Currency

Perhaps you saw my comments last week BEFORE the European Central Bank surprised the markets with an interest rate cut. After seeing the inflation data come in weak, I asked:

Does that mean another LTRO (Long-Term Refinancing Operation) is right around the corner, the same corner around which the eurozone economy will supposedly turn?

Doubtful, at this stage. But don’t abandon the idea completely. If things get nasty, the European Central Bank will need to do something to help re-recapitalize a financial system built on crummy collateral.

The ECB is now moving to counteract, according to Mario Draghi’s post-meeting press conference, a “prolonged period of low inflation.”

And another ECB guy, Ewald Nowotny, is singing the same tune. Nowotny sees low inflation for some time. He also thinks stagflation is a greater risk than inflation. And another ECB guy, Jorg Asmussen, is so cautious he wouldn’t rule out negative interest rates.

Does any of this really surprise us?

If it does, it shouldn’t.

Let me offer you part of an idea we shared with our Global Investor members two weeks ago, titled:Neuroscience warns of financial market risks

Let us refer you to this Wired.co.uk article that summarizes a something else that neuroscientists are working on – it could explain, and even help anticipate, what would generate a coming collapse in risk appetite and risk markets.

“According to Lionel Barnett, lead author on the paper, they found the fact that all the elements “causally influence each other” to be of most importance. It means we must first identify all the parts of a system, then assess the relationship between individual nodes and then their causal effect on the whole. In doing so, we can find out when the fate of a node is dependant on its own behaviour because it behaves so differently from the others, and when its fate is dependant on all other nodes.

“”The dynamics of complex systems — like the brain and the economy — depend on how their elements causally influence each other; in other words, how information flows between them,” said Barnett.”

Now let us try our best to make this relevant …

Based on our shallow, yet appreciative, understanding of behavioral finance, financial markets are driven largely by sentiment. Herd mentality, for example, is one way of categorizing such sentiment.

Hence, if there is something to trigger an abrupt change in sentiment, a feedback loop, a chain reaction, can occur.

…

Back to the Wired article again:

“Using supercomputers at the Charles Sturt University in Australia, the team found that one measure called “global transfer entropy flow” reached a peak, repeatedly, “on the disordered side of the transition — just before the tipping point”.

“It’s the density of the information flow that anticipates the tipping point — “all other measures peak strictly at the tipping point itself” explained Seth.”

Now based on where our discussion is pointing, it seems counterintuitive to suggest the information flow right now is in a state of disorder and, after the tipping point is reached will converge into a state of order. After all, if the tipping point is to unleash a period of market turmoil, does that not imply disorder and chaos?

Actually, it does not if you’re thinking like a neuroscientist or Nassim Taleb. You might remember our recent review of Mr. Taleb’s new must-read book Antifragile: Things that Gain from Disorder.

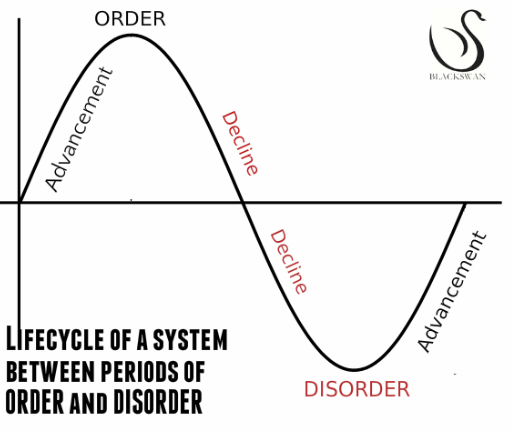

So what we should do is try to visualize the life cycle of a system’s advancement and decline between states of order and disorder. Here’s a diagram we’ve produced that we think generally applies:

I think the diagram is relatively clear. Now let’s assume the system in question is financial markets.

The financial crisis brought disorder. And that disorder bred advancement in financial markets. But amidst this advancement grew up initiatives aimed at producing order, e.g. extraordinary monetary policy.

Our central banks have built a highly-ordered financial system. And because of how the elements in such a complex financial system causally influence one another, our central banks cannot extract a vital element of the system — QE — without causing financial market instability.

It is why we’re constantly suffering through people like Larry Summers, confounded in their smug intellectualism (at best), bumbling on about keeping the lights on during a power outage. He of course equates power outage with economic/financial crisis andlights with fiscal/monetary stimulus.

It’s his analogy to why it’s so important to “contain the financial system.”

And though he did throw out a token criticism of monetary policy at the end — low rates are an inhibitor of economic growth — his overall implication is one that requires a fiscal policy to more closely manage the economy so the lights don’t go off.

But monetary policy, in an effort to enable a dysfunctional fiscal policy, has effectively commandeered control of the light-switch. But because they’ve sought stability in the financial system first and foremost. They sought merely, albeit actively, to restore sentiment instead of letting the economy clear out excesses and malinvestment.

These problems linger. And these problems continue to push down on the light-switch. The only thing holding up the light-switch is indeed extraordinary accommodation.

The million dollar question: can more accommodation, whether monetary or fiscal, in an effort to contain the financial system, eliminate the pressures pushing down on the light-switch?

As Mr. Summers mentioned, we’re four to five years down the road now. I ask: why hasn’t accommodation worked yet? And no, Paul Krugman, I’m not asking you because I already know your answer.

Are we closer to financial system decline — the collapse of the highly-ordered system — than most are willing to believe? If so, maybe we should look at the good that could come from disorder in our financial system …

After all, we’d see the deterioration of “a chronic inhibitor of economic growth”, that which is “holding our economies back from achieving their true potential.”

-JR Crooks

It’s starting to feel like we are part of a giant poker game against the US government, whose hand is the true condition of the American economy. The government has become so good at bluffing that most people feel compelled to watch how the biggest players in the game react to determine their own investment strategy.

Unfortunately, this past month revealed that even pros like Goldman Sachs have no idea what sort of hand Washington is really hiding.

Goldman Bets Against Gold

A week into the government shutdown, Jeffrey Currie, head of commodities research at Goldman Sachs, declared that gold would be a “slam dunk sell” if Washington resolved the budget debate and raised the debt ceiling. The call was based on an underlying narrative that the US economy is experiencing a slow, but inevitable, recovery.

Taking this recovery as a foregone conclusion, conventional Wall Street analysts saw two clear choices for Washington. On the one hand, Congress could reach an agreement, raise the debt ceiling, and allow the recovery to continue. This would allegedly have been the final nail in the coffin of the safe-haven appeal of gold.

On the other hand, if no agreement were reached, the government would have been forced to default on its debt. This would have erased any signs of recovery and sent the economy spiraling back into a terrible recession – while boosting the gold price.

Goldman reasoned that Washington would never allow the latter to unfold and suggested investors prepare to short or sell gold.

While Washington did kick the debt can down the road as predicted, gold rallied 3% on the news – the complete opposite of expectations. That is, expectations outside of Euro Pacific.

Misreading the Signals

After seeing an investment theory crushed by reality, a rational investor would take a moment to reexamine his premises. In Goldman’s case, this would mean second-guessing the conventional belief in an imminent or ongoing US economic recovery.

Yet, the day after Washington reached an agreement, Currie reaffirmed to Goldman’s clients that his US economic outlook for 2014 is positive and that he believes gold faces “significant downside risks.”

Currie must not have wanted to muddy his message by acknowledging that his original forecast was flat wrong. He did, however, hedge his statements by acknowledging that the Federal Reserve would likely hold off on tapering its stimulus until next year.

Major Wall Street investment houses have come to rely on the investing public’s short-term memory to skate by on these bad calls. When the next forecast is issued, clients and subscribers quickly forget that Goldman was blindsided by the Fed’s taper fakeout in September. [Read more about the taper fakeout in my previous Gold Letter.] That Currie accepted the government’s new taper timeline within a month of being burned by the last shows how little stomach they have for sticking to the fundamentals – and how little accountability they face for getting it wrong.

Instead, major players like Goldman Sachs are betting their books on the government’s fearless bluff. In the eyes of Wall Street, the economic indicators support this conclusion – inflation is subdued, GDP is growing!

The Bluff Exposed

I’ve been an outspoken critic of this official data for years. Over the course of my career, I have witnessed the government dramatically change the way it calculates inflation, GDP, and other statistics. While Washington’s latest figures show a year-over-year CPI increase of just 1.2%, the private service ShadowStats, which recalculates the data along the lines that the government used to, finds that real consumer inflation is closer to 9%.

My guess is the true number lies somewhere in between, but that it would be much higher were the US not able to export much of its inflation abroad. The process works as follows: the Fed prints money (inflation) and uses it to buy Treasuries and mortgages. The government and banks, in turn, pass much of that money to consumers, who spend it on imported goods. The money then flows to foreign manufacturers of those products, who then sell it to their own central banks, who print their own currencies (inflation) to buy it. This money goes out to pay wages, rents, etc., which the recipients then spend on goods & services. Finally, the foreign central banks use the dollars they buy to purchase US Treasuries and mortgages, starting the cycle again.

It’s a complicated relationship, but the end result is that inflation created in the US ultimately bids up consumer prices abroad and Treasury prices at home. In other words, our trading partners have to pay much more for goods & services while Americans get to borrow limitless money for next to nothing. The products our trading partners “sell” us increase the supply of goods available to American consumers while simultaneously decreasing the supply available to everyone else. That is what I mean by “exporting inflation,” and the important thing to remember is that its result is to mask inflation at home and transfer wealth from emerging markets to the US.

The bluff gets worse. These understated CPI numbers distort real GDP, which would be lower if the true inflation rate were applied. The GDP calculations also include items like government expenditures, which are possible only because of money printing and not a result of any real economic production. Again, compare the official figure of 1-2% GDP growth in the second quarter of 2013 to ShadowStat’s figure of negative 2%.

If investors can’t bring themselves to question official data, there’s another way to see through the government’s bluff: look to foreign central banks, which are actively preparing for the day when the dollar is no longer the world’s reserve currency.

The Bank of Italy recently affirmed that its gold reserves are essential to its economic independence, while the World Gold Council reported that this past year, European central banks held onto more of their gold reserves than ever before. China, the largest holder of US debt and the biggest consumer of gold in the world, has started openly talking about ending the dollar’s reserve status. And while we don’t know the total gold reserves of the Chinese government, there are signs that they are stockpiling.

Even US Treasury officials admit that the US will never sell its gold reserves to deal with debt obligations. One spokesperson said, “Selling gold would undercut confidence in the US both here and abroad, and would be destabilizing to the world financial system.”

Time to Cash Out

So, who should investors believe about gold? Wall Street bankers who directly benefit from asset bubbles created by the Fed’s inflationary stimulus?

No, it’s time for individual investors to leave the table and redeem their chips. Just remember – the longer you wait to cash out of the US dollar, the less you’re going to get for your winnings.

###

Peter Schiff

C.E.O. of Euro Pacific Precious Metals

email: info@europacmetals.com

website: www.europacmetals.com

Peter Schiff is CEO of Euro Pacific Precious Metals, a gold and silver dealer selling reputable, well-known bullion coins and bars at competitive prices.

For the latest gold market news and analysis, sign up for Peter Schiff’s Gold Report, a monthly newsletter featuring contributions from Peter Schiff, Doug Casey, and other leading experts. Click here for your free subscription.

Copper prices will not suffer significantly from a moderate global surplus next year, the chief executive officer of the world’s No. 1 producer of the metal told Reuters on Tuesday.

“We’re expecting that we’ll surely have a small metal surplus, but at relatively modest levels,” Thomas Keller, CEO of Chile’s Codelco, said at the Ministro Hales mine project near the city of Calama in the nation’s mineral-rich north.

World demand for the red metal has exceeded supply since the global financial crisis, but increased output from new and existing mines has been expected to reverse that trend from 2013.

Analysts expect the global copper market to post a surplus of 182,000 tonnes this year, up from a previous forecast of 153,000 tonnes, and then balloon to 328,000 tonnes in 2014, according to a Reuters poll last month.

Copper has traded at $7,000 to $7,420 a tonne since early August, held back by swelling supply and slower demand growth in China.

“Prices are moving in a range that is to be expected given the market conditions,” Keller said.

Codelco is in the midst of an ambitious investment plan to boost output in its massive but tired mines. The company’s production in 2012 fell to its lowest since 2008, although it was more stable in the first half of this year.

Keller has said Codelco expects output for 2013 as a whole to come in slightly ahead of last year, when it produced roughly 1.65 million tonnes, excluding the El Abra and Anglo American Sur operations.

US dollar bulls had all the fun last week. The 17-member single currency came under a three-prong attack – two from the world’s primary reserve currency and the other one was a calculated self-inflicted wound. Stateside, non-farm payrolls and GDP for Q3 both exceeded expectations. Furthermore, Draghi and company at the ECB decided to cut its cash rate![]() -0.25% to new historical lows. So far, the verbatim list has contributed to the rally of the ‘mighty buck’ against the hapless EUR and other G10 currencies … full article

-0.25% to new historical lows. So far, the verbatim list has contributed to the rally of the ‘mighty buck’ against the hapless EUR and other G10 currencies … full article

It was all going according to plan. POMO lifted the S&P 500 instantly 7 points at 1015ET back to unchanged and the mainstream media could discuss the fact that stocks are “off the lows.” Then (admittedly non-voting member) uber-dove Dennis Lockhart hit the wires with some oddly hawkish commentary: *LOCKHART SAYS TAPERING ‘COULD VERY WELL TAKE PLACE’ NEXT MONTH *LOCKHART SAYS QE NOT MEANT TO BE ‘PERMANENT FIXTURE’ OF POLICY Which sent stocks to the lows of the day … full article