Featured Article

Is anything going right in Europe?

Germany reported a monthly trade deficit in May for the first time since 1991 (following the reunification of East and West Germany) as a direct result of soaring imported energy costs. Energy shortages across the Eurozone may result in rationing later this year, exacerbating the current economic slowdown.

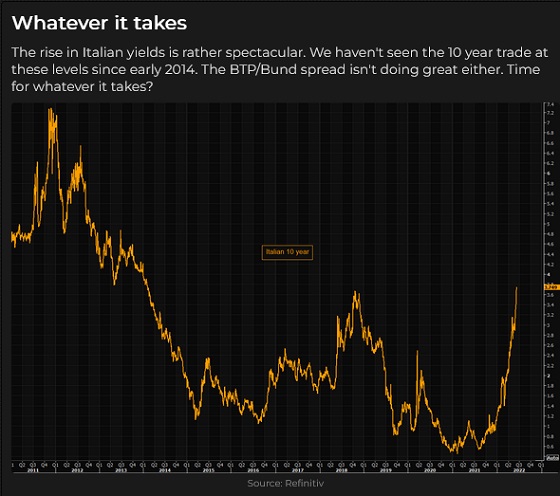

The ECB raised s/t interest rates 50bps this week (to zero!) This was their first raise in 11 years as they attempt to slow inflation which is an average of ~9.5% across the Eurozone.

The Russian/Ukraine war drags on, feeding the existential fear of freezing to death in the dark this winter.

You can read the rest of this Doomberg Twitter thread here.

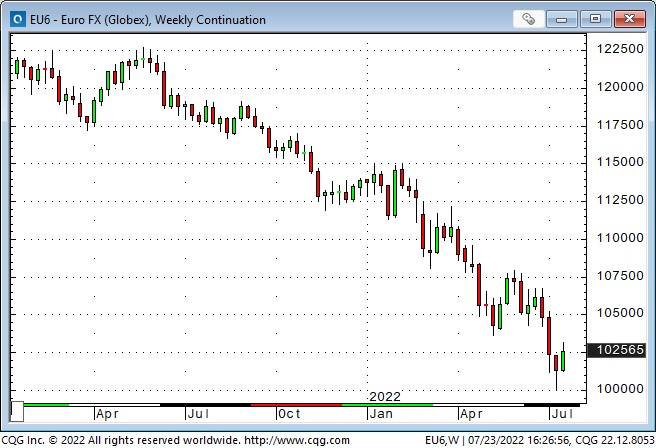

The Euro currency fell below par with the USD last week for the first time in 20 years (as the USD continued its 18-month rally against virtually all currencies.)

The Euro was ~84 when it was introduced in 2001 and rallied to its All-Time high of ~1.60 in the summer of 2008. It has trended lower since 2008, with that downtrend accelerating over the past year as markets expected the Fed to tighten monetary policy much more aggressively than the ECB. The Russian invasion of Ukraine hastened the flow of capital away from Europe to the safety of the USA.

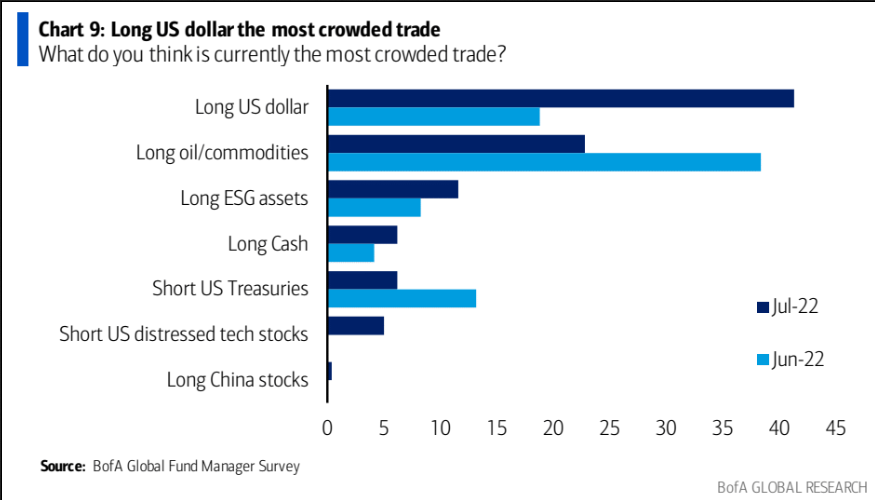

The Euro rallied ~3% this week from last week’s 20-year low. This could be a result of profit-taking on long USD positions (BoA Fund Manager survey sees Long USD as the most crowded trade) and thoughts that Peak Fed is behind us.

What is the Fed going to do?

Very bright analysts with years of experience have decidedly different answers to this question. Some folks believe that a recession is already underway and will quickly get dramatically worse – causing the Fed to “back off” their tightening program. In contrast, other folks believe that a new era of persistently higher supply-shortage inflation has begun after decades of relatively low inflation – which means the Fed will be raising rates far higher and for far longer than the market is currently pricing.

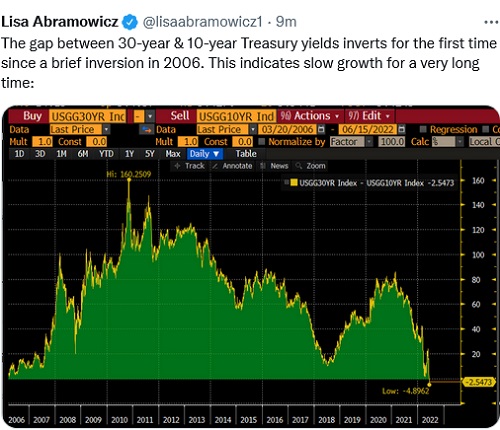

My answer: I think the Fed is determined to get inflation down at all costs, which may take them longer, and require them to raise rates more than the market expects. I can imagine a steeply inverted yield curve, with long rates lower than short rates as the market prices in the future impact of higher s/t rates.

The Fed’s credibility is lost if inflation remains high and inflation expectations remain “unanchored.” Don’t fight the Fed.

What is the macro message across asset classes over the past few weeks?

Since the mid-June FOMC meeting, bonds and short rates have had a good rally, stock indices have bounced, commodity markets have been weak, and the USD has rallied to new 20-year highs but has given back ~50% of those gains in recent days. Based on this macro picture, my guess is that the market sees a recession coming and the Fed “backing off.”

The FOMC meets this coming week, and the market expects another 75bps increase.

Stock indices

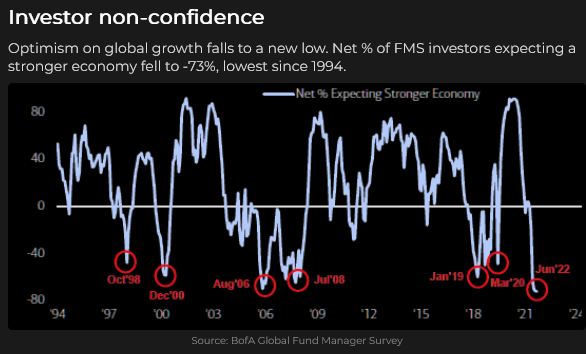

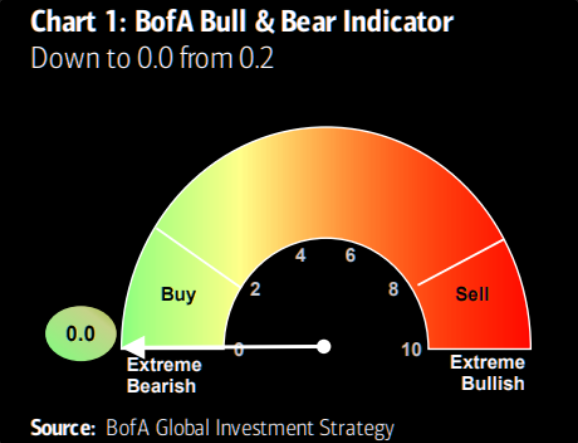

The DJIA bounced ~8% from the mid-June lows to this week’s highs. Market sentiment was extremely negative at the lows and hasn’t improved much since then. Last week I wrote that the stock market had a “damned if you do, damned if you don’t” problem. If a recession is looming, then the Fed would be less aggressive (good news), but if a recession is looming, earnings will take a hit (terrible news.)

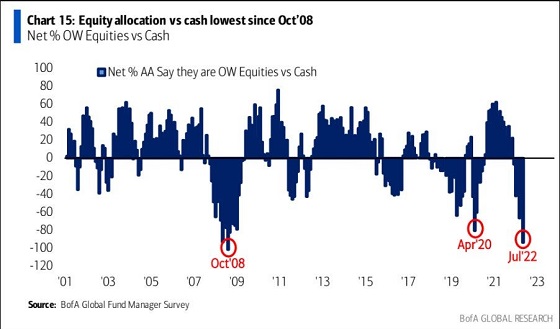

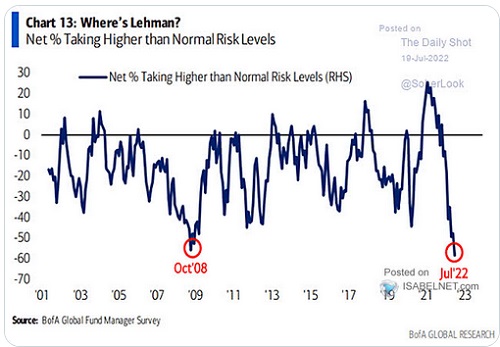

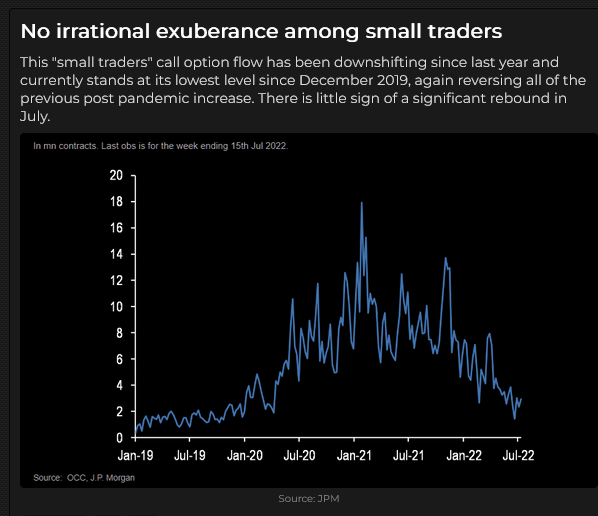

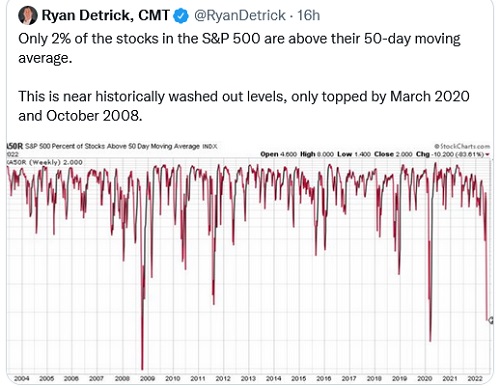

Stock market sentiment is extremely negative:

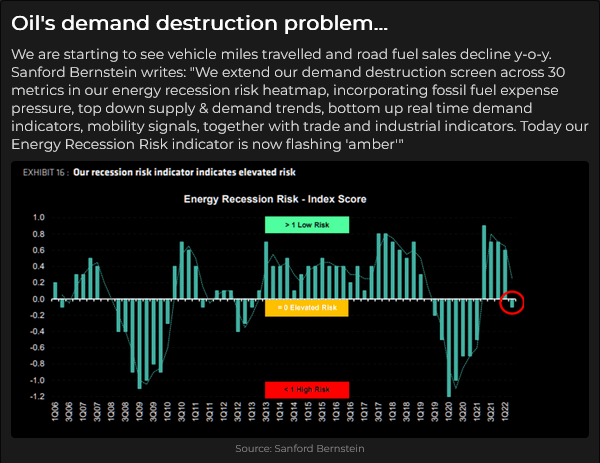

Are falling gasoline prices good news for the stock market? Yes, if you see cheaper gas as a sign of cooling inflation (the Fed won’t need to be so aggressive.) No, if you see cheaper gas as a sign of “demand destruction,” consumers are cutting back on their spending, and in an economy that is 70% driven by consumer spending, that’s not good.

I believe the bounce from the June lows has been another bear market rally. I agree with Michael Harnett, CIO at Bank of America, when he writes: “It’s unlikely that Wall Street will unwind the financial excesses of the last 13 years with a six-month, garden variety bear market.”

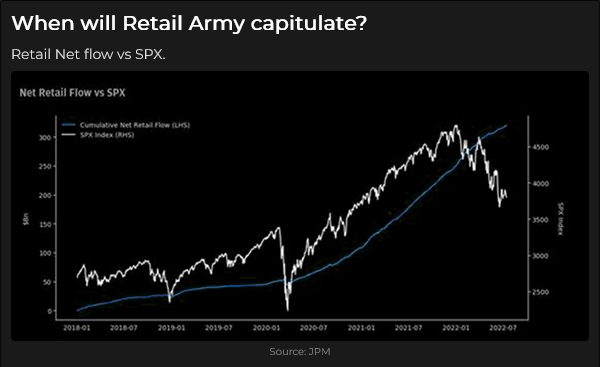

Concerning that 13-year time frame, I have often wondered what will happen to the Passive Investing cohort if/when the major indices fall more and stay down longer than they ever imagined. (Their thesis: The stock market always goes up over time, so keep buying at regular intervals, don’t try to time the market, buy the whole market, don’t try to pick stocks, be prepared for occasional corrections, and see them as good opportunities to lower your average costs, be patient and you will be handsomely rewarded over the long term.) I don’t believe they have begun to sell yet, but they will at some point in the cycle.

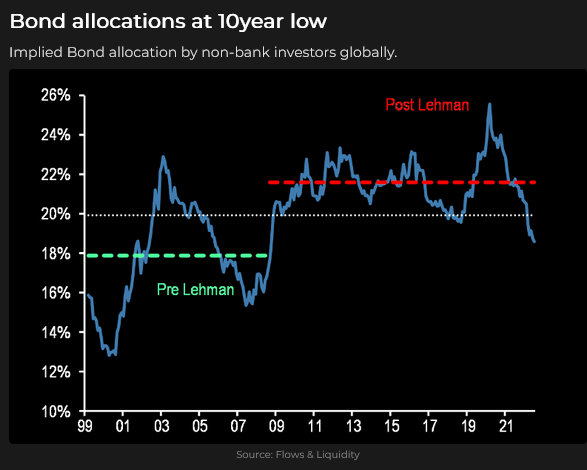

Credit markets

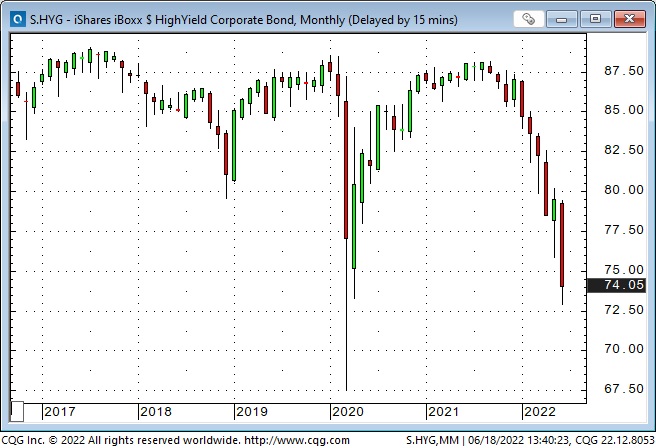

If the Fed is determined to get inflation down, and if that takes longer than the market expects, short rates will rise, bond prices will fall, and quality spreads will widen.

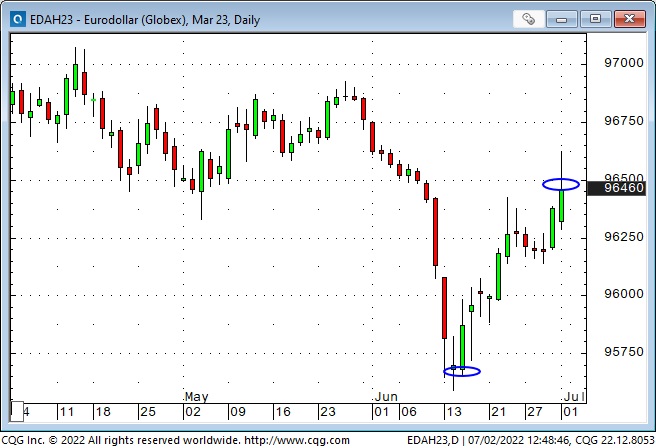

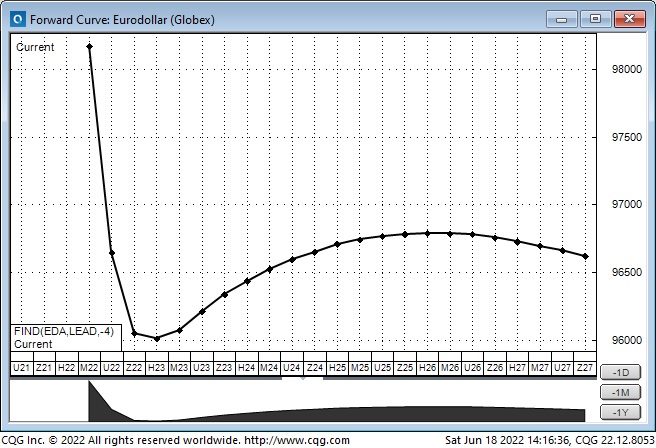

The June 2023 Eurodollar has rallied 100 points since the last FOMC meeting – the market is pricing s/t rates to be 100bps lower than what was priced a month ago. Eurodollar futures will fall if the Fed surprises the market and keeps pushing rates higher.

If the US economy does not go into recession, the Fed will push rates much higher than the market is currently pricing.

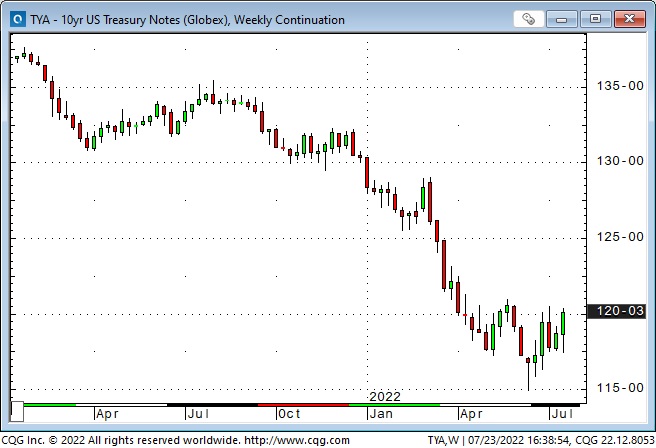

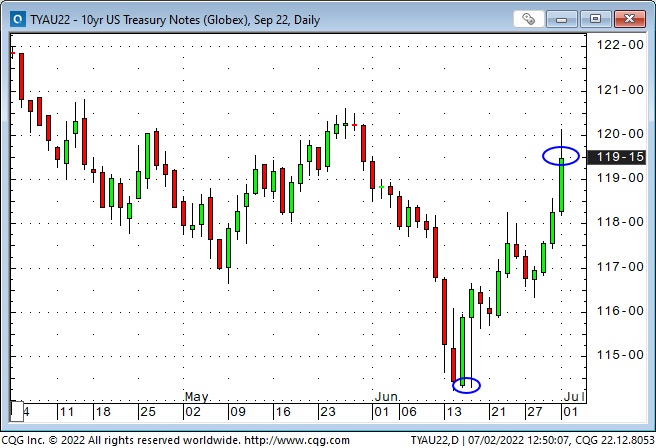

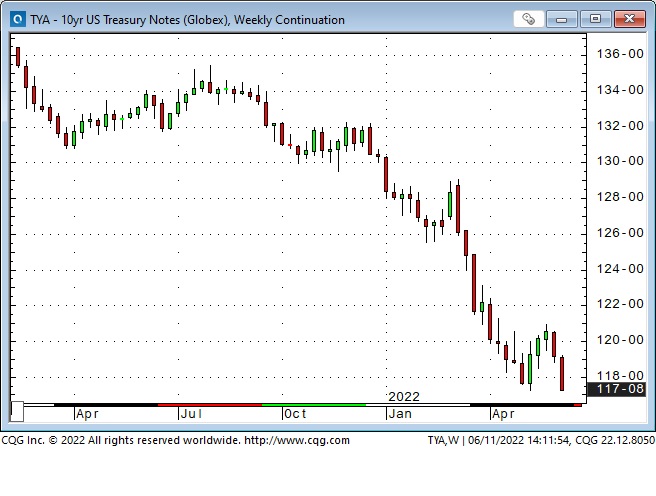

This is a chart of the 10-year T-Note futures contract. Prices have risen ~5 full points since last month’s FOMC meeting (as yields have fallen.) If the Fed surprises the market and takes rates higher for longer, prices will fall. If a recession hits harder and faster than expected, prices will rise.

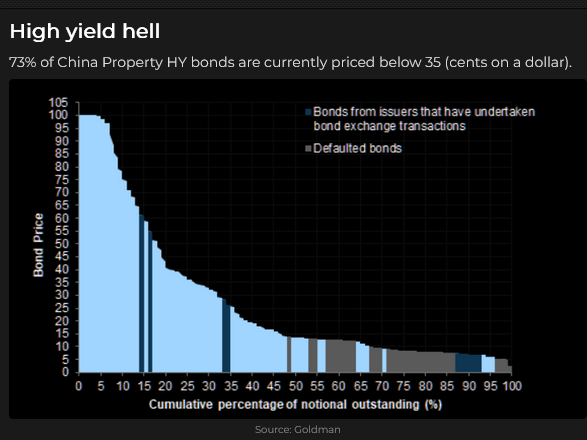

Baring some exogenous events, like over-leveraged China having a severe financial meltdown, I think the only thing that would cause the Fed to “back off” would be a sustained sharp rise in the unemployment rate.

Currencies

For the past 40 years, I’ve said that capital comes to America for safety and opportunity. I’ve also repeatedly said that currency trends go “way further” than seems to make any “sense” before turning on a dime and going the other way.

I acknowledge that the USD looks “over-valued” on several metrics (primarily trade imbalances), but if the Fed is determined to cool inflation (while Europe is lurching into an existential crisis and Japan maintains a zero interest rate policy), the USD will go higher against virtually all currencies.

Commodities

The Goldman Sachs commodity index has closed lower (down ~20%) for seven consecutive weeks. Weaker fossil fuel prices have contributed to this decline, but industrial metals and Ag markets have also tumbled. (The Economist magazine cover in May – The Coming Food Catastrophe – signalled the top of the wheat market – see the May 21, 2022 TD Notes.)

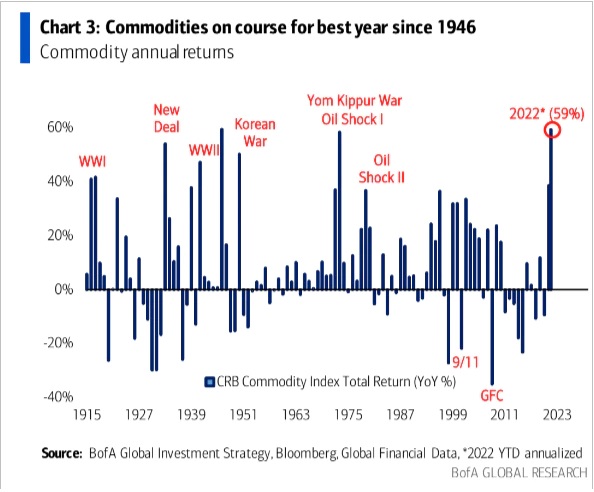

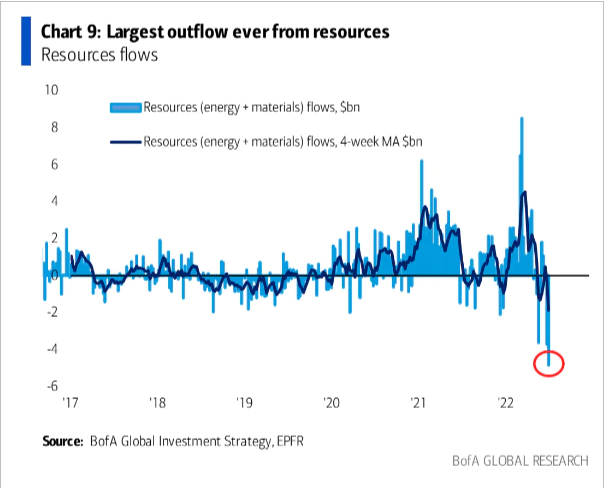

Commodities, especially energy, were The Most Crowded Long trade earlier this year. The bullish narrative was a compelling supply shortage story, exacerbated by the Russian invasion.

There has been severe liquidation of speculative bullish positions in the commodities market despite the Malthusian warnings that future supply shortages will be acute and prices will soar from current “bargain” levels.

The Malthusian theory has been wrong for over 200 years. In commodity markets, the “best cure for high prices is high prices.” High prices bring forth supply – from innovation and substitution.

Instead of millions of people dying of starvation due to the world’s rising population, food innovations have delivered an adequate supply of food to a higher percentage of the world’s population than ever before.

That doesn’t mean that commodity prices won’t spike on supply shortages; they will, and that spike will bring forth more supply – from innovation and substitution. If fossil fuel prices spike over the next few years, that will be a powerful accelerant for innovators to deliver alternative energy sources, like nuclear, for instance!

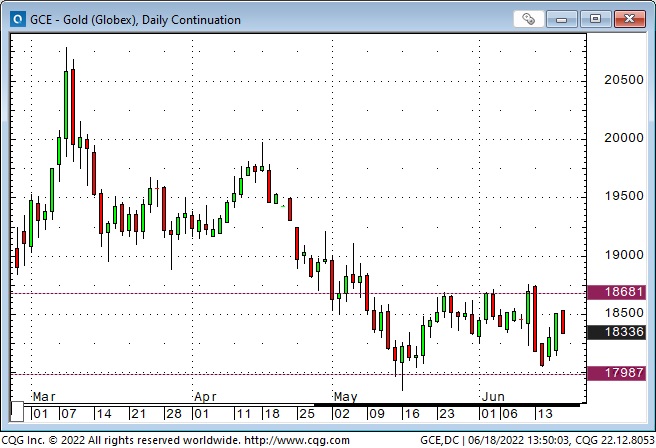

Gold

Gold hit a 15-month low this week, down ~$400 (19%) from the All-Time highs ($2,080) made following the Russian invasion.

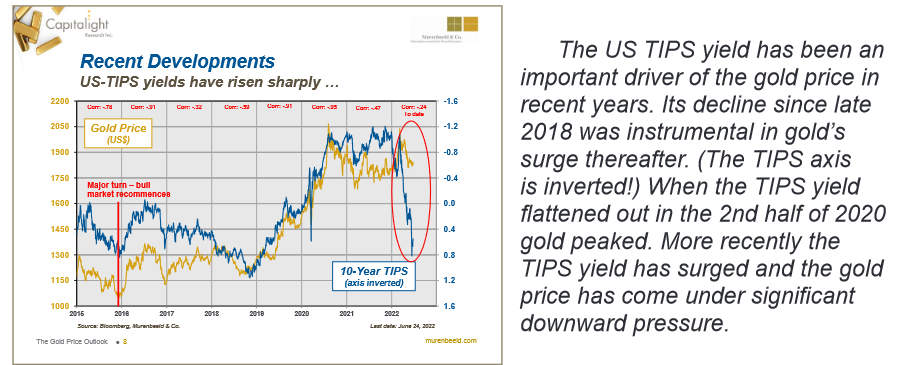

The ultra-strong USD and rising interest rates are a significant headwind for gold. Net speculative long positions on Comex appear to be around a 3-year low (the managed money category is net short ~19,000 contracts), and the gold ETF market has seen net selling for the past few months.

My long-time friend and excellent technical analyst Ross Clark (ChartsandMarkets.com) wrote a report this week, seeing major oversold extremes in the XAU, HUI and Newmont and capitulation in gold futures.

With gold in a downtrend, stories will inevitably surface as people try to explain “why” gold is falling. For instance, there has been a story that Ukraine has been selling gold. Maybe they have, I don’t know. But the best story is that Uganda has “discovered” 320,000 tonnes of gold throughout the country. (To put that “discovery” in perspective, the world currently mines ~3,000 tonnes of gold annually.) This massive discovery has depressed the gold price (so the story goes) because there will “soon” be a flood of supply hitting the market!

While the Uganda news was greeted with skepticism, it got me thinking that perhaps Africa will be the source of supply for the mountains of minerals that the world will need in the future.

My short-term trading

I’ve been in summer vacation mode for the past two weeks. I bought gold Tuesday and was quickly stopped for a slight loss. I shorted the S+P Wednesday and Thursday and was stopped promptly for small losses. I missed being short Friday when the market broke. I’m flat at the end of the week, and my P+L is down ~0.2%

On my radar

I think the S&P rally off the June lows has been a bear market rally, and I’ll be looking for price action to allow me to trade from the short side.

I’ll look for opportunities to buy the USD against CAD and EUR.

The FOMC meets Tuesday/Wednesday, so I’ll be cautious about trading into that, but I’ll watch for price action to confirm (or deny) my idea that the market has over-priced a Fed pause.

Quote of the week

The Barney report

Barney is leading the good life. He is well fed but gets so much exercise that he looks lean. He is well-loved at home; everywhere he goes, people pet him and say he is a beautiful dog.

We were at the ocean again this week, and he was swimming like he’d been doing it all his life. He loves to chase a ball, whether I throw it in the dog park or the ocean and when he comes home, he can fall asleep anywhere, without a worry in the world. Does it get any better than that?

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The July 23 podcast is available at: https://mikesmoneytalks.ca.

I did my monthly 30-minute podcast with Jim Goddard on July 9 and talked about macro markets, Dutch farmers, and risk management. You can listen to This Week In Money – A Howe Street Radio feature.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

“Don’t fight the Fed,” they say, but what will the Fed do?

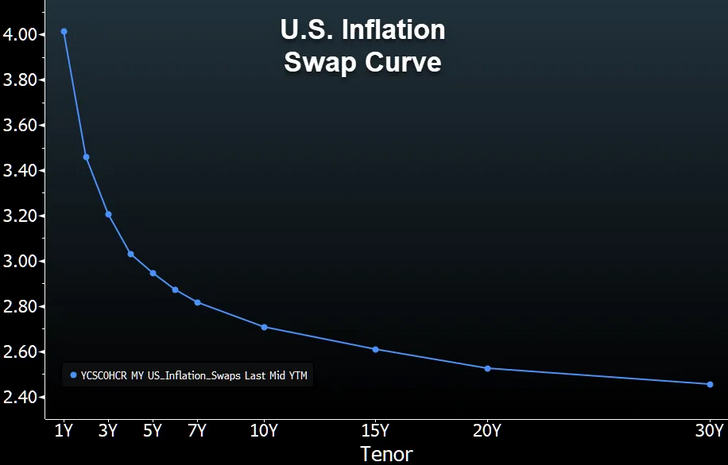

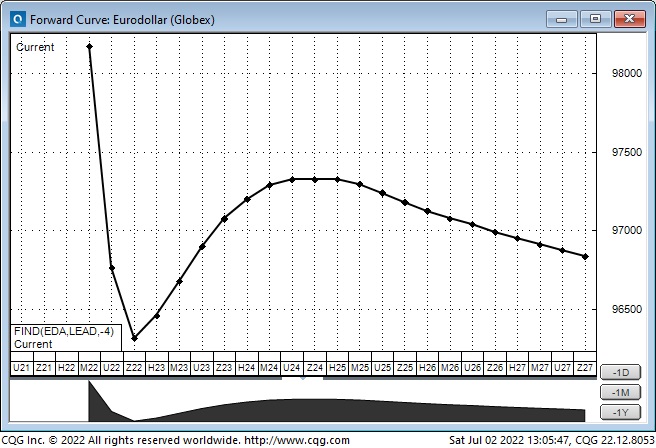

The markets understand that the Fed is determined to cool inflation by raising interest rates another ~125bps between now and December. But then what? The forward markets see the Fed beginning to cut interest rates in early 2023, likely in response to recessionary pressures. But if inflation stays high and employment remains strong, the Fed will keep raising rates.

Markets are searching for the “Peak Fed” moment

If you believe markets have “fully-priced” future Fed tightening, the Peak Fed moment was the June 15 FOMC meeting (when the Fed raised rates by 75bps) despite the Fed’s forecast for many more hikes to come.

That FOMC meeting may have been Peak Fed because the market had already priced in those increases and started reducing future rate expectations following the meeting – thinking that the path of Fed tightening would produce (or amplify) a recession.

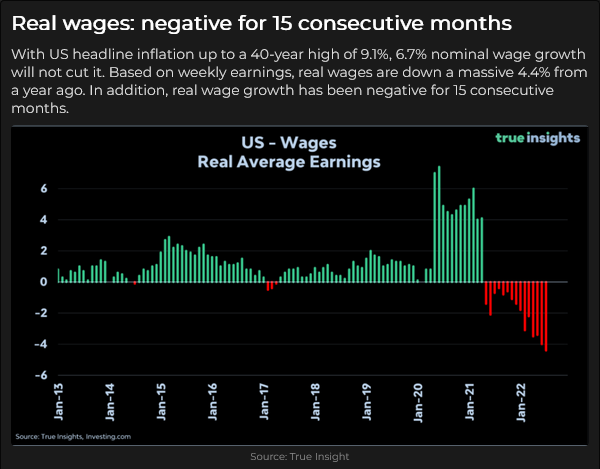

If you believe inflation will stay “higher for longer,” Peak Fed is somewhere in the future. This week’s CPI (9.1%) and last week’s strong employment report suggest inflation may be “higher for longer.” (Falling real wages may create pressure for higher wage demands.)

Markets are searching for Peak Fed – when the Fed pivots away from continually raising interest rates – because Fed policy is THE driver of price discovery across assets. If markets get the idea that Peak Fed has passed, then (all else being equal!) things that were shunned during the rising rates period will be embraced – without fighting the Fed!

10-year T-Notes have rallied from the 12-year low made on June 15 – FOMC day

The 10-year Treasury yield hit a 12-year high (3.5%) on June 15 and has fallen since then (currently ~2.92%.) Do bonds see a recession coming, or do yields ~3% offer an excellent alternative to a soggy stock market?

Equity markets have a “dammed if you do, dammed if you don’t” problem

Rising interest rates have been a problem for stocks this year, but if interest rates start falling because the market decides a recession is coming, that’s bad news for earnings. The major stock indices have chopped up and down since the FOMC meeting.

The US Dollar hit another 20-year high this week

The prospect of an aggressive Fed has helped drive the USD higher against all major currencies, with the Euro dropping below par for the first time in 20 years – down~12% YTD. (The DXY US Dollar Index is mostly the Euro and other European currencies. The Eurozone has been struggling with geopolitical and energy issues, but all US Dollar indices show a strong USD.)

Commodity indices peaked a few days ahead of the FOMC – and have closed lower for six consecutive weeks

The prospect of the Fed tightening into a recession has not been good news for commodities – a recession would likely mean demand destruction. Commodities (especially energy) were the “hottest – most crowded” sector of the market YTD and were vulnerable to a “positioning adjustment.”

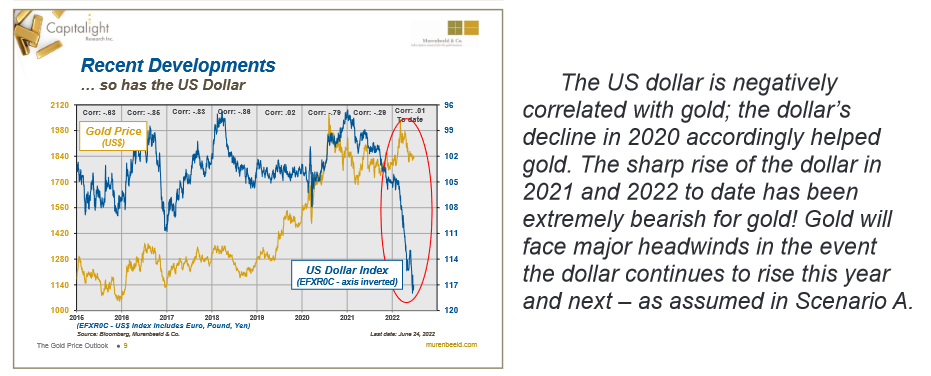

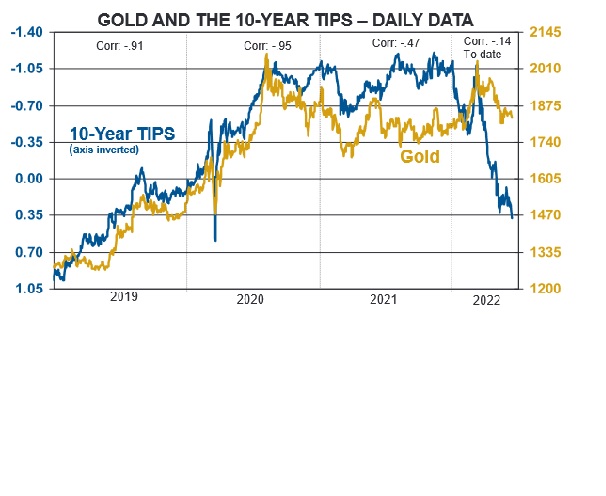

Gold has dropped as much as $385 (18%) from March All-Time Highs

Historically, gold has rallied on high inflation, but the soaring USD and rising real interest rates have been toxic for gold – in US Dollar terms. Comex gold futures have fallen for five consecutive weeks – down ~$175 from last month’s highs. This is the lowest weekly close in 16 months.

(Actually, gold has held up reasonably well. The last time real rates were at current levels, gold was ~$1,500. The last time the USDX was at current levels, gold was ~$350!)

My short-term trading

I started this week with a small S+P position I bought last Friday. I covered that for a slight loss as soon as markets opened Sunday afternoon. I bought the S+P five times Monday to Thursday, looking for a bounce. I traded small sizes with tight stops and lost money on four trades. I missed the 140-point rally from Thursday’s low to Friday’s close (the rally I had been trying to catch!)

I bought the CAD twice, breaking even once and losing a bit on the other trade.

I bought gold Wednesday when it bounced off 10-month lows and was nicely ahead on the trade at one point, but I was stopped overnight for another slight loss.

It was a frustrating week with very choppy price action. I lost money but using small size and tight stops saved me from getting destroyed as I tried to catch a turn in market sentiment. I was flat at the end of the week; my P+L was down ~0.5% on the week.

What does risk management mean – how do I apply it?

The essence of risk management is protecting your capital so that you can live to trade another day.

My friend Dennis Gartman used to say that there were two kinds of capital: the money in your account and mental capital. In his opinion, mental capital was the most important. If you lost your trading capital, you could always find some more money somewhere, but if you lost your mental capital, your willingness to keep going, you were done.

Another way to understand “protecting your capital” is to ask yourself, “What will I do when I’m wrong?”

That question implies that you clearly define what “wrong” means and have a contingency plan to protect your capital when you’re wrong.

Another question that helps identify risk management is, “Am I trying to make money or prove that I’m right?”

Many traders develop a “good” reason for taking a position in the market, and they get their ego involved in the decision-making process. They “have done their homework” and have determined that “X” must go up because of “Y.” If they have used this process before and it has produced profitable results, they will likely be determined to be proven “right” once again.

I’m willing to acknowledge that I don’t know what will happen. I “do my homework” and take risks, but I understand that there’s better than a 50/50 chance that I’m wrong on every trade, so it is “routine” for me to have a plan, and to stick with my plan, to limit losses on every transaction.

I spent decades as a commodities broker and watched 100s and 100s of people lose millions and millions of dollars. There were two main reasons; they used too much leverage, and either didn’t have a plan to limit their losses or didn’t stick with their plan. (We called that a cancel-if-close order!)

I believe every successful trader finds a “way” to trade that suits them. Some people are day-traders; others have a much longer time horizon. Some people swing for the fences; others are content to hit singles. Some of the “big names” are willing to confess that they made horrible mistakes during their early days and are grateful to have survived – but they have set rules for themselves never to make that mistake again.

I wish every trader success, whatever your style, but it truly is a marathon, not a sprint, and if you don’t conserve your capital, you won’t succeed.

Quote of the week

The British Open

It is the 150th Open this week, and Tiger missed the cut. I won’t watch it as much as I watch the Masters, but I had the pleasure of playing the Old Course several years ago in a two-club wind, and I’ll remember that experience forever.

The Barney report

Barney came to us from a lovely lady (Laurel Pickels in Pemberton, BC) who had great success breeding pure-bred Golden Retrievers for many years. But a Border Collie “jumped the fence” at the wrong time, so Barney is part Golden and part Border Collie, which means he is an amiable dog who can run like the wind (and instinctually tries to “herd” me when I take him for a walk.)

I took Barney to the beach twice this week (record low tides), and he had a great time playing in the ocean with two Goldens. He could barely walk back to the car after 30 minutes in the water and curled up in Papa’s chair for a nap as soon as we got home!

(The painting on the wall is an original watercolour of the Merc floor in 2001 – painted years ago by the wife of a long-time friend and commodity broker.)

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The July 15 podcast is available at: https://mikesmoneytalks.ca.

I did my monthly 30-minute podcast with Jim Goddard on July 9 and talked about macro markets, Dutch farmers, and risk management. You can listen to This Week In Money – A Howe Street Radio feature.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

Market worries switch from “relentlessly rising inflation” to “looming recession”

The Fed raised s/t rates by 75bps two weeks ago and warned that they will continue to raise rates in an “unconditional” manner until inflation cries “Uncle.” But interest rates have DROPPED since then as the market focuses on the looming recession rather than on relentless inflation.

Credit markets

March 2023 Eurodollar futures have rallied ~100bps since the Fed raised rates, while the 10-year Treasury yield has fallen from ~3.5% to ~2.9%. (Eurodollars trade at a discount to par. Rising prices = lower yields. Bond prices rally as yields fall.)

Markets are pricing the Fed to raise rates by ~125bps between now and December 2022 and then start CUTTING rates aggressively – because “recession.”

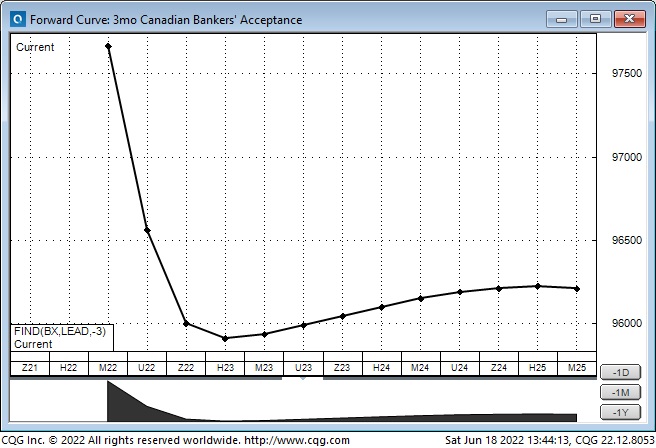

In Canada, the March 2023 Bankers Acceptance futures have rallied ~65bps since June 14, while the 10-year yield has fallen from ~3.62% to ~3.2%. Markets are pricing the BoC to raise rates by ~125bps by December 2022 and then start cutting rates – but not as aggressively as the Fed.

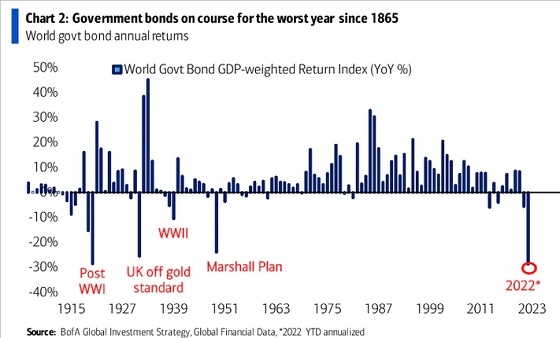

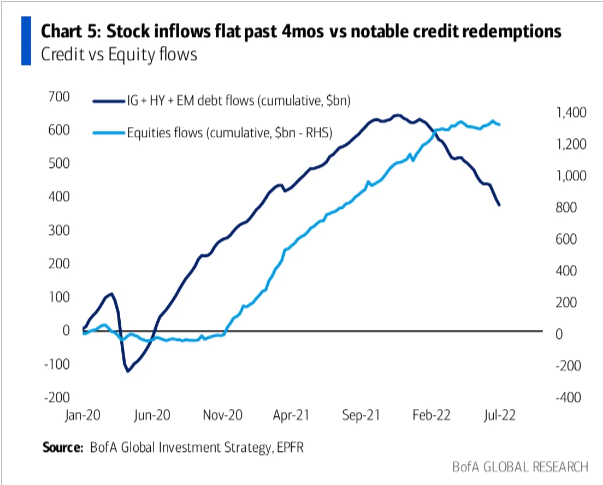

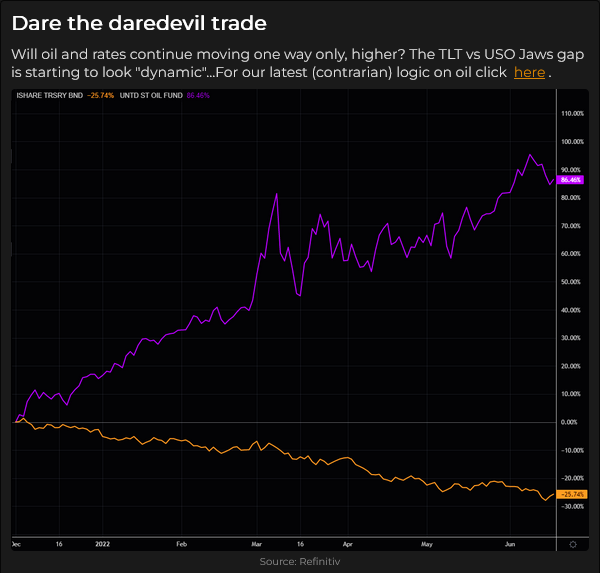

Increasing recession prospects have caused bonds to rally (after having a miserable first six months of 2022) while stocks and commodities have declined.

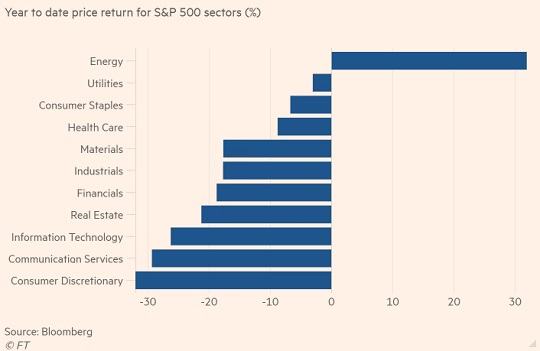

The energy sector of the stock market

Energy has been the hottest stock market sector YTD but has also been the worst performer in June, dropping ~17%. Historically, the energy sector was the worst performer over the past decade.

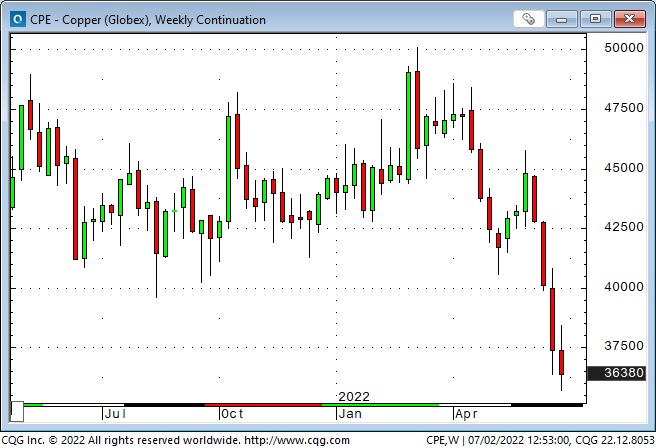

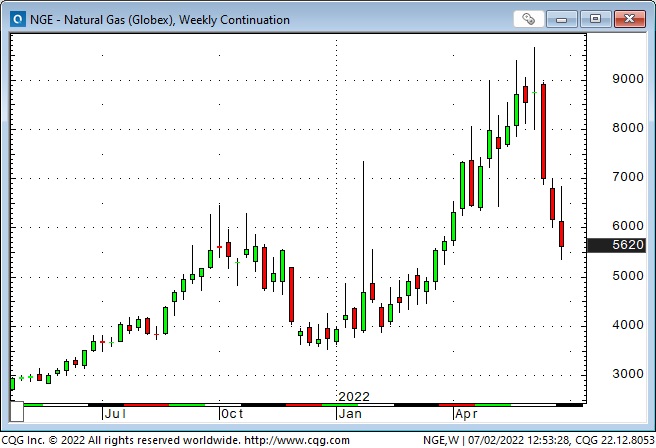

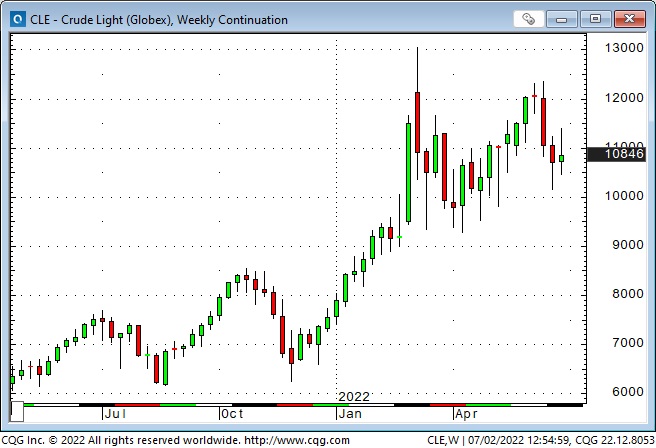

Commodities

The commodity sector is not monolithic, but the entire sector had a booming start this year. Lately, base metals and grains have been weak, as has Natgas, but crude oil and gasoline have been relatively steady.

I’ve circled the “Economist Magazine Cover” top on wheat – May 19.

Commodities had a booming start to the year.

Commodities (save crude oil and derivatives) had a booming start to the year but have fallen sharply lately – because “recession.”

Equities

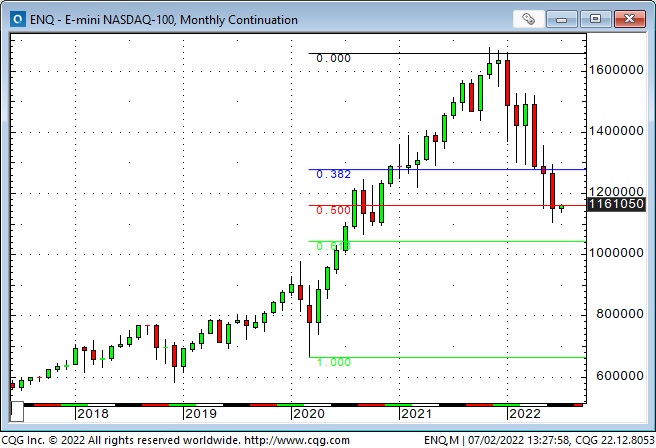

The S+P is down ~21% from its January 4th All-Time Highs. For perspective, the Feb/Mar 2020 bear market dropped ~35%, the 2007-2009 bear market dropped ~57%, while the 1987 bear market fell ~36%.

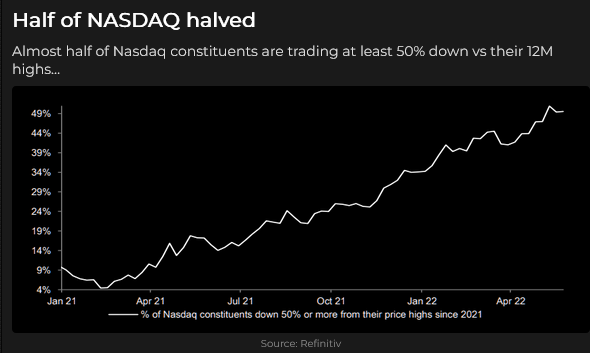

Since January 4, the S+P has “given back” ~ 40% of its gains from the March 2020 lows. The NAZ has “given back” ~50%.

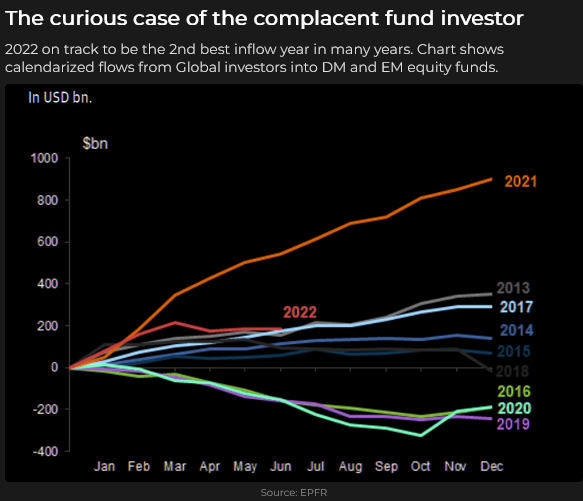

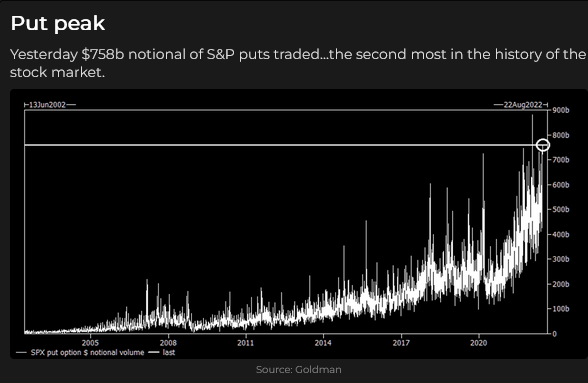

Capital has continued to flow into the stock market YTD, although it has flat-lined recently. There has been selling, but Vol metrics don’t indicate panic, and passive investors have not begun to sell.

Currencies

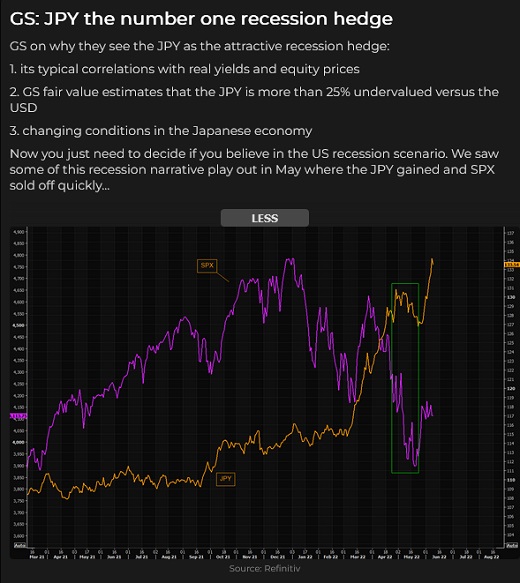

The US Dollar Index closed the week at a new 20-year high; the Yen is at a fresh 24-year low against the USD.

The Euro/Swiss dropped to new lows, while the EURUSD is only a hair away from 20-year lows.

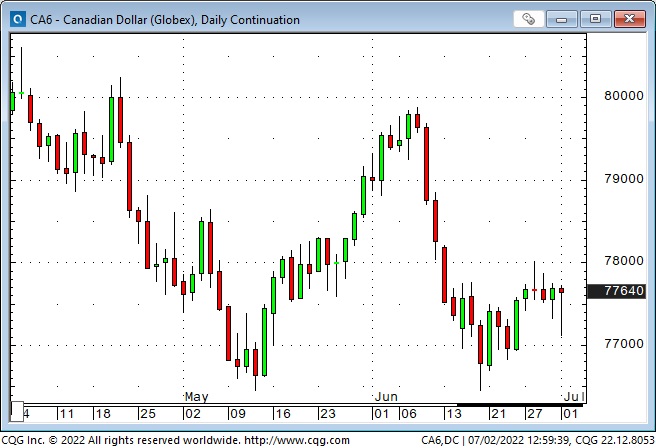

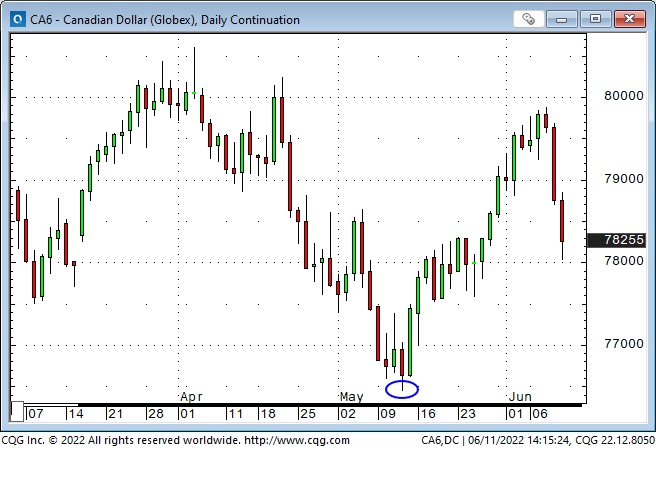

The CAD has held up well, around 77.5 cents, considering the overall strength of the USD, the weak stock market (an expression of risk-off sentiment) and the recent drop in commodities.

Gold

Gold dropped to a 5-month low early Friday but bounced back ~$30 by the close. Silver closed at a 1-year low.

These two charts are from the Gold Monitor, written by my good friend Martin Murenbeeld. The USD and real interest rates significantly impact the gold price.

My short-term trading

I was short the S+P this week, thinking that the bear market rally off the mid-June lows was inspired by the notion that the Fed would not be as aggressive as previously thought – but that the looming recession would overwhelm the idea of an easier Fed, and that would pressure stocks.

I was long T-Notes for much the same reason.

I was short CAD, thinking it would weaken with the USD being strong while stocks and commodities were weak. I covered the position for a small gain, thinking that it might rally if the CAD couldn’t fall in that “risk-off” environment.

I was flat going into the long weekend, and my P+L was up ~1.2% on the week.

Om my radar

I don’t enter a trade based on where I think a market could be months from now or where I think it should be relative to other markets, but I can’t help wondering about those things.

For instance, during H2 of 2021, I repeatedly told our Moneytalks listeners that I thought asset prices were “stretched,” that there was a lot of speculative froth showing up in different sectors, and that people should be careful about chasing things.

I felt a little silly doing that – like I was the buzz-killer telling the kids that if they drank too much at the party, they would wake up with a nasty hangover.

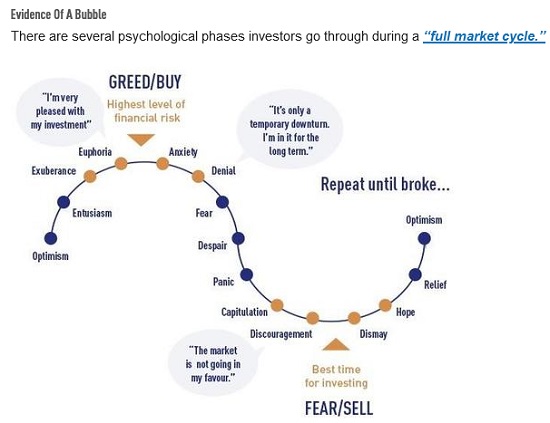

But right now, in my Big Picture view of the world, with the leading stock market indices down 20 -25%, I think the Big Risk is that we “ain’t seen nothing yet.”

We’ve had four or five bear market rallies since January, and each time those rallies ran out of steam, the market rolled over and made new lows. There has been selling but no panic. I know the Passive Investing Crowd believes that, in the long run, the stock market always goes up, but there will be “corrections,” which are good buying opportunities – a chance to lower your average buy-in cost.

I’m not “hoping” that Passive Investors start selling in a panic, and I believe that years of ultra-low interest rates “forced” a lot of people who should have been savers to become “investors.” But I think that trillions of dollars have flowed into the stock market based on some variation of the Passive theme, and if the broad indices keep trending lower, some of that money will start to exit.

Another Big Picture item is the US Dollar at 20-year highs. Many economists will argue, with good reason, that it is over-valued and “should” be lower. They may be correct, but IF the USD keeps trending higher, it will be another symptom of our world changing in unexpected ways.

I’m willing to bet that the recession is already here, and unemployment will start rising. That may be a reason for the Fed to pause, or it may be a reason for stocks to fall further, and I think those things could happen simultaneously.

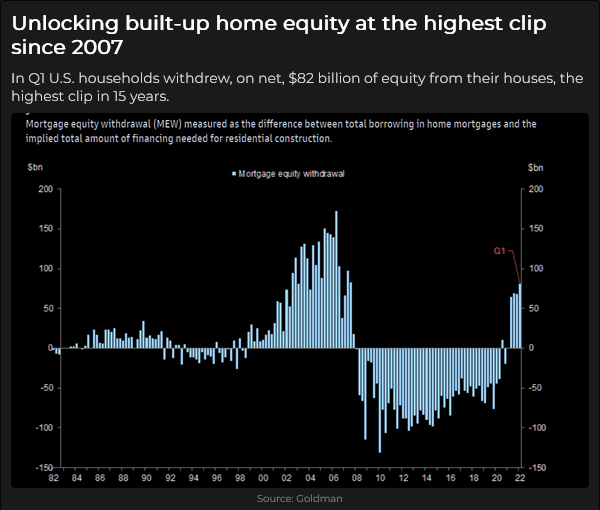

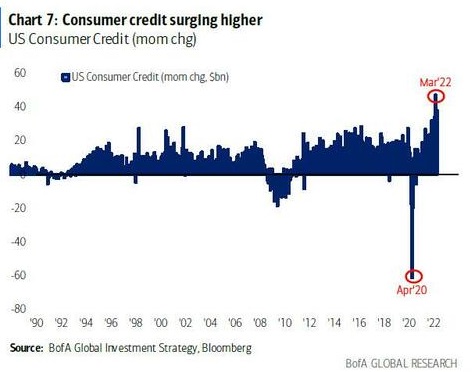

This chart does nothing to dispel my concerns.

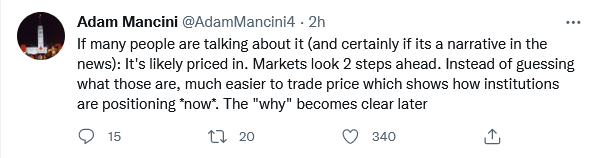

Thoughts on trading

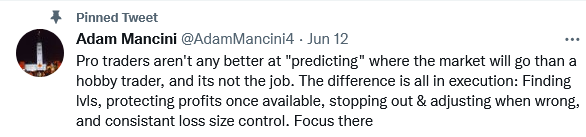

When I see a great quote, I’m happy to steal it – but I also want to give the author full credit for his inspiration. Adam Mancini is a Canadian who actively trades stock index futures, and I recommend his Twitter feed to you. I loved this quote:

The Barney report

Barney is loving summer! This week he swam a few dog-paddle strokes for the first time! Previously, he only waded into the water, but this time he lunged for a floating stick in slightly deeper water and seemed surprised to find himself swimming! Another milestone!

When my grandmother wanted to take pictures of people, she always wanted them to stand in front of her flower garden. Taking photographs with colour film was expensive, and she tried to get the most into each photo. I’ve become my grandmother! Barney and I found a stand of poppies on one of our walks, and I positioned him in front of the flowers!

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The July 1 podcast is available at: https://mikesmoneytalks.ca.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

Central Banks dominated the markets this week

The Fed raised rates by 75bps and forecasts much more to come. The Swiss National Bank surprised markets with a 50bps raise (to minus 25bps), the BoE raised 25bps, the ECB indicated that they would likely raise by more than 25bps in July, and the BoJ stood pat. The Bank of Canada is expected to raise by 50-75bps on July 13.

Short-term price action this week in stock, credit, currency and commodity markets was wickedly choppy. The S+P is down ~24% YTD, the Dow is down ~19%, and the Vanguard Total Stock Market ETF is down ~25%.

The BIG questions about Central Banks

Have Central Banks entered a new (Volker-like) era after more than two decades of throwing money around? Is their resolve to “bring down inflation” strong enough to keep raising rates (and otherwise tighten monetary policy) as “stuff” breaks? Will they continue raising rates into a recession? If they have found “religion,” what will cause them to “back off”? (A stock market down 50%? A crash in real estate prices? Soaring credit spreads? Sharply higher unemployment rates?) Given that they were woefully late in abandoning their “transitory” views, will their timing be any better when markets cry “Uncle?”

The BIG questions for markets

Are Central Banks the driving force in markets or only the catalyst for an overdue “shakeout?” If Central Banks have found “religion,” does that mean that most of the metrics (especially valuation metrics) that have worked over the past two decades are now worse than useless? If Central Banks have entered a “new era” (think of Fed Chair William Martin and his notion of “taking away the punch bowl…”) will people (retail and institutional) who bought into Passive Investing start selling?

Has a recession already started?

It all depends on your time frame

For short-term traders, the cacophony of negative wailing is a temptation to BUY. For longer-term investors, the markdown in various assets has been a sobering reminder that they were not nearly as rich as they thought. Reality (Mister Market) is catching up to unsustainability (over-leveraged speculative excesses), and TINA has gone out of style.

Equities

The major indices have round-tripped to just above where they were when Biden’s election and the Pfizer vaccine announcement in November 2020 ignited the run-for-the-roses final rally in the 12-year bull market.

More speculative issues have had a more dramatic rise and fall.

The S+P futures fell ~13% (top to bottom) in the ten trading days from June 3 to June 16. This sharp decline has only happened on three different occasions in the last eleven years, and each time it was followed by a substantial rally. (But if we are in a new era of Central Bank behaviour, past performance is no guide to future performance.)

Credit

The US 10-Year TNote briefly traded at a record low 0.50% yield in August 2020. This week it briefly traded at a 3.5% yield, an eleven-year high.

High-yield corporate bond prices have tumbled YTD. If this week’s closing level holds until month-end, it would be the lowest monthly close since the grim days of March 2009.

Forward Eurodollar futures contracts are pricing a sharp rise in short-term interest rates between now and March 2023, followed by a modest decrease. (these contracts trade at a discount to par – falling prices mean rising interest rates.)

Canadian Bankers Acceptance futures contracts are pricing a similar trajectory.

Currencies

The US Dollar Index made a 20-year high this week, up ~18% from what I had frequently described as an “inflection point” on January 6, 2021, when the Capital Building in Washington, DC, was under siege. (Think of Rothchild’s quote about buying when blood runs in the streets.)

Short-term volatility in the currency markets has been wicked over the past six weeks.

Commodities

The bullish fossil fuels narrative (supply shortages) has been convincing, and capital has flowed into the “energy” markets – but what about demand? So far, “demand destruction” doesn’t appear to have happened, but markets discount the future, and the message coming from equity and credit markets may spark at least a correction in energy prices.

Gold has chopped sideways within a $75 range for the past six weeks as speculative interest continues to wane. A surging US Dollar and rising real interest rates are typically toxic for gold, so perhaps gold should be credited for “holding its own” lately.

The broad commodity indices (with a heavy energy weighting) may have created a bearish chart pattern: a failed breakout above recent resistance levels (~785) and a “lower high” (at 825) relative to the spike high in early March.

My short-term trading

A few months ago, I asked the rhetorical question: “Will the Fed throw the stock market under the bus in their quest to bring down inflation.” So far, the answer is “Yes.”

I bought the S+P four times this week, looking for a bounce. I traded small positions and used tight stops, but the net loss to my P+L was ~0.5%. On Wednesday, Fed day, I was ahead by 100 points at the high of the day, and if I had taken profits, then I would have had a 0.5% gain for the week instead of a loss. I decided to stay with the trade because I thought the market could rally (it had traded at an 18-month low the day before.)

In retrospect (!) I broke my new “rule” about taking quick profits in a counter-trend trade (and “staying with” trades that were in line with the prevailing trend.)

I bought the Euro on Thursday, looking for it to break above the previous highs for the week (~1.0579.) It did, soaring about 100 points above my entry price. (I bought the Euro because it was rallying despite Europe being neck-deep in negative sentiment.)

Once again, I decided to stay with the trade, rather than take quick profits. There was double bottom (mid-May and mid-June) on the charts, and a break above the 1.07 support/resistance line could ignite a big rally. I raised my stop to limit losses, and it was elected on Friday, resulting in a P+L loss of 0.15%.

I sold OTM short-dated (one week) TNote puts on Monday, thinking that bonds were egregiously over-sold. VOL was near record highs. I covered the position later in the day for a P+L loss of 0.20%.

I re-entered the trade on Thursday when TNotes rebounded from the week’s lows (made on three consecutive days.) I’ve held that position into the weekend.

I added (cautiously) to my bullish TNotes trade on Friday by buying futures and writing short-dated OTM calls, and I’ve held the positions into the weekend. My net unrealized P+L on the TNote trades is ~+0.20%, and my net account P+L is down ~0.65% for the week.

On my radar

Markets feel like they are at a “make or break” point.

As noted in the Equities section above, the S+P has only dropped >12% in ten days on three occasions since 2011, and it rebounded, big time, after each of those events. But if this is a “new Fed era,” the selling pressure may continue.

I think the market is pricing the Fed to tighten into a recession, which may already be dawning, and the economic slowdown will deepen quickly.

My “economic analysis” is only a background to my price action-driven trading decisions – but if price action is harmonious with my economic analysis, I’ll be inclined to “stay with” winning trades rather than take quick profits.

Thoughts on trading and risk management

I watched a fantastic video on Realvision TV this week with Mark Ritchie interviewing my friend, Peter Brandt.

Peter is my kind of trader in that he never “swings for the fences.” He believes that Job #1 for traders is to: Protect Capital. He sees trading as a job and is trying to build cash flow, not pick big winners.

Peter sees himself as a risk manager, not a trader. (Picture a prop trading firm. A bunch of traders are sitting in front of their screens, trying to make money by taking market risks. Behind them sits the risk manager. His job is to see that none of the traders blow up the firm. If a trader loses too much money, he gets a tap on the shoulder from the risk manager. Think of your account as a prop firm and yourself as the risk manager. Protect your capital.)

After keeping records of his trading for 40+ years, Peter discovered that 80% of his trading profits came from less than 20% of his trades. The profits on these trades were substantially more significant than the profits or losses on the other 80% of his trades. His “risk manager” job is to make sure that the other 80% of his trades don’t eat into the profits made by the 20%.

He is a technical “breakout” trader with a swing trading time horizon – a few days to a few weeks. He has also found that almost all of the trades that contributed to 80% of his profits started working immediately. (He put on the trade, and it immediately started making money.) Peter realized that it was essential to develop rules that allowed him to “stay with” a winning trade – to give it a chance to be one of the big winners that constituted 20% of his trades.

RealVision TV: I was a founding subscriber to RTV and also subscribed to some of their more expensive services. I interviewed Raoul on Moneytalks radio (Canada’s most popular financial talk show) and strongly recommended listeners subscribe to RTV. I was dismayed, however, when Raoul publicly declared to his audience (primarily millennials, I believe) that he was “irresponsibly long” crypto. I thought he was “irresponsible” to do that, given his “guru” status with his relatively unsophisticated audience.

I cancelled my RTV subscription but later re-subscribed. They have great interviews with excellent analysts and traders, and I tune out their relentless crypto bullishness.

The Barney report

Barney became part of our family in early November last year when he was eight weeks old. He grew like a weed for the next several months but seems to have levelled out around 60 pounds over the last six weeks. He used to gulp down his food but lately, he will eat some of it and, maybe, come back later and do a cleanup.

He loves to get outside and explore, and we always look for new places to take him. Recently I started taking him to a meadow (about 40 acres in size) with trails through tall grass. He loves it, and we play lots of hide-and-seek games in the tall grass.

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The June 18 podcast is available at: https://mikesmoneytalks.ca.

You can listen to my 30-minute June 11 “This Week In Money” interview with Jim Goddard. Marc Faber and Ross Clark are also on that week’s podcast.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

Markets expect Central Banks to become more aggressive – stocks tumble, while interest rates and the US Dollar surge higher

The ECB finally “grasped the nettle” on Thursday, but their announced intentions (to raise interest rates by 0.25% next month and to also stop buying bonds) were tepid relative to soaring inflation, so the Euro fell sharply Vs. the USD, interest rates jumped, and sovereign spreads widened dramatically.

On Friday, the CPI report was hotter than expected, and consumer sentiment plunged to a record low. Interest rates surged higher, credit quality spreads widened, and the US Dollar soared while stocks tumbled.

Consumer spending is ~70% of American GDP. Consumers are more worried about inflation than anything else. Previously, inflation was mostly confined to financial assets and real estate, but now inflation is hitting consumer necessities like food, fuel and electricity. Consumer spending has been holding up, but consumer debt is rising sharply.

I expect consumer spending to fall sharply as Central Banks raise interest rates. The economy will slow faster than CBs currently expect, corporations will struggle to maintain margins, and PE ratios will shrink.

A few weeks ago, some analysts were toying with the thought that “peak tightening” had come and gone and that the market had “over-priced” how aggressive the Fed would be. By the end of this week, sentiment had shifted to the idea that (to para-phrase BofA’s Michael Hartnett) “In short, the inflation shock isn’t over, and the rates shock is just starting (the growth shock is coming, and so is a recession.”)

The US 10-Year bond futures are at a 12-year low (yields at a 12-year high of 3.17%).

The US 2-year note futures are at a 14-year low (yields at a 14-year high of 3.07%.)

The (May 12 to June 2) bear market rally is over

The S+P has closed lower in 9 of the last 10 weeks, with this week being the worst week YTD, yet volatility metrics remain below the highs made on May 12, when the S+P touched a 14-month low and was (briefly) down more than 20% YTD. Perhaps the market isn’t “worried enough” to have made a bottom.

The market cap of global stocks is down ~$23 Trillion from last November’s ATH of ~$100 Trillion. That’s equivalent to about one full year’s worth of US GDP.

The US Dollar rallied against virtually all other currencies this week

My FX mantra for the past 40 years has been that capital flows to the USA for safety and opportunity. When markets are “worried,” the USD is bid. The “opportunity” in the USD now is higher interest rates and security in an appreciating currency.

The Yen was down again this week (down 14% YTD), hitting a new 20-year low due to ultra-loose BOJ policies. However, a rare joint statement of “concern” from the BoJ, the MoF and the Financial Services Agency late this week may presage a “change in tone” at next week’s BOJ meeting.

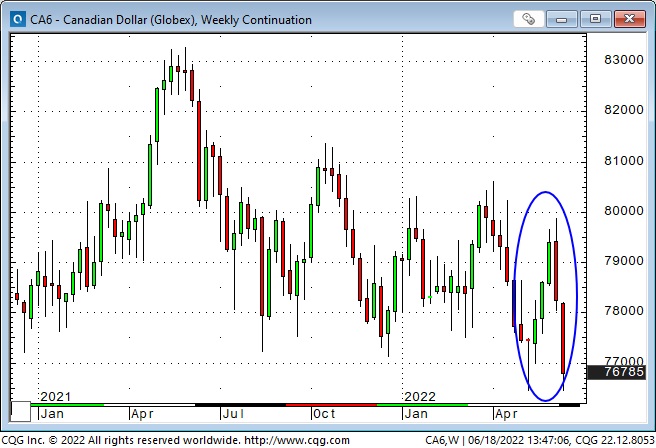

The Canadian Dollar hit a 20-month low on May 12 (as the S+P hit a 14-month low and the USD made a 20-year high) and then rallied to nearly 80 cents over the next four weeks as the USD weakened, commodities (especially crude) and stocks rallied, and market sentiment shifted to risk-on.

The CAD fell nearly two cents this week as the USD surged (the Euro plunged) and stock markets tumbled. The CAD weakness was sustained despite Canadian unemployment levels hitting a 46-year low of 5.1% and average wages growing ~4% YoY. (These reports will likely harden the BoC’s resolve to raise interest rates aggressively – keeping Canadian interest rates at a premium to American rates.) The CAD also fell despite fossil fuel prices remaining firm.

The solid historical correlation between the CAD and commodity prices may not be showing up in USDCAD (the tremendous strength of the USD has trumped the CAD/commodity correlation) but note that the CAD is at a 9-year high against the major European currencies and a 14-year high against the Yen.

Gold rallies ~$50 on Friday despite surging interest rates and a strong USD

Gold hit a new All-Time High of ~$2075 following the Russian invasion of Ukraine (and the subsequent sanctions) but dropped as much as $300 by early May as the USD strengthened and as interest rates (especially real rates) rose.

On Friday morning, gold dropped to a 3-week low on the CPI report but then rallied ~$50 to a one-month high even as the USD soared. It is unusual to see both gold and the USD enjoy a big rally on the same day – it is often a sign that markets are “worried.”

Gold open interest climbed about 28% from early February to the March spike and has now returned to early February levels. (Speculators bought the market on the way up and sold it on the way down.) Given that gold has “held up” reasonably well despite the strong USD and the return of real yields to positive territory, the purging of speculative interests may set the stage for another leg higher.

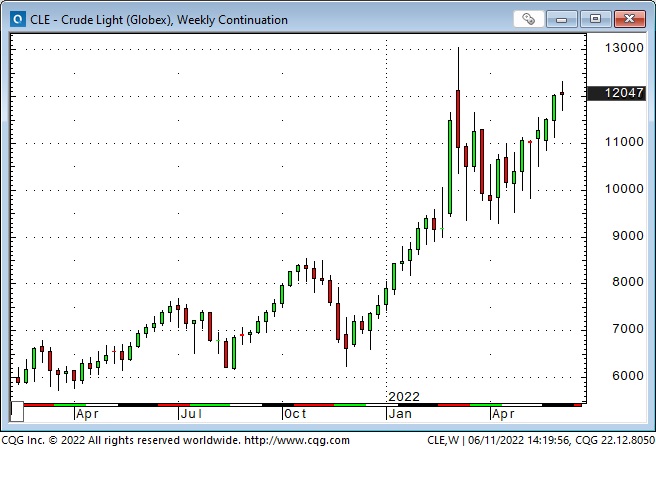

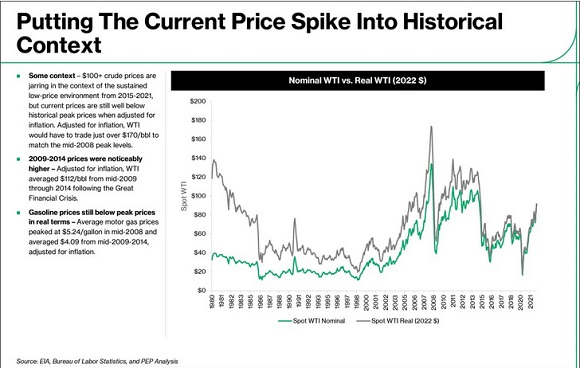

Fossil fuel markets remain strong

WTI crude oil traded above $130 in early March (when gold was hitting ATH) for the first time since 2008. Prices dropped ~$35 following that spike but have been trending higher for the past two months, with this week’s close (on a continuous basis) the highest since 2008. Gasoline and Heating Oil futures (lacking refining capacity) have been stronger than WTI futures and have recently traded at ATH.

While gasoline, diesel and crude oil prices have been the focus of media attention, North American natural gas prices have more than tripled from their average over the past five years. (The US is exporting LNG to Europe.)

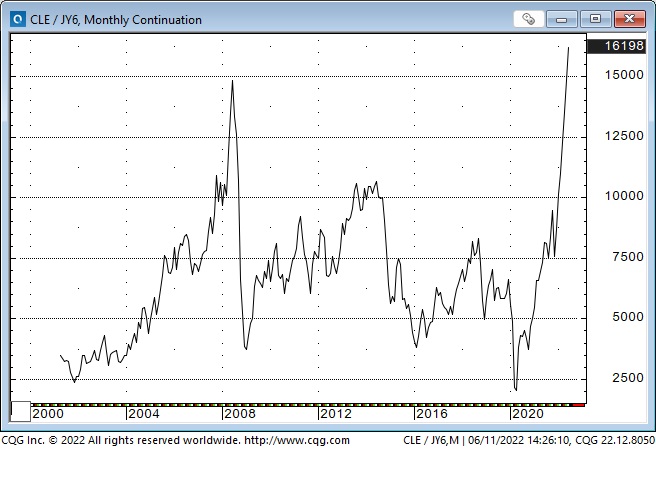

With the Yen at 20-year lows, the Yen price of WTI crude has soared to an ATH.

My short-term trading

I returned from a 5-day road trip on Monday afternoon, and it took me a few days to understand what to do in the markets. I shorted the S+P futures Thursday morning and covered the position shortly after the CPI report Friday morning. I’m flat going into the weekend, and my P+L is up >0.50% on the week.

On my radar

The possibility of Central Banks “tightening into a recession” sets the stage for “something” (or maybe several things) to break. I will look for opportunities in markets that have made strong one-way moves to reverse. That doesn’t mean simply taking a counter-trend position, but if I see a trend break and a subsequent attempt to return to trend fail, I’ll get interested.

Thoughts on trading

One of the best reasons I keep writing this blog is that it connects me with other traders I would not otherwise have met. When swapping emails with another trader, I usually keep the “message” short and to the point. Here are a couple of edited quotes (from me) to another trader this week:

My road trip caused a disconnect between me and the markets, which may be a good thing. My trading time horizon the past few months had become very short-term – day-trading – and historically, my strong suit has been a swing-trading time frame; a few days to a few weeks.

The short-term volatility in markets (particularly equity futures) “forced” me into a shorter-term time horizon.

So I’m back at my desk with a “clean sheet” in front of me. As a person with “multiple personalities,” I’ll be interested to see who shows up!

Interesting that you mention Cathie Wood. I saw a story about her maintaining that deflation is a bigger worry than inflation – that’s an interesting thought (especially if she’s right!)

The essence of what you’re doing (looking at market correlations, seeing a breakdown in CAD/WTI, and CAD/commodities – seeing the near-universal energy market bullishness) is classic Bruce Kovner: What I am really looking for is a consensus that the market is not confirming. I like to know that there are a lot of people that are going to be wrong.

Risk Management Quotes from the Notebook

At that moment, I was confronted with the realization that I had blown a great deal of what I thought I knew about discipline. To this day, when something happens to disturb my emotional equilibrium and my sense of what the world is like, I close out all positions related to that event. Bruce Kovner, The Market Wizards, 1989

My comment: The Market Wizards is a must-read for traders, and the interview with Bruce Kovner is one of the best in the book. As I keep repeating, I make money from managing risk, not from having a great crystal ball. I know that things I can’t possibly anticipate can happen, so I need to do whatever I can to avoid taking a devastating trading loss.

Time and time again, when I read interviews with accomplished traders who are asked for advice for new traders, they say, keep your size small. That way, if you’re wrong, you don’t get killed. Having a BIG position inevitably means you’ve got your ego tied up in the trade, and if it goes against you, you will either fight it or freeze – which is precisely the worst thing you can do.

The Barney report

When I returned from my 5-day road trip, Barney was thrilled to see me – and I was delighted to see him. We had previously never been apart for more than a day.

We live on a golf course, and Barney loves to find golf balls. I take him out in the evening when no players are on the course, and he finds balls I can’t see. He gets a treat every time he finds a ball.

My wife and I have been giving away golf balls on our back fence for the past five years. We will have given away over 11,000 balls by the end of this season – and these days, Barney is finding more balls than my wife and I put together!

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you want to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >20 years. The June 11 podcast is available at: https://mikesmoneytalks.ca.

You can listen to my June 4th interview with Mike, where I talk about some of my risk management rules, here.

You can listen to my 30-minute June 11 “This Week In Money” interview with Jim Goddard. Marc Faber and Ross Clark are also on this week’s podcast.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.