Daily Updates

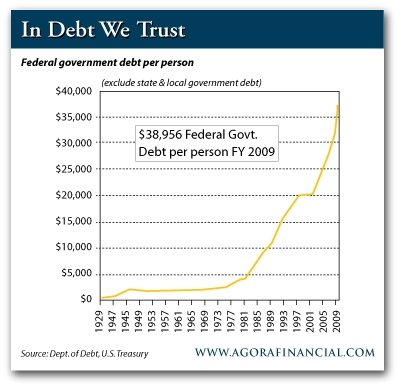

02/23/10 Zurich, Switzerland – Wherever we look at the world economy today, we see a wall of risk…and potential financial catastrophe. We see a large number of virtually bankrupt major sovereign states (US, UK, Spain, Italy, Greece, Japan and many more) teetering atop a financial system that is bankrupt, but is temporarily kept alive with phony valuations and unlimited money printing. Increasingly, therefore, investors will want to exchange this funny money for gold.

Governments like the US and the UK are committed to printing increasing amounts of worthless paper money in order to finance their growing deficits. The consequence of this rescue mission will be a hyperinflationary depression in many countries, due to many currencies becoming worthless.

…..read more HERE.

Quotable

“It’s tempting to think that the US can inflate its way out of its fiscal problems. A faster, sustained increase in prices would erode the real value of past debt, and higher future inflation would – other things equal – reduce the real resources needed to service and pay back the promises we are making today. And there is no mistaking the staggering value of those promises. On our projections, federal marketable debt held by the public, which we estimate will be 60.7% of GDP at the end of F2010, will jump to 87% of GDP in the next decade – a level not seen since the post-WW II period (1947). In absolute terms, such debt will more than double over that period from its January level of US$7.2 trillion.

Adding fuel to the fire, a growing chorus of household-name economists from both sides of the political aisle appears to be advocating higher inflation as the remedy for our fiscal maladies. Indeed, many believe that higher inflation will cure multiple ills, and that central banks should raise their inflation targets to as high as 4% from the current ones (some implicit) that cluster near 2%. From a policy perspective, we couldn’t disagree more. As we see it, central bank responses to this financial crisis underscore the fact that inflation targets are medium-term goals to be met flexibly; they have not limited central banks from responding aggressively to the shock. Specifically, we believe that the Fed’s ‘credit easing’ programs have restored the functioning of many financial markets and enabled policymakers to offset the constraint of interest rates at the ‘zero bound’. But the push for allowing more inflation to lubricate the economy is gaining adherents, so it’s time for sober analysis. – Richard Berner

FX Trading – Center to periphery relationship is still in play…

This from the International Monetary Fund—morphing views on the “free flow” of

capital (our emphasis):

…..read more HERE

Charlie Munger, Warren Buffett’s longtime business partner in Berkshire Hathaway, warns in a new column that the U.S. economic empire is crumbling before our eyes, thanks to federal debt and poor planning.

….read more HERE.

Despite gold’s choppy trading range …

Despite the fact that it’s entering a period of short-term weakness and may even fall to just below $1,000 an ounce …

Everyone — and I mean everyone — should consider owning at least my top three gold mining shares.

Why? Here are just a few reasons …

A. Because the financial crisis is far from over. Indeed, it’s now in a new phase — a period where governments effectively go bankrupt, either by defaulting on their debt obligations outright, or, on the sly by devaluing their currencies.

B. Because our own Federal Reserve is seemingly dead set on a weaker U.S. dollar as well, no matter what the costs to the American people.

C. Because the U.S. government is flat broke, yet it continues to spend money as if it grows on trees (or more accurately, like they can print more of it at any time).

D. Because China is beginning to do what everyone from Main Street … to Wall Street … to Pennsylvania Avenue fears most: It’s starting to dump its holdings of U.S. Treasuries, dumping more than $34 billion in American IOUs in December, slashing its holdings for a second straight month, down a total of $45 billion from last November.

And …

E. Because there’s a great crisis in confidence brewing around the globe, where investors everywhere will eventually seek safety in gold — the one asset that has always, without fail, protected one’s wealth from the mismanagement of the state by the powers-that-be.

If you look closely at gold, you’ll see that even when the price of gold is weak in U.S. dollar terms, in terms of other currencies, it is often roaring to the upside.

Case in point: Right now, gold in U.S. dollars is trading at the $1,100 level — down roughly $127, or 10%, from its record high (in dollars) …

… but in terms of the euro currency …

Gold is exploding higher, reaching new, all-time record highs of more than 813 euros per ounce!

Moreover, the price of gold in euros has almost doubled in the last five years, outperforming nearly every investment on the planet.

Notice how, in euros, gold rose quite sharply from the middle of 2005 through the middle of 2009, gaining more than about 50%.

But then, after some consolidation and sideways trading in the latter part of last year, gold then exploded higher again, forming an even sharper uptrend than the previous liftoff.

The important concept to understand: When looking at an asset or asset class today, it is simply not enough to look at it in terms of one currency, particularly the U.S. dollar.

You must look at market action from additional perspectives, namely, other major currencies, to determine how that asset is performing on an international basis.

In this case, the action in gold in terms of euros is very revealing. The new record highs in euros tells me — without one single shred of doubt in my mind that …

1. Gold’s international bull market is very much intact.

2. When the euro currency starts to strengthen again, and the U.S. dollar starts to weaken again — gold in U.S. dollar terms will begin to look very much like the chart above. With the yellow metal blasting off to new record highs, probably doubling, just like it did in euros, and eventually reaching my minimum target of $2,300 an ounce.

All this is why I feel compelled to remind you, that even though gold is a bit weak right now in U.S. dollar terms — given everything that’s happening in the world — gold and gold shares are just about the best investment you can have in your portfolio to ensure your financial health and that of your loved ones.

Three Must-Own Gold Mining Shares

In previous columns, and in more detail in my Real Wealth Report, I’ve often reviewed what kind of physical gold holdings one should have: Ingots and bars, and gold Exchange Traded Funds.

But today I want to review my top three gold mining shares. These are shares I believe everyone should own, and for the long haul.

Bear in mind I cannot give you precise buy prices, timing signals, risk-reducing strategies, nor instructions on when to grab profits. All those specifics are reserved for active subscribers to Real Wealth Report. I’m sure you’ll understand.

Nevertheless, here they are …

Gold Miner #1: Agnico-Eagle Mines (AEM)

One of my favorite miners and one of the best managed miners in the world. Agnico has a long, stellar reputation of not hedging its gold reserves or production, meaning it can fully participate in gold’s long-term bull market.

Agnico’s total gold reserves now stand at a record 18.4 million ounces, and its important mining operations include …

- LaRonde; Quebec, Canada. Undergoing new development efforts and expected to produce 340,000 ounces of gold per year by 2013.

- Goldex; Quebec, Canada. Based on a nine-year plan in which gold will be produced at a rate of 175,000 ounces per annum at cash costs of around $230 per ounce.

- Kittila; Finland. With more than 5.6 million ounces of gold.

- Lapa; Quebec, Canada. Producing gold at less than $300 an ounce.

- Meadowbank; Nunavut, Canada. Current plans call for a nine year mining life with average gold production of 360,000 ounces per year at cash costs of $300 per ounce.

- Pinos Altos; Chihuahua, Mexico. A fertile gold project with 73 million ounces of silver, to boot.

- And more!

- Moreover, Agnico just reported stellar fourth-quarter 2009 results, including …

- Net income of $47.9 million, or $0.31 per share, compared to net income of $21.9 million, or $0.15 per share a year earlier (Q4, ‘08).

- Record quarterly production of 163,276 ounces, 2009 total production, a record 492,972 ounces.

- Cash costs per ounce of gold mined: $347, making Agnico one of the lowest cost gold producers out there.

Gold Miner #2: Goldcorp (GG)

Another one of my favorites, this blue-chip gold miner is a low-cost, debt-free, unhedged gold producer with 10 mining operations, and 22.7 million ounces of proven gold reserves.

Important mining operations include …

- Red Lake; Ontario, Canada. Expected to produce more than 1 million ounces of gold by 2012.

- Porcupine; Ontario, Canada. With a 20-year mine life and expected production over 350,000 ounces per annum.

- Marlin; Huehuetenango, Guatemala. A cash cow for Goldcorp, with gold production costs of less than $200 an ounce, plus loads of silver credits, to boot.

- Los Filos; Guerrero, Mexico. Potentially Mexico’s largest gold mining operation, Los Filos should soon be producing 300,000 ounces of gold per annum at cash costs of under $300 an ounce. A 5 million ounce gold reserve base.

- Alumbrera; Catamarca, Argentina. One of the largest copper/gold mines in the world with the capacity to produce 180,000 metric tonnes of copper and 650,000 ounces of gold.

- Peñasquito; Zacatecas, Mexico. This property was Goldcorp’s motive for acquiring Glamis Gold back in 2006.

Gold Miner #3: Kinross Gold (KGC)

Kinross entered the gold mining industry as a junior producer in 1993. Throughout the rest of the 1990s the company thrived while many of its peers fell by the wayside as the price of gold continued to fall.

Now Kinross is a major league miner, with nearly 51 million ounces of proven and probable gold reserves.

- Some highlights from the company’s fourth-quarter 2009 results, released on February 17 …

- Fourth-quarter record production of 613,858 gold equivalent ounces, an increase of 12% over the same period last year.

- Full-year 2009 gold equivalent production was 2,238,665 ounces,

- a 22% increase over 2008.

- Record revenue of $699.0 million, a 48% increase over the $484.4 million in revenue in the fourth-quarter of 2008.

- Full-year 2009 revenue of $2,412.1 million, a 49% increase over full-year 2008.

- Gross profit margin averaged $530 per ounce in 2009, an increase of 22% year-over-year, compared with a 13% year-over-year increase in the average gold price.

Kinross’s important mining operations include …

- Kupol; Chukotka, Russia. A high-grade gold deposit cash cow for Kinross, expected to produce more than 550,000 gold equivalent ounces per annum, over a seven-year mining life, and at a low cash cost of under $250 per ounce.

- Fort Knox; Alaska. Discovered in the mid-1980s, this property has been a major gold producer since it went live in 1997 and is now Alaska’s largest gold mine.

- Round Mountain; Nevada. Produces more than 500,000 ounces of gold per year. A 50/50 joint-venture with Barrick Gold.

- Cerro Casale; Atacama, Chile. An exploration property that hosts one of the largest undeveloped gold and copper deposits in the world, with potential reserves of up to 23 million ounces of gold and 2.7 million metric tonnes of copper. Kinross recently entered into an agreement with Barrick Gold to sell half of its 50% interest in this property for $475 million.

These are just my top three gold mining shares.

There are several more. Details, including how to trade them even for short-term profits can be found in my Real Wealth Report. To subscribe, consider a one-year membership. At just $99, it’s a bargain!

Best wishes for your health and wealth,

Larry

This investment news is brought to you by Uncommon Wisdom. Uncommon Wisdom is a free daily investment newsletter from Weiss Research analysts offering the latest investing news and financial insights for the stock market, precious metals, natural resources, Asian and South American markets. From time to time, the authors of Uncommon Wisdom also cover other topics they feel can contribute to making you healthy, wealthy and wise. To view archives or subscribe, visit http://www.uncommonwisdomdaily.com.

Special offer from Mark Leibovit for Money Talks only: The intense analysis of Gold in the 10-12 page The VR Gold Letter is right now 75% off for the first month or $29.95 (regularly $125.00 a month). The weekly VR Gold Letter focuses on Gold and Gold shares.Go HERE and use the Money Talks promo code CBC12210

In times of uncertainty, traders move to gold. With the Fed starting to raise interest rates, Russia lowering them, the IMF selling off its gold, but China and India in the market for more gold reserves, and Greece falling apart with strikes and protests increasing, traders have pushed gold up near its highest level in a month. For the week, gold rose 24.70 or 2.26%, silver gained 0.78 or 5.03%, platinum was up 18 or 1.19%,palladium rallied 23 or 5.5%, and copper jumped 0.2745 or 8.91%. Obviously, the metals had a great week. So did crude oil, which gained 5.68 or 7.66%. But natural gas fell 0.424 or 7.75%.

The International Monetary Fund plans to sell 191.3 tons of gold on the open market. Speculation is that a central bank, such as India or China, will step up and buy the gold. Remember, back in November the Reserve Bank of India had purchased 200 tons of the precious metal from the International Monetary Fund. But the metals gave up their gains after the Fed announcement.

While gold is still about $100 below its recovery high set in December, gold rose to new all-time high in euro terms at 823 euros per ounce on Thursday. So the gold rally continues, but those in the US (and Canada too) have not seen it because of the strong US (and Canadian) currency.

Bottom line: If you are not long from the February 5 ‘Key Reversal’ patterns reported in the February 8 edition of the VR Gold Letter, look to buy on the next pullback following the above mentioned guidelines for GLD, keeping in mind that the overall equity market and Gold market still has risk of forming a secondary or ‘retest’ low between now and mid-March.

The weekly VR Gold Letter focuses on Gold and Gold shares. The letter is available to Platinum subscribers for only an additional $50 per month and to Silver subscribers for only $70 per month. Email me at mark.vrtrader@gmail.com.

Special offer from Mark Leibovit for Money Talks only: The intense analysis of Gold in the 10-12 page The VR Gold Letter is right now 75% off for the first month or $29.95 (regularly $125.00 a month). Go HERE and use the Money Talks promo code CBC12210

Marks VRTrader Silver Newletter covers Stock, TSE Stocks, Bonds, Gold, Base Metals, Uranium, Oil and the US Dollar.

More kudos – Mark Leibovit was named the #1 Intermediate Market Timer for the 10 year period ending in 2007; the #1 Intermediate Market Timer for the 3 year period ending in 2007; the #1 Intermediate Market Timer for the 8 year period ending in 2007; and the #8 Intermediate Market Timer for the 5 year period ending in 2007. NO OTHER ANALYST SURVEYED APPEARED IN ALL FOUR CATEGORIES FOR INTERMEDIATE MARKET TIMING AS PUBLISHED IN TIMER DIGEST JANUARY 28, 2008!

For a trial Subscription of The VR Silver Newsletter covering Stocks, Bonds, Gold, US Dollar, Oil CLICK HERE

The VR Gold Letter is available to Platinum subscribers for only an additional $20 per month, while for Silver subscribers the price is only an additional $70.00 per month. Prices are going up very shortl, so act now! Separately, the VR Gold Letter retails for $1500 a year! The VR Gold Letter is published WEEKLY. It is 10 to 16 pages jam-packed with commentary and charts. Please call or email us right away. Tel: 928-282-1275. Email: mark.vrtrader@gmail.com .