Asset protection

Is Hong Kong a harbinger of what is coming to the US?

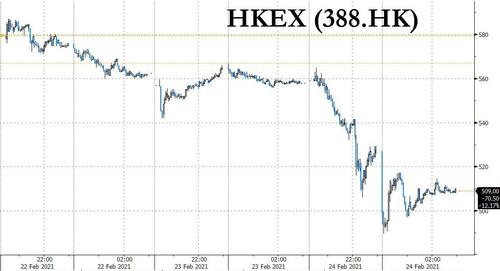

With speculation growing in the US that in the aftermath of the Robinhood scandal, the Biden administration may pass a transaction, or “Tobin Tax” demanded by progressive democrats (according to a 2018 CBO estimate, a 0.1% tax on stock, bond and derivative transactions could raise $777 billion over a decade) and targeting HFTs and other “market makers”, overnight Hong Kong showed how it’s done when in a shock announcement, Hong Kong unveiled its first stamp-duty increase on stock trades since 1993, sparking a furious selloff in the $7.6 trillion market and sending shares of the city’s exchange to their biggest plunge in more than five years.

As Bloomberg reports, the plan for a trading-tax hike to 0.13% from 0.10% is part of a raft of new measures announced in Hong Kong’s budget on Wednesday that included increased spending and cash handouts (in the form of coupons) to help residents weather the pandemic. Even as the city’s economy has plunged over the past year, stock prices and trading have surged amid a global market boom.

The news sent local stocks tumbling, with Hong Kong’s Hang Seng Index closing 3% lower, led by a 8.8% tumble in Hong Kong Exchanges & Clearing.

The plunge was especially awkward as it came after the bourse operator reported record annual earnings on Wednesday. Mainland-based funds sold a record $2.6 billion worth of Hong Kong stocks through exchange links with Shenzhen and Shanghai. That comes after 38 days of net purchases from north of the border.

The news was as shocking to the exchange as it was to everyone else. Calvin Tai, HKEX interim CEO said in an earnings call that the he wasn’t consulted by the government on its decision to hike the stamp duty.

“The impact will be significant,” said Kingston Lin, managing director of the asset management department at Canfield Securities in Hong Kong, ahead of the announcement by the city. “The market is doing very well and, of course, it will bring more revenue to the government. But higher transaction costs will be a concern for the exchange.”

And in a true Robinhood twist, an exchange spokesperson said that “whilst we are disappointed about the government’s decision to raise stamp duty for stock transactions, we recognize that such a levy is an important source of government revenue,” adding that “HKEX looks forward to continue working closely with all its stakeholders to drive the continued success, resiliency, vibrancy and attractiveness of Hong Kong’s capital markets.”

According to local media including Apple Daily and NowTV, the trading tax hike will be launched on Aug. 1 and the government expects it to generate an extra HK$12 billion a year. In the 2019/2020 fiscal year, the duty contributed HK$33.2 billion in revenue.

That said, the move risks damping a trading boom that has gripped the city and propelled earnings at the exchange. The bourse on Wednesday reported that profit rose 23% to a record HK$11.5 billion in 2020, helped by a 60% jump in stock trading. Its shares have surged about 150% from a low last year, making it the world’s biggest by market value.

Analysts at Citigroup Inc. estimated that the increased stamp duty will raise trading costs by 6% to 15%, pressing down trading volumes and crimping the exchange’s earnings per share by 3% to 7%.

Separately, the government announced spending measures of more than HK$120 billion ($15.5 billion) to alleviate economic hardship for city residents struggling after a two-year economic recession.

While Hong Kong has been an outlier when it comes to taxing stock transactions, with major markets such as the U.S. and regional rival Singapore refraining, HK’s action may prompt more politicians into acting to transfer some capital from the financial sector to the people. Indeed, talk of implementing a tax on financial transactions has recently been rekindled by some Democrats in the U.S. after the recent trading frenzy in GameStop Corp. shares.

“And despite the state of the world, we are actually “net optimistic” for the next couple years…albeit with bumps along the way. A strong start to 2021 in Equity markets is a real blessing.” Read the Jan.20th “Views from the Crowsnest” newsletter from Integrated Wealth Management in Calgary. ~Ed.

While 2020 will be remembered by most folks as the year of the Covid-19 pandemic, I believe that far more consequential things unfolded. The pandemic was the headline, but the real story was and continues to be 1) the accentuation of clear differences of worldview, and 2) an acceleration of the creep of global socialism.

The great news is that – thanks to the skill and temperament of our Portfolio Managers – our retired clients have all made it through the massive volatility in early 2020 with their financial independence intact. Those not yet retired will not need to defer their retirement date. Tellingly, Martin Armstrong entitled his recent conference as, “World Economic Conference 2020: The End of Democracy. Rising Markets.” All is not lost.

Well known Dilbert creator (and trained hypnotist) Scott Adams asserts that we do not decide our own opinions; they’re assigned to us by the media sources we consume and trust. I strongly agree, so I view sources on both sides of our political spectrum…because both sides lie and spin for their chosen team. My hope is that readers might adopt a similar habit, and think for themselves.

I mourn the death of reasonable centrist views, both left and right. Polarization is deeply damaging to civil discourse, and I’m totally finished with the incessant propagation of fear and panic from all levels of government and their communications department, aka the mainstream media.

In a recently recorded video that will air during Michael Campbell’s World Outlook Financial Conference (Feb 5 & 6), I asked if people are feeling like they’re crazy after years of “gas-lighting” by the mainstream media. To wit:

Are You Crazy If You Believe…?

- In the Sovereignty of the Individual (as opposed to allowing a police state)

- In Equality of Opportunity (NOT Equality of Outcome)

- The answer to “bad speech” is more speech (not de-platforming, or “un-personing”)

- Today feels like both “A Brave New World” AND “1984,” and

Are You Crazy If You Believe That…?

- A fair, unbiased press & open access to the public square are essential to a free society

- Free, fair & transparent elections are fundamental to public trust and civility

- Government over-spending creates both longer-term dependency & financial risk

These classical liberal views are part of the foundation of a great, open democratic society. Many public figures seem to have forgotten these principles, if they ever embraced them. Ideas matter, per se, and all elections have consequences.

THINK, while it’s still legal. Secret handshakes may soon be required. What did Mike and the Mechanics know back in the 80’s? Give this a listen.

While we cannot change what’s happening in the world at large, we’re very grateful for the skills and calmness of our Portfolio Managers. They continue doing a fantastic job of filtering out the noise and remaining focused on their only job: preserving and growing client capital.

And despite the state of the world, we are actually “net optimistic” for the next couple years…albeit with bumps along the way. A strong start to 2021 in Equity markets is a real blessing.

If you didn’t have the chance, click here to view our Dec. 15th webinar, The Great Reset, Viruses & Government Debt, where I share more in-depth thoughts on the markets and strategies used by our portfolio managers.

Patience and Discipline are accretive to wealth, health and happiness; so focus on these.

Andrew Ruhland

Founder, Integrated Wealth Management

Capital One, the bank lately dominating the celebrity-featured advertising space in this industry, and claiming to have “reimagined” banking, has now been fined by the authorities for ‘willful’ anti-money-laundering failures–for the second time in six months.

The Treasury Department’s Financial Crimes Enforcement Network (FinCEN) fined America’s fifth-largest credit card issuer $390 million for engaging in willful and negligent violations of the Bank Secrecy Act, an anti-money laundering law.

FinCEN said in a statement that Capital One admitted that it failed to file “thousands of suspicious activity reports” and “thousands of Currency Transaction Reports” with respect to a business unit known as the Check Cashing Group

“The violations occurred from at least 2008 through 2014 and caused millions of dollars in suspicious transactions to go unreported in a timely and accurate manner,” FinCEN added.

Capital One acquired the check-cashing group when it bought New York-based North Fork Bank in 2006 for $14.6 billion and shut it down 8 years later. CLICK for complete article

In the later stages of a bull market advance, the financial media and Wall Street analysts start seeking out rationalizations to support their bullish views. One common refrain is “there are trillions of dollars in cash sitting on the sidelines just waiting to come into the market.”

For example, Barron’s recently penned the following:

“There is record amounts of cash sitting in checking accounts of American households—and for optimistic investors, it’s just one more reason the stock market should keep pushing higher.

Yahoo! Finance also jumped on the claim:

“It should also come as no surprise that there’s never been so much cash sitting on the sidelines — nearly $5 trillion, as a matter of fact. This is significantly above the record $3.8 trillion in cash set back in January 2009 during the financial crisis!”

McKinsey & Co also published the following graphic.

See. There are just tons of “cash on the sidelines” waiting to flow into the market.

Except there isn’t. CLICK for complete article

China Inc will recycle used white guys

American company men may find a savior in China Inc. As corporations try to make their ranks more ethnically representative, many experienced – if white and older – males will find themselves without a job. Chinese companies, deterred from acquiring U.S. firms with valuable intellectual property, can recruit their discarded human capital instead.

Some of the largest U.S. companies are moving quickly to rebalance their headcount. At Apple, for example, women made up 38% of workers under 30 in 2018 versus just 31% four years earlier. The share of under-represented minorities in that group rose 10 percentage points to 35%. Meantime the employment-to-population ratio of white men fell from 76% in 1972 to 67% in 2018.

The coming year should be a banner on diversity… CLICK for complete article