Real Estate

Last year’s mortgage rule changes are clearly impeding young buyers from breaking into the housing market, according to one veteran, but there is an even larger obstacle in the way.

Last year’s mortgage rule changes are clearly impeding young buyers from breaking into the housing market, according to one veteran, but there is an even larger obstacle in the way.

“One of the things that came out of the report was millennials impression that the government’s actions relating to restrictive actions to mortgage insurance was an impendent,” Phil Soper, president of Royal LePage, said. “Yet, I’d say a larger impediment was 20% year-over-year price appreciation.”

According to Royal LePage’s most recent report, 49% of peak millennials believe the federal government’s mortgage regulations have impacted affordability.

As a result, they have been forced to consider lower-priced homes.

“When looking for a home, 53% of peak millennial purchasers across Canada are willing to spend up to $350,000, which would typically buy them a 2.5 bedroom, 1.5 bathroom property nationwide, with 1,272 square feet of living space,” the report reads. “Yet, with 58% of respondents having a annual household income of less than $69,000, and only 34% currently tracking to have a sufficient down payment of over 20 % to qualify for a mortgage in this price range, the actual logistics of homeownership can be quite difficult.”

The study also found 61% of millennials prefer to buy a detached home but only 36% believe that wish is realistic.

“In addition to high home values, peak millennials also face increasingly stringent mortgage stress test regulations, which push potential buyers to the sidelines, electing to either remain in the rental market to save up enough money for a down payment, or move to more affordable regions,” the report reads.

“When asked, 64% of peak millennials currently believe that homes in their area are unaffordable, with a significant proportion of respondents in both British Columbia (83%) and Ontario (72%) asserting that prices are simply too high. Of those that do not believe they will be able to own a home in the next five years, 69% stated that they cannot afford a home in their region or the type of home they want, while roughly a quarter (24%) are unable to qualify for a mortgage.”

….also: Available supply in Calgary ramps up amid listless transaction volumes—report

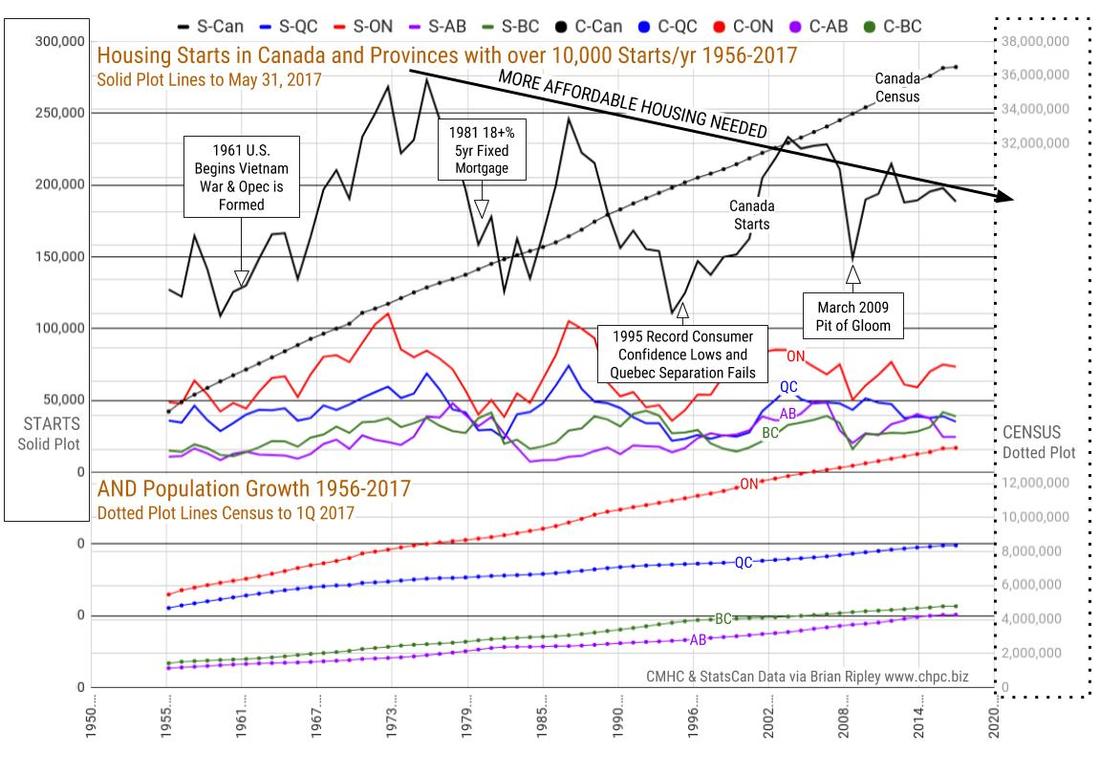

“The trend in housing starts for Canada reached its highest level in almost five years”, said Bob Dugan, CMHC’s chief economist. “So far this year, all regions are on pace to surpass construction levels from 2016 except for British Columbia, where starts have declined year-to-date after reaching near-record levels last summer.” CMHC News Room

NOTE: The chart below shows the actual annual totals count from 1956 through 2016.

The 2017 data points on the chart are derived from the “annualized” provincial data set in the charts above and are therefor a projection of what year end 2017 might look like.

|

|

Projected Year End 2017 Totals

Canada = 190,424 (-4% Y/Y) ON = 74,310 (-1% Y/Y) QC = 35,100 (-9% Y/Y) BC = 39,131 (-7% Y/Y) AB = 25,423 (-4% Y/Y) |

One week after we channeled Deutsche Bank’s Torsten Slok, who two years ago warned that “Canada is in serious trouble“, a warning which was especially resonant after last week’s rate hike by the Bank of Canada – the first since 2010 – which we argued threatens to burst Canada’s gargantuan housing bubble… CLICK HERE for the complete article

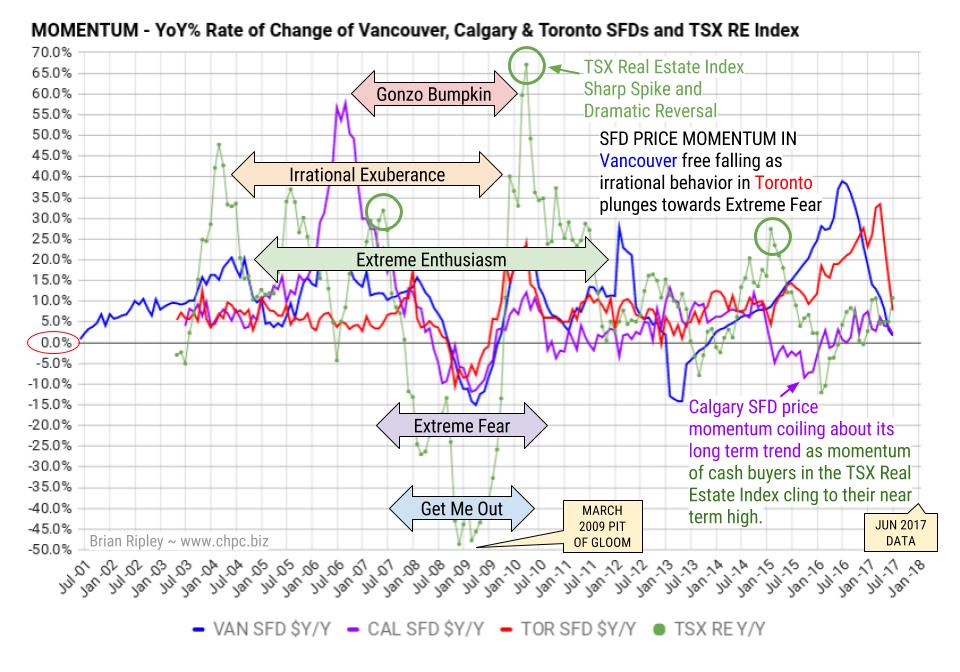

HOUSING PRICE MOMENTUM Y/Y RATE OF CHANGE for Vancouver, Calgary, Toronto Single Family Detached Prices and the TSX Real Estate Index

….read more on the Housing Price Momentum HERE and the Millionaire Metric HERE

I’ve been seeing a lot in the news lately about Canadian and Australian real estate prices. Here’s just a sampling:

New Brunswick real estate offers a lesson on peak housing prices

Condo flipping on the rise as Vancouver market heats up

Face it Canada – you’re a real estate addict and no one wants a cure

Canada real estate industry welcomes Buffett to the neighborhood

Canada’s red hot real estate heats up apartment market to heights not seen in 30 years

Canada is on the ‘A-list’ for commercial real estate investors, in a world of uncertainty

Most of what we’re hearing is that there’s little to worry about with our neighbor’s real estate prices shooting to the moon.

Well, as I told 5 Day Forecast readers yesterday, there IS something to worry about. Something BIG.

Today, I’ll share with you what I told Boom & Bust subscribers yesterday…

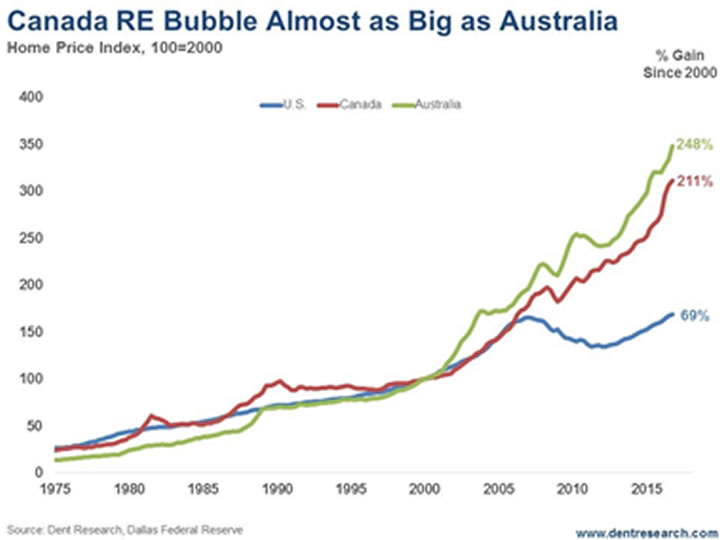

Between early 2006 and late 2012, real estate in the U.S. took a whipping worse than what the Great Depression dished out. It lost 34% compared to the 26% it shed back in the early 1930s.

But property prices in Canada and Australia hardly paused, and then they continued their march higher.

Canadian home prices are now 84% higher than in the U.S.!

Despite Canadian’s slightly lower incomes!!

And the Aussies’ are even higher. Home prices in Australia are now 107% higher than those in the U.S.!

It’s terrifying. Stephen King should turn it into one of his horror stories. It’d be a best-seller.