Quotable

“Never in history has hyperinflation resulted from governments monetizing domestic spending.”

Michael Hudson

Commentary & Analysis

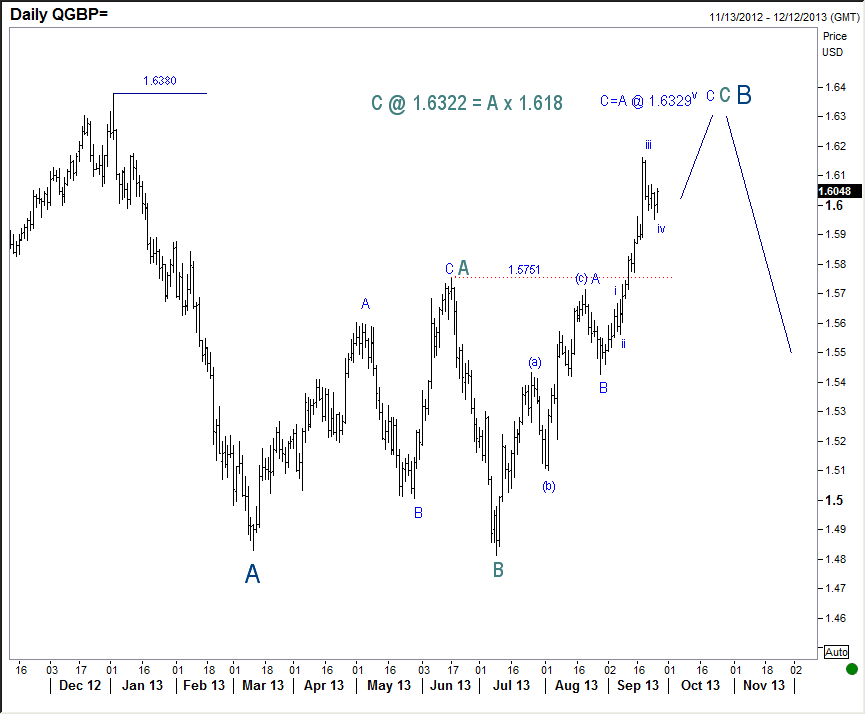

GBP/USD to 1.6300? Three rationales…

1) Much stronger than expected (by me) rebound in the UK economy will likely positively impact the market view of Bank of England monetary policy going forward, i.e. the rationale that more stimulus would be needed to ensure a recovery is now in question—that is GBP/USD positive.

2) Still negative British pound positioning by specs in CME futures per the latest Commitment of Traders report; however, this is clearly conversion flow from the prior week as British pound short positioning fell by 20,653 contracts.

3) Technically it appears at least one more thrust higher is in order.

Please click here for a view video update [shared yesterday with BSFX members]

Regards,

Jack Crooks

Black Swan Capital

www.blackswantrading.com, info@blackswantrading.com

Sign-up for Jack’s Free Currency Currents HERE (enter email on the upper right)