Timing & trends

Many already think that the European sovereign debt crisis is passing. That the latest bond deal and bailout for Greece solves everything.

But as far as I’m concerned, nothing could be further from the truth.

First, severe austerity measures do not create growth. So there’s no way Greece can grow its way out of its debt morass, even after the latest debt write-downs.

The proof is simple math. Before the Greek crisis flared up, debt-to-GDP in Greece stood at 120%. Today — and I repeat, even after all the write-offs — Greek debt-to-GDP stands somewhere north of a whopping 160%.

That’s more than 40% higher than it was at the beginning of the crisis — and the austerity measures are literally causing the Greek economy to implode, creating some of the worst social chaos we have seen in modern times.

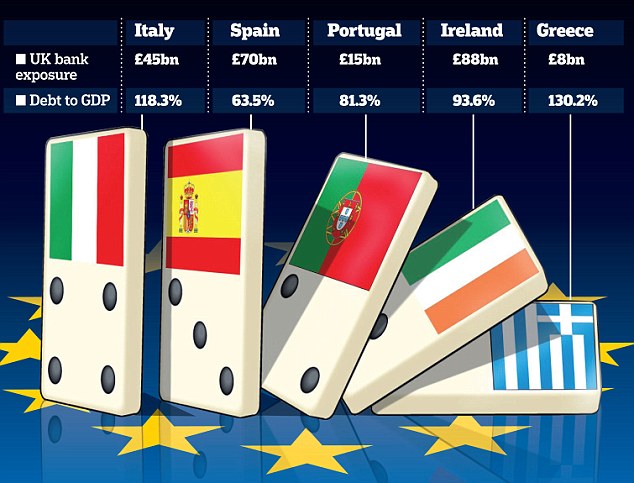

Second, Italy, Portugal and Spain still remain vulnerable dominos. Each and every one of them is in hock way over their heads. And each and every one of them is just beginning to feel the impact of austerity measures.

Unemployment among youth is as much as 25%. Corporate and personal bankruptcies are surging. Social discontent is on the rise again. And tensions between countries within Europe are as high as ever.

Third, European banks themselves don’t buy any of the solutions. They show no confidence in Europe’s ability to survive the crisis.

That’s why Europe’s banks are holding on to money for dear life. Rather than lend into the economy, these banks are hoarding their cash, stashing droves of it at the European Central Bank (ECB) …and even scrambling to deposit hundreds of billions with Western central banks for safe-keeping.

Fourth, Europe’s economy as a whole is sinking. The ECB’s latest economic projections show the economy may contract 0.1%. That may not sound like much, but the previous forecast was for 0.3% positive growth.

Worse, that’s not going to help Europe’s internal financing needs this year. Italy and France alone have over $795 billion in debt that will have to be rolled over this year. With growth sharply slowing, plus uncertainty about which dominoes will be the next to fall, there’s a very real chance of a massive bear market collapse in European debts this year that takes down the entire European Union.

Fifth, high energy prices are making matters all that much worse. It would be one thing if we were seeing $35-a-barrel oil and cheap gasoline prices. But we’re not. So, high energy prices are certainly not helping the situation in Europe. Period.

Neither is inflation. With austerity measures squashing growth all over Europe and inflation on the rise, Europe is facing a double whammy in the months ahead. More hits to economic growth, more trouble rolling over debt and, soon, another renewed rise in social discontent.

In short, nothing, and I mean nothing, has been solved in Europe. There may be a lull in the crisis, but it will soon return with a vengeance.

As for the United States — don’t kid yourself. The U.S. economy looks better only because Europe looks so bad. In reality, the U.S. debt mountain is in even worse shape. And when it falls, it will fall hard.

Fortunately, we have some time before it crumbles. But not much. And as long as Europe’s crisis worsens, the U.S. will look like the better place to invest.

Which is precisely why the U.S. dollar is starting to rally again.

My suggestions …

A. Keep most of your liquid funds in cash, ready to be deployed on a moment’s notice, but as safe as can be right now. The best way: A short-term Treasury-only fund in the U.S., or the equivalent.

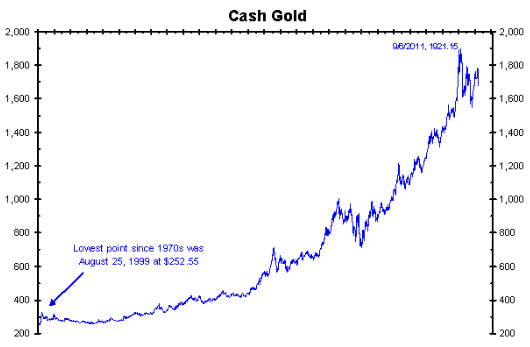

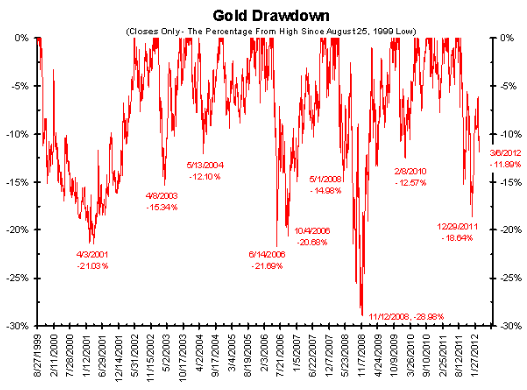

B. Hold on to all long-term gold holdings. You do not want to let go of those. Gold is heading to well over $5,000 an ounce over the next few years.

In the short term, however, I would not be surprised to see gold — and silver — move lower.

For one thing, as the U.S. dollar strengthens again, some of the shine will come off of the precious metals, even as Europe’s problems fester.

For another — and very importantly — both gold and silver failed to give monthly buy signals on Wednesday, February 29.

In fact, they failed miserably, with gold plunging more than $100 an ounce, more than 5.5%, in a single day and failing to take out the monthly buy signal at $1,789.

Silver, meanwhile, plunged almost 10% on February 29 and failed to close above its monthly buy signal at $35.85.

These are significant failed signals that strongly suggest that my forecast for lower metals prices — before they truly break out to the upside — remain on target.

Indeed, the next important levels of support for the metals — which I expect to see tested in the weeks ahead — are now at the $1,490 level in gold and the $29 level in silver. If those levels give way, even lower prices could be seen in the short term.

So if you’ve acted on any of my recent suggestions for light speculative bearish positions in gold and silver via inverse ETFs such as the ProShares UltraShort Gold (GLL) and ProShares UltraShort Silver (ZSL), I suggest you continue to hold those positions.

Ditto for my suggestion for bearish speculative positions on the euro via the ProShares UltraShort Euro (EUO) …and for the stock market via inverse stock index ETFs such as the ProShares UltraPro Short S&P 500 (SPXU).

Don’t overtrade them, though. Those are speculative positions and I cannot help you via this column with precise timing and risk management. So keep that in mind.

Best wishes,

Larry

P.S. I’m just putting the finishing touches on the March issue of my Real Wealth Report. If you’re already a member, be sure to check your inbox this Friday, March 16, for my latest forecasts and a lot of news about how Real Wealth is going to help you get positioned for profits. If you’re not a member, this is a fantastic time to get started.

To join for the year, click here now. It will be the best money you spend this year. I repeat, click here now.

Over the years, we have discussed the various ways that companies utilize their free cash flow to generate a return for their shareholders. In our small-cap universe, we have traditionally focused on companies that reinvest their earnings back into the business to generate sustainable growth. More recently the markets have started focusing on companies that payout their cash flow to shareholders in the form of dividends or distributions. Even better are those companies that generate so much cash that they can afford to invest in growth as well as pay a dividend. But there is also a third method of allocating capital that is often misused and even more often misunderstood – share repurchases (buybacks).

The consensus is mixed on whether or not share repurchases are in fact a viable strategy for generating shareholder returns. When a company has excess cash and they believe their shares are undervalued, they will often issue a normal course issuer bid which allows them to purchase and cancel a predetermined maximum number of shares of their own company. The idea is that if you believe that your own company will provide you with the best risk-adjusted return on your capital then why would you invest your capital anywhere else.

Warren Buffet recently said in his 2012 letter to shareholders (http://www.berkshirehathaway.com/letters/2011ltr.pdf) that in addition to generating strong earnings growth he also typically hopes that the stock prices of the companies he purchases languish in the markets for several years after he buys them. Using an example of IBM, he explained that if the company were to spend $50 billion over a 5 year period to repurchase its shares that his current interest of 5.5% in the company would growth to 7% if the share price were to average $200 over the period, but only 6.5% if the share price where to average $300. Since Warren has no intention of selling his shares during that period his best case scenario would be if the cash flow remained strong but the stock price plummeted. This is a wide diversion from the mentality of many retail investors who require constant validation from the market in the form of appreciating stock prices.

The reason that share repurchases are often criticized is because they are very commonly misused. Very often companies will publicly disclose that they have received exchange approval to proceed with a share buyback but then fail to repurchase any shares. The hope is that the announcement alone will garner investor interest. The more common problem is when share repurchases are made by companies that are not undervalued. Warren Buffet said, “I favor repurchases when two conditions are met: first, a company has ample funds to take care of the operational and liquidity needs of its business; second, its stock is selling at a material discount to the company’s intrinsic business value, conservatively calculated. We have witnessed many bouts of repurchasing that failed our second test.” The CEO and Board of Directors commonly have a tendency to view their own company as undervalued, particularly if it has suffered a large decline in the share price. This bias can lead firms to repurchase stock when it is in fact overvalued, an activity which has the impact of destroying shareholder value.

The key to assessing a share repurchase strategy is to analyze the metrics of the individual situation. Does this company have the available liquidity to repurchase shares? Is the company clearly undervalued on the basis of free cash flow and will a share repurchase have the intended impact of improving performance on a per share basis? If the answer to these questions is yes then a share repurchase may be a very viable strategy for creating shareholder value long term.

MINING.com editor Andrew Topf sits down with mining analyst Mickey Fulp, who topped the site’s list of recommended mining bloggers and newsletter writers. In this brief interview on the sidelines of the PDAC convention in Toronto, Fulp touches on gold stocks, current market volatility, and two metals he likes best right now: uranium and graphite.

Andrew Topf: What metals are you bullish on right now?

Mickey Fulp: Copper, gold and uranium, and I’ll put graphite into that too.

Andrew Topf: Right, graphite seems to be the belle of the ball right now.

Mickey Fulp: It is, it’s the next big thing it reminds me very much what happened with REEs in 2009. We’re building a bubble in graphite, every snake oil salesman, shark and charlatan is swimming aorund in Coal Harbor in Vanouver right now. Every Vancouver promoter is scurrying around trying to find a shell to throw a graphite project in, so it looks very much like the next big thing. Like other area and commodity plays the juniors will rush in and 95% of them will fail and the ones with good deposits and good business plans will succeed.

…..read the entire interview HERE

Food prices are skyrocketing all across the globe, and there’s no end in sight. The United Nations says food inflation is currently at 30% a year, and the fast-eroding value of the dollar is causing food prices to appear even higher (in contrast to a weakening currency). As the dollar drops in value due to runaway money printing at the Federal Reserve, the cost to import foods from other nations looks to double in just the next two years — and possibly every two years thereafter.

That’s probably why investors around the globe are flocking to farmland as the new growth industry. “Investors are pouring into farmland in the U.S. and parts of Europe, Latin America and Africa as global food prices soar,” reports Bloomberg magazine HERE. “A fund controlled by George Soros, the billionaire hedge-fund manager, owns 23.4 percent of South American farmland venture Adecoagro SA.”

Jim Rogers is also quoted in the same story, saying, “I have frequently told people that one of the best investments in the world will be farmland.”

That’s because demand for food is accelerating even as radical climate changes, a loss of fossil water supplies, and the failure of genetically engineered crops is actually reducing food yields around the globe. Ceres Partners, which invests in farmland, has produced astonishing 16 percent annual returns since its launch in 2008. And this is during a depressed economy when most other industries are showing losses.

….read (scroll down) “Why growing and storing your own food can be a goldmine” & “Lessons from post World War II Taiwan and why food is more valuable than gold” HERE