Economic Outlook

Crashing Oil Prices Portends Unspeakable Horrors

Frankly, we could write entire articles on no less than a dozen “horrible headlines” this morning, including…

- Greek stock and bonds collapsing as a 2015 default appears certain

- The collapsing French government, as Hollande has lost political support

- Plunging German growth estimates

- The growing Italian movement to secede from the Euro monetary system

- Growing support of Catalonian secession

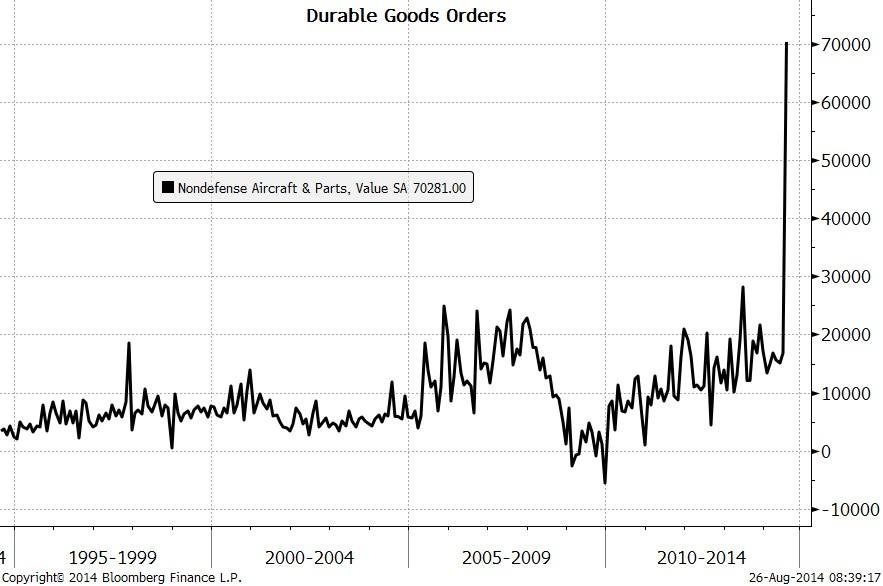

- This morning’s horrifying plunges in U.S. Retail Sales, the Empire State Manufacturing Index and Mortgage Purchase Originations

- Wells Fargo reporting yesterday that mortgage activity has plummeted to 2008 Lehman levels

- The all-out global commodity crash, highlighted in today’s article

- Exploding currency volatility – i.e., the “single most bullish precious metals factor imaginable”

- Unmitigated Western bond yield crash as the “most damning proof yet of QE failure” exposes a collapsing global economy.

- Exploding U.S. debt about to eclipse $17.9 billion due to the “unreported” $100 billion spent on Iraq, Syria and the Ukraine

- Last night’s absurd stock repurchase admission by Intel – likely, marking the painful end of one of QE’s most hideous shareholder-destroying practices. It is estimated that 95% of all 2014 U.S. corporate earnings were plowed into buybacks – often supplemented by new debt – at historically high valuations, whilst average property, plant, and equipment averaged 22 years of age, its oldest level in 60 years.

- A new study purporting the largest “TBTF” banks may require $900 billion of capital to remain solvent

However, we don’t have time – so suffice to say, this morning’s burgeoning global market crash may well constitute the beginning of what could be a very, very rapid end. The U.S. 10-year yield closed last night at 2.21%; but as I write, is down to an astounding 1.93%, in perhaps its largest daily move ever – en route first to ZERO, and subsequently INFINITY, when the upcomingimminent (yes, I said imminent) announcement of QE’s 4, 5 and 6 emerges. Frankly, if the PPT can’t pull a rabbit out of its hat and “save” the world with unprecedented market manipulation, we think it likely the Fed will not only cancel the “taper” at its October 29th meeting but hint at reversing it entirely.

If we really get a sustained, disinflationary forecast … then I think moving back to additional asset purchases should be something we should seriously consider.

– John Williams, SF Fed President, October 14, 2014

In other words, the “countdown to the Yellen reversal” has commenced”; and if it occurs this Fall, we may well see the long-awaited collapse of the gold Cartel.

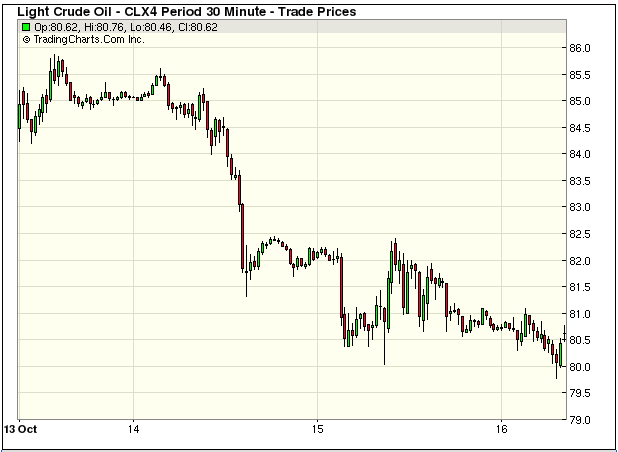

This morning (Oct 15th), WTI crude prices are down another $1+ to $81/bbl., whilst Brent Crude has plunged to $84/bbl. The carnage on energy industry equities is catastrophic, as all energy-related sectors have broken down to multi-year lows, portending a horrific 2008-style crash.

(Chart from 5:20am today)

….continue reading HERE

World Economic Outlook

World Economic Outlook

The International Monetary Fund (IMF) published their most recent outlook for the global economy Tuesday. While most of the headlines covered the IMF’s relatively tame outlook, the report also warned investors about financial excess. From the IMF:

Easy financial conditions, and the resulting search for yield, could fuel financial excess. Markets may have underpriced risks by not fully internalizing the uncertainties around the global outlook. A larger-than-expected increase in U.S. long-term interest rates, geopolitical events, or major growth disappointments could trigger widespread disruption.

How Concerned Should We Be?

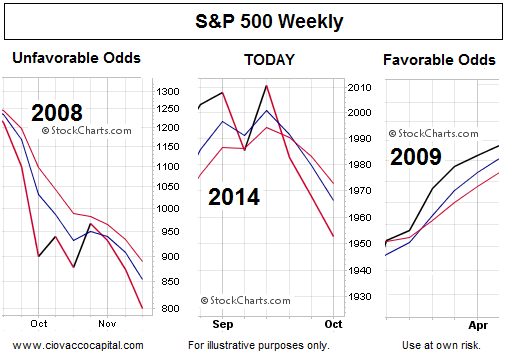

The charts below show the S&P 500 weekly during Tuesday’s session (middle), the S&P 500 in 2008 (left), and the S&P 500 in 2009 (right). While the market can find its footing at any time, the present day market is telling us to “pay closer attention to risk management” in the coming weeks. The charts below are described in more detail in a October 3 video clip.

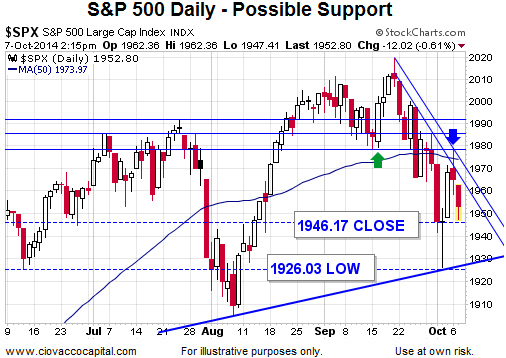

Investment Implications – The Weight Of The Evidence

As noted in recent weeks, our market model has already called for a significant reduction in equity exposure based on the evidence we have in hand. Since it is not possible for stocks to drop for several weeks or several months without first taking out the S&P 500 levels shown below, we can use them as bull/bear guideposts in the coming sessions.

If the S&P 500 closes below last Thursday’s closing level of 1946, we will consider cutting our exposure to stocks (SPY) again. If the markets can respond favorably to the Fed minutes or Fed speakers this week, while remaining above 1946, we will try to exercise some “let’s see how things play out” patience.

About Chris Ciovacco

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC.

On September 26th, the English Parliament voted to join the U.S.-led bombing of ISIL, at least in Iraq. The news was received with relief by most in the Anglosphere world and throughout Europe. However, very little regard has been paid to the relative benefits and costs. The military actions that the UK has committed herself to conduct will have a low probability of achieving the stated objective of “degrading and destroying” ISIL. However, there is a much higher likelihood that air strikes from the UK will increase ISIL’s stated objective of projecting fear and terrorism deeper into the West. If that were to occur, the resulting implications for business will be difficult to project.

On September 26th, the English Parliament voted to join the U.S.-led bombing of ISIL, at least in Iraq. The news was received with relief by most in the Anglosphere world and throughout Europe. However, very little regard has been paid to the relative benefits and costs. The military actions that the UK has committed herself to conduct will have a low probability of achieving the stated objective of “degrading and destroying” ISIL. However, there is a much higher likelihood that air strikes from the UK will increase ISIL’s stated objective of projecting fear and terrorism deeper into the West. If that were to occur, the resulting implications for business will be difficult to project.

Despite apparent successes in very different conflicts in Libya and Kosovo, air power alone is unlikely to dislodge ISIL from its dominant position in Western Iraq and eastern Syria. The strategy is like trying to engage a boxer by throwing apples from outside the ring. It may bruise your opponent, but it will not result in victory. It may even cause retribution outside the ring, where the Queensbury rules do not apply. This is particularly apparent when one considers how the parliamentary authorization only applies to territory in Iraq, not Syria. If ISIL does not respect 20th Century borders, why should the West?

The U.S.-led air war appears set to achieve only limited degradation of ISIL’s capabilities. To succeed, air strikes would have to be coupled with a strong, organized, dependable and politically aligned ground force. That half of the equation is not available in Iraq or Syria. ISIL’s brutal “take no-prisoners” policies have been too much for the local, poorly motivated ground forces to confront. An air campaign can certainly be expected to slow ISIL’s progress but it should also be expected to heighten the likelihood of terrorist attacks, particularly within the U.S. and UK. Given the fragility of current markets, such an outcome could be financially catastrophic.

Why, therefore, did the British agree eventually to participate? This answer is far more complex than most care to admit.

The British approved of their government supporting the Allied cause in Gulf War I, which was seen as a legally justified reaction to Saddam Hussein’s invasion of Kuwait. But unlike Americans, the British public approved of George H.W. Bush’s decision to leave Saddam Hussein in place, after he was forced out of Kuwait.

Gulf War II, however, was a very different story. The British saw it as illegal and unwise to conduct an unprovoked attack on Iraq merely to replace a strong regime with sectarian chaos. Further, they feared the price in terms of blood and pointless military expenditures. Despite this, the need to preserve the Anglo-American ‘Special Relationship’ as the crucial tenant of UK defense policy proved more important to many British elites. But an already wary public turned away sharply when the WMDs could not be found and the invasion turned into a quagmire.

The aversion to further Middle Eastern adventurism came to the fore in August 2013 when the English Parliament voted by a majority of 13 not to join the U.S.-led bombing of Syria. Interestingly, the mainline media missed completely the crucial fact that this defeat was due largely to a rebellion by Conservative eurosceptic MPs who were angry with Cameron for failure to follow through on his “cast-iron guarantee” of an EU referendum.

Another ‘no’ vote could have been disastrous for Cameron’s political authority. So this time around his party whips took time to ‘bend’ the votes of malcontent MPs. As September is a period of Parliamentary recess and party conferences, this added to delays.

It also meant that Cameron needed to keep the bill highly focused, preventing Britain from joining the U.S.-led bombing outside of Iraq. In desert terrain, however, who will know whether British bombs are dropped on Syrian territory? Doubtless, British and even Australian Special Forces are already, or soon will be, working with Americans in Syria to identify strike targets.

Thanks to the ‘open-door’ immigration policies imposed on the UK by the EU, British civilians now are exposed irresponsibly and dangerously to Jihadist terrorism. Already, in some sectors within certain UK cities, sharia law rules, de facto. Mob scenes in Britain regularly depict banner hate that if shown or spoken by the native English would result in jail sentences. It is no accident that the bloodthirsty Jihadist responsible for beheading the British and American citizens spoke with an accent that grew up in immigrant communities within the UK.

British military probably warned their political leaders against an illegal, ineffective air war with the implication of a massive increase in domestic terrorism. However, in order to preserve the Special Relationship, likely they were overruled politically after delays.

Now, British and American civilians, with wide open borders and none of the personal protections granted their political masters, must face the threat of greatly increased, even horrific domestic terror.

Hopefully British and American politicians will decide eventually to spend on the effective policing of their borders and the physical protection of their people rather than wasting billions of dollars in pounding illusive targets on the enemy’s choice of ground-distant, near empty sands!

John Browne is a Senior Economic Consultant to Euro Pacific Capital. Opinions expressed are those of the writer, and may or may not reflect those held by Euro Pacific Capital, or its CEO, Peter Schiff.

Subscribe to Euro Pacific’s Weekly Digest: Receive all commentaries by Peter Schiff, John Browne, and other Euro Pacific commentators delivered to your inbox every Monday!

74% of all Municipals want to raise Taxes. Municipal governments are going broke everywhere. This entire structure of government would never have been designed even by a moron. In Germany. a survey of 300 municipalities shows that 74% are planning to raise taxes. Now 27% plan to increase their cemetery fees, 25% want to demand more money for attending daycare or day schools. 21% plan to increase the property tax assessment rate, and 13% intend to raise the dog tax. (see latest German survery)

We are headed into this Sovereign Debt Crisis and Western Society as we know it cannot POSSIBLY exist. The problem with politicians is they just look at the people as a bottomless-pit of revenue to be taxed at will. They have no grand plan nor have they ever contemplated the long-term viability of such a system with no fiscal restraints whatsoever. They never see themselves as part of any problem – it is always the cheating people who do not hand them everything they demand.

This is the source of the civil unrest we see coming everywhere. Governments do not respect the people nor do they really care about our future. This is now all about them and they only see raising taxes rather than downsizing or reform.

In the United States, the resistance toward raising taxes to pay for repairs in infrastructure has the Obama Administration pitching the pension funds to join in and invest in an “infrastructure fund”. They are soliciting pension funds because they will benefit from tolls etc and that will be more palatable than watching you toll dollars go to bankers. The idea is this will be salable to the public. California’s pensions Capers is on board and have already announced they will liquidate $4 billion from hedge funds. They have not announced where they will shift that money, but it appears they are getting ready for another Obama star project up there with Obamacare.

State and local government cannot print money. This is the DEFLATIONARY aspect that first impacts society. Courts begin to rule only in government’s favor and you then see the collapse of investment and society as a whole when the rule of law vanishes. The higher they raise taxes, the lower the disposable income, the lower the economic growth, and the higher we will see unemployment. Government wastes money – they consume capital and are incapable of producing anything worthwhile to contribute the economic growth. This is why government MUST be restricted to defined percentages of GDP to prevent it from growing like corporations until they become so big, they are unable to function.

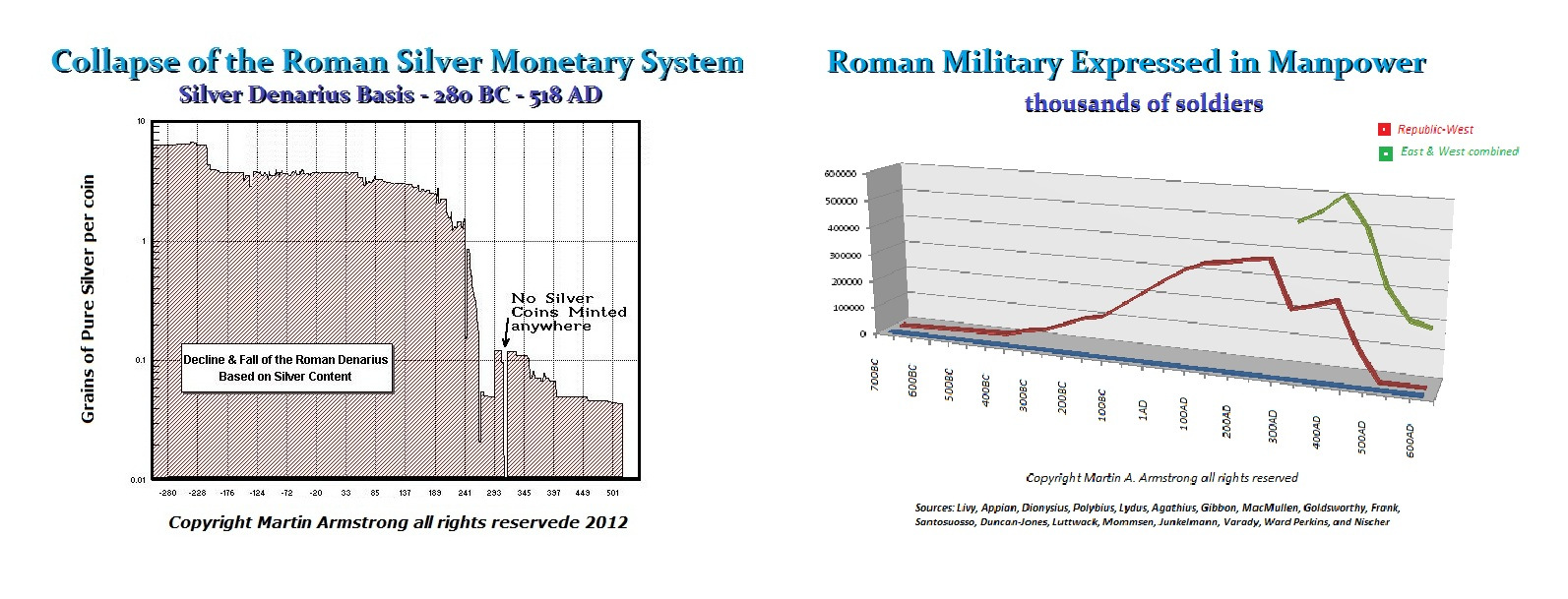

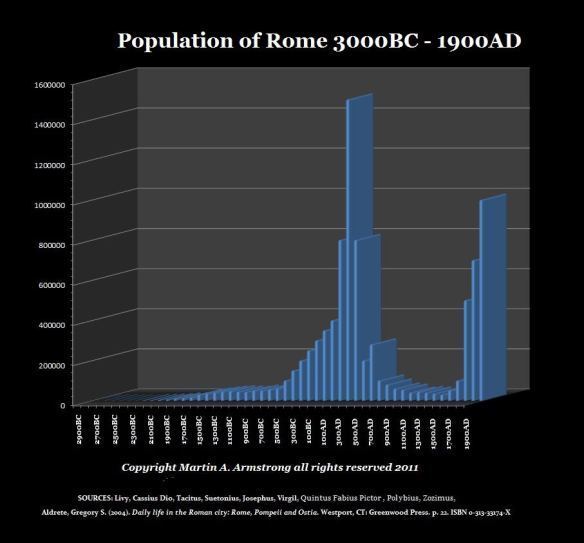

Public unions are already advocating just taking money from other sectors to pay them. This is precisely the same trend that unfolded in Rome setting in motion the decline and fall. When Rome could not fund its pensions to the military, they began numerous revolutions and that justified sacking cities that opposed their wishes.

Click image for larger view

As Rome could not pay the troop pensions, they tore the empire apart at the seams. This is what lowered the defenses allowing the Barbarians to finally invade. Rome fell from within for the same faulty structure of fiscal mismanagement. The inflation (debasement) in the currency was NOT the cause of the fall of Rome, it was the symptom that followed the corruption.

So pay attention. It is the DEFLATION that comes FIRST. Inflation NEVER appears first with nothing driving it. It has always been the expansion of government that unfolds FIRSTthat later manifests in inflation only when you cross that point of no return in PUBLIC CONFIDENCE. As taxes were raised on property, people began to vacate the cities. The population of Rome collapsed as property values fell due to rising taxes. Sound familiar? Only with rising taxation did people just start to migrate away from Rome.

Roman Passport

The Roman Emperor Diocletian (284-305AD) introduced passports. Not to travel from one country to another, but to be able to travel at all AFTER you were verified that you owed no taxes. Today, the US has introduced a law that if you owe the government $50,000 in taxes, they can revoke your passport until you pay. Wonderful how history repeats.

Ed Note: Another great article by Martin about the Stock Market HERE

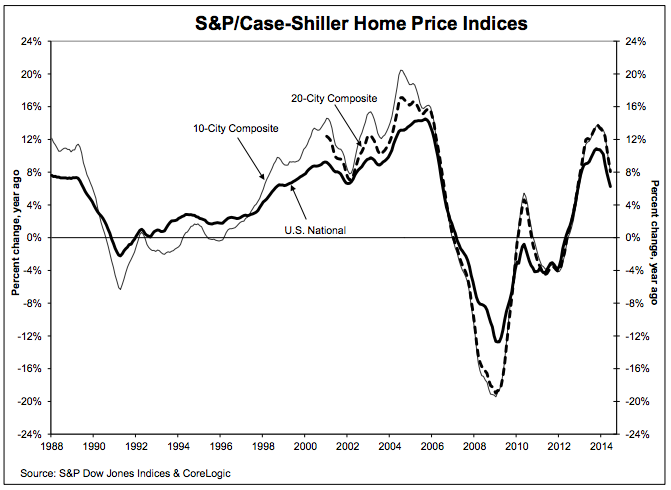

S&P’s Case-Shiller home price index have declined for the second-straight month.

June prices fell 0.2%, worse than the consensus estimate for no change, and even with the decline seen in May.

Year-over-year, prices climbed 8.1%, about in-line with forecasts but slower than a revised 9.4% gain for May.

The 20-city index hit 172.33, about in-line with forecasts and up from a revised 170.68 in June 2013.

“Home price gains continue to ease as they have since last fall,” David M. Blitzer, Chairman of

the Index Committee at S&P Dow Jones Indices, said in a release. “For the first time since February 2008, all cities showed lower annual rates than the previous month. Other housing indicators – starts, existing home sales and builders’ sentiment – are positive. Taken together, these point to a more normal housing

sector.”

Here’s what it’s looked like recently:

WIDESPREAD SLOWDOWN IN US HOME PRICE GAINS

S&P’s Case-Shiller home price index have declined for the second-straight month.

June prices fell 0.2%, worse than the consensus estimate for no change, and even with the decline seen in May.

Year-over-year, prices climbed 8.1%, about in-line with forecasts but slower than a revised 9.4% gain for May.

The 20-city index hit 172.33, about in-line with forecasts and up from a revised 170.68 in June 2013.

“Home price gains continue to ease as they have since last fall,” David M. Blitzer, Chairman of

the Index Committee at S&P Dow Jones Indices, said in a release. “For the first time since February 2008, all cities showed lower annual rates than the previous month. Other housing indicators – starts, existing home sales and builders’ sentiment – are positive. Taken together, these point to a more normal housing

sector.”

Here’s what it’s looked like recently: