Daily Updates

Donald Vialoux shares his short- and longer-term outlooks for the stock market and explains why he will be watching stocks closely in late October. What’s happening in the market now and what should you do about it….

A critical historical lesson from Art Cashin, focusing on an event that took place 89 years ago. An event which as Cashin says is “one of the most devastating economic events in recorded history and an important backdrop to Europe today”. It all began with the efforts of a few, well-intentioned government officials.

In this article, we will look at three of the most significant reasons why gold is not in a bubble and will continue rising in value for years to come.

There are two ways of looking at gold. The first is the Western way, viewing gold through the lens of fiat currency training. This approach sees gold as a wealth-gaining asset that can be traded like any other asset class or commodity for currency gains. The second way is how the world’s major gold buyers at this time see gold. The Chinese, Indians and Middle Easterners see gold as a wealth-preserving asset that serves the purpose of money. The second group will ultimately be responsible for driving gold into the five-digit range. Many of these people have had direct experience of the damage to one’s wealth a currency crisis can cause. The most aggressive buyers, the Chinese, experienced 4,000 percent inflation per month between 1947 and 1949.

….read more HERE

It didn’t matter which market we were watching – currencies, commodities, stocks – they had become oversold after a plunge throughout the month of September 2011. We expected a bounce and positioned our members accordingly. It is paying off so far. And as we currently see it, this is only a near-term correction that is going to be resolved in another major market collapse.

Perhaps the magnitude of the September move won’t be matched in depth and/or speed, but we believe most markets will ultimately fall through those September lows.

As those who follow us regularly know, we are big fans of using Elliott Wave principles to pinpoint trade setups. We recently came across this article from Elliott Wave International that does a good job of establishing the technical justification for another steep market decline. Give it a read – you’ll learn a lot in just 5 minutes.

Thanks,

Jack

P.S. They are also offering a FREE report at the end of the article. I think it’s worth checking out — you’ll be happy you did …

Did the Past 7 Weeks of Rally Lull You to Sleep?Here’s why you SHOULDN’T get too comfortable

Don’t get me wrong — we are not in the bear market territory yet. At least, not officially. An “official” bear market begins when the stocks indexes decline 20%. The DJIA’s decline from the May 2, 2011 high to the September 21 low is about 17%. Close, but no cigar.

Add to that the strong rallies we’ve seen over the past few weeks (Sept. 12-20: +685 points in the Dow, for example) — and lots of people conclude that despite the volatility, things aren’t so bad.

But let’s get some perspective. The stock market has been around a while. Only when you look at its history do you realize just how cunning — and fast, and strong — bear markets can be.

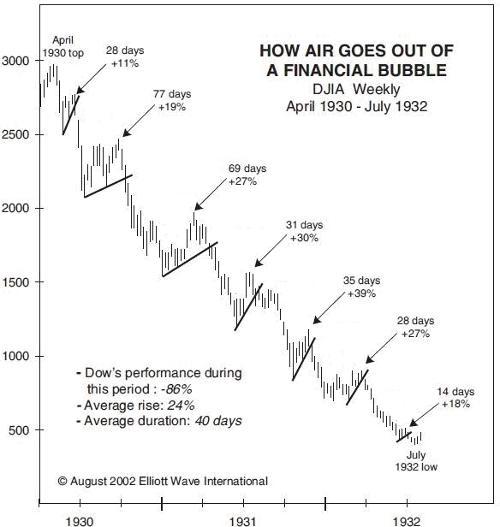

Here’s a chart we’ve shown readers before. It’s worth printing out and keeping on the wall above the desk where you open your brokerage statements.

This is the DJIA between 1930 and 1932, one of the worst bear markets in history. Robert Prechter, EWI’s president, took the time to measure the percentage gain of each bear market rally during the 2-year period — you can see them in this chart.

When you routinely see double-digit rallies (11 percent, 18 percent, even 39%) over the course of two or three years, it’s easy to be lulled into thinking that maybe things aren’t so bad.

The reality, of course, is that the bear market’s chokehold grows tighter around your neck with every drop-rally sequence. (Think back to the 2007-2009 collapse, and you’ll remember the same behavior.)

Which brings us to here and now. Rallies and declines of 300-400+ points have been so common since August that we’re kinda getting used to them.

The question is: Are we in a bear market, or is it that “maybe things aren’t so bad”?

You need some perspective to answer that question. The research we do here at EWI can help.

(Ed Note: I have subscribed and downloaded and took a screen shot of the 3 shocking charts below.)

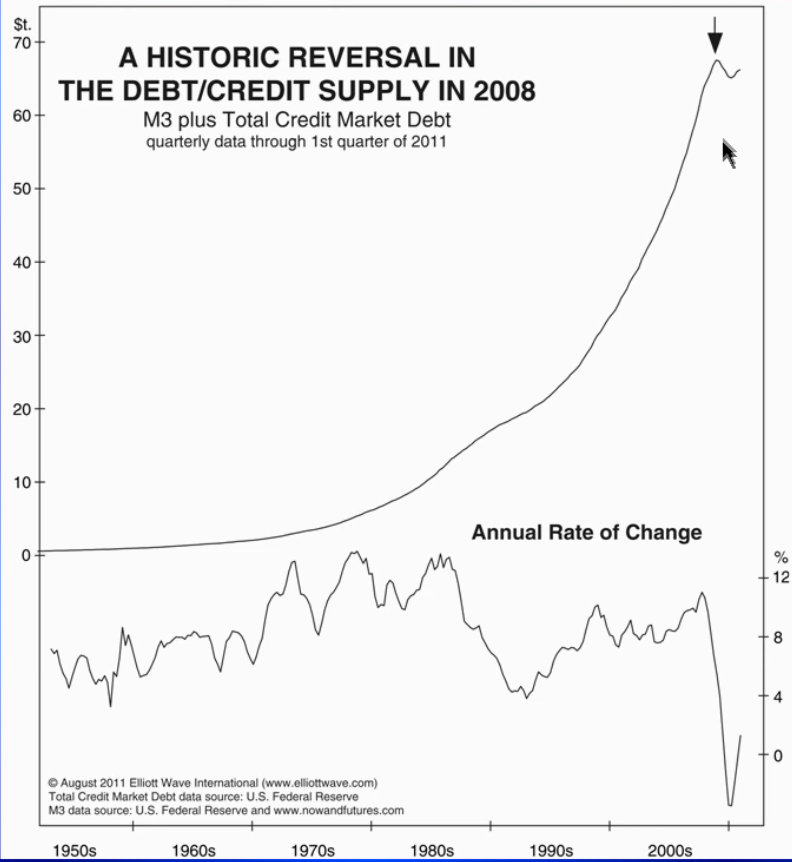

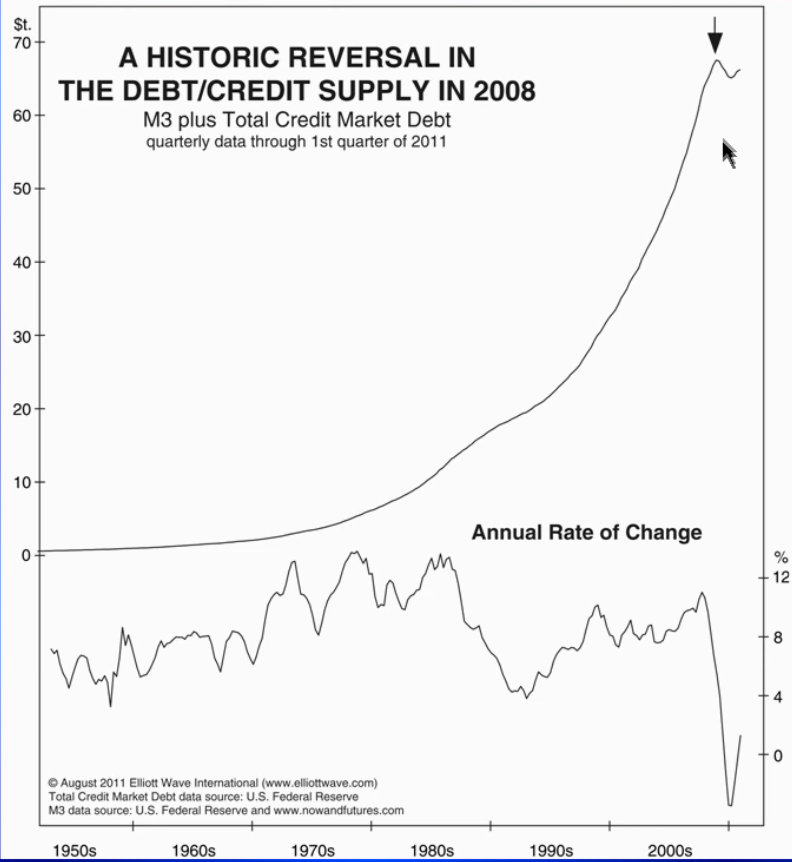

What is the problem behind the markets? According to Bob Prechter the answer is Debt began to implode in 2008. As you can see on this first chart below, “debt has been growing constantly since the 1930’s, it got into a parabolic rise in the 1990’s and 2000’s That’s what supported the Real Estate market and the stock boom, all these new dollars in terms of IOU’s. That change reversed in 2008, had a slight recovery during bear market rally from 08′. But this trend is exhausted”. – Prechter

Prechter thinks “we started a new Bear Market when all the markets hit an all-time high, real estate in 2006, Stocks in 2007 and commodities in 2008, and that the Historic Reversal in the Debt/Credit Supply is about a Deflationary Depression which is already upon us”. – Prechter

What is the major component of the Debit/Credit line above? Mortgages . You can see in the chart below that Mortages actually peaked in 2005, a year before the Real Estate market peaked in the USA. You can also see below that the number of mortgages fell to a new low last year in 2010 when an Economic recovery was supposed to be in motion.

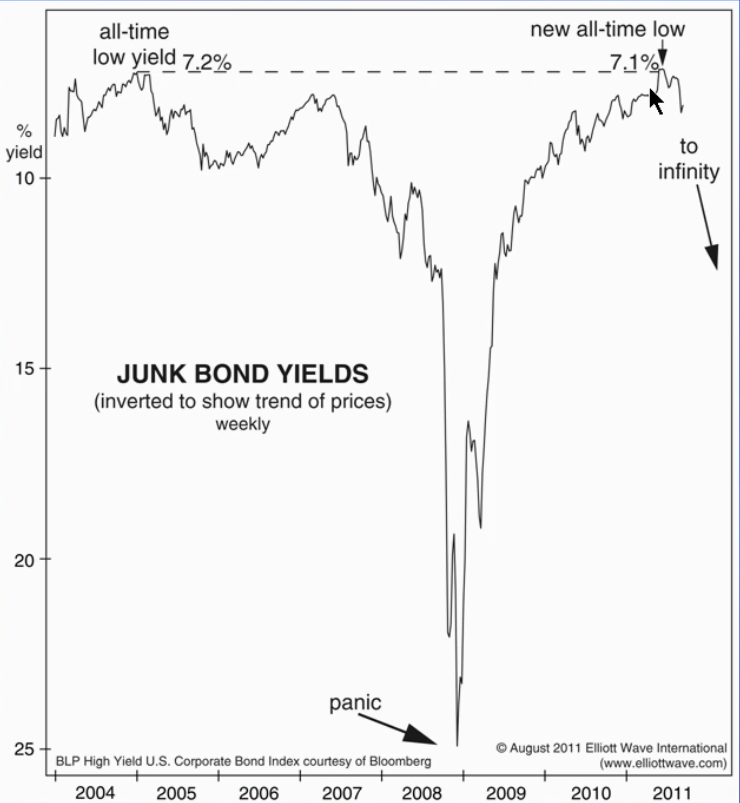

Elliottwave’s Bob Prechter thinks that complacency at an all time low as measured by Junk Bonds precedes an imminent collapse. Junk bonds actually made a new all time high price in April of 2011, taking out the Optimism of the high’s in 2005. A new decline has begun and if it takes out the bottoms struck in 2008 “they are going to go to zero” – Prechter

EWI report Buying Opportunity Ahead or Another “Free Fall” Ahead that Jack Crooks refers to, you can subscribe to the EWI Free Report HERE

Legendary mining entrepreneur Ross Beaty is an optimist. He likes the opportunities present in both bear and bull markets. In this exclusive interview with The Gold Report at the Casey Research Summit in Phoenix, he explains his love of metals and alternative energy and what he is doing to position himself regardless of where the markets go.

The Gold Report: Your talk was titled “Gold, Silver, Copper, Nickel and Alternative Energy: the Commodities I Still Like.” Before we get into the specific commodities, I wanted to ask you about the distortions in supply and demand that you mentioned. As more investment is going into exploration, fewer discoveries are being made. Is that because the easy ones have already been mined? Are costs higher? Are there more regulatory burdens? And how does that impact share prices?

Ross Beaty: It is more expensive to discover resources because there are more barriers to development; there are more empowered people who don’t want a mine in their back yard. The U.S. is a perfect example where there are some great ore bodies that simply are not allowed to be developed. What used to take three years now takes 10 or 20. That means that supply just can’t respond quickly enough to rises in prices and prices stay higher longer.

Share prices are influenced by many factors—perceptions about long-term and short-term trends. The winds of change that affect profitability of a mine in a particular place present a very complicated picture. You have to look at operating and capital costs. If you work anywhere other than the U.S., in Chile for example where the currency has increased in value 30% against the dollar in the last three years, you have to consider the impact of the devalued dollar because suddenly all local costs have gone up 30%. All of this weighs on profitability. It is difficult to break out the impact of just the price of development alone on share price, but it does have an impact.

You also have to realize that exploration and mining companies are very different. Exploration companies won’t have cash flow for many years. It’s a much riskier business to evaluate compared to a mining company that suffers changes in revenue and costs minute by minute. For example, one of my companies, Pan American Silver Corp. (PAA:TSX; PAAS:NASDAQ), the second-largest primary silver producer in the world, produces 24 million ounces of silver each year. If we have a silver price change of year-on-year $10/ounce, that immediately translates into an extra $240 million (M) of cash flow. If I have a deposit in the ground that will take 10 years to dig out, short-term price fluctuations mean absolutely nothing to the profitability of the company. It’s a very different thing.

TGR: Do people have longer-term investing strategies toward exploration stocks if it takes so long to pay off?

RB: It always surprises me that people treat exploration stocks as if they were producing mining companies. Share prices go up and down based on the price of the metal. It makes no sense, but they do. They also judge the immediate value of an exploration company based on political changes when often the political situation will have changed completely by the time the mine is producing in five or ten years.

TGR: Does politics play an important role in the profitability of producing mining companies?

RB: Politics have greater impact on producing companies. We have an asset in Bolivia. In May, the president made a sweeping statement that he wanted to nationalize the mining industry. Pan American was hit by 15% share price drop overnight even though nothing happened, the rules didn’t change, the mine is still operating. And that mine is only about 6% of the net asset value of our company anyway. Investors sell on rumors. That is the world we live in.

TGR: Once a mining company finds a resource and gets through the long permitting process, is it difficult to find qualified people?

RB: The existence of a trained workforce—engineers and geologists—is a very serious problem today. Not enough are being educated. The same is true in the oil industry. Keep your bankers and lawyers, but send us your engineers and geologists. It’s the same in Peru, Argentina and Chile. That will impact how long it takes to get a mine built, how well it is built and how profitable it will be in the end. It is a very serious problem.

TGR: Is there a solution?

RB: There is a lag and often it ends up countercyclical. When the market is up, students go in, but it takes four years and by then the market could be down. I have seen this many times, but this particular construction boom is just sucking up everyone. We need more people going into these programs.

TGR: You said gold has great legs. How high can it go?

RB: I have no idea. I just know the forces driving metal prices are very strong right now. Gold is in a secular bull market with long-term upswing driven by governments printing money, lack of supply and increased demand from China. These are powerful forces. When they will stop, I don’t know, but I don’t see things changing anytime soon. That is especially good for gold and silver.

TGR: You sold Ventana Gold Corp. (VEN:TSX) last year for $1.5 billion. Now you are an investor inKeegan Resources Inc. (KGN:TSX; KGN:NYSE.A). Is that the same business model: explore, derisk and sell?

RB: I like the story. Keegan is basically the same business model as Ventana. The company is developing a gold deposit in Ghana. It hopes to sell it and that usually commands a premium. It could take a month or it could take three years. My money is on the shorter term.

TGR: You called silver the schizoid metal because it doesn’t know if it is a precious metal, an industrial metal or an investment insurance play and that can make it more volatile. Are ETFs bringing more investors and therefore making it even more volatile?

RB: The silver ETF has been the most important thing driving silver prices in history. It has created a whole new demand from people who want an easy way to buy physical silver.

TGR: Is it a new demand or does it cannibalize the equities?

RB: It definitely cannibalizes equities, so does the gold ETF. But I would rather have a higher silver price since that provides better cash generation and a more sustainable long-term business. They are both good ways to have exposure to silver. I was a big part of the establishment of the silver ETF and without a doubt that has profoundly contributed to the rise in silver prices.

TGR: Is that also true on the gold side?

RB: Not as much on the gold side. Silver is a much thinner market so a little bit of money on the silver side has a bigger impact than the same amount on the gold side. Gold is also held by central banks in significant amounts and that has its own impacts.

TGR: Pan American is selling for less today than it was a year ago when the price of silver was higher. What is causing the distortion?

RB: Forward-looking investors bought in the $10 range with the expectation that the price of silver would go up.

TGR: So today’s higher silver price was priced into the stock?

RB: Yes. Today a lot of people have taken money out of the equities because they fear perturbations in world economies that will drive down all metals.

The other factor is that Pan American had some unusual political exposure this year. For example, Peru. When Ollanta Humala was elected president, people thought he would be another Chavez and nationalize the mining industry, so they sold our stock. That didn’t happen, but the stock took a hit anyway. We also have an enormous asset in Argentina, but it needs some political changes before its value becomes apparent. These things weigh on our share price.

I am optimistic about the price going forward because these concerns haven’t been realized. We are taking advantage of the share price devaluation to buy back $150M of our stock. It is a great use of our capital. So, this market correction is a gift because it gives us a chance to increase the value-per-share for shareholders who want to keep their shares long term.

TGR: Are the same dynamics at play in copper?

RB: They call copper “Dr. Copper” because of its ability to reflect global economic conditions. In the last 50 years, it has had many cycles. The most recent bull trend is really driven by industrial demand from China. Copper is used in energy transmission, energy generation and, at the other end, all kinds of consumer goods. Cars use a huge amount of copper and electric cars use even more. Developing countries use an immense amount of copper to grow.

TGR: But if China experiences an economic slowdown, what does that do to copper demand?

RB: I have a different view of China. I don’t believe the enormous ship of China has turned course. It may have hit a few waves but it still has a long way to go to improve living conditions for its people. I don’t see growth stopping because there is a little bit more debt than it should have or it is acting a little bit more bellicose than it should. China will take its place as a world leader and remain an engine for economic growth.

TGR: Why aren’t stock prices reflecting Chinese demand?

RB: China has been the single most important factor in the metals bull market of the last nine years for fundamental reasons. The recent problems in the stock market haven’t been about China but because of the problems in the rest of the world. In early 2009, a lot of people were saying China’s run is over. That was the best investment opportunity in my lifetime. That was when you wanted to back up the truck because everything was so oversold. A lot of people said it was the end of the world, the end of the bull market. It turned out metal prices bounced right back and they have been like that for the last couple of years and are just slightly off that peak now. Copper is still at prices that most mining companies just love. I’m taking the view that this is a great opportunity to be a buyer. It’s the people who are contrarians and have the courage to buy when everyone else is selling who make the big money.

TGR: But this downturn is less about financial institutions collapsing than fears of a double recession. If “Dr. Copper” reflects economic growth, why are you still optimistic?

RB: I look at the whole world as a source of demand. Things are booming in Saudi Arabia, South America, India, parts of Asia. In all those places there is growth, which demands new infrastructure and that requires a lot of copper. Even though there is a slowdown in the U.S. and Europe, there is great growth elsewhere. Every day more people are born and more people want stuff. This is very supportive of long-term high prices. Nothing goes up forever in a straight line. Price corrections are absolutely normal and healthy.

TGR: Is this the same thing you are seeing in nickel?

RB: Nickel is less complicated. It has one use—stainless steel. You just have to look at demand for that and things look pretty good there. On the nickel supply side, it is changing radically. The cheap, easy-to-operate nickel mines are being mined out and being replaced by expensive-to-build and operate nickel mines. So you need high nickel prices to bring into production and sustain those mines. If nickel prices go down, those may be shut down, which will reduce supply and increase prices.

TGR: What is the magic number where nickel mining is no longer profitable?

RB: That might be $5–$6/pound on a global average, maybe more.

TGR: Lumina Copper Corp (LCC:TSX) and Anfield Nickel Corporation (ANF:TSX.V) are two metals companies you are involved in with an explore-and-sell business model. Mergers and acquisition activity has been off lately. Do you see that changing?

RB: I think there has been a lot of acquisition in the last year globally. A big deal was announced last week by a Chinese company for an African copper producer.

TGR: Is that the trend, that China will be the home of a lot of the acquirers?

RB: China has been the number one buyer for sure. It isn’t just limited to the Chinese companies, however. In the last cycle it was English, American and Canadian companies. Now it’s the developing countries: Indian and Korean companies are entering the space. They want to secure long-term metal supplies because they need them to secure supply for their manufacturing businesses. They are worried about buying on the open market and the prices going up, so they are taking action by buying assets in the ground. It also reduces their exposure to the U.S. dollar. I don’t see that changing anytime soon.

TGR: You said you are an optimist and the proof might be your dedication to renewable energy.

RB: I’m doing that as much for love as money. I think it is an important legacy for my children to wean ourselves from fossil fuels. Oil and gas are great for making a lot of things, but it is a terrible waste to burn them. Alterra Power Corp. (AXY:TSX) started up in 2008, went public in 2009 and already has $1.1 billion in assets, all generating clean power, profitably.

TGR: Your strategy has been to make it bigger. You started with geothermal and added wind and run of river. Will you keep growing it?

RB: Even though I am disappointed in the stock market reaction the last couple of years, I am proud of our execution of the business plan. We have a wonderful team of experts, adequate capital and we are building a large alternative energy company that is profitable and sustainable and will live way beyond my lifetime. This is based on development of energy sources that are free: wind, heat and water. You just have to hook them up to a turbine. This takes a lot of money, but once they get going, they run essentially forever at very low cost.

Alterra is already a medium-sized alternative power company that will survive and prosper for a long time. We are working on how much bigger we can get and with what technology: wind, water or geothermal. Do we want to grow organically or do we want to buy other businesses on an accretive basis? It has to be a winning proposition for everyone. This is the ultimate long-term business.

TGR: Long term and steady, but without big jumps in price.

RB: It’s the opposite extreme of mining where you have no control over your revenues. In this business, you fix the prices for the long term, 20–25 year contracts, so your revenues are steady and predictable. Banks love these long-term businesses. These are ultimately big dividend producers.

TGR: How long before it starts paying off?

RB: We are in a position to pay dividends today. But I think we can better reward our shareholders by growing. We might be there next year or sometime after that.

TGR: What are you most excited about?

RB: I am most excited about continuing to build Alterra Power into a bigger and better clean energy company. We can do this in any market, be it bear or bull. Bear markets aren’t all bad. It is often easier and cheaper to build things in tough markets when other companies are stressed. Slower markets usually also mean lower capital costs. But I also like bull markets; it’s always nice to see the share price go up.

I don’t know what is going to happen next week or next month, but if we keep our heads down and execute on our business plan, we will build value.

TGR: We are at the “When Money Dies” conference that says fiat currencies will die. Since you are so tied to U.S. dollars, do you believe that and how do you deal with that?

RB: I am involved in a natural hedge against dollar devaluation—metals mining. As currencies weaken, metals prices go up. It’s a good place to be today. And in alternative energy, once you have operating plants using wind, water or geothermal heat, you have long-term predictable revenues and no exposure to commodity prices. It’s another great place to be today.

TGR: But if the dollar weakens, don’t your operating costs go up as well?

RB: You have to hope that revenue increases faster than expenses and that is what has happened so far.

For the complete audio collection of the Casey Research/Sprott Inc. Summit “When the Money Dies,”click here.

Ross J. Beaty is a geologist and entrepreneur who currently serves as chairman and CEO of Alterra Power Corp. and Pan American Silver Corp. He also founded and divested a number of other public mineral resource companies. Born in Vancouver, Beaty has degrees from the Royal School of Mines, University of London, (M.Sc., Distinction in Mineral Exploration, 1975) and the University of British Columbia (LL.B. [Law] 1979 and B.Sc. [Honors Geology] 1974). Working in 50-plus different countries during the course of 37-plus years in the international minerals industry, he speaks English, French and Spanish, as well as some Russian, German and Italian.

Beaty is a past president of the Silver Institute in Washington, D.C., a fellow of the Geological Association of Canada and the Canadian Institute of Mining, recipient of the Institute’s Past President’s Memorial Medal, and a founder of the Pacific Mineral Museum in British Columbia. Beaty received the Association of Mineral Exploration of B.C.’s Colin Spence Award for excellence in global mineral exploration in 2007 and in 2008 the Mining Person of the Year award from the Mining Association of B.C. and the Ernst & Young, Natural Resources Entrepreneur of the Year award.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) JT Long and Karen Roche of The Gold Report conducted this interview. They personally and/or their families own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: None.

3) Ross Beaty: I personally and/or my family own shares of the following companies mentioned in this interview: Pan American Silver Corp., Alterra Power Corp., Keegan Resouces Inc. I personally and/or my family am paid by the following company mentioned in this interview: Pan American Silver Corp.