Op/Ed

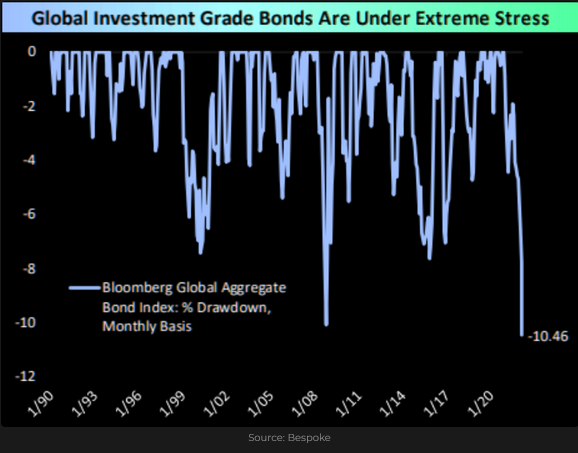

Interest rates are surging higher

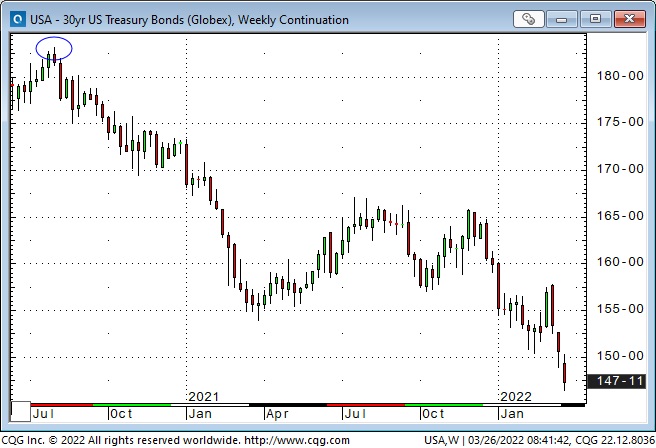

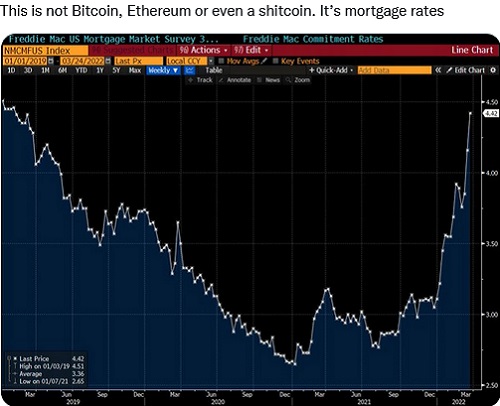

American interest rates hit All-Time Lows in August 2020. Short rates stayed close to zero for the next fifteen months while mid-term and especially long-term bond yields rose (prices fell.)

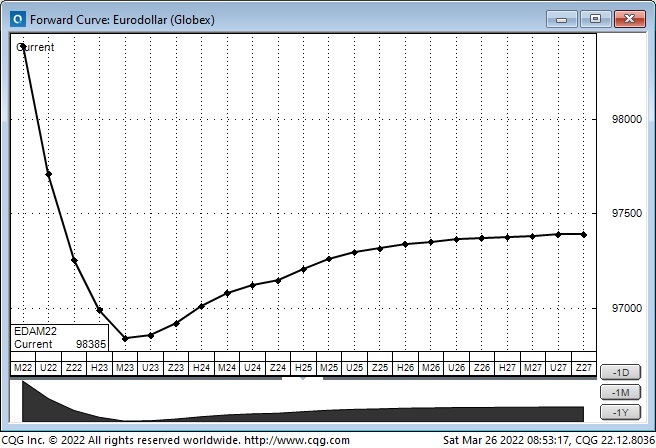

In October 2021, forward markets for short-term rates began to rise. The rate of change accelerated in January and February, stalled when Russia invaded Ukraine in late February but dramatically accelerated the last three weeks.

Short rates have been rising faster than long rates, causing some inversions (when short-term interest rates are higher than longer rates.) Historically, an inversion in the 2-year/10-year spread is a harbinger of recession. The 10-year is currently ~20bps premium the 2-year.

Why are interest rates rising so quickly?

The keyword for the Fed last year was “Transitory.” The Fed expected the sharp rise in inflation to be a “flash in the pan,” and therefore, it would be wrong to raise interest rates (or to stop their QE program) to “kill inflation.”

Some folks agreed with the Fed’s assessment, other folks didn’t, but as inflation continued to rise and became more pervasive, the forward markets began to price in higher interest rates.

This year, communications from the Fed have become increasingly hawkish, and market analysts have “hop-scotched” one another as they continued to raise their interest rate forecasts. This week, Citibank announced that they expect the Fed to raise rates by 50 bps at each May, June, July, and September FOMC meeting and raise rates by 275 bps in 2022.

There is also “talk” that some major players are wrongly positioned with their interest rate exposure and are aggressively selling Eurodollar futures. (Think of Jeremy Irons and Kevin Spacey in Margin Call.) If there is a “motivated seller” hitting all bids, other players will try to front-run that seller – adding to pressure on prices.

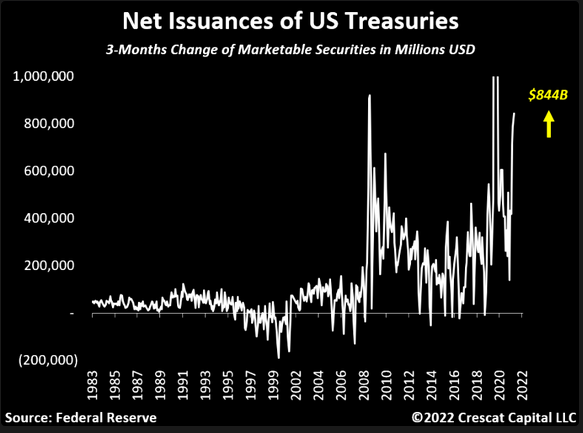

Then there is the thought that governments (everywhere?) will be spending more “stimmy” to help voters deal with rising food and energy costs. Why not? Governments “crossed the Rubicon” with direct fiscal stimulus (helicopter money) during the Covid lockdowns, and there’s no going back to fiscal “prudence” now (especially with mid-term elections looming!) Who wants to buy Treasuries when governments are issuing a flood of paper to fund fiscal stimulus, and the Fed has shut down QE?

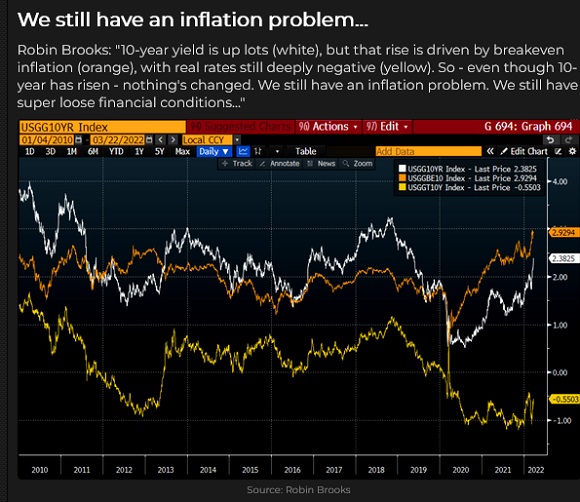

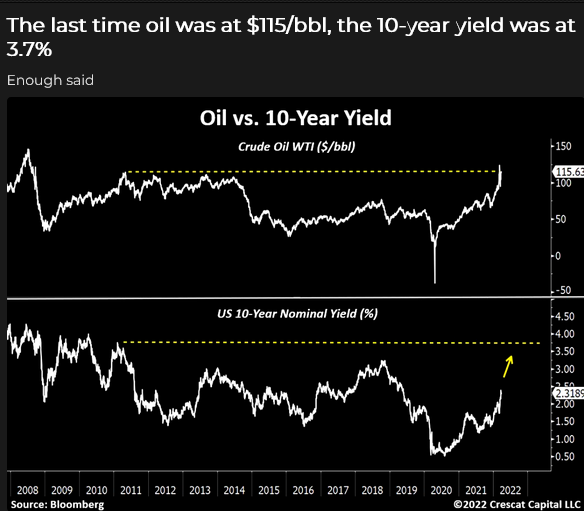

This chart was created mid-week (when 10-year yields were only 2.38%), but its point is even more valid, with rates at 2.5%.

Remember when high prices were the best cure for high prices? That quaint thought assumed that high prices stimulated both new supply and demand destruction. But as the Heisenberg Report argues, “demand destruction” in Western Democracies may no longer be politically viable. Governments will fight inflation with inflationary policies! Voters will love it, but bond investors won’t.

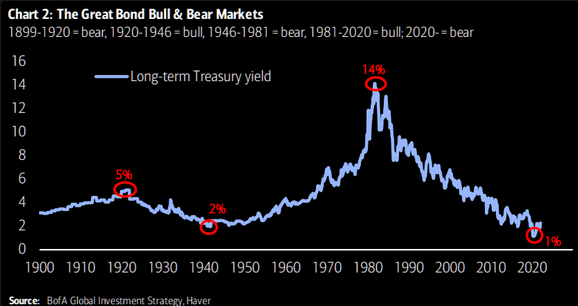

Is the forty-year bond bull market over?

The All-Time High in the bond bull market was August 2020, when the ten-year Treasury yield was ~0.50%. The current yield is ~2.50%, and the forty-year uptrend line is at risk of being decisively broken.

But the Eurodollar forward curve shows rates rising into June 2023 but then drifting lower after that. This pricing may be on the expectation that the Fed will be “tightening into a recession” and will have to reverse course or risk an economic collapse.

If that is the case, the bond market will “see” the slowdown coming, and bond prices will rise. Maybe.

Canada/Commodities

Canadian interest rates have also been soaring. This week the yield on the ten-year closed at 2.55% – an eight-year high. Futures market pricing for December 2022 Banker Acceptances has 3-month yields >3%, an increase of ~ 1.2% in the last three weeks.

The Loonie closed above 80 cents this week for the first time since early November as commodity currencies are bid.

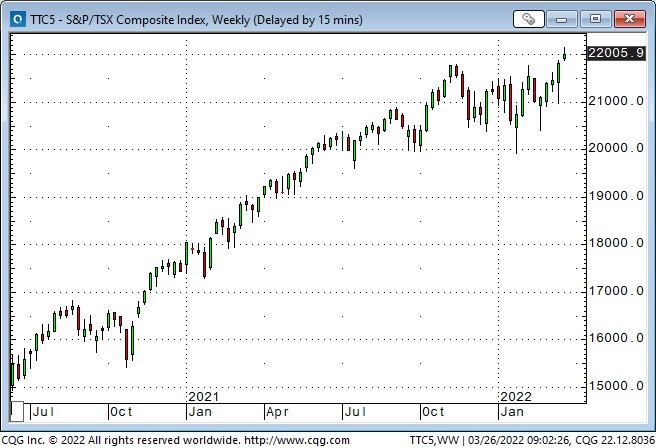

The Toronto Stock Index hit new All-Time Highs this week. Australian and Brazilian stock markets have also been surging higher.

Japan

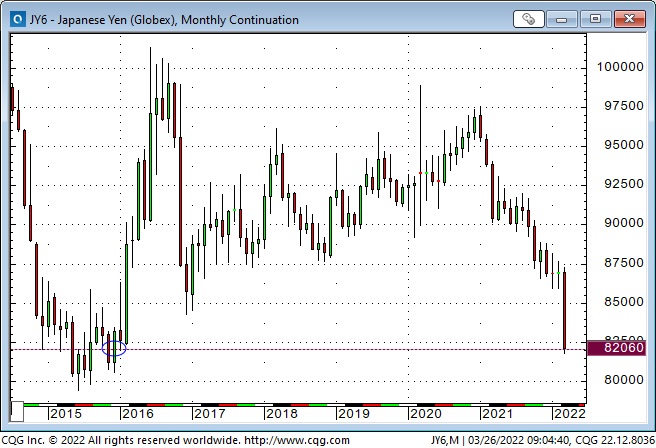

The Yen plunged the past three weeks, hitting a six-year low, as American interest rates have surged while the BoJ is committed to capping their ten-year bond at 0.25%. Red hot commodity markets also hurt the Yen, but a weak Yen helps the Japanese stock market.

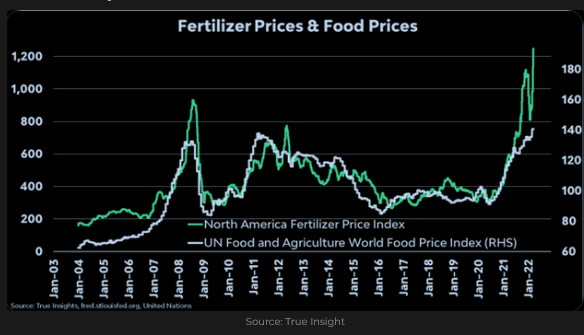

The intersection of food, energy policies and geopolitics

The Russian invasion of Ukraine set off multiple chains of consequences in food and energy that may quickly escalate into a generational food crisis due to diminishing supply availability. I recommend the latest piece from Doomberg (a ten-minute read) that examines how shortages of fertilizer, herbicides, diesel, propane, computer chips, and labour may impact the cost and availability of food. (Late note: a subscriber just emailed me that Doomberg should have added that a severe drought is developing in Canadian and American grain-growing regions. Pray for rain!)

The low on this chart was March 24th – the day Russia invaded Ukraine. We are going to need more tractors.

How delusional green policies set up the Russian invasion of Ukraine

Here’s a quote from Michael Shellenberger’s latest piece: “But it was the West’s focus on healing the planet with “soft energy” renewables, and moving away from natural gas and nuclear, that allowed Putin to gain a stranglehold over Europe’s energy supply. As the West fell into a hypnotic trance about healing its relationship with nature, averting climate apocalypse and worshiping a teenager named Greta, Vladimir Putin made his moves.”

My short term trading

I “got busy” with other things this week and didn’t trade much. I thought that the stock market might correct after last week’s steep rally (in last week’s Notes, I wrote that it may have been a bear market rally), and I looked for setups to get short. That didn’t work, and my P+L was down ~0.20% on the week. (I was trading small size with tight stops.)

I thought soaring interest rates might cause stocks (especially long-duration tech stocks) to weaken, that the winding down of corporate buybacks going into the blackout period ahead of quarterly reports would weaken stocks, that option dealers not being net short gamma after last week’s rally would weaken stocks – but they just kept rising. Maybe the market is looking at the seasonality chart! Yikes!

One of my favourite trading mantras is that there’s nothing wrong with being wrong except staying wrong, so when I’m wrong, I’m gone.

Thoughts on trading

I’m falling behind in my attempt to “keep up.” I’ve got podcasts and videos and research reports stacking up, and I know I’ll have to hit the “delete” button on many of them. Other traders I talk to/swap emails with tell me they have the same problem.

There is so much “going on” and so many violent moves in so many different markets that it’s impossible to stay current with everything.

Quotes from the notebook

“There are no solutions, there are only trade-offs; and you try to get the best trade-off you can get, that’s all you can hope for.” Thomas Sowell

My comment: I’ve been a Thomas Sowell fan for years. He is a true American icon. This quote seems particularly appropriate for today. It applies to Russia/Ukraine, the Maltusiasn forecasts of soaring commodity prices, the prospect of ever-growing and ever-intrusive government, and to virtually any problem I see today. Do yourself a favour and spend a few minutes reading about this man, his life and his pithy quotes. He is a beacon of clear-eyed observation and an inspiration to truth-seekers everywhere.

The Barney report

One of the great things about writing this blog is that I have developed relationships with people worldwide that I would otherwise never have known.

Recently, a man in Connecticut asked his wife to paint a portrait of Barney based on a photo I posted on this blog. He sent me the picture (painted on a rock) as a thank you for the value he received from reading my blog.

How amazing is that!

The portrait stands on the windowsill behind my screens – right where I can see it every day.

You can see more of his wife’s pet portraits on her Art Instagram page: @querocks.

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The March 26th podcast is available at: https://mikesmoneytalks.ca.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

B.C. drivers will get $110 in ICBC rebates in May to help them cope with high gasoline prices. Commercial ICBC insurance holders will get a $165 rebate.

Premier John Horgan and Solicitor General Mike Farnworth announced the one-time rebates Friday to help British Columbians drivers cope with soaring gasoline prices. In total, ICBC will rebate back $395 million to B.C. drivers.

“These small contributions will be large for many people across British Columbia,” Horgan said.

Gasoline prices have broken North American records in Metro Vancouver, thanks to war in the Ukraine roiling global oil markets.

Gasoline prices are expected to tick down by three cents Saturday, according to GasWizard, after hitting an average of $1.99 per litre this week. But global oil prices are ticking back up, so higher gasoline prices are sure to follow. And on April 1, B.C.’s carbon tax will go up, adding one cent to the price of regular gasoline.

Given that British Columbians pay disproportionately high taxes on gasoline, Horgan has been under pressure to cut gas taxes, as Alberta has done…read more.

Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 30 energy, energy service and pipeline & infrastructure companies with regular updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

Russia/Ukraine War Update:

Diplomatic talks to create an extended ceasefire are being worked on by delegations of Ukrainians and Russians. The talks initially are to open safe routes for refugees to exit war-torn cities, but no extended and safe routes have opened. It appears that over 4M Ukrainians have reached safety in NATO countries (displaced Ukrainians now over 6M) and the largest exit route appears to be through Lviv to Poland (>50% of total refugees). Massive global humanitarian aid is assisting this migration, the largest since WWII.

Just yesterday President Zelensky made what could be a critical concession to end the invasion. He stated that they would be willing to not enter the EU or NATO if they got security guarantees from its neighbors (Poland, Turkey etc. who are members of NATO). Negotiating this may take some time and what is included in the guarantees may not be amenable to Russia. In the meantime the Russian invasion is being more destructive. Tsar Putin is planning to add to his invasion force with experienced foreign fighters from Syria and Chechnya. The numbers range from 16,000 to 40,000 fighters. These are fighters who fought in urban environments and Putin needs them for the takeover of Mariupol, Kyiv and Odessa, if that is still his plan. These forces are likely to be initially sent to Mariupol and Kharkiv to complete their takeovers and give Russia a land corridor from the breakaway Donbas region to Crimea with an extensive land bridge.

If Putin does not accept Zelensky’s Austria-like option of an independent state then the war is likely to enter a more vicious and deadly phase in the coming weeks. Once Putin’s additional fighters enter the Ukrainian arena we may see an escalation of pressure on the unconquered cities. Russia’s willingness to attack bases in western Ukraine and calling aid convoys from the west as legitimate military targets shows where his focus is heading. If he cuts off food and munitions aid to Kyiv then the war from his perspective could be won. The failure to make faster progress in taking over the country is impacting Putin’s diatribes. That is why the EU is worried he will use his foreign fighters to rubblize the cities not yet captured and may use WMDs including thermobaric bombs and chemical or biological weapons. If a diplomatic solution is not seen in the coming week then the risk of the war escalating becomes more likely. Putin needs to capture Mariupal and Kharkiv for bargaining power when diplomatic talks get real. Russian forces are now using naval assets to target Odessa (Ukraine’s largest Black Sea Port). If he succeeds in taking Odessa he will have captured a large land position with total control of eastern and southern Ukraine, and landlocked the remaining part of the Ukraine state. These are the prizes he wanted from the start but stiff Ukrainian opposition is thwarting his chances of achieving all his military goals.

What is unfortunate is that the fighting has delayed or canceled Ukraine planting this year’s food crops. With bullets flying and fertilizer (made from very expensive energy) sharply more expensive, food shortages will likely be a problem for the world in the coming months. As low inventories get used and many producing countries face drought or rising input costs, crop yields will be lower. Food insecurity may be a catalyst for more confrontations later this year.

EIA Weekly Oil Data: The EIA data of Wednesday March 23th was moderately bearish for domestic energy prices. US Commercial Crude Stocks fell 2.5Mb to 413.4Mb versus the forecast of a rise of 114Kb. The divergence was due to Exports rising by 908Kb/d, or by 6.4Mb on the week as the US helped energy-short allies. Motor Gasoline Inventories fell 2.9Mb while Distillate Fuel Oil Inventories fell 2.1Mb. Refinery Utilization rose 0.7 points to 91.1% as refiners work to add more product to offset the cut-off of Russian products. US Crude Production remained steady at 11.6Mb.

Total Demand rose 472Kb/d to 21.12Mb/d as Distillate Demand rose 812Kb/d to 4.52Mb/d. Motor Gasoline usage fell 307Kb/d to 8.64Mb/d as high prices lowered demand. Jet Fuel Consumption rose 292Kb/d to 1.74Mb/d. Cushing Crude Inventories are rebuilding and rose 1.2Mb last week to 25.2Mb.

EIA Weekly Natural Gas Data: Weekly winter withdrawals continue but at a much slower pace as winter nears its end. Last week’s data showed a withdrawal of 79 Bcf, lowering storage to 1.440 Tcf. The biggest US draws were in the East (27 Bcf) Midwest (27 Bcf), and in South Central (11 Bcf).

The five-year average for last week was a withdrawal of 87 Bcf and in 2021 was 11 Bcf due to the warming weather and the end of winter consumption at the end of this month. April starts the new injection season. Storage is now 17.4% below the five-year average of 1,744 Tcf. Today NYMEX is US$5.25/mcf. AECO is trading at $4.64/mcf. After winter is over natural gas prices typically retreat and as the general stock market continues to decline, a great buying window should develop at much lower levels for natural gas stocks in Q3/22.

Baker Hughes Rig Data: The data for the week ending March 18th showed the US rig count flat at 663 rigs (up 13 rigs last week). Of the total rigs working last week, 524 were drilling for oil and the rest were focused on natural gas activity. The overall US rig count is up 61% from 402 rigs working a year ago. The US oil rig count is up 65% from 318 rigs last year at this time. The natural gas rig count is up a more modest 49% from last year’s 92 rigs, now at 137 rigs.

Spring break-up and road bans have returned to Canada. Last week 30 more rigs were removed from activity (down 11 rigs last week) to 176 rigs. The rig count level will continue to fall over the next few weeks. Only rigs staying on location drilling pad wells will be active shortly. Canadian activity however is still up 91% from 92 rigs last year as more activity moves to pad drilling. There was a 24 rig decrease for oil rigs and the count is now 103 oil rigs working. However this is up from 41 working at this time last year. There are 73 rigs (down six on the week) working on natural gas projects now, but still up from 51 rigs working last year. Staffing of rigs in Canada is a problem and adding significantly more rigs this summer may be problematic. While rig and frack day rates are rising, so are costs and so margin improvements are not what one should expect as the industry activity picks up. Service industry margins need to rise materially in 2H/22 if drilling and completion activity is to rise.

The overall increase in rig activity from a year ago in both the US and Canada should translate into rising liquids and natural gas volumes over the coming months. The data from many companies’ plans for 2022 support this rising production profile expectation. We expect to see US crude oil production reaching 12.0Mb/d in the coming months. Companies are taking advantage of attractive drilling and completion costs and want to lock up experienced rigs, frack units and their crews as staffing issues are difficult for the sector. The EIA forecasts US production reaching 12.5Mb/d before the end of this year. From a focus on paying down debt and then increasing shareholder returns, we see companies adding growth to their 2H/22 plans as national and continental energy security of supply concerns change the focus of Board directed spending plans.

Conclusion:

Bullish pressure on crude prices:

- Russia’s invasion of Ukraine and the severe destruction of the country has rallied European nations against Russia. Even though crude oil and natural gas imports into Europe are allowed currently, oil tanker companies are finding getting insurance difficult and have abandoned the business. Now only tankers owned by Russia, India and China handle the trade that can be done. It appears that 2.5Mb of Russian crude is finding buyers in China and India, however 2Mb/d+ is not, even at US$30/b discounts. India is now contemplating paying for Russian crude in Rupees, Yuan or Rubles. China may be moving to create an alternative to the world reserve currency (the US dollar) and lifting the Yuan to the second position ahead of the Eurodollar. If quite a few countries follow this lead and other commodities get priced in Yuan then the dollar’s powerful position as the world reserve currency would be negatively affected.The removal of Russia was the catalyst for this major change in pricing of commodities. The US dollar remains the big kahuna with over 50% of world trade conducted in its currency. This is the biggest threat the US dollar has ever faced.

- Saudi Arabia, UAE and Kuwait have not responded positively to President Biden’s pressure to increase production by 2-3Mb/d immediately. In the case of the Crown Prince of Saudi Arabia, Biden will not even talk to him (just to his father) as he calls him a ‘pariah’ for the murder of his citizens and his flawed war in Yemen. Last week’s attack by Houthi against Saudi energy infrastructure may be the catalyst for a change in US policy as they cannot afford to have Saudis 12Mb/d of capacity threatened.

- The Biden administration continues talks with Iran to conclude a nuclear deal and then remove sanctions so that they can increase crude sales by 1.3-1.5Mb/d in the near term. Now he has his administration dialoguing with Venezuela. It seems buying oil from despotic murdering thugs is more palatable to Biden for US consumers, than buying from Canada or expanding the cleaner and more ethical US oil and gas.

Bearish pressure on crude prices:

- Covid is picking up around the world and lockdowns are restarting. China is seeing the most lockdowns with 60M people from the eastern cities of Shanghai, Shenzhen, Hong Kong and other areas under lockdown and their economies are non-functional. Demand for energy in the country of 14.5Mb/d (2021 data) could decline by 1.5-2.0Mb/d during the lockdowns. Europe is also seeing rising caseloads with Germany adding 208K cases. The biggest increases seem to be occurring in Asia with Vietnam adding 254K cases and South Korea adding 362K new cases. World death rates now exceed 6.09M of which 973K are US deaths.

- The Iran nuclear negotiations are working towards sealing a deal and having sanctions removed so that they can sell their oil around the world. President Biden may be giving away more concessions to Iran (removing the Iran Revolutionary Gaurd (IRGC) from the terrorist list) in order to have sanctioned Iranian oil available. This one has neighbors in the Middle East apoplectic. US politicians from both sides of the aisle are also opposed. What is Biden doing – is there any moral line he will not cross? Putin is evil but Iran’s ruling mullahs and terrorist forces have killed more civilians around the world. Are deaths in Europe more valuable and require military and sanctions than deaths in Africa or Asia?

- Venezuela appreciates the olive branch offered by the US and released two imprisoned Americans after their initial talks with US officials. Will this be a thaw in the relationship? Will the US just give them sanction relief but not require a unity government formed? It looks like barrels may win. Venezuela could increase production by over 2Mb/d (from 680Kb/d in February) but how quickly is not known due to the poor maintenance of their fields and infrastructure.

- The US and allies are releasing 60Mb of oil from their strategic oil reserves. The US will supply 30Mb of those volumes in April and May.

- The likelihood of a worldwide recession is rising. The high cost of energy is lowering consumers and industry’s capacity to handle the cost pressures. Many businesses are closing or limiting their hours in Europe. Food costs are exploding! Russia and Ukraine produce one-third of global wheat and barley production. Ukraine provides European livestock farmers with corn and other grain additives. None of this is being shipped now from the Black Sea ports. Nickel prices have exploded to the upside (doubled to US$100,000/ton) and the London Metal Exchange (LME) suspended trading and canceled trades as producers who presold production got margin calls that they couldn’t meet. This may be a multi-billion dollar margin call disaster like the ‘Lehman event’ of the 2008 financial crisis.

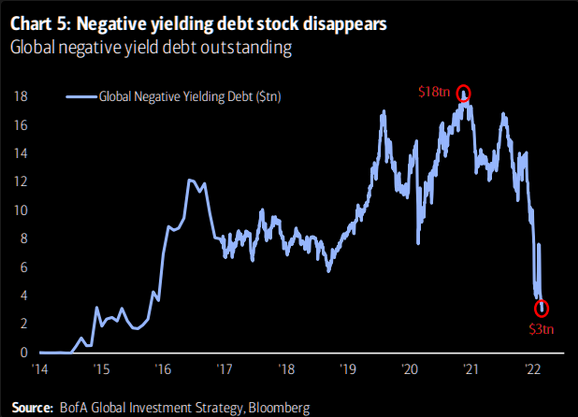

- Inflation is now exceeding 10% in the US and around the world. Do they fight inflation by raising interest rates and lower financial liquidity? The Federal Reserve has been behind the eight ball and is being pushed to react by the unfolding bad news. The US Treasury bond structure has gone from positively sloped to an inversion in recent days. The three and five year US Treasury yields have traded above the yield of the 10-year. This has historically led to US recessions which other countries follow. A global recession is now very possible later this year due to the ongoing and persistent inflation pressure on food, transportation and shelter. Central banks are behind the inflation curve which they themselves caused by their generous accommodation. Allowing low interest rates in Europe and Asia to go negative, was abysmal.

- US Retail Sales out today were terrible. Ex-Gas/Autos, they fell by 0.4% (prior month +5.2%) and this is before knowing that consumer prices rose 0.8% in the month. Consumption is likely to decline in the coming months as the burden of higher food, energy and housing costs rise and leave less spending for other items. Remember consumer spending is around 70% of total spend.

CONCLUSION:

The invasion of Ukraine has spiked up crude prices. We expect that higher energy costs will knock down crude demand by 4-5Mb/d later this year resulting in a global recession. When global recessions unfold, crude prices plunge sharply. In 2008-2009 during the financial crisis demand fell by over 5Mb/d (from over 88Mb/d to 83Mb/d). The price of crude fell from US$147.27/b to US$33.55/b in eight months. During Iraq’s invasion of Kuwait prices rocketed from US$16.16/b in July 1990 to a high of US$41.15/b in October and then plunged in four months to US$17.45/b as recessionary demand destruction occurred. WTI today is at US115.04/b as some European countries contemplate cutting off using Russian crude. Of note, Germany does not want to join this Biden planned new sanction.

Energy Stock Market: The stock markets around the world are gyrating with large daily price moves. Today the Dow is down 250 points. The S&P/TSX Energy Index has recovered 5+ points to the 225 level due to the recent rise again in crude oil prices.

Our March SER Report comes out next Thursday March 31st. It will include a detailed review of the economic impact and likely difficult recession the world will be facing in the coming months. Previous recessions, after parabolic energy and other commodity inflationary price spikes, have been severe and stock markets have been crushed. The current market declines are just the tip of the iceberg. Downside for the Dow Jones Industrials is towards the 24,000-25,000 range during Q3/22 (today 34,460 – down from the high at the start of this year of 36,953). We expect violent market swings in the coming weeks with over 1,000 point down and up days for the Dow Jones Industrials as it works its way through this inflation and war-induced bear market.

In our upcoming SER Monthly report we go over in detail the financial and operating results of 11 companies that have reported. The financial results have been for the most part quite healthy given the war premium in commodity prices. The exception is the energy service sector which is having a tough time getting a decent return on capital employed and passing through the large cost increases they face. Our energy company models have the war and supply disruption windfall cash flows removed from Q3/22 onward. Energy, Energy Service and Pipeline and Infrastructure stocks are trading at or close to our one-year targets so the appreciation upside is limited. Use days of strength to lower exposure and build cash reserves for the next great buying opportunity.

If you want access to this encompassing and timely market update report and to know which energy sector stocks provide the most attractive returns longer term and at what prices they would again be attractive for purchase (when the phase of the energy Bull Market re-commences) become a subscriber. Go to https://bit.ly/3jjCPgH to subscribe.

Please feel free to forward our weekly ‘Eye on Energy’ to friends and colleagues. We always welcome new subscribers to our complimentary energy overview newsletter.

Frank Stronach, founder of one of Canada’s largest global companies, says the country is “fairly close” to a public debt crisis and Canadians need to force politicians to rein in spending.

The Magna International Inc founder was speaking on BNN Bloomberg Wednesday after writing an op-ed for the National Post this week.

When asked how close Canada was to a debt crisis similar to the one that threatened the country in the 1990s, Stronach said: “I think fairly close, you know, our debt rises about $400 million every day, right? So that should be a great concern.”

In his op-ed, Stronach wrote that Canada is not immune to the slide toward bankruptcy seen by other countries such as Argentina and Greece.

“On the contrary, at the rate we’re going, we’re moving closer and closer toward that scenario. Canada’s debt-to-GDP ratio in 2021 was approximately 109 per cent — the same percentage as Greece just a few short years before it was bailed out. In other words, the amount of money Canada owes is more than the amount we produce in goods and services. That’s never a good sign,” he wrote…read more.

The Singapore-based company bankrolling the $1.6 billion Woodfibre LNG plans to spend US$500 million this year on the Squamish based project.

In an update to mayor and council in Squamish Tuesday, Woodfibre LNG’s new CEO, Christine Kennedy, said the company behind the LNG project, Pacific Energy Corp., has approved more than $600 million (US$500 million) in spending for the project in 2022.

“While we have not yet issued our final notice to proceed, this confirmed investment is indicative of our intent to start pre-construction work this year, and complete this critical low-emission energy project in 2027,” Kennedy said in a statement to BIV News.

Woodfibre officially set up its office in Squamish in 2013. Several setbacks have pushed back a final investment decision and construction start date, requiring Woodfibre LNG to get extensions to its environmental certificate…read more.