The Gold Report: Derek, when it comes to junior mining equities you’re something like a shark cruising for prey, seeking an opportunity to strike. What common buying opportunities do you look for that other investors might overlook?

Derek Macpherson: We seek out assets that have been underappreciated or unjustly tossed aside, companies whose stories are starting to change. That change might be an operations turnaround, a turnover in the management team or a revision to the capital structure.

TGR: One of your recent research flashes reported on the Mexican government’s consideration of imposing a royalty on Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) on companies that mine commodities in Mexico. Tell us about that.

DM: Whenever that topic comes up, it puts pressure on Mexican producers and developers. We are seeing the potential of a royalty getting priced in to those companies, and priced in as a worst case scenario.

Initial discussions centered on a 5% EBITDA royalty, which could affect company valuations significantly. However, Mexican mining companies are working with the government to find a more reasonable solution. If the proposal gets ratcheted down to a 2.5% EBITDA royalty or perhaps a 2% net smelter return, then company valuations could recover.

In Mexico, you want to look for companies that have low all-in cash costs. They will be somewhat insulated from the royalty because their margins won’t be as compressed as higher cost operations.

For example, we like Timmins Gold Corp. (TMM:TSX; TGD:NYSE.MKT), which sold off on the royalty news. We think the selloff was unjustified, because the company has generally low all-in cash costs and higher margins than many of its peers.

TGR: Timmins is expected to announce that the mine life at San Francisco could be extended 10 years. Would that attract a buyer?

DM: It could, but I don’t think Timmins is in the sweet spot for acquisition. The company is too small for a big company to acquire and too big for some of the midtier companies.

Once Timmins’ resource report comes out, the stock should move up as investor confidence improves. There has always been concern about Timmins’ long-term grade profile and the mine life at San Francisco. The pending resource update will answer those questions.

TGR: Your share target on Timmins is $3.20, correct?

DM: Yes, and we have a buy rating on Timmins. Considering its cash cost profile, Timmins is trading below three times 2014 EBITDA. If you look at the company’s low cash cost peers in Mexico, similar open-pit, heap-leach operations trade at six to eight times EBITDA. I think the resource update will improve investor confidence and we could see an upward rerating.

TGR: What other common events lead you to undervalued equities?

DM: One of the most obvious is when management teams disappoint; the mining space is littered with those.

In those instances, we look at the underlying value and whether the management team can turn the operation around. We ask ourselves if the selloff was excessive, potentially creating a buying opportunity if the damage is recoverable.

TGR: Do you think management teams are being punished too harshly for performance shortcomings?

DM: I think it’s partly a function of the commodity price environment. In a rising gold price environment, there was more room for error and setback didn’t have as large an impact on project economics.

In a volatile price environment, investors have shown very little patience. If production results or a resource update aren’t in line with projections or better, the market pushes the stock down.

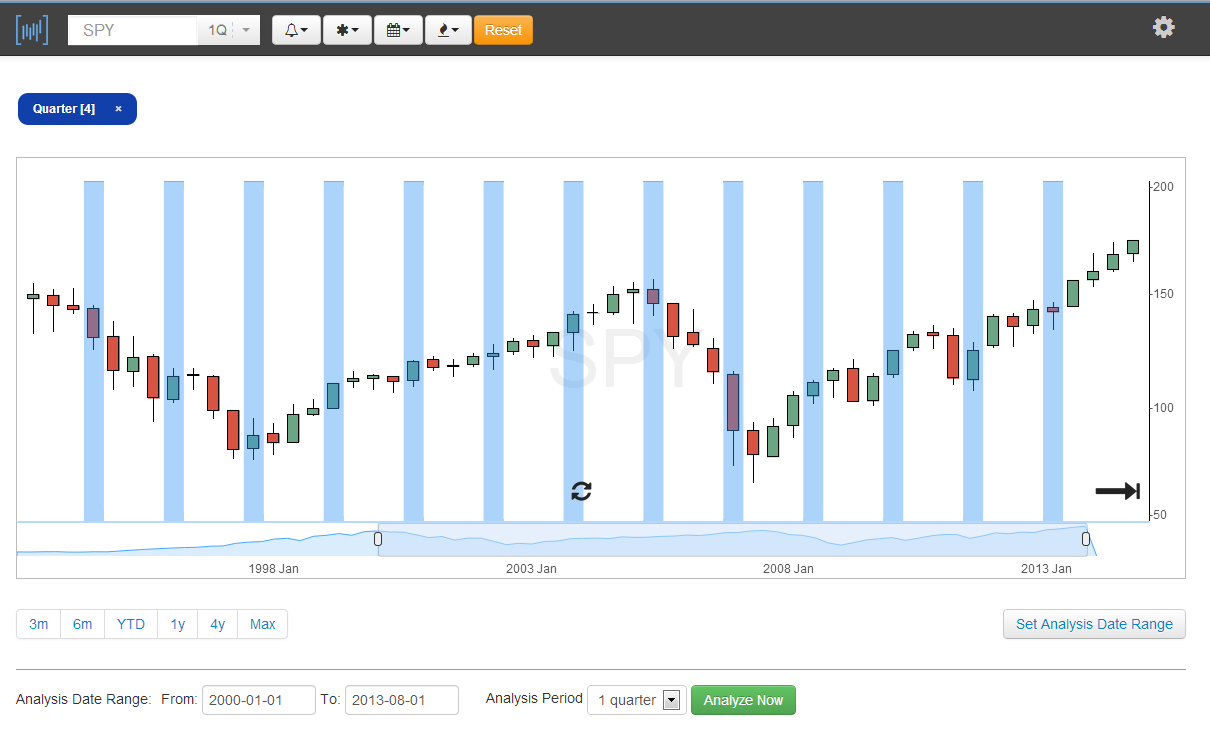

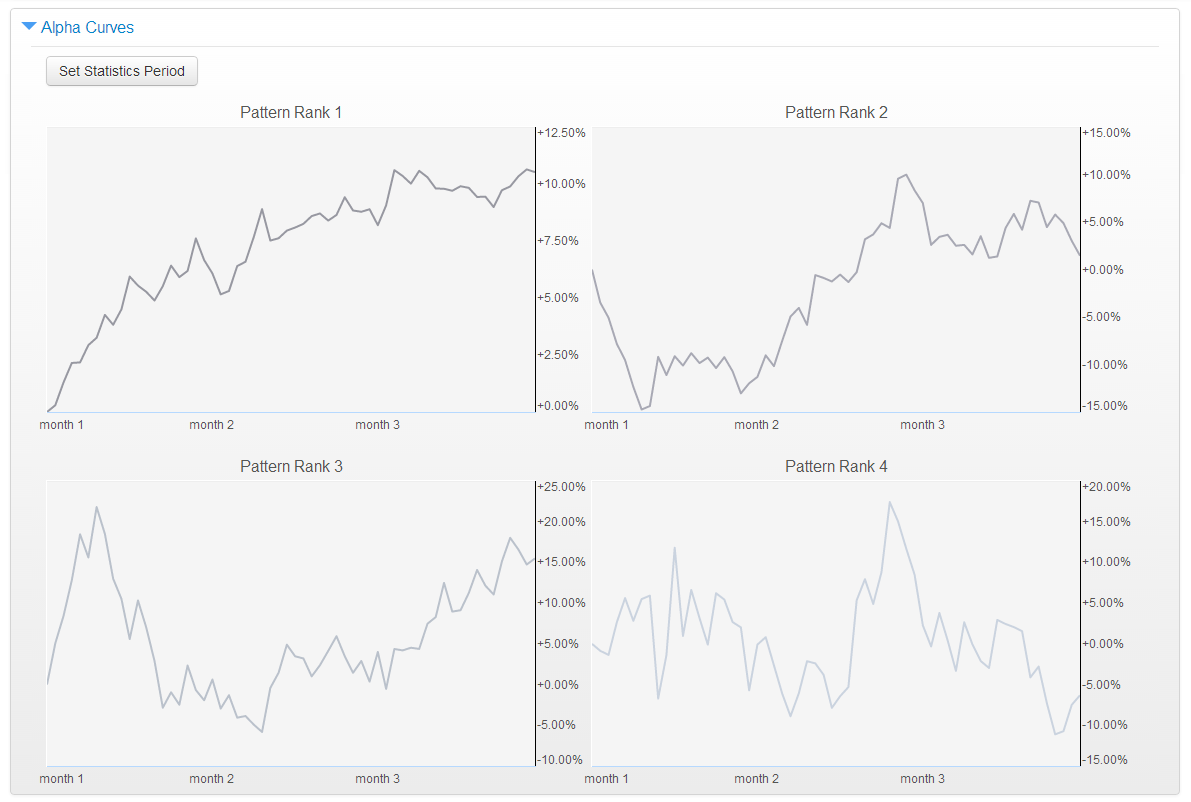

TGR: Do you watch for seasonal opportunities, or has seasonality become less predictable?

DM: Seasonality has been a bit less predictable. It has been dampened, first, by gold being driven by macro events and, second, by it being technically traded.

This year, in particular, investors should be looking at the season for tax-loss selling. I expect to see an accelerated selloff near the end of 2013, as investors try to capitalize on their tax losses. This should create a buying opportunity for a lot of good stocks. This is the time for investors to do their homework and find the stocks they want to pick up as they sell off later in the year.

TGR: What types of stocks do you think will sell off more than others?

DM: I think it will be a function of the company’s year-to-date performance. Companies that had a tough time from January to October will be the most affected. That doesn’t speak to the quality of their projects, which could create buying opportunities.

TGR: News flow used to dry up in the summer and start to flow again in September with the publication of summer drill results. Does news flow still matter?

DM: To a certain extent, yes. Drill results became a bit of a selling opportunity or a liquidity event this summer. However, we are seeing that abate, particularly in September.

TGR: Haywood Securities produces a quarterly report on the junior exploration companies that looks out three months to forecast how the companies listed will perform quarter to quarter. Do you look for quarter-to-quarter performance or do you look more long term?

DM: In the junior exploration space, you have to look a little bit longer term. It often takes time and money to determine the value of a deposit. We try to look through flashy drill results that might move the stock over the short term but don’t necessarily indicate anything about a company’s long-term economic viability.

We try to hitch our wagon to companies that take a long-term approach to how they do their work and a long-term approach to driving value.

TGR: Can you give us an example of drill results that have moved a stock?

DM: Two base metals names are good examples: Colorado Resources Ltd. (CXO:TSX.V) and Gold Reach Resources Ltd. (GRV:TSX.V). Both have been hitting good results in northwest British Columbia. Both are near two of Imperial Metals Corp’s. (III:TSX) assets, a company we cover. Their results, even through this summer’s tough market, moved the stocks up. However, the market is very selective when rewarding good drill results. At the very least, it has to be a good project in a good location.

TGR: It also helps if your neighbor has a world-class asset.

DM: Yes, Colorado Resources benefits from being next to Red Chris. That provides an obvious synergistic solution for the company.

Imperial is building a 30,000 ton per day (30,000 tpd) mill at Red Chris, and there is likely more to come on its own property. I wouldn’t be in a rush to say that Colorado Resources is on its way to becoming part of Imperial. Imperial has its hands full maximizing the value of Red Chris over the medium term.

TGR: Speaking to those of our readers who are new to the junior mining space, what are some effective approaches for novice investors?

DM: You certainly need to account for commodity volatility. Pick companies that have lower risk and can withstand volatility.

When it comes to projects, we look for one of two things: a project needs to have very high grade, for example, Klondex Mines Ltd. (KDX:TSX; KLNDF:OTCBB), or it needs to be technically simple, such as Timmins Gold’s open-pit, heap-leach project. Having one of those two features can reduce the risk of your investment.

The next thing to be aware of is jurisdiction. In the current market, there is an increased discount for political or permitting risk, and for the additional capital expense (capex) needed to put infrastructure in a remote location. Consequently, we tend to focus on North America, Mexico and some South American jurisdictions. In South America we look for jurisdictions with an existing mining culture, which can mean focusing on a specific region or even town in a given country. Peru is a good example; mining is welcome in some areas and is more challenging in others.

TGR: What about playing the volatility itself in metals prices?

DM: That’s very difficult to do because investors have to guess right on which way metal prices go that day. If investors want to play that volatility through equities, they have to get into more leveraged names, which tend to have a higher risk balance sheet. Playing the volatility can be very difficult and very expensive if you guess wrong.

TGR: Your thesis seems to prefer companies with cash and those that can raise cash with low-cash projects. Is that accurate?

DM: Yes. That is, in part, a function of the current market environment. Klondex and Timmins are two examples of low-cash costs and clean balance sheets: Klondex, thanks to its recent equity raise and ability to self-fund development going forward and Timmins, which should see its balance sheet strengthen over the next several quarters as it starts to generate free cash flow.

Temex Resources Corp. (TME:TSX.V; TQ1:FSE) fits into that category as well as an exploration-stage company with an attractive project that should be able to finance in the current market environment. Its project has the potential to be a high-grade, low all-in cash cost producer. It has low capex to start and $6 million ($6M) in cash on May 31 of this year. This is the type of company likely to get funded in the current market environment.

TGR: Temex is trading at $3/ounce ($3/oz), when some of its peers are as high as $20/oz. What accounts for that discount?

DM: As you know, exploration-stage companies are not as popular as they once were. Temex is still at an early stage, and investors might not fully understand the low-capex and shortened path to production that the Whitney project represents.

I think Temex is an excellent investment in the current environment for two reasons. First, it is in a joint venture with Goldcorp Inc. (G:TSX; GG:NYSE) on the Whitney project near Timmins, Ontario. That’s shaping up to be a higher grade, low-tonnage underground project.

The project is within sight of Lake Shore Gold Corp’s. (LSG:TSX) Bell Creek mill and about 12 kilometers (12km) from Goldcorp Inc.’s Dome mill. However, the Whitney ore is likely to be higher grade than either of those mills currently run, and consequently could displace ore at one of those mills. The market is still unsure of how real that opportunity is. The updated resource due out from Temex should increase market confidence in its potential.

Second, the Juby project makes Temex a good investment for the next gold price environment. Juby is the kind of lower grade, high-tonnage project that’s been popular target for majors. It resembles Prodigy Gold Inc., Rainy River Resources Ltd. and Trelawney Resources Ltd.—all of which have been taken out. Already at 3.2 million ounces (3.2 Moz) gold, there is a lot of upside at Juby, as it is still early days.

TGR: How long would its $6M cash in hand keep Temex running?

DM: Probably into mid-2014.

TGR: Does the board have access to funds?

DM: The board is strong. Ian Campbell is the CEO and the board includes René Marion and Gregory Gibson, both of whom have good track records.

TGR: In September you published a research flash on Trevali Mining Corp. (TV:TSX; TREVF:OTCQX; TV:BVL) that said, “Trevali is currently trading at 3.5 times consensus 2015 EBITDA whereas other base metal producers trade closer to 5.4 times EBITDA.” Is that discount strictly zinc related?

DM: No, the flash was issued when concentrate production had just started at Santander, something the market had been waiting for. Trevali has now been operating for less than two months. The discount is related to the risk of being at such an early stage.

When it comes to zinc, Trevali is one of the few pure-play zinc producers in the midtier base metal space. The macro environment for zinc is looking very positive. With so few vehicles to play in that positive macro environment, Trevali could trade at a premium to its peers.

TGR: You recently visited the Santander mine in Peru.

DM: It was a good trip, and the operation appears to be ramping up smoothly now that the mill has started. The silver lining to the delays in getting the mill commissioned was that Trevali was able to ramp up the underground operations and get approximately 140,000 tonnes ahead of the mill. That is about two months of mill feed and gives the company lots of flexibility as it brings underground operations to a steady state. In our view, the mill is very close to its operating capacity already, after just over a month of operation.

TGR: What is the mill’s capacity?

DM: Full throughput is 2,000 tpd, although Trevali has talked about the potential to expand to 4,000 tpd. Based on what we saw—the mill and crushing capacity, the underground mining width and the amount of development—we think 4,000 tpd is achievable, but not for a couple of years. Before an expansion at Santander, Trevali will be working to restart the Caribou mine in New Brunswick.

TGR: Is it realistic to think that Trevali will be generating cash flow by the end of October?

DM: Based on what we saw, yes. While we were on-site, we saw concentrate shipments leaving the mill. Because Trevali gets paid within a couple weeks of the shipments being delivered to the port, it should be generating cash very soon.

TGR: Trevali has discovered some high-grade mineralization at Magistral Norte, which is part of the Santander complex. What do you know about that?

DM: Trevali was aware of the Rosa Vein but had done little exploration on it from surface because the deposit’s orientation made it difficult. Once underground, it became easier to explore this new zone. Initial results point to the potential for higher than resource grades.

The high-grade potential led to Trevali completing some initial development in the zone and we actually stood in that zone when we were on-site. This zone further increases Santander’s tonnes per vertical meter and supports our view that an expansion to 4,000 tpd is likely.

TGR: Where else have you visited lately?

DM: We went to Klondex Mines, where we were also impressed with the ramp up. Klondex has exceptionally high grade; Measured and Indicated grade is 44 grams/tonne (44 g/t) gold.

TGR: But it’s a very small resource. Could it be expanded?

DM: The resource is 720,000 oz; however, the grade has gone up substantially. While the previous resource was larger, the earlier resource methodology wasn’t suited for this type of deposit. The new management team reworked the resource with a more applicable methodology and consequently now has a higher quality resource. We believe there is opportunity to grow the resource.

Resource growth is likely to come from two areas. The first is additional exploration; generally speaking the property is underexplored, providing the opportunity to expand the resource along the existing veins, and add new ones. The second opportunity for growth is the mineralized halo. Unlike most narrow-vein deposits, the host rock is also mineralized; however, it’s not included in the existing resource. The halo could be included in future updates, as Klondex’s understanding of it increases. The other benefit of a mineralized halo is an effective reduction in mining dilution, which should also benefit project economics.

TGR: What can you tell us about Klondex’s toll milling arrangements?

DM: Klondex doesn’t have its own mill. Klondex has toll milling agreements with both Newmont Mining Corp. (NEM:NYSE) and Veris Gold Corp. (VG:TSX; YNGFF:OTCBB).

In the current environment, saving capex is important. It allows Klondex to get cash flow very quickly. In fact, it has already started receiving payments from its toll milling agreements.

This ability to generate cash in the near term should allow Klondex to continue exploring while doing the necessary development for steady-state operations. We model it reaching 500 tpd and producing over 80,000 oz gold in 2015; Klondex is able to fund the underground exploration drilling needed to meet these targets.

TGR: What other stories would you like to share with our readers today?

DM: Atico Mining Corp. (ATY:TSX.V; ATCMF:OTCBB) is making the rapid transition from being a base metal developer to a producer. The company recently exercised the option on the El Roble property in Colombia. Because El Roble was a producing asset, Atico will go from being a developer to a producer once it completes that agreement later this quarter.

El Roble historically has generated positive cash flow even though there is significant opportunity for the operations to improve. Applying new engineering and a modern approach should allow Atico to surface additional value. As Atico improves El Roble, the stock should move higher.

TGR: It sounds a little like Klondex.

DM: It is, as it’s also a high-grade, low-tonnage operation. The recent resource update for this Cu-Au-Ag deposit had copper equivalent grades above 6%.

As a result of exercising the option a few weeks ago, Atico should be generating positive operating cash flow by year-end.

TGR: In March, the share price was more than $1/share. Now it’s about $0.50/share. What happened?

DM: Early on, Atico had some pretty flashy drill results at El Roble, which drove the share price higher. However, Atico had to raise money to exercise the option—the last option payment was $14M. That probably put an overhang on the stock. It is also worth noting that the move down in the stock price coincided with the drop in commodity prices.

TGR: Atico just completed a number of financings as well.

DM: Yes, that money went toward two things. First was $14M to exercise the option on El Roble, which gives Atico 90% ownership of the asset. Additional funds were raised to reinvest in El Roble’s operations, allowing Atico to optimize the asset.

TGR: And the final name that you want to talk about today?

DM: That is Mega Precious Metals Inc. (MGP:TSX.V), an exploration-stage company in northeast Manitoba—a good jurisdiction.

Mega Precious is sitting on 3.6 Moz of 1.25 g/t gold and has defined resources over a 4km trend with a total potential strike length of 8km. And, it has yet to test three parallel structures. Obviously, this could be a real district play.

The really interesting thing about this story is the presence of a tungsten kicker. Management is re-assaying old core to determine how much tungsten is present. Based on results released to date, there could be as much as a 25–30% improvement in gold-equivalent grade from the inclusion of tungsten. This could significantly improve project economics with limited additional investment.

TGR: Do you have any parting thought for our readers?

DM: Even though markets are challenging for mining equities, some high-quality names have sold off, creating an opportunity for investors to get involved at a reasonable price. Despite the overhang that equity markets have put on the space, it will get better; it’s just a matter of when.

TGR: Derek, thanks for your time and insights.

Derek Macpherson Derek Macpherson is a mining analyst at M Partners; before joining M Partners he worked in mining research for a bank-owned investment dealer. Prior to entering capital markets, MacPherson spent six years working as a metallurgist. Macpherson has a Bachelor of Engineering and Management in materials science and a finance-focused MBA.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Related Articles

- Thibaut Lepouttre: Juniors That Can Deliver the Goods

- Maximizing Returns in an Uncertain Mining Market: Tom Szabo

DISCLOSURE:

1) Brian Sylvester conducted this interview for The Gold Report and provides services to The Gold Reportas an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Timmins Gold Corp, Colorado Resources Ltd., Klondex Mines Ltd., Trevali Mining Corp. and Atico Mining Corp. Goldcorp Inc. is not affiliated with The Gold Report. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Derek Macpherson: I or my family own shares of the following companies mentioned in this interview: None. I personally am or my family is paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: Klondex Mines Ltd, Timmins Gold Corp. and Temex Resources Corp. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

COMPANIES MENTIONED:

COMPANIES MENTIONED: