Real Estate

Michael asks Kyle Green, President of the Green mortgage team for his Big Fat Idea in real estate. What is it? This week its buy commercial real estate!

….related, don’t miss Ozzie: Hot Properties: New Numbers Plus Cost of Going Green

Ozzie brings forward the newest real estate numbers, also brings up to date the cost of building a green home. Ozzie winds up with two red hot properties.

….also Michael’s Editorial: The Blatant Media Bias

Price Waterhouse Cooper report says Vancouver’s housing market is still going to be #1 in 2017 and the city will lead all others in the country in economic growth. Michael goes over the numbers and CHMC’s response in this Mid-Week Update

…also: after gaining $10 being bullish from August 3 Todd Market Forecast: Turns Bearish Crude Oil

This is what happens when government doesn’t understand markets as sales numbers for Vancouver to October 21st has condo’s down 53% & single family homes down 77%! Thank you foreign buyers tax and Canada’s Mortgage rule changes. Where to from here for Canada’s strongest industry?

….also from Michael: Powerful Trends That Are Changing Everything

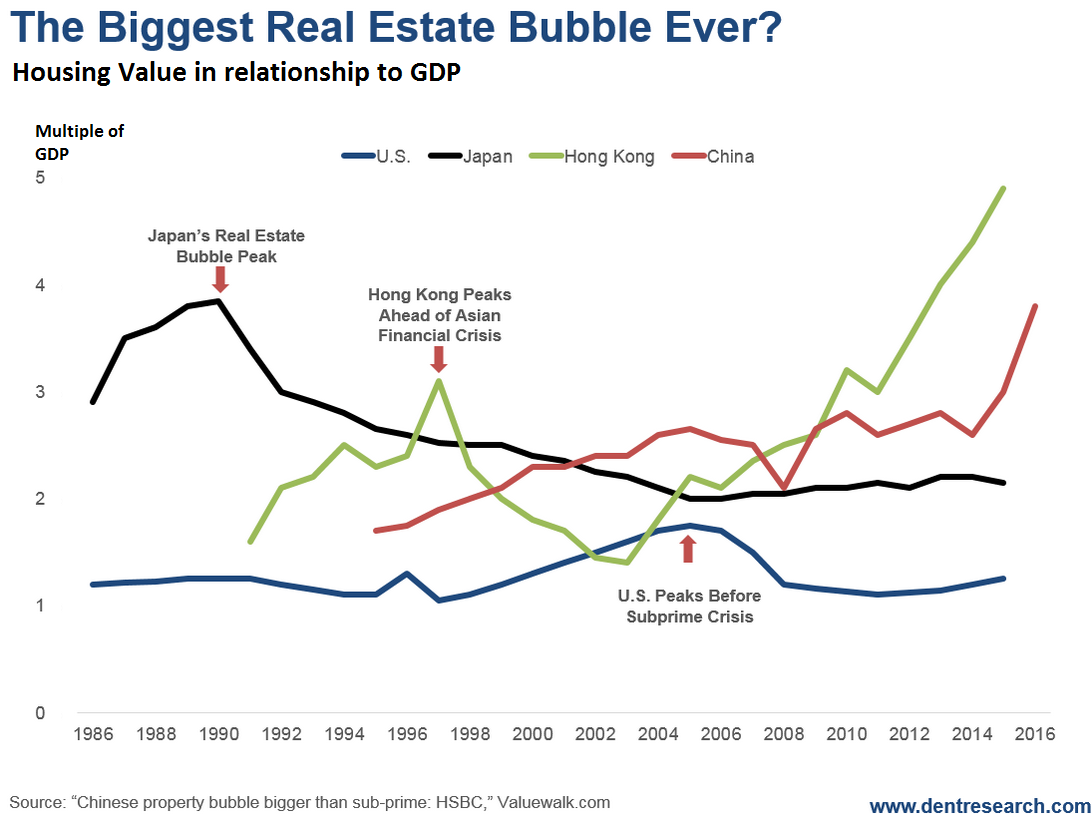

Property mogul: “The biggest bubble in history.”

No question about it. China definitely takes the cake when it comes to bubble creation. The government encouraged everyday people to speculate in stocks in late 2014 and 2015 to help offset the slowdown in its gargantuan real estate bubble. The stock market bubbled 160% in one year and then crashed 50% (and you can be sure there’ll be more losses to come after a year of propping up a market that has merely gone sideways…)

Then to cushion that 2015 stock crash, the government made loans easier for real estate again. Bank loans surged by 7.5 trillion renminbi (RMB) in 2015 and are on track to surpass 15 trillion RMB by the end of this year. About half of these loans are in mortgages.

So what happened?