Stocks & Equities

A solid strategy for investors looking to outperform in flat and down markets starts with a portfolio built of low volatility, dividend-paying companies.

A solid strategy for investors looking to outperform in flat and down markets starts with a portfolio built of low volatility, dividend-paying companies.

This month several mainstream media outlets joined the Mauldin Economics chorus in praising dividend stocks. Take a look at these headlines…

From CFO Journal by the Wall Street Journal:

From Forbes: (also includes 10 attractive buys) – Editor Money Talks

And this extremely accurate headline from the New York Times:

Why extremely accurate? Because most often, the bigger the yield, the greater your risk. The takeaway here is: Don’t fall into the high-dividend yield trap.

Building a portfolio of the right dividend-paying stocks is not simple or easy. Fact is, it takes as much research as any other type of investing-perhaps more. But, if you succeed, the rewards are a continuing stream of income in an otherwise “yieldless” environment.

That’s the goal of Mauldin Economic’s most popular investment letter, Yield Shark-helping investors build the right type of income portfolio for today’s market.

And we’re on the right track-in 2013,Yield Shark generated a total return of 18.59%.

How did we do it?

-

By carefully constructing a low-beta portfolio-made up of companies with strong dividend yields, low valuations, and less volatility than the S&P 500, and

-

By selling positions when, in this choppy market, a stock became overbought. With Yield Shark, we’re investing for long-term income, but when the opportunity to take an outsized profit arises, it makes sense to grab it.

I’m more than proud of our analysts and the portfolio they’ve built. They’ve successfully balanced risk and reward to generate a double-digit return while maintaining a low beta.

And they’re on track to do it again in 2014.

Our next recommendation-set for release in the next issue of Yield Shark-is for an exceptional timberland company paying an annual dividend of over 4%. But what’s more, the capital gain we expect to see could push its total return well into the double digits. And all backed by a company with hard assets of real estate and timber and a long history of increasing its dividend payments.

*Note: The following is an advertisment for a service, some of you may be interested in the offer so I have included it. For those who want to understand the author’s strategy the articles that are linked above should do the job – Money Talks Editor

I’d like you to see this recommendation, and the entireYield Shark portfolio, so you can determine if Yield Shark is the right tool to help you invest.

I also want to make sure you fully understand the challenges and opportunities presented by today’s market. That’s why I want to send you a copy of John Mauldin and Jonathan Tepper’s latest book, Code Red.

This best seller details the actions taken by the Fed since the financial crisis of 2008, predicts the bubbles that are now becoming very evident, and outlines the steps you should consider taking to protect your wealth.

Give Yield Shark a try and we’ll send you a copy of Code Red, with our compliments.

If for any reason in the first 90 days you are not completely satisfied, we’ll send you a prompt refund, less a modest 10% reprocessing fee (I need to pay for shipping and handling on that book!).

A one-year subscription to Yield Shark is only $99, and we’ll guarantee that price for life, so long as you maintain your subscription. Code Red makes a perfect investment companion and reminds you of the risks and opportunities today’s markets present.

If you already have a copy of Code Red, please pass this one on to a friend or relative not fully aware of the situation we face as investors.

Don’t go it alone in this market. Take a risk-free look at our most popular letter, Yield Shark, and read up on the challenges facing investors in this Code Red world. You won’t regret it.

Sincerely,

Ed D’Agostino,

Publisher, Yield Shark

A gain of 45 points Wednesday left the Dow at 16,580, four points above the record high it set on Dec. 31.

The Dow hadn’t been in the black for 2014 until today.

The Standard & Poor’s 500 index increased five points, or 0.3 percent, to 1,883. The index is seven points below the record high set April 2.

The Nasdaq composite rose 11 points, or 0.3 percent, to 4,114.

Twitter slumped 9 percent after its customer growth fell short of what investors were hoping for.

The Federal Reserve said would reduce its bond purchases by another $10 billion a month, in line with what investors were expecting.

The yield on the 10-year Treasury note fell to 2.65 percent.

Pfizer said on Monday it proposed a takeover to AstraZeneca in January worth 58.8 billion pounds ($98.9 billion), or nearly 47 pounds per share. It had contacted its British rival again on Saturday, seeking to discuss further a takeover.

The chase was welcomed by investors in both companies, as deal-making grips the healthcare industry….

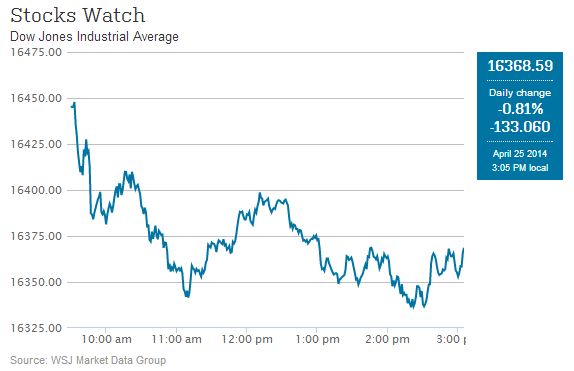

The Nasdaq Composite Index, heavily weighted toward fast-growing technology and early-stage health-care companies that have borne the brunt of recent selling, slid 56 points, or 1.4%, to 4092 in midday trading.

The Dow Jones Industrial Average lost 119 points, or 0.7%, to 16383 and the S&P 500 index fell 12 points, or 0.6%, to 1867.

The recent decline in shares of social-media, cloud-computing and biotechnology companies resumed the last few days and rolled on Friday, following a respite last week.

Despite big drops in many stocks, “you’re not seeing the bigger buy tickets come back into those names,” said Brett Mock, managing director at brokerage firm JonesTrading Institutional Services LLC. “You’re seeing people sitting and waiting.”

Yesterday, we were explaining how the US empire and the Fed-induced credit bubble depend on each other. To make a long story short, after the 1970s there was not enough juice in the US economy to pay for a welfare state at home… and an imperial juggernaut all over the world.

The solution? More credit.

Borrowing by the private sector created some $33 trillion in excess (above the traditional level of debt to GDP) economic activity. It fueled sales… spending… jobs… corporate profits (heavily concentrated in the financial sector) and investment profits.

All of these things gave voters the feeling they were making progress. And they gave the government tax revenues, which it badly needed.

Debt grew. We’ve been over the numbers so often we don’t need to repeat them. More important, the economy – and the US empire – became more and more dependent on debt just to continue doing business as usual.

Debt no longer provided a big boost to economic growth; it was necessary just to stay in the same place. Take it away, the stock market crashes… and the economy goes into recession or depression. That was what happened in 2008-09. The private sector stopped taking on debt. And all Hell broke loose.

Hog Wild on Spending

The background: The Bush II Administration went hog wild on spending. It did so largely because it was the most overtly pro-empire US administration ever.

Covertly, it was also the most pro-welfare state administration in history. Guns and butter – the Bush team liked them both. It never met a country in which it didn’t want to meddle… never found a trap into which it didn’t want to put its big foot… and never saw a spending bill it wanted to veto. Under cover of “security” spending, it blundered into the biggest deficits in history.

After the 9/11 attacks, jingoism clouded budget discussions. “Security” depended on a strong economy… which depended on continuing credit expansion.

Then… and again after the crisis of 2008-09… the credit expansion seemed in danger of coming to an end. But the Fed came to the rescue; and its chiefs were hailed as Scipios and Caesars.

Alan Greenspan and Ben Bernanke got their mugs on the cover of TIME magazine, as though they were conquering heroes, rather than nerdy economists with dubious theories.

In 1999, TIME labeled Greenspan, along with Robert Rubin and Larry Summers, “The Committee to Save the World.” And later, The Atlantic labeled Bernanke “The Hero”… andTIME named him “Person of the Year.”

Their real contributions?

They helped Americans go further into debt… which in turn helped unproductive industries keep their grip on a large part of the nation’s resources.

More Rules

And now, the feds exert more and more control over the way money is spent… and invested.The Economist reports:

Ever since Lehman Brothers went bankrupt in 2008 a common assumption has been that the crisis happened because the state surrendered control of finance to the market. The answer, it follows, must be more rules.

The latest target is American housing, the source of the dodgy loans that brought down Lehman. Plans are afoot to set up a permanent public backstop to mortgage markets, with the government insuring 90% of losses in a crisis.

Which might be comforting, except for two things. First, it is hard to see how entrenching state support will prevent excessive risk-taking. And, second, whatever was wrong with the American housing market, it was not lack of government: far from a free market, it was one of the most regulated industries in the world, funded by taxpayer subsidies and with lending decisions taken by the state.

But… the more the state protected the system, the more likely it was that people in it would take risks with impunity.

That danger was amply illustrated in 2007-08. Having pocketed the gains from state-underwritten risk-taking during the boom years, bankers presented the bill to taxpayers when the bubble went pop. Yet the lesson has not been learnt. Since 2008 there has been a mass of new rules, from America’s unwieldy Dodd-Frank law to transaction taxes in Europe.

Some steps to boost banks’ capital and liquidity do make finance more self-reliant: America’s banks face a tough new leverage ratio. But overall the urge to regulate and protect leaves an industry that depends too heavily on state support.

Since investors know governments will usually bail out big financial firms, they let them borrow at lower rates than other businesses. America’s mortgage giants, Fannie Mae and Freddie Mac, used a $120 billion funding subsidy to line shareholders’ pockets for decades.

The overall subsidy for banks is worth up to $110 billion in Britain and Japan, and $300 billion in the euro area, according to the IMF. At a total of $630 billion in the rich world, the distortion is bigger than Sweden’s GDP – and more than the net profits of the 1,000 biggest banks.

In many cases the rationale for the rules and the rescues has been to protect ordinary investors from the evils of finance. Yet the overall effect is to add ever more layers of state padding and distort risk-taking.

Predictably, the return on investment falls… and growth slows. As it does, current output is less able to keep up with debt service costs and current spending. The need for more credit increases.

But now we hear the federal budget situation is improving. Tax receipts are up. Expenditures are down. Alas, this is a temporary phenomenon. Congressional Budget Office estimates show the federal deficit bottoming out this year and next – still at over $500 billion! – and then turning up again.

This is good news for the empire… and for the credit-dependent economy. Debt can’t grow unless someone is foolish enough to borrow. So, the Fed has become the borrower of last resort. It will continue to borrow to fund the empire… and its zombie industries… until they all blow up.

Regards,

Bill

Editor’s Note: The single best way to protect your portfolio from the collapse of the credit bubble Bill warns about is to buy gold. That’s why we’ve identified five ultra-cheap gold playsto get you started.

From the desk of Chris Hunter, Editor-in-Chief, Bonner & Partners

When most folks think of bubbles they think of stocks…

But the really dangerous bubble blowing up right now may be in the US bond market.

The Fed wants low interest rates to spur the real estate market (through cheaper mortgages) and to spur the stock market (by making bonds a less attractive alternative).

Low interest rates also allow Uncle Sam to borrow cheaply to keep funding its budget deficit.

But these low interest rates are allowing the US corporate sector to gorge on debt.

And I mean gorge…

As the chart below shows, non-financial companies have borrowed the equivalent of 55% of US GDP.

Last year, total US corporate bond issuance was $1.3 trillion – higher than its pre-crisis levels. More important, the amount of junk bond issuance – basically, lending to companies with higher risk of default – rose to $336 billion. That is far in excess of pre-crisis levels.

Who’s lending all this money at ultra-low rates of return?

US banks and other large financial institutions.

What happens when rates start to rise again?

We don’t know exactly. But we don’t expect it will be pretty.

Unlike bonds, gold doesn’t have any counterparty risk. If you’re interested in owning gold at knock-down prices, don’t forget to check out our special report on the gold market here.