Energy & Commodities

The energy content of uranium is 3 million times greater than Fossil Fuel. Placing this in perspective, the energy in three tons of coal can be found in around just one gram of uranium. That’s value that is hard to ignore.

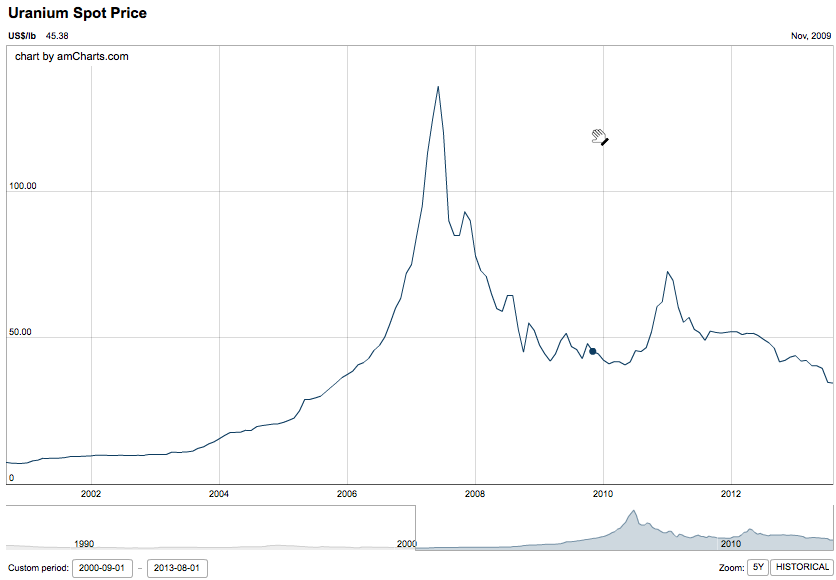

From the chart below one certainly wouldn’t be buying Uranium at top prices. Additionally it is currently very unpopular since the Fukushima incident fitting that investment maxim to buy opposite to the crowd to make money. Which is not easy to do because we are programmed to listen to the people around us, or influenced by it. But it is the way to go.

Further as James Dines told Michael this weekend, “Fukushima occurred not because of the plant, it occurred because they were too stingy to put a high enough wall up in front of it to prevent against a tsunami. That’s what caused the trouble.”

Tom Vulcan takes a two part look at Uranium below – Ed

Uranium Prices May Be Depressed Now, But Long-Term Fundamentals Paint A Brighter Picture

Post-Fukushima, Nuclear Power Alive & Kicking, But Quickly Losing Market Share

…..on Options Expiry as Hong Kong Prepares for Golden Week.

WHOLESALE gold held unchanged in London on Wednesday, moving around last week’s finish of $1325 per ounce as world stock markets and the US Dollar also reversed yesterday’s small moves.

Silver traded in a 15-cent range either side of $21.70 per ounce.

Major government bonds were flat. Crude oil and industrial commodities ticked higher.

“It will likely be a very quiet few days,” reckons brokerage INTL FCStone in a note, “at least until Friday, when we get some end-of-the-quarter book squaring.”

October gold options contracts on the US Comex expire today.

“We remain range bound,” agrees brokers Marex, “but the drop down towards 1300 yesterday and the subsequent good recovery will have deterred the bears for the time being.”

However, “speculation that the Feds will begin tapering as early as next month,” counters Commerzbank, “continues to pressure the yellow metal.”

London’s wholesale precious metals trading is likely to be subdued early next week, as trade group the London Bullion Market Association holds its annual conference from Sunday to Tuesday, this year in Rome.

China’s long Golden Week holidays are also likely to dent import demand from stockists, dealers report.

Ahead of Golden Week, the government of Hong Kong – a major tourist destination for mainland residents during these annual holidays – has banned “forced shopping” trips, says the South China Morning Post.

Cut-price flights and hotel rooms were previously subsidized by kick-backs from stores to tour operators who brought in large groups, the paper explains.

Almost one million mainland tourists went to Hong Kong in Golden Week 2012, theWall Street Journal reported last October, “up nearly 25%” from the prior year. But sales of watches and gold jewelry “actually dropped” compared with 2011.

Gold prices for Chinese consumers have now fallen 25% since Golden Week 2012.

“We’re not seeing too much physical demand around,” Bloomberg today quotes senior vice-president Afshin Nabavi at Swiss refiner MKS in Geneva.

Elsewhere the newswire reports that for iPhone manufacturer Apple Inc., “bringing together China and gold is a recipe for success” after the US company reportedly asked its suppliers last week to increase production of “gold-colored” plastic casings for the new 5S handset.

Forbes says the same of gold-colored iPhone sales in India – now widely expected to take second place to China in physical gold demand this year.

“An assistant of the Punjab chief minister called me and asked for five gold-colored iPhones,” the magazine quotes a distributor for Apple products in the affluent Indian region.

Across in Thailand, meantime, YLG Bullion International Co. – the largest gold importer into the world’s 6th largest gold-buying nation last year – says its gold inflows will double in 2013 thanks to the surge in demand caused by gold’s 25% price drop.

YLG is also one of seven Thai companies calling for the launch of a formal bullion-contract exchange, the Bangkok Post reports, aiming to “enhance Thailand as a regional gold trading hub.”

Adrian Ash

Gold price chart, no delay | Buy gold online

Adrian Ash is head of research at BullionVault, the secure, low-cost gold and silver market for private investors online, where you can fully allocated bullion already vaulted in your choice of London, New York, Singapore, Toronto or Zurich for just 0.5% commission.

(c) BullionVault 2013

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

Quotable

“Never in history has hyperinflation resulted from governments monetizing domestic spending.”

Michael Hudson

Commentary & Analysis

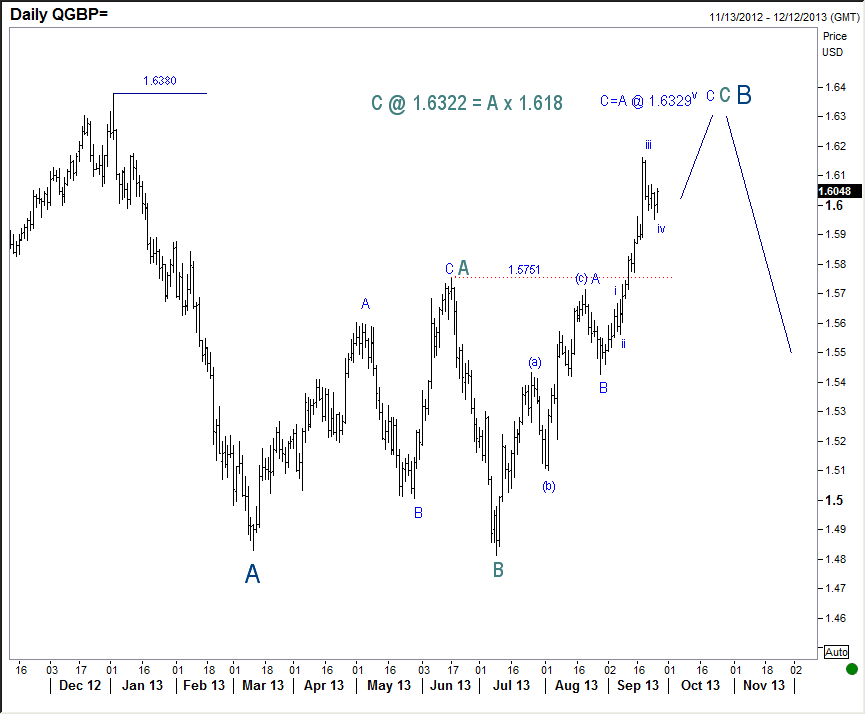

GBP/USD to 1.6300? Three rationales…

1) Much stronger than expected (by me) rebound in the UK economy will likely positively impact the market view of Bank of England monetary policy going forward, i.e. the rationale that more stimulus would be needed to ensure a recovery is now in question—that is GBP/USD positive.

2) Still negative British pound positioning by specs in CME futures per the latest Commitment of Traders report; however, this is clearly conversion flow from the prior week as British pound short positioning fell by 20,653 contracts.

3) Technically it appears at least one more thrust higher is in order.

Please click here for a view video update [shared yesterday with BSFX members]

Regards,

Jack Crooks

Black Swan Capital

www.blackswantrading.com, info@blackswantrading.com

Sign-up for Jack’s Free Currency Currents HERE (enter email on the upper right)

Sales of new single-family houses in August 2013 were at a seasonally adjusted annual rate of 421,000, according

This is 7.9 percent above the revised July rate of 390,000 and is 12.6 percent above the August

2012 estimate of 374,000.

Drew Zimmerman

Investment & Commodities/Futures Advisor

604-664-2842 – Direct

604 664 2900 – Main

604 664 2666 – Fax

800 810 7022 – Toll Free