Real Estate

Last October the stress test was announced which requires all borrowers putting less than 20% down to qualify at the benchmark rate which is currently 4.84%. Previously only variable rate mortgages or mortgages with terms of less than 5 years had to qualify at the benchmark rate, so taking a 5yr fixed was a commonly chosen option to qualify. The change reduced borrower eligibility for those who would be taking a 5yr fixed by 20%. Currently with 20% taking a 5yr fixed rate is still a way to qualify at the actual rate, not the benchmark. The government is looking to likely close this option which will reduce borrowing power by 20%. This will reduce incentive for borrowers to take 5yr fixed rate mortgages and enter more variable rate contracts as there is no qualification incentive to take the perceived “safer” option of the longer term rate.

We have heard from a few lenders that they worry the next round of changes will impact some of their lending products. One lender in particular has a “net worth” program which allows borrowers to not need an income to qualify for a mortgage, which has been a dying breed in today’s lending climate as lenders fear government auditing and wrist slapping for non-income qualifying loans. It is possible that this next wave of changes brings about further restricting lenders to lend based on their comfort level and pushes more borrowers to seek more expensive alternative lenders.

There is a possible reconsideration of launching these guidelines however. Toronto’s market has dropped considerably over the summer and most other markets in Canada has been fairly flat over the past few months. It is possible that they tap the brakes on launching new guidelines for fear of sending some markets like Toronto is a more aggressive tailspin.

What should you do?

If you are looking to buy with 20% down or want to refinance to unlock equity to invest, you may want to look at doing this sooner rather than later. The government has been more apt to moving swiftly once changes are made so policies may come into effect quickly.

Also, consider that Credit Unions are provincially regulated, not federally regulated. Over the past few years this has given them a few competitive advantages when it comes to qualification guidelines. Further government changes may widen this gap and give Credit Unions a larger piece of the mortgage pie, if they want it.

It’s been a bad few weeks for natural disasters. A series of hurricanes ripped through Texas, Florida, and the Caribbean, killing hundreds and racking up hundreds of billions of dollars in damage. Wildfires are raging in the Western U.S., and a pair of powerful earthquakes have battered Mexico.

It’s been a bad few weeks for natural disasters. A series of hurricanes ripped through Texas, Florida, and the Caribbean, killing hundreds and racking up hundreds of billions of dollars in damage. Wildfires are raging in the Western U.S., and a pair of powerful earthquakes have battered Mexico.

Amid the terrifying recent events is a worrisome finding from a new report: The parts of the U.S. most at risk of natural disasters are also the places where property values are highest and increasing most quickly.

ATTOM Data Solutions, curator of the nation’s largest multi-sourced property database, today released its 2017 U.S. Natural Hazard Housing Risk Index, which found that median home prices in U.S. cities in the 80th percentile for natural hazard risk (top 20 percent with highest risk) have increased more than twice as fast over the past five years and over the past 10 years than median home prices in U.S cities in the 20th percentile for natural hazard risk (bottom 20 percent with lowest risk).

….continue reading HERE (be sure to view the 2017 Natural Hazard Housing Risk Heat Map)

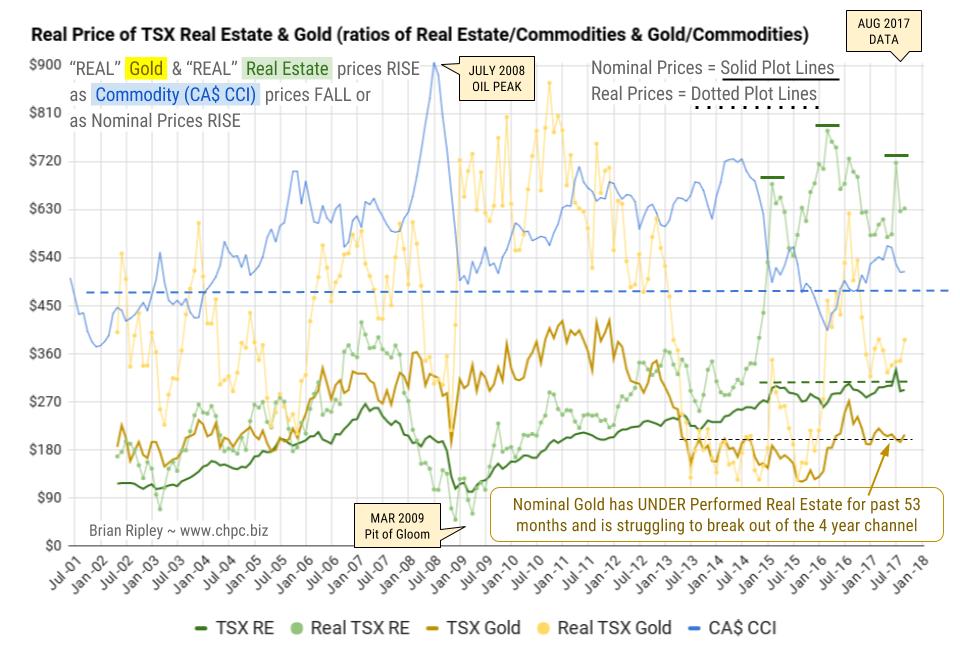

“Real” Gold (click image)

The chart above shows the “real” price of the TSX real estate index (RE/CCI green dotted plot line) and the “real” price of the TSX gold index (Gold/CCI yellow dotted plot line).

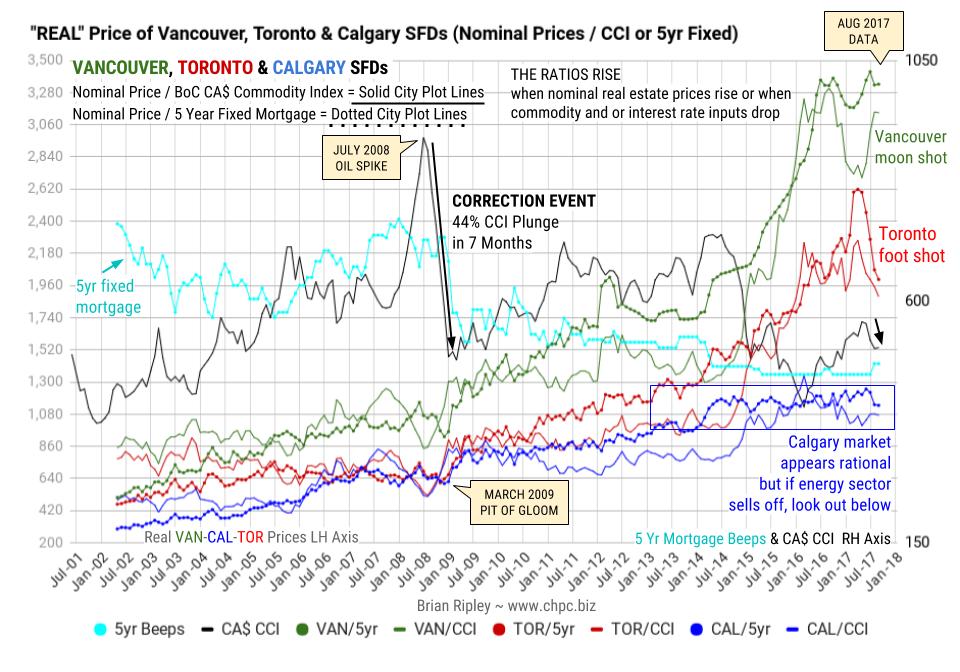

Real Housing Price (click image)

The chart above shows the “real price” of Vancouver, Toronto & Calgary SFDs when looked at from the point of view of the BoC Canadian Commodity Index (CCI) and Borrowing Costs (retail 5yr Mortgage) which are the main input costs apart from operating expenses and tax.

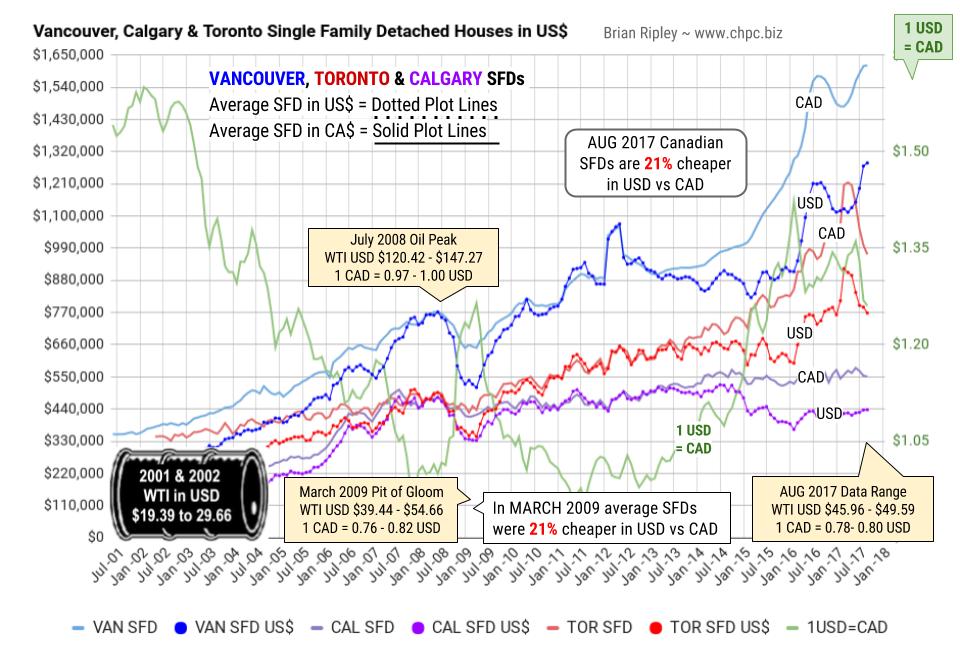

Real Housing Price (click image)

In August 2017 a single family dwelling in the hot metros of Vancouver, Calgary and Toronto is 21% cheaper if purchased in USD as opposed to CAD. They were 28% cheaper in February 2016 and at the March 2009 Pit of Gloom, prices were 21% cheaper in USD.

Also related:

The Toronto housing bubble: calm or carnage?

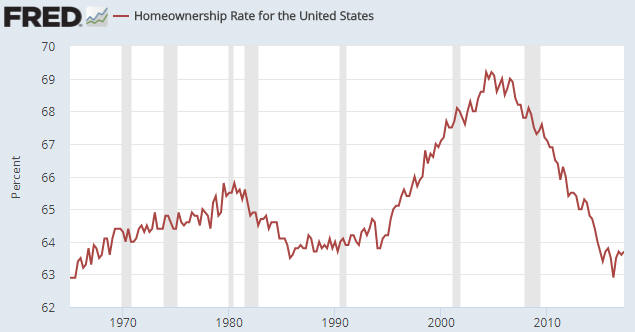

In a 2015 blog post titled “Unintended Consequences” I explained that policies implemented by the Clinton and Bush administrations to boost the rate of home ownership not only had unintended consequences, but the opposite of the intended consequence. This post is a brief update on the US home ownership situation.

As evidenced by the following chart, the government was initially successful in its endeavours. The home-ownership rate sky-rocketed during the second half of the 1990s and the first half of the 2000s as it became possible for almost anyone to borrow money to buy a house. As also evidenced by the following chart, the home-ownership rate subsequently collapsed. The collapse was an inevitable consequence of people throughout the economy first responding to the Fed’s and the government’s incentives to take on excessive debt and then finding themselves in drastically-weakened financial situations.

The home ownership rate ended up bottoming in Q2-2016 at a 50-year low.

No one in the government or at the Fed has ever admitted culpability for the mortgage-related debt binge that led to the spectacular rise and equally-spectacular fall in the US home-ownership rate. Apparently, it was a market failure.

|

The Bank of Canada announced another rate hike to the overnight lending rate (which is what the banks base their prime rate on) again by .25%, going to 1%. Subsequently, the banks moved up .25% as well. The reason for the move was impressive growth that was nearly triple the previous quarters’. After the previous rate hike earlier in the year, Stephen Poloz put the country on notice that they may be raising again during 2017 and with strong data in July and August, they decided to hike the rate. Now, this is in general good news for Canadians. It means that most provinces are not in a recession (with AB finally climbing out of the hole) with strong economic growth almost across the board. Keep in mind too that the reason for the rate decreases in 2015 was primarily due to oil price concerns, and with AB in the black again it was a fairly easy decision to go back to square one again. The question we’ve been getting a lot is should we lock in our variable rate mortgages? Keep in mind that fixed rates have gone up over the past few months, so you’ll likely be locking in to a rate over 3%. Many of you with variable rate mortgages will still be lower than the fixed rate you would be locking into. More importantly though, is the potential penalty to break a 5yr fixed rate mortgage compared to a variable rate mortgage. The penalty is max 3 months interest in a variable and either 3 months interest or an IRD (Interest Rate Differential) in a fixed rate. I wrote a good blog post about how the banks calculate these penalties (in an unfair way) that you can read here. We have found that currently this penalty is about 5x more expensive than the 3 month interest penalty. Recently we ran an estimation for a client who’s penalty would be $9,000 if they took a variable and between $47,000 – $54,000 to break a 5yr rate if they cancelled it in 1-2 years. WOW! Many of you are probably thinking that you won’t be breaking your mortgage. But believe it or not, 6/10 borrowers who take a 5yr mortgage break it early. That’s much higher than you would expect. Life happens. So what should you do? We are still advocating sticking with the variable. There will be ups and downs (right now is an up) but this world is still very volatile and there are still a lot of things that can happen. F |

Kyle Green

DLC Homeline Mortgages

Homeline Financial Services Inc.

Owner

Office: 604-229-5515

Toll Free: 1-888-531-8890

Fax: 1-866-551-8836