Timing & trends

“I wake up in the middle of the night staring at the ceiling with my eyes as big as saucers wondering what is going to happen to our Country.” – Stephen Todd – Todd Market Forecast

“I wake up in the middle of the night staring at the ceiling with my eyes as big as saucers wondering what is going to happen to our Country.” – Stephen Todd – Todd Market Forecast

BONDS

CURRENCIES

STOCKS

GOLD

OIL

Most Read this week:

1. Forget the politics – LOVE the new TFSA policy by Craig Burrows

2. Important Q&A With Larry Edelson

Rumors abound that the Chinese yuan will soon be given reserve status by the World Bank or IMF. That might occur as early as October. It is also said that the U.S. dollar will crash as a result.

Rumors abound that the Chinese yuan will soon be given reserve status by the World Bank or IMF. That might occur as early as October. It is also said that the U.S. dollar will crash as a result.

Why are you so bullish on Asia, China, while so many analysts are bearish?

Is gold still on track for lower lows? Silver?

Larry’s latest on the U.S stock markets

3. Are Gold Stocks the Cheapest Ever?

Silver reached a 30 year high in April of 2011. Since then it has fallen nearly 70%. In any correction or bear market – call it what you want – we hear calls for lower prices as the market falls. Similarly, as a market rallies we hear supposedly well-reasoned arguments why prices should rise even higher.

Examples:

- Gold peaked over $850 in 1980. There were calls in 1980 for gold at $1,000. Currently we hear analysts calling for $900 gold.

- The NASDAQ peaked in year 2000 about 5,000. There were probably a few investors calling for 10,000.

- Do you remember the call for the Dow at 36,000?

- When silver was selling for nearly $50 in April 2011, which in retrospect was clearly a move too far and too fast, there were calls for $100 silver. (Note: $100 silver is coming – the “money printers” and deficit spending governments will make it happen.)

- It is easy to project the continuation of a trend. But how do we obtain more objective information? Use Ratios! Consider:

Silver compared to the S&P 500 index since 9-11. The graph clearly shows that silver prices streaked higher in 2010 and 2011 compared to the S&P. The chart also shows that silver is currently low compared to the S&P and that the linear trend indicates the ratio should triple in the next few years.

Silver compared to the S&P 500 index for 30 years. Clearly silver is inexpensive compared to the S&P – based on 30 years of data. Expect silver to rally.

Silver compared to gold prices for 30 years. When the ratio is low so are silver prices. But when silver rises, it usually moves much faster than gold so the ratio rises to the high end of the channel. Note the circled lows in the ratio in 1991, 2008, and 2015. Significant lows in silver prices occurred in 1991 and 2008. I suspect late 2014 – early 2015 will be seen, in retrospect, as a significant low in silver prices. (Repeat: $100 silver is coming.)

Silver compared to crude oil for 30 years. Even though crude oil prices have crashed in the past year, the ratio is still in the middle of its 30 year range. Silver is NOT expensive compared to crude oil.

CONCLUSIONS:

Based on the 30 year ratios to the S&P 500 index, gold, and crude oil, silver is currently inexpensive. The High-Frequency-Traders can push prices lower or higher quite easily so this analysis says little about what silver prices will do next week or next month, but it clearly says that in the long-term silver prices are low and likely to rise significantly in the next few years.

If you are stacking silver (or gold) then appreciate the long-term trends and the gift of lower prices that has been given to us by the central banks and HF Traders who wish to pretend that all is well in our global financial systems.

Gary Christenson

The Deviant Investor

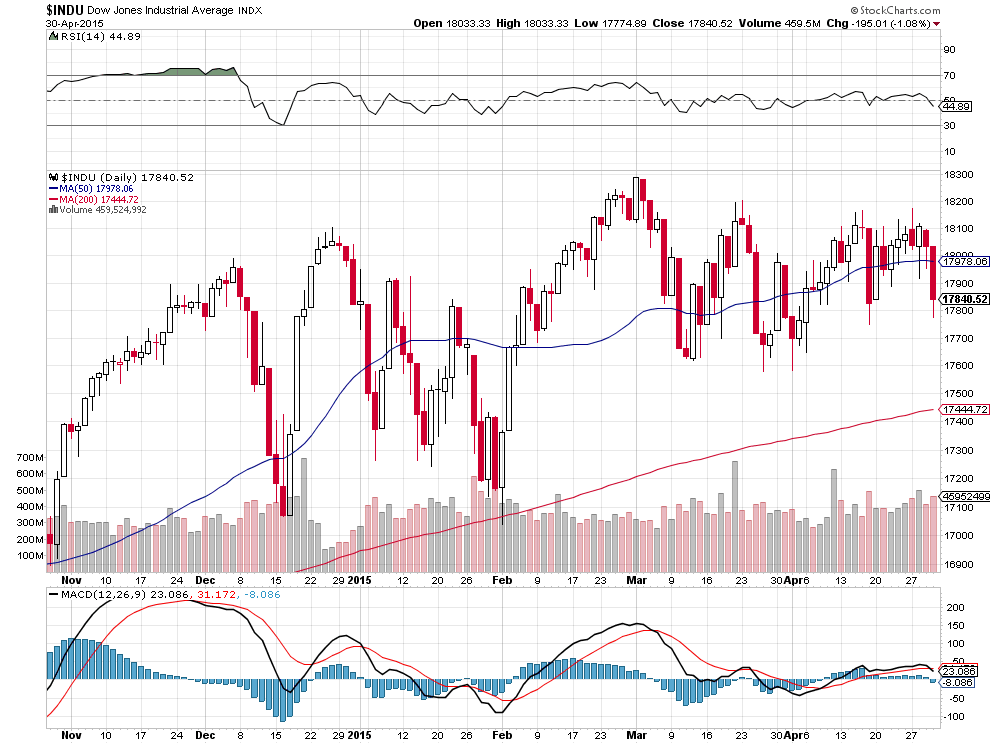

DOW – 195 on 1650 net declines

NASDAQ COMP – 62 on 1500 net declines

SHORT TERM TREND Bearish (change)

INTERMEDIATE TERM TREND Bullish

Editor’s note: This is an abbreviated update because of travel. I’ll give a complete update and make up the numbers on Friday’s update.

STOCKS:I thought the action today was pretty bad. Can’t blame it on the dollar which has been taken to the woodshed. .

Today the so called good 6 months ended. We are now entering unfavorable seasonality. More on that in Friday’s update.

I think that we are close to a short term rebound, but I suspect it will be a counter trend bounce.

GOLD: Gold collapsed for $28. The story was that a drop in initial claims would cause the Fed to raise rates earlier rather than later. I know one thing. This is a very skittish and choppy market. We’ll stay bullish for now since the yellow metal has not broken its lows of April 24, but we need to keep a close eye.

Intermediate term investors are long the SPY from 206.41. I think we will use a short term rebound to get out of this position.

System 7 traders sold the SSO at 131.68 for a gain of .09. We gave back a nice gain, but it’s better than a loss.

Todd Market Forecast for Thursday April 30, 2015

Available Mon- Friday after 6:00 P.M. Eastern, 3:00 Pacific.

Tesla’s announcement last week about creating a new line of batteries for use by businesses, consumers, and the electrical grid at large is a game-changer for the industry. Currently, when individuals or companies need back-up power, they usually rely on generators. Effective battery storage for large amounts of energy would be a game changer in that it would enable a separation of generation and use of energy produced through clean fuels like solar and wind power.

Tesla’s announcement last week about creating a new line of batteries for use by businesses, consumers, and the electrical grid at large is a game-changer for the industry. Currently, when individuals or companies need back-up power, they usually rely on generators. Effective battery storage for large amounts of energy would be a game changer in that it would enable a separation of generation and use of energy produced through clean fuels like solar and wind power.

The big problem with solar and wind right now is that the energy is only useful when it is actually produced and, because a company cannot modify generation to correspond with demand needs, any excess power has to be sold back to the market for immediate use. Tesla’s new batteries could go a long way towards solving this problem. It is likely that Solar City, for example, would be very interested in any home application for large scale battery technology.

The unique differentiator here is not necessarily Tesla’s technology. The company certainly has state of the art tech, but what might make battery production feasible is the economies of scale that Tesla is looking to capture in battery production. Tesla’s new gigafactory will be an enormous production facility when it is completed and the facility should be able to produce 50 GWh of annual battery production eventually. This level of production should enable mass production of batteries at a fraction of the current cost.

But beyond Tesla, these economies of scale could also have benefits for other firms in the same industry. To the extent that Tesla’s production capabilities create new demand for component parts, the result would be lower costs for inputs in batteries. As supply costs fall, battery production costs across the industry would fall also leading to increased quantity demanded by consumers and businesses.

Put differently, when Edison invented the light bulb, the standard method for producing vase shaped glass vessels was very different than what it is today. Producing a vase by traditional glass blowing is expensive and time consuming. So if a person had to make just one or two light bulbs, it would likely take hours of work. Once millions of light bulbs are needed, the process becomes industrialized and the cost per bulb falls to pennies. The same principle applies to the economics of battery production, and that already has even competing producers salivating.

Batteries already may be much more profitable than most people realize, and so if Tesla can open up new markets for its products, it could drive the company’s earnings dramatically higher. The exact level of profit will depend on many different factors of course, but assuming that Tesla can sell its batteries based on charge capacity, then the profits could be astronomical. Tesla recently increased the price on some of its vehicles by $4,000 in concert with a 10KWh increase in battery capacity.

This implies that the company thinks 1KWh of battery capacity is worth roughly $400. 1 GWh is equal to 1 million KWh and Tesla’s new factory should be able to produce 50 GWh annually when at full production. This would, in turn, imply $20B in annual revenue from output produced by the factory. Of course this value will vary dramatically based on many factors including battery size and usage, but the raw figures are mind-boggling nonetheless and suggest the magnitude of the market potential here. Even if Tesla ultimately ends up selling battery capacity for one-tenth this amount, then the result would still be a huge boost to the company’s bottom line.

Source: http://oilprice.com/Alternative-Energy/Renewable-Energy/Tesla-Could-Be-Changing-The-Dynamics-Of-Global-Energy.html

By Michael McDonald of Oilprice.com