Stocks & Equities

Before we look at some charts tonight I would like to follow up on a post Sir SA Viking did at the Chartology Forum today about not trading in the first 30 minutes of a new trading day. He is absolutely correct. If you’ve been trading in the markets for any length of time then you have heard the expression that the first 30 minutes of trading is for amateurs. The reason for this old adage is because a lot of amateurs will trade on the previous days price action and have to get in a trade no matter what. Many times you will see the smart money fade the open after the first half hour of trading trapping the new guys that just had to buy. The only time I will trade in the first half hour is when we have a nice profit and the price action is close to a price objective that was laid out previous. I will usually try to sell in the first 15 minutes if possible.

I also want to talk about using sell/stops. I personally never use sell/stops as it shows the specialist, the market maker, where all the treasure is buried. They will then run the sell/stops, taking in that new inventory of stock, with the purpose of selling it higher. I’m between a rock and a hard spot using sell/stops for our members as I know many need to know where to exit if things go wrong even if it’s a fake out before the breakout. As I’m watching the market very close each day I personally don’t need them. I’ve stated this before that I may not elect to execute a sell/stop if it is hit because it’s for those that need it. If I do decide to execute a sell/stop I will always tell you for future reference.

If you remember our sell/stop was hit this week on our DUST trade by about .15 cents or so and then the price action reversed back up. That was a perfect example of running the sell/stops and then reversing the move once the stops were hit. I wish there was a better way to do this but it is what it is. It’s all part of the game.

Precious Metals

The first chart I would like to show you tonight is the one I posted today on the GDX. So far this downtrend has four separate chart patterns in it. The top is comprised of the blue 5pt bearish expanding rising wedge reversal pattern. The second pattern is the red bear flag. The third pattern is the red bearish rising wedge and the fourth and most important chart pattern is the potential blue bearish falling wedge which should be a halfway pattern to the downside.

This longer term daily chart for the GDX shows how small the bearish falling wedge is on the chart below, in red. As you know I’ve been looking at this possible 4th reversal point on the much bigger blue falling flag as the reversal point to get us back down to the bottom of the blue falling flag. The little red bearish falling wedge should get us down to the previous low at reversal point #3. At this moment this is our primary price objective. Keep in mind that I’m also looking at the blue falling flag as a halfway pattern. Note the blue bearish expanding rising wedge at the top of the chart and the fourth reversal point. That 4th reversal point marked the beginning of that big impulse move down to reversal point #1 on our blue falling flag. If we have just put in the 4th reversal point, in the blue falling flag, then we should see a similar move that matched the first leg down out of the 4 point point bearish expanding rising wedge down to the 11.40 area or so. This is the potential huge reward I’m looking at right now. I can tell it’s not going to be easy as you are already finding out by this little consolidation area we’ve been in for several weeks now. The price objective down to the 11.40 area is not a pipe dream. This is how markets work. They build a top or bottom and then have an impulse move followed by a consolidation pattern. We’ve been in our latest consolidation pattern for 10 months so far as it’s correcting that big impulse move down from that 4th reversal point in the blue bearish expanding rising wedge at the top of the chart.

Lets now look at the daily chart for gold I’ve been showing you that shows how an uptrend and downtrend work. The blue arrows on the left side of the chart shows a beautiful uptrend where each minor low is higher than the previous low. Since the top was put, top red arrow, just the opposite has been happening. As you can see gold has been creating lower lows down to the current price action at the 1265 area. Gold has made three attempts to break below the 1265 area that would then confirm a new low which would also confirm the continuation of the downtrend channel. You can see how violent the price action is becoming between the upper and lower brown shaded support and resistance zones. The bulls and the bears are fighting it out for control of the trend. How long this battle goes on is anyone’s guess but the sideways trading range, rectangle, is trying to finish up its fourth reversal point that we have to see at a minimum to create a consolidation pattern. Now that we have more information we just need to follow the price action for more clues as to when a breakout may occur. It could happen tomorrow or next week or when it just good and ready to show its hand. There is no doubt we’ll be on top of it when its ready to move.

Big Cap Tech

I will be spending more time covering this sector and others in the General Markets as it appears

a clear trend is developing . As Most Members know , I have never met a Trend I didn’t like .

Let us turn our attention to a few big cap tech stocks, recent darlings that aren’t looking very hot anymore.

The first chart is a weekly look at AZMN that is showing a very well defined H&S top complete with a breakout and backtest.

EBAY has been chopping out an 11 point blue rectangle for well over a year now. You can see it had a symmetry false breakout from the bottom rail and then one through the top rail that may have been the exhaustion move where it finally ran out of gas. Remember an even number of reversal points equals a consolidation pattern and an odd number of reversal points equals a reversal pattern. As you can see EBAY is strongly testing the bottom rail right now. A solid break will create a very large top reversal pattern.

The daily chart for GOOGL shows us a double H&S top that isn’t one of the prettiest H&S tops I’ve ever seen but it’s making lower highs and lower lows which is creating a downtrend. It will be interesting to see how GOOGL deals with that huge gap, brown shaded area.

This long term weekly look at GOOGL shows how I’ve following this stock through the years. What is the most important thing to understand is where the H&S top, I showed you on the daily chart above, has formed on the weekly chart below. If there was ever a place to look for a H&S top reversal pattern this chart shows that place in spades.

NFLX has been a high flyer but it to looks like it’s building out a H&S topping pattern. Note the beautiful H&S top that was made in 2011 and the decline that followed.

The last time I posted this chart for PCLN was when it was breaking out from the H&S consolidation pattern back at the beginning of 2013. You never know what kind of price rise you’ll get only that it should be a good one when a stock breaks out of a fairly large consolidation pattern. This chart also shows you a perfect example of how support and resistance works. Notice the eight point blue rectangle that formed back in 2011. Once the price action broke above the top blue rail it then reversed its role from, what had been resistance to then support as shown by the double headed H&S consolidation pattern. That is perfect Chartology 101.

I think some of these charts above are showing you why the NDX 100 is trading way below the Dow and SPX. These big guys led on the way up and are now going to lead on the way down. There are many more examples I could show you but I think these big cap tech stocks paints a pretty good picture of what is going on below the surface.

This is the why behind our recent addition of SQQQ, the 3X Bear Big Cap Tech ETF to our Model Portfolio

Stay Tuned

All the best…Rambus

#10. Calloway Real Estate Investment Trust (TSE:CWT.UN.CA) — 5.8% YIELD

At #10, Calloway Real Estate Investment Trust is an unincorporated open-ended mutual fund trust. The Trust owns, develops, manages and operates income properties located in Canada. As of Dec 31 2010, Co.’s national portfolio included 119 operating properties and 11 development properties with total gross leasable area of 24,218,389 sq. ft., located across Canada.

Stockscores.com Perspectives for the week ending May 5, 2014

WEEKLY COMMENTARY

WEEKLY COMMENTARY

Stockscores Market Minutes Video

Waiting for the news can leave you entering trades too late because the market tends to price in new information before it is made public. This week, Tyler shows two examples where this is the case before he provides his regular weekly market analysis. Watch the video by clicking here.

Trade to Win

Do you invest to win or to avoid losing? The latter has been infamous in great sporting breakdowns. Teams from any sport who played to defend their lead and avoid losing have so often given back their margin of victory, granting them membership status to the Chokers Hall of Fame, that hallowed institution of which Greg Norman is President.

Their emotional attachment to money puts many traders on the defensive, casting their trading decisions to avoid losses. If visualization lends to the achievement of results, then this negative form of myopia certainly leads to long term failure.

Are you afraid of losing money in the market? Do you find yourself making decisions to exit a stock on a minor pull back because you are worried you will watch the profit evaporate? Do you delay entering a position until the market has moved up significantly so that your entry decision is proven correct?

If so, you are normal. Unfortunately, being normal is a sure way to be a loser in the stock market.

Here are some ways to combat fear and put a focus on making money instead of avoiding losses:

1. Have a plan – writing down your rules for entry and exit gives you something to check your emotional decision making against. Without a written plan you have nothing to guide you through dangerous emotional moments.

2. Don’t take too much risk – the more risk you take on a trade, the more you will feel fear. If you risk less money than you are willing to lose you will make better decisions.

3. Don’t judge your success one trade at a time – in trading, you can be better than your last trade. Losing money is part of trading so judge your performance over at least 10 trades.

4. Plan your losses – before you enter the trade, plan the point that you will exit at a loss. If the stock gets there, take the loss and move on.

5. Trade quality – make sure that you trade stocks that fit the criteria of a proven strategy. If you don’t believe in what you are doing you will go on the defensive and be a loser even before you enter a trade.

6. Think like a winner – be positive, aspire to be great and don’t accept anything less than beating the market. It is you against every other trader, destroy your competition.

7. Trade your plan – when you have a few losses in a row it is easy to start breaking rules and try to trade your way out of pain. When this happens, go back to your plan or stop trading until the emotion subsides.

STRATEGY OF THE WEEK

No feature stocks this week

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Perspectives is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of Perspectives may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligence.

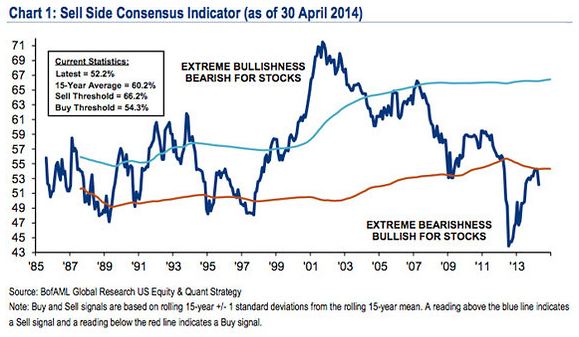

Subramanian noted that B. of A. Merrill Lynch’s Sell Side Indicator, which has been on the rise lately, took a sharp downturn recently to 52.2 from 54.1. The contrarian indicator denotes the average stock-allocation weighting from strategists. The lower the indicator, the more likely stocks will have a positive return.

Subramanian writes:

Given the contrarian nature of this indicator, we remain encouraged by Wall Street’s ongoing lack of optimism and the fact that strategists are still recommending that investors significantly underweight equities, at 52% vs. a traditional long-term average benchmark weighting of 60-65%. Even though the S&P 500 has risen by over 35% since sentiment bottomed in 2012, history suggests that strong equity returns can last for years after the indicator troughs.

In the meantime, stocks are clawing their way back from a rough 2014. On Wednesday, the Dow Jones Industrial Average DJIA reached its first record high close of the year, topping a Dec. 31 high, while on Thursday, the S&P 500 IndexSPX traded within 0.3% of its closing high set on April 2.

In the past, the strategist notes, the indicator has had a pretty good track record with the next 12 months logging gains 97% of the time when the indicator has been this low or lower, with a median 12-month return of 27%.

CWS Market Review – May 2, 2014

CWS Market Review – May 2, 2014

What a busy week for us! First-quarter earnings reports are still coming in, the Federal Reserve announced another taper, plus we had several important economic reports like Q1 GDP and ISM. On top of that, news broke that AT&T is considering buying our favorite satellite-TV stock, DirecTV. I don’t know if any deal will come about, but shares of DTV jumped more than 4% yesterday to reach a new all-time high. I’ll have more on that in a bit.

Overall, earnings season is going well. Of course, going into earnings season, a lot of companies skillfully lowered expectations just enough to exceed them. So far, 352 of the 500 companies in the S&P 500 have reported results. Of that, 75% have beaten earnings expectations, while 52% have beaten sales expectations.

Before Thursday’s minor 0.01% drop in the S&P 500, the index rallied 10 times in 12 days. In fact, during the day on Thursday, the S&P 500 reached its highest level since April 4, which was the day the index hit its all-time intra-day high. At one point, we were less than 0.5% from reaching a new all-time high. On Wednesday, the Dow Jones 30 did close at an all-time high (thanks to $100+ stocks like Merck, Exxon, 3M and our own McDonald’s).

In this week’s CWS Market Review, I’ll break down the latest goings-on for you. I’ll also preview next week’s Buy List earnings reports from DirecTV and Cognizant Technology. But first, let’s look at some recent economic news.

Q1 Was Bad, but Q2 Should Be Better

By now, the evidence is clear that the economy was lousy in Q1 thanks to the bitter winter weather. On Wednesday, the Commerce Department reported that real GDP rose by a grand total of 0.1% for the first three months of 2014. That’s pretty bad. The economy needs to grow, in real terms, around 2.5% just to absorb new folks entering the workforce. One of the positives in the report was that personal-consumption expenditures rose by 3%. Also, the big drag caused by austerity at the state and local level seems to have ended.

We won’t know until the summer how well the economy did during Q2, but I suspect we’ll see some improvements. Some evidence for my optimism came on Thursday, when we learned that the ISM Manufacturing Index rose for the third straight month. For April, the index climbed to 54.9. Any reading above 50 means that the manufacturing sector of the economy is expanding. The ISM dropped sharply in January, and we’ve made back most of what we lost.

I’m writing this report early on Friday, ahead of the big April jobs report, which I think could be a big one (be sure to check the blog for updates). Economists expect an increase of 215,000 jobs. Earlier this week, ADP, the payroll firm, said that 220,000 private-sector jobs were created last month. I should warn you that the ADP report doesn’t have a great track record of predicting the government’s numbers. The recent initial jobless claims reports have been encouraging, although this past week’s report dropped off some. Slowly but surely, the economy and jobs market are getting better.

It’s not just me saying that, but the Federal Reserve as well. Here’s the opening sentence of the Fed’s latest policy statement: “Information received since the Federal Open Market Committee met in March indicates that growth in economic activity has picked up recently, after having slowed sharply during the winter, in part because of adverse weather conditions.” (Remember how the bears laughed at the weather excuse?)

The Fed announced it will again taper its bond purchases. Starting in May, the Fed will buy $25 billion worth of Treasuries and $20 billion worth of mortgage-backed securities. Janet and her pals on the FOMC said, “The Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.” At this rate, the Fed should be completely done with its Quantitative Easing by the end of the year. Interestingly, this week’s policy statement got a unanimous vote.

On Thursday, the Commerce reported that consumer spending rose by 0.9% in March. That’s the biggest increase in nearly five years. Those numbers probably reflect the pent-up demand created by the frigid weather. Economists were expecting an increase of 0.6%. The evidence continues to suggest a slow- to moderate-paced recovery.

Keeping in mind the issues surrounding Q1, let’s take a look at our recent earnings reports.

Ford Misses by Seven Cents per Share

I confidently predicted that Ford Motor (F) would easily beat its earnings estimates. Boy was I wrong. The winter hit them harder than I expected. Last Friday, Ford said that it earned 24 cents per share for Q1, which was seven cents below Wall Street’s estimates.

On the plus side, revenues came in at $35.9 billion, which was $1.7 billion more than expectations. Ford’s core business is truck sales in North America, and that was fairly sluggish, but Ford is seeing better numbers overseas. Sales in Europe were up 11%, and sales in China jumped 45%.

I was pleased to hear the automaker stick by its full-year profit forecast of $7 billion to $8 billion. On Thursday, Ford said that sales in April fell by 1%, but their truck sales were up by 7%. The company also made official what everyone expected: COO Mark Fields will take over as CEO in July when Alan Mulally departs. We should give credit to Mulally. He did a great job at Ford. I’m keeping my Buy Below on Ford at $18 per share.

Moog Is a Buy up to $69 per Share

Moog (MOG-A) was our problem child last earnings season, so I was pleased to see better news this time. Last Friday, Moog reported earnings of 82 cents per share, which matched expectations. In January, the maker of flight-control systems beat earnings by a penny per share but lowered their full-year guidance to $3.65 per share (their fiscal year ends in September). The previous range was $3.95 to $4.10 per share.

The good news is that Moog still stands by its $3.65 target for this fiscal year. The CEO said, “This was a good-news quarter, with earnings coming in ahead of plan and healthy cash flow.” I like these results. I’m raising my Buy Below on Moog to $69 per share.

Four Buy List Earnings: AFL, EBAY, ESRX and FISV

On Tuesday, we had four Buy List earnings reports. Here are summaries of each one.

With AFLAC (AFL), it’s the same story that by now we know well. The supplemental-insurance company is doing very well businesswise, but the weak yen continues to gobble up their profits. For Q1, AFLAC had operating earnings of $1.69 per share, and that’s after the unfavorable exchange rate knocked off ten cents per share (which isn’t as bad as the results from some recent quarters). Excluding currency problems, operating earnings were up 5.9% from a year ago.

What I really wanted to see was AFLAC’s guidance. For Q2, AFLAC sees earnings ranging between $1.54 and $1.68 per share. That’s pretty good. Wall Street had been expecting $1.58. The downside is that AFLAC lowered their full-year guidance. The original range was $6.31 to $6.49 per share. Now it’s $6.06 to $6.40 per share. Those estimates are based on a yen/dollar exchange rate between 100 and 105. The stock got a nice boost when the earnings report came out. I’m keeping our Buy Below at $68 per share. AFLAC is going for about 10 times this year’s estimate. Keep in mind Iago’s words from this week’s epigraph.

Shares of eBay (EBAY) got hit hard this week, even though the online marketplace beat estimates. In last week’s CWS Market Review, I said that Wall Street’s consensus of 67 cents per share was almost certainly too low, and I was right. eBay reported Q1 adjusted earnings of 70 cents per share, which topped the Street by three cents per share. Officially, eBay lost $2.3 billion last quarter, going by net earnings, but that’s because they took a massive tax charge in order to repatriate $9 billion in foreign earnings. A lot of tech companies have been warehousing mountains of cash overseas because they don’t want to generate a fat tax bill, so it was a bit of a shock that eBay went through with it. Maybe others will follow.

For Q2, eBay sees earnings of 67 to 69 cents per share, which was a tad below the Street’s consensus of 70 cents per share. Importantly, eBay reiterated their full-year guidance of $2.95 to $3.00 per share. Wall Street’s consensus was at $2.99 per share. Sales for Q1 rose 14% to $4.26 billion. These numbers are pretty much what I expected, but I think traders wanted something to get excited about. Who knows, but the stock dropped 5% on Wednesday, and I really can’t see why. I’m lowering my Buy Below on eBay to $58 to reflect the downturn, but I think the stock continues to be a very good buy.

I found the earnings report at Express Scripts (ESRX) more troubling than the one at eBay. The pharmacy-benefit manager reported Q1 earnings of 99 cents per share, which was two cents below expectations. Express Scripts also lowered their full-year guidance by six cents per share at each end. The new range is $4.82 to $4.94 per share, but that still adds up to year-over-year growth of 17% to 20%. The company said it will lay off 1,890 workers nationwide. As if that weren’t enough, the company also said that it received subpoenas related to its relationships with drug makers. Traders did not like the bad news. ESRX got dinged for a 6.2% loss on Tuesday. I’m lowering my Buy Below to $71 per share.

Fiserv (FISV) may be the big star of this earnings season. For Q1, they made 82 cents per share, which easily beat Wall Street’s estimates of 74 cents per share. Earnings were up 22% from a year ago, while quarterly revenue rose 7.1% to $1.23 billion (which also beat expectations). Fiserv reaffirmed full-year guidance of $3.28 to $3.37 per share, which represents growth of 10% to 13%. The stock jumped after the earnings news and continued to rally to a new 52-week high. I like this stock a lot. I’m raising our Buy Below on Fiserv to $64 per share.

Earnings Next Week from DirecTV and Cognizant

We have two Buy List earnings reports for next week. On Tuesday, May 6, DirecTV will report Q1 earnings. Then on Wednesday, May 7, Cognizant Technology Solutions is due to report.

Three months ago, DirecTV (DTV) smashed Wall Street’s earnings forecast by 23 cents per share. The satellite-TV firm has been doing a great business lately, especially in Latin America. I also like that DirecTV uses its share buybacks to reduce share count. Too many companies merely buy back the same amount they’ve issued to senior execs.

But the big news for DirecTV came on Thursday, when the Wall Street Journal reported that AT&T has been talking to them about a possible acquisition. This makes sense as a response to the Comcast/Time Warner Cable deal. DirecTV has a market cap of $41 billion. There aren’t many companies big enough to buy them, but AT&T is one. I can’t predict if a deal will happen, but I’ll note that it makes a lot of sense.

On Thursday, shares of DTV jumped more than 4% to close at $80.76 per share. Analysts currently expect earnings of $1.50 per share for Q1. For now, I’m keeping my Buy Below price at $84 per share.

Shares of Cognizant Technology Solutions (CTSH) have been pretty quiet latel, but I think that could change soon. Three months ago, Cognizant told us to expect Q1 earnings of 59 cents per share on revenue of $2.42 billion. Bear in mind that Cognizant earned 47 cents per share for last year’s Q1, so we’re talking about pretty strong growth.

For all of 2014, Cognizant sees earnings of at least $2.51 per share and revenues of at least$10.3 billion. To add some context, CTSH earned $2.02 per share last year and $1.72 per share in 2012. Cognizant remains a good buy up to $52 per share.

That’s all for now. More earnings reports are coming our way next week. We’ll also get reports on trade, consumer credit and productivity. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy