Timing & trends

Surging Crude a Worry for Broader Economy, Boon for Service Stocks in Our Coverage Universe

For the most part, stocks have proven bears wrong so far in 2012 – for now. Strength has been more pronounced in the U.S. where a five-month rally has been built on a string of improving economic data that suggests U.S. corporate profit growth will remain intact near term at least.

The Standard & Poor’s 500 is up for eight of the last nine weeks. This week, the Dow closed above the 13,000 mark for the first time since May 2008 and the S&P 500 twice closed above 1,370, up 9% in 2012 alone. The NASDAQ, at one point, crossed the 3,000 level this week and is trading at its highest since 2000.

While Toronto’s main index closed lower on the day, driven down by slumping resource issues as oil prices fell 2.3% a day after hitting a 10-month high above US$110 on supply concerns in the Middle East. Lower gold prices also affected the resource weighted index, but year to date, the S&P/TSX Composite index is up 5.76%.

Look close enough and you can find both strident bears and bulls at present with relatively reasoned arguments on each side. In the near term, the markets may be due for a pull-back – this can be a natural conclusion. But in the end, we tend to care little about the near-term noise.

The fact is, there are some really expensive stocks out there and some really cheap ones when we look 1-3 years out. It is our job to find them.

OIL RAISES A RED FLAG AND AN OPPORTUNITY – One we have been positioned for over a year to take advantage of.

Investors are focusing more on economic data lately, with a bailout package for Greece in the works and U.S. earnings news winding down. But rising oil prices create some anxiety for the broader economy as crude is often considered a tax on doing business. As it rises, growth can slow. Concern about supply disruptions from Middle Eastern oil producers has kept crude oil above US$120 a barrel.

While the strength in crude could become a drag on the rather tepid recovery, it has already been a boon for oil service stocks as both energy producers and explorers continue to drill and utilize their strong current cash flow to expand. Year-end and quarterly numbers from the oil service stocks in our coverage universe started to come in at the end of this week and the growth has been very strong (as expected).

Forecasts for Q1 continue to be strong and we expect a relatively solid 2012. We will be updating these oil service stocks over the coming weeks for our clients with fully updated BUY/SELL/HOLD ratings.

Our first report will be on Strad Energy (SDY:TSX) which reported recorded record numbers and instituted a dividend policy late today. We are happy to report the stock reacted very favourably this week.

KeyStone’s Latest Reports Section

- Extrusion & Automotive Manufacturer Posts Strong Q1 2012, Pays Strong Dividend (3.1%), Looks for Growth in 2012 – Reiterate BUY (Flash Update)

- Micro-Cap Oil Sands Service Company Trades at 4 Times Earnings and with Big Growth Opportunities in 2012 (New Buy Report)

- Technology – Software Company Reports Record 2011 Results, Q4 EPS Significantly Beats Street Estimates (Flash Update)

- Oil & Gas Equipment Manufacturer Announces Tripling of Quarterly Dividend (Yield Now 4%) (Flash Update)

- Contract Drilling Company, Low Valuations (5.5 times EPS), Strong Growth, Strong Rig Growth – Initiating Coverage with SPEC BUY (Focus BUY) (New Buy Report)

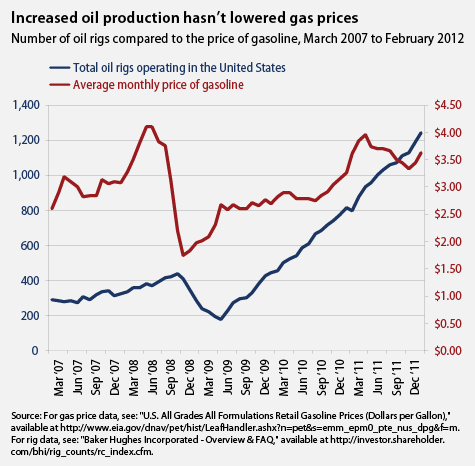

This month, as unleaded gasoline prices increased for 17 consecutive days (to a national average of $3.647 per gallon – up 11% thus far this year) and West Texas Intermediate crude joined Brent crude in breaking through a $100 per barrel level, energy prices emerged as a full blown political issue. While President Obama conveniently claimed that rising prices were the consequence of an improving economy (they’re not, and it isn’t) Republican fingers began to point sanctimoniously at current drilling policies. And while none of the accusers had any idea why prices were actually going up, the award for the most dangerous ‘solution’ must go to Bill O’Reilly at Fox News. The master of the “No Spin Zone” announced that high pump prices could be permanently brought down by a presidential order to restrict exports of refined gasoline. Not only does Mr. O’Reilly’s idea demonstrate contempt for the U.S. Constitution but it also displays a thorough lack of economic understanding.

Oil and gas prices are high now for a very simple reason: the U.S. Federal Reserve has gone on an unapologetic campaign to push up inflation and push down the value of the U.S. dollar. Just last week on CNBC James Bullard, the President of the Federal Reserve Bank of St. Louis, stated this unequivocally. What is somewhat overlooked is the degree to which an inflationary policy at home creates inflation abroad. Many countries who peg their currencies to the U.S. dollar need to follow suit with the Fed. As China, for example, prints yuan to keep it from appreciating against the dollar, prices rise in China. This is especially true for commodities like crude oil.

Many critics, such as Mr. O’Reilly, have relied on a limited understanding of the supply/demand dynamic to question why gas prices are currently so high at home. With domestic gasoline production at a multi-year high and domestic demand at a multi-year low, he logically expects low prices. But he fails to grasp the fact that the price of gasoline is set internationally and that U.S. factors are only a component.

O’Reilly’s loudly proclaimed solution is to limit the ability of U.S. refiners (and drillers) to export production abroad. If the energy stays at home, he argues, the increased supply would push down prices. Although O’Reilly professes to be a believer in free markets he argues that oil (and gasoline by extension) is really a natural resource that doesn’t belong to the energy companies, but to the “folks” on Main Street. What good would “drill baby drill” do for us, he argues, if all the production is simply shipped to China?

First off, the U.S. government has no authority whatsoever to determine to whom a company may or may not sell. This concept should be absolutely clear to anyone with at least a casual allegiance to free markets. In particular, the U.S. Constitution makes it explicit that export duties are prohibited. Furthermore, energy extracted from the ground, and produced by a private enterprise, is no more a public good than a chest of drawers that has been manufactured from a tree that grows on U.S soil. Frankly, this point from Mr. O’Reilly comes straight out of the Marxist handbook and in many ways mirrors the sentiments that have been championed by the Occupy Wall Street movement. When such ideas come from the supposed “right,” we should be very concerned.

But apart from the Constitutional and ideological concerns, the idea simply makes no economic sense.

In 2011 the United States ran a trade deficit of $558 billion. For now at least America has been able to reap huge benefits from the willingness of foreign producers to export to the U.S. without equal amounts of imports. China supplies us with low priced consumer goods and Saudi Arabia sells us vast quantities of oil. In return they take U.S. IOUs. Without their largesse, domestic prices for consumers would be much higher. How long they will continue to extend credit is anybody’s guess, but shutting off the spigots of one of our most valuable exports won’t help.

In recent years petroleum has become an increasingly large component of U.S. exports, partially filling the void left by our manufacturing output. According to the IMF, the U.S. exported $10.3 billion of oil products in 2001. By 2011, this figure had jumped nearly seven fold to more than $70 billion. How would our trading partners respond if we decided to deny them our gasoline?

Keeping more gasoline at home could hold down prices temporarily, but how much better off would the “folks” be if all the prices of Chinese made goods at Wal-Mart suddenly went up, or if such products completely disappeared from our shelves because the Chinese government decided to ban exports that they declared “belonged to the Chinese people?” What would happen to the price of energy here if Saudi Arabia made a similar decision with respect to their oil?

But most importantly, limiting the ability of U.S. energy companies to export abroad will do absolutely nothing to improve the American economy. As a result of our diminished purchasing power, American demand for oil has declined in relation to the growing demand abroad. Consequently, we are buying a continually lower percentage of the world’s energy output. Consumers in emerging markets can now afford to buy some of the production that used to be snapped up by Americans. If U.S. suppliers were limited to domestic customers, then prices could drop temporarily. But what would happen then?

With the U.S. adopting a protectionist stance, and with gasoline prices in the U.S. lower than in other parts of the world, less overseas crude would be sent to American refineries. At the same time lower prices at home would constrict profits for domestic suppliers who would then scale back production (and lay off workers). The resulting decrease in supply would send prices right back up, potentially higher than before. The only change would be that we would have hamstrung one of our few viable industrial sectors. (For more about how diminishing supplies could exert upward pressures on a variety of energy products, please see the article in the latest edition of my Global Investor newsletter).

Mr. O’Reilly can spin this any way he wants it, but he is dead wrong on this point. It is surprising to me that such comments have not sparked greater outrage from the usual mainstream defenders of the free market. To an extent that very few appreciate, America derives a great deal of benefits from the current globalization of trade. Sparking a trade war now would severely reduce our already falling living standards. And given our weak position with respect to our trading partners, such a provocation may be the ultimate example of bringing a knife to a gun fight.

Rather than bashing oil companies, O’Reilly, as well as other frustrated American motorists, should direct their anger at Washington. That is because higher gasoline prices are really a Federal tax in disguise. The government’s enormous deficit is financed largely by bonds that are sold to the Federal Reserve, which pays for them with newly printed money. Those excess dollars are sent abroad where they help to bid oil prices higher.

For years, mainstream economists argued that as long as unemployment remained high, the Fed could print as much money as it wanted without worrying about inflation. The argument was that the reduction in demand that results from unemployment would limit the ability of business to raise prices. However, what those economists overlooked was the simultaneous reduction in domestic supply that results from a weaker dollar (the consequence of printing money).

I have long argued that neither recession nor high unemployment would protect us from inflation. If demand falls, but supply falls faster, prices will rise. That is exactly what is happening with gas. The same dynamic is already evident in the airline industry. Fewer people are flying, but prices keep rising because airlines have responded to declining demand by reducing capacity. Since seats are disappearing faster than passengers, airlines can raise prices. At some point Americans will be complaining about soaring food prices as much more of what American farmers produce ends up on Chinese dinner tables. Because the Fed is likely to continue monetizing huge budget deficits, Americans are going to be consuming a lot less of everything, and paying a lot more for those few things they can still afford.

For full access to the March 2012 edition of the Global Investor Newsletter, click here

There are several forces lining up now to send stocks into a new bull market. Chief among them …

First, the sovereign-debt crisis. The money that’s going to come out of bonds has to go somewhere. It can’t all go into gold, silver and commodities.

So as money shifts out of sovereign-bond markets in Europe, and eventually the United States, there’s going to be a huge influx of capital into stocks — especially the cream-of-the-crop stocks, the blue chips and top S&P 500 names.

Second, precisely because of the European debt crisis, the U.S. looks like a heck of a lot better place to invest these days, especially for Europeans. That’s a corollary of the above point, but it’s already in force — European money is showing up on U.S. shores in droves, and most of it is going into U.S. stocks and bonds.

Third, as I’ve often said in the past, good quality stocks can often take on many of the attributes of commodities. In the sense that stocks can and often do inflate higher with money-printing and inflation, they can and do adjust upward as the underlying currency depreciates, or in anticipation of a currency devaluation.

This happened in the 1930s … and in just about every third-world and emerging-market country that experienced a depreciating currency. From Argentina to Brazil, from Indonesia to Malaysia, from Pakistan to Zimbabwe.

The only difference now and in the future is that the sovereign-debt crisis is not happening in emerging or third-world countries but instead is hitting the FIRST WORLD!

Money-Printing to the Rescue?

So, what could cause a new bull market in stocks when there are so many problems in the world?

The worldwide money-printing phenomenon will not be the cause of it. Even though money-printing is bullish for commodities and stocks, it’s not necessarily bullish all the time.

For instance, a lot of the recent money-printing has managed to help (at least temporarily) push back the European sovereign-debt crisis. So this can have the effect of temporarily taking some of the shine off of tangible assets. We’ve seen this happen in sugar, coffee, cotton and select other commodities that normally do well under a money-printing scenario, but are not doing so now.

And notably, right now the money-printing has largely gone to support banks in Europe. To help liquidity, to help the banks remain solvent, to help the credit markets, to bail out Greece again, and more.

But the money is not yet finding its way into the private sector, where loan demand and credit remains tight. So the fires of inflation are NOT being stoked by the current money-printing, and the inflation force behind a bull market in commodities or stocks is not yet here, either.

Simply put, money-printing is inflationary and bullish for asset prices under most scenarios, yes, but not always.

If it were, gold would already be at new record highs because there’s a heck of a lot more money-printing going on now than before.

We’re Not There Yet,

But When Is That Day Coming?

As strong as gold and silver appear … as strong as the Dow Industrials … the S&P 500 … and even oil look — they are not yet at the point where I can confidently say that new bull legs higher are starting.

Yes, I have been wrong in the short term. Very wrong. And I dislike that just as much as you do.

In fact, I personally am and have been short gold, silver, oil and the S&P 500 in the futures markets. So I fully understand how lousy it feels when you’re on the wrong side of the market.

But I will not succumb to emotions, guilt or popular sentiment just because I’ve been wrong in the short term. That would be the worst thing to do.

Instead, I have to go with hard, technical evidence gathered from my more than 30 years of experience, and from all my trading models and indicators, to draw my conclusions.

Here they are …

- Gold has taken out the December high, which is very positive for the longer term. It confirms that gold is still in a long-term bull market. But that’s all it says.

- To truly break out to the upside, we need to see gold take out the $1,808 and $1,835 levels — preferably on a weekly or monthly closing basis. Until then, gold remains in a very broad trading range that could easily see gold plunge back down.

- Silver, as noted previously, needs to take out the $35.85 level on a monthly closing basis. If silver cannot close above that level on Tuesday, February 28, then it is still at risk of a sharp decline.

- For the Dow Industrials, we need to see a close above the 12,850 level at month-end, before I can say for sure that the new bull market in the Dow that I’ve talked about many times is here. Short of that monthly breakout and buy signal, the Dow also remains at risk of a sharp decline.

- In oil, we need to see a close above the $111 level before I can confidently say that a renewed long-term bull market in energy is back.

This may occur this week, or next month. But no matter what, you can rest assured that, when these markets are fully flashing green, any money you missed out on making recently or any hits you may have taken following my short-term calls will be more than made up for. Many times over.

Best wishes,

Larry

P.S. Our natural-resources expert Sean Brodrick is finalizing an urgent series of recommendations on some new natural gas companies that he’s looking at … and his instructions went out at 1 PM Eastern Time Monday, February 27.

To get the full story on this incredible “New Fuel Revolution” straight from Sean … and to learn how to get the names of these stocks as soon as he reveals them, click here immediately!

About Larry Edelson

Larry has nearly 33 years of investing experience with a focus in the precious metals and natural resources markets. His Real Wealth Report (a monthly publication) and Resource Windfall Trader (weekly) provide a continuing education on natural resource investments, with recommendations aiming for both profit and risk management.

For more information on Real Wealth Report, click here.

For more information on Resource Windfall Trader, click here.

From the Tulip Mania of the 1600s all the way to the recent housing bubble, market manipulators have employed a wide range of tactics to lighten the wallets of unsuspecting investors.

And even though market manipulation is prohibited in the U.S. under a section of the Securities Exchange Act of 1934– it’s as American as apple pie.

Everyone from high-ranking government officials to investment bankers have been caught with their hands in the cookie jar.

The list includes scofflaws like Ivan Boesky, Michael Milken, and Jack Abramoff.

Jim Cramer, the host of CNBC’s “Mad Money,” said he regularly manipulated the market when he ran his hedge fund, calling it “a fun…and lucrative game.”

Not surprisingly, a recent study found that those closest to the information loop -corporate insiders, brokers, underwriters, large shareholders and market makers – are most likely to be the perpetrators.

To give you an idea of how things work, here are three notorious examples of market manipulation.

Stock Market Manipulation Is

as Old as the Hills

1) The Erie War: In 1867, American financier and railroad builder Jay Gould sat on the board of directors of the financially troubled Erie Railroad.

In what is known as the ‘Erie War’ Gould fought to keep Cornelius Vanderbilt from acquiring Erie and consolidating the industry.

To pull it off, Gould issued 100,000 shares of new Erie stock by illegally converting debentures.

He then used the money to bribe New York legislators to make the conversion legal. Outfoxed, Vanderbilt settled, receiving $1 million as a sweetener.

Afterwards, Gould vastly expanded Erie’s debt and launched it on an expansion campaign. Meanwhile, he sold its stock short, and made a killing before Erie went bankrupt in 1875.

2) The Enron Scam: After merging two gas pipeline companies to form Enron Co. in 1985, Ken Lay helped establish the market for selling electricity. Later, he successfully lobbied the U.S. Congress to deregulate the sale of natural gas.

Enron soon began trading these markets to drive up energy prices and significantly increase its revenue. Meanwhile, Lay and CEO Jeff Skilling used accounting loopholes and misappropriated investments to keep billions in debt off the books.

But perhaps their greatest feat was their ability to pressure Arthur Anderson & Co. staffers to cooperate in fooling the board of directors and audit committees.

Investors lost more than $70 billion when the Enron scandal ended in one of the biggest bankruptcies in history, driving its stock down from a high of $90 per share in mid-2000 to less than $1 by the end of November 2001.

Andersen, one of the five largest accounting partnerships in the world, lost most of its customers and shut down.

The scandal eventually led to the enactment of the Sarbanes-Oxley Act to expand the accuracy of financial reporting for public companies and punish those attempting to defraud shareholders.

3) The Internet Swindle: It used to take rooms full of stockbrokers feverishly working massive phone banks to manipulate a company’s shares.

Now anyone can reach millions of potential traders instantly, all while remaining completely anonymous.

In 1999, two UCLA students drove the stock of a bankrupt printing company from 13 cents to more than $15 in twotrading days, dramatically demonstrating how the Internet had transformed the old game of stock market manipulation.

The students had spent two weeks acquiring 97% of the thinly traded stock of NEI Webworld Inc., The New York Times reported. After the market closed on Friday, they sent out hundreds of messages on Internet bulletin boards touting a takeover and the huge profits to come.

On Monday, based on orders made by those who believed the fake postings over the weekend, the stock rocketed up 106,600% to $15.50a share–in a half- hour.

The students sold their shares into the buying frenzy and eventually bagged over $350,000 in profits. NEI shares closed that day at 75 cents.

Is Silver Next?

The latest market manipulation could be ripped from the pages of a Hollywood thriller, according to Peter Krauth, a highly regarded expert in metals who runs the Global Resource Alert investment service.

Only this story is not fiction… and it’s happening now, he says.

Krauth spent the last six months conducting an exhaustive investigation of a backroom deal to keep the price of silverartificially depressed. Now he’s ready to expose what’s been going on behind the scenes in the silver market and why the price is headed to $200 or more.

He reveals all the details – and how investors can profit – in a free report.

You can access it HERE.

Investor Jim Rogers, the chairman of Rogers Holdings who predicted a global commodities rally in 1999, said Myanmar is embracing reform as China did decades earlier and he’s optimistic about the resource-rich nation’s prospects.

If I could put all of my money into Myanmar, I would,’ Mr Rogers said at a conference in Singapore yesterday. ‘Myanmar is in the same place China was in early 1979, when Deng Xiaoping said we have to do something new. Myanmar is now opening up.’

Mr Rogers’ comments highlight increased investor interest in the economy that may be Asia’s ‘next economic frontier’, according to the International Monetary Fund (IMF).

The IMF is pushing for an overhaul of Myanmar’s finances as President Thein Sein releases dissidents and engages with opposition leader Aung San Suu Kyi in moves that have prompted the US and Europe to reassess sanctions against the former military dictatorship.

‘It’s right between China and India, 60 million people, massive natural resources, agriculture,’ Singapore-based Mr Rogers said at the gathering organised by New York-based INTL FCStone Inc. ‘You could feed much of Asia, they have metals, they have energy, they have everything.’

China’s Deng introduced capitalist reforms in the late 1970s, lifting more than 200 million people out of poverty and transforming the nation into the world’s second-largest economy and its biggest consumer of steel, copper and coal.

‘In 1962 Myanmar was the single richest country in Asia,’ said Mr Rogers, referring to the year that marked the start of military rule. ‘Now it’s the poorest because it’s been so badly managed in the past 50 years. But they are changing that now.’

Myanmar may grow 5.5 per cent in 2011-2012 and 6 per cent in 2012-2013 on commodity exports and higher investment, the IMF said last month. The country ‘could become the next economic frontier in Asia’ if it takes advantage of its natural resources and proximity to China and India, according to Meral Karasulu, who led an IMF mission to the country in January.

George Soros, the billionaire investor, said last month he had visited Myanmar recently and the president and his ministers ‘genuinely want an opening’.

Rice exports from Myanmar, formerly the world’s largest shipper, may more than double to 1.5 million tonnes this year, the Myanmar Rice Industry Association forecast last month. Sales totalled 700,000 tonnes in 2011.

China and India share more than 3,600km of border with Myanmar, whose 64 million people earn an average of just US$2.25 per day, according to IMF estimates. Both nations have sought increased access to the nation’s reserves of natural gas. — Bloomberg