Timing & trends

Canada’s much-watched housing market is sending out mixed signals these days — even for analysts.

A spate of fresh data and yet one more market-cooling tweak from Ottawa last week has put one of the most important sectors in the Canadian economy, and the most important asset-source for most Canadians, on a kind of death watch.

That’s because while some of the data, such as home prices and starts, is pointing to the soothing “soft landing” that homeowners, economists, banks and politicians are fingers-crossed hoping for, others, like land purchases and building permits suggest the real message is: the crash is coming.

Last week, Statistics Canada reported that building permits in the residential sector fell 12.9 per cent in June, and permits for multi-unit dwellings — mostly condos — sank even further by 18.8 per cent.

Even more frightening, research conducted by RealNet Canada found that in some of the bigger markets — Toronto, Vancouver and Calgary — residential land investments for future home building has already crashed through the floor, plunging 51, 52 and 30 per cent respectively.

Solid sales, prices: calm before the storm?

Muddying the picture is that a new temperature reading of the housing market from the Canadian Real Estate Association (CREA) being released on Thursday is likely to show that home sales are doing just dandy and likely rose significantly in July, along with average home prices.

But David Madani of Capital Economics says it is the calm before the storm.

Or as he put it in a note to clients — “homebuilders are having a Wile E. Coyote moment” as when the perpetually ill-starred cartoon character realizes he has overshot the cliff and looks down to see nothing but air under his feet.

“It’s astonishing to me that people are not picking up on this. If you see volumes crash and prices still rising, you shouldn’t be thinking everything is fine, you should see that as a warning sign,” he says.

“Here in Toronto, if you look at new home sales, we’re at near-record lows. If you think about the implication this has for home building, new construction and all the jobs that go along with that, this is quite startling.”

Some of that is yesterday’s news.

Housing sales have recently begun trending upwards again — even in Toronto and Vancouver — after almost a year’s slump brought on by Ottawa’s decision to apply the brakes on mortgages last July.

Bank of Montreal chief economist Doug Porter predicts next week’s report from CREA will show a 10 per cent surge in home sales from a year ago. He bases that on already reported data from big centres such as Toronto, Vancouver, Calgary and Edmonton, which all had boffo months, although there was a drawdown in Montreal and Ottawa.

Depending on whether you are an optimist or pessimist, this is either evidence of a soft or no landing, or a red flashing light.

The government’s decision last week to put a limit on the issuing of mortgaged-backed securities is an indication that Ottawa views this development as anything but reassuring.

“Arguably this is the second last thing anyone wanted to see in the housing sector, a re-acceleration,” Porter said. “That last thing people wanted to see was a hard landing.”

Good news like strong home sales is potentially bad, says Porter, on the theory that Canadians are already drunk on housing, so imbibing more means the inevitable hangover will be all that much worse.

Benjamin Tal, CIBC’s housing expert and deputy chief economist, wouldn’t go as far as Madani in predicting a price correction of as much as 25 per cent, but he agrees the time has come for caution.

“If I was a speculator, I would not be buying,” he says. “The days of flipping houses and speculating on increasing prices are clearly coming to a close. We are in the ninth inning of this boom.”

It’s been quite a ride. From January 2006 to June 2013, average home prices have risen from about $256,000 to almost $389,000, despite very low inflation and a little hiccup called the Great Recession. And, household debt from buying mortgages has ballooned to record levels above 160 per cent of disposable income.

The ride must end, agrees Tal, the only issue being is will it crash or simply coast.

So far, the consensus is on a slow coast, although the very real possibility of a hard crash has caused the Bank of Canada to put housing at the top of the list of domestic risks for the economy.

Housing bust would trigger chain reaction

While housing constitutes only about seven per cent of the economy, the number underscores its impact.

Like a domino, if it topples, it triggers a chain reaction. Construction jobs are lost, household net worth diminishes, confidence drops and consumers start cutting back on other spending. On top of that, with families already highly indebted, defaults will almost certainly increase and lenders, such as banks, could find themselves taking enormous losses, dropping equity values, leading to tighter credit and slower growth. And on it goes in what economists call a re-inforcing negative feed-back loop.

“If we were indeed to have a serious setback in housing it would have pretty wide implications on the economy,” says BMO’s Porter.

The consensus view is still that the market will slowly decelerate rather than brake hard, if only because the economy continues to grow, employment is holding up and most critically with interest rates at super-low levels, borrowing is cheap.

But even Tal, who is in the soft-landing camp, acknowledges the danger. The housing market could stand to take a breather, he says.

That may be a good thing, given the exposure young people face in trying to buy even a starter home in cities like Toronto and Vancouver.

“I think the rental market will be stronger (going forward),” he predicts.

“We in Canada, especially in big cities, are fixated on buying a house the moment you graduate from university or get married. That’s not the case in many other cities in the world, there young people don’t think it a crime to rent for a time.”

Emerging Markets Decline as America Leads Growth

The US Economy is emerging as the center of economic growth in the world. US growth in the latest readings shows an annual 1.7% growth rate while Japan’s economy advanced at 2.6% due to the decline in the yen as Investors in Emerging Markets have seen things get much worse right down to rising civil unrest in Brazil. Euro may show some moderate growth only due to the decline in the euro last quarter.

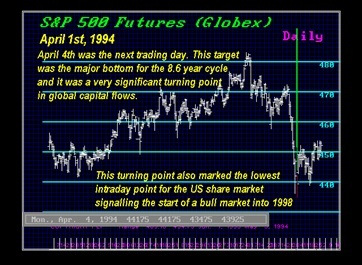

The developed world accounts for more growth in the $74 trillion global economy than the developing world this is similar to the position in 1994.25 when the US began to rise drawing in capital that ultimately led to the Asian Currency Crisis in 1997. The stars are in the right position for a strong US equity rally into 2015.75.

….also from Martin:

The financial system as we knew it is changing. It will no longer be the same and the days of proprietary trading are numbered. Their cycle of proprietary trading has come to an end and going forward, we will see how hard these banker will fall. This reminds me of Margaret Thatcher who had an instinctive gut feeling about cycles when she told me John Major and the conservatives would lose power long before there were any polls. She said to me when I asked her why: “It’s just Time”.

….read the whole article HERE

It is the worlds smallest country with the most billionaires per capita, where a 4 bedroom property with cost you about $26 million.

….look at this short 1:40 video of a country that has no income tax either.

There is more evidence that the Federal Reserve is falling out of love with asset purchases.

Economists at the San Francisco Fed Bank released a paper on Monday estimating that asset purchases, also known as quantitative easing, add only “a moderate boost” to economic growth.

And that boost itself is dicey, as it really depends on the central bank promising not to raise short-term interest rates, the study found.

The economic letter, written by Vasco Curdia and Andrea Ferrero, senior economists at the San Francisco regional bank, focused on the Fed’s second round of asset purchases: $600 billion of long-term Treasurys purchased between November 2010 and June 2011. The economists said the purchases added about 0.13 percentage point to real GDP growth.

And without the guidance from the Fed that rates would be held close to zero, QE2 would only have added 0.04 percentage point to growth, the economists found.

There was no discussion of the cost of QE2 in the paper.

The Fed is currently buying $85 billion a month in Treasurys and mortgage related assets. It has signaled it wants to pull back the stimulus. Charles Evans, the president of the Chicago Fed, estimated that the central bank will buy $1.2 trillion of assets once the third round of the program is completed.

The study fits with the view of some monetary policy experts who argue that asset purchases are really just “earnest money,” or a signal to markets that the Fed is going to keep interest rates low for longer. In other words, while the Fed is buying assets, it won’t be raising rates.

According to this view, once the Fed starts to taper asset purchases, the market will quickly turn its attention to when the Fed will hike rates.

The study itself concludes: ”Communication about when the Fed will begin to raise the federal funds rate from its near-zero level will be more important than signals about the precise timing of the end of QE3.”