Asset protection

On the heels of the Shanghai stock market plunging over 6%, the Godfather of newsletter writers, 91-year-old Richard Russell, declares gold bottomed as China shocked the world. The legend also discussed the chaos in China as well as a trapped and increasingly desperate Federal Reserve.

On the heels of the Shanghai stock market plunging over 6%, the Godfather of newsletter writers, 91-year-old Richard Russell, declares gold bottomed as China shocked the world. The legend also discussed the chaos in China as well as a trapped and increasingly desperate Federal Reserve.

……read more HERE

ALSO JUST RELEASED: Richard Russell – The Big Picture, Chaos In China And The Monster That’s Scaring All Investors CLICK HERE.

ALSO JUST RELEASED: Richard Russell – The Big Picture, Chaos In China And The Monster That’s Scaring All Investors CLICK HERE.

From Egon Greyerz

“this coming September – October all hell will break loose in the world economy and markets. A lot of factors point to that, both fundamental and technical indicators and this indicates that we could have a number of shocks this autumn”.….read more from Egon von Greyerz

Multi-Market Update (NFTRH Premium)

Following is a detailed update of the US dollar, precious metals, US and global stock markets and commodities, which was sent to premium subscribers this morning.

The update is passed along to eLetter readers to remind you that NFTRH premium is a well rounded service, with not only a detailed 25-35 page (pdf) report emailed each Sunday, but as many or as few interim updates (posted at NFTRH.com and emailed) as required to keep us on the right side of markets.

Today’s markets are not cut and dry and I simply think NFTRH is the best overall service of its kind, bar none, in its ability to keep its subscribers on the right side of global markets.

Multi-Market Update

Add the US dollar to the list of items that are in question and on the move. The green circles show the higher highs and higher lows made by USD since the May low. In June it spiked down, tested that low and then shot higher.

Most recently we noted that the modest new high was enough to keep the uptrend going and that USD can correct, even all the way down to key support in the most extreme case, and still keep a bullish case going. In making a lower low to July, it is in danger of losing initial support but is clinging to the MA 50. The two most recent peaks would in that case be a double top of short-term significance only. Whether or not Uncle Buck holds support right here is very key to other markets and their bounce/rally potentials.

Please read this column carefully, for if you don’t, you are destined to be one of the millions of investors who are soon going to learn about the markets’ next moves the hard way: Through giant losses.

Please read this column carefully, for if you don’t, you are destined to be one of the millions of investors who are soon going to learn about the markets’ next moves the hard way: Through giant losses.

Why? Because in a nutshell, most analysts and investors are confusing normal times with abnormal times.

More specifically, we are approaching a sovereign-debt crisis that will soon cripple the socialist-style Western governments of Europe, Japan and the United States. The ramifications and consequences are going to be felt far and wide. Even in interest rates.

For instance, no one knows for sure if Janet Yellen will raise rates come September or October. But let’s say she does indeed raise rates. Many are predicting some sort of Black Friday, where virtually all markets crash as a result. Gold, commodities in general, stocks, and of course, real estate prices.

And in normal times, that may be true. But these aren’t normal times.

First, we’re coming out of the lowest interest rates in the history of the country. A period that was fraught with financial dislocations, even the near total collapse of the monetary system, and a period where the Fed deliberately kept its short-term interest rates at record lows.

Second, a sovereign-debt crisis is rapidly approaching. It’s already hitting Europe. Soon, it will migrate to Japan, one of the most indebted economies on the planet, And then it will hit Washington, D.C. — the most indebted government in the history of the world.

Third, most investors are not making the appropriate distinction between normal and abnormal times. Nor have they studied history in detail.

Why do I say that? Because when a sovereign-debt crisis starts to hit, almost no one recognizes it.

Moreover, when a sovereign-debt crisis lurks right around the corner, rising interest rates have nothing to do at all with economic growth or inflation. Nothing to do with what analysts are calling “normalization” of interest rates.

Instead, rising rates in a sovereign debt crisis cycle have everything to do with the fact that governments are going bankrupt.

And what does that mean? It means that when interest rates start to rise, so will some of the biggest bull markets you have ever seen.

Simple logic explains why …

FIRST, rates were at record lows because almost nobody wanted to borrow. The demand for credit simply wasn’t there. It’s been a “risk-off” mentality for some time.

So as rates and the cost of money and credit rises, guess what happens. Demand goes up too. All the potential homeowners out there and businesses looking to borrow, for instance, will want to suddenly borrow again, before interest rates go any higher. And that in turn will stoke all sorts of demand, from housing, to commodities, to corporate earnings and to the stock market.

SECOND, interest rates negatively impact indebted governments. Unlike you, indebted governments don’t have the ability to hedge against rising interest rates. They don’t have the ability to reduce their interest-expense burden. All they can do is sit idly by while the cost and burden of their debts explode higher.

THIRD, there will come a time — in the not-too-distant future — when our foreign creditors, knowing fully well our government is broke, start to sell U.S. sovereign debt hand over fist, as they are already starting to do in countries like Greece, Portugal, Spain and in fact, most of the European Union and in Japan.

And that’s when — also not too far off in the future — the resulting rocket ride higher in U.S. interest rates that will occur will be the direct result of our country’s patently unpayable debt of well over $200 trillion.

When that moment comes, when investors begin to realize that it is Washington that is going broke and that Washington’s debts are really the force driving rates higher — they will then start to buy commodities, stocks, prime real estate …

And anything else they can find that is a hedge against collapsing governments.

This is how sovereign-debt crises have unfolded before, time after time. If you study the history of empires like Rome, Byzantium, the Spanish Empire, the British Empire and more.

Almost all of those collapses saw interest rates liftoff from abnormally low levels, to soar to abnormally high levels, and along with the rate ride higher came some of the biggest bull markets the world has ever seen.

All because government was collapsing. Not because of inflation. Not because of high economic growth. But because those empires had run out of ways to fund their patently unpayable debts.

Savvy investors are no dummies. When they see governments failing, they buy certain assets. Portable wealth shines bright: Diamonds, gold, silver, platinum, palladium, art and other collectibles.

Blue chip-like publicly traded stocks shine bright too, as do AAA corporate bonds.

So beware: The Fed’s first rate hike may seem like it’s overdue. Analysts may call it “normalization” of interest rates. Savers will jump for joy that they can get a better yield in CDs and money markets.

But in reality, any rate hike that is forthcoming will merely be the first subtle signs that a sovereign-debt crisis is right around the corner.

Don’t be one of the millions caught off guard with huge losses. Don’t be one of the millions who don’t understand what’s happening or about to happen.

Instead, think out of the box and act out of the box to protect and grow your wealth.

Best wishes and stay safe,

Larry

About Larry Edelson

Larry Edelson, one of the world’s foremost experts on gold and precious metals, is the editor of Real Wealth Report, Power Portfolio and Gold and Silver Trader.

Larry has called the ups and downs in the gold market time and again. As a result, he is often called upon by the media for his investing views. Larry has been featured on Bloomberg, Reuters and CNBC as well as The New York Times and New York Sun.

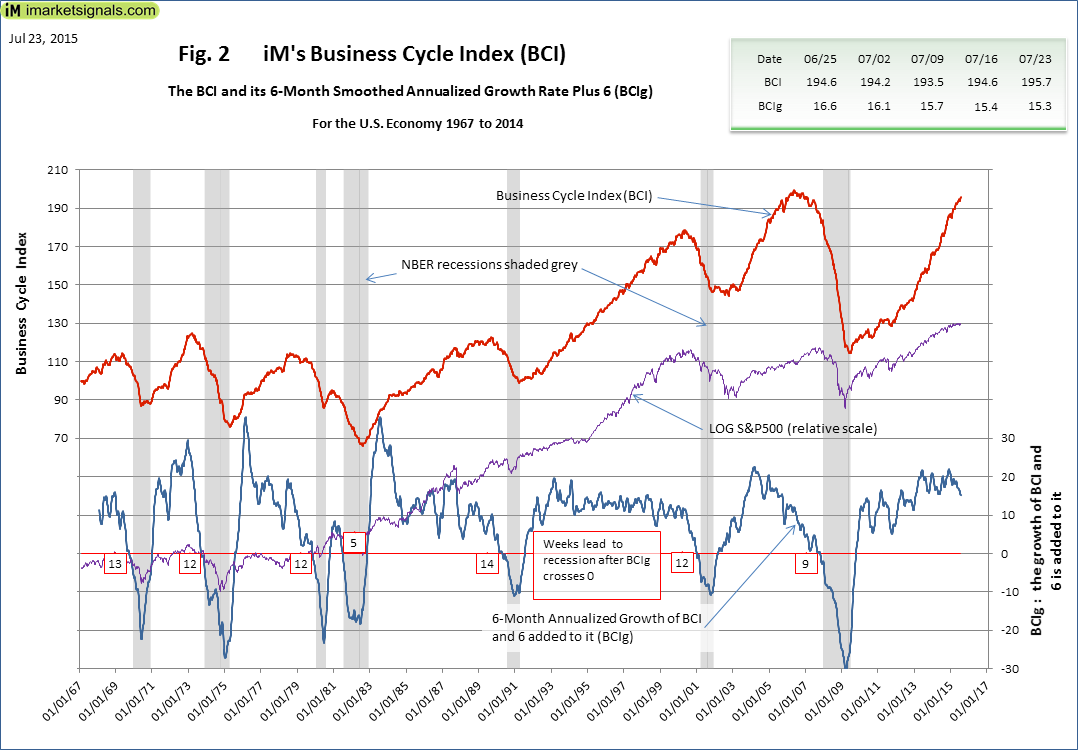

The TSE 300 and S&P 500 have been in a Bull Market for six years now, which simply means a recession and market correction is somewhere between zero and 4 years away according to the 50 year chart below:

Overall Stock Market losses in each recession average 34.6%, with the worst the 56.8% correction in 2008:

To make matters worse for investors, the other major investment class, Bonds, have seen yields dropping to their lowest levels in more than 50 years:

So with stocks becoming less and less attractive, Bonds with miniscule yield, just what is an investor to do? Here again I think the 71-year-old Bill Gross hit it on the head when he wrote in an investment outlook for Janus Capital Group Inc. that:

“Investors should stop focusing on price appreciation and instead look to “mildly levered income,” such as his recommendation to short German government debt.

Also, eliminating long-term bonds from your portfolios, avoiding the most rate-sensitive sectors of the stock market, sticking only with the highest-rated stocks in powerful sectors experiencing their own private bull markets, and dabbling (gingerly) in the most beaten-down, dirt cheap stocks that already reflect a huge amount of pessimism.

And to meet that criteria of beaten down stocks, I think this article below says it best:

Precious Metals Offer The Most Profitable Secular Opportunity Today

by The Secular Investor

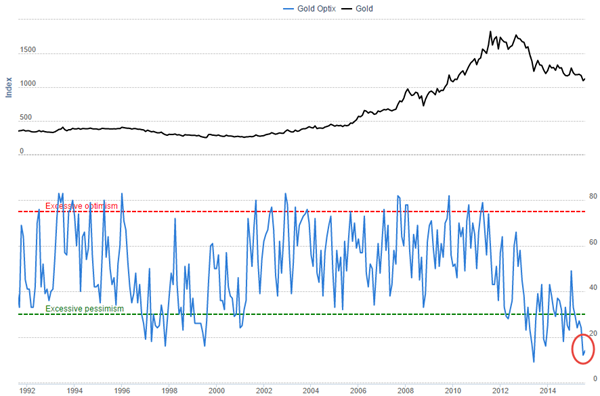

July was a horrible month for precious metals prices. Sentiment reached levels never seen before. As metals and the miners broke through a long term support line, so did pessimism.

To get an idea of the level of pessimism, we are including a very long term chart going back to 1992 (courtesy of Sentimentrader). As readers can see, market sentiment in the last 2 years is worse than the bear market lows of 1998 – 2000.

…read the entire Secular Investor article HERE