Bonds & Interest Rates

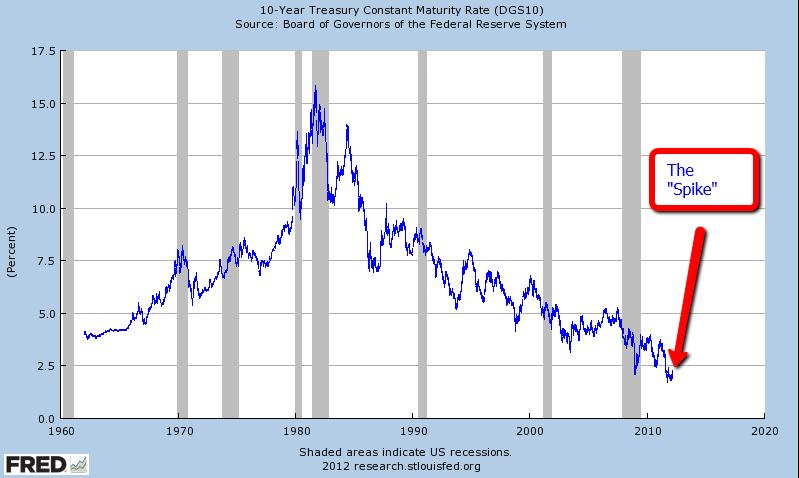

There has been a lot of talk about the “spike” in bond yields over the past week. Some are declaring the end of the bull run in bonds and some are even calling for a complete spike in yields. Everyone is so sure that bond yields are now headed higher since “risk-on” is back as the Stock Market hits 3.5 year highs.

For years now, US government bonds have looked like terrible investments, what with those trillion-dollar deficits and multiple wars and all. But Treasuries just kept rising, earning their owners nice returns and making their critics seem like financial illiterates who didn’t know a AAAA credit when they saw one.

There has been a lot of talk about the “spike” in bond yields over the past week. Some are declaring the end of the bull run in bonds and some are even calling for a complete spike in yields. Everyone is so sure that bond yields are now headed higher since “risk-on” is back as the Stock Market hits 3.5 year highs.

But we all need some perspective. The “spike” that we saw last week was not inordinary.

These stable businesses offer some of the most reliable dividends on the market today.

When gold was first discovered at Sutter’s Mill in the foothills of California’s Sierra Nevada mountains in 1848, thousands of people dropped everything and headed west with dreams of striking it rich.

Within a year, San Francisco was transformed from a sleepy outpost with a few dozen shacks into a bustling mining hub. As gold fever spread, would-be prospectors poured in by the boatload from as far away as Chile and Hawaii.

There was plenty of gold to be had in rivers and streams, particularly in the early days. But much of it went to larger operations that utilized high-volume hydraulic recovery techniques. The average miner sifting with a simple pan or other crude device was lucky to break even and recoup expenses. Thousands went home disillusioned and broke.

However, while the great gold rush was a bust for many, the huge population influx was a boon for gaming houses, saloons and brothels. And several entrepreneurs made a fortune, among them a peddler of denim pants named Levi Strauss.

In fact, the first millionaire to emerge from all of this was an enterprising retailer named Sam Brannan. Brannan famously cornered the market and bought nearly all of the available supplies of picks, shovels and pans. Then to drum up business, he ran through the streets showing everyone the newfound gold dust.

Brannan was clever. He knew that some would find gold and others wouldn’t — but they would all need tools. And he was happy to supply them, at a substantial mark-up, of course. At the peak, Brannan was reportedly raking in $5,000 a day in sales, more than $140,000 in today’s dollars.

What does any of this have to do with income investing? Plenty…

As the Chief Strategist behind StreetAuthority’s Energy & Income advisory, I think the easiest way to explain this is using the energy field as an example.

From small independent explorers to integrated global giants, companies that find and produce oil and gas can make a ton of money for their shareholders.

And many of these companies pay out steady dividends. For example, ExxonMobil (NYSE: XOM) has raised dividends nearly 6% annually for the past three decades.

But these companies are also exposed to fluctuating commodity markets. And as we all know, energy prices can be notoriously volatile.

For example, Exxon shares are still well below their highs from before the recession on the heels of lower energy prices.

By contrast, companies that provide necessary equipment and services to these exploration companies aren’t in the business of selling oil and gas. So they don’t directly feel those day-to-day price swings. As long as prices are strong enough to support continued exploration and development activity, they stay happy.

It’s the same situation that the “pick and shovel” companies during the Gold Rush were able to use to their advantage.

In the income and energy field, there are a number of these types of companies… and many pay high yields.

Perhaps the best known group is master limited partnerships (MLPs). These aren’t your traditional equipment and service companies that make pumps or drill bits… but they are every bit as important.

Without MLPs, the energy pumped out of the ground by energy companies would be useless. That’s because these companies own the pipeline and storage assets — so called “midstream” assets — that help get energy from the field to the end user.

MLPs typically aren’t concerned with energy prices. They get paid for the volume shipped through their pipelines and storage terminals. They usually earn the same amount whether a barrel of oil is $150 or $50.

Of course, when you make money from simply transporting commodities (which are in constant demand) and don’t have to worry about swings in their prices, you’d expect to see steady cash flow. This is the case with many MLPs, which pass along the bulk of that money to their investors in the form of steady yields. Most MLPs have yields averaging 5-6%, and it’s not uncommon for some MLPs yield in the double-digits.

But this same principal can be applied across the entire income universe. There are plenty of yields that come from companies doing the “exploring” — whether it be actual exploration for energy, delivering the next breakthrough drug, or building a new airplane.

If you want to invest in the most stable businesses, however, look to the companies that will make money supplying the “picks, shovels and pans”… even if other companies don’t strike gold.

[Note: For more about the income opportunities in the energy field, don’t miss my recent presentation about energy royalty trusts. This field is small — only about two dozen trade on the market. But we’ve found one trust yielding up to 17.1%. For more information — including names and ticker symbols — visit this link.]

Good investing!

Nathan Slaughter

Chief Investment Strategist, Energy & Income

Disclosure: Neither Nathan Slaughter not StreetAuthority own shares of the securities mentioned. In accordance with company policies, StreetAuthority always provides readers with at least 48 hours advance notice before buying or selling any securities in any “real money” model portfolio. Members of our staff are restricted from buying or selling any securities for two weeks after being featured in our advisories or on our website, as monitored by our compliance officer.

This week’s downside breakout in the T-Bond futures market and the associated rise in the T-Bond yield has prompted us to re-visit the relationship between gold and interest rates. In the process of doing so we’ll address the question: are rising interest rates bullish or bearish for gold?

We’ll begin by noting what happened to nominal interest rates during the long-term gold bull markets of the past 100 years. Interest rates generally trended downward during the gold bull market of the 1930s, upward during the gold bull market of the 1960s and 1970s, and downward during the first 10 years of the current bull market. Therefore, history’s message is that the trend in the nominal interest rate does NOT determine gold’s long-term price trend.

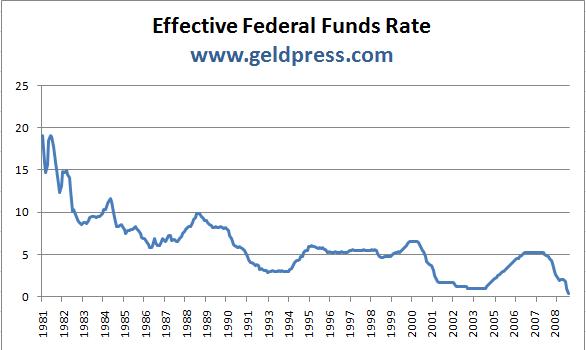

The Federal Reserve ran another “stress test” on major financial institutions and has determined that 15 of the 19 tested are safe, even in the most extreme circumstances: an unemployment rate of 13%, a 50% decline in stock prices, and a further 21% decline in housing prices. The problem is that the most important factor that will determine these banks’ long-term viability was purposefully overlooked – interest rates.

In the wake of the Credit Crunch, the Fed solved the problem of resetting adjustable-rate mortgages by essentially putting the entire country on an teaser rate. Just like those homeowners who really couldn’t afford their houses, our balance sheet looks fineunless you factor in higher rates. The recent stress tests assume market interest rates stay low, the federal funds rate remains near-zero, and 10-year Treasuries keep below 2%. Why are those safe assumptions? Historic rates have averaged around 6%, a level that would cause every major US bank to fail!

The truth is that higher rates are the biggest threat to the banking system and the Fed knows it. These institutions remain leveraged to the hilt and dependent upon short-term financing to stay afloat. While American families have had to stop paying off one credit card by moving the balance to another one, this behavior continues on Wall Street.

In fact, this gets to the heart of why the Fed is keeping interest rates so low. Despite endorsing phony economic data that shows the US is in recovery, the Fed knows full well that the American economy cannot move forward without its low interest-rate crutches. Ben Bernanke is trying desperately to pretend that he can keep rates low forever, which is why that variable was deliberately left out of the stress tests.

Unfortunately, rates are kept low with money-printing, and those funds are starting to bubble over into consumer prices. Bernanke acknowledged that the price of oil is rising, but said without justification the he expects the price to subside. This shows that Bernanke either doesn’t know or doesn’t care that the real culprit behind rising oil prices is inflation. McDonald’s, meanwhile, is eliminating items from its increasingly unprofitable Dollar Menu. A dollar apparently can’t even buy you a small order of fries anymore.

Unless the Fed expects us to live with steadily increasing prices for basic goods and services, it will eventually be forced to allow interest rates to rise. However, if it does so, it will quickly bankrupt the US Treasury, the banking system, and any Americans left with flexible-rate debt.

That is why the Fed feels it has no choice but to lie about inflation. If it admits inflation exists, then it may be pressured to stop it. However, if it stops the presses, it will bring on the real crash that I have been warning about for the past decade. Just as the Fed’s response to the 2001 crisis led directly to the 2008 crisis, its response to 2008 is leading inevitably to either deep austerity or a currency crisis.

[For more on the crisis ahead, pre-order Peter Schiff’s latest book, The Real Crash, due out in May.]

Imagine this scenario:

When the banks fail as a result of higher interest rates, the FDIC will also go bankrupt. Without access to credit, the US Treasury will not be able to bail out the insurance fund – which only contains $9.2 billion as of this writing. So, not only will shareholders and bondholders lose their money next time, but so too will depositors!

Americans are much less self-sufficient than they were in the Great Depression. One only needs to look at Greece to see how a service-based economy deals with this kind of economic collapse – crime, riots, vandalism, and strikes.

There are a few countermeasures left in the government’s arsenal, including selling the nation’s gold, but there comes a point at which the charade can go on no longer. The sharply widening current account deficit shows that we are becoming even more dependent on imports that we cannot afford. Just as homeowners had a good run pulling equity from their overvalued properties, Washington and Wall Street will soon find the music turned off. And there will be no one there to help them clean up the mess left behind.

I propose a new rule of thumb: until true economic growth resumes in the distant future, the fed funds rate should also be used as the “Federal Reserve credibility rate.” We’ll use a scale of 0-20, which is approximately how high rates went under Paul Volcker to restore confidence in the dollar. So, until the end of this crisis, if the fed funds rate is near-zero, all the Fed’s statements, forecasts, and stress tests should be given near-zero credibility. When rates rise to 5%, the Fed’s words can be assumed to be ¼ credible. When they hit 20%, that would be a Fed whose words you could take to the bank – if you can still find one.

For in-depth analysis of this and other investment topics, subscribe to Peter Schiff’s Global Investor newsletter. CLICK HERE for your free subscription.

For a great primer on economics, be sure to pick up a copy of Peter Schiff’s hit economic parable, How an Economy Grows and Why It Crashes.

For years now, US government bonds have looked like terrible investments, what with those trillion-dollar deficits and multiple wars and all. But Treasuries just kept rising, earning their owners nice returns and making their critics seem like financial illiterates who didn’t know a AAAA credit when they saw one.

Check out the chart for TBT, a 2X negative long-term Treasury ETF (in other words, a fund that bets against Treasury bonds). In case the price numbers are hard to read, this fund peaked at 70 in 2008 and has since fallen steadily if irregularly to less than 20. Far from being the short of the decade, Treasuries, especially if you were using leverage to bet against them, have been a sound-money investor’s nightmare. …

(Click on image for further reading)

….read more HERE