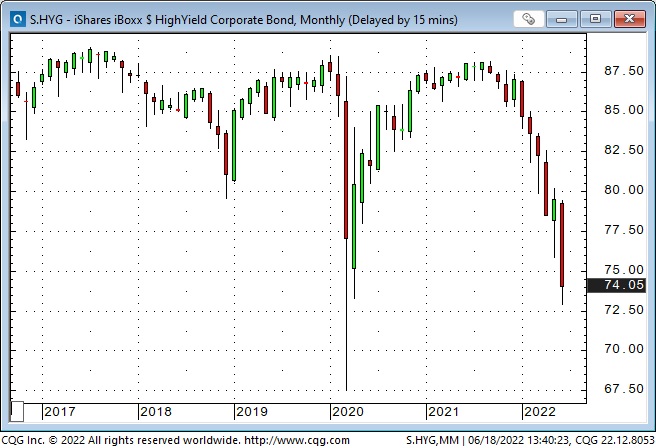

High-yield corporate bond prices have tumbled YTD. If this week’s closing level holds until month-end, it would be the lowest monthly close since the grim days of March 2009.

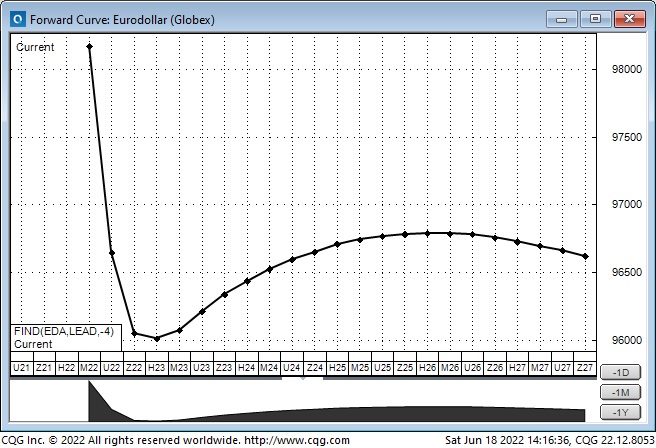

Forward Eurodollar futures contracts are pricing a sharp rise in short-term interest rates between now and March 2023, followed by a modest decrease. (these contracts trade at a discount to par – falling prices mean rising interest rates.)

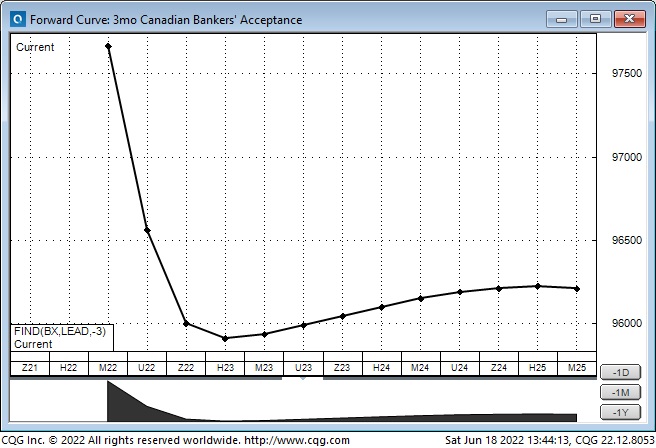

Canadian Bankers Acceptance futures contracts are pricing a similar trajectory.

Currencies

The US Dollar Index made a 20-year high this week, up ~18% from what I had frequently described as an “inflection point” on January 6, 2021, when the Capital Building in Washington, DC, was under siege. (Think of Rothchild’s quote about buying when blood runs in the streets.)

Short-term volatility in the currency markets has been wicked over the past six weeks.

Commodities

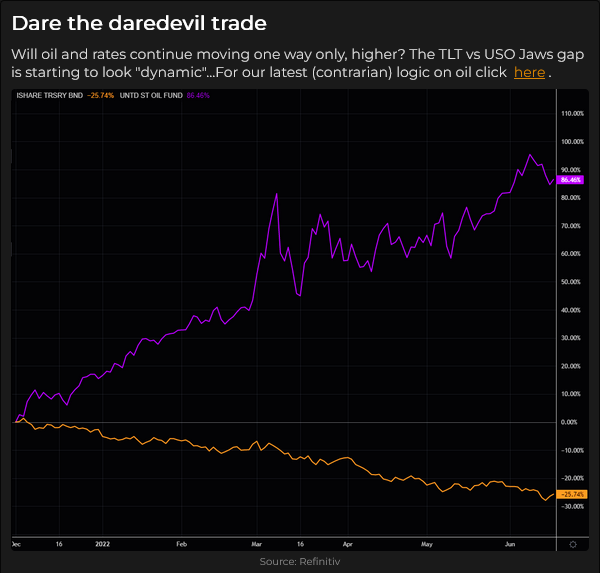

The bullish fossil fuels narrative (supply shortages) has been convincing, and capital has flowed into the “energy” markets – but what about demand? So far, “demand destruction” doesn’t appear to have happened, but markets discount the future, and the message coming from equity and credit markets may spark at least a correction in energy prices.

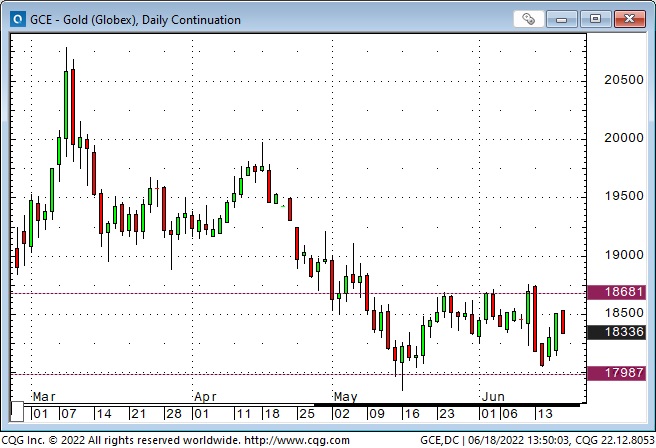

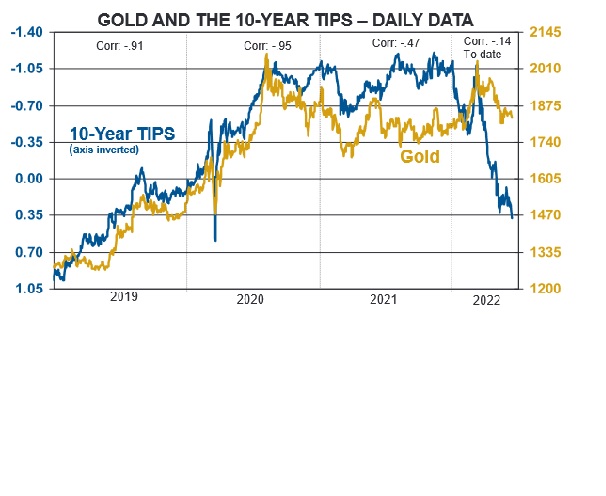

Gold has chopped sideways within a $75 range for the past six weeks as speculative interest continues to wane. A surging US Dollar and rising real interest rates are typically toxic for gold, so perhaps gold should be credited for “holding its own” lately.

The broad commodity indices (with a heavy energy weighting) may have created a bearish chart pattern: a failed breakout above recent resistance levels (~785) and a “lower high” (at 825) relative to the spike high in early March.

My short-term trading

A few months ago, I asked the rhetorical question: “Will the Fed throw the stock market under the bus in their quest to bring down inflation.” So far, the answer is “Yes.”

I bought the S+P four times this week, looking for a bounce. I traded small positions and used tight stops, but the net loss to my P+L was ~0.5%. On Wednesday, Fed day, I was ahead by 100 points at the high of the day, and if I had taken profits, then I would have had a 0.5% gain for the week instead of a loss. I decided to stay with the trade because I thought the market could rally (it had traded at an 18-month low the day before.)

In retrospect (!) I broke my new “rule” about taking quick profits in a counter-trend trade (and “staying with” trades that were in line with the prevailing trend.)

I bought the Euro on Thursday, looking for it to break above the previous highs for the week (~1.0579.) It did, soaring about 100 points above my entry price. (I bought the Euro because it was rallying despite Europe being neck-deep in negative sentiment.)

Once again, I decided to stay with the trade, rather than take quick profits. There was double bottom (mid-May and mid-June) on the charts, and a break above the 1.07 support/resistance line could ignite a big rally. I raised my stop to limit losses, and it was elected on Friday, resulting in a P+L loss of 0.15%.

I sold OTM short-dated (one week) TNote puts on Monday, thinking that bonds were egregiously over-sold. VOL was near record highs. I covered the position later in the day for a P+L loss of 0.20%.

I re-entered the trade on Thursday when TNotes rebounded from the week’s lows (made on three consecutive days.) I’ve held that position into the weekend.

I added (cautiously) to my bullish TNotes trade on Friday by buying futures and writing short-dated OTM calls, and I’ve held the positions into the weekend. My net unrealized P+L on the TNote trades is ~+0.20%, and my net account P+L is down ~0.65% for the week.

On my radar

Markets feel like they are at a “make or break” point.

As noted in the Equities section above, the S+P has only dropped >12% in ten days on three occasions since 2011, and it rebounded, big time, after each of those events. But if this is a “new Fed era,” the selling pressure may continue.

I think the market is pricing the Fed to tighten into a recession, which may already be dawning, and the economic slowdown will deepen quickly.

My “economic analysis” is only a background to my price action-driven trading decisions – but if price action is harmonious with my economic analysis, I’ll be inclined to “stay with” winning trades rather than take quick profits.

Thoughts on trading and risk management

I watched a fantastic video on Realvision TV this week with Mark Ritchie interviewing my friend, Peter Brandt.

Peter is my kind of trader in that he never “swings for the fences.” He believes that Job #1 for traders is to: Protect Capital. He sees trading as a job and is trying to build cash flow, not pick big winners.

Peter sees himself as a risk manager, not a trader. (Picture a prop trading firm. A bunch of traders are sitting in front of their screens, trying to make money by taking market risks. Behind them sits the risk manager. His job is to see that none of the traders blow up the firm. If a trader loses too much money, he gets a tap on the shoulder from the risk manager. Think of your account as a prop firm and yourself as the risk manager. Protect your capital.)

After keeping records of his trading for 40+ years, Peter discovered that 80% of his trading profits came from less than 20% of his trades. The profits on these trades were substantially more significant than the profits or losses on the other 80% of his trades. His “risk manager” job is to make sure that the other 80% of his trades don’t eat into the profits made by the 20%.

He is a technical “breakout” trader with a swing trading time horizon – a few days to a few weeks. He has also found that almost all of the trades that contributed to 80% of his profits started working immediately. (He put on the trade, and it immediately started making money.) Peter realized that it was essential to develop rules that allowed him to “stay with” a winning trade – to give it a chance to be one of the big winners that constituted 20% of his trades.

RealVision TV: I was a founding subscriber to RTV and also subscribed to some of their more expensive services. I interviewed Raoul on Moneytalks radio (Canada’s most popular financial talk show) and strongly recommended listeners subscribe to RTV. I was dismayed, however, when Raoul publicly declared to his audience (primarily millennials, I believe) that he was “irresponsibly long” crypto. I thought he was “irresponsible” to do that, given his “guru” status with his relatively unsophisticated audience.

I cancelled my RTV subscription but later re-subscribed. They have great interviews with excellent analysts and traders, and I tune out their relentless crypto bullishness.

The Barney report

Barney became part of our family in early November last year when he was eight weeks old. He grew like a weed for the next several months but seems to have levelled out around 60 pounds over the last six weeks. He used to gulp down his food but lately, he will eat some of it and, maybe, come back later and do a cleanup.

He loves to get outside and explore, and we always look for new places to take him. Recently I started taking him to a meadow (about 40 acres in size) with trails through tall grass. He loves it, and we play lots of hide-and-seek games in the tall grass.

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The June 18 podcast is available at: https://mikesmoneytalks.ca.

You can listen to my 30-minute June 11 “This Week In Money” interview with Jim Goddard. Marc Faber and Ross Clark are also on that week’s podcast.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

Markets expect Central Banks to become more aggressive – stocks tumble, while interest rates and the US Dollar surge higher

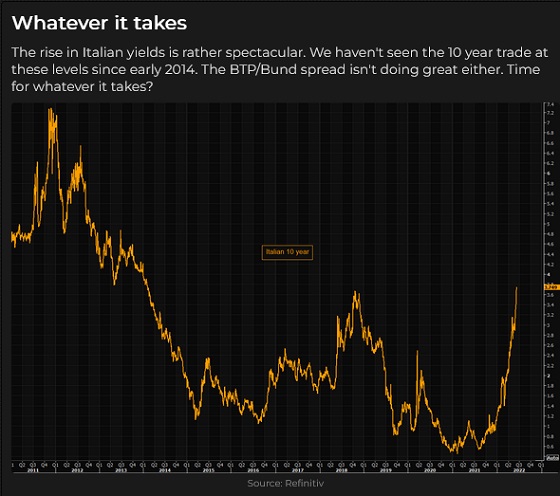

The ECB finally “grasped the nettle” on Thursday, but their announced intentions (to raise interest rates by 0.25% next month and to also stop buying bonds) were tepid relative to soaring inflation, so the Euro fell sharply Vs. the USD, interest rates jumped, and sovereign spreads widened dramatically.

On Friday, the CPI report was hotter than expected, and consumer sentiment plunged to a record low. Interest rates surged higher, credit quality spreads widened, and the US Dollar soared while stocks tumbled.

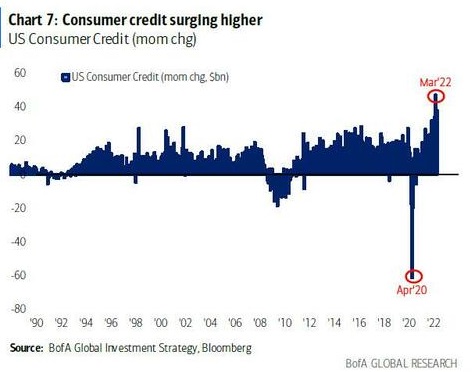

Consumer spending is ~70% of American GDP. Consumers are more worried about inflation than anything else. Previously, inflation was mostly confined to financial assets and real estate, but now inflation is hitting consumer necessities like food, fuel and electricity. Consumer spending has been holding up, but consumer debt is rising sharply.

I expect consumer spending to fall sharply as Central Banks raise interest rates. The economy will slow faster than CBs currently expect, corporations will struggle to maintain margins, and PE ratios will shrink.

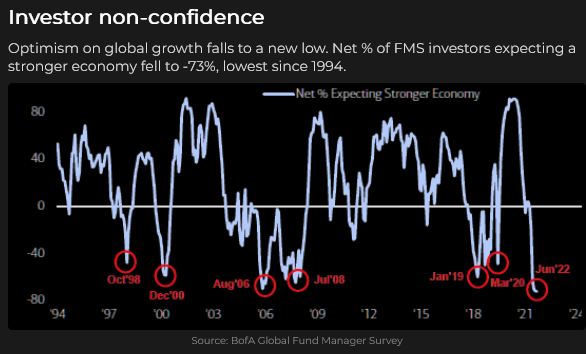

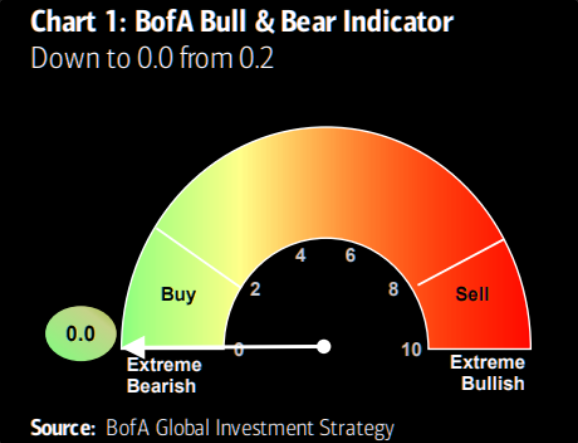

A few weeks ago, some analysts were toying with the thought that “peak tightening” had come and gone and that the market had “over-priced” how aggressive the Fed would be. By the end of this week, sentiment had shifted to the idea that (to para-phrase BofA’s Michael Hartnett) “In short, the inflation shock isn’t over, and the rates shock is just starting (the growth shock is coming, and so is a recession.”)

The US 10-Year bond futures are at a 12-year low (yields at a 12-year high of 3.17%).

The US 2-year note futures are at a 14-year low (yields at a 14-year high of 3.07%.)

The (May 12 to June 2) bear market rally is over

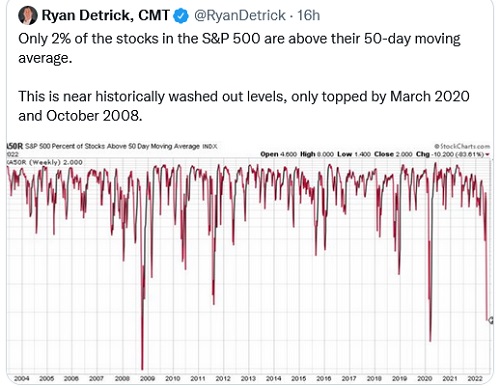

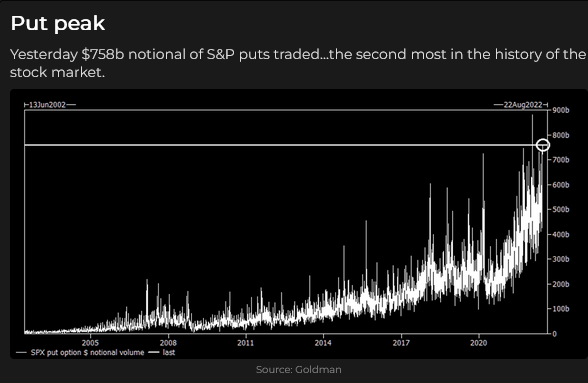

The S+P has closed lower in 9 of the last 10 weeks, with this week being the worst week YTD, yet volatility metrics remain below the highs made on May 12, when the S+P touched a 14-month low and was (briefly) down more than 20% YTD. Perhaps the market isn’t “worried enough” to have made a bottom.

The market cap of global stocks is down ~$23 Trillion from last November’s ATH of ~$100 Trillion. That’s equivalent to about one full year’s worth of US GDP.

The US Dollar rallied against virtually all other currencies this week

My FX mantra for the past 40 years has been that capital flows to the USA for safety and opportunity. When markets are “worried,” the USD is bid. The “opportunity” in the USD now is higher interest rates and security in an appreciating currency.

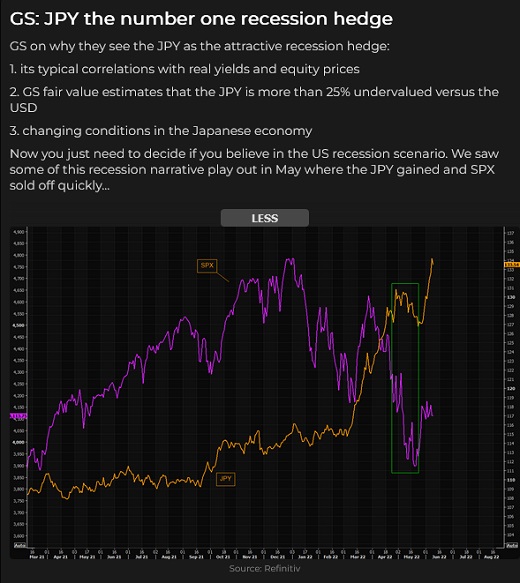

The Yen was down again this week (down 14% YTD), hitting a new 20-year low due to ultra-loose BOJ policies. However, a rare joint statement of “concern” from the BoJ, the MoF and the Financial Services Agency late this week may presage a “change in tone” at next week’s BOJ meeting.

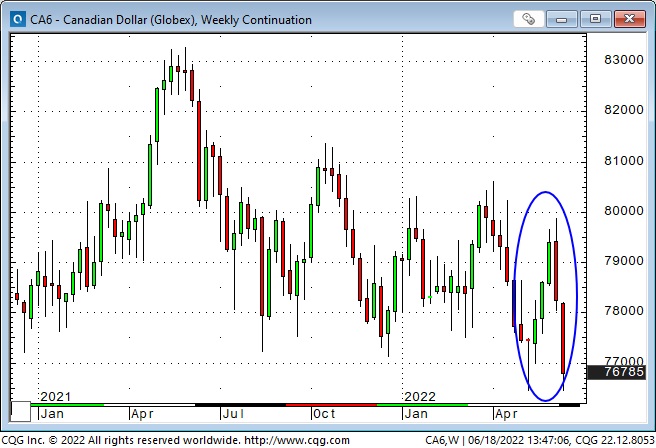

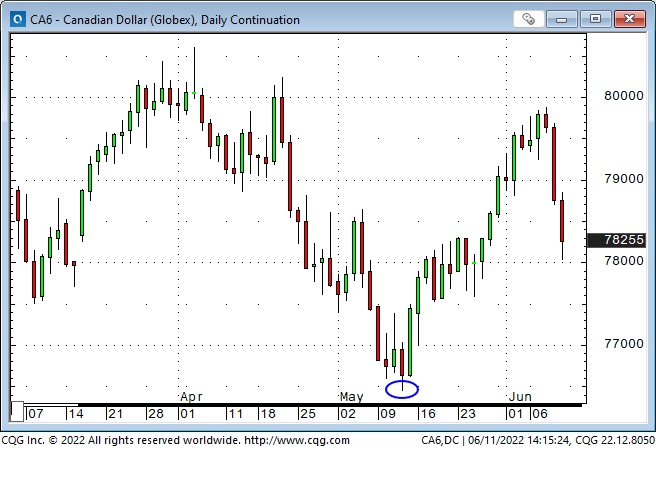

The Canadian Dollar hit a 20-month low on May 12 (as the S+P hit a 14-month low and the USD made a 20-year high) and then rallied to nearly 80 cents over the next four weeks as the USD weakened, commodities (especially crude) and stocks rallied, and market sentiment shifted to risk-on.

The CAD fell nearly two cents this week as the USD surged (the Euro plunged) and stock markets tumbled. The CAD weakness was sustained despite Canadian unemployment levels hitting a 46-year low of 5.1% and average wages growing ~4% YoY. (These reports will likely harden the BoC’s resolve to raise interest rates aggressively – keeping Canadian interest rates at a premium to American rates.) The CAD also fell despite fossil fuel prices remaining firm.

The solid historical correlation between the CAD and commodity prices may not be showing up in USDCAD (the tremendous strength of the USD has trumped the CAD/commodity correlation) but note that the CAD is at a 9-year high against the major European currencies and a 14-year high against the Yen.

Gold rallies ~$50 on Friday despite surging interest rates and a strong USD

Gold hit a new All-Time High of ~$2075 following the Russian invasion of Ukraine (and the subsequent sanctions) but dropped as much as $300 by early May as the USD strengthened and as interest rates (especially real rates) rose.

On Friday morning, gold dropped to a 3-week low on the CPI report but then rallied ~$50 to a one-month high even as the USD soared. It is unusual to see both gold and the USD enjoy a big rally on the same day – it is often a sign that markets are “worried.”

Gold open interest climbed about 28% from early February to the March spike and has now returned to early February levels. (Speculators bought the market on the way up and sold it on the way down.) Given that gold has “held up” reasonably well despite the strong USD and the return of real yields to positive territory, the purging of speculative interests may set the stage for another leg higher.

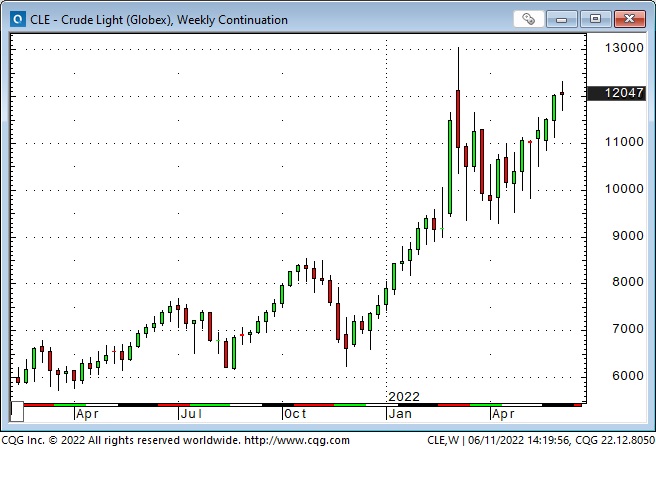

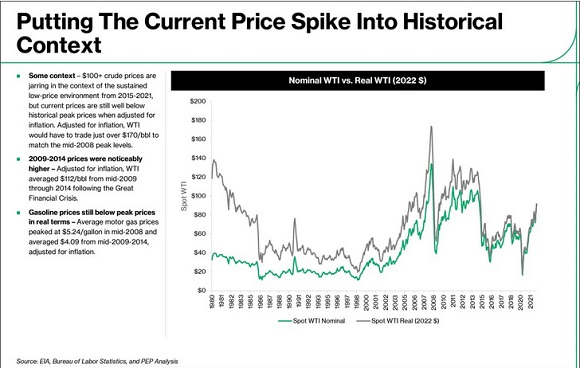

Fossil fuel markets remain strong

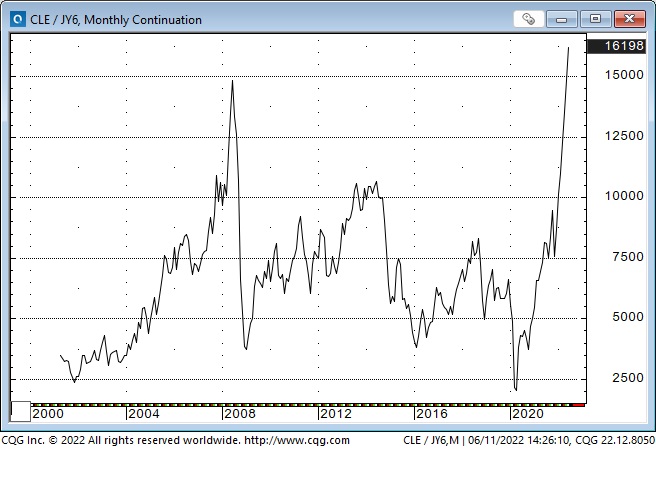

WTI crude oil traded above $130 in early March (when gold was hitting ATH) for the first time since 2008. Prices dropped ~$35 following that spike but have been trending higher for the past two months, with this week’s close (on a continuous basis) the highest since 2008. Gasoline and Heating Oil futures (lacking refining capacity) have been stronger than WTI futures and have recently traded at ATH.

While gasoline, diesel and crude oil prices have been the focus of media attention, North American natural gas prices have more than tripled from their average over the past five years. (The US is exporting LNG to Europe.)

With the Yen at 20-year lows, the Yen price of WTI crude has soared to an ATH.

My short-term trading

I returned from a 5-day road trip on Monday afternoon, and it took me a few days to understand what to do in the markets. I shorted the S+P futures Thursday morning and covered the position shortly after the CPI report Friday morning. I’m flat going into the weekend, and my P+L is up >0.50% on the week.

On my radar

The possibility of Central Banks “tightening into a recession” sets the stage for “something” (or maybe several things) to break. I will look for opportunities in markets that have made strong one-way moves to reverse. That doesn’t mean simply taking a counter-trend position, but if I see a trend break and a subsequent attempt to return to trend fail, I’ll get interested.

Thoughts on trading

One of the best reasons I keep writing this blog is that it connects me with other traders I would not otherwise have met. When swapping emails with another trader, I usually keep the “message” short and to the point. Here are a couple of edited quotes (from me) to another trader this week:

My road trip caused a disconnect between me and the markets, which may be a good thing. My trading time horizon the past few months had become very short-term – day-trading – and historically, my strong suit has been a swing-trading time frame; a few days to a few weeks.

The short-term volatility in markets (particularly equity futures) “forced” me into a shorter-term time horizon.

So I’m back at my desk with a “clean sheet” in front of me. As a person with “multiple personalities,” I’ll be interested to see who shows up!

Interesting that you mention Cathie Wood. I saw a story about her maintaining that deflation is a bigger worry than inflation – that’s an interesting thought (especially if she’s right!)

The essence of what you’re doing (looking at market correlations, seeing a breakdown in CAD/WTI, and CAD/commodities – seeing the near-universal energy market bullishness) is classic Bruce Kovner: What I am really looking for is a consensus that the market is not confirming. I like to know that there are a lot of people that are going to be wrong.

Risk Management Quotes from the Notebook

At that moment, I was confronted with the realization that I had blown a great deal of what I thought I knew about discipline. To this day, when something happens to disturb my emotional equilibrium and my sense of what the world is like, I close out all positions related to that event. Bruce Kovner, The Market Wizards, 1989

My comment: The Market Wizards is a must-read for traders, and the interview with Bruce Kovner is one of the best in the book. As I keep repeating, I make money from managing risk, not from having a great crystal ball. I know that things I can’t possibly anticipate can happen, so I need to do whatever I can to avoid taking a devastating trading loss.

Time and time again, when I read interviews with accomplished traders who are asked for advice for new traders, they say, keep your size small. That way, if you’re wrong, you don’t get killed. Having a BIG position inevitably means you’ve got your ego tied up in the trade, and if it goes against you, you will either fight it or freeze – which is precisely the worst thing you can do.

The Barney report

When I returned from my 5-day road trip, Barney was thrilled to see me – and I was delighted to see him. We had previously never been apart for more than a day.

We live on a golf course, and Barney loves to find golf balls. I take him out in the evening when no players are on the course, and he finds balls I can’t see. He gets a treat every time he finds a ball.

My wife and I have been giving away golf balls on our back fence for the past five years. We will have given away over 11,000 balls by the end of this season – and these days, Barney is finding more balls than my wife and I put together!

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you want to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >20 years. The June 11 podcast is available at: https://mikesmoneytalks.ca.

You can listen to my June 4th interview with Mike, where I talk about some of my risk management rules, here.

You can listen to my 30-minute June 11 “This Week In Money” interview with Jim Goddard. Marc Faber and Ross Clark are also on this week’s podcast.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

Bloomberg: The US may need 250 million acres for wind farms alone to reach zero emissions by 2050.

- A 200-megawatt wind farm takes up 13 square miles.

- A natural-gas power plant with that same generating capacity could fit onto a single city block.

~ Brian Gitt

Q1 Report:

‣ $6.9 million in total revenue over a three-month period

‣ Acquisition of Integra Networks, a cybersecurity solutions provider with a large Canadian federal presence in Ottawa

‣ Expanded leadership team with two seasoned C-level executives coming aboard

As it stands, the broad stock market hasn’t entered bear territory, defined as a 20% decline from recent highs. As of midday Tuesday, the S&P 500 was trading 18.5% below its January peak. But that doesn’t mean you aren’t experiencing your own personal version, especially if you own individual stocks or cryptocurrency.

“Technically we’re not in a bear market, but the average investor is in a bear market,” says Ryan Detrick, chief market strategist for LPL Financial. “The median stock is down 25%. Half the stocks in the Nasdaq have been cut in half. Investors feel like it’s a bear if they look at their portfolios.”

If you’ve made some speculative bets in your portfolio that look like losers lately, your situation may get worse. That’s because you may be prone to unconscious biases that guide your choices around your individual investments that could hurt your portfolio further, say behavioral finance experts.

“All of these investor biases tend to run into each other, but when markets get really volatile, some of them really stand out,” says Scott Nations, president of investment volatility analytics firm NationsShares and author of “The Anxious Investor.”…read more.