Asset protection

Interest rates, oil prices, earnings, GDP, wars, peace, terrorism, inflation, monetary policy, etc. — NONE have a reliable effect on the stock market

You may remember that after the 2008-2009 crash, many called into question traditional economic models. Why did they fail?

And more importantly, will they warn us of a new approaching doomsday, should there be one?

This series gives you a well-researched answer. Here is Part VI; come back soon for Part VII.

Myth #6: “Wars are bullish/bearish for stocks.”

By Robert Prechter (excerpted from the monthly Elliott Wave Theorist; published since 1979)

… If the stock market is not reflecting macroeconomic realities, what else could it possibly be doing? Well, how about political news? Maybe political events trump macroeconomic events.

It is common for economists to offer a forecast for the stock market yet add a caveat to the effect that “If a war shock or terrorist attack occurs, then I would have to modify my outlook.”

For such statements to have any validity, there must be a relationship between war, peace and terrorist attacks on the one hand and the stock market on the other. Surely, since economists say these things, we can assume that they must have access to a study showing that such events affect the stock market, right?

The answer is no, for the same reason that they do not check relationships between interest rates, oil prices or the trade balance and the stock market. The causality just seems too sensible to doubt.

Claim #6: “Wars are bullish/bearish for stock prices.”

Observe in the form of this claim that you have a choice for the outcome of the event. Economists have in fact argued both sides of this one. Some have held that war stimulates the economy, because the government spends money furiously and induces companies to gear up for production of war materials. Makes sense.

Others have argued that war hurts the economy because it diverts resources from productive enterprise, not to mention that is usually ends up destroying cities, factories and capital goods. Hmm; that makes sense, too.

I will not take sides here. We can negate both cases just by looking at a few charts.

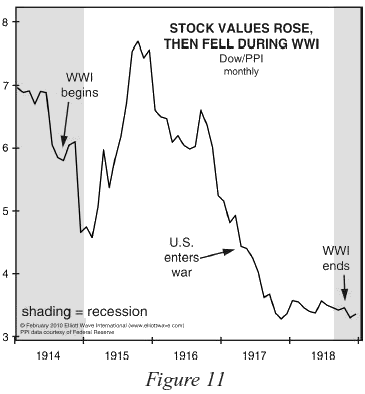

Figure 11 shows a time of war when stock values rose, then fell.

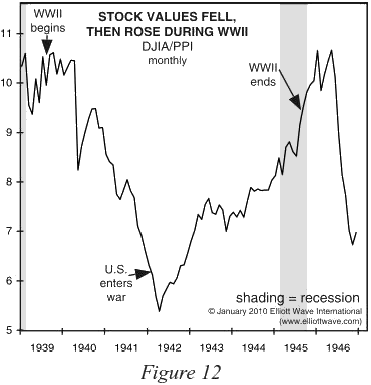

Figure 12 shows a time of war when stock values fell, then rose.

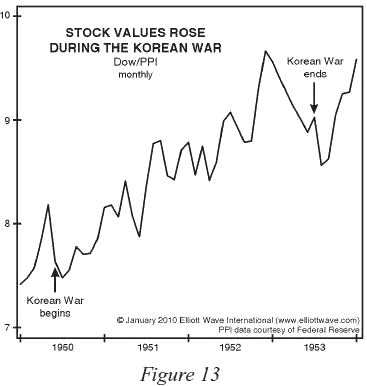

Figure 13 shows a time when stock values rose throughout.

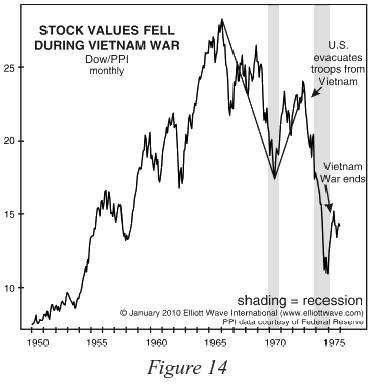

Figure 14 shows a time when stock values fell throughout.

Who wins the war seems to mean little, either. A group of Allies won World War I as stock values reached 14-year lows; and nearly the same group of Allies won World War II as stock values neared 14-year highs.

Given such conflicting relationships, why and how, exactly, does an economist expect war to affect his economic forecasts?

(Stay tuned for Part VII of this important series, where Prechter examines another popular investment myth: Namely, that “Peace is bullish for stocks.”)Free Report:

Unimaginable consequences?

These are not my words. They’re the words of the People’s Daily, the leading voice of the Chinese Communist Party. And they’re not a forecast or a speculation.

They’re a thinly-veiled threat!

In a moment, I’ll explain what I think those consequences might be — for the world and for you. But first let me give you a sense of how important this is and why I’m qualified to opine.

Hong Kong is the biggest financial center of the largest, most populous, fastest growing continent on the planet — Asia.

Only two other centers eclipse Hong Kong in power and size — New York, the financial capital of the world’s dominant superpower; and London, the center of the greatest empire in history.

Hong Kong’s banking, stock market, bond market and derivatives market are bigger than those of Frankfurt (the largest financial center of continental Europe) and of Tokyo (despite a national GDP that’s 22 times larger).

Tens of thousands of corporations, operating all over Asia, are incorporated in Hong Kong.

Over 1,600 companies, half based in mainland China, are listed on the Hong Kong Exchange.

And no matter what, if you want to do business in Asia, you almost invariably must go through Hong Kong.

I know from personal experience.

In the early 1980s, I was working in Tokyo as a stock analyst for Wako Sh?ken, one of Japan’s larger brokerage firms.

In the early 1980s, I was working in Tokyo as a stock analyst for Wako Sh?ken, one of Japan’s larger brokerage firms.

And soon after I began there, my boss sent me off to Hong Kong for a project with their local subsidiary.

My task was to develop presentations about Japanese stocks, while interpreting from Japanese to English and to Cantonese. (They overestimated my linguistic abilities.)

Even back then, business at their Hong Kong subsidiary was a big deal for them — bigger than their subsidiaries or branch offices in New York, London, Dubai and a half dozen other centers. And that was 35 years ago, before Hong Kong’s meteoric expansion!

Why? Because of one single, powerful force that has propelled Hong Kong’s growth:

Freedom.

Freedom to trade, freedom from taxes, freedom from regulations, and above all, freedom from political interference or manipulation.

The authorities in Beijing seem to understand this — so much so that they’ve pursued something similar for Shanghai and other Chinese cities (within strict limits, of course).

What they don’t yet seem to understand is this: Economic and financial freedom cannot forever co-exist with political and social repression.

The Rise and Fall of

“Peaceful Co-Existence”

This is also an extremely important issue. So let me give you a quick overview.

Historically, the concept of peaceful co-existence was all about the relationship between communist and capitalist economies.

It first emerged in the early years of the Cold War. Moscow embraced it. But Beijing did not. And this landmark dispute became a key aspect of a great Sino-Soviet split — years of conflict, border clashes and even wars between the two communist powers.

Why did China and Russia disagree? One reason was because Mao Zedong rejected the idea out of hand. He called it “Marxist revisionism.” He argued that capitalism and communism are fundamentally incompatible.

Was he right? Or let me ask it this way …

Is it ultimately possible for capitalist free markets to survive under the thumb of an overarching — and over-reaching — communist dictatorship?

That is THE fundamental question that’s coming to a head in Hong Kong right now.

Now, some might argue that communism survives in China in name only. But that’s beside the point.

Indeed, that’s what Mao’s sixth successor, China’s president Xi Jinping, must decide very, very soon.

Indeed, that’s what Mao’s sixth successor, China’s president Xi Jinping, must decide very, very soon.

Whether it’s under the rubric of “communism,” “fascism” or some other -ism, the question still boils down to the same thing:

Is economic freedom ultimately

viable without political freedom?

If the answer is “no” … if it is not possible for capitalism to survive under a repressive dictatorship,” then …

Mr. Xi and China lose their most valuable single asset. They lose the richest, most prosperous 436 square miles of the entire Middle Kingdom, their pipeline to global capital, their gateway to Western markets. They lose what makes Hong Kong what it is.

But that’s not the only question Mr. Xi is worried about. In fact, no matter how valuable Hong Kong may be to him, it’s not even his greater concern.

“What could possibly be more important to President Xi than the fate of Hong Kong?” you ask.

It should be obvious: The fate of China.

Just go back to that fundamental question I asked you a moment ago. Turn it upside down. And then ask it this way:

Is it ultimately possible for dictatorships to survive as the grand masters of free-enterprise? Can they forever repress the demands for freedom of a rising middle class and newly-empowered corporate elites?

For this question, no speculation is required, and no evidence is lacking.

For this question, no speculation is required, and no evidence is lacking.

A thorough — even a cursory — review of history gives us all the answers we might ever need. I know. Because I was there when it happened — several times, in fact.

You see, as a young stock analyst in my 30s, I saw a lot in Asia.

But as a student in my teens and early 20s, I also lived and traveled a lot in Latin America.

In Brazil, I saw the generals come to power after central bank money printing went wild. Then, twenty year later, I saw them fall as their stubborn rigidity gave way to free markets and free enterprise.

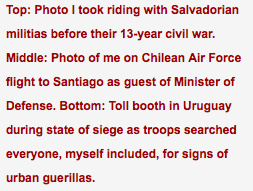

I was in Guatemala, El Salvador, and Nicaragua … Chile and Argentina … Uruguay and Paraguay … when those countries were in the throes of similar cycles — guerilla wars, states of siege, and worse.

More recently, I crisscrossed East Germany not long after the fall of the Berlin Wall.

A few years later, I visited one of the former “closed cities” of the Soviet Union (nuclear and aerospace centers that even Soviet citizens could not enter).

And I can tell you flatly: In every case, I saw how dictatorships come and go … how free markets, free enterprise — and freedom of self-determination — always prevail.

That’s the great lesson of history.

That’s what Mao Zedong was afraid of when he split from his communist counterparts in Moscow.

And that’s also the great fear of his sixth successor, China’s President Xi Jinping, the man who must decide history’s next major turn.

So what WILL be the final outcome of the Hong Kong crisis?

What will be the “unimaginable consequences” that China’s People’s Daily is referring to.

I cannot speak to what they’re able (or unable) to imagine. But I can tell you what’s in my mind …

Consequence #1 is a crackdown. Mr. Xi is resolute in his view that there is simply no other alternative.

He’s the hardest-line leader of China since Mao.

His entire support base and source of power derive from a no-negotiation, no-compromise line in the sand he’s drawn between China’s Communist party leadership and China’s 1.4 billion people.

His entire support base and source of power derive from a no-negotiation, no-compromise line in the sand he’s drawn between China’s Communist party leadership and China’s 1.4 billion people.

He’s convinced that, if he gives in to the tens of thousands mobbing the streets of Hong Kong, he will unleash pent-up revolutionary forces on the mainland akin to those that toppled the Berlin Wall and doomed the Soviet Union.

If he’s pushed against the wall, he will crack down!

Will it be as bad as the 1989 Tiananmen massacre, which killed thousands and shattered China’s democracy movement?

In terms of lives lost, I doubt it.

But in terms of global impact, it could be a lot worse.

Consequence #2 is a hotter phase of the new cold war. We’ve been warning you about a new cold war for over a year. Now it’s here.

And, depending on the consequences in Hong Kong, imaginable or not, we may be on the verge of a new round of escalation.

Already, Chinese authorities have warned the West to stay out of the conflict. Already, they’re accusing the West of fomenting the chaos.

Consequence #3 is a global money tsunami.

I’m not the only one who sees trouble ahead in Hong Kong.

Global investors also fear a massive police crackdown on tens of thousands of protesters, massive censorship of the media and the Internet, untold numbers of arrests, and worse.

In response, they have embarked on a new flight to quality — away from commodities, currencies and many stock markets.

The big island of safety in their view: The United States.

The big winner (for now): The U.S. dollar.

But make no mistake: Just as we warned you, global crises are spreading — from Russia … to Ukraine … to ISIS … to Europe’s economic woes … and now to Hong Kong.

Just as we predicted, these crises are driving wave after wave of flight capital to our shores.

And just as we said, all of this is reaching a crescendo, injecting more emotion into investor decision-making, including fear of global chaos.

The Global Dash for Cash

That’s why, over the past few days, most of this new capital has moved into cash or cash equivalents, earning practically zero yield.

It’s all clear as day. But it’s also raising urgent questions for investors like you and me …

How long will foreign investors be content to hold zero-yielding cash? How long will they sit there, dead in the water? When will they resume moving that money into stocks for a more decent return?

No one has the precise answer, of course. Markets could fall further.

That’s why, in my ultimate portfolio, I still have 83 percent of my money in cash.

That’s why I’m waiting patiently for bargains.

And that’s why, when the time is right, I will target exclusively top-quality investments that are the first choice of risk-adverse investors all over the world.

I suggest you do the same.

The full story of how my family and I have been building this strategy since 1930 … and why I’ve decided to implement it now for the first time … is on my website.

Good luck and God bless!

Martin

Today’s forecast: yield-starved investors forced into the market by seemingly permanent low interest rates will continue to be collateral damage. For some, that collateral damage may involve more than the loss of income opportunities… many could be wiped out completely.

I asked the participants in a discussion group: “If there were safe, fixed-income opportunities available paying 5-7%, would you move a major portion of your portfolio out of the market?”

They all answered a resounding, “Absolutely.”

Participants relying on their nest eggs for retirement income said they felt forced into the market for yield. Their retirement projections weren’t based on 2% yields, the rough rate now available on fixed-income investments. They’d planned on 6% or so. What other choice do they have now?

The Federal Reserve knows seniors and savers are collateral damage. Former Fed Chairman Ben Bernanke has openly acknowledged that the Fed’s low-interest-rate policy is designed to prompt savers to take more chances with riskier investments. In their book Code Red, authors John Mauldin and Jonathan Tepper shine a harsh light on that policy, writing:

Central banks want people to take their money out of safe investments and put them into risky investments. They call it the “portfolio balance channel,” but you could call it “starve people for yield and they’ll buy anything.”

I have to agree with Mauldin and Tepper.

The collateral damage inflicted upon seniors and savers is twofold. First, it’s the loss of safe income opportunities. The Fed’s low-interest-rate policies have saved banks and the government an estimated $2 trillion in interest alone. $2 trillion added to the balances of 401(k) and IRA accounts would sure bolster a lot of desperate retirement plans.

But there’s no sign the Fed will reverse its low-interest-rate policies in the foreseeable future. So, yield-starved investors, including throngs of baby boomers maturing into retirement age each day, play the market and risk their nest eggs in the process.

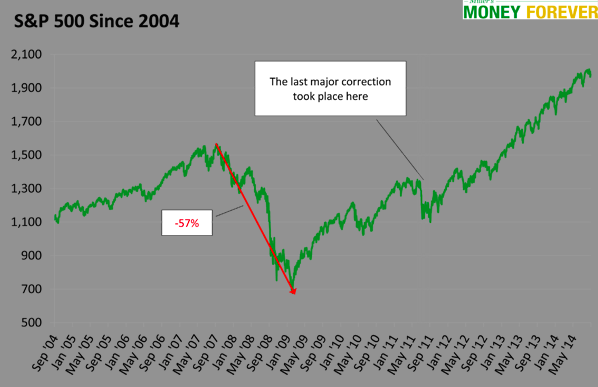

The Federal Reserve has succeeded in forcing savers to take billions of dollars out of fixed-income investments to hunt for better yields. Take a look at the chart below showing the S&P 500’s performance since 2004. The Index has almost tripled since its 2009 bottom. There hasn’t been a major correction in well over 1,000 days.

When the bubble burst in 2007, the S&P took a 57% drop. I had friends just entering retirement who suffered

40-50% losses. Their stories are not uncommon, and some are now back at work—and not by choice.

This is the second form of collateral damage, and it can be much more devastating. It’s one thing to lose an income opportunity and call it collateral damage, but quite another to lose 50% or more of your life savings. If the market drops radically, as it did less than a decade ago, the life savings of many baby boomers could be destroyed.

No one knows when the next correction will occur. However, many pundits believe a major correction is due. Others say we can continue on the same track, much like Japan has done for 25 years.

Here’s what we do know: the Fed has made it clear that it plans to hold interest rates down for quite some time.

When you invest money earmarked for retirement, you risk trying to time the market. Even seasoned investors would be foolhardy to think they’ll have enough time to easily exit their positions and lock in gains. It never works that way.

Now is the time for caution. Whether you’re a do-it-yourself investor or work with an investment professional, it’s a good time for a complete portfolio analysis with an eye on this question:

What happens to my portfolio if the market completely collapses?

There are concrete steps you can take to avoid catastrophic collateral damage. Sticking to firm position limits, diversifying geographically (including international holdings), non-correlated assets, setting trailing stop losses, and holding short-duration bonds come to mind.

Be wary of any advisor touting the “buy and hold” philosophy. They’d point to the chart above and note that the market went from 700 to 1,900+ in five years. If investors are patient, it will come back after the next drop. Unfortunately, seniors don’t have time to sit around and wait.

No one can guarantee the market will rebound as quickly as it did in the last decade. It’s not the “buy” in “buy and hold” that concerns me. There are excellent companies out there that pay healthy dividends and will rebound relatively quickly. Depending on your age and financial condition, it’s the indefinite holding that could be a problem.

If you’re not comfortable holding an investment for a decade or more, consider using a stop loss. After all, would you rather suffer a major loss and hope against hope that the market rebounds fast, or be proactive and keep your nest egg intact?

The best way to avoid becoming collateral damage is to take safety precautions before the next big, bad event takes place.

The article Yield-Hungry Baby Boomers Are on a Death March was originally published at millersmoney.com.

US stock markets tumbled again yesterday as the recent sell off gathers speed. Traders note that the markets are now very close to their 200-day moving averages and when those are passed there is every possibility of a major crash for the most overvalued equities in the world whose internal support has been hollowed out over the past year.

US stock markets tumbled again yesterday as the recent sell off gathers speed. Traders note that the markets are now very close to their 200-day moving averages and when those are passed there is every possibility of a major crash for the most overvalued equities in the world whose internal support has been hollowed out over the past year.

After the falls on Tuesday the Dow is under 200 points away from the 200-day moving average trigger line, and the Nasdaq is even closer to this tripwire with 90 points to go. Automated selling could turn into a market panic to get out at this point.

Exhausted rally

The long rally is exhausted. The QE3 money machine is coming to an end. Where are the buyers going to come from now? Besides the small caps have been selling down for ages. This is a hollow shell of a market just waiting for the big guys to join the rout.

It’s also a market exhibiting every sign of the madness of crowd buying, from the all-time high for margin debt to the leveraging of corporate balance sheets to buy back stocks on an epic scale. The most overvalued stock market in the world now faces a global recession and high dollar.

Subscribers to our highly regarded monthly newsletter have been aware of this for some time and will have crash proof portfolios if they have heeded our advice (subscribe here). How well are you positioned for a Black Monday 1987-style of a 2010-vintage Flash Crash?

Inevitable

We are close to the brink now with not a sign of anything on the horizon to alter this inevitable fate.

Have we gotten this sort of prediction right before? Well have a look back at our whacky prediction of a crash back in October 2008 (click here). How was that for timing and accuracy about the level of the fall?

Where to this time round? Dow at 6,000 anybody?

Today a 42-year market veteran & founder of Matterhorn Asset Management out of Switzerland speaks about the gold market & why all hell is breaking loose in the global markets and fear is taking hold.

Today a 42-year market veteran & founder of Matterhorn Asset Management out of Switzerland speaks about the gold market & why all hell is breaking loose in the global markets and fear is taking hold.

Greyerz: “Eric, we’ve had a long period now when all news is good news for stocks, and that’s typical for a bull market. But we are now very close to a period when all news will instead be bad news for global stock markets. For instance, the mainstream media is telling people that stocks are falling because of the end of QE and the Ebola crisis….

“Previously, this type of bad news was simply ignored. But as I said, everything that comes out now will begin to add to the selloff in global stock markets.

People being interviewed on KWN have discussed Ebola and how it will have a major impact on the world economy. In Liberia productivity is down between 50 – 75 percent and inflation is surging and food prices are going up. We could see this happening to a lot of countries in the world if the Ebola virus really starts to spread.

In Argentina we just had the head of the central bank resign because he was not printing enough money. Argentina has a history of currency disasters. The peso is crashing. It’s down 75 percent since 2012 and the inflation rate is now 40 percent. I mention what is happening in Argentina because I believe this is going to happen to a lot of countries once the global money printing starts in earnest.

Countries will eventually get to a point where they can’t borrow enough money. This will even happen to the United States. And the eurozone is in decline. Production is down, lending is down, and GDP is down. The latest German PMI figures were down for the first time in 15 months. France is continuing to decline. And in Greece 60 percent of the people live in poverty or on the verge of poverty.

In the U.S. the PMI figures were also down. This is at a time when the United States is officially ending QE. The end of QE won’t last because as the stock market decline becomes too painful and European banks come under increasing pressure, there will be a new stimulus program announced.

The U.S. government is now borrowing a staggering $8 trillion each year. $8 trillion of new Treasuries are issued every year. That represents half of the debt that is renewed annually. This means the U.S. is conducting a policy which is very unsound by borrowing short-term to take advantage of the extremely low or virtually zero interest rates. If interest rates go to 5 – 10 percent, which I believe they will, it will be disastrous for the U.S. government because there is no way they could service their debt. This would mean the U.S. would technically default due to the collapsing dollar. This will also mean the dollar will be displaced as the world’s reserve currency.

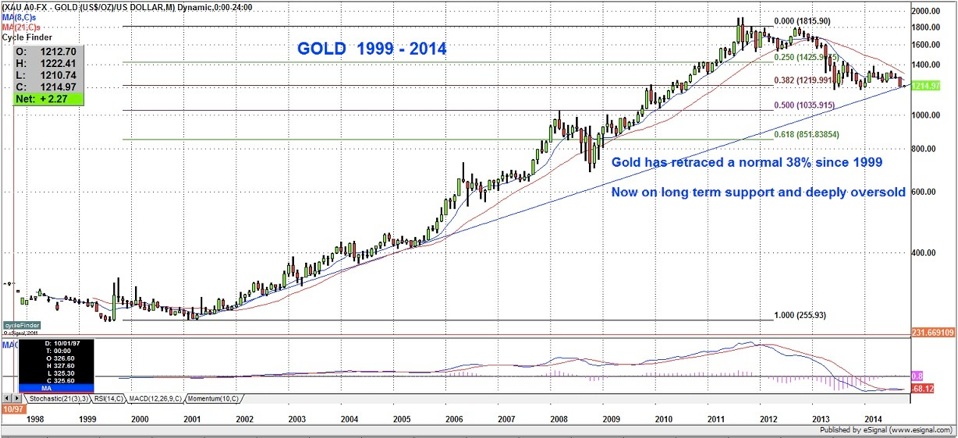

Coming to gold, I’ve included two charts. One illustrates the price of gold vs the dollar. If you look at the chart since 1999, gold is up almost 400 percent (see chart below).

…..read more of what Egon von Greyerz had to say in this extraordinary interview (with much larger charts) HERE

…..read more of what Egon von Greyerz had to say and view much larger charts) HERE