Mike's Content

Our apologies if you were not able to login for the 1st MoneyTalks LIVE webinar after the show on Saturday. We will look to improve our login system to avoid problems in the future.

“Ever since I started Dow Theory Letters (Richard is 88 & began publishing in 1958) I’ve been extolling the magic of compounding. But how about the magic of compounding in reverse along with rising interest rates? Below we see the widely-followed TLT fund, and sadly, it’s in a distinct downtrend. Declining bonds mean rising interest rates, and as the government rolls over its monstrous and compounding debt, the situations becomes increasingly impossible to manage.

Question – where is the government going to get the additional money needed to manage the debt? Easy, the Treasury will just issue more bonds. And who will buy the bonds? Certainly not Japan or China, they are trying to unload their cache of Treasuries. Well, as usual, the Fed will buy the bonds — hasn’t the Fed been buying all the government’s debt for months? But as all this new money is being created, won’t this flatten the dollar and cause inflation? Maybe, but we’ll worry about that later — if it happens.

Why guess when we have charts that let us see exactly what is happening. Below we see the US dollar. The dollar has fallen below both its 50-day and 200-day moving averages. Recent weakness in the dollar is probably due to the mounting budget and debt concerns.

What about interest rates? Below we see the rate on the bellwether 10-Year Treasury Note. The rate has doubled since earlier this year. The normal rate, without QE, is thought to be about 4-5%. As these rates rise, it pushes the national debt to new highs — there’s nothing more powerful than compounding our debt with increasingly higher rates.

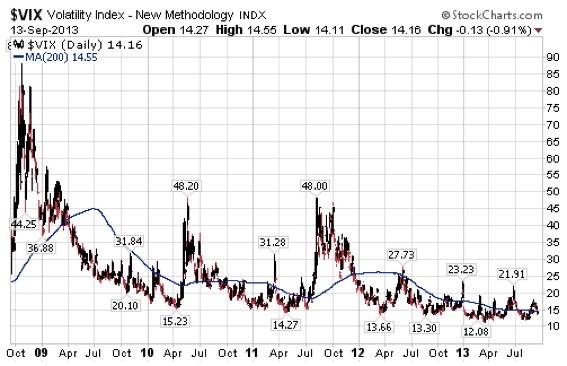

Below, we see VIX, the volatility index. The VIX has dropped to a super-low level, below 15. I wonder if this could be the calm before the storm.

Because it is so important, I’m including a P&F chart of silver below. Silver has (recently) rallied and is now ready to attack resistance starting at the 27 box. A bullish upside effort would arrive if silver can move into the 32 to 33 boxes. This could just be an exciting week!

Russell opinions — The institutions and pension funds need money — income or profits. There’s no place that’s offering safe income, so money managers are forced to go to the one place where there is upside activity, and that’s the stock market and more specifically the Dow. The concentrated buying in the Dow has propelled the Average to wonderland.

If you buy the Dow or the DIAs here you are buying on the thesis that you will be able to sell your shares at a higher price to a greater fool. You and I are not pressured to be in this market. Because of the current madness, a few well-known money managers have recently quit the business. I’m staying with it, but I’m offering fewer opinions and more charts. The charts allow me to tell my subscribers what’s happening and what has happened. As one advisor put it, “I’m not only unsure of where the market’s going, I’m not even sure of where it is.”

Ed Note: Popular Articles by Richard Russell:

Rich Man, Poor Man (The Power of Compounding)

Fixed Income and Interest Rates

About Richard Russell

Russell began publishing Dow Theory Letters in 1958, and he has been writing the Letters ever since (never once having skipped a Letter). Dow Theory Letters is the oldest service continuously written by one person in the business.

Russell gained wide recognition via a series of over 30 Dow Theory and technical articles that he wrote for Barron’s during the late-’50s through the ’90s. Through Barron’s and via word of mouth, he gained a wide following. Russell was the first (in 1960) to recommend gold stocks. He called the top of the 1949-’66 bull market. And almost to the day he called the bottom of the great 1972-’74 bear market, and the beginning of the great bull market which started in December 1974.

The Letters, published every three weeks, cover the US stock market, foreign markets, bonds, precious metals, commodities, economics –plus Russell’s widely-followed comments and observations and stock market philosophy.

In 1989 Russell took over Julian Snyder’s well-known advisory service, “International Moneyline”, a service which Mr. Synder ran from Switzerland. Then, in 1998 Russell took over the Zweig Forecast from famed market analyst, Martin Zweig. Russell has written articles and been quoted in such publications as Bloomberg magazine, Barron’s, Time, Newsweek, Money Magazine, the Wall Street Journal, the New York Times, Reuters, and others. Subscribers to Dow Theory Letters number over 12,000, hailing from all 50 states and dozens of overseas counties.

A native New Yorker (born in 1924) Russell has lived through depressions and booms, through good times and bad, through war and peace. He was educated at Rutgers and received his BA at NYU. Russell flew as a combat bombardier on B-25 Mitchell Bombers with the 12th Air Force during World War II.

One of the favorite features of the Letter is Russell’s daily Primary Trend Index (PTI), which is a proprietary index which has been included in the Letters since 1971. The PTI has been an amazingly accurate and useful guide to the trend of the market, and it often actually differs with Russell’s opinions. But Russell always defers to his PTI. Says Russell, “The PTI is a lot smarter than I am. It’s a great ego-deflator, as far as I’m concerned, and I’ve learned never to fight it.”

Letters are published and mailed every three weeks. We offer a TRIAL (two consecutive up-to-date issues) for $1.00 (same price that was originally charged in 1958). Trials, please one time only. Mail your $1.00 check to: Dow Theory Letters, PO Box 1759, La Jolla, CA 92038 (annual cost of a subscription is $300, tax deductible if ordered through your business).

IMPORTANT: As an added plus for subscribers, the latest Primary Trend Index (PTI) figure for the day will be posted on our web site — posting will take place a few hours after the close of the market. Also included will be Russell’s comments and observations on the day’s action along with critical market data. Each subscriber will be issued a private user name and password for entrance to the members area of the website.

Investors Intelligence is the organization that monitors almost ALL market letters and then releases their widely-followed “percentage of bullish or bearish advisory services.” This is what Investors Intelligence says about Richard Russell’s Dow Theory Letters: “Richard Russell is by far the most interesting writer of all the services we get.” Feb. 19, 1999.

Below are two of the most widely read articles published by Dow Theory Letters over the past 40 years. Request for these pieces have been received from dozens of organizations. Click on the titles to read the articles.

“Rich Man, Poor Man (The Power of Compounding)“

Quotable

“If we become increasingly humble about how little we know, we may be more eager to search.”

Sir John Templeton

I’m not sure what the Fed will share with us tomorrow. But I am looking for a bounce to 136^32 on the 30-yr T-bond futures. Thus, risking two points to make five isn’t a terrible risk/reward for a short-term trade.

Regards,

Jack Crooks

Black Swan Capital, www.blackswantrading.com, info@blackswantrading.com

Debt crisis is not over

Despite the fact that Syria’s been on the front burner you should be aware that the risk in the financial system that’s dominated news for the last five years is absolutely not over. I mean, trying to paper over the sovereign debt crisis by adding more debt is not a solution. It was simply a short-term band-aid.

Every Western nation including Canada has added to record debt levels since the crisis began. All that has happened is that in the absence of political leadership, central banks stepped in with record-low interest rates and programs designed to put massive amounts of freshly minted money into the system. Meanwhile the escalating debt necessitates higher government revenues, spurring higher levels of taxation which in turn reduces growth in the private sector.

France is the latest country to admit the shortcomings of that approach as their deficit continues higher than forecast, while unemployment grows and the economy stagnates. Since the crisis-hit the Federal Reserve has created over $10 trillion dollars, the US federal debt has hit record highs, the recovery is the worst on record in terms of full-time job growth and now there’s some disconcerting signs that even the anemic recovery is slowing.

Here is the point. There is still major risk in the financial system. Any investment that is heavily leveraged is vulnerable to sharp price declines. If borrowed money has been what led the prices higher then de-leveraging can bring them back down with a vengeance. We’ve seen it in real estate in many parts of the world. In the stock market and recently in gold.

Bad news for the market as one of the most reliable contrary indicators signals trouble – Time Magazine is bullish.

Time Magazine’s Cover story is “How Wall Street Won” with a picture of a bull on the cover??? As Dennis Gartman says, “Time in the past has called the highs and the lows of the stock market far, far too often by being bullish at the highs and bearish at the lows and this cover gives us reason to pause…very,very real reason.”