Currency

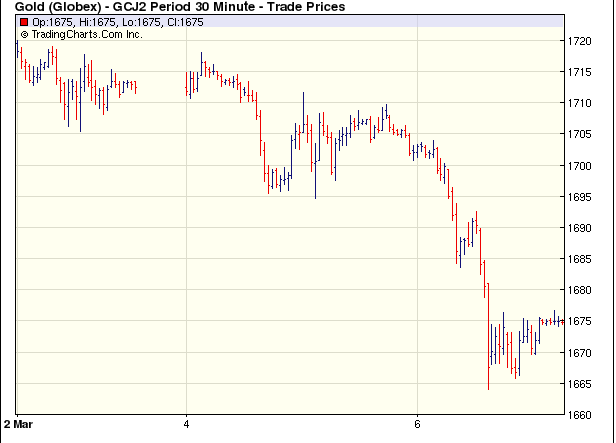

#1 Gold Timer of the Year 2011 Stephen Todd March 6th/2012: “GOLD: Gold got clobbered along with stocks. This finally puts us on a sell.”

#2 Gold Timer of the Year 2011 & #1 Gold Market timer for the 5 year period ending in 2010 Mark Leibovit March 6th/2012: GOLD – ACTION ALERT – BUY (And Take Delivery Of The Physical Metals)

Billionaire Sprott: What are the repercussions of all this money printing?

2012 is proving to be the ‘Year of the Central Bank’. It is an exciting celebration of all the wonderful maneuvers central banks can employ to keep the system from falling apart. Western central banks have gone into complete overdrive since last November, convening, colluding and printing their way out of the mess that is the Eurozone. The scale and frequency of their maneuvering seems to increase with every passing week, and speaks to the desperate fragility that continues to define much of the financial system today.

The first major maneuver took place on November 30, 2011, when the world’s G6 central banks (the Federal Reserve, the Bank of England, the Bank of Japan, the European Central Bank [ECB], the Swiss National Bank, and the Bank of Canada) announced “coordinated actions to enhance their capacity to provide liquidity support to the global financial system”. Long story short, in an effort to avert a total collapse in the European banking system, the US Fed agreed to offer unlimited US dollar swap agreements with the other central banks. These US dollar swaps allow the other central banks, most notably the ECB, to borrow US dollars from the Federal Reserve and lend them to their respective national banks to meet withdrawals and make debt payments. The best part about these swaps is that they are limitless in scope — meaning that until February 1, 2013, the Federal Reserve is, and will be, prepared to lend as many US dollars as it takes to keep the financial system from imploding. It sounds absolutely great, and the Europeans should be nothing but thankful, except for the tiny little fact that to supply these unlimited US dollars, the Federal Reserve will have to print them out of thin air.

Don’t worry, it gets better. Since unlimited US swap lines weren’t enough to solve the problem, roughly three weeks later, on December 21, 2011, the European Central Bank launched the first tranche of its lauded Long Term Refinancing Operation (LTRO). This is the program where the ECB flooded 523 separate European banks with 489 billion euros worth of 3-year loans to keep them going through Christmas. A second tranche of LTRO loans is planned to launch at the end of February, with expectations for size ranging from 300 billion to more than 1 trillion euros of uptake. The good news is that Italian, Portuguese and Spanish bond yields have dropped since the first LTRO went through, which suggests that at least some of the initial LTRO funds have been reinvested back into sovereign debt auctions. The bad news is that the Eurozone banks may now be hooked on what is clearly a back-door quantitative easing (QE) program, and as the warning goes for addictive drugs — once you start, it can be very hard to stop.

Britain is definitely hooked. On February 9, 2012, the Bank of England announced another QE extension for 50 billion pounds, raising their total QE print to £325 billion since March 2009. Japan’s hooked as well. On February 14, 2012, the Bank of Japan announced a ¥10 trillion ($129 billion) expansion to its own QE program, raising its total QE program to ¥65 trillion ($825 billion). Not to be outdone, in the most recent Fed news conference, US Fed Chairman Bernanke signaled that the Fed will keep interest rates near zero until late 2014, which is 18 months later than he had promised in Fed meetings last year. If Bernanke keeps his word, by the end of 2014 the US government will have enjoyed near zero interest rates for six years in a row. Granted, extended zero percent interest rates is not nearly as satisfying as a proper QE program, but who needs traditional QE when the Fed already buys 91 percent of all 20-30 year maturity US Treasury bonds? Perhaps they’re saving traditional QE for the upcoming election.

All of this pervasive intervention most likely explains more than 90 percent of the market’s positive performance this past January. Had the G6 NOT convened on swaps, had the ECB NOT launched the LTRO programs, and had Bernanke NOT expressed a continuation of zero interest rates, one wonders where the equity indices would trade today. One also wonders if the European banking system would have made it through December. Thank goodness for “coordinated action”. It does work in the short-term.

But what about the long-term? What are the unintended consequences of repeatedly juicing the system? What are the repercussions of all this money printing? We can think of a few.

First and foremost, without continued central bank support, interbank liquidity may cease to function entirely in the coming year. Consider the implications of the ECB’s LTRO program: when you create a loan program to save the EU banks and make its participation voluntary, every one of those 523 banks that participates is essentially admitting that they have a problem. How will they ever lend money to each other again? If you’re a bank that participated in the LTRO program because you were on the verge of bankruptcy, how can you possibly trust other banks that took advantage of the same program? The ECB’s LTRO program has the potential to be very dangerous, because if the EU banks start to rely on the loans too heavily, the ECB may find itself inadvertently attached to the broken EU banking system forever.

The second unintended consequence is the impact that interventions have had on the non-G6 countries’ perception of western solvency. If you’re a foreign lender to the United States, Britain, Europe or Japan today, how comfortable can you possibly be in lending them money? How do you lend to countries whose sole basis as a going concern rests in their ability to wrangle cash injections printed by their respective central banks? Going further, what happens when the rest of the world, the non-G6 world, starts to question the G6 Central Banks themselves? What entity exists to bailout the financial system if the market moves against the Fed or the ECB?

The fact remains that there are few rungs left in the financial confidence chain in 2012, and central banks may end up pushing their printing schemes too far. In 2008-2009, it was the banks that lost credibility and required massive bailouts by their respective sovereign states. In 2010-2011, it was the sovereigns, most notably those in Europe, that lost credibility and required massive bailouts by their respective central banks. But there is no lender of last resort for the central banks themselves. That the IMF is now trying to raise another $600 billion as a security buffer doesn’t go unnoticed, but do they honestly think that’s going to make any difference?

When reviewing today’s macro environment, we keep coming back to the same conclusion. The non-G6 world isn’t blind to the efforts of the Fed and the ECB. When the Fed openly targets a 2 percent inflation rate, foreign lenders know that means they will lose, at a minimum, at least 2 percent of purchasing power on their US loans in 2012. It therefore shouldn’t surprise anyone to see those lenders piling into alternative assets that have a better chance at protecting their wealth, long-term.

This is likely why China reduced its US Treasury exposure by $32 billion in the month of December (See Figure 1). This is also why China, which produced 360 tonnes of gold internally last year, also imported an additional 428 tonnes in 2011, up from 119 tonnes in 2010. This may also be why China’s copper imports hit a record high of 508,942 tonnes in December 2011, up 47.7 percent from the previous year, despite the fact that their GDP declined at year-end. Same goes for their crude oil imports, which hit a record high of 23.41 million metric tons this past January, up 7.4 percent year- over-year. The so-called experts have a habit of downplaying these numbers, but it seems pretty clear to us: China isn’t waiting around for next QE program. They are accelerating their move away from paper currencies and into hard assets.

2012 is proving to be the ‘Year of the Central Bank’. It is an exciting celebration of all the wonderful maneuvers central banks can employ to keep the system from falling apart. Western central banks have gone into complete overdrive since last November, convening, colluding and printing their way out of the mess that is the Eurozone. The scale and frequency of their maneuvering seems to increase with every passing week, and speaks to the desperate fragility that continues to define much of the financial system today.

The first major maneuver took place on November 30, 2011, when the world’s G6 central banks (the Federal Reserve, the Bank of England, the Bank of Japan, the European Central Bank [ECB], the Swiss National Bank, and the Bank of Canada) announced “coordinated actions to enhance their capacity to provide liquidity support to the global financial system”. Long story short, in an effort to avert a total collapse in the European banking system, the US Fed agreed to offer unlimited US dollar swap agreements with the other central banks. These US dollar swaps allow the other central banks, most notably the ECB, to borrow US dollars from the Federal Reserve and lend them to their respective national banks to meet withdrawals and make debt payments. The best part about these swaps is that they are limitless in scope — meaning that until February 1, 2013, the Federal Reserve is, and will be, prepared to lend as many US dollars as it takes to keep the financial system from imploding. It sounds absolutely great, and the Europeans should be nothing but thankful, except for the tiny little fact that to supply these unlimited US dollars, the Federal Reserve will have to print them out of thin air.

Don’t worry, it gets better. Since unlimited US swap lines weren’t enough to solve the problem, roughly three weeks later, on December 21, 2011, the European Central Bank launched the first tranche of its lauded Long Term Refinancing Operation (LTRO). This is the program where the ECB flooded 523 separate European banks with 489 billion euros worth of 3-year loans to keep them going through Christmas. A second tranche of LTRO loans is planned to launch at the end of February, with expectations for size ranging from 300 billion to more than 1 trillion euros of uptake. The good news is that Italian, Portuguese and Spanish bond yields have dropped since the first LTRO went through, which suggests that at least some of the initial LTRO funds have been reinvested back into sovereign debt auctions. The bad news is that the Eurozone banks may now be hooked on what is clearly a back-door quantitative easing (QE) program, and as the warning goes for addictive drugs — once you start, it can be very hard to stop.

Britain is definitely hooked. On February 9, 2012, the Bank of England announced another QE extension for 50 billion pounds, raising their total QE print to £325 billion since March 2009. Japan’s hooked as well. On February 14, 2012, the Bank of Japan announced a ¥10 trillion ($129 billion) expansion to its own QE program, raising its total QE program to ¥65 trillion ($825 billion). Not to be outdone, in the most recent Fed news conference, US Fed Chairman Bernanke signaled that the Fed will keep interest rates near zero until late 2014, which is 18 months later than he had promised in Fed meetings last year. If Bernanke keeps his word, by the end of 2014 the US government will have enjoyed near zero interest rates for six years in a row. Granted, extended zero percent interest rates is not nearly as satisfying as a proper QE program, but who needs traditional QE when the Fed already buys 91 percent of all 20-30 year maturity US Treasury bonds? Perhaps they’re saving traditional QE for the upcoming election.

All of this pervasive intervention most likely explains more than 90 percent of the market’s positive performance this past January. Had the G6 NOT convened on swaps, had the ECB NOT launched the LTRO programs, and had Bernanke NOT expressed a continuation of zero interest rates, one wonders where the equity indices would trade today. One also wonders if the European banking system would have made it through December. Thank goodness for “coordinated action”. It does work in the short-term.

But what about the long-term? What are the unintended consequences of repeatedly juicing the system? What are the repercussions of all this money printing? We can think of a few.

First and foremost, without continued central bank support, interbank liquidity may cease to function entirely in the coming year. Consider the implications of the ECB’s LTRO program: when you create a loan program to save the EU banks and make its participation voluntary, every one of those 523 banks that participates is essentially admitting that they have a problem. How will they ever lend money to each other again? If you’re a bank that participated in the LTRO program because you were on the verge of bankruptcy, how can you possibly trust other banks that took advantage of the same program? The ECB’s LTRO program has the potential to be very dangerous, because if the EU banks start to rely on the loans too heavily, the ECB may find itself inadvertently attached to the broken EU banking system forever.

The second unintended consequence is the impact that interventions have had on the non-G6 countries’ perception of western solvency. If you’re a foreign lender to the United States, Britain, Europe or Japan today, how comfortable can you possibly be in lending them money? How do you lend to countries whose sole basis as a going concern rests in their ability to wrangle cash injections printed by their respective central banks? Going further, what happens when the rest of the world, the non-G6 world, starts to question the G6 Central Banks themselves? What entity exists to bailout the financial system if the market moves against the Fed or the ECB?

The fact remains that there are few rungs left in the financial confidence chain in 2012, and central banks may end up pushing their printing schemes too far. In 2008-2009, it was the banks that lost credibility and required massive bailouts by their respective sovereign states. In 2010-2011, it was the sovereigns, most notably those in Europe, that lost credibility and required massive bailouts by their respective central banks. But there is no lender of last resort for the central banks themselves. That the IMF is now trying to raise another $600 billion as a security buffer doesn’t go unnoticed, but do they honestly think that’s going to make any difference?

When reviewing today’s macro environment, we keep coming back to the same conclusion. The non-G6 world isn’t blind to the efforts of the Fed and the ECB. When the Fed openly targets a 2 percent inflation rate, foreign lenders know that means they will lose, at a minimum, at least 2 percent of purchasing power on their US loans in 2012. It therefore shouldn’t surprise anyone to see those lenders piling into alternative assets that have a better chance at protecting their wealth, long-term.

This is likely why China reduced its US Treasury exposure by $32 billion in the month of December (See Figure 1). This is also why China, which produced 360 tonnes of gold internally last year, also imported an additional 428 tonnes in 2011, up from 119 tonnes in 2010. This may also be why China’s copper imports hit a record high of 508,942 tonnes in December 2011, up 47.7 percent from the previous year, despite the fact that their GDP declined at year-end. Same goes for their crude oil imports, which hit a record high of 23.41 million metric tons this past January, up 7.4 percent year- over-year. The so-called experts have a habit of downplaying these numbers, but it seems pretty clear to us: China isn’t waiting around for next QE program. They are accelerating their move away from paper currencies and into hard assets.

China is not alone in this trend either. Russia has reportedly cut its US Treasury exposure by half since October 2010. Not surprisingly, Russia was also a big buyer of gold in 2011, adding approximately 95 tonnes to its gold reserves, with 33 tonnes added in the fourth quarter alone. It’s not hard to envision higher gold prices if the rest of the non-G6 countries follow-suit.

The problem with central bank intervention is that it never works out as planned. The unintended consequences end up cancelling out the short-term benefits. Back in 2008, when the Fed introduced zero percent interest rates, everyone thought it was a great policy. Four years later, however, and we’re finally beginning to appreciate the complete destruction it has wreaked on savers. Just look at the horror show that is the pension industry today: According to Credit Suisse, of the 341 companies in the S&P 500 index with defined benefit pension plans, 97 percent are underfunded today. According to a recent pension study by Seattle-based Milliman Inc., the combined deficit of the 100 largest defined-benefit plans in the US increased by $236.4 billion in 2011 alone. The main culprit for the increase? Depressed interest rates on government bonds.

Let’s also not forget the public sector pension shortfalls, which are outright frightening. In Europe, unfunded state pension obligations are estimated to total $39 trillion dollars, which is approximately five times higher than Europe’s combined gross debt. In the United States, unfunded pension obligations increased by $2.9 trillion in 2011. If the US actually acknowledged these costs in their deficit calculations, their official 2011 fiscal deficit would have risen from the reported $1.3 trillion to $4.2 trillion. Written the long way, that’s a deficit of $4,200,000,000,000,… in one year.

There is unfortunately no economic textbook to guide us through these strange times, but common sense suggests we should be extremely wary of the continued maneuvering by central banks. The more central banks print to save the system, the more the system will rely on their printing to stay solvent — and you cannot solve a debt problem with more debt, and you cannot print money without serious repercussions. The central banks are fueling a growing distrust among the creditor nations that is forcing them to take pre-emptive actions with their currency reserves. Individual investors should take note and follow-suit, because it will be a lot easier to enjoy the “Year of the Central Bank” if you own things that can actually benefit from all their printing, as opposed to things that can only be destroyed by it.

Regards,

Eric Sprott and David Baker

for The Daily Reckoning

Mark Leibovit – STOCKS – ACTION ALERT – SELL (Looking to Buy In A Month or Two)

What’s interesting is that the year to date has been the best start in stock indices since 1998 according to Dow Jones Newswires. As of the close today this is the 45th consecutive day without a triple digit decline. A canary in the coal mine? Today is ‘Turnaround Tuesday’, so with markets down a bit yesterday perhaps we can stage a rally today. But wait! Tomorrow is ‘Weird Wollie Wednesday’ and often either tomorrow or Thursday, according to the lore, there should be a shakeout ahead of a week from Friday’s Options Expiration. Is all of this just noise? Well, maybe not. We’re approaching that time of year when the markets often experience some form of indigestion. Yesterday, though the volume was NOT excessive, nevertheless we did volume increase to the downside. Benjamin Netanyahu spoke last night (covered sole on Fox News) before the American Israel Public Affairs Committee (AIPAC) and warned that time is running out for Iran. Folks, brace yourself. Sometime before now and the end of May, we’re likely to see a full scale confrontation unfold as the Mayans watch from the heavens. Would this be a good time to be in the marketplace? Markets don’t like uncertainty. I think the answer is no. The 50 and 200 day moving averages in the S&P 500 current sit at roughly 1323 and 1270. These are the next two potential downside targets if the S&P 500 cannot post a new high between now and the first of April. Apple, Inc. took a bit of a nosedive today. If Apple can’t rally (and it was about the only big stock doing so), the writing may be on the wall. Think about it. I can’t imagine one mutual fund, one institution, one endowment or one growth portfolio not owning Apple. Everyone now owns it, but where are the buyers should these folks decide to sell? I have avoided Apple because it is technically way, way too, extended and would only arouse my interest if it sold off back into the low to mid 400s – maybe lower. I’ve changed my mind. Time to flip to a SELL signal. Let’s see where the market is come the beginning of April or even perhaps the end of May. If the market rallies a bit higher first and you decide not to sell here, I would use that strength to lighten up. Now is a time to step aside and watch from the sidelines. I still believe there could be another big rally, but let’s revisit this market in a month or two. I am going to cash! – Mark Leibovit – for a VRTrader TRIAL SIGNUP go HERE

Four Cycle Turns Warn of a Stock Market Top in March 2012

There is a lot of cycle evidence that suggests a top is coming in March 2012. How significant a top is hard to say, but the odds are the coming decline will be at least in the 10 percent area. If this coming top is the top of Grand Supercycle degree wave {III}, then stocks will begin a decline that could retrace 50 percent or more of the market over the next several years, with large chunks of decline occurring incrementally, followed by normal 40 to 60 percent retracements as stocks work toward significantly lower levels. This weekend we will present this cycle evidence, which we believe is compelling.

First of all, the last phi mate turn date was in December, which led to a two month rally of significance. It was a major phi mate turn. March 7th is the next phi mate date, and the only phi mate turn date since that December turn. It also is a major phi mate turn, meaning its phi mate, its partner date, was also a major turn.

….read & view more charts HERE

Last month, Money Morning showed you how to use a technique called selling “cash-secured puts” to generate a steady flow of cash from a stock – even if you no longer own the shares.

It is a highly effective income strategy that can also be used to buy stocks at bargain prices.

But selling cash-secured puts does have a couple of drawbacks:

•First, it’s fairly expensive since you have to post a large cash margin deposit to ensure that you’ll be able to follow through on the transaction if the shares are “exercised.” Thus the name, “cash-secured” puts.

•Second, if the market – or the specific stock on which you sell the puts – falls sharply in price, you could have to buy the shares at a price well above their current value, taking a substantial paper loss.

Fortunately, there is a way to offset both these disadvantages while continuing to generate a steady income stream.

It’s called a “credit put spread” and it strictly limits both the initial cost and the potential risk of a major price decline.

I’ll show exactly how it works in just a second, but first I have to set the stage…

The Advantage of Credit Put Spreads

Assume you had owned 300 shares of diesel-engine manufacturer Cummins Inc. (NYSE: CMI) and had been selling covered calls against the stock to supplement the $1.60 annual dividend and boost the yield of 1.30%.

Let’s also assume that back in mid-January, when the stock was around $110 a share, you sold three February $120 calls because it seemed like a safe bet at the time.

However, when CMI’s price later moved sharply higher, hitting $122.07/share, your shares were called away when the options matured on Feb. 17.

That means you had to sell them at $120 per share to fulfill your call option. That might leave you with the following dilemma.

Thanks to the recent rally, the stocks you follow are too high to buy with the proceeds from your CMI sale. On the other hand, you also hate to forfeit the income you had been getting from the CMI dividend and selling covered calls.

You also decide you wouldn’t mind owning CMI again if the price pulled back below $120.

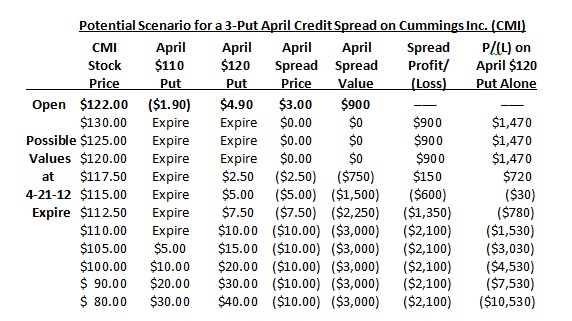

In this case, your first inclination might be to use the money from the CMI sale as a margin deposit for the cash-secured sale of three April $120 CMI puts, recently priced at about $4.90, or $490 for a full 100-share option contract.

That would have brought in a total of $1,470 (less a small commission), which would be yours to keep if Cummins remains above $120 a share when the puts expire on April 21.

That sounds pretty appealing, but…

The minimum margin requirement for the sale of those three puts – and, be aware, most brokerage firms require more than the minimum – would be a fairly hefty $8,190.

[Note: For an explanation of how margin requirements on options are calculated, you can refer to the Chicago Board Option Exchange (CBOE) Margin Calculator, which shows how the minimum margin is determined for a variety of popular strategies.]

Your potential return on the sale of the three puts would thus be 17.94% on the required margin deposit ($1,470/$8,190 = 17.94%), or 4.08% on the full $36,000 purchase price of the 300 CMI shares you might have to buy.

Either of those returns is attractive given that the trade lasts under two months – but you also have to consider the downside.

Should the market plunge into a spring correction, taking Cummins stock with it, the loss on simply selling the April $120 puts could be substantial.

For example, if CMI fell back to $100 a share, where it was as recently as early January, the puts would be exercised.

You’d have to buy the stock back at a price of $120 a share, giving you an immediate paper loss of $6,000 – or, after deducting the $1,470 you received for selling the puts, $4,530.

And, if CMI fell all the way back to its 52-week low near $80, the net loss would be $10,530. (See the final column in the accompanying table.)

All of a sudden, that’s not such an attractive prospect.

And that’s where a credit put spread picks up its advantage.

But selling cash-secured puts does have a couple of drawbacks:

•First, it’s fairly expensive since you have to post a large cash margin deposit to ensure that you’ll be able to follow through on the transaction if the shares are “exercised.” Thus the name, “cash-secured” puts.

•Second, if the market – or the specific stock on which you sell the puts – falls sharply in price, you could have to buy the shares at a price well above their current value, taking a substantial paper loss.

Fortunately, there is a way to offset both these disadvantages while continuing to generate a steady income stream.

It’s called a “credit put spread” and it strictly limits both the initial cost and the potential risk of a major price decline.

I’ll show exactly how it works in just a second, but first I have to set the stage…

The Advantage of Credit Put Spreads

Assume you had owned 300 shares of diesel-engine manufacturer Cummins Inc. (NYSE: CMI) and had been selling covered calls against the stock to supplement the $1.60 annual dividend and boost the yield of 1.30%.

Let’s also assume that back in mid-January, when the stock was around $110 a share, you sold three February $120 calls because it seemed like a safe bet at the time.

However, when CMI’s price later moved sharply higher, hitting $122.07/share, your shares were called away when the options matured on Feb. 17.

That means you had to sell them at $120 per share to fulfill your call option. That might leave you with the following dilemma.

Thanks to the recent rally, the stocks you follow are too high to buy with the proceeds from your CMI sale. On the other hand, you also hate to forfeit the income you had been getting from the CMI dividend and selling covered calls.

You also decide you wouldn’t mind owning CMI again if the price pulled back below $120.

In this case, your first inclination might be to use the money from the CMI sale as a margin deposit for the cash-secured sale of three April $120 CMI puts, recently priced at about $4.90, or $490 for a full 100-share option contract.

That would have brought in a total of $1,470 (less a small commission), which would be yours to keep if Cummins remains above $120 a share when the puts expire on April 21.

That sounds pretty appealing, but…

The minimum margin requirement for the sale of those three puts – and, be aware, most brokerage firms require more than the minimum – would be a fairly hefty $8,190.

[Note: For an explanation of how margin requirements on options are calculated, you can refer to the Chicago Board Option Exchange (CBOE) Margin Calculator, which shows how the minimum margin is determined for a variety of popular strategies.]

Your potential return on the sale of the three puts would thus be 17.94% on the required margin deposit ($1,470/$8,190 = 17.94%), or 4.08% on the full $36,000 purchase price of the 300 CMI shares you might have to buy.

Either of those returns is attractive given that the trade lasts under two months – but you also have to consider the downside.

Should the market plunge into a spring correction, taking Cummins stock with it, the loss on simply selling the April $120 puts could be substantial.

For example, if CMI fell back to $100 a share, where it was as recently as early January, the puts would be exercised.

You’d have to buy the stock back at a price of $120 a share, giving you an immediate paper loss of $6,000 – or, after deducting the $1,470 you received for selling the puts, $4,530.

And, if CMI fell all the way back to its 52-week low near $80, the net loss would be $10,530. (See the final column in the accompanying table.)

All of a sudden, that’s not such an attractive prospect.

And that’s where a credit put spread picks up its advantage.

Here’s how it works…

How to Create a Credit Put Spread

Instead of just selling three April CMI $120 puts at $4.90 ($1,470 total), you also BUY three April CMI $110 puts, priced late last week at about $1.90, or $570 total.

Because you have both long and short option positions on the same stock, the trade is referred to as a “spread,” and because you take in more money than you pay out, it’s called a “credit” spread.

And, in this case, the “credit” you receive on establishing the position is $900 ($1,470 – $570 = $900).

Again, that $900 is yours to keep so long as CMI stays above $120 by the option expiration date in April.

However, because the April $110 puts you bought “cover” the April $120 puts you sold, your net margin requirement is just $2,100 – which is also the maximum amount you can lose on this trade, regardless of how far CMI’s share price might fall. (Again, see the accompanying table for verification.)

That’s because, as soon as the short $120 puts are exercised, forcing you to buy 300 shares of CMI for $36,000, you can simultaneously exercise your long $110 puts, forcing someone else to buy the 300 shares for $33,000.

Thus, your loss on the stock would be $3,000, which is reduced by the $900 credit you received on the spread, making your maximum possible loss on the trade $2,100.

On the positive side, if things work out – i.e. CMI stays above $120 in April – and you get to keep the full $900, the return on the lower $2,100 margin deposit is a whopping 42.85% in less than two months, or roughly 278.5% annualized.

Plus, as is the case with most option income strategies, you can continue doing new credit spreads every two or three months, generating a steady cash flow until you’re ready to repurchase the stock at a more desirable price.

In this case, we say “ready” to repurchase because you’re never forced to buy the stock; you can always repurchase the options you sold short prior to expiration.

This strategy has substantial cost-cutting benefits when trading higher-priced issues like CMI, but it’s also a very effective short-term income strategy with lower-priced shares.

For example, with Wells Fargo & Co. (NYSE: WFC) trading near $31.50 late last week, an April credit spread using the $31 and $28 puts would bring in a net credit of 75 cents a share, or $225 on a three-option spread.

Since the net margin deposit on the trade would be just $675, you’d get a potential return of 33.3% in only seven weeks if WFC remains above $31 a share.

As you can see, credit put spreads are a great way to boost your gains while lowering your risks, especially in stable or rising markets.

So why not give yourself some credit.

Source http://moneymorning.com/2012/03/05/options-101-credit-put-spreads-can-boost-your-gains-and-lower-your-risk/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email:customerservice@moneymorning.com” target=”_blank”>customerservice@moneymorning.com

Here’s how it works…

How to Create a Credit Put Spread

Instead of just selling three April CMI $120 puts at $4.90 ($1,470 total), you also BUY three April CMI $110 puts, priced late last week at about $1.90, or $570 total.

Because you have both long and short option positions on the same stock, the trade is referred to as a “spread,” and because you take in more money than you pay out, it’s called a “credit” spread.

And, in this case, the “credit” you receive on establishing the position is $900 ($1,470 – $570 = $900).

Again, that $900 is yours to keep so long as CMI stays above $120 by the option expiration date in April.

However, because the April $110 puts you bought “cover” the April $120 puts you sold, your net margin requirement is just $2,100 – which is also the maximum amount you can lose on this trade, regardless of how far CMI’s share price might fall. (Again, see the accompanying table for verification.)

That’s because, as soon as the short $120 puts are exercised, forcing you to buy 300 shares of CMI for $36,000, you can simultaneously exercise your long $110 puts, forcing someone else to buy the 300 shares for $33,000.

Thus, your loss on the stock would be $3,000, which is reduced by the $900 credit you received on the spread, making your maximum possible loss on the trade $2,100.

On the positive side, if things work out – i.e. CMI stays above $120 in April – and you get to keep the full $900, the return on the lower $2,100 margin deposit is a whopping 42.85% in less than two months, or roughly 278.5% annualized.

Plus, as is the case with most option income strategies, you can continue doing new credit spreads every two or three months, generating a steady cash flow until you’re ready to repurchase the stock at a more desirable price.

In this case, we say “ready” to repurchase because you’re never forced to buy the stock; you can always repurchase the options you sold short prior to expiration.

This strategy has substantial cost-cutting benefits when trading higher-priced issues like CMI, but it’s also a very effective short-term income strategy with lower-priced shares.

For example, with Wells Fargo & Co. (NYSE: WFC) trading near $31.50 late last week, an April credit spread using the $31 and $28 puts would bring in a net credit of 75 cents a share, or $225 on a three-option spread.

Since the net margin deposit on the trade would be just $675, you’d get a potential return of 33.3% in only seven weeks if WFC remains above $31 a share.

As you can see, credit put spreads are a great way to boost your gains while lowering your risks, especially in stable or rising markets.

So why not give yourself some credit.

Source http://moneymorning.com/2012/03/05/options-101-credit-put-spreads-can-boost-your-gains-and-lower-your-risk/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email:customerservice@moneymorning.com” target=”_blank”>customerservice@moneymorning.com

0.51 (+0.42%)

0.51 (+0.42%)