Bonds & Interest Rates

Jim Rogers, legendary commodities investor and co-founder of the Quantum Fund along with George Soros (a legend in his own right), has been looking at the pace of money printing in the developed world. And he doesn’t like what he sees. In fact, the legendary investor was recently quoted as predicting, “inflation run amok.”

Rogers isn’t just another Wall Street prognosticator. He predicted the housing bubble and financial crash, and started selling stocks in the sectors in 2006. He also saw the slowdown we’ve seen during the past couple years in Chinese stocks coming. During the 10 years he helped manage the Quantum Fund with Soros, the fund returned 4,200%.

So it’s easy to see why people tend to sit up and pay attention when Rogers warns of trouble on the horizon.

….read more HERE

In the late 1950s, John Bogle changed the investing world.

Bogle became the chief advocate for index investing, a strategy based around the idea that investors should stop trying to pick individual stocks, quit buying mutual funds, and just buy the big stock indexes.

Why would an investor take such a hands-off approach? Bogle cited research that proved that most actively managed mutual funds don’t beat the market — and on top of that, they charged hefty management fees for their mediocre performance. The data was damning, and Bogle’s fund, the Vanguard 500 Fund, became one of the most popular investment funds in history, today worth more than $26 billion.

The Vanguard 500 fund doesn’t pick stocks. Its managers don’t have opinions on which indexes are best. It just tries to mirror the S&P 500 Index as closely as possible. And it does it for a tiny management fee.

Today, there are scores of index funds and ETFs that mirror all sorts of different market indices. If you want to buy “the market” or “stocks in general,” just plow some cash into one of the funds. Passive, hands-off investing has become the norm for scores of investors in the last five decades, becoming the “buy and hold” strategy that most people know about.

So, if passive index investing is so great, why would you ever want to pick a stock again? Well, it’s because the hands-off, buy and hold approach isn’t so great after all.

Today, I want to bust some myths about everyone’s favorite way to invest…

For starters, there’s no such thing as a “buy and hold forever” approach (no matter what certain octogenarian billionaires in Omaha may claim). That’s because everyone who’s ever tried it is broke.

Even though everyone in the industry calls index investing “passive,” there’s really nothing passive about it. The Dow, the S&P, the Russell — they’re all active investment strategies. Don’t follow?

Of all of the stocks that were part of the original Dow Jones Industrial Average, only General Electric is still a part of the index. All told, the index has changed 48 times since it was created — all of those changes being picked by the editors of The Wall Street Journal. That means that the Dow is, in fact, an active stock-picking index.

It’s how they unloaded garbage names like Kodak, Chrysler, and Woolworth when they hit the skids…

The S&P 500 is no different. S&P components are picked by a committee at Standard & Poor’s, who try to make the index mirror the 500 biggest stocks on the market. Since the rules on who makes it into the S&P 500 are largely based on who’s the biggest, stocks that fall get tossed out, and stocks that increase in value get added. So, in other words, the S&P committee is selling the losers and buying the winners. It’s the very reason why Apple (NASDAQ:AAPL) is a bigger chunk of the S&P 500 now, and Enron isn’t. We’ll get back to that in a minute.

The bottom line is this: passive investing doesn’t spare investors from the risks of stock picking. It just takes the stock picking off of portfolio managers’ plates and leaves it up to Dow and S&P. Clearly, that hasn’t worked very well lately. In the last 12 years, for example, the S&P 500 has actually lost just over 2%. So much for “buy and hold” always working out in the long-term.

But there is a different way to invest — a better way…

The key is in that phrase I mentioned from the S&P: selling losers and buying winners. It’s ironic, but the most successful long-term strategy any fundamental investor can point out is in essence a technical approach known as “trend following”.

The main idea behind trend following is simple: the market moves in big, long-term trends, and if you can identify them, you can ride them. It’s an approach that some of the most successful investors in history have used — and one you can use too.

Trend following can also avoid the pitfalls that index investors have struggled with over the past few years. You see, the S&P’s approach to trend following is crude at best. Since correlations between stocks in the S&P are very high, it’s not as effective at reducing risk as it could be. That’s why a purpose-built trend following approach makes so much more sense than all of this buy-and-hold brouhaha.

So, what would it look like?

For trend followers, there are basically two steps to figuring out what to buy: identifying when a trend begins and identifying when a trend ends. To do that, we don’t rely on emotion or opinion — instead, it’s critical to base any investment decisions on a set-in-stone system.

Today, we’ll construct a quick one.

Spotting a Trend Using Math

If you’re familiar with “technical analysis” at all, you’ve probably heard of a moving average. In short, it’s the average price of a stock over a set number of days. A moving average is a stellar indicator of trend — if it’s moving steadily higher, then we know that a stock is generally moving higher over the time period that we’ve set. More importantly, we can define moving averages mathematically, so, we’ll go ahead and use a moving average as our “trend indicator”.

For simplicity’s sake, we’ll apply it to just one investment: the SPDR S&P 500 ETF (NYSE:SPY).

So let’s create a quick rule. If SPY moves above the 300-day moving average (a long-term average that approximates a year’s worth of price data), we’ll buy. If it falls below the 300-day, we’ll sell. In real terms, that rule says that if SPY moves above the 300-day moving average, Mr. Market is entering an uptrend, and if it moves below, it’s entering a downtrend.

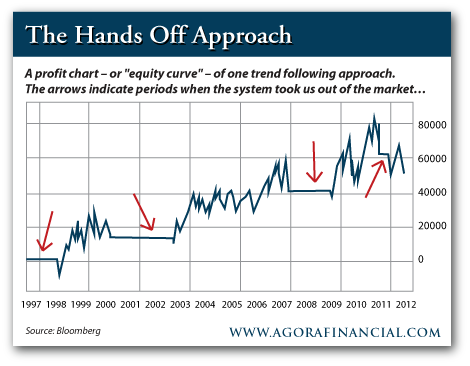

So, how would that simple strategy have fared over the last fifteen years? The chart below shows the hypothetical profit and loss of sitting back and letting that simple system trade for you:

All told, you’d end up with gains of 74.3% — nearly double the 40% and change that a buy and hold approach would have earned you. But there’s an even more exciting story there…

See the handful of flat lines (with red arrows pointing to them) over that period? Those are the times you’re out of the market because the system said “sell”. So you didn’t touch stocks for almost 2 years while the tech bubble was bursting, and you were out of the market for all of 2008! I think you can see just how dramatically this system reduced the risks of being an investor.

Because despite that “hands off” approach to investing, you still beat the market by a wide margin.

Remember, the rules we just made up are crude. By adding some extra simple short selling rules to the approach, our trend following system could have upped its total profits to 80.8%, and actually made substantial profits when the floor was falling out for everyone else in 2008.

Our crude trend following system produced a chart that’s hard to believe, especially when you consider the fact that it includes two of the biggest market crashes in most investors’ memories.

There’s a lot an investor can do to improve performance beyond what I’ve shown you here — adding individual stocks, more complex rules, or introducing statistical optimization are all things that can easily improve returns under a trend following system.

But the key here is the fact that following trends (and not trying to predict them) can fuel some incredible returns while smashing risks much lower than you’d see from a “buy and hold” approach.

Regards,

Jonas Elmerraji, CMT,

for The Daily Reckoning

USA Has Peaked as did Britain in 1914 & The Sun is Setting Rapidly on the American Empire

The one thing on this global tour that is pouring out of the seams is just how much the United States is seen as a dictator & bully to the rest of the world refusing to respect territorial jurisdiction. In every country I have visited, I have been embraced as an American Political Prisoner. Everyone can see we bought portfolios in Japan and Japanese companies were bleeding out of their eye sockets rather than being flush with billions in cash to speculate in hedge funds. The changing of transcripts by the judges has exposed to the world just how corrupt New York really is which is why the Facebook suits around the country were usurped and taken to NYC where the judges will protect the investment bankers involved. Because of this status, the discussions are even more frank than ever before. The audacity of the USA to threaten to seize any assets of a foreign company who does not report what an American is doing overseas is the greatest threat to international law since the days of Black Beard & Pirates.

I met a European who was married to an American who inherited money from her family and because she is American, no bank will accept her money despite the fact that she has lived in Europe for nearly 20 years. Americans have been thrown out of everywhere. Hedge funds will no longer deal with Americans even living in Europe. The damage to international capital flows is off the charts. This single law has wiped out whatever international trade advantages Americans once enjoyed.

This law has inspired real resentment of the United States internationally. Even Americans with safety deposit boxes in Switzerland were given 3 days to get out. There are no Americans left unless they have work permits. American Express will not issue a card to an American outside the United States without work permit status. USA policies of making everyone wait 1.5 to 2 hours at airports just to visit on a business trip and finger-printing travelers is way over the top. A old friend of mine was visiting from Canada. I went to pick her up at the airport. Immigration call me on my phone and asked if I spoke french. I couldn’t believe what they were doing. When I said she was Canadian, the response was she was still an alien.

The lowering of $10,000 to $3,000 as the reporting threshold on bank wires is just insane. We tried to wire funds to simply pay for the Bangkok WEC and the bank refused to accept it worried that they would have to prove that we were really just paying expenses rather than trying to hide money offshore despite the fact it was someone else’s account. Trying to do business internationally for Americans is becoming a real nightmare. The once land of the free & home of the brave has been transformed into George Orwell’s 1984 nightmare squared. Americans are now just economic slaves – property of the state no matter where they reside. Americans are being forced to resign citizenship just to survive.

Americans have become the most detested internationally as well as the most oppressed economically. You have no right to even resign your citizenship for they view you as the property of the state and they are entitled to future income even if you leave. Only Americans and Japanese are economic slaves taxed on worldwide income, not because you owe a “fair share” of services you receive, but because you were born as property of the state. This attitude is contributing to the Decline & Fall of the United States and indeed China will surpass the US as the Financial Capital of the World.In Asia, the US is becoming secondary as 40% of China’s imports are from Asia as a whole. China has been buying up farms in Australia. They are pushing for their currency to be considered reserve status in Asia.

While the US portrays China as corrupt in America they are just given titles – “lobbyists”! As for China violating human rights, just look at the Occupy Wall Street Crowd. The US never locks you up for what you say, they have 1 billion laws available to arrest you for something else.Freedom of Speech is an illusion. In our own case, we have documented written evidence that the government wanted Princeton Economics silenced. When another company wanted to rent the operation to keep the staff in place and the forecasting going, the Receiver Alan Cohen and Tancred Shiavoni of O.Melveny & Myers said they did not care if they offered $50 million in rent per year, the Institute would be closed unless I turned over the source code to the computer model over to them.

While the US portrays China as corrupt in America they are just given titles – “lobbyists”! As for China violating human rights, just look at the Occupy Wall Street Crowd. The US never locks you up for what you say, they have 1 billion laws available to arrest you for something else.Freedom of Speech is an illusion. In our own case, we have documented written evidence that the government wanted Princeton Economics silenced. When another company wanted to rent the operation to keep the staff in place and the forecasting going, the Receiver Alan Cohen and Tancred Shiavoni of O.Melveny & Myers said they did not care if they offered $50 million in rent per year, the Institute would be closed unless I turned over the source code to the computer model over to them.

The pepper spraying of students who were sitting down in protest is an illustration that America does not practice human rights any more than any other authoritarian government. If they do not like what you are saying, they will also take action under the pretense of some other law.

The pepper spraying of students who were sitting down in protest is an illustration that America does not practice human rights any more than any other authoritarian government. If they do not like what you are saying, they will also take action under the pretense of some other law.

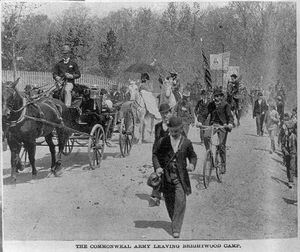

Coxey’s Army that marched on Washington due to the Panic of 1893 was broken up by arresting the leaders for walking on the grass. This was the march that was the inspiration for the Wizard of Oz complaining about the austerity of the gold standard (yellow brick road) and the Off to see the Wizard was Congress with the tin man being industry, the scarecrow agriculture, the cowardly lion was William Jennings Bryan.

Coxey’s Army that marched on Washington due to the Panic of 1893 was broken up by arresting the leaders for walking on the grass. This was the march that was the inspiration for the Wizard of Oz complaining about the austerity of the gold standard (yellow brick road) and the Off to see the Wizard was Congress with the tin man being industry, the scarecrow agriculture, the cowardly lion was William Jennings Bryan.

The veterans who marched on Washington during the Great Depression were  attacked by US troops that even killed children and saw US tanks rolling down the streets of Washington, DC. They were known as the Bonus Army and the abuse they suffered forced the government to issue the GI Bill for World War II because no one would trust their empty promises anymore.

attacked by US troops that even killed children and saw US tanks rolling down the streets of Washington, DC. They were known as the Bonus Army and the abuse they suffered forced the government to issue the GI Bill for World War II because no one would trust their empty promises anymore.

Now, even China has refused to buy US government bonds from NY bankers. The sun is setting very rapidly and the more power handed to the bureaucrats, the more rapid the demise of the United States will be. Yes it could be stopped. We need serious political reform and clean up the corruption. Even Edward I of England was forced to sack all the judges because of the abuse of legal corruption. Thus – history repeats continually.

This is part of the cycle where capital is starting to move away from PUBLIC investment and into the PRIVATE sector. But as long as the American press refuses to address the real issues, then nothing will change. Even respect for the American press has diminished worldwide. Here is a piece in the Guardian showing the undertone of the lack of respect that is centered around the USA press. Is it any wonder why we are in a PRIVATE wave with confidence shifting away from government? This is the catalyst that will force political change but not until the economy forces the issue. We are in the last stages of the collapse of Marxism. That began in 1989.95 and it should be a 26 year decline meaning 2015.75 is indeed where we may see the strong rise of a new third party movement based at last on economics rather than social issue nonsense. For in the end, two guys will be sleeping on a park bench after losing their homes and families. One will say – at least the gays can’t get married. The other will say – well those rich bastards can’t take their money overseas anymore. Sometimes we burn down the barn to get the mouse.

Does a 91% bullish reading makes sense for the Canadian dollar?

According to the latest Commitment of Traders Report for November 6th, speculators are positioned 91% long Canadian dollar futures (or short USD/CAD in the spot market); that is down 1% from the reading on October 39th. Does that seem high to you?