Daily Updates

Complacency vs. Risk Aversion Probabilities Seemingly Rising

“Just as there has never been a bubble that hasn’t burst in the end, so there has never been an investment boom that hasn’t been followed by a bust. If China’s investment-to-GDP ratio were to drop to the levels of 1960s Japan – not an absurd idea, since that is also where it was in China ten years ago – the impact would be catastrophic. China itself would face slump and the mother of all banking crises.”

…..read more HERE

First, from John Mauldin (Ed Note: The article The Coming BioTech Boom is below John’s comment)

In last Friday’s letter, I said that I had not bought any single stocks in the last decade, preferring funds and managers, and in general I still do. However, I am now going to start buying a specific asset class this month and currently plan to add to those holdings at least every quarter for several years. This is the high risk portion of my portfolio, so it will not be all that large a percentage. (Do not write and ask me what the right percentage is. It will be different for everybody. For some of you the answer will be none, as you need to be taking very little risk. Consult your investment professionals.).

Let me state emphatically that I am not going to become a stock picker. My regular letter will remain focused on the macro economic environment and investments in general. This is not my recommended advice to you but what I am doing as an individual investor. I simply know that many readers are interested in what I am doing personally and in my investment ideas. If this doesn’t make sense to you, then by all means hit the delete button later. With that thought, let’s dive right in.

In the 70s, we had a bubble in gold and commodity stocks. Some stocks had huge run-ups because of major gold finds coupled with the price of gold going up over 20 times over the period. A gold mine became a hole in the ground with four promoters standing around it telling you a story about why there was gold in the hole. Sometimes there was, but often the “gold” was the stock the promoters sold. I was too young and poor for that bubble, although I did get into a few (sadly too few) later winners.

Then we had the tech bubble. And the internet craze. Obviously, some of those stocks are still around and have been longer term winners, but the number of stocks that went public with crazy offerings, no revenues and valuations from left field eclipsed anything I have ever witnessed. I missed that bubble as well, as I was bearish about the markets in general and tech in particular, as I wrote in my first book (1998).

I think there is a potential for another bubble over the next decade. There will probably be several, but there is one I am particularly interested in and that is biotech, with an emphasis on stem cell and gene therapy and their allied kin. For reasons outlined by my friend Patrick Cox, writer of the newsletter Breakthrough Technology Alert, in today’s Outside the Box, I think we are on the cusp of a decade of remarkable breakthroughs which will change the way we do medicine.

While some of these breakthroughs will come via large firms, others will be in smaller companies. Imagine cures for certain types of cancer. Rejuvenation of failing hearts? Livers? Genetic therapies for all types of diseases? The list of potential blockbuster therapies from current research is enormous and growing.

There are going to be some companies which will simply see their stocks explode. Of course, for everyone that has a large run, there will be failures which will go to zero. Or companies that seemingly have “the cure” only to have another company come along with something faster and cheaper, wrecking their share values. (Think of the dawn of the computer age and how many once high flying stocks went to zero. Biotech stocks are not bonds.)

But I think (personal belief here) that what will capture the imagination will be the large winners. Everyone will want to be in at the beginning of a new home run. As the decade goes along, we will see companies go public before they are really ready, just because they have a great story and people will want to fund that story.

It has the classic potential to become a bubble, because there is a deep reality – some substance to the stories of the winners – that will make people look for the next big winner. So far, we as humans have not proven ourselves able to resist bubbles. Maybe this will be the time we all become adults and there will be no bubble. Maybe. But my thought is that it will not be.

And as I have been ending my speeches recently, I have lived through a number of bubbles. I have never gotten to invest in one. This time, dear God, just once please let me be at the beginning of a bubble.

Now, I have no particular expertise in biotech stocks. I go to conferences, read articles and hear amazing stories. They all sound good to me. But for about a year I have been reading Patrick’s newsletter, and have spent a lot of time talking with him (and others in the biotech industry). He does have expertise in looking at all types of breakthrough technologies (and not just biotech). He is one of my main sources for ideas in this space, and if you are interested in the tech and biotech world, you might consider subscribing to his letter (I will provide a link later). As an aside, he will be writing the chapter on biotech in my next book.

Starting this month, I will begin to buy some of the stocks in his suggested portfolio. I will start with four stocks and add to those positions and other stocks over the coming years. I think this is a long term play. My best guess is that the coming recession I predicted last Friday may hurt the value of these stocks, but I simply don’t know. This is not a trade, nor will I be hedging (at least not for some time). I expect to be adding small positions for years.

Do not write and ask me which stocks I will buy. For lots of reasons, I won’t do that, not least of which it is not fair to Patrick for me to use his intellectual work. I am building a portfolio, and I can almost guarantee you that some of those stocks will end up being dogs. Second, Patrick is not going to mention any specific stocks in this week’s letter. It would not be fair to his smaller subscriber base to mention a stock to 1 million readers. Third, if you do subscribe and after some time reading and researching on your own, decide to buy a stock or two, do not chase the price. And I would suggest you do not buy all you intend to buy all at once. Space it out over time. These stocks can be very volatile and it is probably better to average in over time.

There are some other letters and analysts that I am going to introduce you to over time. There is no need to rush. Also, if you know of another writer I should be aware of, feel free to drop me a note with their name. Now, if after you read this week’s Outside the Box you are interested in subscribing to Patrick’s letter, you can do so here. The writing on the web site is fairly typical in it’s over the top promotional style, but see through that to his actual work. And they are knocking off $300 off the regular price of $895 for my readers. I am a big fan of Patrick, and admire his thoroughness and work. If you want to invest in this sector, starting off with Patrick is a good way to go. Take your time, read, learn and then invest. Again, no hurry here. But do get started researching.

A couple of caveats. I may be completely wrong about there being a potential bubble in biotechs. Just because there may be similarities to previous bubbles does not mean there will be another. Past performance is not indicative of future results, as I say time and time again. Second, stocks you buy in the near future may really get hit in the next recession. You might consider waiting if that will make a big difference to you. Like I said, there is no rush. Consult with your investment professionals about this, and do not take large positions relative to your total portfolio. A stock that I could be convinced about today can be made obsolete by newer technology. Cautious optimism is always proper, with the emphasis on caution.

Finally, and as a reminder, this is a market and sector call by me. I have no idea on who the real winners will be in ten years, although I hope I get lucky and find a few. And for those of you who don’t have enough money (yet) to buy into this concept but still like the idea, consider a small cap biotech mutual fund as a way to start. There are several.

Now, let’s see what Patrick has to say about the coming new world of biotech.

John Mauldin, Editor

Outside the Box

The Coming BioTech Bubble

by Patrick Cox

BioTech Overview

In just a few paragraphs, I’m going to tell you something that will, if you are a demographically typical American, extend your healthy life span significantly. Moreover, what I’m going to recommend that you do is essentially free. On top of that, top researchers report it will make you feel better within a few weeks.

Get richer. Live longer. Feel better. Impossible, right? Obviously, some joke or a scam that slipped past your spam catcher. On the contrary, I’m entirely serious and I can site a preponderance of peer-reviewed science from the most prestigious scientific journals to prove it. Within a few years, this information will be common knowledge. Very few people know about it today however.

My purpose for telling you about this scientific breakthrough is not simply to impart the benefits of this new research. It is to make a much more important point. That point is this: the biotech sciences have been leading the discovery race for years now and almost nobody has noticed.

You probably know about 3D television and the newest whiz-bang smart phones. You may know about private orbital launchers and new toys that let kids control objects just by thinking. Virtually no one outside the biological sciences, however, knows about the astonishing biotech progress that has gone on “under the radar.”

There are a number of reasons for this. One is that the mainstream media is patently incapable of grasping or reporting complex scientific subjects. This was the case even before major news organizations began slashing news staffs. Moreover, many biotech stories are so technical in their details that few journalists have the background or patience to actually dig in and understand them.

My biologist wife’s theory, incidentally, is that biotech breakthroughs just don’t make great theater. This is especially true when compared to developments in physics and computer sciences.

You know that IT continues to accelerate. You can touch and hold new computers in your hands. You’ve personally seen the dramatic improvements in Internet performance and the resultant explosions in social media like Facebook, YouTube and Twitter. Similarly, big physics experiments make big headlines. They require huge budgets and enormous structures, like the Large Hadron Collider.

Biotech advances, however, typically take place in relatively small laboratories. The experiments themselves produce results that can only be observed on a microscopic or sub-microscopic level, and they are measured using the language of careful obtuse statistical analysis. Nevertheless, my message today is that biotech is where the really big breakthroughs and profits will take place in the next few years. Moreover, these advances will ultimately change the world in ways that dwarf the direct impact of computers and the Internet.

So now, I’m going to give you an overview of some of the truly remarkable breakthroughs in biotech, as John Mauldin has asked me to do. First, however, I’ll tell you how to live longer, get richer and feel better, as promised.

It is this: Optimal vitamin D serum blood levels, attained through sunlight or supplementation, dramatically reduce the risk of most serious diseases by an astonishing 50 to 80 percent. These diseases include osteoporosis, osteomalacia, hypertension and a range of cancers from breast and colon to deadly melanoma skin cancers.

Yes, that’s right. The risk of contracting the really nasty skin cancers can be dramatically lowered by getting moderate, sensible sunshine or through vitamin D supplementation. Non-melanoma skin cancers do increase somewhat with sun exposure, especially with sun burns but they are relatively benign and are easily detected and removed.

This is not the end of the list, though. The big killers and most expensive diseases respond similarly to adequate D. I’m talking about cardiovascular disease and stroke. So do type 1 diabetes, type 2 to a lesser extent, rheumatoid arthritis, peripheral vascular disease, multiple sclerosis, dementia, autoimmune diseases and apparently even viral diseases such as H1N1 and AIDs. I emphases that some of these diseases are not “cured” by sufficient D as some bone diseases are. The risk of developing other diseases and the severity of their symptoms if you do is much lower, however, if you are not vitamin D deficient.

There is, by the way, no simple prescription in terms of sunlight exposure or vitamin D supplementation because age, skin color, body weight and even location play huge factors in your circulating blood levels, which should be at least 40 ng/ml of 25-hydroxyvitamin D. Ideally, you should consult a physician who can prescribe blood tests to see where your D levels are.

This information is not new but the odds are that you are unaware of it unless you read the New England Journal of Medicine or other scientific publications. I’ll include links at the end of this article for you to investigate this matter further, including the NEJM paper I just referred to.

This new consensus regarding vitamin D must be viewed as a sign of the biotech revolution on the horizon. Just as new IT and nanotech sensing technologies have shed light on the function of vitamin D, they are leading scientists to entirely unexpected discoveries in other areas as well. More importantly, these discoveries, unlike sunshine, can be patented. You, therefore, can invest in the companies that own the IP and reap transformational profits.

Some of the contributing technologies include supercomputing, without which the human genome could not have been decoded. We now know, by the way, that the activity of about 2000 human genes is moderated by vitamin D. Supercomputing has also enabled an entire new means of biological experimentation called in silico. Simply put, in silico experimentation uses 3D computer models of organic molecules. These models, existing in virtual reality environments, can be manipulated at incredibly high speeds to quickly yield results that once would have taken decades in physical labs.

Incidentally, the reason that I can confidently say that the vitamin D information will make most people wealthier is simply this. Personal wealth is directly correlated to age. As an investor, I can assume that you understand exponential growth. You know, therefore, that diversified portfolios grow faster over time. Every additional year that you live will see, statistically speaking, an increasingly rapid rate of wealth accumulation.

I believe, based on discussions with top scientists, that the impact of attaining optimal vitamin D blood levels for the vast majority of people, whose serum D levels are insufficient, will be an increase in average healthy life spans of 5 to 8 years. This is pretty breathtaking news, frankly, but you have to view it as just one manifestation of accelerating scientific discovery.

Average lifespans have been increasing steadily for hundreds of years but have recently begun to accelerate noticeably. This trend will continue to increase as proven biotechnologies, now in the developmental stage, come to market. These biotechnologies include RNA interference, nanotech biosensors, personalized medicine, nanotech viricides and stem cell technologies among others. Non-medical biotechnologies will not directly impact lifespans but they will create enormous wealth. Notably, I’m talking about cellular engineering.

There is still work to do in all these areas but the science behind them is solid. When they come to market, which will be sooner than almost anyone expects, they will create enormous wealth for those with the foresight to invest in them before the general public has caught on.

Think, for example, back to the birthing days of the computer and software industries. Remember when virtually everybody considered personal computers expensive toys that would never really catch on? Do you remember when financial gurus were saying the Internet was a fad and that e-commerce would never be more than a novelty? This year, by the way, Amazon.com sold more e-books than paper books.

When those technologies were ramping up, it was possible to buy a diversified mix of the best players at bargain prices. When the technology proved itself, people who held such portfolios made immense fortunes despite the fact that many of the original companies failed. You can own a bunch of losers but still makes thousands of percent returns if your portfolio included the big winners like Intel, Apple and Microsoft.

As people catch on to the potential of these new biotechnologies, we will see similar bubbles. John Mauldin, in fact, has predicted just that. Now, therefore, is the time to begin building a diversified portfolio of the most promising transformational biotechs. So just what biotechnologies are we talking about?

Regenerative Medicine

This is numero uno; stem cell technologies. They may not be first to market, but the technology’s potential is unparalleled in history for reasons I’ll explain. Other huge transformational technologies may treat and prevent currently incurable diseases before regenerative medicine matures. Stem cells, however, are unique in their ability to rejuvenate the human biology. I’m not, by the way, talking about obsolete embryonic stem cells (eSCs). Despite the political rhetoric, the scientific action has moved far beyond eSCs to several other forms of stem cells.

Unless you are reading scientific publications, however, you probably wouldn’t know this. In fact, the scientific literature itself is usually outdated because leading stem cell scientists are not working in academia with its “publish or perish” pressures. The last thing that scientists in start-ups and small caps want to do is give away the inside information about their innovations. As a result, almost none of the real breakthrough news in stem cell or other cutting edge science makes it to the mainstream or financial medias. Let me prove my point with a pop quiz.

Q: How long will it be before scientists can duplicate the army of clones scenario that George Lucas portrayed in Star Wars II: Attack of the Clones. In other words, when will scientists be able to swab the inside of your mouth, take a single cell and turn it into an unlimited horde of healthy babies, each with your identical DNA?

A: If you said “several years ago,” you are right. This is routine, well-established science at this point. We don’t believe anybody has actually used this ability with humans yet, for obvious ethical reasons. Scientists, however, have taken adult skin cells from mice and transformed them into a new kind of stem cell called an induced pluripotent stem (iPS) cells. Those iPS cells have, in turn, been allowed to develop into healthy adult mice.

As dramatic as this ability is, it is not particularly useful outside of agriculture where the technology will be used to produce perfect livestock. The real promise of iPS cells is “potentiation” for specific medical needs. What I’m talking about is taking an iPS cell, which is fundamentally identical to an embryonic stem cell, and programming it to repair aged or damage tissues.

Potentiated iPS cells could be be grown, using your own cells, that would rejuvenate your heart muscles, one of the muscle tissues that cannot regenerate on its own. These cells could be programmed to become fresh cartilage, another cell type that doesn’t regenerate, thus giving the aged and arthritis sufferers youthful pain-free joints.

We’re looking at non-surgical organ replacement, one cell at a time. An injection or series of injections of these potentiated stem cells would, for example, transform an aged, damaged liver into a healthy youthful organ.

Someone suffering from severe diabetes could get off-the-shelf islet cells that produce insulin, saving their lives and allowing them to live normal lives. People who are blind due to macular degeneration could see again. You name it, these extraordinary cells will do it. In fact, they did do it. Every cell in your body, cartilage, kidney, heart, skin and bones, started out as a stem cell.

So let’s have another quiz.

Q: How long will it be before the programming code for cartilage stem cells is cracked.

A: Once again, the answer is that it has already happened. Top private industry scientists have decoded the secrets of hundreds of cell types and are experimenting now with cartilage, nerve and other cell types. Human tests, probably offshore because of the FDA’s snail pace, will begin if not this year, then next year. These therapies will be offered initially outside the United States. Many of us believe that, once Americans begin coming back home healed of conditions previously thought incurable, the FDA will bow to public demand. Regenerative medicine will inevitably be fast-tracked.

(Note: there will be lots of scams offering all sorts of purported stem cell therapies offshore offering “cures” for all sorts of diseases. Don’t buy them or subject yourself to them. The legitimate players will surface over time, associated with real hospitals and researchers.)

There is one final aspect to the regenerative medicine picture that makes it especially attractive to long-term investors. Let me tell you a story to make this point.

Last year, I was in Canada speaking at a financial conference about emerging biotechnologies. I was privileged to share the forum with Harvard futurist, best-selling author and venture capitalist, Juan Enriquez. Enriquez is a major force in cellular engineering, working closely with the genius ex-surfer Craig Venter who cracked the human genome for a fraction of the cost and in a fraction of the time that the US government had allotted. President Clinton, in fact, issued an emergency executive order denying Venter IP rights to the genome he had decoded.

Today, Venter is applying his genetic genius to the other end of DNA complexity. He is developing the tools to reprogram the genetically simplest life: microorganisms. Venter compares DNA to computer code and scientists following his work say he will create the first artificial life form, probably this year. It will be, in fact, a designer bacteria. More importantly, his next step is engineer algae that secrete high-grade hydrocarbons that can be refined into transportation fuels. ExxonMobil believes him and gave Venter’s research firm $300 million to work on the project.

Anyway, I asked Venter’s associate, the venture capitalist Enriquez, why his biotech funds weren’t invested in stem cells. His answer was straightforward. He said that the IP was already tied up. This is an astonishing fact. The intellectual property, the patents, for this phenomenal rejuvenative technology is already applied for or awarded.

The IP structure of regenerative medicine is unlike most other pharmaceutical or biotech industries, including cellular engineering. Traditional drug discovery, in fact, consists largely of identifying which of many molecules can do a certain thing. Frequently, only a small percentage of possible candidates are identified and then, through an elimination process, one is identified for testing and approval.

Cellular engineering is more dramatic but the potential number of new biofuel-producing algae is theoretically unlimited. Anyone who creates a new breed of algae can patent only that microorganism.

This is not the case with stem cells. There are very few “pluripotent” stem cell types that can become all the other cells. Already, the means of producing these cells and, in many cases, the cells themselves have been patented or applied for.

To invest in algae biofuels, which I probably will do, I will have to pick the most likely winners from a field of players to guarantee owning the big transformational winners. This is possible but it is much riskier than the stem cell space. This is because the number of companies that hold the bulk of the really valuable IP and patent applications can be counted on one hand. If big pharma wants into the regenerative medicine business, and they will, they’re going to have to pay these tiny small caps for the right. This reduces the risk of buying losers enormously.

RNA Interference

There are many standalone breakthroughs in biotech and I’ll mention a few in a bit. First, I want to tell you about the other big biotechnology industry, RNA interference. RNAi is a perfect fit with regenerative medicine, which has the power to restore damaged and aged tissues but does not attack the causes of diseases. This is where RNA interference fits in.

This field is actually younger even than stem cell sciences. The scientific paper that broke open the field was published in 1998 and the Nobel Prize for medicine was awarded to its authors in just four years ago in 2006. RNAi had one major advantage over regenerative medicine, however. It was not effected by the political and moral controversies that regenerative medicine faced before it moved past embryonic stem cells. As a result, researchers have had no trouble getting government and private funding.

Here is the overview. Our DNA is, in effect, locked and protected in a cellular clean room without a door. DNA communicates with the rest of the body by sending out messages with orders to turn genes on or off. Those messages are RNA, or ribonucleic acid. Therefore, the right RNA sequence can be introduced to the body to mimic those messages, which are then identified as invaders. The provokes the body to treat certain of its own RNA messages as invaders and destroy them.

This is RNA interference and it provides the ability to control any of the genes in our body and the proteins they produce. Those proteins, in turn, are the key to most human diseases. RNAi can both increase and decrease these proteins, providing cures for innumerable diseases. The companies that own those therapies will, in turn, become new pharm giants or they will be acquired by existing pharma.

RNAi researchers are working on drugs that could reduce production of bad cholesterol or increase production of the good form. RNAi could be used to turn off the gene that allows cancers to develop capillary networks. Similarly, it has been demonstrated to turn off the gene that provokes the excess blood delivery that causes wet macular degeneration. It could moderate the ability of the body to store fat or increase muscle mass. In could turn off hypertension or insulin resistance as well as neoplasias such as tumors, infections, and neurodegenerative disorders like Parkinson’s and Alzheimer’s Disease.

For the first time, science is looking not to treat symptoms, but to actually stop the gene functions that cause diseases. This is truly a revolution. The challenge to this remarkably young science now is the actual delivery of RNAi drugs to cells. We know they work in the lab but RNA molecules are large and fragile, so they don’t penetrate cellular membranes under normal circumstances. Additionally, the body tends to clear itself of RNAi drugs through the kidneys or inside the cell itself. Nuclease, which exists inside the cell, also breaks down RNA.

For this reason, a number of delivery mechanisms are being developed to safely transport the RNA as a payload. A handful of small companies with superb talent and IP are racing to perfect their own varying solutions. Each has a different approach to solving the delivery problem but all have demonstrated efficacy. At this point, we don’t know which will yield the big solutions. It appears increasingly likely, however, that different platforms will be best suited for different RNAi applications. Each has huge profit potential. RNAi drugs are in trials and big pharm has already snapped up one small cap player.

The Nanotech/IT/Biotech Convergence

I’ve already mentioned cellular engineering. Craig Venter calls cells hardware and DNA software. He treats DNA like the ones and zeroes in current software. The same IT/biotech convergence is also evident in new in silico experimentation.

Nanotechnologies are contributing indirectly to the explosion in biotech innovation indirectly through new lithographic chip fabrication techniques that increase computer speed and power. The decoding of the stem cell potentiation process relies on this power and would have been impossible only ten years ago. Nanotechnologies are also directly impacting a whole range of biotech applications by allowing increasingly smaller interventions.

I read very recently an editorial in the Wall Street Journal by a writer and research at Ethics and Public Policy Center. In it, he basically declares Richard Feynman’s original vision of nanotechnologies a bust. He obviously isn’t reading my newsletter because we are currently seeing animal tests of new medicines that combing nanotech polymer structures with biological parts in ways that trick and attack viruses. Already on the market are nanotech sensing systems using submicrosopic biological components married to metal molecules that provide nearly instantaneous diagnoses of a rapidly expanding range of pathogens.

These sensors are going to power an even larger revolution in personalized medicine. For those unfamiliar with the concept, allow me to explain.

Currently, medicine is, to a large degree, a “one size fits all” proposition. Doctors watch for adverse effects and check personal and family histories. Medical technologies, however, are designed for the general population, not individuals.

That’s going to change.

We know that many current treatments work on some people, yet not others. Some drugs are safe for many people, but have dangerous side effects for others. Some are just the opposite. This is because all of us have individual differences in our genetic code based on heredity and environment. Even slight differences can lead to very different reactions to medications.

This has created serious regulatory problems. Drugs are denied regulatory approval not because they do not work, but because some fraction of the population suffers adverse effects. As a result, patients are often denied incredibly effective therapies simply because they are not universally effective.

This shockingly primitive state of affairs exists because, until very lately, we simply have not had the tools to get to the genetic roots of disease. Scientists and pharmaceutical companies haven’t precisely known how a particular drug’s chemical profile interacts with a genetic one. Medical science, in turn, has been unable to tailor drugs to work with a specific genetic makeup. That is rapidly changing.

The Impact of the Genome

With the mapping of the genome, scientists can now identify single genes and their individual expressions. Nanotech biosensors can identify genetic characteristics in individuals so that individual reactions to drugs can be known before they are taken. It is meaningful, from the investor’s perspective, that Dr. Francis Collins, the head of the Human Genome Project, now heads the National Institutes of Health. Collins has long been a prominent champion for using the knowledge gained from human genome to accelerate personalized medicine.

Collins has also stated that genomics is currently where the computer industry was back in the 1970s – at the beginning of a technological revolution. While he was speaking in scientific terms, we should remember that the ’70s was also the right time to begin investing in a diversified portfolio of breakthrough computer technologies.

I believe this is true across the board for a range of revolutionary biotechnologies. I also like to remind readers that important innovations traditionally do not slow down during economic turn downs. The Great Depression, in fact, is considered by many to be one of the most important periods in the history of innovation.

What I’m hearing now, talking to people who range from Nobel Prize winners to CEOs of biotech start-ups and small caps, is that the world is going to change very soon in ways that no one is prepared for. Our lives are going to be significantly better and longer.

I also like to point out that private investors will not only profit from this revolution, they will power it. This is especially meaningful because one of the most dramatic impacts of these new technologies is longer life spans. By investing in regenerative medicine and other important biotechnologies, you are helping extend your own life. Traditionally, financial analysts have always told us that we should invest more conservatively as we age, with less of our portfolio in speculative higher-risk stocks.

For the first time in history, I believe this is exactly the wrong advice. You don’t know how long you are going to live and, with these new therapies, it could be much longer than you’ve been led to believe. By investing as a younger person, you might actually make it so.

One last thing, here is the link regarding vitamin D that I promised.

http://www.vitamindhealth.org/

John back: Patrick is clearly enthusiastic about the potential for biotech. But that is because he is talking to the guys who are making it happen. He has been introducing them to me over the past year. They have been in my home or we have met on the road. And I have to admit, that enthusiasm is contagious. There is a deep reality here. I am fully cognizant that it will not happen the way we envision, but something large – very large – is on its way. Again, if you are interested in the letter, you can find out more information HERE.

The non-dollar currencies and commodities are flying high this morning, hammering the dollar. The Aussie (AUD) and Canadian (CAD) dollars are heading to parity once again, the euro (EUR) is back over the 1.45 handle, and gold is up $20! It’s “all good” for non-dollar investors this morning… I don’t want to sound like a cheerleader – of which I have in the past – but, this is a currency/economy letter, and it’s geared to non-dollar currency investors… So, take that as it may come.

So… What’s got the non-dollar currencies and commodities all lathered up, this morning? A report from China yesterday that showed that China’s December trade data posted the first positive surprise in the new year. Exports growth jumped to 17.7% in Dec from -1.2% in Nov. Imports registered a stunning 55.9% growth in Dec, reflecting the strength in domestic demand.

Let’s remember that our “friend” that had a business in China for years, told us to believe 1/2 of what China says in their data reports… So, if that’s the case, their exports grew more than 8% in December, and that’s still a HUGE jump! And when applied to their imports, it reduces the gain to 27%, and that’s still a HUGE jump!

Of the two, I find that the imports number is the best of all worlds for Commodity countries, and thus, the rise in the Aussie dollar and Canadian dollar / loonie this morning!

The selling of the dollar began on Friday, when, as you’ve probably heard by now, job losses came in at 85,000, not the 0 (zero) the “experts” were forecasting… And… If we add in the 59,000 jobs the Bureau of Labor Statistics created out of thin air, the job losses would have been 144,000… The unemployment rate remained at 10%, and the air was completely let out of the sails of the “the recession is over, and the Fed will be raising interest rates soon” campers…

And, that’s the BIG PICTURE this morning folks… Here in the U.S. our job losses continue to drag down the economy, but in China Imports show domestic demand, and exports are soaring once again. In Australia, we’ve seen 3 rate hikes, and in Norway we’ve seen 2 rate hikes… The worlds’ economies are spooling up for a strong rebound, and here in the U.S. we’re still licking our wounds… Now… Don’t get me wrong here, I’m not enjoying telling you this… But it has to be said, so that the major media, who are spoon fed from Washington, can’t spin this to be positive… For it’s not! It’s that simple!

The other thing that came out of Friday’s reaction to the job losses was the fact that the dollar got sold on the bad data… Yet, another sign that we are returning to fundamentals… Now, if those responsible for this return to fundamentals would take another look at what’s under the table here in the U.S. Like a national debt of $12.3 Trillion, and… Unfunded obligations of $106.9 Trillion… And no ability to shake our Gov’t out of their deficit spending mind frame…

OK, enough of that… Like that’s not depressing enough!

Let’s do a country run-down…

In the Eurozone, European Central Bank (ECB) President, Trichet, is expected to speak today, a day after Moodys said that Portugal was in danger of having their credit rating cut… I hope Trichet speaks from the heart, and really tells it like it is, and not to feel the pressure to not talk that way… For, if Trichet were to speak from the heart, the euro would be trading 1.50 by the end of the week! But his hands are tied here folks…

In Australia, a job ads report showed a huge increase, in fact the highest since May of 2007, which could mean good things from the Jobs report / employment data due this Thursday… If we see an upside spike in jobs created this Thursday in Australia, it could very well be the springboard to A$ parity to the U.S. dollar… Yes, I’m quite well aware of the fact that the A$ is still 6.5-cents away from parity… I said, “it could be the springboard”…

In Canada, there’s a ton of data to print this week, and as long as none of it shows Canada slipping down the slippery slope, we could see this move to 97.5 – cents this morning, added to as the week goes along…

All this talk of reaching parity to the dollar by the A$ and C$ is fine… But… The first currency to get there just might be the Swiss franc, whom we’ve seen at parity on more than one occasion in the past. As the franc edges closer to parity, new Swiss National Bank (SNB) Gov. Hildebrand, is getting his feet wet in the verbal intervention game, by reminding the markets that the central bank will continue to combat excessive appreciation… Those are just words, folks… And they won’t mean a thing, until Mr. Hildebrand, shows us the swing… Real, physical intervention…

And… Talk about some wild swings! That Brazilian real… You’ve got to have an iron stomach, or, just not watch these daily wild swings in this currency! On Friday morning, I bought some reals at 1.74… This morning, the real is 1.7190! And that’s a tame swing for this currency! But… As last year showed us, if you don’t get caught up in the daily noise and these wild swings, the end result of a 33% return VS the dollar could have been your reward…

The thing to think about here is that these HUGE moves were done overnight in Asia, and Europe… We’ll have to wait-n-see what the U.S. traders think of these moves, and if they go along with the dollar selling, or do they think this has gone too far, too fast, and pull back on the reins…

Well… It’s another Treasury Issuance Week… This week’s issuance brings us $84 Billion of new issues to auction off… $40 Billion 3-year, $21 Billion 10-year, $13 Billion 30-year, and $10 Billion 10-year TIPS…

There’s a number of Fed Heads on the speaking docket this week, and they are all what I would consider to be hawks… So, there’s always a chance that they slip in a reference to higher rates in the U.S., which after last week’s jobs losses, would be a far reach, and hopefully the markets see any such mention of higher rates for what they are…

And what that might be, I hear you asking? Ahhh grasshopper… We’ve played this game for so long now, but I do realize there are new players all the time, so for them… Basically, it’s like this… The U.S. needs a weaker dollar… But they can’t be seen to “want a weaker dollar” for that would scare the bejeebers out of the foreigners that the U.S. Gov’t depends on to buy our debt… So… They play this game, of give and take, it’s game they play, to keep foreigners from thinking the Gov’t wants a weaker dollar…

When in reality, it’s the only way, they have a chance to pay the interest on their debt that they have issued… (Notice I didn’t say pay back the principal?, for we can’t even think of doing that!) To change $20 into $5 bills, so that they go farther in paying the interest…

I hope you all can make it to the Orlando Money Show, for I’m going to get down and dirty and show you a long list of errors, lies, and omissions that the Gov’t. / Fed / Treasury/ has given us in the past 5 years, and then compare it to the list of statements I’ve made in the past 10 years… You don’t want to miss that! Once back from the Show, I’ll share this whole presentation’s text with you…

Then there was this… Get ready for it! The HUGE jobs gains this year! These are guaranteed to be created! Yes, step right up, and don’t be shy, cause you won’t believe your eyes! 1.2 million jobs will be created this year… OK… Let’s calm down… The 1.2 Million jobs will be created by the Gov’t for the Census… Not really, a long time job commitments, eh? But… These 1.2 workers will be spending the money they make during this time… So… Look for the major media knuckleheads to get all lathered up about the jobs increases in the coming months… Not having a clue that they are Gov’t hired census workers…

To recap… The Jobs Jamboree on Friday surprised the markets with a “real” -144,000 job losses, and the dollar got sold… Overnight though the Big move in the non-dollar currencies and commodities have come via the Chinese report on December exports and imports, with both showing HUGE gains, thus turning on the green light to currency appreciation for the commodity currencies… And commodities with Gold up $20 this morning!

Currencies today 1/11/10: American Style A$ .9320, kiwi .7410, C$ .9740, euro 1.4530, sterling 1.6180, Swiss .9835, European Style: rand 7.3190, krone 5.60, SEK 7.0150, forint 183.50, zloty 2.7885, koruna 18.0250, RUB 29.38, yen 92.40, sing 1.3875, HKD 7.7545, INR 45.32, China 6.8263, pesos 12.62, BRL 1.72, dollar index 76.91, Oil $83.83, 10-year 3.84%, Silver $18.86, and Gold… $1,158.50

That’s it for today… I totally forgot to mention on Friday, that it was our Mary Vance’s birthday. Mary shares her birthday with Elvis, who would have been 75 this year… Imagine Elvis at 75… I tried my best to remain indoors this past weekend, hunkered down, watching football playoff games, and my beloved Missouri Tigers win their basketball game on Saturday… The kids were all over yesterday to celebrate son Andrew’s birthday (tomorrow), which meant little Delaney Grace was entertaining us… She is just so darn cute! Took the Christmas Tree out to the curb yesterday… All the decorations are down, it’s so depressing… Now all we have is two months of cold, gray days, with no colored lights, no decorations to warm us… Oh well, it’s not like this is the first time! And it won’t be the last either! So deal with it Chuck! And… On that note, I’ll get this out the door… I sure hope that you have a Marvelous Monday, and if not, tomorrow will be better!

To Sign up for the FREE Daily Phennig quick-reading daily e-letter on world currencies, economic trends, and the occasional baseball score go HERE.

Chuck Butler is President of EverBank® World Markets and the author of the popular Daily Pfennig newsletter, which is reposted here at The Daily Reckoning. With a career in investment services and currencies extending over 35 years, Mr. Butler oversees all aspects of customer service and the trading desk for EverBank World Markets. A respected analyst of the currency market, Mr. Butler has frequently made appearances or been quoted by the national media. These include the Wall Street Journal, US News and World Report, MarketWatch, USAToday, CNNfn, Bloomberg TV, CNBC, and the Chicago Tribune. Mr. Butler was previously the Chief International Bond Trader and Director of Risk Management for Mark Twain Bank, and has held significant positions in the investment industry since 1973.

FROM THE SUBLIME TO THE RIDICULOUS

This is what the weekend Wall Street Journal had to say regarding the market reaction to Friday’s payroll data (page A5). “Stocks edged higher Friday, with disappointment over the jobs report offset by expectations that the news would keep the Federal Reserve from raising rates.” So we are left with the impression that had the number come in at +85,000 and the market rallied, that we would have been notified that even as rate hike expectations intensified, there

This is why this is called the Houdini market — it goes up on any news, good or bad. The good news is evident; the bad news is always rationalized.

……read the entire report HERE.

Topics in the letter below:

……read the entire report HERE.

Global Markets in Review: How Much More Upside?

Back from the festive season break, traders pushed stock market indices to new highs for the rally, logging a full house of five up-days for the S&P 500 Index and pushing the CBOE Volatility (VIX) Index – also referred to as the “fear gauge” of the U.S. stock markets – down to levels last seen pre-Lehman in 2008.

Pundits shrugged off Friday’s unexpected decline in non-farm payrolls, as well as mixed economic data earlier in the week, focusing instead on the Federal Open Market Committee’s (FOMC) communiqué for its December 15-16 meeting which maintained its “extended period” stance for easy monetary policy, i.e. more “juice” for risky assets.

Asha Bangalore (Northern Trust) said:

The details and tone of the December employment report indicate that labor market conditions remain bothersome. A meaningful pace of hiring is unlikely in the next few months given the structural unemployment in the economy, the shortened workweek, and the large number of part-time workers. In other words, the December employment report reinforces expectations of the FOMC on hold in the near term. The Fed is unlikely to undertake a reduction of monetary accommodation until the unemployment rate has peaked.

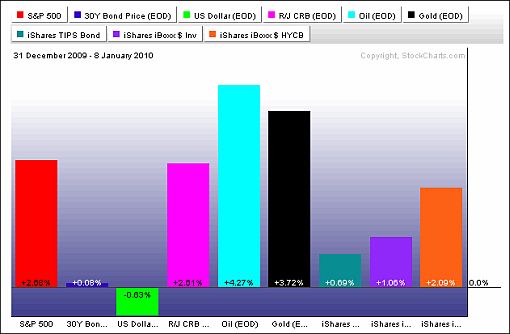

The past week’s performance of the major asset classes is summarized by the chart below – a set of numbers that indicates renewed investor appetite for risky assets. Silver (+9.5%), “the poor man’s gold”, and platinum (+7.0%) were the stars of the week, playing catch-up on historically cheap ratios relative to gold bullion. The yellow metal (+3.7%) also resumed its uptrend with a so-called “upward price dynamic” on Monday. Bonds performed poorly as PIMCO and BlackRock, among others, cut holdings of U.S. and U.K. debt as the two nations’ borrowings hit record levels.

(Click HERE to Enlarge the graph below)

…..read a lot more HERE.