Op/Ed

The Fed is finally ready to roll

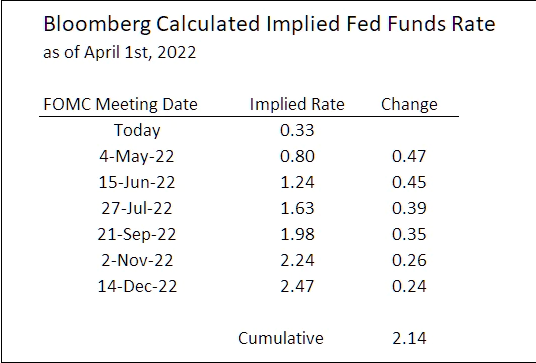

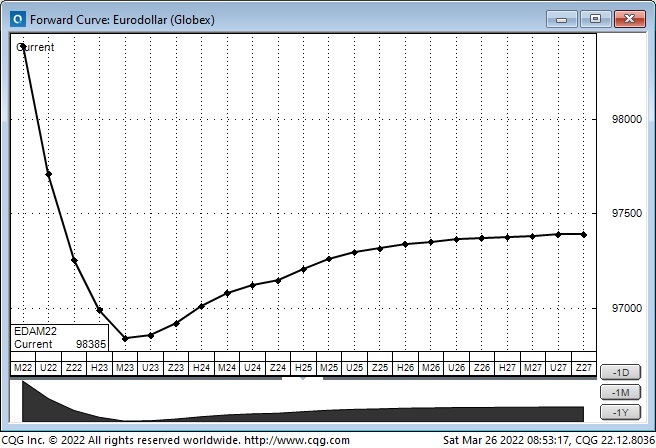

After much hesitation, the Fed is signalling that it will raise interest rates aggressively over the next several months. Here’s what the market expects from the Fed (h/t to The Macrotourist):

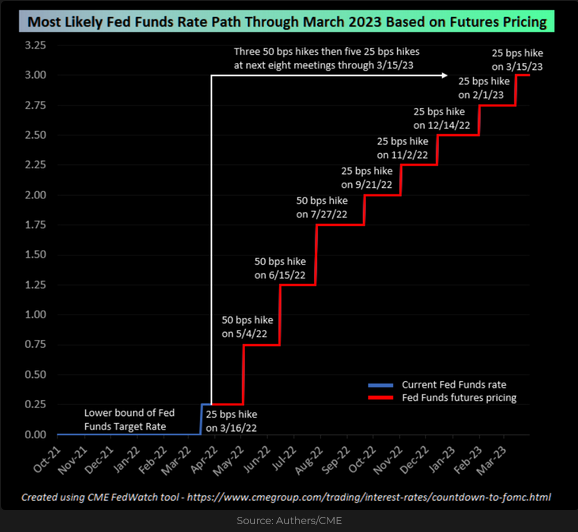

The Chicago Mercantile Exchange futures market pricing of Fed funds through March 2023:

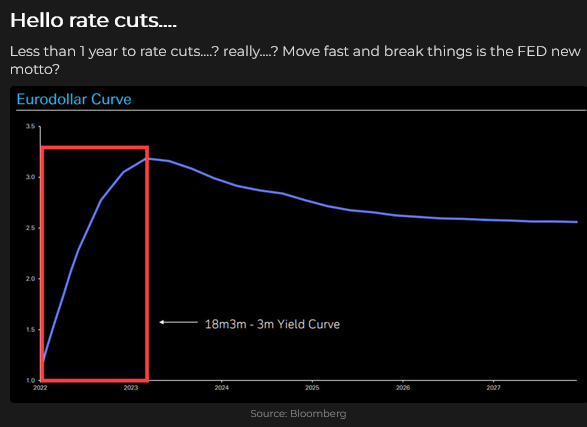

After the sharp rise over the next 12 months, the market is pricing short-term interest rates to drift lower (tightening into a recession?)

Last year, in the face of sharply rising inflation, the Fed not only kept interest rates low but sustained their Quantitative Easing (QE) policies, buying hundreds of billions of dollars worth of bonds and mortgages. Their justification was that inflationary pressures were “transitory” and that “on average” inflation would be around 2%.

The market saw things differently and began to price in persistent and rising inflationary pressures. The market viewed the Fed as being “behind the curve;” the Fed was following, not leading the market.

This chart of the Treasury 2-year Note gives some perspective on how dramatically the market moved (before the Fed) since last fall. (Falling prices mean yields are rising.)

Some analysts expect the Fed’s tightening (their attempt to “cool” inflation) will cause the economy to contract (a highly indebted economy can’t handle rising interest rates), and they will be guilty of tightening into a recession.

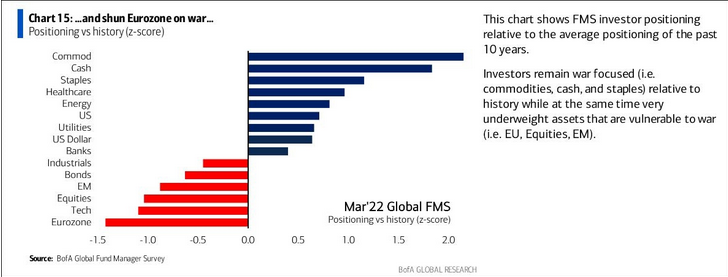

Other analysts see continuing high inflation, despite rising interest rates as governments increasingly embrace fiscal deficits. They believe that real interest rates will remain negative, and the market will demand “inflation hedges.”

From a consumer (voter) perspective, inflation creates a lower standard of living as their money has less purchasing power. Governments, seeking votes, may attempt to ameliorate this perception of a lower standard of living. For instance, they may cut some taxes, run large budget deficits, release crude oil from the strategic reserve, and suggest that to ensure the security of domestic supply, people will need to “shoulder” higher prices for “the common good.” (Do you remember President Jimmy Carter telling people to turn down the thermostat and put on a sweater when fuel prices soared?)

It seems highly likely that after twenty or thirty years of relatively benign inflation, we are “transitioning” into an era of higher inflation and supply shortages.

Real estate charts

USA home prices:

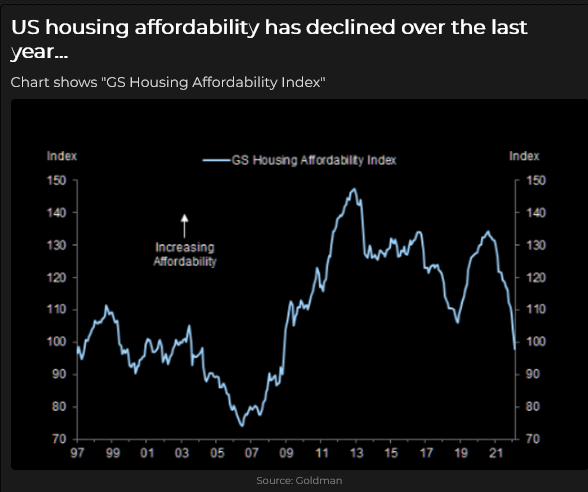

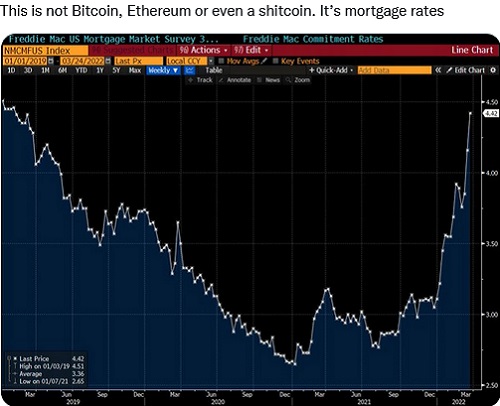

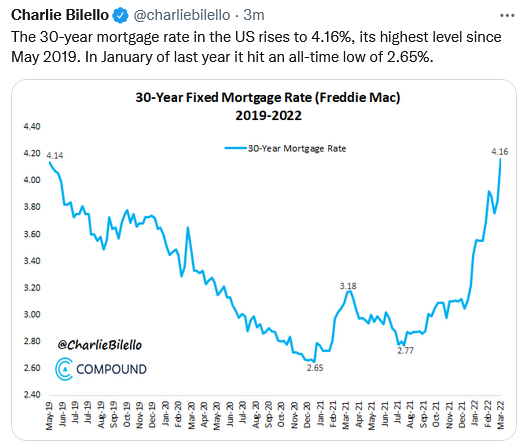

Soaring home prices and mortgage rates may produce “demand destruction” for new and existing homes. This chart of the Homebuilder’s ETF is at >12-month lows.

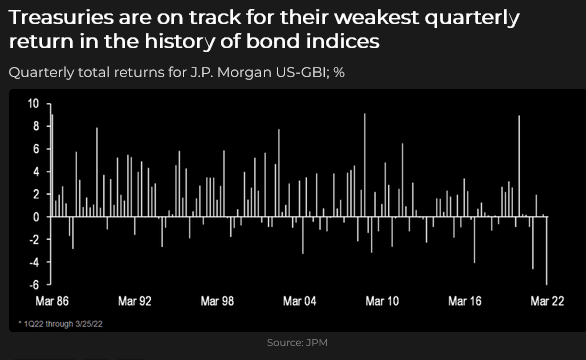

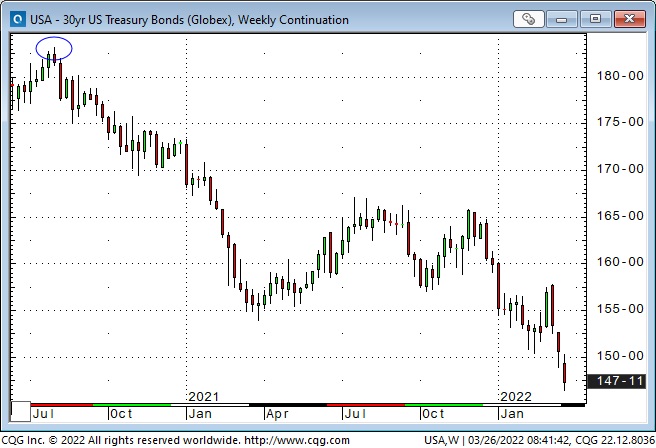

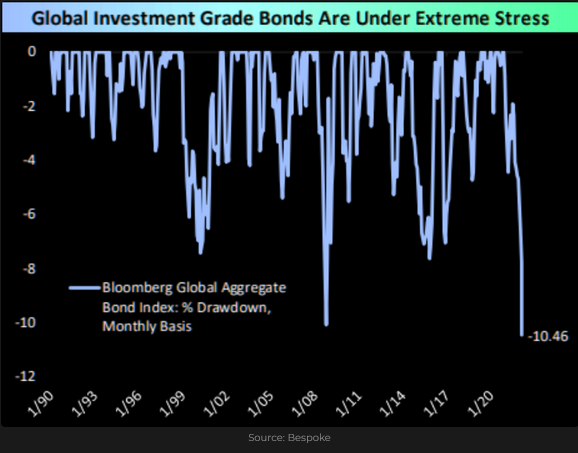

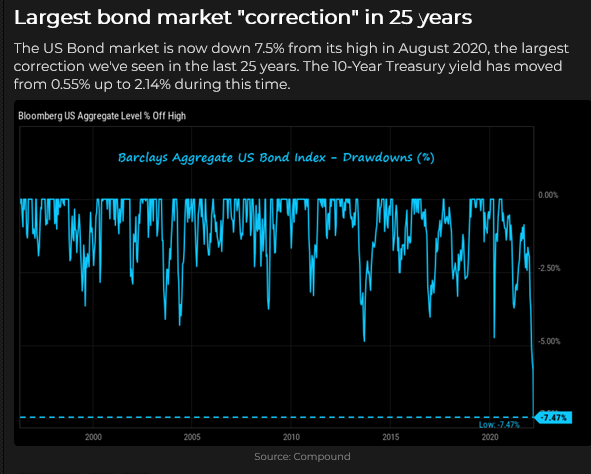

The bond market: was Q1/22 the worst quarter ever?

Different analysts have described Q1/22 as the “worst ever” for the bond market. When I look at multi-decade charts of the long bond, I can’t entirely agree with that conclusion, but if I look at shorter-term bond charts (two to five-year maturity), I can agree.

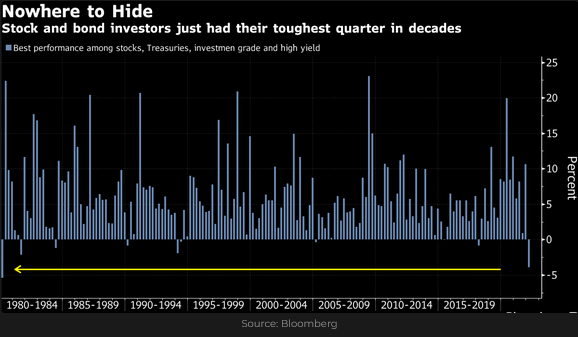

I’ve seen other reports claiming that the classic 60/40 stock/bond portfolio had its worst quarterly performance in >40 years as stock and bond prices fell in Q1/22.

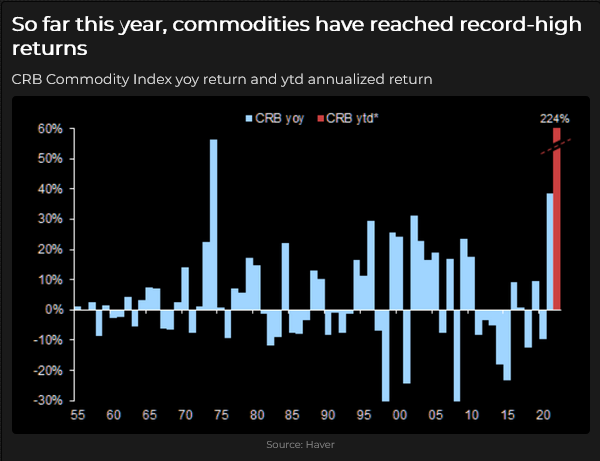

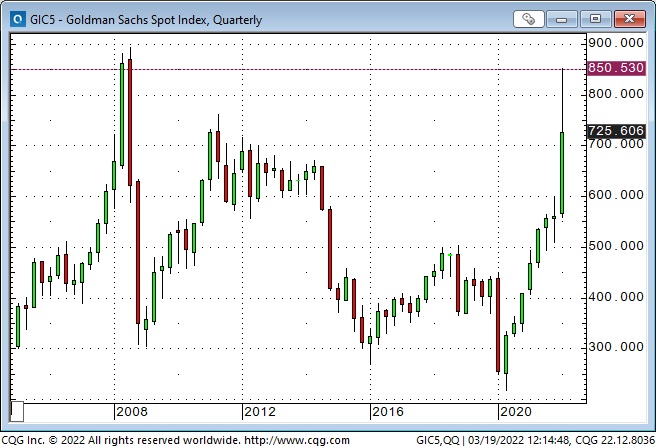

The commodity market: Q1/22 was the best ever!

The leading commodity indices have been trending higher since the 20+ year low made in early 2020. The indices spiked dramatically higher in Q1/22 as the Russian invasion of Ukraine ignited supply concerns for food, energy, base metals and other commodities.

The ultimate “pain trade”: buy bonds / short commodities!

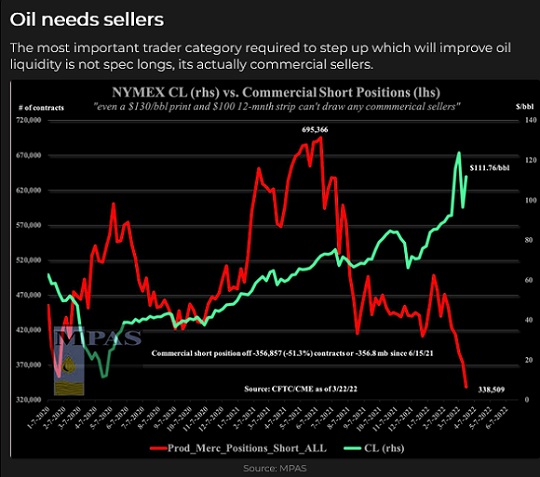

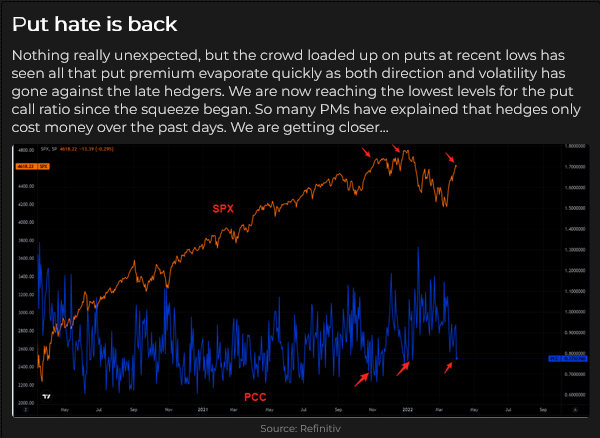

On the theory that market momentum takes markets too far in one direction and that “reversion to the mean” causes the price/sentiment “pendulum” to reverse course, is there an opportunity/reason to look at buying bonds and selling commodities – as an outright trade or as a “recession” hedge? Could a Fed “policy error” induce a “growth shock?“

Commodities have had a spectacular run with a possible blow-off top in March, and they have rolled over from a lower high. The bullish commodity “narrative” remains strong, and prices may well be much higher in the future, but if the indices drop through the March lows, they could fall further.

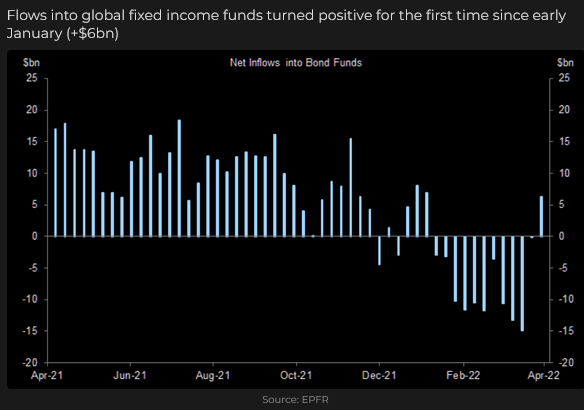

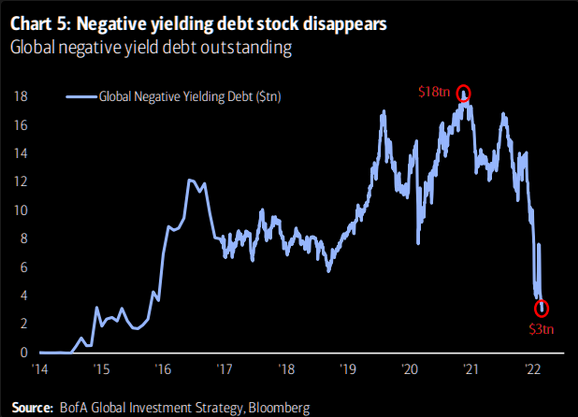

Bonds have been in the doghouse, and the “whole world” is short bonds. Maybe the “inflation is going to be much higher for much longer” narrative is fully priced in. (See the Quotes section below for a discussion of “fully priced in.”)

A vicious circle: wild price action and shrinking liquidity

Wild price swings across equities, interest rates, commodities and some currencies in Q1/22 led to significantly reduced liquidity as traders backed away from risk as margin requirements skyrocketed. Volatility soared. Falling liquidity accelerated short-term price swings and meant that option positioning and capital flows had an outsized impact on prices.

Open interest in several futures markets fell to multi-year lows as wild price action and increased margin requirements caused traders to back away. For instance, open interest in the leading S+P 500 futures contract dropped to a 14 year low. Open interest in fossil fuel contracts, wheat and soy oil contracts, and silver and copper contracts fell to multi-year lows.

My short term trading

I caught the first few days of the stock market rally off the mid-March lows – but took profits too soon. Last week, I started shorting the rally (with small positions and tight stops) and lost a little money. I thought that the rally was a bear market rally and would rollover. This week, I continued with that idea, lost a little money early but benefitted from the 100+ point decline late in the week. I stayed short a small S+P position (with stops that will lock in a profit if the market rallies) into the weekend.

The Wednesday to Friday decline may have been only a brief correction to the rally that began mid-month, but if prices break decisively below 4500, that will harden my views that this has been a bear market rally.

I’ve been shorting the CAD around 80 cents, thinking that the spectacular YTD commodity rally could fade. I’ve lost a little money shorting the CAD but remain short into the weekend.

My P+L on realized trades is down ~0.75% this week, while unrealized gains total ~0.60%.

Transports flash a warning: Only one stock in the 20-stock Transports Index closed higher on Friday, and it was only up a fraction of 1%. The index closed Friday down ~7.3% below the 4-month highs made Wednesday.

Thoughts on trading

My primary trading objective is to protect my capital. My experience tells me that I will have winning trades and losing trades, so it’s important to keep losses small to be “alive and willing” to make future trades that might be winners. Staying alive and willing to trade is critical!!

I measure my risk tolerance in absolute dollars, not as a percentage of the item I’m trading. As a result, the huge price swings in many markets over the past few months drew me into shorter and shorter time frames and smaller-sized trades. For instance, it has not been unusual for the S+P (and many other markets) to move as much in an hour as it previously moved in a day.

Intraday trading seems to be more subject to chart patterns and random “noise” than swing trading. (Or it could be that all time frames have been subject to the recent poor liquidity, “headline” risk and choppy price action.)

I’ve long maintained that traders need to find a way to trade that “suits” them. My “sweet spot” seems to be a swing trading time frame of a few days to a few weeks, and that time frame appears to assign value to assessing market fundamentals, shifting sentiment and price action.

For most of my trading career, if I closed out a trade the same day I put it on, it was almost always a losing trade – I rarely initiated a trade to book a profit from it the same day. I’ve done some day-trading the past couple of months, and I’ve made some money doing that, but it required me to be constantly in front of my screens, and it is a different way of trading. I prefer the swing trading time frame over the day-trading time frame.

Years ago, I wondered if the path to making more money from trading would require me to increase my size substantially or to stay with my winning trades much longer. Or both! I decided to try staying with winning trades longer. In terms of the Rabbit or the Tortoise, I seem to be a Tortoise! I hate big losses – so I’m not willing to risk big losses to make big gains!

Quote of the week

“Sometimes the most difficult part of investing is not figuring out what will occur, but what’s already priced in!” Kevin Muir, the Macrotourist, April 1, 2022.

My comment: I read this quote in Kevin’s blog yesterday and laughed out loud! This is the trader’s perennial conundrum – “Is my trade idea already fully expressed in the market? If it is, I’m buying the high; if it isn’t, I can make money if I buy it here, and the market goes higher.”

Dennis Gartman used to say that a trader’s job was to buy high and sell higher – that is, buy markets that are going up and sell them after they have gone up some more. (Sell markets that are going down and take profits after they have gone down further.) In other words, trade in line with the trend.

The Barney report

Barney is nearly seven months old and weighs 52 pounds. Most days, we do a one to two-hour morning walk and a half-hour afternoon walk, and he sleeps when we come home. This week, we got out for his first-ever after-dinner walk, and Barney saw his first rabbit. Thankfully, he was on a leash at the time!

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The April 2nd podcast is available at: https://mikesmoneytalks.ca.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

Interest rates are surging higher

American interest rates hit All-Time Lows in August 2020. Short rates stayed close to zero for the next fifteen months while mid-term and especially long-term bond yields rose (prices fell.)

In October 2021, forward markets for short-term rates began to rise. The rate of change accelerated in January and February, stalled when Russia invaded Ukraine in late February but dramatically accelerated the last three weeks.

Short rates have been rising faster than long rates, causing some inversions (when short-term interest rates are higher than longer rates.) Historically, an inversion in the 2-year/10-year spread is a harbinger of recession. The 10-year is currently ~20bps premium the 2-year.

Why are interest rates rising so quickly?

The keyword for the Fed last year was “Transitory.” The Fed expected the sharp rise in inflation to be a “flash in the pan,” and therefore, it would be wrong to raise interest rates (or to stop their QE program) to “kill inflation.”

Some folks agreed with the Fed’s assessment, other folks didn’t, but as inflation continued to rise and became more pervasive, the forward markets began to price in higher interest rates.

This year, communications from the Fed have become increasingly hawkish, and market analysts have “hop-scotched” one another as they continued to raise their interest rate forecasts. This week, Citibank announced that they expect the Fed to raise rates by 50 bps at each May, June, July, and September FOMC meeting and raise rates by 275 bps in 2022.

There is also “talk” that some major players are wrongly positioned with their interest rate exposure and are aggressively selling Eurodollar futures. (Think of Jeremy Irons and Kevin Spacey in Margin Call.) If there is a “motivated seller” hitting all bids, other players will try to front-run that seller – adding to pressure on prices.

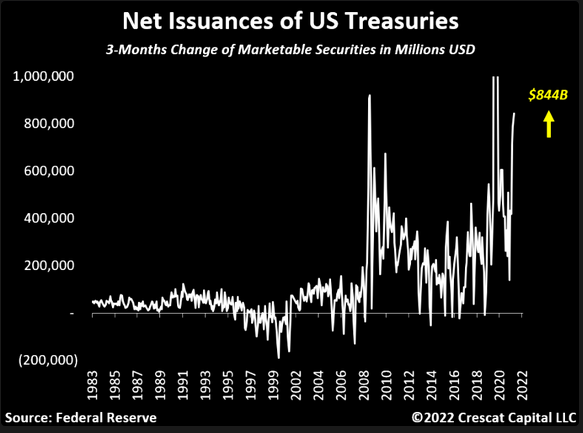

Then there is the thought that governments (everywhere?) will be spending more “stimmy” to help voters deal with rising food and energy costs. Why not? Governments “crossed the Rubicon” with direct fiscal stimulus (helicopter money) during the Covid lockdowns, and there’s no going back to fiscal “prudence” now (especially with mid-term elections looming!) Who wants to buy Treasuries when governments are issuing a flood of paper to fund fiscal stimulus, and the Fed has shut down QE?

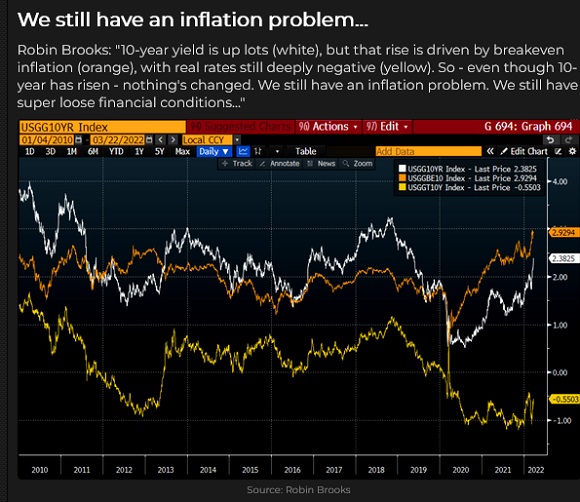

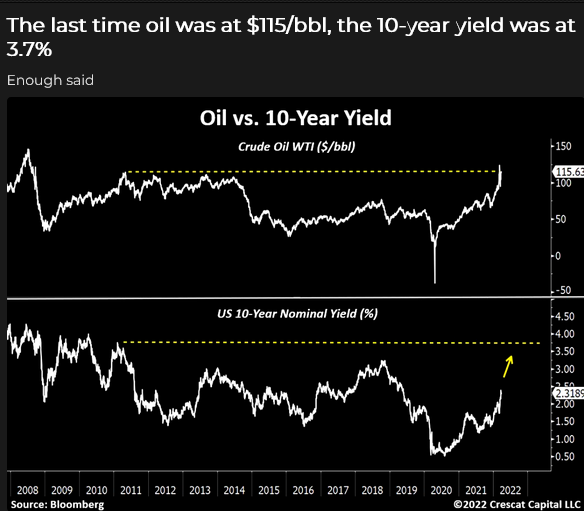

This chart was created mid-week (when 10-year yields were only 2.38%), but its point is even more valid, with rates at 2.5%.

Remember when high prices were the best cure for high prices? That quaint thought assumed that high prices stimulated both new supply and demand destruction. But as the Heisenberg Report argues, “demand destruction” in Western Democracies may no longer be politically viable. Governments will fight inflation with inflationary policies! Voters will love it, but bond investors won’t.

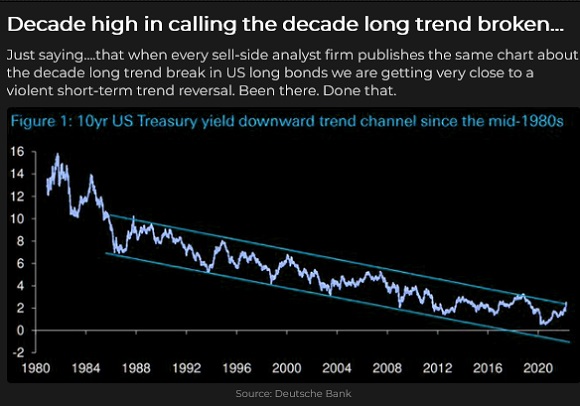

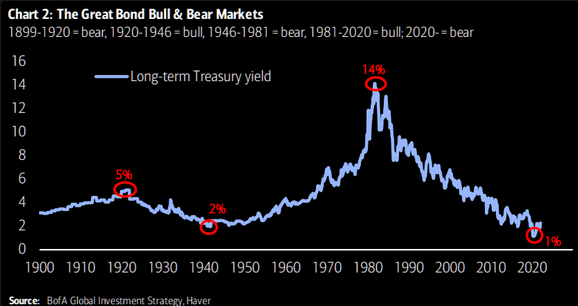

Is the forty-year bond bull market over?

The All-Time High in the bond bull market was August 2020, when the ten-year Treasury yield was ~0.50%. The current yield is ~2.50%, and the forty-year uptrend line is at risk of being decisively broken.

But the Eurodollar forward curve shows rates rising into June 2023 but then drifting lower after that. This pricing may be on the expectation that the Fed will be “tightening into a recession” and will have to reverse course or risk an economic collapse.

If that is the case, the bond market will “see” the slowdown coming, and bond prices will rise. Maybe.

Canada/Commodities

Canadian interest rates have also been soaring. This week the yield on the ten-year closed at 2.55% – an eight-year high. Futures market pricing for December 2022 Banker Acceptances has 3-month yields >3%, an increase of ~ 1.2% in the last three weeks.

The Loonie closed above 80 cents this week for the first time since early November as commodity currencies are bid.

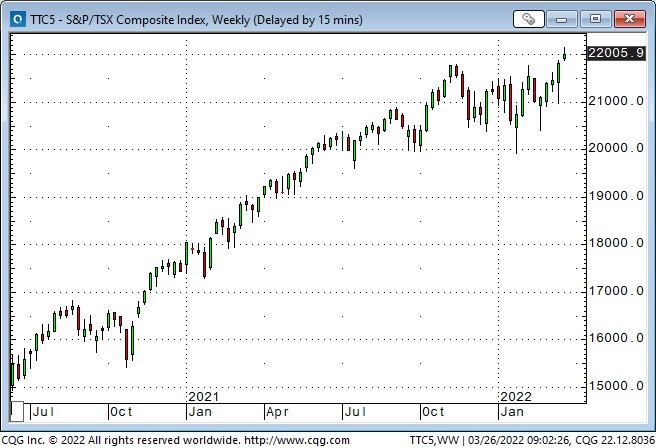

The Toronto Stock Index hit new All-Time Highs this week. Australian and Brazilian stock markets have also been surging higher.

Japan

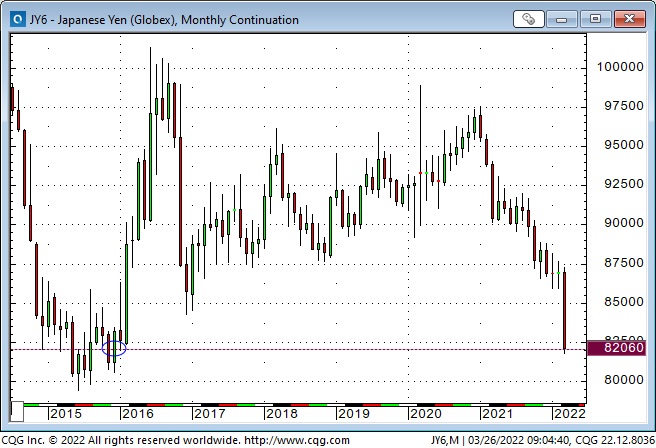

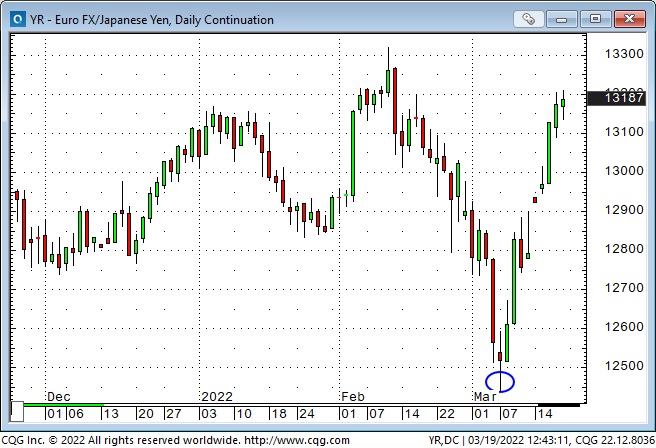

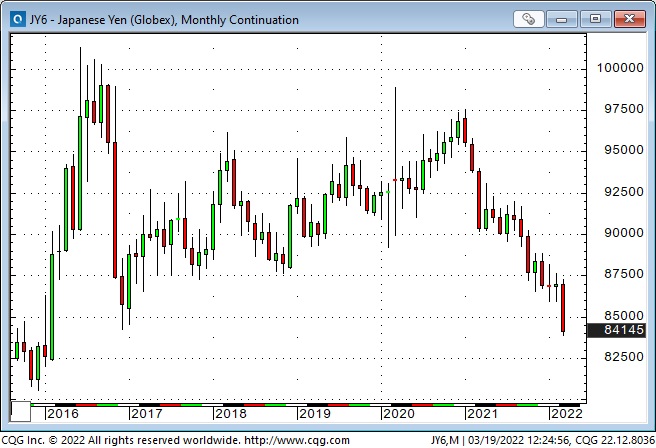

The Yen plunged the past three weeks, hitting a six-year low, as American interest rates have surged while the BoJ is committed to capping their ten-year bond at 0.25%. Red hot commodity markets also hurt the Yen, but a weak Yen helps the Japanese stock market.

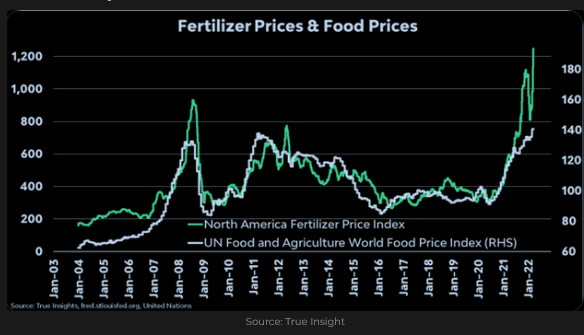

The intersection of food, energy policies and geopolitics

The Russian invasion of Ukraine set off multiple chains of consequences in food and energy that may quickly escalate into a generational food crisis due to diminishing supply availability. I recommend the latest piece from Doomberg (a ten-minute read) that examines how shortages of fertilizer, herbicides, diesel, propane, computer chips, and labour may impact the cost and availability of food. (Late note: a subscriber just emailed me that Doomberg should have added that a severe drought is developing in Canadian and American grain-growing regions. Pray for rain!)

The low on this chart was March 24th – the day Russia invaded Ukraine. We are going to need more tractors.

How delusional green policies set up the Russian invasion of Ukraine

Here’s a quote from Michael Shellenberger’s latest piece: “But it was the West’s focus on healing the planet with “soft energy” renewables, and moving away from natural gas and nuclear, that allowed Putin to gain a stranglehold over Europe’s energy supply. As the West fell into a hypnotic trance about healing its relationship with nature, averting climate apocalypse and worshiping a teenager named Greta, Vladimir Putin made his moves.”

My short term trading

I “got busy” with other things this week and didn’t trade much. I thought that the stock market might correct after last week’s steep rally (in last week’s Notes, I wrote that it may have been a bear market rally), and I looked for setups to get short. That didn’t work, and my P+L was down ~0.20% on the week. (I was trading small size with tight stops.)

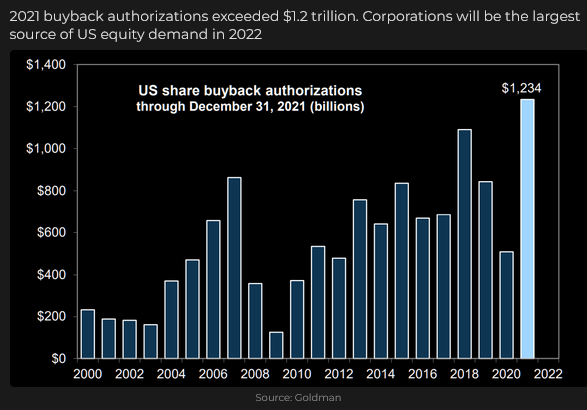

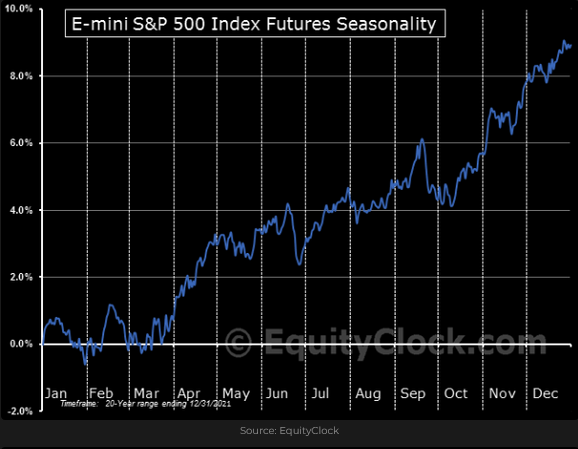

I thought soaring interest rates might cause stocks (especially long-duration tech stocks) to weaken, that the winding down of corporate buybacks going into the blackout period ahead of quarterly reports would weaken stocks, that option dealers not being net short gamma after last week’s rally would weaken stocks – but they just kept rising. Maybe the market is looking at the seasonality chart! Yikes!

One of my favourite trading mantras is that there’s nothing wrong with being wrong except staying wrong, so when I’m wrong, I’m gone.

Thoughts on trading

I’m falling behind in my attempt to “keep up.” I’ve got podcasts and videos and research reports stacking up, and I know I’ll have to hit the “delete” button on many of them. Other traders I talk to/swap emails with tell me they have the same problem.

There is so much “going on” and so many violent moves in so many different markets that it’s impossible to stay current with everything.

Quotes from the notebook

“There are no solutions, there are only trade-offs; and you try to get the best trade-off you can get, that’s all you can hope for.” Thomas Sowell

My comment: I’ve been a Thomas Sowell fan for years. He is a true American icon. This quote seems particularly appropriate for today. It applies to Russia/Ukraine, the Maltusiasn forecasts of soaring commodity prices, the prospect of ever-growing and ever-intrusive government, and to virtually any problem I see today. Do yourself a favour and spend a few minutes reading about this man, his life and his pithy quotes. He is a beacon of clear-eyed observation and an inspiration to truth-seekers everywhere.

The Barney report

One of the great things about writing this blog is that I have developed relationships with people worldwide that I would otherwise never have known.

Recently, a man in Connecticut asked his wife to paint a portrait of Barney based on a photo I posted on this blog. He sent me the picture (painted on a rock) as a thank you for the value he received from reading my blog.

How amazing is that!

The portrait stands on the windowsill behind my screens – right where I can see it every day.

You can see more of his wife’s pet portraits on her Art Instagram page: @querocks.

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The March 26th podcast is available at: https://mikesmoneytalks.ca.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

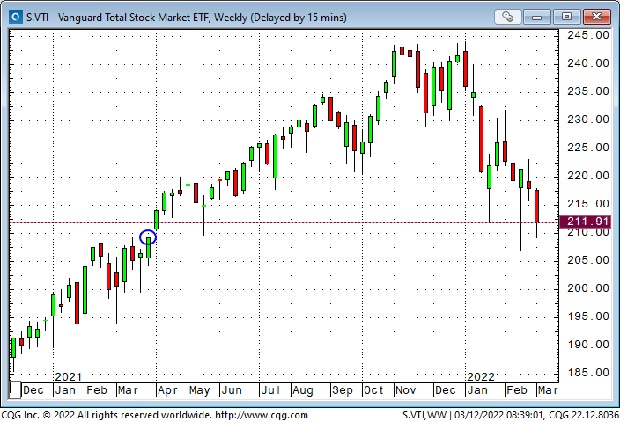

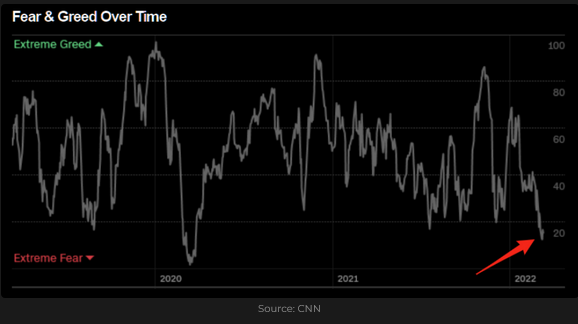

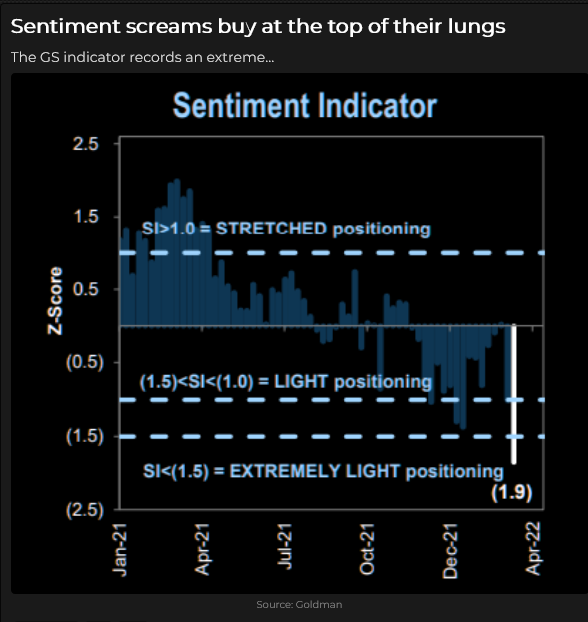

The best weekly equity market rally in two years was “setup” by extremely negative sentiment

The Vanguard Total Stock Market ETF (VTI) had its lowest weekly close in nearly a year last Friday – down ~14% from January’s All-Time Highs. In last week’s TD Notes, I wrote: Equity market sentiment is currently very negative. If/when prices turn higher, the rally could be dramatic.

It was.

Extreme negative sentiment persisted early this week. The major stock indices fell on Monday, but sentiment reversed in the Monday overnight session, and the indices began to surge higher. DJIA futures rallied >2,000 points from the Monday overnight lows to Friday’s close. All of the leading American Indices closed Friday at their best levels in over a month, the Dow Jones Transportation index had its best weekly close in four months, and the (commodity heavy) Toronto Stock Index closed at All-Time Highs.

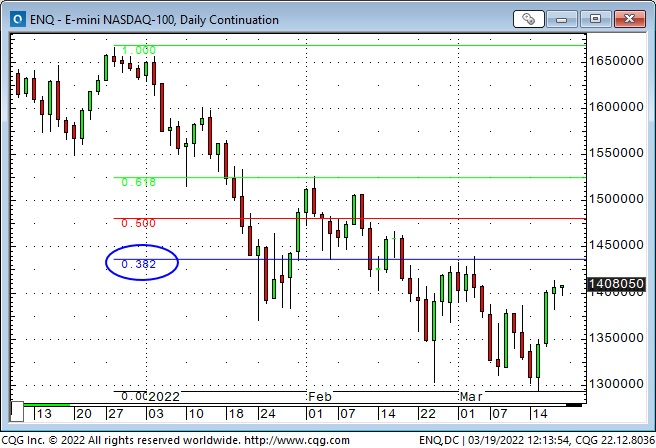

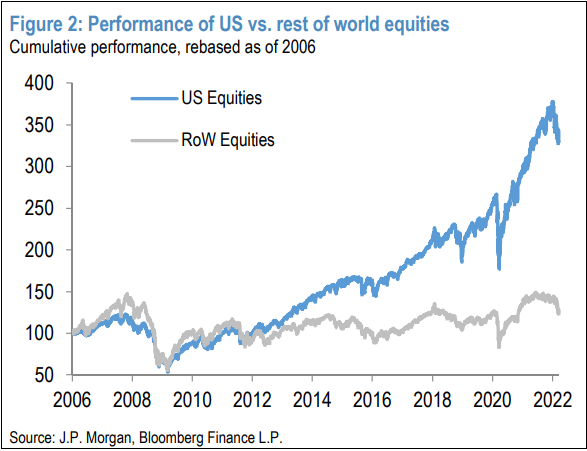

The DJIA, S+P and VTI indices have recovered ~50% of their declines from ATH; the NAZ has recovered <38%. (The different recovery levels hint at the “rotation” since November.)

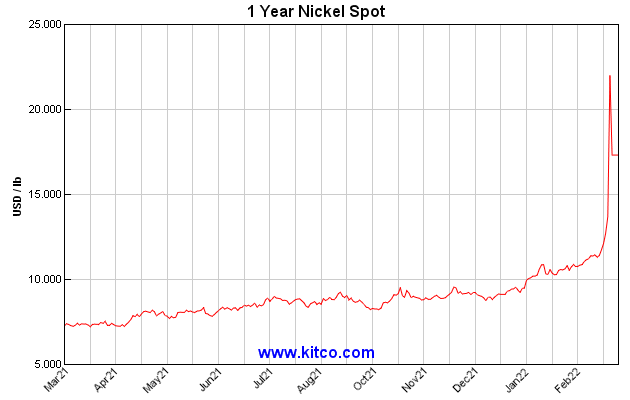

Extreme commodity market sentiment also “set up” dramatic price reversals

WTI crude oil futures and the broad commodity indices surged to 14-year highs last week; Chicago wheat and New York copper surged to All-Time Highs. The concern was “supply shortages,” but uncertainty, poor liquidity and volatility created fears of existential systemic risk – a grand Minsky moment – when over-levered “Big Shorts” might trigger this market’s version of a Lehman failure.

The peak in the commodity surge was in sync with the “Nickel” publicity, and markets reversed sharply after that.

Currency markets also had dramatic sentiment-driven reversals

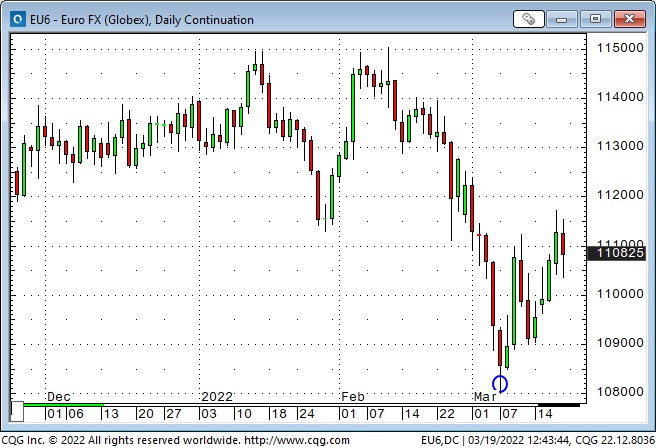

The US Dollar Index hit a 22-month high last week, but the real “action” was in Euro spreads. The Euro plunged against the Yen, the Swiss Franc, the British Pound and the USD in February / early March, but reversed higher against all currencies on March 7th.

The Euro Vs the USD:

The Japanese Yen fell to a 6-year low against the USD this week. The prospect of rising US interest rates while Japanese rates stay flat and the possibility of soaring commodity prices apparently paints a dim future for the Yen, and speculators are (not unexpectedly) hugely net short. What could possibly cause the Yen to rally?

Gold spiked and fell back

Comex gold futures spiked to new All-Time Highs on March 8th but were nearly $100 lower within 24 hours. This week, gold briefly traded $185 below last week’s highs.

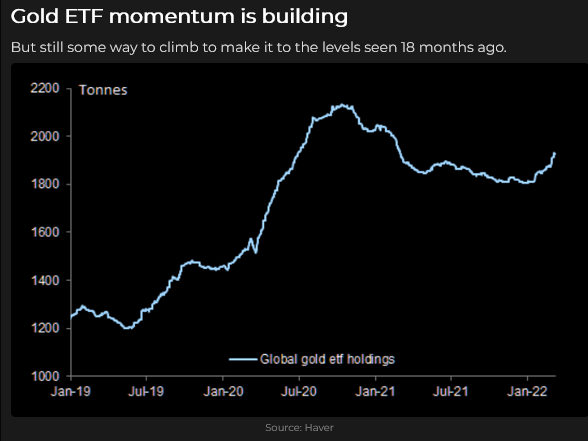

Gold ETF holdings have risen ~192 tonnes YTD, after falling ~ 287 tonnes in 2021. In 2020 gold ETF holdings increased ~ 751 tonnes.

Interest rates had a different kind of reversal

Interest rate futures rallied briefly around the beginning of March (maybe the Fed would “back off” from raising rates because of the war), but expectations reversed from those levels as the war seemed to be increasing inflationary pressures. Short rates have been rising faster than long rates, creating “inverted yield curves,” which may foreshadow a recession.

The Fed has been following, not leading the market.

My short term trading

I started this week flat, but I was looking for a bounce from last week’s extremely negative sentiment. I made ten trades, beginning Sunday afternoon, buying S+P, Dow and Euro futures. Three of the trades lost money; seven produced gains. I was trading small size with tight stops. I covered my last position on Thursday’s close and stayed flat into the weekend. My P+L was up ~1% on the week.

On my radar

“What are we trading?” is an existential question. Uncertainty, volatility and thin liquidity make it challenging to define/quantify risk. Headline risk is relentless. The possibility/inevitability of another “Nickel” debacle is ever-present. Inter-market correlations continue to shift. Broken supply chains are likely to sustain high inflation, while political risks limit arbitrage that could dampen price spikes and volatility. It’s a Brave New World.

Sentiment drives prices. Extreme sentiment = extreme price action = a set up for extreme price reversals.

This week, the 2,000 point rally in the Dow may have been the beginning of a charge to new All-Time Highs, or it may have been a classic bear market rally. I don’t know, but I’m leaning towards a bear market rally.

I’ll be looking for opportunities to trade price action rather than “hunches” about what “should” happen.

Thoughts on trading

In the January 29th Notes, in the Quotes from the notebook section, I quoted Bruce Kovner from the 1989 edition of The Market Wizards:

“What I’m really looking for is a consensus that the market is not confirming.”

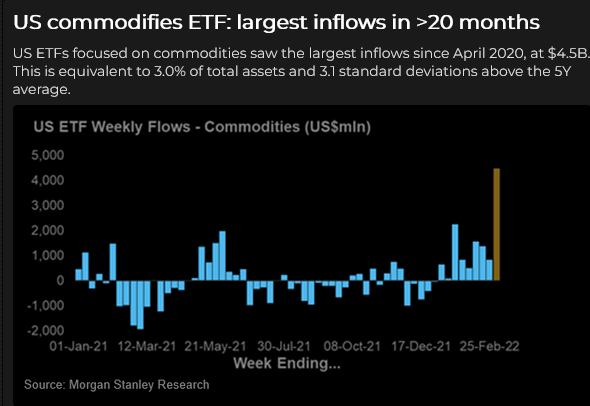

I keep that in mind when I see “retail” rush into some part of the market. The late 1990s Dot-Com boom and the subsequent crash was a classic, but so was the rush in cannabis, ESG, work-from-home, and lately, commodities – except that commodities haven’t crashed yet – and they may not crash, but the bullish “narrative” has been robust. If the bounce-back following the correction from the March 8th highs rolls over, I’ll look for opportunities to fade bullish commodity enthusiasm.

Quotes from the notebook

“The best traders have evolved to the point where they believe without a shred of doubt or internal conflict that “anything can happen.” Mark Douglas, Trading in the Zone, 2000

My comment: I used to have a Post-it note taped to one of my screens that said, “Anything Can Happen.” I had never heard of Mark Douglas when I taped the note to my screen, but I kept it there after reading his book.

I once had a senior lawyer from a big law firm interview me to do some trading for his client. Years later, he told me that he decided to recommend me to his client when he saw that Post-it on my screen!

“The trader’s job is to imagine the future different than what it is now – find a trade that will profit from that change, and manage the risk of that trade.” Ben Melkman, RTV, 2017

My comment: I agree 100%.

The Barney report

It’s hard to pay attention to my screens when Barney wants to play – so I take him for a long walk, which keeps me from getting too wired, and when we return home, he falls asleep at my feet, and I can get some work done!

Chicago dyes the Chicago River Green on St. Patrick’s Day! I’ve seen it and I love it!

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The March 19th podcast is available at: https://mikesmoneytalks.ca. Mike’s closing editorial – he calls it his “Goofy” – is a scathing review of the Government’s hypocrisy around the freezing of bank accounts near the end of the Trucker’s Convoy protest.

This week I also did a 30-minute interview with Jim Goddard on Howe Street Radio. We talked about the wild market action, my trading, and what I think may happen next in different markets. The Youtube link is:

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 30 energy, energy service and pipeline & infrastructure companies with regular updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

Russia/Ukraine War Update:

Diplomatic talks to create an extended ceasefire are being worked on by delegations of Ukrainians and Russians. The talks to open safe routes for refugees to exit war-torn cities are making progress and some routes have opened. It appears that over 3M Ukrainians have reached safety in NATO countries and the largest exit route appears to be through Lviv to Poland (50% of total refugees). Massive global humanitarian aid is assisting this migration, the largest since WWII.

Just yesterday President Zelensky made what could be a critical concession to end the invasion. He stated that they would be willing to not enter the EU or NATO if they got security guarantees from its neighbors (who are members of NATO). Negotiating this may take some time and what is included in the guarantees may not be amenable to Russia. In the meantime the Russian invasion is being more destructive. Tsar Putin is planning to add to his invasion force with experienced fighters from Syria and Chechnya. The numbers range from 16,000 to 40,000 fighters. These are fighters who fought in urban environments and Putin would need them for the takeover of Kyiv and Odessa, if that is still his plan.

President Zelensky continued his diplomatic offensive and spoke to Canada’s parliament yesterday and to the US Congress today. He is thankful for all the military and humanitarian assistance given so far but continues to push for the countrywide no-fly zone. This is a non-starter for many NATO countries with the US and Germany the most vociferously against the proposal. They see a direct confrontation with Russia leading to a broader European or even world war. A proposal for a non-fly zone for the refugee exit routes might get some traction.

If Putin does not accept Zelensky’s Austria-like option of an independent state then the war is likely to enter a more vicious and deadly phase in the coming weeks. Once Putin’s additional fighters enter the Ukrainian arena we may see an escalation of pressure on the unconquered cities. Russia’s willingness to attack bases in western Ukraine and calling aid convoys from the west as legitimate targets shows where his focus is heading. If he cuts off food and munitions aid to Kyiv then the war from his perspective could be won in just a few more weeks. The failure to make faster progress in taking over the country is impacting Putin’s diatribes. He seems to be losing his cool in interviews. That is why the EU is worried he will use his foreign fighters to rubblize the cities not captured and may use WMDs including thermobaric bombs and chemical or biological weapons. If a diplomatic solution is not seen in the coming days then the risk of the war escalating becomes more likely.

Interestingly business continues. Russia increased exports of natural gas this month to its EU buyers as pipeline sales are not disrupted by the sanctions. Exports rose by 30% over February and this has pulled European spot prices down to US$40/mmBtu.

EIA Weekly Oil Data: The EIA data of Wednesday March 16th was moderately bearish for domestic energy prices. US Commercial Crude Stocks rose 4.3Mb to 415.9Mb versus the forecast of a decline of 1.38Mb. It could have grown by 3.6Mb more if not for Exports rising by 514Kb/d last week. Motor Gasoline Inventories fell 3.6Mb while Distillate Fuel Oil Inventories rose 0.3Mb as heating oil needs slows down with the warmer weather. Refinery Utilization rose 1.1 points to 90.4% as refiners work to add more product to offset the cut-off of Russian products. US Crude Production remained steady at 11.6Mb.

Total Demand fell 558Kb/d to 20.65Mb/d as Distillate Demand fell 883Kb/d to 3.71Mb/d as winter demand peaked. Other Oils consumption fell 311Kb/d to 4.62Mb/d. Motor Gasoline usage fell a modest 19Kb/d to 8.94Mb/d. Jet Fuel Consumption rose 93Kb/d to 1.45Mb/d. Cushing Crude Inventories are now rebuilding and rose 1.8Mb last week to 24.0Mb.

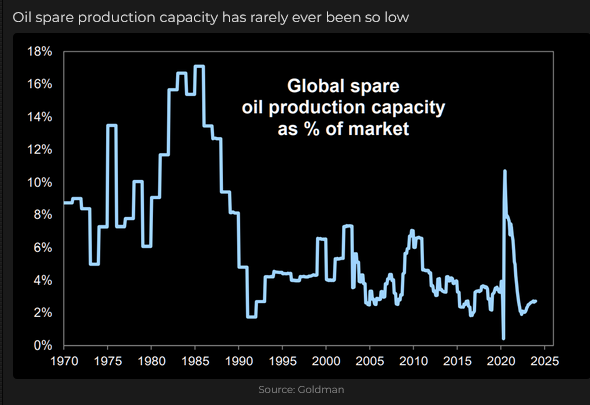

OPEC February Monthly: On March 15th OPEC released their March 2022 Monthly Forecast Report (February data). It now appears that OPEC is reacting to moral suasion from its customers and has added more supply. While in January they added only 64Kb/d, in February they added 440Kb/d to reach 28.5Mb/d. However this still remains below the 29.4Mb/d produced in December 2019 before the pandemic hit. So they still have nearly 900Kb/d to bring on just to get back to pre-pandemic levels. Saudi Arabia and the UAE alone could add 2.5Mb/d if they wanted to.

The increases came from Saudi Arabia at 141Kb/d, followed by Libya at 105Kb/d (as supply disruptions ended) by Iran at 44Kb/d an additional 36Kb/d by Iraq, Kuwait increasing by 32Kb/d and the UAE an additional 26Kb/d. Venezuela saw a rise of 21Kb/d to 680Kb/d as they got sufficient diluent this month from Iran, China and Russia. OPEC sees 2022 consumption at 100.8Mb/d, up 4.15Mb/d from the 96.63Mb/d consumed in 2021.

OPEC has now started to be concerned about world economic health and sees some risk in its forecast of demand growth this year of 4.1Mb/d to a 100.9Mb/d average. If a global recession hits this year there may be no growth in demand and that is what concerns us.

EIA Weekly Natural Gas Data: Weekly winter withdrawals continue but at a much slower pace as winter nears its end. Last week’s data showed a withdrawal of 124 Bcf, lowering storage to 1.519 Tcf. The biggest US draws were in the East (41 Bcf) Midwest (40 Bcf), and in South Central (38 Bcf).

The five-year average for last week was a withdrawal of 38 Bcf and in 2021 was 52 Bcf due to the warming weather and the end of winter consumption at the end of this month. April starts the new injection season. Storage is now 16.0% below the five-year average of 1,809 Tcf. Today NYMEX is US$4.70/mcf due to milder weather. AECO is trading at $4.56/mcf. After winter is over natural gas prices typically retreat and as the general stock market continues to decline, a great buying window should develop at much lower levels for natural gas stocks in Q3/22.

Baker Hughes Rig Data: The data for the week ending March 11th showed the US rig count rose 13 rigs to 663 rigs (unchanged last week). Of the total rigs working last week, 527 were drilling for oil and the rest were focused on natural gas activity. The overall US rig count is up 65% from 402 rigs working a year ago. The US oil rig count is up 71% from 309 rigs last year at this time. The natural gas rig count is up a more modest 47% from last year’s 92 rigs, now at 135 rigs. Texas added 12 rigs last week with six of those rigs added to the Permian fleet which now has 316 rigs, up 49% from last year’s 212 rigs.

Spring break-up and road bans have returned to Canada. Last week 11 more rigs were removed from activity (down seven rigs last week) to 206 rigs. The rig count level will continue to fall over the next few weeks. Only rigs staying on location drilling pad wells will be active shortly. Canadian activity however is still up 78% from 116 rigs last year as more activity moves to pad drilling. There was a seven rig decrease for oil rigs and the count is now 127 oil rigs working. However this is up from 58 working at this time last year. There are 79 rigs (down three on the week) working on natural gas projects now, but still up from 58 rigs working last year. Staffing of rigs in Canada is a problem and adding significantly more rigs this summer may be problematic. While rig and frack day rates are rising, so are costs and therefore margin improvements are not what one should expect as the industry activity picks up. Service industry margins need to rise materially in 2H/22 if drilling and completion activity is to rise.

The overall increase in rig activity from a year ago in both the US and Canada should translate into rising liquids and natural gas volumes over the coming months. The data from many companies’ plans for 2022 support this rising production profile expectation. We expect to see US crude oil production reaching 12.0Mb/d in the coming months. Companies are taking advantage of attractive drilling and completion costs and want to lock up experienced rigs, frack units and their crews as staffing issues are difficult for the sector. The EIA forecasts US production reaching 12.5Mb/d before the end of this year. From a focus on paying down debt and then increasing shareholder returns we see companies adding growth to their 2H/22 plans as national and continental energy security of supply concerns change the focus of Board directed spending plans.

Conclusion:

Bullish pressure on crude prices:

- Russia’s invasion of Ukraine and the severe destruction of the country has rallied European nations against Russia. Even though imports into Europe of crude oil and natural gas are allowed, oil tanker companies are finding getting insurance difficult and have abandoned this business. Now only tankers owned by Russia, India and China handle the trade that can be done. It appears that 2.0-2.5Mb of Russian crude is finding buyers but 2Mb/d+ is not finding buyers even at US$20-25/b discounts.

- Exports have problems from insurance to lack of shipping by the buyers and the lengthy time it takes to get Urals oil from western Russia to the buyers countries. Travel time may be five times longer. India is now contemplating paying for Russian crude in Rupees or Rubles.

- Saudi Arabia, UAE and Kuwait have not responded positively to President Biden’s pressure to increase production by 2-3Mb/d immediately. In the case of the Crown Prince of Saudi Arabia, Biden will not even talk to him (just to his father) as he calls him a ‘pariah’ for the murder of his citizens and his flawed war in Yemen.

- EU countries and the US have not gone on a war footing to replace Russian crude oil supplies. President Biden has not made one speech asking the US oil industry to focus on adding as many new oil barrels as possible, and as quickly as possible. He remains in his climate focused bunker even though the industry would respond to a patriotic call to action. Canada’s capability to increase crude exports is being ignored as a policy choice, as the Biden administration continues talks with Iran and now has started dialogue with Venezuela. It seems buying oil from despotic murdering thugs is more palatable to Biden for US consumers, than buying from us.

Bearish pressure on crude prices:

- Covid is picking up around the world and lockdowns are restarting. China is seeing the most lockdowns with 60M people from the eastern cities of Shanghai, Shenzhen, Hong Kong etc, are under lockdown and their economies are non-functional. Demand for energy in the country of 14.5Mb/d (2021 data) could decline by 1.5-2.0Mb/d during the lockdowns. Europe is also seeing rising caseloads. The biggest increases seem to be occurring in Asia with South Korea adding 283K new cases and Vietnam with 210K. World death rates now exceed 6.046M of which 965K are US deaths. A new variant has been discovered in Israel which has the highest vaccination rate in the world.

- The Iran nuclear negotiations are working towards sealing a deal and having sanctions removed so that they can sell their oil around the world. President Biden may be giving away more concessions to Iran in order to have sanctioned Iranian oil available. One complication in finalizing the deal is that Russia wants its trade with Iran allowed going forward or they will not acquiesce to it. If a deal is concluded and Iran receives sanction relief, they could increase production by 1.3-1.5Mb/d quite quickly. Iran also has over 100Mb in floating storage around the world near its buyers and another 100Mb ready to sell.

- Venezuela appreciates the olive branch offered by the US and released two imprisoned Americans after their initial talks with US officials. Will this be a thaw in the relationship? Will the US just give them sanction relief but not require a unity government formed? It looks like barrels may win. Venezuela could increase production by over 2Mb/d (from 680Kb/d in February) but how quickly is not known due to the poor maintenance of their fields and infrastructure.

- The US and allies are releasing 60Mb of crude from their strategic reserves to meet short term needs. The US will supply 30Mb of the volumes in April and May to meet near term needs.

- The likelihood of a worldwide recession is rising. The high cost of energy is lowering consumers and industry’s capacity to handle the cost pressures. Many businesses are closing or limiting their hours in Europe. Food costs are exploding! Russia and Ukraine produce one-third of global wheat and barley production. Ukraine provides European livestock farmers with corn and other grain additives. None of this is being shipped now from the Black Sea ports. Nickel prices have exploded to the upside (doubled to US$100,000/ton) and the London Metal Exchange (LME) suspended trading and canceled trades as producers who presold production got margin calls that they couldn’t meet. This exchange remains closed. This may be a multi-billion dollar disaster and could be the ‘Lehman event’ of this financial and military crisis.

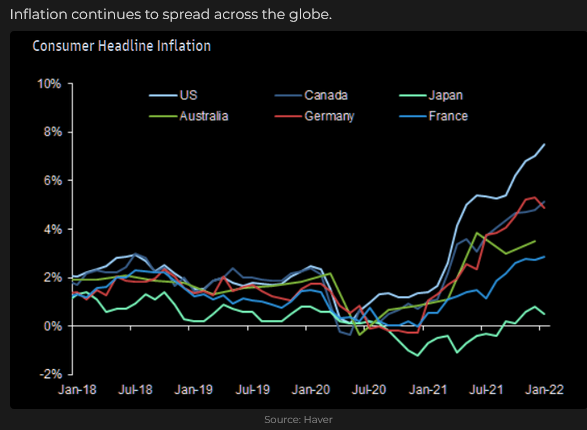

- Inflation is now exceeding 10% in the US and around the world (Italy the worst hit with PPI up 32.9% in January 2022) and will box Central Banks in. Do they fight inflation by raising rates and lowering liquidity or do they provide accommodation during this war event. In either case the world faces a moderate or possibly a severe recession once hostilities end.

- US Retail Sales out today were terrible. Ex-Gas/Auto’s, they fell by 0.4% (prior month +5.2%) and this is before knowing that consumer prices rose 0.8% in the month. Consumption is likely to decline in the coming months as the burden of higher food, energy and housing costs rise and leave less spending for other items. The likelihood of a recession in the US in the coming months now exceeds 50%.

CONCLUSION:

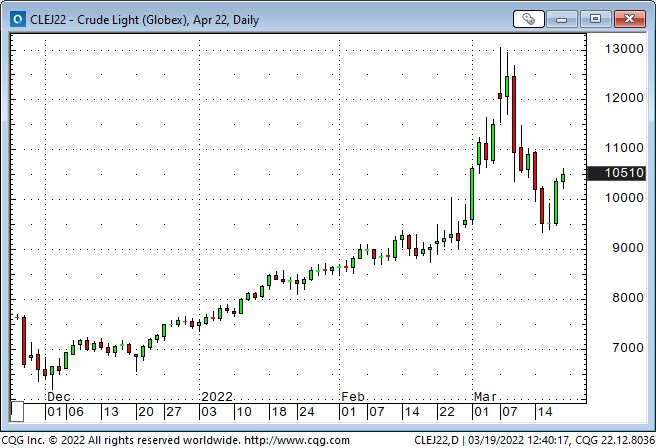

The invasion of Ukraine has spiked up crude prices. We expect that higher energy costs will knock down crude demand by 4-5Mb/d later this year resulting in a global recession. When global recessions unfold, crude prices plunge sharply. One bank energy forecaster predicted today that we may see Brent exceed US$200/b in the coming weeks as the next painful phase of the war is initiated by Russia, but will fall rapidly to US$50/b once recession takes over. In 2008-2009 during the financial crisis demand fell by over 5Mb/d (from over 88Mb/d to 83Mb/d). The price of crude fell from US$147.27/b to US$33.55/b in eight months. During Iraq’s invasion of Kuwait prices rocketed from US$16.16/b in July 1990 to a high of US$41.15/b in October and then plunged in four months to US$17.45/b as recessionary demand destruction occurred. WTI today is at US96.49/b.

Energy Stock Market: The stock markets around the world are gyrating with large daily price moves. Today the upside is 380 points (as the market awaits the Federal Reserve rate increase and the more important hawkish or dovish commentary). The S&P/TSX Energy Index has retreated 11 points over the last week to the 205 level (down 25 points from the 2022 high of 230) due to the recent pullback in crude oil prices.

Our March Interim SER Report comes out tomorrow Thursday March 17th. It will include a detailed review of the economic impact and likely difficult recession the world will be facing in the coming months. Previous recessions, after parabolic energy and other commodity inflationary price spikes, have been severe and stock markets have been crushed. The current market declines are just the tip of the iceberg. Downside for the Dow Jones Industrials is the 24,000-25,000 during Q3/22 (today 33,900 – down from the high at the start of this year of 36,953). We expect violent market swings in the coming weeks with over 1,000 point down and up days for the Dow Jones Industrials as it works its way through this inflation and war-induced bear market.

In our Interim report we go over in detail the financial and operating results of 13 companies that have reported. The financial results have been fabulous given the war premium in commodity prices. Our models have this windfall cash flow removed from Q3/22 data onward. Stocks are trading at or close to our one-year targets so the upside is limited.

If you want access to this encompassing and timely market update report and to know which energy sector stocks provide the most attractive returns (when the energy Bull Market re-commences) then become a subscriber. Go to https://bit.ly/3jjCPgH to subscribe.

Please feel free to forward our weekly ‘Eye on Energy’ to friends and colleagues. We always welcome new subscribers to our complimentary energy overview newsletter.

The inevitable consequences of soaring commodity prices

In last week’s Notes, I wrote: “There are always unexpected consequences. Somewhere in the world, there is a massive “short commodity” position that may “blow up” as a result of soaring commodity prices – causing severe “collateral damage.” My first guess is that soaring European energy costs will blow a fuse, and my second guess is that it will be tied to soaring food costs – hungry peasants will be storming the castle somewhere.”

The nickel market “blew up” on Monday (For a colourful description of the event, see the Heisenberg Report) when LME prices surged 4X from last week’s level – and, sure enough, there was a massive short position in nickel. In terms of “collateral damage,” there were hundreds of millions of dollars worth of margin calls, other commodity prices spiked, the LME took the highly unusual action of suspending nickel trading (and cancelled many of Monday’s trades), and the share price of CMEGroup tumbled as people worried about the knock-on effects (solvency) of commodity brokerage firms and exchanges.

When a market moves sharply against “existing positions” (or existing sentiment), there is the possibility of a dramatically extended move – a “falling dominos” effect. Markets are currently extra sensitive to these “iceberg” risks; hence, we have lower liquidity and higher volatility.

FOMO (Fear Of Missing Out) orders are replaced by GMO (GET ME OUT) orders in a falling dominos market.

Arbitrage is a KEY market concept – if commodity prices are high in one location and cheap in another, traders will find a way to buy the cheap market and deliver into the higher-priced market to make a profit. (Think of US LNG headed for Europe.) But sanctions on Russia (and other effects of the war) have created a bifurcated market: commodities are cheaper in Russia and higher outside Russia, and traders can’t arb the difference. This “sets the table” for more commodity “blow-ups.”

Equities fell further this week without the hoped-for ceasefire

The Vanguard Total Stock Market ETF had its lowest weekly close in nearly a year – down ~14% from ATH in January.

The Nasdaq Composite hit a 15 month low this week – down ~21% from November 2021 ATH.

The PowerShares Chinese Technology Portfolio ETF fell to a 2-year low – down ~60% from Jan 2021 ATH.

ARKK hit 22-month lows – down ~65% from Feb 2021 ATH.

Implied volatility on S+P put options closed ~26% this week – the highest weekly close since the Covid panic two years ago.

Equity market sentiment is currently very negative. If/when prices turn higher, the rally could be dramatic.

Gold hit All-Time Highs this week

Comex April gold futures hit $2078 on Monday but were $100 lower less than 24 hours later. At Monday’s high, gold was up ~$300 from the late January lows.

Newmont (the go-to gold investment for institutional accounts) rallied to an All-Time high of >$80 – up ~30% from early January lows.

WTI crude oil hit $130, NYMEX Gasoline hit All-Time Highs

NYMEX front-month WTI surged to $100 on February 24th when the Russians invaded Ukraine but fell back to close the day ~$93 (expectations of a quick end to the conflict?) But in early March, prices surged from $95 to $130 as the consequences of sanctions and a prolonged war became apparent. Wild intra-day price swings took WTI down as much as $25 two days later.

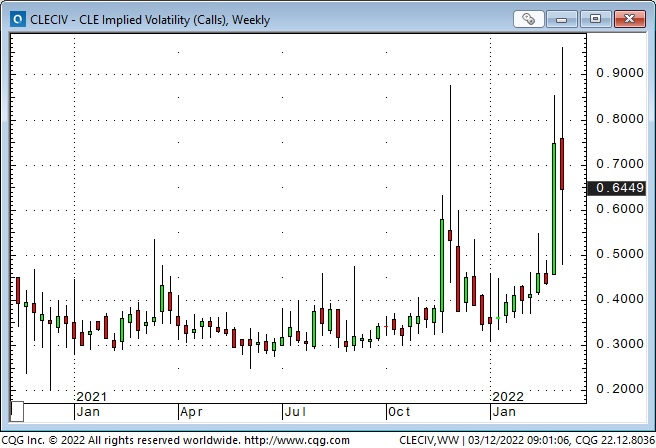

Implied Vol on WTI call options ranged between 50 and 100% this week. Yikes!

NYMEX RBOB gasoline had similar price action to WTI but briefly eclipsed the previous all-time high in 2008.

The public seems to be buying commodities aggressively. My long-time friend Ross Clark, who does terrific technical analysis, issued blow-off warnings for gold and commodities this week.

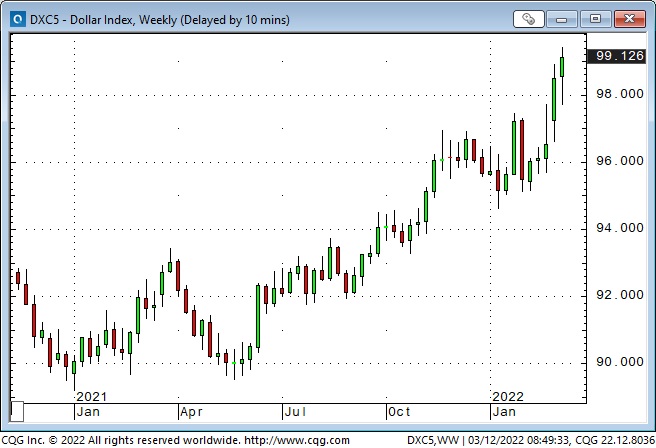

The US Dollar Index: highest weekly close in 22 months

The Japanese Yen tumbled to its lowest weekly finish in over six years.

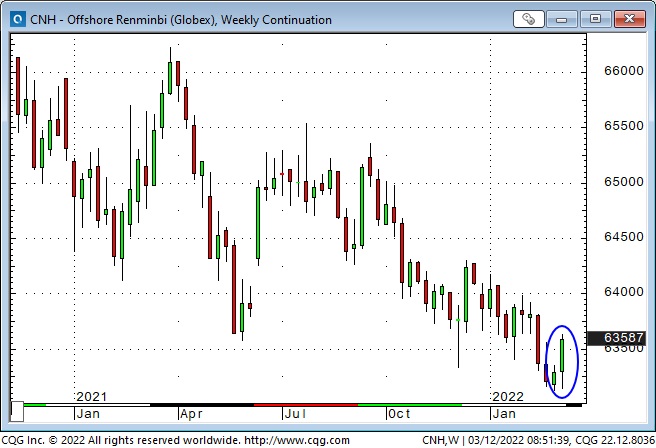

The offshore Renminbi hit its highest level against the USD in four years this week but weakened Friday as the USD rallied against most currencies. (In this chart, lower prices mean the USD is falling against the RMB.)

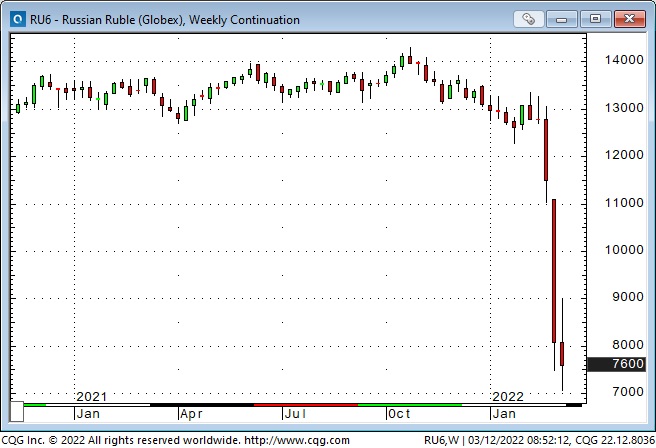

Russian Ruble futures have tumbled dramatically in the last three weeks – the Ruble is down ~80% from its July 2008 highs (when WTI was $147.)

The Canadian Dollar

Last week I posed the question: “What’s wrong with the Loonie?” Commodities have been soaring, but the CAD has not been keeping pace. What’s the problem? My answer was that the USD has been super strong against virtually all other currencies and that (together with rising risk-off sentiment) trumped the bullish effect that increasing commodity prices usually have on the CAD.

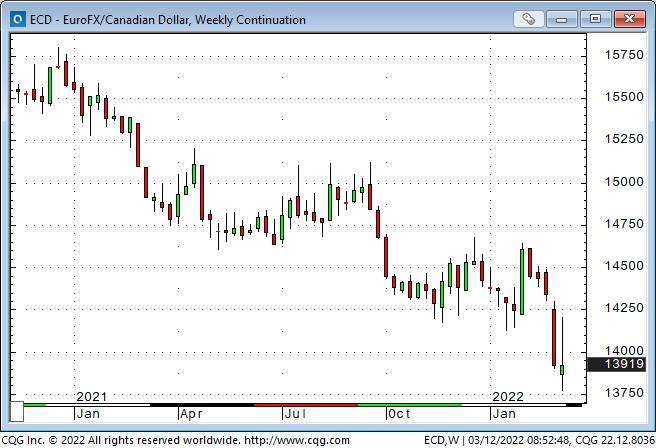

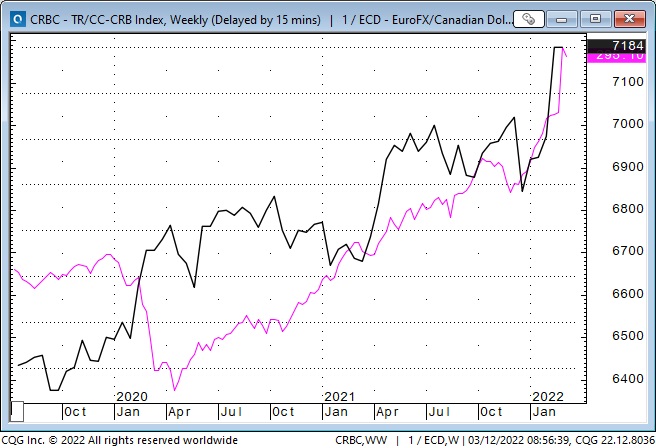

This EURCAD chart shows that the Euro is at seven-year lows against the CAD.

This chart shows that the reciprocal of the EURCAD (the rising black line is the CAD gaining on the Euro) has maintained a close correlation with the increasing CRBC commodity index (pink line.) So, In Euro terms, the CAD has been rising with commodities – in USD terms, not so much.

Expectations of Fed policy tightening have a more significant impact on US interest rates than the Russia/Ukraine conflict

American interest rates rose from December through February on expectations that the Fed would reverse ultra-easy monetary policies and start tightening in March 2022. Then Russia invaded Ukraine, and expectations briefly shifted to the Fed NOT tightening aggressively. But this week, sentiment turned back to the idea that the Fed will tighten policy because inflation will be even higher due to the invasion.

One-year forward Eurodollar contracts are pricing ~150 bp increase from current levels.

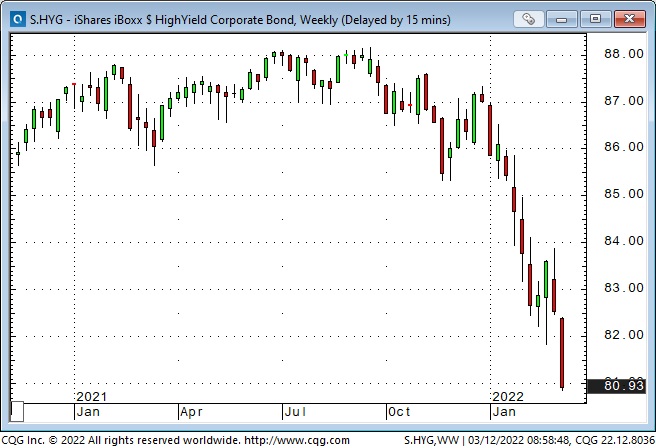

Credit quality spreads are widening as interest rates rise.

My short term trading

I was much more active this week than last week. My central theme was to try to pre-position ahead of a possible rally in the S+P (any indication of a ceasefire would cause stocks to soar.) I made several small-sized trades with tight stops. I had some winners and some losers, but net/net, I lost money.

I also bought the Euro and the CAD, thinking they would rally (after falling sharply last week) if there were any hint of a ceasefire. I made a little money on the Euro and was stopped for a slight loss on the CAD. I’m flat at the end of the week, and my P+L was down <0.50% on the week.

On my radar

ESG momentum may have stalled after being the “trendy” investment theme of 2021, but that doesn’t mean that long-term corporate Capex will surge because of higher energy prices. Corporations and investors will need to see a 180-degree change in attitude from Federal governments in North America before making serious long-term investments to develop domestic energy supplies. But Biden and Trudeau continue to be willfully oblivious to practical solutions that could make North American energy secure.

Regular readers know that my Big Picture thinking since last fall has been that equity markets are overdue for a substantial correction. I’ve written about “passive investing” (which now accounts for >50% of the new money coming into the market) being a relentless bid in the market. I think passive investors (who believe that the market only goes up over the long term) will NOT begin to sell unless the market has been trending lower for at least six months and the leading indices are down 30% or more.

Last week in the “Quotes” section, I quoted Michael Lewitt (The Credit Strategist) saying, “Wall Street’s job is to sell people things they should not buy. Like “short volatility!”

The ultra-low interest rate environment since 2008 has caused folks to “reach for yield” (to take more risk to generate income.) One of the things they have done is to sell option volatility and that selling depressed option Vol below where it would otherwise have been.

My guess (and my experience is that) unsophisticated option sellers will learn the hard way that they are taking too much risk, and that option Vols will trend higher as they leave the arena.

I first wrote about Fortress North America immediately after 9/11. My idea was that Canada, the USA and Mexico combined didn’t need much from the rest of the world.

That idea faded as globalization became the way of the world. Still, now that supply chain problems and geopolitical issues are generating thoughts of “on-shoring,” I wonder if the idea of a North American Bloc will re-surface (especially if China and Russia become best-of-friends.)

Thoughts on trading

People want to know “why” something happened – or will happen. They want a narrative that explains price action. For instance, crude oil is up because sanctions will reduce Russian supply. We’re told that if you’re going to be a good communicator, tell a story.

As a trader, I have to be aware that a narrative that “explains” price action may be deeply flawed or dead wrong. For instance, if I believe the story that “X” will cause “Y” to happen, and I make HUGE money betting on “Y” (without knowing that “X” had nothing to do with “Y”), then I’m at risk of thinking I can “see” things that other people can’t – that I have exceptional “variant perception.” That degree of hubris inevitably has painful consequences!

Trying to trade the “misinformation” flow from the Russia/Ukraine conflict is fraught with risk – especially if I’m predisposed to selectively choose the misinformation that supports my underlying bias (such as, “we must be close to a ceasefire!”)

Quotes from the notebook

“I acknowledge that I don’t have all the facts. I acknowledge that I don’t know what motivates other people participating in the markets that I trade. So why would price action in those markets have to “make sense” to me?” Victor Adair 2019

My comment: This kind of thinking is the basis of my risk management. I do not get stubborn with a trade that is going against me, and I never “give it a little more time.” I’m willing to take a slight loss and move on.

“It ain’t what you don’t know that gets you into trouble. It’s what you know “for sure” that just ain’t so…that gets you into trouble.” attributed to Mark Twain

My comment: 100%!

“In my darkest moments, Fanny, I’m afraid it’s all about marketing.” Victor Adair, during an unscripted TV interview with Fanny Kiefer, 2003

My comment: Fanny and I went back and forth about markets and human behaviour, and she got me to say the above quote. I had no idea I was going to say that – and once it was said, there was silence between us for a moment and then she faced the camera and said, “we will be right back after this commercial break.”

The Barney report

The Barns is six months old today. He’s forty-eight pounds and still growing. He’s asleep at my feet, but as soon as he wakes up, he will give me the “sad-face” until I leave my computers and play with him.

I love the way he prances along with his head up and his tail wagging when he’s found a good stick.

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The March 12th podcast is available at: https://mikesmoneytalks.ca.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.