Daily Updates

“Domestic oil and gas in the Bakken of the Dakotas and Saskatchewan, oil and gas offshore of the US and heavy oil production in the lower 48 can significantly reduce our dependence and trade deficits while increasing our security and geopolitical options.”

….read Michael Berry’s full commentary HERE.

Ed Note: For an explanation of the fascinating and massive Bakken Formation go HERE. “The Bakken formation has the potential to eliminate all American dependence on foreign Oil“.

Richard Russell has made his subscribers fortunes. One of the best values anywhere in the financial world at only a $300 subscription to get his DAILY report for a year. HERE to subscribe. Amongst his achievements Richard was in cash before the 2008/2009 Crash and he has been Bullish Gold since below $300.

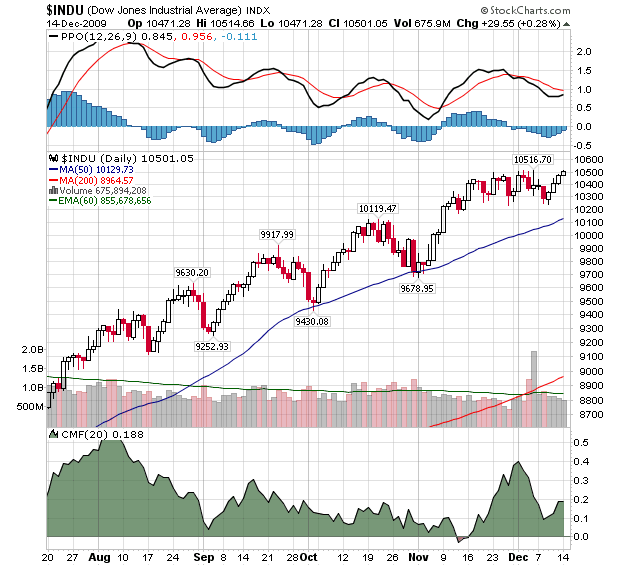

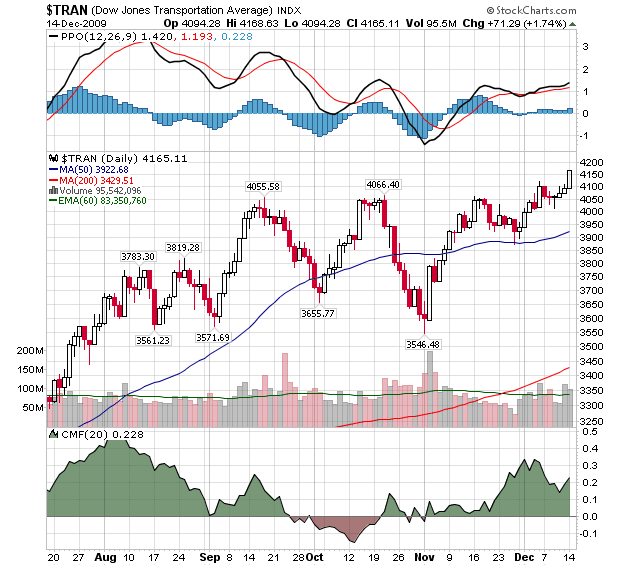

Late Notes — A mild rising day. But wait, it was better than that. The Dow and the Transports BOTH rose to new highs for the move. This is almost a guarantee of higher prices. And it’s a reconfirmation that the secondary trend of the market is bullish.

(for an explanation of the Dow Theory go HERE.)

Ed Note: Below from Don Vialoux’s Monday technical analysis of the Dow Industrials and Dow Transportation average in which he agree’s with Russells view of higher US Stock prices:

“The Dow Jones Industrial Average improved 82.60 points (0.79%) last week despite strength in the U.S. Dollar. Intermediate trend remains up. Its 50 day moving average currently at 10,109.46 has proven to be a reliable intermediate support level. Short term momentum indicators recently slipped to a neutral level. Support also is indicated at 9,678.95. Strength relative to the S&P 500 Index remains positive. Seasonal influences currently are positive.”

“The Dow Jones Transportation Average slipped 7.94 points (0.19%) last week. Intermediate trend is up. The Average remains above its 50 and 200 day moving averages. Short term momentum indictors are overbought, but have yet to show signs of rolling over. Strength relative to the S&P 500 Index remains neutral. Support is indicated at 3,546.48.

Ed Note: Don’s Bottom Line: ‘Tis the season for equity markets to move higher until early January! Look for history to repeat.

Back to Russell:

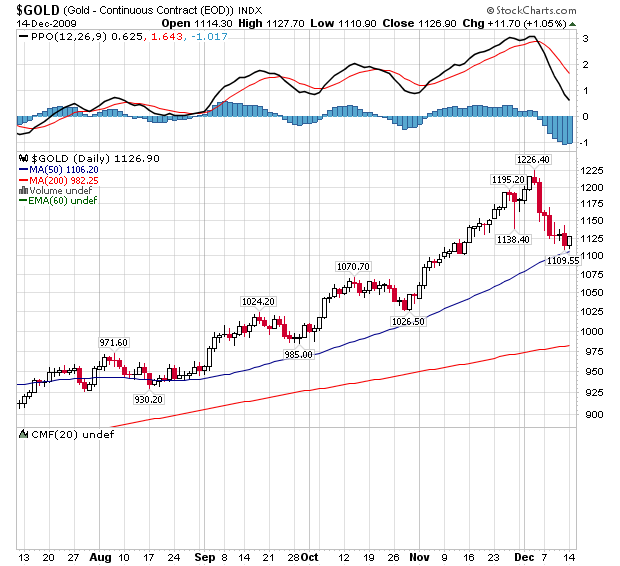

“Gold Thoughts — Buying and accumulating gold must be seen as a LONG-TERM proposition. I can tell you that gold is going much higher, but I can’t tell you when. I can tell you what to buy — gold bullion coins — but I can’t tell you when it’s going to go into its bubble phase. By the same token, I can tell you that the dollar will go into its “water fall phase,” but I can’t tell you when.

Don’t buy gold to “make a killing.” Buy gold as a permanent store of wealth, and one that can’t go bankrupt. Rich people understand that.

Bull markets eventually come to a boil, but the time of the boiling is never obvious. Apply that thinking to the gold bull market.

China is now the leading gold miner and producer in the world. China is actively encouraging its people to buy and accumulate gold. And I wonder how long it will be before the US government imitates China. Yes, I foresee the time when the US government (as stupid as it’s been, so far) will do a reverse and encourage the American people to buy and accumulate gold.

China, Russia and most of the Asian central banks still have only a small percentage of their reserves in gold. All of these nations want to increase the gold percentage of their reserves. There was an announcement over the weekend that the Russian central bank was adding to its gold reserves.”

Daily Gold Chart

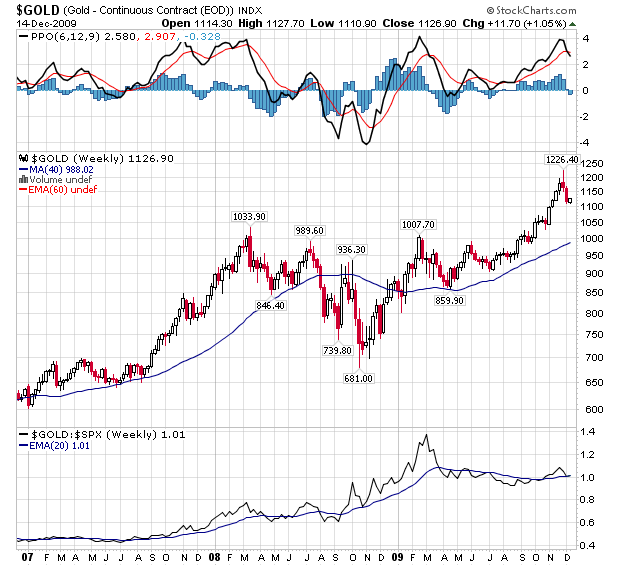

Weekly Gold Chart

Monthly Gold Chart

The 84 yr. old writes a market comment daily since the internet age began. In recent years, he began strongly advocated buying gold coins in the late 1990’s below $300. His position before the recent crash was cash and gold. There is little in markets he has not seen. Mr. Russell gained wide recognition via a series of over 30 Dow Theory and technical articles that he wrote for Barron’s during the late-’50s through the ’90s. Russell was the first (in 1960) to recommend gold stocks. He called the top of the 1949-’66 bull market. And almost to the day he called the bottom of the great 1972-’74 bear market, and the beginning of the great bull market which started in December 1974.

It sure looks that way.

In Canada, nationwide average home prices are now more than 20% year- over-year…

At a time when personal income is down around 1% over the past year, we have seen nationwide average home prices soar over 20% and last month hit a record high; as did home sales. In real terms, home price appreciation is back to where it was in 1989. Of course, back then, interest rates were far higher but then again, the economy was in the late stages of a phenomenal multi-year economic expansion, not making a transition from deep recession to nascent recovery.

….read the entire report HERE.

(Earlier Today)

THE NEXT WAVE OF INSTABILITY — SOVEREIGN DEBT

The reason why gold is back to a four-week low is because the bull trade became very overcrowded and the yellow metal was ripe for correction after a parabolic move, but what a buying opportunity this is going to prove to be. Of course, the U.S. dollar has recovered from the abyss, but only for now. While the greenback has re-emerged as a safety-valve, what makes gold special is that it is not responsive to global economic shifts or is it any government’s liability. The situation in Europe is troubling — fiscal concerns are mounting, not just in Greece and Ireland (where deficit ratios are north of 9%) but also the U.K., Spain and Portugal (though Ireland did come out with a very austere budget last week).

….read David’s Breakfast Lite summary HERE

….read David’s full Breakfast with Dave commentary HERE.

THE NEXT WAVE OF INSTABILITY — SOVEREIGN DEBT

The reason why gold is back to a four-week low is because the bull trade became very overcrowded and the yellow metal was ripe for correction after a parabolic move, but what a buying opportunity this is going to prove to be. Of course, the U.S. dollar has recovered from the abyss, but only for now. While the greenback has re-emerged as a safety-valve, what makes gold special is that it is not responsive to global economic shifts or is it any government’s liability. The situation in Europe is troubling — fiscal concerns are mounting, not just in Greece and Ireland (where deficit ratios are north of 9%) but also the U.K., Spain and Portugal (though Ireland did come out with a very austere budget last week).

….read David’s Breakfast Lite summary HERE

….read David’s full Breakfast with Dave commentary HERE.