Today a 42-year market veteran & founder of Matterhorn Asset Management out of Switzerland speaks about the gold market & why all hell is breaking loose in the global markets and fear is taking hold.

Today a 42-year market veteran & founder of Matterhorn Asset Management out of Switzerland speaks about the gold market & why all hell is breaking loose in the global markets and fear is taking hold.

Greyerz: “Eric, we’ve had a long period now when all news is good news for stocks, and that’s typical for a bull market. But we are now very close to a period when all news will instead be bad news for global stock markets. For instance, the mainstream media is telling people that stocks are falling because of the end of QE and the Ebola crisis….

“Previously, this type of bad news was simply ignored. But as I said, everything that comes out now will begin to add to the selloff in global stock markets.

People being interviewed on KWN have discussed Ebola and how it will have a major impact on the world economy. In Liberia productivity is down between 50 – 75 percent and inflation is surging and food prices are going up. We could see this happening to a lot of countries in the world if the Ebola virus really starts to spread.

In Argentina we just had the head of the central bank resign because he was not printing enough money. Argentina has a history of currency disasters. The peso is crashing. It’s down 75 percent since 2012 and the inflation rate is now 40 percent. I mention what is happening in Argentina because I believe this is going to happen to a lot of countries once the global money printing starts in earnest.

Countries will eventually get to a point where they can’t borrow enough money. This will even happen to the United States. And the eurozone is in decline. Production is down, lending is down, and GDP is down. The latest German PMI figures were down for the first time in 15 months. France is continuing to decline. And in Greece 60 percent of the people live in poverty or on the verge of poverty.

In the U.S. the PMI figures were also down. This is at a time when the United States is officially ending QE. The end of QE won’t last because as the stock market decline becomes too painful and European banks come under increasing pressure, there will be a new stimulus program announced.

The U.S. government is now borrowing a staggering $8 trillion each year. $8 trillion of new Treasuries are issued every year. That represents half of the debt that is renewed annually. This means the U.S. is conducting a policy which is very unsound by borrowing short-term to take advantage of the extremely low or virtually zero interest rates. If interest rates go to 5 – 10 percent, which I believe they will, it will be disastrous for the U.S. government because there is no way they could service their debt. This would mean the U.S. would technically default due to the collapsing dollar. This will also mean the dollar will be displaced as the world’s reserve currency.

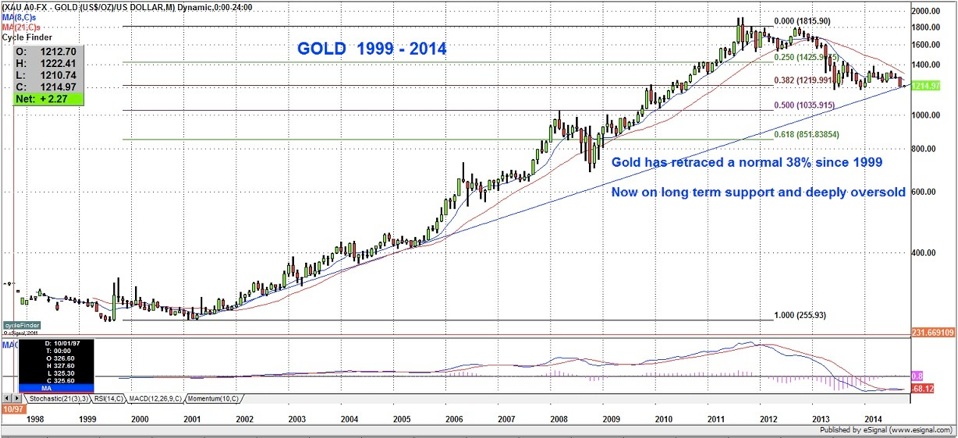

Coming to gold, I’ve included two charts. One illustrates the price of gold vs the dollar. If you look at the chart since 1999, gold is up almost 400 percent (see chart below).

…..read more of what Egon von Greyerz had to say in this extraordinary interview (with much larger charts) HERE

…..read more of what Egon von Greyerz had to say and view much larger charts) HERE