Op/Ed

Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 30 energy, energy service and pipeline & infrastructure companies with regular updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

Russia/Ukraine War Update:

President Biden Tuesday, at the urging of both the parties in Congress, announced the cut-off by the US of all energy product imports (crude oil, crude products, LNG and coal) from Russia. This pushed the price of crude up. The recent high for WTI is US$130.50/b and today it is at $109.12/b (down US$14.58/b as I write this, and the daily price swing has been over US$20/b) on rumors of some unnamed OPEC country willing to increase supplies. If the Saudi’s don’t add supplies as they have the only large capacity left then this is just part of the daily volatility price swings. Crude prices are expected to continue to have large daily moves as the horror of the fighting in Ukraine escalates and more sanctions are imposed on Russia. In return, Russian retaliatory moves will impact prices. If Putin decides to use WMDs or cuts off some of the natural gas currently provided to Europe in spite, some pundits are calling for crude to rise over US$175/b. Even more dire forecasts have come from military experts who fear that the unbalanced President Putin could, in frustration with the lack of progress to capture Kiev and Kharkiv, use a low level tactical nuclear device on a small to medium Ukrainian city to force Ukraine’s government to surrender. They see Brent rising over US$200/b if this horrible event occurs. The first two weeks of the war have been devastating and genocidal (use of cluster bombs and bombing of civilian faciliites like hospitals and schools) but the worst is likely to come in the next few weeks. Once the mass migration of refugees has occurred (2M+ so far and expected to rise to over 5M in the coming weeks) Putin may unleash his fearsome’ total war’ phase as he did in Chechnya and Syria.

Putin is under pressure but even the lower energy volumes he can sell at discounts to willing buyers still provide Russia with high prices and large revenues in Yuan, gold and crypto due to the commodities’ significantly higher war prices.

EIA Weekly Oil Data: The EIA data of Wednesday March 9th was moderately bearish for energy prices but the price of WTI and Brent crude are reacting to the invasion by Russia. Bank of America forecasts that each 1Mb of crude oil product lost to the tight market means a $US20/b increase. With 3-4Mb of crude and products now unsaleable, the war premium is now $US60-80/b, or over half of the current price. They speculate that if 5Mb ends up being unsaleable as Europe joins the US embargo the price spike could take prices to over US$150/b.

US Commercial Crude Stocks fell 1.9Mb versus the forecast of a decline of 0.7Mb. Motor Gasoline Inventories fell 1.4Mb while Distillate Fuel Oil Inventories fell 5.2Mb. Refinery Utilization rose 1.6 points to 89.3% as refiners work to add more product for the energy shortage in the US and the world. Increased product could be sent to Europe to alleviate the tighter conditions there. US Crude Production remained steady at 11.6Mb. Gasoline prices have rocketed up to over US$7/gal in parts of the US, particularly in California. EVs are looking a lot more financially and fuel cost attractive to consumers. However, while the US industry is advertising a lot of new EVs they are still months or years away from availability. Selling prices for all cars are now above manufacturer’s recommended prices as dealers maximize profits from the low inventories in their showrooms.

Total Demand rose 381Kb/d to 21.21Mb/d as Other Oils demand rose 454Kb/d to 4.93Mb/d. Motor Gasoline demand rose 219Kb/d to 8.96Mb/d. Jet Fuel Consumption fell 117Kb/d to 1.35Mb/d. Cushing Crude Inventories fell 0.6Mb to 22.2Mb.

EIA Weekly Natural Gas Data: Weekly winter withdrawals continue. Last week’s data showed a withdrawal of 139 Bcf, lowering storage to 1.643 Tcf. The biggest US draws were in the Midwest (46 Bcf), the East (38 Bcf) and in South Central (35 Bcf).

The five-year average for last week was a withdrawal of 121 Bcf and in 2021 was 98 Bcf due to the warming weather and the end of winter consumption at the end of this month. April starts the new injection season. Storage is now 13.4% below the five-year average of 1,898 Tcf. Today NYMEX is US$4.53/mcf due to milder weather. AECO is trading at $4.75/mcf. After winter is over natural gas prices typically retreat and as the general stock market continues to decline, a great buying window should develop at much lower levels for natural gas stocks in Q3/22.

Baker Hughes Rig Data: The data for the week ending March 4th showed the US rig count unchanged at 650 rigs (up five rigs in the prior week). Of the total rigs working last week, 519 were drilling for oil and the rest were focused on natural gas activity. The overall US rig count is up 61% from 403 rigs working a year ago. The US oil rig count is up 67% from 310 rigs last year at this time. The natural gas rig count is up a more modest 41% from last year’s 92 rigs, now at 130 rigs.

Canada had a loss of seven rigs (up four rigs last week) to 217 rigs as springtime road bans halt most drilling. The rig count level will start falling sharply in the coming weeks. Only rigs staying on location drilling pad wells will be active shortly. Canadian activity is up 54% from 141 rigs last year. There was a four rig decrease for oil rigs and the count is now 134 oil rigs working. However this is up from 80 working at this time last year. There are 82 rigs (down three on the week) working on natural gas projects now, but still up from 61 rigs working last year. Staffing of rigs in Canada is still a problem and adding significantly more rigs this summer may be problematic. While rig and frack day rates are rising, so are costs and therefore margin improvements are not what one should expect as the industry activity picks up. Service industry margins need to rise materially in 2H/22 if drilling and completion activity is to rise.

The overall increase in rig activity from a year ago in both the US and Canada should translate into rising liquids and natural gas volumes over the coming months. The data from many companies’ plans for 2022 support this rising production profile expectation. We expect to see US crude oil production reaching 12.0Mb/d in the coming months. Companies are taking advantage of attractive drilling and completion costs and want to lock up experienced rigs, frack units and their crews as staffing issues are difficult for the sector. The EIA forecasts US production reaching 12.5Mb/d before the end of this year.

President Biden has not encouraged the US industry to solve the cut-off of Russian products by adding production of 750Kb/d as quickly as they can. He remains committed to his clean energy game plan which may take decades and US$Trillions to achieve. To meet the near-term problem of lack of supply in Europe he is not asking American energy companies to rise to the occasion but is working to get despotic and murderous regimes in Iran and Venezuela to provide the shortfall. His moral fiber on clean energy has been trumped by his desire to get much dirtier oil from autocratic countries. NUTS!

Conclusion:

Bullish pressure on crude prices:

- Russia’s invasion of Ukraine and the severe destruction of the country has rallied European nations against Russia. Even though imports into Europe of crude oil and natural gas are allowed, oil tanker companies are finding getting insurance difficult and have abandoned this business. Now only tankers owned by Russia, India and China handle the trade that can be done. Natural gas should not be impacted unless some of the current export pipelines are destroyed or Russia holds back supplies.

- Libya is having production problems again. How much volumes are down and for how long is yet unknown.

- Russia is now the most sanctioned country in the world, far exceeding the sanctions imposed on Iran and North Korea. Putin likely does not see a face-saving way out and may just increase his oppression, using WMDs including thermobaric bombs to flatten Ukraine. If he can’t capture the country he may just destroy it. The horrors of WWII are back in play.

- Saudi Arabia, UAE and Kuwait have not responded positively to President Biden’s pressure to increase production by 2-3Mb/d immediately. In the case of the Crown Prince of Saudi Arabia, Biden will not even talk to him (just to his father) as he calls him a pariah for the murder of his citizens and his flawed war in Yemen.

Bearish pressure on crude prices:

- The Iran nuclear negotiations are working towards sealing a deal and having sanctions removed so that they can sell their oil around the world. President Biden may be giving away more concessions to Iran in order to have sanctioned Iranian oil available. If a deal is concluded in the next week or so and Iran receives sanction relief, Iran could increase production by 1.3-1.5Mb/d immediately. Iran also has over 100Mb in floating storage around the world near its buyers and another 100Mb ready to sell.

- Venezuela appreciates the olive branch offered by the US and released two imprisoned Americans after their initial talks with US officials. Will this be a thaw in the relationship? Will the US just give them sanction relief but not require a unity government formed? It looks like barrels may win. Venezuela could increase production by over 2Mb/d but how quickly is not known due to the poor maintenance of their fields and infrastructure.

- The US and allies are releasing 60Mb of crude from their strategic reserves to meet short term needs. The US will supply 30Mb of the volumes to meet near term needs.

- The likelihood of a worldwide recession is rising. The high cost of energy is lowering consumers and industry capacity to handle. Many businesses are closing or limiting their hours in Europe. Food costs are exploding! Russia and Ukraine produce one-third of global wheat and barley production. Ukraine provides European livestock farmers with corn and other grain additives. None of this is being shipped now from the Black Sea ports. Nickel prices have exploded to the upside (doubled to US$100,000/ton) and the London Metal Exchange (LME) suspended trading and canceled trades as producers who presold production got margin calls that they couldn’t meet. This may be a multi-billion dollar disaster and could be the Lehman event of this financial and military crisis.

- Inflation will likely exceed 10% for CPI and PPI around the world and will box Central Banks in. Do they fight inflation by raising rates and lowering liquidity or do they provide accommodation during this war event. In either case the world faces a moderate or severe recession once hostilities end.

CONCLUSION:

The invasion of Ukraine has spiked up crude prices. In the end the higher energy prices will knock down demand 4-5Mb/d and we are likely to see recessions around the world later this year. If a worldwide recession unfolds, the price of crude could plunge sharply. One bank energy forecaster predicted today that we may see Brent exceed US$200/b in the coming weeks as the next painful phase of the war is initiated by Russia, but will fall rapidly to US$50/b once recessions take over. In 2008-2009 during the financial crisis demand fell by over 5Mb/d (from over 88Mb/d to 83Mb/d). The price of crude fell from US$147.27/b to US$33.55/b in eight months. During Iraq’s invasion of Kuwait prices rocketed from US$16.16/b in July 1990 to a high of US$41.15/b in October and then plunged in four months to US$17.45/b as recessionary demand destruction occurred.

Energy Stock Market: The stock markets around the world are gyrating with large daily price moves. Today the upside is 650 points (short covering rally day) for the Dow after the recent US sanction on Russian energy imports is applauded. The next move is Putin’s. Something bad (some kind of escalation by Tsar Putin) is about to happen in the coming days. The S&P/TSX Energy Index has retreated 3.7% today or over 8 points to the 216 level due to the sharp pullback in crude oil prices. Our energy sector has been benefiting from our attraction as a secure and safe supply source. The Canadian government is having chats about building LNG plants to provide natural gas to Europe but we are skeptical that this gets traction with the left -focused government agenda that needs the anti-energy industry NDP support to get anything done.

Our March Interim SER Report will be coming out next Thursday March 17th. It will include a detailed review of the economic impact and likely difficult recession the world will be facing in the coming months. Previous recessions after parabolic energy and other commodity inflationary price spikes have been severe and stock markets have been crushed. The current market declines are just the tip of the iceberg. Downside for the Dow Jones Industrials is the 24,000-25,000 during Q3/22 (today 33,300 – down from the high at the start of this year of 36,953). We expect violent market swings in the coming weeks with over 1,000 point down and up days for the Dow Jones Industrials as it works its way through this inflation and war induced bear market.

In our Interim report we go over in detail the financial and operating results of 13 companies that have reported. The financial results have been fabulous given the war premium in commodity prices. Our models have this windfall cash flow removed from Q3/22 data onward. Stocks are trading at or close to our one year targets so the upside is limited.

If you want access to this encompassing and timely market update report become a subscriber. Go to https://bit.ly/34iKcRt to subscribe.

Please feel free to forward our weekly ‘Eye on Energy’ to friends and colleagues. We always welcome new subscribers to our complimentary energy overview newsletter.

Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 30 energy, energy service and pipeline & infrastructure companies with regular updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

Russia/Ukraine War Update:

The second installment of sanctions against Russia have been crippling. They target financing and moving exports & imports, those around Tsar Putin and the Central Bank of the country. This makes for even a more dire moment in history. WTI today rose to over US$112/b. How high crude prices go in the near term depends upon what amounts of crude that Russia is able to sell and the nastiness of the next phase of the war. Russia is now using more carpet bombing (like in WWII) and if Putin uses thermobaric or hypersonic weapons (WMDs) in Ukraine this will mark a significant increase in the intensity and ferocity of the war. If this occurs, then even more painful sanctions are likely to be added by the US and its NATO allies. Putin has threatened to use tactical nuclear weapons as he is finding a lack of success on the battlefield and doesn’t seem to care about casualties.

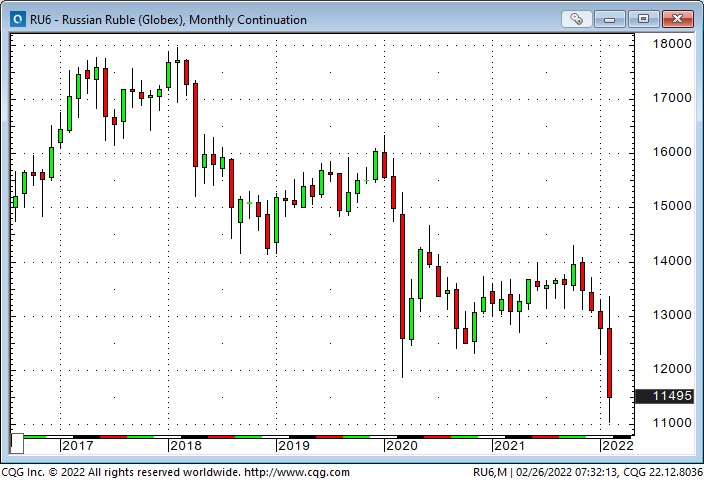

Russians are facing currency runs on their banks, a sharply falling currency, rapidly rising inflation and shockingly higher interest rates. A severe and lengthy recession is now likely. This war has been going on for a week now and the forecast of a 2-4 week invasion now looks to be taking a longer timeline. Russia has now added their best troops to the forces moving towards Kyiv and has added to its captured land in eastern and southern Ukraine. The Ukrainian held cities of Kharkiv, Kherson and Mariupol are now encircled and likely to be captured in the next week. The decapitation of the civilian and military leadership of Ukraine seems to be Putin’s next major goal. An attempt (authorized by Putin) by two Chechan attack groups to go and kill President Zelensky has been stopped with the help from Russian FSB members who are against the invasion (reported today by Newsweek).

EIA Weekly Oil Data: The EIA data of Wednesday March 2nd was moderately bearish for energy prices but the price of WTI and Brent crude are reacting to the increased escalation by Russia. WTI as I write this is US$110.65/b, down slightly from the day’s high of US$112.51/b. How high it goes in the coming weeks depends upon the ferocity of the next phase of the war or if diplomacy has a chance. Some pundits see prices rising to US$150/b if WMDs are used.

US Commercial Crude Stocks fell 2.6MMb versus the forecast of a rise of 2.75Mb. The main reason for this difference is that Net Imports fell 2.171Mb/d or by 15.2Mb on the week. Had Net Imports been flat, Crude Stocks would have grown by 12.6Mb on the week. Motor Gasoline Inventories fell 0.5Mb while Distillate Fuel Oil Inventories rose 0.3Mb. Refinery Utilization rose 0.3 points to 87.7 US Crude Production remained steady at 11.6Mb.

Total Demand fell 654Kb/d to 20.83Mb/d as Other Oils demand fell by 452Kb/d to 4.47Mb and Propane/Propylene consumption fell 403Kb/d to 1.48Mb/d. Motor Gasoline rose 86Kb/d to 8.74Mb/d. Jet Fuel Consumption fell 6Kb/d to 1.47Mb/d. Cushing Crude Inventories fell 1.0Mb to 22.8Mb.

EIA Weekly Natural Gas Data: Weekly winter withdrawals continue. Last week’s data showed a withdrawal of 129 Bcf, lowering storage to 1.782 Tcf. The biggest US draws were in the Midwest (46 Bcf), and the East (39 Bcf) and in South Central (34 Bcf).

The five-year average for last week was a withdrawal of 184 Bcf and in 2021 was a whopping 338 Bcf due to the severe weather that week. Storage is now 10.7% below the five-year average of 1.996 Tcf. Today NYMEX is US$4.72/mcf due to an expected colder spell in the coming days. AECO is trading at $4.47/mcf. After winter is over natural gas prices typically retreat and if the general stock market decline unfolds as we expect, a great buying window should develop at much lower levels for natural gas stocks in Q3/22.

Baker Hughes Rig Data: The data for the week ending February 25th showed the US rig count rose by five rigs (up 10 rigs in the prior week) to 650 rigs last week. Of the total rigs working last week, 522 were drilling for oil and the rest were focused on natural gas activity. The overall US rig count is up 62% from 402 rigs working a year ago. The US oil rig count is up 69% from 309 rigs last year at this time. The natural gas rig count is up a more modest 38% from last year’s 92 rigs, now at 127 rigs. Texas had the largest increase in rigs with four added last week and the total rising to 312 rigs. The Permian (Texas and New Mexico) added three rigs taking the total rigs working in this lucrative basin to 309 rigs.

Canada had an increase of four rigs (up one rig last week as well) to 224 rigs. Canadian activity is up 37% from 163 rigs last year. There was a three rig increase for oil rigs and the count is now 138 oil rigs working up from 92 last year. There are 85 rigs working on natural gas projects now, up from 71 rigs working last year. Staffing of rigs in Canada is becoming a problem and adding significant more rigs in the near term is unlikely. While day rates are rising, so are costs and therefore margin improvements are not what one should expect as the industry activity picks up. The current view is that margins should rise after spring breakup.

The overall increase in rig activity from a year ago in both the US and Canada should translate into rising liquids and natural gas volumes over the coming months. The data from many companies’ plans for 2022 support this rising production profile expectation. We expect to see US crude oil production reaching 12.0Mb/d in the coming months. Companies are taking advantage of attractive drilling and completion costs and want to lock up experienced rigs, frack units and their crews as staffing issues are difficult for the sector. The EIA forecasts US production reaching 12.5Mb/d before the end of this year.

Conclusion:

Bullish pressure on crude prices:

• Russia’s invasion of Ukraine and the severe destruction of the country has rallied European nations against Russia. Germany, the closest to Russia, has announced that Nord Stream 2 will not be approved to start up and that they are sending lethal weapons to Ukraine. They even reversed their pacifist military spending and will raise the total to over 2% of GDP which the US has been pushing them to do for the last few decades. The tough ‘SWIFT’ financial transaction limitations (just excluding exports of energy products) will be crippling to Russia as they were providing 2.5Mb/d to Europe. Even the US has imported from them. Two weeks ago they imported 106Kb/d according to EIA reports. Even though exports of crude oil are allowed, tanker companies are finding getting insurance difficult and have abandoned this business. Tankers owned by Russia and China will handle the trade that can be done which may be only 30% of the prior amount according to industry experts. Natural gas should not be impacted unless some of the current export pipelines are destroyed.

Bearish pressure on crude prices:

• The Iran nuclear negotiations are working towards sealing a deal and having sanctions removed so that they can sell their oil around the world. Negotiations appear to be making a breakthrough with a timeline of next week. President Biden may be giving away more concessions to Iran in order to have sanctioned Iranian oil available if Russia is precluded from sales to Europe and the US. If a deal is concluded in the next week or so and Iran receives sanction relief, Iran could increase production by 1.3-1.5Mb/d immediately. Iran also has over 100Mb in floating storage around the world near its buyers and another 100Mb ready to sell.

• The preliminary report of February OPEC production shows that they increased volumes by over 420Kb/d, exceeding their stated 400Kb/d goal and much above the January increase of a miniscule 64Kb/d. It appears that the invasion risk and the arm twist by President Biden has worked.

• The US and allies plan to release 60Mb of crude to meet short term needs from their strategic reserves. The US will supply 30Mb of the volumes to meet near term needs.

CONCLUSION:

The invasion of Ukraine has spiked up crude prices. In the end the higher energy prices will knock down demand and we are likely to see recessions around the world later this year. Russia will feel the most pain as it goes into a severe recession. If a worldwide recession unfolds then total demand could fall 3-5Mb/d and the price of crude will fall from its current war premium, elevated level. In 2008-2009 during the financial crisis demand fell by over 5Mb/d (from over 88Mb/d to 83Mb/d).

Energy Stock Market: The stock markets around the world are gyrating with large daily price moves. When the focus was on the invasion and sanctions then the stock market had big down days (March 1st down 598 points for the Dow). Today the upside is 563 points as we write this, as the focus is on the Fed as Chairman Powell testifies before Congress. He has soothed fears of a rapid rise in interest rates. In his testimony he said he supports only a 25 basis point increase in rates. Today the S&P/TSX Energy Index is up two points to 214 as higher crude prices lift the sector. Security of supply is now an attractive focus of investors and Canada is a beneficiary as is US domestic companies.

Our Q1/22 quarterly SER webinar was held on Thursday February 24th at 7PM MT. If you want to listen to this event in our archives then become a subscriber. Go to https://bit.ly/34iKcRt to subscribe.

Please feel free to forward our weekly ‘Eye on Energy’ to friends and colleagues. We always welcome new subscribers to our complimentary energy overview newsletter.

The Russian Blitzkrieg invasion of Ukraine initiated DRAMATIC surges and reversals across markets

The S+P plunged to a 9-month low early Thursday morning (down ~15% from January All-Time Highs) but then rallied hard into Friday’s close.

The DJI tumbled and bounced back ~1,700 points in this 4-day week to close almost precisely where it closed last week! (Like nothing happened!)

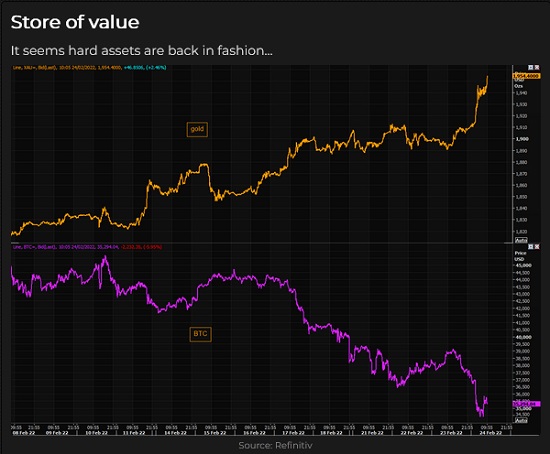

Gold had been trending higher (up ~ $125) since late January but soared another ~$75 early Thursday, only to plunge nearly $100 later the same day.

Gold is leaving Bitcoin in the dust.

WTI crude oil rallied ~50% from early December to mid-February – it soared and collapsed ~$9 on Thursday (after briefly trading above $100 for the first time in eight years.)

Chicago wheat soared to a 12-year high and then tumbled sharply on Friday (soybeans and corn also surged and fell this week.)

The US Dollar Index surged to a new 20-month high (as the Euro plunged to a 20-month low), then fell sharply into Friday’s close.

The Russian Ruble tumbled to a new All-Time Low Vs. the US Dollar.

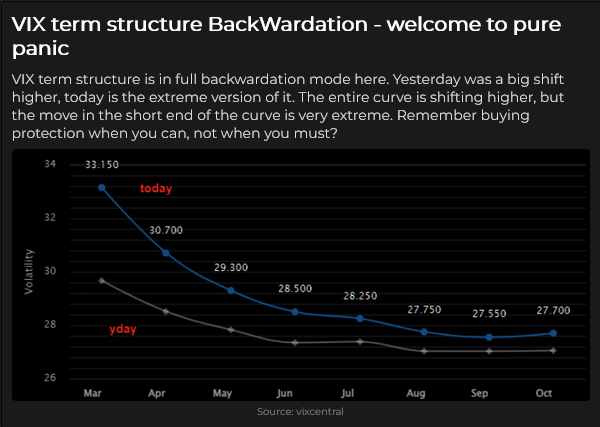

Stock index options volatility soared to nearly the highest levels since the Covid panic in 2020 but fell sharply on Friday.

This chart is from Thursday:

Why the stunning market reversals this week?

Markets were shocked at the Russian attack’s speed, size, and ferociousness. Everybody knew the Russians had massed troops and military hardware to the North, South and East of Ukraine, and the “geopolitical stress” had exacerbated risk-off sentiment last week, especially with American and British intelligence services predicting an imminent attack.

this chart was released mid-week:

But “nothing” happened in Ukraine early in the week, and then, suddenly, Wednesday evening, the Russians charged. Markets did what you’d expect: stocks fell, the US Dollar, gold, commodities and volatility soared.

Stocks gapped lower when Thursday’s day session began – but Big Tech began to rally immediately while the broader market went sideways to lower.

On Thursday’s gap lower opening MSFT was down >20% from its November high. AAPL was down >16% from its January high. GOOG was down ~18% in less than a month. AMZN was down ~26% from its November highs. TSLA was down >40% from its early January highs, and NVDA was down ~38% from its November highs. FB was down>40% in less than a month.

Somebody started buying Big Teck with both hands when the market opened sharply lower Thursday morning. It was probably hedge funds covering shorts, which sparked the monster rally.

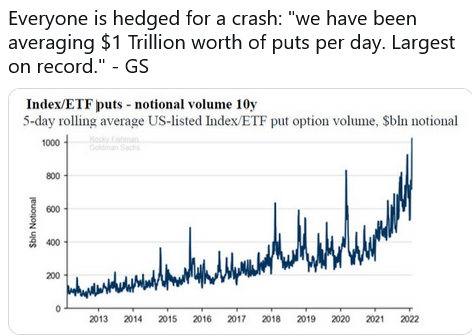

Market liquidity was thin – a war had just started – and option volatility had soared. As Big Tech started to rally, options dealers turned buyers to manage gamma risk – and as markets continued to rally, people who had previously bought puts began selling them, adding fuel to the fire.

When market sentiment becomes extremely risk-off (like when a war starts), correlations between assets go to one. With Big Tech leading the stock markets higher (the Nasdaq 100 was HUGELY out-performing the Dow), people started selling the spike rallies in gold, crude, grains and the US Dollar. People who had bought those markets (thinking they would have massive rallies because of the war) were positioned wrong and had to sell, accelerating the reversals from the spike highs.

One of the characteristics of bear markets is that they have face-ripping “bear market rallies,” – which we saw on Thursday and Friday. (One of the great market chestnuts is that everybody loses money in a bear market.)

It is critical to understand that the rally was NOT caused by people assuming that the war in Ukraine was “no big deal.” The war may end this weekend – or it may continue for months – but it is still a huge deal even if it does end this weekend. Putin has taken the gloves off, and a new cold war has started, which will have a HUGE impact on markets.

Russia is now a severe problem. Russia is not monolithic, and Russia is NOT Putin – who has been exposed as a cold-hearted liar. Thousands of Russian citizens have been arrested for protesting the war. The speed of the attack may have made Russia appear invincible, which may be far from the truth. The assumption that Putin will have unwavering support from China may also be wrong. (Wouldn’t it be interesting if Xi turned his back on Putin the Pariah?)

Russia will be isolated and will likely retaliate against the sanctions. Think cyber-attacks against the West. Commodity exports from Russia will be reduced – buyers will have to source products from other commodity-producing countries.

Western governments may be shocked into abandoning virtue-signalling ESG driven energy policies and start encouraging the development of reliable energy supplies. The USA, for instance, may promote the development of domestic fossil fuels and Canadian oil sands. (Note: CNQ closed at All-Time Highs Friday – despite WTI closing $9 below Thursday’s high.)

Biden has the State of the Union address on March 1, and this will be his opportunity to turn around his and the Democratic party’s fading popularity.

My short term trading

I got off to a slow start this week after the 3-day President’s Day weekend. I was flat at the end of last week and in no hurry to find a trade just for the sake of “doing something.”

I bought the S+P Tuesday and closed the trade for a small gain. I bought the Dow futures Wednesday and closed the trade for a slight loss.

I bought the S+P early Thursday morning as the market rallied back from the overnight lows but was stopped for a small gain. I rebought it a few minutes later as the market recovered from a brief setback and covered it on the close for a 110 point gain. I thought that the rally was a bear market short squeeze, and 110 points was a great move. The market rallied another 100+ points Friday without me.

The S+P rallied almost 300 points from early Thursday morning to Friday’s close. To put that stunning move into perspective: since the market turned up from the Covid panic lows in March 2020, there have only been three entire weeks with a 300 point high/low range.

I was flat going into the weekend, and my P+L was up ~1.2% on the week.

On my radar

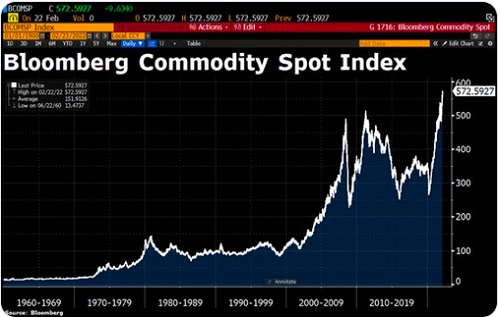

The spectacular commodity rally that saw the indices gain >200% since the March 2020 lows may have made an important top this week. The same thinking may apply to crude oil. I’m not saying the BIG commodity rally is over, but a correction is overdue.

I think the stock market rally off this week’s lows is a bear market rally, and it will run out of steam and rollover.

My son Drew points out that oil bulls might consider writing December ATM puts. Dec closed Friday at ~$81, an $11 discount to front-month April. The Dec $81 strike puts trade at around $11. Net/net if you sell the puts and get exercised at the end of November, you will effectively be long WTI at ~$70, which is ~$22 below the current front month price of $92. Backwardation creates opportunities. (This is not investment advice. Remember, WTI dropped from $147 in July 2008 to $33 in December.)

If WTI and commodities have the correction I expect, and then steady, I will look at writing forward dated WTI puts.

Thoughts on trading

This week was a great week for “making peace” with the fact that I can’t catch every move. I wanted to sell gold up $80 Thursday morning, and I wanted to sell WTI at $100. But I already had “the trade” on by being long the S+P. I noted above that correlation goes to one when sentiment is extreme. In that sense, in this environment, being long S+P was the “same thing” as being short gold or WTI. If I made the gold or WTI trade, I would be “concentrating” my risk exposure – and that’s great if you’re right, deadly if you’re wrong.

Of course, you can never have enough on when the market is soaring in your favour!

I’ve noticed my trading time horizon has shrunk as short-term price ranges have increased, which is purely intuitive risk management. I never used to be a day trader – but with today’s intra-day price swings more significant than what we used to see in a week or a month – well, it seems we’re all day traders now!

Quotes from the notebook

“Old school media want your top picks – they don’t care about or want to hear about your process.” Kieth McCullough – Hedgeye, RTV interview 2019

“Commentator’s (ie, chief strategists) success is linked to how often they are right or wrong. (They don’t have a P+L.) They are therefore entertainers…their fame is the result of their presentation skills.” Nasim Taleb – Fooled By Randomness

“I keep an eye on “the news” and “commentary” to get an idea of “positioning.” I want to have some idea of how much mispricing will be exposed if markets move contrary to the “commentary.” I want to front-run that re-positioning.”

Victor Adair, notes to myself, 2019

The Barney report

The Barns and I have been home alone for a few days this week as Moma is in the Big City helping friends. I make a point of getting him out for at least two long walks every day. This week he discovered Papa’s reading chair as a good place to rest up after a long walk. His claws are leaving marks on the leather – but what can you do – it’s the perfect place for him!

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk markets on a podcast

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The February 26 edition is available at: https://mikesmoneytalks.ca.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 30 energy, energy service and pipeline & infrastructure companies with regular updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

We are in a dire moment in history. Russia has invaded Ukraine and the war premium for crude has risen sharply. WTI today rose over US$100/b. How high crude prices go in the near term depends upon the severity of sanctions that will be imposed in the coming days. The key is what will Germany accept as they are the largest importer of energy from Russia. If energy, metals and grain exports by Russia are impacted by sanctions then all three of these product groups will have further significant upside price moves. Crude in this situation could rise over US$120/b in the short term. If only sanctions on Putin and those close to him are implemented and Russia is removed from the SWIFT financial clearing system, then crude will not skyrocket much higher. Today’s sanctions relate to use of outside currencies to purchase Russian goods. Also exports like technology are now not allowed which should hurt the Russian economy. They did not remove them from the SWIFT financial system as Europe still needs to pay for imports from Russia. These increased sanctions will be challenging for Russia but not severe enough to change Putin’s naked aggression. The next two weeks are the window of uncertainty as we see what Russia’s plans for Ukraine and its neighbors are. While these sanctions are tough, China has agreed to support Russia through these more difficult economic times.

EIA Weekly Oil Data: The EIA data of Thursday February 24th was moderately bearish for energy prices but the price of WTI and Brent crude are reacting to the Russian invasion of Ukraine and the possibility of energy export sanctions against Russia. Russia provides Europe with 25% of its crude and products and over 40% of its natural gas needs.

US Commercial Crude Stocks rose 4.5Mb versus the forecast of a rise of only 0.4Mb. The main reason for this difference is that Net Imports rose 623Kb or by 4.3Mb on the week. Motor Gasoline Inventories fell 0.6Mb while Distillate Fuel Oil Inventories fell 0.6Mb. Refinery Utilization rose 2.1 points to 87.4% from 85.3% a week ago. US Crude Production remained steady at 11.6Mb.

Total Demand fell 1.26Mb/d to 21.5Mb/d as Other Oils demand fell by 874Kb/d to 4.93Mb. Motor Gasoline rose 87Kb/d to 8.66Mb/d. Jet Fuel Consumption fell 30Kb/d to 1.48Mb/d. Cushing Crude Inventories fell 2.0Mb to 23.8Mb.

EIA Weekly Natural Gas Data: Weekly withdrawals remain high as winter continues. Last week’s data showed a withdrawal of 129 Bcf, lowering storage to 1.782 Tcf. The biggest US draws were in the Midwest (46 Bcf) and the East (39 Bcf) and in South Central (34 Bcf).

The five-year average for last week was a withdrawal of 163 Bcf and in 2021 was a whopping 338 Bcf due to the severe weather that week. Storage is now 10.7% below the five-year average of 1.996 Tcf. Today NYMEX is US$4.70/mcf due to an expected colder spell in the coming days. AECO is trading at $4.46/mcf. After winter is over natural gas prices typically retreat and if the general stock market decline unfolds as we expect, a great buying window should develop at much lower levels for natural gas stocks in Q3/22.

Baker Hughes Rig Data: The data for the week ending February 18th showed the US rig count rose by 10 rigs (up 22 rigs in the prior week) to 645 rigs last week. Of the total rigs working last week, 520 were drilling for oil and the rest were focused on natural gas activity. The overall US rig count is up 60% from 397 rigs working a year ago. The US oil rig count is up 71% from 305 rigs last year at this time. The natural gas rig count is up a more modest 36% from last year’s 91 rigs, now at 124 rigs. Texas had the largest increase in rigs with 8 added last week and the total rising to 308 rigs. The Permian (Texas and New Mexico) added five rigs taking the total rigs working in this lucrative basin to 306 rigs.

Canada had an increase of one rig (up one rig last week as well) to 220 rigs. Canadian activity is up 28% from 176 rigs last year. There was a two rigs decline for oil rigs and the count is now 135 oil rigs working up from 100 last year. There are 85 rigs working on natural gas projects now, up from 72 rigs working last year. Staffing of rigs in Canada is becoming a problematic issue and adding significant more rigs in the near term is unlikely. While day rates are rising, so are costs and therefore margin improvements are not what one should expect as the industry activity picks up. The current view is that margins should rise after spring breakup.

The overall increase in rig activity from a year ago in both the US and Canada should translate into rising liquids and natural gas volumes over the coming months. The data from many companies’ plans for 2022 support this rising production profile expectation. We expect to see US crude oil production reaching 12.0Mb/d in the coming months. Companies are taking advantage of attractive drilling and completion costs and want to lock up experienced rigs, frack units and their crews as staffing issues are difficult for the sector. The EIA forecasts US production reaching 12.5Mb/d before the end of this year.

Conclusion:

Bearish pressure on crude prices:

1. The Omicron pandemic is far from over but is losing its impact as individuals have been vaccinated and reopenings occur with no mask requirements. Covid-19 deaths are rising for the unvaccinated. Deaths in the US have reached 936K (up 14K over the last week) and worldwide has reached 5.89M.

2. The Iran nuclear negotiations are working towards sealing a deal and having sanctions removed so that they can sell their oil around the world. Negotiations appear to be making a breakthrough with a timeline of next week. President Biden may be giving away more concessions to Iran in order to have sanctioned Iranian oil available if Russia is precluded from sales to Europe and the US. If a deal is concluded in the next week or so and Iran receives sanction relief, Iran could increase production by over 1.5Mb/d immediately. Iran also has over 200Mb in storage around the world near its buyers, so those volumes could be added to supplies quite quickly.

Bullish pressure on crude prices:

1. Russia has invaded Ukraine and this is likely going to continue for a few weeks to complete their objectives. The US sees Russia having 200K troops in their invasion force. Cyber and air attacks since the invasion launch on Wednesday February 23rd have been happening throughout the country. The land battle has started with the invasion forces landing at the Black Sea ports and land forces coming in from the east and the north.

Russia provides over 26% of western Europe’s crude oil and product needs and over 40% of its natural gas needs. Any sanctions on these sales would not be easily met by other producers. This effectively is a two-edged sword. The US is sending over more cargoes of LNG and has asked Qatar and other producers to do the same. What new sanctions are agreed to with European countries will be key to how high crude prices go in the near term. If Russia is not allowed to export to Europe, then the shortage will be difficult to meet even with Iran being allowed to sell again to the world. Germany is the key to what occurs as they are the most reliant on Russia. WTI crude has lifted to over US$100/b today and may go up much more in the short term if Russia loses access to western markets. In the end though Russia will find a buyer for its energy volumes from China, so the issue will be logistics to make this happen.

The cost of this war is significant for Russia but the rise in prices of energy, metals and grains has been so large that this may be a financial boon for Russia. Crazy!

CONCLUSION:

The invasion of Ukraine has spiked up crude prices. WTI rose today to over US$100/b and has reversed to $92 with the sanction announcement. If financial access to the ‘SWIFT’ clearing system is added later then crude could spike upward again. If Russia is precluded from selling energy and other products to Europe then crude could spike to over US$120/b in the near term. So far this has not happened. Today’s sanctions will hurt but will not change Russia’s course of action.

In the end the higher energy prices will knock down demand and we are likely to see recessions around the world later this year. If this unfolds then demand could fall 3-5Mb/d and the price of crude will fall from its current war premium, elevated level.

Energy Stock Market: The stock markets around the world are getting hit hard as the concerns about the extent of the war and its implications spook markets. The Dow, the S&P, the Nasdaq, the TSX and other world exchanges (Germany has been hit by 5% earlier today) have broken support levels and look to have significant further downside. The bubble has burst already for the MEME and FAANG US stocks and now the overall market bubble has been pricked. Today even with all the bullish price action in crude the S&P/TSX Energy Index is down on the day and currently trades at 197 (down seven points from last week).

Our February SER Monthly Report comes out tomorrow and covers the latest signs of deterioration in the general stock market and increased weakness in key world economies. Significant stock market downside is ahead and investors should be defensively prepared. Some of you may remember the market upheaval of other bear markets like in 1987, 2000, 2008, and 2020? We hope you have prepared yourselves for this impairment risk to your assets. We have had six significant down days for the Dow Jones Industrials this month and much greater daily declines are likely in the weeks ahead.

Our February SER report covers this painful market situation. The Q4/21 and year end results for 2021 are starting to be released for the 30 companies that we cover. In next week’s issue we cover four companies that have reported by the close on Friday February 18th. In the March issues we will cover the rest of the regular reporting run.

Our Q1/22 quarterly SER webinar will be held tonight Thursday February 24th at 7PM MT. If you want to join/register for this event or access our Interim Report or the upcoming SER Monthly become a subscriber. Go to https://bit.ly/34iKcRt to subscribe.

Please feel free to forward our weekly ‘Eye on Energy’ to friends and colleagues. We always welcome new subscribers to our complimentary energy overview newsletter.

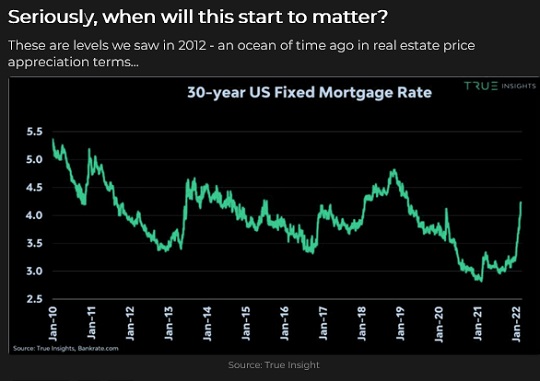

Interest rates have steadied after surging higher since November

The Dec 2022 Eurodollar futures contract closed red for 11 consecutive weeks but finally closed green this week as the relentless surge in short-term interest rates took a breather. (Eurodollar futures trade at a discount to par, or zero, so a price of 98 = a 2% interest rate.)

The US T-Note futures contract closed green this week with the 10-year yielding ~1.93%, down from last week’s high of ~2.05%.

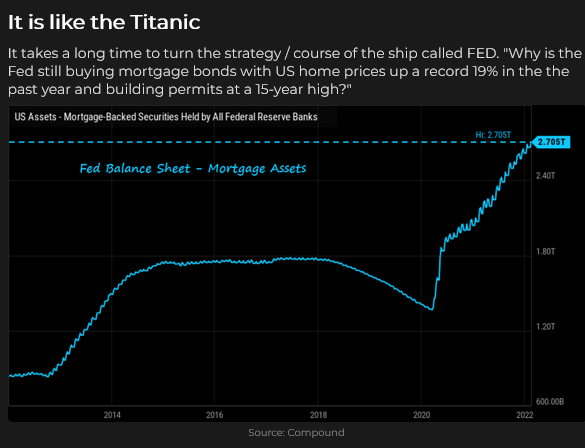

Mortgage rates have increased sharply as bond yields have spiked.

One of the reasons mortgage rates have been rising, other than interest rates spiking, is that demand for mortgages is WAY up.

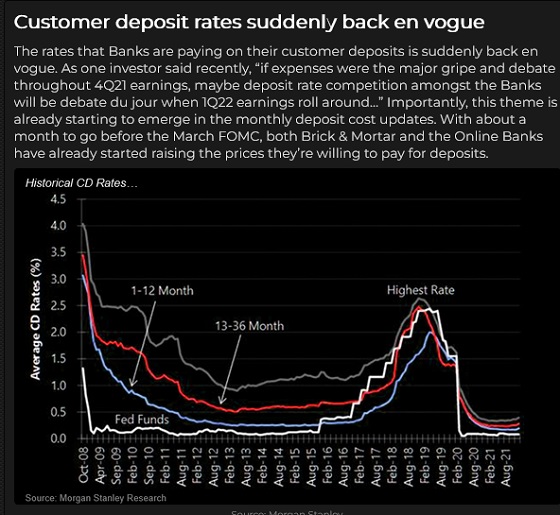

Interest rates for bank deposits haven’t increased much, but if/when they do, it will be interesting to see if people stop “reaching for yield” the way they have been.

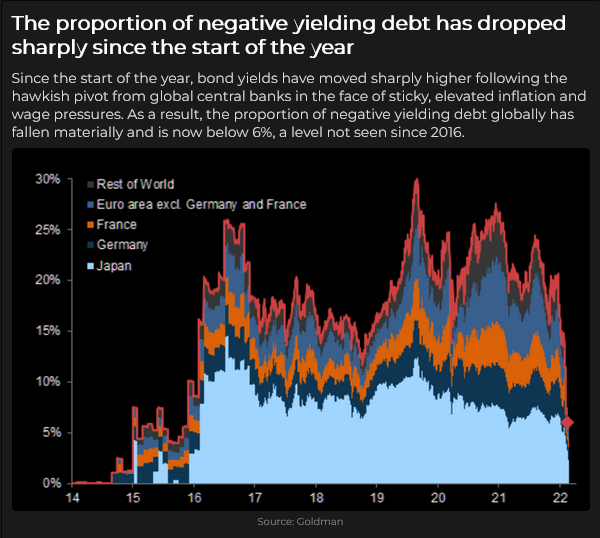

The global supply of negative-yielding debt keeps shrinking as interest rates rise.

Stock markets were under pressure again this week

The DJIA, the S+P and the (much broader) Vanguard Total Stock Market ETF had their lowest weekly close in over six months.

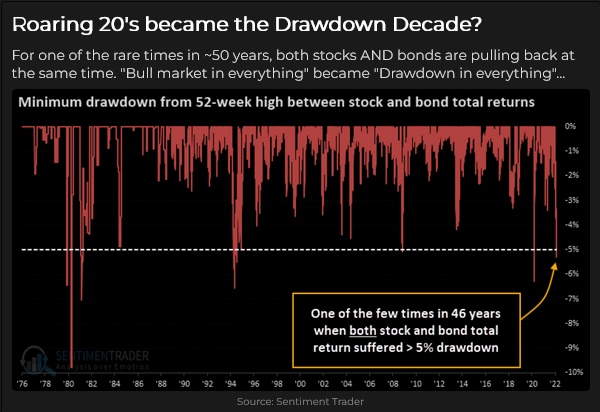

Classic 60/40 portfolios are not doing well YTD, with both stocks and bonds down.

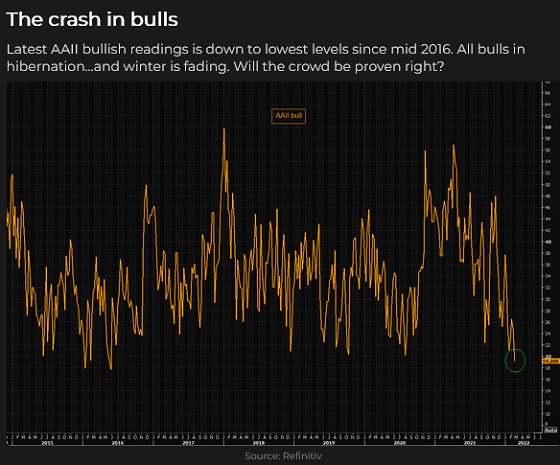

With stocks down, interest rates rising, inflation and geopolitical tensions, it’s no wonder bulls are pulling in their horns.

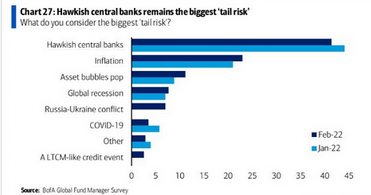

Here’s what Fund Managers worry about:

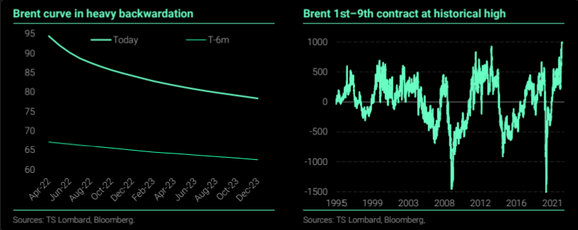

WTI crude oil futures steadied this week after rising 9 of the 10 previous weeks, up >50% from December lows

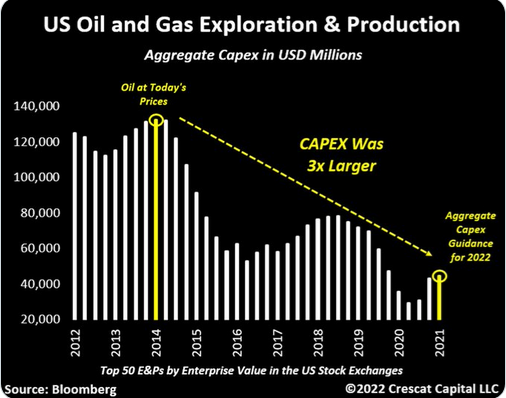

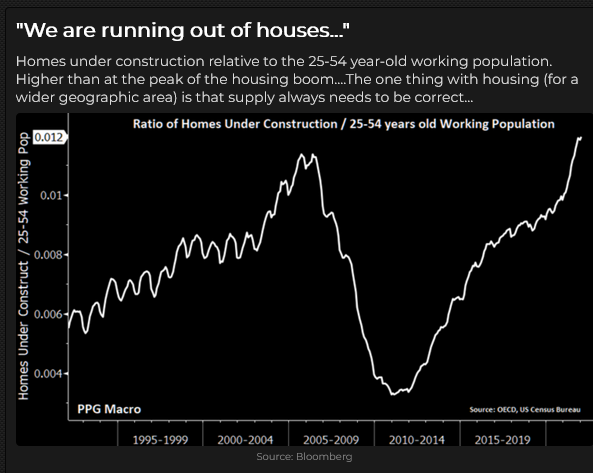

Geopolitical risk is giving energy markets a lift. Still, the BIG story is that rising global demand is gobbling up supply while spare production capacity shrinks thanks to chronic underinvestment in developing new reserves. And then there’s the ESG factor.

The “geopolitical risk premium” in crude oil markets has driven the time spreads to historical wides.

Gold and gold shares have been smoking hot on inflation and especially geopolitical concerns

I’ve read every weekly issue of the GOLD MONITOR, published by my friend Martin Mureenbeeld, since 1992. Gold producers and institutional investors around the world subscribe to his service. If you are seriously interested in gold you can sign up for a free trial on his website.

In this week’s letter Martin notes that, “gold has clearly broken away from the dollar and interest rate factors, confirming that the overriding determinant of gold just now is geopolitical. The Russia/Ukraine crisis may have added some $100 to the price of gold to date. This will be much larger in the event Putin chooses to invade (a typical rise translates into $180 today!) Gold will sell off quickly in the event Putin backs off.”

Gold shares have underperformed bullion for months but have jumped relative to the S&P this month.

The US Dollar Index has been broadly sideways since November – but closed green this week – Russia/Ukraine

The USDX hit an 18-month high in January but couldn’t sustain those gains.

The Canadian Dollar started to rally with WTI from the December lows but ran out of gas. Perhaps the risk-off tone in American equity markets put a damper on the CAD.

FOR THREE WEEKS, the CAD stayed in a narrow range between 7825 and 7900. The CAD has not reacted to the draconian Emergency Measures Act instituted by the Federal government this week. I’m assuming the market thinks this policy will be very narrowly focused and will quickly “blow over.” However, suppose that is not the case. In that event, I expect to see capital flight from Canada to the USA (which will be seen as the “Switzerland” of North America by worried Canadians) and substantially less Foreign Direct Investment in Canada.

You have to wonder if the boy wonder did a cost/benefit analysis before he made his draconian announcement. Not likely.

The following is my Valentine’s Day Tweet following the announcement of the Emergency Measures Act:

I’ve been a huge Mordecai Richler fan for decades. I’ve read “Barney’s Version” six times and watched the movie several times. (Yes, I named my dog after Barney.) If Mordecai were alive today, he would be ripping into the Federal Government with a venomous pen. Nobody could do it better!

Busybodies

Several years ago, when I was hosting the Moneytalks radio show, I referenced an article I’d read in the newspaper which quoted a person described as an “activist.” This person was determined that people agree with her vision of how the world “should” be.

I explained to my listeners that anytime I read an article that cites an “activist,” I automatically substituted the word “busybody.” My grandmother used the word “busybody” to describe people who thought they knew best about how other people should spend their time and money.

When covid came along, I realized it would be a busybody’s wet dream. They would feel morally justified shrieking at other people about how they should behave.

It turned out to be way worse than I imagined. The busybodies were everywhere and lusted for the authority to enforce their views. Many of the busybodies held elected office and did what they could to make other people do what they thought was best.

No wonder we’re seeing a magnificent decline in people’s respect for (or confidence in) government. This loss of confidence will change the world as we know it; the trading opportunities will be extraordinary!

My short term trading

I started this week short S+P futures from last week. I had stayed short over the weekend because the market had been down hard Thursday and Friday, and I thought it would likely fall further this week.

The market was lower in the Sunday overnight session but rallied ahead of the Monday day session, so I covered my position for a gain of ~85 bps.

I bought the S+P Tuesday but was stopped for a slight loss (and missed the Tuesday overnight rally.) I shorted the market Wednesday but was stopped for another slight loss (and missed the big Thursday/Friday drop.)

As you can imagine, I was mumbling to myself about having my stops too tight in a choppy market. But at the end of the week, I was flat, and my P+L was up ~0.55% for the week.

I looked hard at buying bonds and shorting stocks Friday. I didn’t make either trade because they were FOMO motivated, and I didn’t have a good setup. I would have been “making a bet” on things getting worse in Ukraine over the long weekend (once the Olympics were over.)

I cannot handicap the existential Ukraine crisis. If it gets worse, stocks will probably fall, and bonds will likely rally (as will gold.) But protecting my capital by not “making a bet” was the right thing to do.

Quotes from the notebook

“A good deal of selling takes place because people like the fact that their assets show gains, and they’re afraid the profits will go away.” Howard Marks, in his Selling Out Memo, January 2022

My Comment: I’m a big Howard Marks fan; I read his book, The Most Important Thing – Illuminated, twice. You might think it odd that a short-term futures trader would take an interest in a value investor who holds positions for years. Still, he is a hugely successful investor with 50 years of experience – and I like his way of looking at markets and people’s behaviour. I’ve read his monthly memos for years. I recommend him to you.

“There is tons of talk (about) how Central Banks have lost control of inflation expectations – nothing could be further from the truth. Markets still have complete confidence that Central Bankers will control inflation in the coming quarters.”

“So far, the market believes we have experienced a cyclical inflationary upswing within a secular dis-inflationary environment. At some point, market participants will realize that we are not going back to the post-Volcker-pre-COVID world. When that happens, the repricing of assets will be fierce and brutal.”

“Watch for this shift. It will likely prove to be the inflection point for a whole new investing environment.” Kevin Muir, THE NEXT INFLATIONARY INFLECTION POINT The Macrotourist February 2022

My Comment: I lifted this quote from Kevin’s latest piece on his Macrotourist subscription service. I read ALL of his pre-subscription essays over four years and became a paid subscriber when he went behind a paywall two years ago. His service is worth every penny. I highly recommend him to you.

If I could paraphrase his message, it would be: The market expects the Fed to tighten (bonds, for instance, are NOT in free-fall because the market expects that Fed tightening will rein in inflation) but eventually, the Fed will “waffle” (will NOT keep tightening when they should) and then long-term higher inflation expectations will (really) kick into gear – and we will enter a whole new investing environment.

The Barney report

The “Golden Boy” has Papa wrapped around his (not so little) paw. I love taking him places to “run wild” and have a great time. When we come home, he laps up a bowl of water and falls dead asleep. This is the look I get when he thinks it’s time for me to take him for another long walk.

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk markets on podcasts

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for the last 15 years. The February 19 edition is available at: https://mikesmoneytalks.ca

I also recorded a 30 minute (This Week In Money) podcast on February 18 with my good friends at Howestreet.com.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.