Real Estate

Last week I ran into a friend whom I’d been worrying about. He’s a real estate appraiser and his work had been drying up as interest rates rose and homeowners stopped refinancing their mortgages.

But now he’s back to being happily swamped because instead of refinancing, everyone is buying — often, he says, for above the asking price.

A couple of days later my wife and I were at a slide show put on by friends just back from New Zealand. They’d heard that a neighbor was thinking about selling his house and on an impulse made him an offer. He accepted, and our friends became instant homeowners.

The very next day my wife’s father called to say that the company running a gas station next to his house wants to expand in his direction. They made him an unsolicited – and very generous — offer, which he accepted.

Then, I did an interview with Gordon T. Long’s Macro Analytics website in which Gordon told the following story:

My brother just sold one of his properties in Toronto [Ontario]. He had bidding war with 11 bidders so he demanded cash. Several of the Chinese buyers were on the phone overnight raising the money, which they got. My brother’s still partying after that sale.

It definitely feels like the housing bubble is back. Here’s part of a (factual rather than anecdotal) overview of the subject from Charles Hugh Smith:

Housing’s Echo Bubble Now Exceeds the 2006-07 Bubble Peak

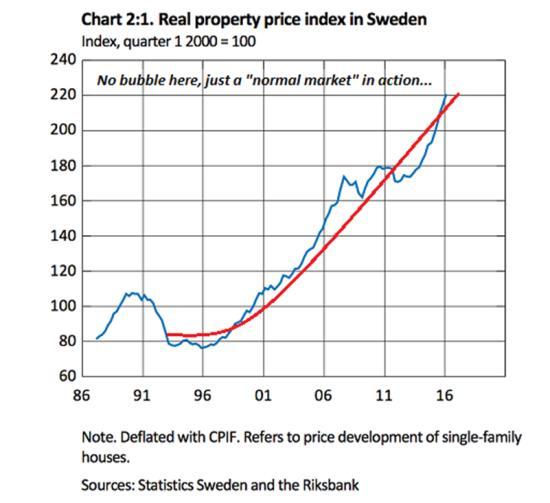

If you need some evidence that the echo-bubble in housing is global, take a look at this chart of Sweden’s housing bubble.

A funny thing often occurs after a mania-fueled asset bubble pops: an echo-bubble inflates a few years later, as monetary authorities and all the institutions that depend on rising asset valuations go all-in to reflate the crushed asset class.

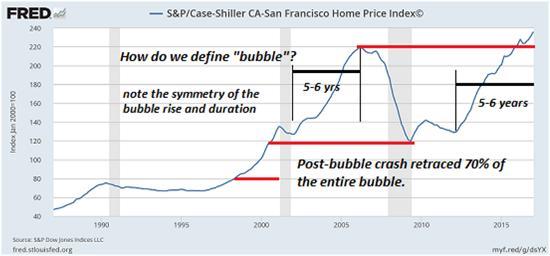

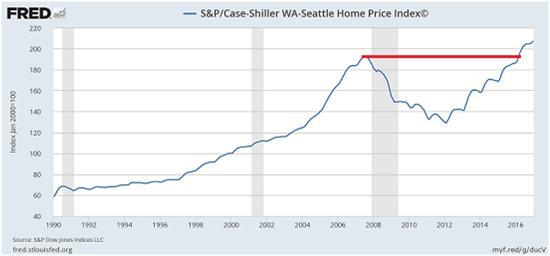

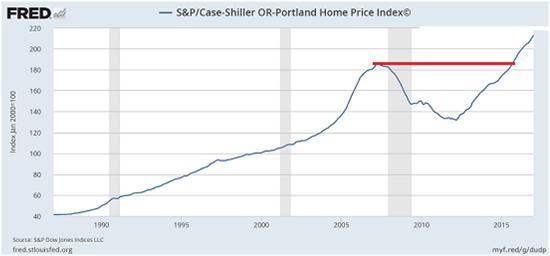

Take a quick look at the Case-Shiller Home Price Index charts for San Francisco, Seattle and Portland, OR. Each now exceeds its previous Housing Bubble #1 peak:

Is an asset bubble merely in the eye of the beholder? This is what the multitudes of monetary authorities (central banks, realty industry analysts, etc.) are claiming: there’s no bubble here, just a “normal market” in action.

This self-serving justification–a bubble isn’t a bubble because we need soaring asset prices–ignores the tell-tale characteristics of bubbles. Even a cursory glance at these charts reveals various characteristics of bubbles: a steep, sustained lift-off, a defined peak, a sharp decline that retraces much or all of the bubble’s rise, and a symmetrical duration of the time needed to inflate and deflate the bubble extremes.

It seems housing bubbles take about 5 to 6 years to reach their bubble peaks, and about half that time to retrace much or all of the gains.

Bubbles have a habit of overshooting on the downside when they finally burst. The Federal Reserve acted quickly in 2009-10 to re-inflate the housing bubble by lowering interest rates to near-zero and buying over $1 trillion of mortgage-backed securities.

When bubbles are followed by echo-bubbles, the bursting of the second bubble tends to signal the end of the speculative cycle in that asset class. There is no fundamental reason why housing could not round-trip to levels below the 2011 post-bubble #1 trough.

If you need some evidence that the echo-bubble in housing is global, take a look at this chart of Sweden’s housing bubble. Oops, did I say bubble? I meant “normal market in action.”

Who is prepared for the inevitable bursting of the echo bubble in housing? Certainly not those who cling to the fantasy that there is no bubble in housing.

Dozens of other stats and charts are out there to support this assertion. With one big departure from 2007: This time around housing is just part of a constellation of bubbles that includes government bonds around the world, equities (the Nasdaq just hit 6000) and all manner of trophy assets like fine art.

Predicting the imminent end of this mother of all financial manias is tiresome for both writers and readers, so let’s just assume it will end eventually, and that its demise will be spectacular.

Question: What if you find yourself as I do with real estate being the MAJORITY of your portfolio?

Question: What if you find yourself as I do with real estate being the MAJORITY of your portfolio?

Answer:

“”If you have the bulk of your assets in real estate, then one way to keep them is to run out and get a 30-year FIXED mortgage now while you can. You have sold the risk to a third party and it is now their problem. You have the cash and wisely use for investment into other movable areas.”

“Real estate depends on how far down the rabbit hole we go. If government does not blink and it just keeps raising taxes trying to support a system that is unsustainable, then we end up in the full crash and burn and you are compelled to walk away from real estate. Hopefully, with education understanding the past, we can for once avoid the same outcome and advance in this learning curve of civilization.

Vacation properties are the worst to survive. I bought such a place to live in at about 50% of its 2007 high. So while high-end properties in cities were rising, vacation spots on the beach declined. I wanted beach front. So understanding the cycle helps tremendously for entry and exit points.

The risk of mortgages declining is real. As governments get in trouble, long-term confidence starts to decline….”

…more in this comphrensive article by Martin HERE

…related:

Michael Campbell & Ozzie Jurock more short term: Hot Properties: A Normal Spring Market?

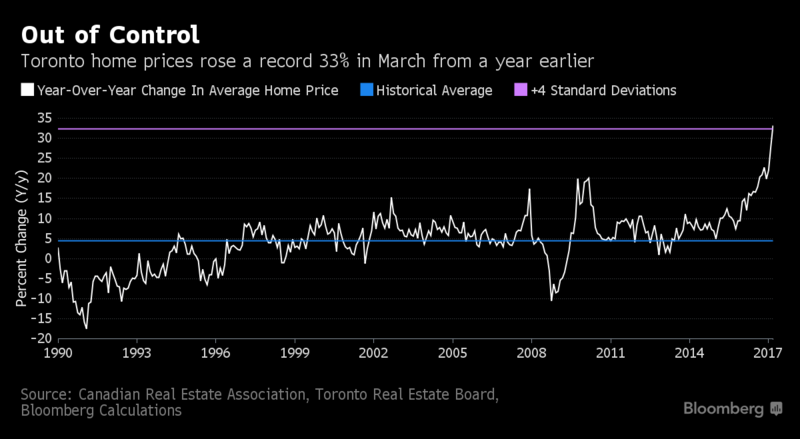

Toronto’s residential housing market showed no signs of cooling last month, with the average sale price soaring a record 33 percent from a year ago, pushing the cost of a detached home in the heart of the city to almost C$1.6 million ($1.2 million). In Toronto and surrounding suburbs prices climbed by a third in every major housing category, including townhouses and condominiums, as demand rose and listings failed to keep pace, according to figures from the Toronto Real Estate Board.

Birds are not the only creatures migrating south. In the United States, more and more people are leaving the highest taxes state and moving to lower tax states. One of the states that has seen large scale migration outward has been Illinois, where taxes are going insane and the there is no end in sight. Florida seems to be the number one destination. Housing prices are rising because of the net migration leaving the higher taxed states in the North. Within Europe, the youth have been migrating from Greece and Spain northward in search of jobs.

Birds are not the only creatures migrating south. In the United States, more and more people are leaving the highest taxes state and moving to lower tax states. One of the states that has seen large scale migration outward has been Illinois, where taxes are going insane and the there is no end in sight. Florida seems to be the number one destination. Housing prices are rising because of the net migration leaving the higher taxed states in the North. Within Europe, the youth have been migrating from Greece and Spain northward in search of jobs.

Likewise, we are also starting to see a surge in real estate in some areas driven by the first upticks in interest rates. Contrary to what the pundits believe that higher interest rates would cause the economy to turn down along with the stock market, they are being proven wrong every time because people are not as stupid as the pundits. Why buy a house and rush to lock in a low interest rate when they keep moving lower? As soon as mortgage rates began to rise, that’s when people spend because they KNOW it will cost them more to now wait.

The same thing happened in Japan. The month before a big imposition of sales tax was to hit, everyone ran out and bought whatever they contemplated. The surge one month before the tax increase made people think the economy recovered overnight.

Plain an simple, the average person responds to what they see. They do not understand the financial news nor do they even bother to watch it. I remembered that lesson from the peak in interest rates in 1981. My mother and her sister ran out and bought 10 year CDs at the bank locking in 20%. They picked the high and never watched a single TV show on markets. They did not ask me. They just did it.

Gold and the stock market will take off when people realize that government is in trouble. When they lose confidence, that is when they will start to pour into tangible assets.

…also from Martin:

Real estate is moving in many spots around the globe. You’ll never guess where the hottest European real estate market can be found. Where the money is headed. Is there still be an elimination of the tax exemption for a home office?

…also from Michael: The Key To Keystone’s Great Stock Market Success