Timing & trends

“Thousands upon thousands are yearly brought into a state of real poverty by their great anxiety not to be thought of as poor.” – Robert Mallett

I hear the term de-leveraging relentlessly from the mainstream media. The storyline that the American consumer has been denying themselves and paying down debt is completely 100% false. The proliferation of this Big Lie has been spread by Wall Street and their mouthpieces in the corporate media. The purpose is to convince the ignorant masses they have deprived themselves long enough and deserve to start spending again. The propaganda being spouted by those who depend on Americans to go further into debt is relentless. The “fantastic” automaker recovery is being driven by 0% financing for seven years peddled to subprime (aka deadbeats) borrowers for mammoth SUVs and pickup trucks that get 15 mpg as gas prices surge past $4.00 a gallon. What could possibly go wrong in that scenario? Furniture merchants are offering no interest, no payment deals for four years on their product lines. Of course, the interest rate from your friends at GE Capital reverts retroactively to 29.99% at the end of four years after the average dolt forgot to save enough to pay off the balance. I’m again receiving two to three credit card offers per day in the mail. According to the Wall Street vampire squids that continue to suck the life blood from what’s left of the American economy, this is a return to normalcy.

The definition of normal is: “The usual, average, or typical state or condition”. The fallacy is calling what we’ve had for the last three decades of illusion – Normal. Nothing could be further from the truth. We’ve experienced abnormal psychotic behavior by the citizens of this country, aided and abetted by Wall Street and their sugar daddies at the Federal Reserve. You would have to be mad to believe the debt financed spending frenzy of the last few decades was not abnormal.

The Age of Illusion

“Illusions commend themselves to us because they save us pain and allow us to enjoy pleasure instead. We must therefore accept it without complaint when they sometimes collide with a bit of reality against which they are dashed to pieces.” – Sigmund Freud

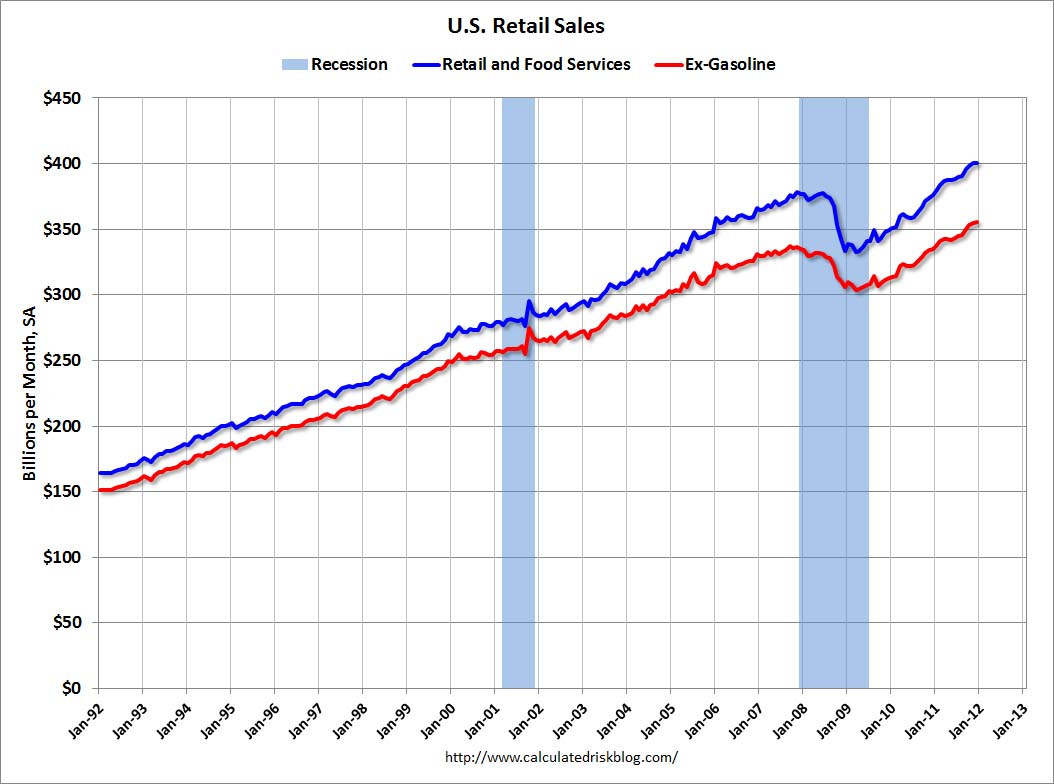

In my last article Extend & Pretend Coming to an End, I addressed the commercial real estate debacle coming down the pike. I briefly touched upon the idiocy of retailers who have based their business and expansion plans upon the unsustainable dynamic of an ever expanding level of consumer debt doled out by Wall Street banks. One only has to examine the facts to understand the fallacy of a return to normalcy. We haven’t come close to experiencing normalcy. When retail sales, consumer spending and consumer debt return to a sustainable level of normalcy, the carcasses of thousands of retailers will litter the highways and malls of America. It will be a sight to see. The chart below details the two decade surge in retail sales, with the first ever decline in 2008. Retail sales grew from $2 trillion in 1992 to $4.5 trillion in 2007. The Wall Street created crisis in 2008/2009 resulted in a decline to $4.1 trillion in 2009, but the resilient and still delusional American consumer, with the support of their credit card drug pushers on Wall Street, set a new record in 2011 of $4.7 trillion.

…..read more HERE

Below are factors that suggest that water will be the world’s most sought-after commodity in a handful of decades.

I couldn’t help but notice a new ad on Yahoo! Mail from Fidelity Investments that boldly asks, “Are you ready for water to become a globally traded commodity?”

This video accompanying the Fidelity Investments ad is as thought-provoking as it is ominous. The video discusses the respective costs in water to make items like a slice of bread, a cup of coffee, and a hamburger. From the video: “With global population expected to increase by 30 percent by 2050 and more developing nations transitioning to higher standards of living, regional water shortages and peak water issues will become more widespread.” The issue of water becomes more complicated in considering the accessibility and availability of drinking water in the years to come. From the video: “Global consumption of water is expected to increase by 40 percent over the next 20 years. And according to some estimates, more than half of the world’s population could be living under conditions of water stress by 2025.” Thus, the video suggests that water stress could intensify geopolitical affairs and “border disputes” related to the water supply.

…..read more and view Action Items (scroll to the bottom) HERE

“The most bullish examples would see the pattern develop into a series of lows around $1690 or an A-B-C correction, as experienced in 2010, which holds around $1660 (50% retracement from the December lows). A close above $1775 would be the catalyst for a challenge of $1900 to $2155. At the other extreme, a failure to hold $1625 (62% retracement from $1523) would imply that the December lows will be taken out.”

….read and view all charts HERE

For investors seeking high potential returns and the thrill of participating in market innovation, the smallcap energy space is where it’s at. Managing Director and Co-Founder Laird Cagan of merchant bank Cagan McAfee Capital Partners has built his career by backing companies that are both filling current demand and creating new markets. In this exclusive interview with The Energy Report, Cagan shares his experiences and discusses several companies at the forefront of the energy revolution.

The Energy Report: Laird, you and your partner are active investors. You are company founders, you sit on the boards and you actually run the businesses in some cases. What kind of advantage does that give you?

Laird Cagan: We are involved with fewer portfolio companies compared to a private equity or larger firm. Because we take a very active role and are starting companies at early stages, our preference is to create a new platform company and a new business opportunity. So the benefit is that we can be very close to the company and try to launch it quickly to take advantage of whatever market opportunity we see. We have a lot of skin in the game, a lot of ownership, and we try to help guide companies in the right direction. But like private equity investors, we generally have professional managers from the industry who were either co-founders or who were brought in to lead the company on a day-to-day basis. One exception is the case of my partner Eric McAfee, who has been running Aemetis Inc. (AMTX:OTCPK) since 2005, when we started that company.

TER: What kinds of companies interest you most?

LC: For the last 10 years or so we’ve been focused on building companies in the microcap public space. We have found that this has given us better, faster access to capital for the right opportunities. Public investors don’t want to take the three, six, nine or 12 months that venture capitalists and private equity firms take to investigate opportunities before making an investment decision. Public investors want to see something faster and want an opportunity that they can understand. Typically, that means we stay away from pure-play technologies, but we do look for technologies that are creating new markets. For example, we founded Evolution Petroleum Corporation (EPM:NYSE) in 2002, when oil was $25 per barrel (/bbl). We created that company to do enhanced oil recovery using technologies like lateral drilling, which was not very prevalent back then. We could take mature oil and gas fields and extract additional reserves using new technologies. But we also benefited greatly from having oil prices go from $25–100/bbl. We founded Pacific Ethanol Inc. (PEIX:NAS) to replace gasoline additive MTBE (methyl tertiary butyl ether), which was outlawed in 2004 in California and many other states. Ethanol was the only known oxygenate that would burn gasoline cleanly enough to meet the clean air act. So, it was less of an alternative energy play than a replacement-commodity play with a West Coast focus. Those companies, Evolution Petroleum and Pacific Ethanol, got us into the energy space. With rising energy prices and a multitrillion-dollar marketplace, all sorts of new opportunities began to arise because of technology. Aemetis, originally called AE Biofuels, was focused on next-generation biofuel moving from corn to other feedstocks that would be more plentiful, more predictable and would not be in the food chain.

TER: Was horizontal drilling technology more capital-intensive at the time, with oil at $25/bbl?

LC: Not particularly. There were thousands and thousands of wells around the United States that had been drilled and shut-in or were at a trickle of their former production. Some were getting ready to shut down. People would practically give them away because it costs money from an environmental standpoint to close them. For us, Evolution was an opportunity to create an early-stage platform company to produce oil using enhanced oil recovery. We were fortunate that by 2006 oil prices were at $40–50/bbl.

TER: What’s the technique?

LC: The technique used is called CO2 (carbon dioxide) flooding, where you inject CO2 into the ground and it releases the trapped extra oil, which then bubbles up. The CO2 adds pressure, just as it does in a carbonated beverage. When you drill an oil well for the first time and release the virgin pressure by traditional means, you might get 40% of the oil. This means somewhere between 50% and 60% of the original oil in place is still there. With the CO2 floods, you can typically get between 15% and 20% of the original oil in place, and that’s a meaningful well.

TER: As a pioneer of this technology, where did you incur the most extensive costs?

LC: You have to have a pipeline to get your source CO2, and that’s a challenge. If you’re close to a source, the cost of injecting it can be around $10/bbl. But a project’s viability depends a lot on the fixed cost of getting the CO2 to the site. At the Delhi Field in Northern Louisiana, Evolution Petroleum formed a very effective partnership with the leading CO2 player in the industry, Denbury Resources Inc. (DNR:NYSE). Together we’ve done very well. The Delhi Field was 14,000 acres and is estimated to be capable of releasing an additional 60 million barrels (MMbbl) of oil. And with oil now over $100/bbl, that’s $6B worth of oil, and you can afford to spend a lot to go after that.

TER: Great foresight.

LC: I would say yes, it was foresight and some luck. We didn’t anticipate $100/bbl oil at the time. But, we really do focus on trying to get a play at the beginning of a growth cycle. Of course for any investor, being at the beginning of a rising tide is one of the keys to success and having superior returns.

TER: You’re not as actively involved in Camac Energy Inc. (CAK:NYSE) as you are in some of your portfolio companies, but starting the company has been an interesting saga. Can you tell us about that?

LC: In 2006, after having had some success with both Evolution Petroleum and Pacific Ethanol, I was introduced to Frank Ingriselli, the former head of Texaco International. He developed some important relationships in China and he had a lot of very high-level experience with majors in that region. After Chevron Corporation (CVX:NYSE) bought Texaco in 2001, he wanted to start a new oil and gas company and needed capital to grow, for which I was approached. We ended up funding a $21M offering and creating a new public entity, Pacific Asia Petroleum. Frank went to China to visit as a long-time contact and was granted a concession of 175,000 acres in the prime coal-bed-methane region of China. Without any upfront money, we got a hold of a major resource that launched the company. The Chinese government’s goal was to bring in people that had expertise and ability and who could bring capital for projects, because the country needs energy. Over time we ended up acquiring Camac, which owned a large property in offshore Nigeria that was just beginning production. In a sense it was a reverse merger for Camac because it became the majority shareholder and ended up taking control by its Chairman and CEO Kase Lawal. I dropped off the board around that period of time.

TER: Camac shares have been flat over the past six months, but down about 50% from a year ago. What accounts for the lag in the stock price?

LC: Its first production well started out at 20 thousand barrels per day (Mbbl/d) and it has gone down to about 4 Mbbl/d, but there’s still a huge reserve there, which is estimated to be between 600 MMbbl–2.2 billion (B) bbl of recoverable oil in the entire field. Camac is working on getting a new partner to come in and develop that. I’m bullish on the long-term. It’s going to take time, but it should be very exciting. I’m still a big shareholder and waiting, watching and hoping for the best.

TER: Were there any other companies you wanted to mention briefly?

LC: I recently became chairman of Blue Earth Inc. (BBLU:OTC), which is in the energy efficiency space. This is a very important new category, and it is frankly the lowest-hanging fruit of energy conservation by reducing energy consumption. Commercial real estate uses about 20% of our nation’s energy. Making those buildings more efficient is very important, and provides quick returns. For example, replacing old motors and with energy-efficient motors produces a one- to two-year payback. Blue Earth is geared toward doing that.

TER: Is the company actually manufacturing new technology?

LC: It’s not a technology company, but it’s using the latest improvements in energy efficiency to retrofit commercial real estate. It will also do energy audits for clients’ buildings and recommend an energy-generation project, be it solar, fuel cell, etc. that fits the client’s needs. This is called distributed generation: Instead of going into the grid and selling power back to the utility, the company sells directly to the customer. It therefore has none of the energy losses of going through the grid, nor any of the capex issues. Retrofitting to localize energy at a site is a tremendous innovation that needs to happen in order to reduce national and even global energy consumption. I’m very bullish on the energy efficiency and distributed generation space for the next 50 years. It has the power to replace and transform our energy production. We are not going to get rid of utilities because we need them, but we can chip away at our use of fossil fuels from our insatiable appetite for energy in a way that is cost effective. It also reduces carbon emissions.

TER: Is Blue Earth a consulting company?

LC: No. It’s more of a contractor, or a construction company. In other words, it does the work. In the solar world it’s called Engineering Procurement Construction or EPC. After the energy audit, the company does the engineering, including procurement of parts and construction. As we move on and migrate this business model, the company will also provide the financing and effectively become the developer. There are some good tax incentives involved in alternative energy, both in solar and fuel cells. Depreciation is also available, and that adds to the return.

TER: Solar systems would be on the roof or on land, but how far away would a generating fuel cell typically be from the building?

LC: Adjacent to the building. There’s no sound, and there are no moving parts. You need a footprint about the size of a tractor trailer. There are a few significant fuel cell manufacturers in the U.S., and they are growing nicely. Fuel cells are significantly more cost effective than solar if you can use energy 24 hours a day such as in a data center and can have net paybacks in 5–10 years at most, whereas it might take solar 10–20-years to payback.

TER: What are the fuel cell companies?

LC: One of the companies to look at is Bloom Energy (private). It has the larger units, and Google Inc. (GOOG:NASDAQ) put Bloom units into its building in Silicon Valley with a lot of publicity a year or so ago. Bloom is different from the other three manufacturers, as there is no waste heat, which is interesting. So, if you have large, consistent needs, Bloom is good. The data centers that Google runs are 24-hour operations. So, it would not be quite as suitable for a company that shuts down at night because you can’t amortize 24 hours, and perhaps solar would be better for a company that needs mostly peak daytime energy. That’s why an energy audit is so important, so clients can understand what’s most appropriate for their business.

Other companies include FuelCell Energy Inc. (FCEL:NASDAQ) and ClearEdge Power (private), the latter of which makes a variety of units, including small residential-size fuel cells. ClearEdge is blitzing homes. It’s the SolarCity (private) equivalent. SolarCity is trying to put solar on your roof, and ClearEdge is trying to put a fuel cell next to your house, and it makes systems all the way down to 5 kilowatts, which is appropriate for a midsize house.

TER: It has been a pleasure meeting you, Laird.

LC: Thank you.

Laird Cagan is managing director and co-founder of Cagan McAfee Capital Partners LLC, a merchant bank in Cupertino, CA. Cagan McAfee has founded, funded and taken public 10 companies in a variety of industries including energy, computing, healthcare and environmental. The company has helped raise over $500M for these companies, which achieved a combined market capitalization of over $2B. Mr. Cagan was the founder/chairman of Evolution Petroleum Corporation (AMEX: EPM), a company established to develop mature oil and gas fields with advanced technologies, and he is a former director of American Ethanol (AEB) and Pacific Asia Petroleum (PFAP).

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) George Mack of The Energy Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: None. Streetwise Reports does not accept stock in exchange for services.

3) Laird Cagan: I personally and/or my family own shares of the following companies mentioned in this interview: Evolution Petroleum Corporation, Camac Energy, Aemetis Inc. and Blue Earth Inc. I personally and/or my family are paid by the following companies mentioned in this interview: Evolution Petroleum Corporation, Aemetis Inc. and Blue Earth Inc. I was not paid by Streetwise for this interview.