Energy & Commodities

Proving that idiocy truly has no bounds, Spain issued a “royal decree” taxing sunlight gatherers. The state threatens fines as much as 30 million euros for those who illegally gather sunlight without paying a tax.

Proving that idiocy truly has no bounds, Spain issued a “royal decree” taxing sunlight gatherers. The state threatens fines as much as 30 million euros for those who illegally gather sunlight without paying a tax.

The tax is just enough to make sure that homeowners cannot gather and store solar energy cheaper than state-sponsored providers.

Via Mish-modified Google Translate from Energias Renovables, please consider Photovoltaic Sector, Stunned

The Secretary of State for Energy, Alberto Nadal, signed a draft royal decree in which consumption taxes are levied on those who want to start solar power systems on their rooftops. The tax, labeled a “backup toll” is high enough to ensure that it will be cheaper to keep buying energy from current providers.

Spain Privatizes the Sun

Via Google translate from El Pais, please consider Spain Privatizes The Sun

If you get caught collecting photons of sunlight for your own use, you can be fined as much as 30 million euros.

If you were thinking the best energy option was to buy some solar panels that were down 80% in price, you can forget about it.

“Of all the possible scenarios, this is the worst,” said José Donoso, president of the Spanish Photovoltaic Union (UNEF), which represents 85% of the sector’s activity.

Before the decree it took 12 years to recover the investment in a residential installation of 2.4 kilowatts of power. Following the decree, it will take an additional 23 years according to estimates by UNEF.

Petition of the Candle Makers Revisited

And so the “Petition of the Candle Makers” comes to pass.

I have written about the “petition” on many occasions, but here is the latest reference: Extremely Difficult to Keep Up With Economic Stupidity

Reflections on “Unfair Competition”

Corporations always consider it “unfair” when any other company can do things faster, smarter, or cheaper than they can. The buggy whip industry once protested cars.

Today, land-line telecom companies have to compete with wireless and they don’t like it. Now, we see protests about VOIP (voice over internet protocol).

Technology marches on. But France does not like it. The French solution is to tax Skype because it has an “unfair advantage“.

This is an age-old unwinnable argument.

Petition of the Candle Makers

The ultimate irony is France’s preposterous “unfair advantage” argument was lampooned by French economist Frederic Bastiat back in 1845 when he penned ‘Petition of the Candle Makers‘.

In his article, candle makers were incensed that the light of the sun could be had for free. The sun’s unfair trade advantage was to the “detriment of fair industries” who could not compete against the sun’s price.

Something had to be done to “shut off as much as possible, all access to natural light, and thereby create a need for artificial light” so that “industry in France will encouraged”.

The moral to this story is “Don’t propose something purposefully stupid hoping to make a point. Some idiot might actually think it’s a good idea and do it”.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com

Read more at http://globaleconomicanalysis.blogspot.com/2013/07/spain-levies-consumption-tax-on-sunlight.html#k7liqm6ZudIqHw0F.99

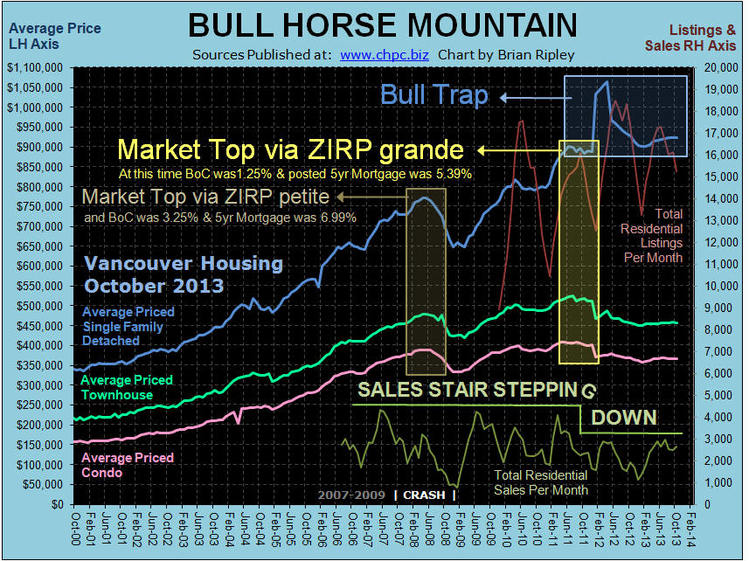

Notice on the chart above that during the labelled periods ZIRP grande and ZIRP petite, all three Vancouver residential housing sectors sold off in price and total number of residential sales. A significant difference was that during ZIRP grande, single family detached housing diverged from the whole market and produced a false trend change signal and went on to zoom into the blow off phase adding another 20% to the price which has mostly evaporated.

….whole article HERE

Too Damn Bullish

- Sentiment extremes flash warning signs

- Sleepwalking investors are finally buying

- Plus: What’s price telling us right now?

The individual investor is back. And he’s too damn bullish, according to about 5,000 reports I stumbled upon over the weekend.

In fact, the “everyone’s too bullish” theme is boiling over into the workweek.

“Stocks Regain Broad Appeal” reads the headline splashed across the front page of the Wall Street Journal this morning…

Of course, stories like this one are filled with quotes from Ma and Pa Investor who just received their third quarter statements in the mail. After sleepwalking through the first four years of this market rally, they’re finally ready to buy in now that they see those always-elusive market gains coming back to life.

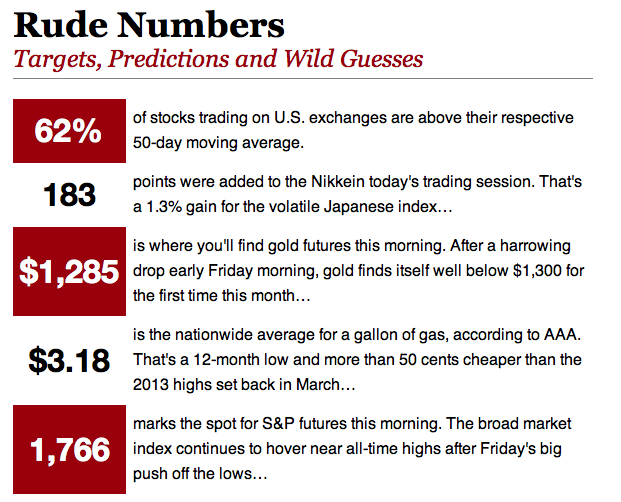

Let’s check the stats to find out just where the super-bulls stand:

“A particularly worrisome [measure] is the Investors Intelligence gauge of adviser sentiment. Its last reading showed that 55.2% of respondents were bullish and just 15.6% bearish, tying the highest difference between the two this year,” reads yet another WSJ report. “The last time the gap was bigger was April 8, 2011, which preceded the sharpest stock-market correction of the current bull market.”

Yikes.

On the other hand, there’s also evidence that investors are getting cautious as the broad market reaches toward new highs.

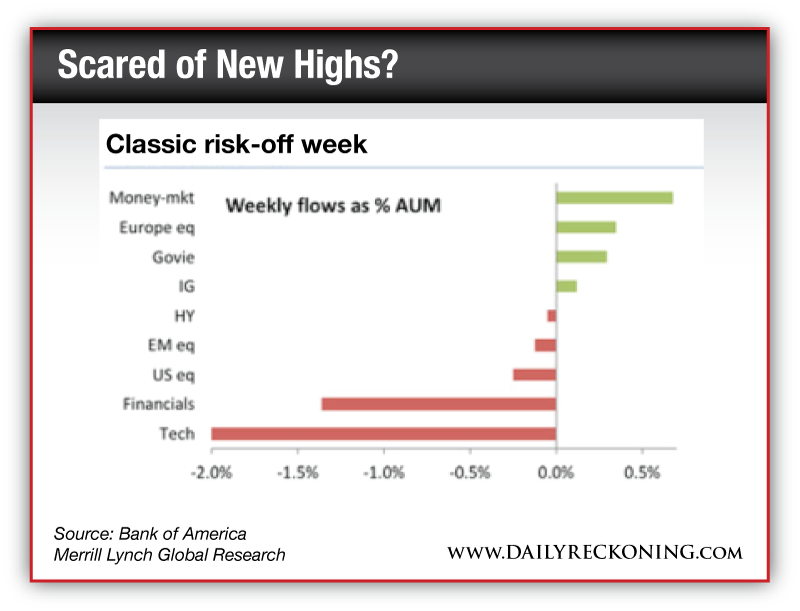

According to Bank of America Merrill Lynch Global Research, investors pulled $7.5 billion from U.S. equity funds last week. Financial and tech names lost the most coin as investors fled to money market funds…

While more investors are embracing the stock market as this year’s historic rally continues to unfold, there’s still a healthy amount of fear out there.

Yes, our end-of-year momentum rally was put on hold late last week. But strong buying Friday proves we’re still in a “buy the dips” market for now. Sentiment extremes could continue to rattle the market as we head into the final stretch of 2013. But until price breaks down, the benefit of the doubt belongs to the rally…

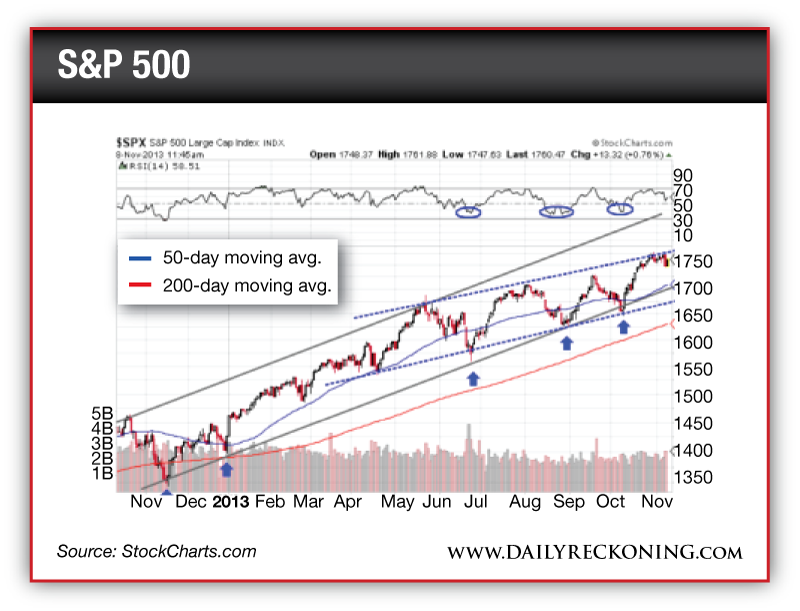

“In the chart above, I’ve annotated the current long-term uptrend in grey,” Jonas continues. “But there’s another uptrend in play that’s marked off by the dashed blue trendlines. So, which one is the ‘correct’ uptrend for stocks? Well, both of them are right now…

“The fact that Mr. Market is hitting his head on resistance at that dashed line definitely gives me more confidence in its ability to hold the S&P’s price action this fall. But we’ll really see which of the two trends wins out on the next move back down to support.”

Right now, Jonas is patiently stalking a new trade. Join him today so you won’t miss his next potentially profitable move…

[Ed. Note: Send your feedback here: rude@agorafinancial.com – and follow me on Twitter: @GregGuenthner]

P.S. Starting November 18th we’ll be delivering the Rude Awakening to you from a different email address: rude@agorafinancial.com. To be sure you won’t miss a single issue, take the time to whitelist this address right now…

And of course, we always welcome feedback from our readers. If you have any questions about this free subscription upgrade, send us an email atrude@agorafinancial.com.

“Behind every great fortune there is a crime,” said Balzac. Before the age of capitalism – which gave people the means to build their fortunes without taking anything away from others – that was largely true.

“Behind every great fortune there is a crime,” said Balzac. Before the age of capitalism – which gave people the means to build their fortunes without taking anything away from others – that was largely true.

So, what lay behind the fortune which Anthony van Sallee used to buy up much of Long Island, New York, in the 17th century: larceny, murder, slavery?

All of the above. This ancestor to the Vanderbilts… to the Whitneys… and through their mother to our own children was, in the language of Baltimore’s street life, “one mean motherf*****.”

What did he do? Where was he from? The name gives us a clue…

The “van” part is Dutch. Like most of New York’s early settlers, he carried the “van” which means “of” or “from” to tell us that he was from Sallee.

But where is that? Ah. Check the map. You will find no Sallee anywhere near Amsterdam or Liege. In fact, it is not to be found anywhere in Europe. Instead, it is a city in North Africa. On what was known as the Barbary Coast, the center of the white slave trade.

What follows is a discussion of involuntary servitude, capitalism and how to explain it to a hundred or so drunken Irishmen crammed into the back of a Kilkenny bar…

Travel does not always take you where you want to go or where you expected to be. But you often end up where you ought to have gone in the first place.

A recent trip took us to Kilkenny, Ireland, where we were to attend an economics festival called Kilkenomics, which can be loosely described as “Davos with jokes” or, perhaps more pertinently, as “Davos without the hookers.”

In fact, it was not much like Davos in any way, except that a few people with PhDs in economics tried to tell others what to do.

First, Kilkenny has little in common with Davos. The former is a tiny, quaint, medieval Irish city. The latter is a chic resort in the Swiss Alps.

Second, the focus of the discussion at Kilkenomics was not on how to improve the world, but on how to give the limping Irish economy a boost.

Third, the conference organizer – one of Ireland’s best-known and most savvy economists, David McWilliams – did not invite Janet Yellen or Paul Krugman. Instead, he invited your editor. (We took that as a sign of desperation. Or else there is something wrong with him. As a precaution, we avoided the tap water.)

Kilkenny is a charmingly Irish city. There is a pub on every corner and two or three down the street. A man in need of another pint has only to haul himself a few steps in any direction.

Even a few steps were too much for a couple of the girls we ran into on Saturday. They were dressed in the latest fashion for fat girls: tight white dresses cut off just below the crotch… and awkwardly balanced on high platform shoes (“arse-raisers” in the vernacular).

It is hard enough to walk on stilts when you are sober. After three hours in Cleere’s bar, it is practically impossible. Coming out onto the street, they had scarcely gone three steps before they began listing dangerously. One caught a light-post and steadied herself. The other, no public utility within reach, sank to the street. There she lay, on the cobblestones, as we stepped over her.

We had just come from a discussion with economists. Every economist knows that people always act in their own rational self-interest. Since we couldn’t figure out any way in which the girl could benefit from laying in the middle of the street – in the rain… in a party dress hiked up to the very edge of decency – the girl could not exist.

Inside Cleere’s, the discussion had been on the nature of capitalism. How could it be kept on the straight and narrow? This was the question we were meant to address. But the crowd had already been drinking for hours before we began. No two people had the same idea about what capitalism actually was. And our opponent was as well prepared as we with persuasive air.

“These dreamers… these idealists… imagine a perfect world of commerce, invention, and freedom,” he began, pointing in our direction.

“But it doesn’t work that way. In practice, they get a world where money talks… and it tells us all what to do. They preached deregulation… and brought about the worst financial crisis since the Great Depression.

“They’re always complaining about the government, but if it were not for the government this crisis would have turned into another Great Depression. Without the government, we’d all be completely unprotected against these greedy, rapacious rich people.

“Besides, they would be nothing without the government. The government provides the infrastructure. It provides a system of laws and justice that makes it possible for them to earn their fortunes.

“Government is the source of major innovations, too. It wasn’t the free market, for example, that developed the Internet; it was the government. Private companies were offered the opportunity to develop it themselves. They refused. Because they couldn’t figure out how to make a profit on it.

“So I say, stop bellyaching about the government. Stop pretending that the free market is the source of all good things. And sit down and figure out how we can get these banksters off our backs… and make this mixed system, of capitalism with some measure of state control, work better.”

This opening salvo drew a warm applause. He had scored a direct hit amidships. He had the drunks on his side. We hadn’t said a word and we were already taking on water.

More tomorrow…

Regards,

Bill