Stocks & Equities

It was all going according to plan. POMO lifted the S&P 500 instantly 7 points at 1015ET back to unchanged and the mainstream media could discuss the fact that stocks are “off the lows.” Then (admittedly non-voting member) uber-dove Dennis Lockhart hit the wires with some oddly hawkish commentary: *LOCKHART SAYS TAPERING ‘COULD VERY WELL TAKE PLACE’ NEXT MONTH *LOCKHART SAYS QE NOT MEANT TO BE ‘PERMANENT FIXTURE’ OF POLICY Which sent stocks to the lows of the day … full article

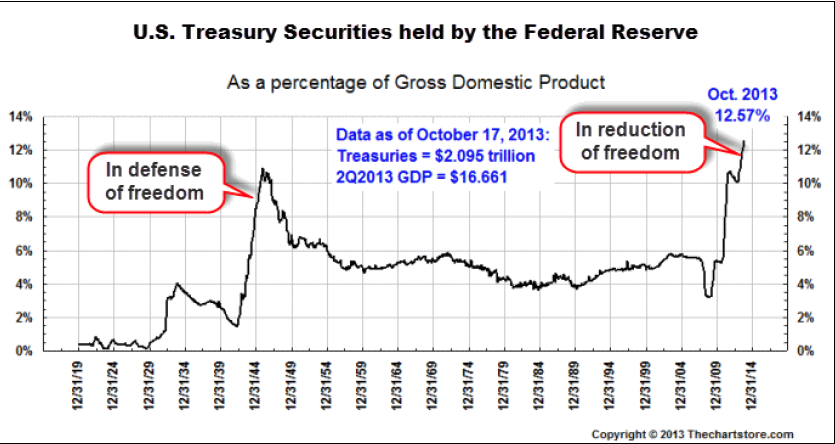

– World War II was prosecuted in the defense of freedom.

– Extraordinary funding measures were justifiable.

– The increase was from 1.8% to 11%, or when rounded 10 points.

– Freedom was restored where possible.

– It has since been a challenge to ambitious governments.

– The recent increase has been from 3.3% to 12.6%, which rounds out to 9 points.

– Essentially, this has been to fund the expansion of the state for the state itself.

– Ironically, this has been part of a relentless attempt to extinguish freedom.

From Bob Hoye: By way of “proof of the pudding”, we will provide you with a FREE TRIAL SUBSCRIPTION.

Opinions in this report are solely those of the author. The information herein was obtained from various sources; however we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized.

Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures contracts. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this report. In addition, investors in securities such as ADRs, whose values are influenced by the currency of the underlying security, effectively assume currency risk. Moreover, from time to time, members of the Institutional Advisors team may be long or short positions discussed in our publications.

BOB HOYE, INSTITUTIONAL ADVISORS EMAIL bhoye.institutionaladvisors@telus.net WEBSITE www.institutionaladvisors.com

Equity indices have climbed off their lows, but they continue to sport slim losses. The Russell 2000 (-0.2%) is the weakest-performing index while the Dow hovers just below its flat line.

Most sectors remain in negative territory, but technology (+0.3%) has joined the telecom services sector (+0.4%) in the green. Chipmakers have contributed to the rebound as the PHLX Semiconductor Index trades higher by 0.3%.

TORONTO (Reuters) – It would be foolish for Canadian rules on foreign investment to be too clear because Ottawa needs a certain amount of discretion when considering takeover bids, Prime Minister Stephen Harper said on Friday. Full Article