Currency

LONDON – The dollar pared earlier gains on Wednesday as investors positioned themselves for U.S. data later this week that could be key indicators of when the Federal Reserve will slow its huge bond buying program.

The euro fell to a two-month low against the Swiss franc after data showed an uneven recovery in the currency bloc. Hedge funds sold the euro ahead of next week’s Swiss National Bank meeting, at which it is likely to reiterate its commitment to the euro/Swiss peg of 1.20 francs.

….read more HERE

(Reuters) – World shares fell for a third day on Wednesday and gold dropped to a five-month low, as focus returned to whether the U.S. Federal Reserve will start to wind down its bond-buying stimulus as soon as this month or next.

The to-and-fro of when the Fed will begin to halt the flow of cheap dollars has dominated trading worldwide for months. A run of data ending in the main U.S. jobs indicator – non-farm payrolls – on Friday may yet tip the balance again.

Polls of analysts and traders still point firmly to the U.S. central bank holding fire until next March but some stronger data has reheated speculation it could move earlier.

That prompted investors to cash in gains from recent rallies, and despite a steadier morning, European stocks .FTEU3 were on the slide again as the Wall Street open neared, after suffering their biggest tumble since August on Tuesday.

A better-than-expected ADP jobs report, which showed U.S. private employers added a chunky 215,000 jobs in November, bolstered the feeling that payrolls on Friday may be strong.

But Johan Jooste, head of fund manager Julius Baer’s London investment office said it wasn’t necessarily the start of the Fed’s withdrawal that would drive the market’s reaction.

“The whole market has been focused on when tapering will start, but what I would ask (incoming Fed chief) Janet Yellen is when does she perceive it ending.

“If the Fed starts in Jan or March I’m not so sure that’s necessarily the big deal, but it’s a bigger deal if it ends it quickly,” Jooste added.

The worry is that the reduction in Fed support will be like a stab with a pin for recently inflated asset prices.

A sharp 2.2 percent fall for the Nikkei in Tokyo .N225 as it recoiled from a six-year high had led Asia lower overnight, and with Europe buckling again MSCI’s world share index extended its losses for the day to 0.5 percent. .MIWD00000PUS

Wall Street had been expected to open slightly higher after Tuesday’s falls but the robust data helped cement a turnaround in futures prices, with the Dow Jones industrial average.DJI the S&P 500 Index .SPX now expected to dip again. .N

In the FX market, the dollar remained lower against the yen and a basket of currencies.DXY but as the data pushed benchmark U.S. Treasury yields back above 2.8 percent, upwards pressure was starting to be felt.

ECB TIME

Ahead of the European Central Bank’s meeting on Thursday, mixed euro zone PMI data reinforced the differing fortunes of its main economies, though having only cut rates last month additional measures from the bank look unlikely for now.

Britain is currently one of Europe’s best performing economies, but high-flying sterling saw its wings clipped as growth in the dominant service sector slowed a little last month, breaking a run of upside data surprises.

The specter of cuts in the Fed’s bond-buying continued to cast a shadow over emerging market shares and currencies. They were among the hardest-hit when Fed Chairman Ben Bernanke first floated the prospect of “tapering” back in May.

MSCI’s emerging market .MSCIEF spent a third day in the red, while the Indonesian rupiah weakened 0.9 percent to 11,975 rupiah per dollar after earlier falling to 12,000 to match a near five-year low touched last week.

William de Vijlder, chief investment officer at BNP Paribas said that while further sell-offs were likely in EM assets, they shouldn’t be as dramatic as earlier in the year.

“We call it ‘tapering echoes’. With each echo you have, the intensity of the noise fades,” he said.

With Ukraine’s under-fire president out of the country, there was a temporary lull in the political tensions that have rattled its markets hard in recent days.

In Thailand were there has also been recent upheaval, the baht also stabilized at around 32.26 baht per dollar after the country’s navy chief ruled out a coup after days of anti-government protests.

AUSSIE, GOLD DOWN

Back in Europe, the euro began to back-pedal from $1.3550 as the dollar flexed its muscles again, having hit a two-month low against the Swiss franc following the euro zone data.

A buoyant Germany was not enough to stop the 17-nation euro zone’s private sector losing momentum in November, dragged backwards by a downturn in France – the bloc’s second biggest economy – and a continued recession in Italy.

Down under, the Australian dollar saw its biggest fall since July as it plunged to a three-month low of $0.9025 after data showed its economy running slower than expected.

Oil prices jumped ahead of this week’s OPEC meeting, with U.S. crude futures hitting a five-week high and Brent holding comfortably above $112 a barrel.

But gold and silver, which like stocks have benefited from the U.S. stimulus because of inflation fears, traded near five-month lows. Gold last stood at $1,213 per ounce while silver traded at $19.04, having slipped to $18.94 on Tuesday.

“There is definitely an attitude of wait-and-see in other assets and more selling pressure in gold,” Mitsubishi analyst Jonathan Butler said. “The next leg down is being awaited and the stimulus for that could be the (U.S. jobs) numbers on Friday.”

Getting ready for Christmas? What’s Santa got in his sack for you this year? Well, if there’s one thing you should be preparing for, then it can only be the big crash of February 2014. The signs have been there for months now and it’s definitely now on the books for February next year. Santa will be emptying his sack and it won’t be presents that will be falling from the sky as his sleigh goes whizzing past us.

Preordained Events

Stick the date in your diary, pop it on your iPad and synch it with your iPhone. Use them while you can, because they will be relics of the past most undoubtedly in the coming months. You won’t be needing anything in the future, once the financial world implodes and it is set to happen in February 2014.

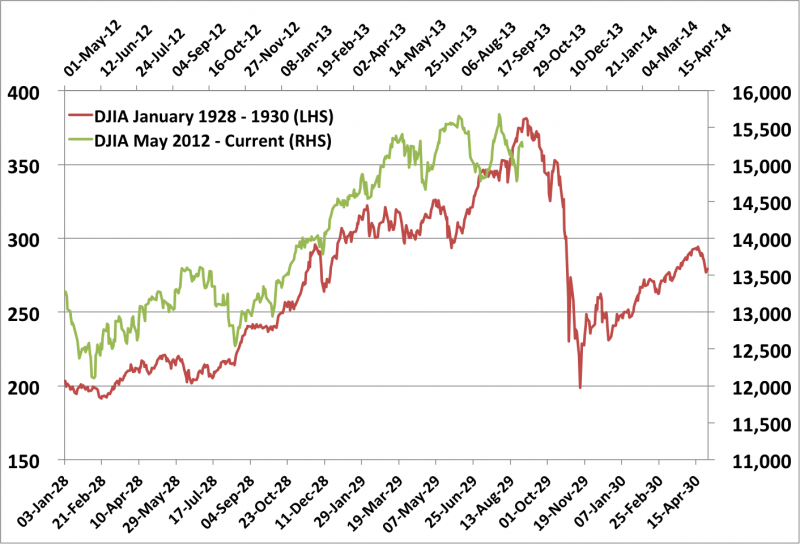

If we were in 1929, this would be June 1929, just a few months before the crash happened back then. Yes, we can say whatever we like with numbers, but like cameras, there are some calculations that never seem to lie. Businesssweek’sTom DeMark, a financial analyst has put together indicators that are able to predict movements of the market with surprising accuracy. DeMark states that “the market’s going to have one more rally, then once we get above that high, I think it’s going to be treacherous. I think it’s all preordained right now”.

Some might be saying that we didn’t need a crystal ball and we had no need for mathematics either to show that. You just had to look at how the Federal Reserve has bounced the financial markets back into a false-sense of security without actually doing anything at all to change the economy. Where’s the employment, where’s the increase in industry? It’s in the past. The only thing that is there right now is the virtual prosperity of the financiers and the banks. The next US shutdown and arrival at the debt ceiling will be just in time too for the biggest crash in history and will probably be linked.

Cash in on the last rise of the financial markets before what has been set down long ago comes of age and ripens completely. After that, who knows! You’ll have to buy low and wait a long time before the markets move back up.

The chart that compares pre-1929 and today is uncannily identical. Take a look for yourself. Pooh-pooh it, refuse to see it, do whatever you wish, but the crash will be coming and it’s the banks that started it all. The government will finish it all. God bless America! Game over! Goodnight!

….continue reading HERE

WEEKLY COMMENTARY

Stockscores Market Minutes Video

A strong stock in a strong sector has a greater chance for success. Learn how to use the Stockscores.com Sector Watch tool to focus on the right sectors with this week’s Market Minutes, watch the video on Youtube by clicking here.

There are two risk factors which contribute to a stock’s price performance. First, those factors directly related to the company’s business. Earnings, management, new products or services – these are termed Alpha factors and are what the market is interested in when seeking stocks that can beat the performance of the overall index or sector group.

The second factor is the market itself. All stocks have some correlation to what the overall market is doing because all companies are dependent on the general economy and investor psychology. The Beta factor is what guides most stocks most of the time.

My approach to the market is to focus on abnormal activity. This brings out the Alpha factor which is what allows a stock to beat the performance of the overall market. When stocks are trading abnormally, it is likely that there is something happening with their company fundamentals that deserves attention.

With this in mind, it is still important that respect the Beta factor. A gold miner that discovers Gold will not be rewarded as well as it should if the price of Gold is falling and there is a general sense of pessimism around Gold mining stocks. You have to pay attention to the health of the stock’s sector.

That makes Sector analysis an important part of the research process. You can use Stockscores.com to gauge the strength of a stock’s sector. If you find a stock you like, its investment quality is better if the sector is also strong.

For most large cap stocks, Stockscores will show the sector chart and rating. To see it, first pull up the stock chart by entering the symbol in the upper right of Stockscores.com. Below the large chart or beside the small chart you will see a Sector tab. Click on that to see the chart and Stockscores of the company’s sector. Give favor to the stocks that have a strong sector confirmation.

Want to see the ratings for all of the Sectors? Advanced and Pro Stockscores users can utilize the Sector Watch tool to see the Stockscores ratings for all sectors. Focus on the sectors with a Sentiment Stockscore of 60 or higher.

STRATEGY OF THE WEEK

Here is the scenario. You are a Canadian investor, retired or nearing retirement and looking for stocks that pay a yield but also have some potential for capital appreciation. Here is a scan that will help you find some good candidates:

Exchange = All Canadian

Sentiment Stockscores > 60 < 75

Pays Dividends – Checked

Yield > 2%

I ran this scan and found the following stocks that have good yields and good charts. Keep in mind that the yield amounts quoted are historical and are not guaranteed to be future yield.

STOCKS THAT MEET THE FEATURED STRATEGY

1. T.PGF

T.PGF has been on my feature list since it was at $6, it is now $6.69 and the historical yield is 7.17%. Rising bottoms over the past 7 months show investors are optimistic after a lengthy period of poor performance.

2. T.SGY

After a bad month of November, T.SGY has bounced and broken its pull back, appearing poised to continue the long term upward trend. Historical yield is 7.91%.

3. T.AQN

T.AQN recently saw its Sentiment Stockscores cross up and over the 60 threshold as it breaks higher from a rising bottom. Historical yield of 4.89%.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Perspectives is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of Perspectives may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligence.