Timing & trends

“Thousands upon thousands are yearly brought into a state of real poverty by their great anxiety not to be thought of as poor.” – Robert Mallett

I hear the term de-leveraging relentlessly from the mainstream media. The storyline that the American consumer has been denying themselves and paying down debt is completely 100% false. The proliferation of this Big Lie has been spread by Wall Street and their mouthpieces in the corporate media. The purpose is to convince the ignorant masses they have deprived themselves long enough and deserve to start spending again. The propaganda being spouted by those who depend on Americans to go further into debt is relentless. The “fantastic” automaker recovery is being driven by 0% financing for seven years peddled to subprime (aka deadbeats) borrowers for mammoth SUVs and pickup trucks that get 15 mpg as gas prices surge past $4.00 a gallon. What could possibly go wrong in that scenario? Furniture merchants are offering no interest, no payment deals for four years on their product lines. Of course, the interest rate from your friends at GE Capital reverts retroactively to 29.99% at the end of four years after the average dolt forgot to save enough to pay off the balance. I’m again receiving two to three credit card offers per day in the mail. According to the Wall Street vampire squids that continue to suck the life blood from what’s left of the American economy, this is a return to normalcy.

The definition of normal is: “The usual, average, or typical state or condition”. The fallacy is calling what we’ve had for the last three decades of illusion – Normal. Nothing could be further from the truth. We’ve experienced abnormal psychotic behavior by the citizens of this country, aided and abetted by Wall Street and their sugar daddies at the Federal Reserve. You would have to be mad to believe the debt financed spending frenzy of the last few decades was not abnormal.

The Age of Illusion

“Illusions commend themselves to us because they save us pain and allow us to enjoy pleasure instead. We must therefore accept it without complaint when they sometimes collide with a bit of reality against which they are dashed to pieces.” – Sigmund Freud

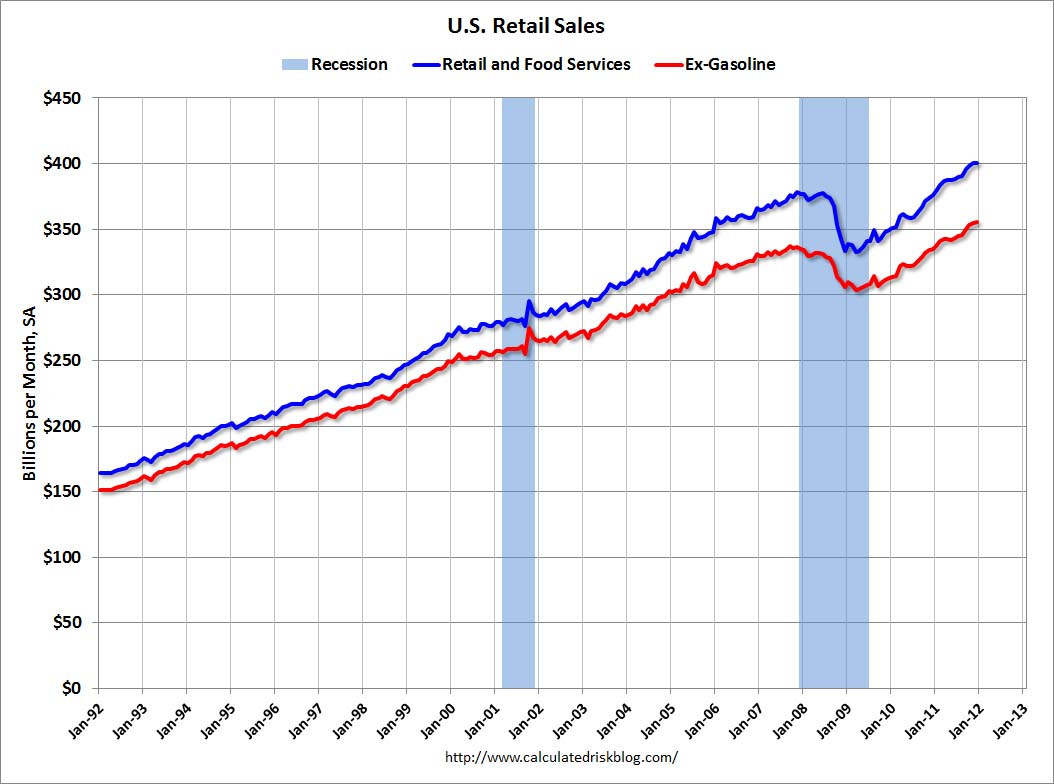

In my last article Extend & Pretend Coming to an End, I addressed the commercial real estate debacle coming down the pike. I briefly touched upon the idiocy of retailers who have based their business and expansion plans upon the unsustainable dynamic of an ever expanding level of consumer debt doled out by Wall Street banks. One only has to examine the facts to understand the fallacy of a return to normalcy. We haven’t come close to experiencing normalcy. When retail sales, consumer spending and consumer debt return to a sustainable level of normalcy, the carcasses of thousands of retailers will litter the highways and malls of America. It will be a sight to see. The chart below details the two decade surge in retail sales, with the first ever decline in 2008. Retail sales grew from $2 trillion in 1992 to $4.5 trillion in 2007. The Wall Street created crisis in 2008/2009 resulted in a decline to $4.1 trillion in 2009, but the resilient and still delusional American consumer, with the support of their credit card drug pushers on Wall Street, set a new record in 2011 of $4.7 trillion.

…..read more HERE

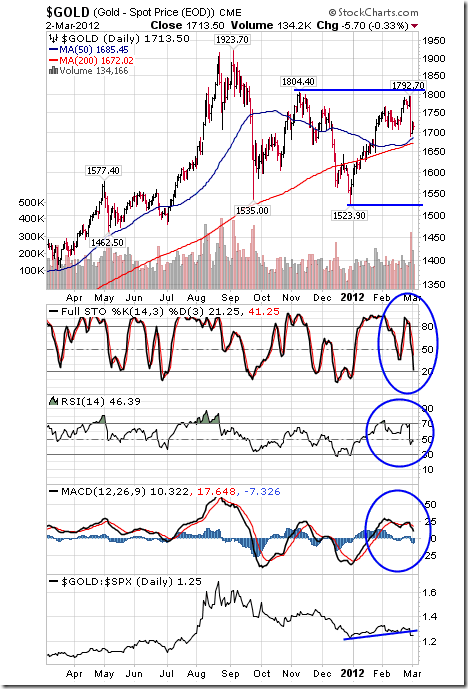

“The most bullish examples would see the pattern develop into a series of lows around $1690 or an A-B-C correction, as experienced in 2010, which holds around $1660 (50% retracement from the December lows). A close above $1775 would be the catalyst for a challenge of $1900 to $2155. At the other extreme, a failure to hold $1625 (62% retracement from $1523) would imply that the December lows will be taken out.”

….read and view all charts HERE

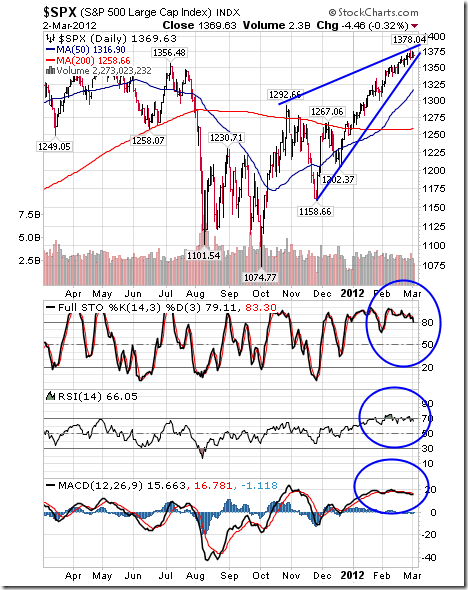

Mark Leibovit – STOCKS – ACTION ALERT – SELL (Looking to Buy In A Month or Two)

What’s interesting is that the year to date has been the best start in stock indices since 1998 according to Dow Jones Newswires. As of the close today this is the 45th consecutive day without a triple digit decline. A canary in the coal mine? Today is ‘Turnaround Tuesday’, so with markets down a bit yesterday perhaps we can stage a rally today. But wait! Tomorrow is ‘Weird Wollie Wednesday’ and often either tomorrow or Thursday, according to the lore, there should be a shakeout ahead of a week from Friday’s Options Expiration. Is all of this just noise? Well, maybe not. We’re approaching that time of year when the markets often experience some form of indigestion. Yesterday, though the volume was NOT excessive, nevertheless we did volume increase to the downside. Benjamin Netanyahu spoke last night (covered sole on Fox News) before the American Israel Public Affairs Committee (AIPAC) and warned that time is running out for Iran. Folks, brace yourself. Sometime before now and the end of May, we’re likely to see a full scale confrontation unfold as the Mayans watch from the heavens. Would this be a good time to be in the marketplace? Markets don’t like uncertainty. I think the answer is no. The 50 and 200 day moving averages in the S&P 500 current sit at roughly 1323 and 1270. These are the next two potential downside targets if the S&P 500 cannot post a new high between now and the first of April. Apple, Inc. took a bit of a nosedive today. If Apple can’t rally (and it was about the only big stock doing so), the writing may be on the wall. Think about it. I can’t imagine one mutual fund, one institution, one endowment or one growth portfolio not owning Apple. Everyone now owns it, but where are the buyers should these folks decide to sell? I have avoided Apple because it is technically way, way too, extended and would only arouse my interest if it sold off back into the low to mid 400s – maybe lower. I’ve changed my mind. Time to flip to a SELL signal. Let’s see where the market is come the beginning of April or even perhaps the end of May. If the market rallies a bit higher first and you decide not to sell here, I would use that strength to lighten up. Now is a time to step aside and watch from the sidelines. I still believe there could be another big rally, but let’s revisit this market in a month or two. I am going to cash! – Mark Leibovit – for a VRTrader TRIAL SIGNUP go HERE

Four Cycle Turns Warn of a Stock Market Top in March 2012

There is a lot of cycle evidence that suggests a top is coming in March 2012. How significant a top is hard to say, but the odds are the coming decline will be at least in the 10 percent area. If this coming top is the top of Grand Supercycle degree wave {III}, then stocks will begin a decline that could retrace 50 percent or more of the market over the next several years, with large chunks of decline occurring incrementally, followed by normal 40 to 60 percent retracements as stocks work toward significantly lower levels. This weekend we will present this cycle evidence, which we believe is compelling.

First of all, the last phi mate turn date was in December, which led to a two month rally of significance. It was a major phi mate turn. March 7th is the next phi mate date, and the only phi mate turn date since that December turn. It also is a major phi mate turn, meaning its phi mate, its partner date, was also a major turn.

….read & view more charts HERE

Over the past 5 months we have seen volatility steadily decline as stocks and commodities rise in value. The 65% drop in the volatility index is now trading at a level which has triggered many selloffs in the stock market over the years as investors become more and more comfortable and greedy with rising stock prices.

Looking at the market from a HERD mentality and seeing everyone run to buy more stocks for their portfolio has me on edge. We could see a strong wave of fear/selling hit the S&P 500 Index over the next two weeks catching the masses with their hand in the cookie jar . . . again.

If you don’t know what the volatility index (VIX) is, then think of it as the fear index. It tells us how fearful/uncertain investors are or how complacent they are with rising stock prices. Additionally a rising VIX also demonstrates how certain the herd is that higher prices should continue.

The chart below shows this fear index on top with the SP500 index below and the correlation between the two underlying assets. Just remember the phrase “When the VIX is low it’s time to GO, When the VIX is high it’s time to BUY”.

Additionally the Volatility Index prices in fear for the next 30 days so do not be looking at this for big picture analysis. Fear happens very quickly and turns on a dime so it should only be used for short term trading, generally 3-15 days.

Volatility Index and SP500 Correlation & Forecast Daily Chart:

Global Issues Continue To Grow But What Will Spark Global Fear?

Everyone has to admit the stock market has been on fire since the October lows of last year with the S&P 500 Index trading up over 26%. It has been a great run, but is it about to end? Where should investors focus on putting their money? Dividend stocks, bonds, gold, or just sit in cash for the time being??

I may be able to help you figure that out.

Below is a chart of the Volatility index and the gold exchange traded fund which tracks the price of gold bullion. Notice how when fear is just starting to ramp up gold tends to be a neutral or a little weak but not long after investors start selling their shares of securities we see money flow into the shiny yellow safe haven.

Gold & Fear Go Hand-In-Hand: Daily Chart

Looking at the relationship between investor fear/uncertainty and gold you will notice scared money has a tendency to move out of stocks and into safe havens.

Trading Conclusion Looking Forward 3 months…

In short, I feel the financial markets overall (stocks, commodities, and currencies) are going to start seeing a rise in volatility meaning larger daily swings which inherently increased overall downside risk to portfolios and all open positions.

To give you a really basic example of how risk increases, look at the daily potential risk the SP500 can have during different VIX price levels:

Volatility index under 20.00 Low Risk: Expect up to 1% price gaps at 9:30am ET, and up to 5% corrections from a previous high.

Volatility index between 20 – 30 Medium Risk: Expect up to 2% price gaps at 9:30am ET, and up to 15% corrections from recent market tops or bottoms.

Volatility index over 30 High Risk: Expect 3+% price gaps at 9:30am ET, and possibly another 5-15% correction from the previous VIX reading at Medium Risk

Note on price gaps: If you don’t know what I am talking about a price gap is simply the difference between the previous day’s close at 4:00pm ET and the opening price at 9:30am ET.

To continue on my market outlook, I feel the stock market will trade sideways or possibly grind higher for the next 1-2 weeks, during this time volatility should trade flat or slightly higher because it is already trading at a historically low level. It is just a matter of time before some bad news hits the market or sellers start to apply pressure and either of these will send the fear index higher.

I hope you found this info useful and if you would like to get these reports free every week delivered to your inbox be sure to join my FREE NEWSLETTER HERE: www.GoldAndOilGuy.com

Chris Vermeulen

Downside risk in equity markets and most sectors exceed short term upside potential. Short term weakness will provide an opportunity to enter into seasonal plays this spring including Energy, Mines and Metals, Chemicals and the Auto sector. Energy already is showing encouraging signs of seasonal strength.

The TSX Composite Index slipped 81.95 points (0.64%) last week. Intermediate trend is up. Support is at 11,420.78. The Index remains above its 50 and 200 day moving averages. Short term momentum indicators are overbought. Strength relative to the S&P 500 Index remains slightly positive.

The S&P 500 Index added 3.89 points (0.28%) last week. Intermediate trend is up. The Index remains within a rising wedge pattern and well above its 50 and 200 day moving averages. Short term momentum indicators are overbought and showing signs of rolling over. However, short term momentum indicators are not significant as long as the Index remains in the rising wedge pattern.

The U.S. Dollar added 1.18 last week. Intermediate trend remains up. Short term momentum indicators are recovering from oversold levels.

Crude oil slipped $2.78 per barrel (2.54%) last week (including a spike on Thursday to $110.55). Intermediate trend is up. Short term momentum indicators are overbought and showing early signs of rolling over. ‘Tis the season for crude oil prices to move higher!

Gold plunged $62.30 per ounce (3.51%) including a Leibovit volume reversal on Thursday. Support is at 1,523.90 and resistance is at 1,804.40. Short term momentum indicators have rolled over from an overbought level. Strength relative to the S&P 500 Index no longer is positive.

Silver dropped $0.48 per ounce (1.35%) last week. Intermediate trend remains up despite a Leibovit negative volume reversal on Thursday. Silver remains above its 50 and 200 day moving averages. Short term momentum indicators have rolled over from overbought levels. Strength relative to gold remains positive. Seasonal influences remain positive.

….view 45 more Charts and Analysis HERE