Real Estate

Is it time to lock in your variable mortgage?

The Bank of Canada has recently raised rates a few times and experts are saying that they expect another 2 rate hikes by the end of the year. This affects you if you have a Variable Rate Mortgage or a Line of Credit (aka HELOC). You can thank the increasing strength of the global economy for that.

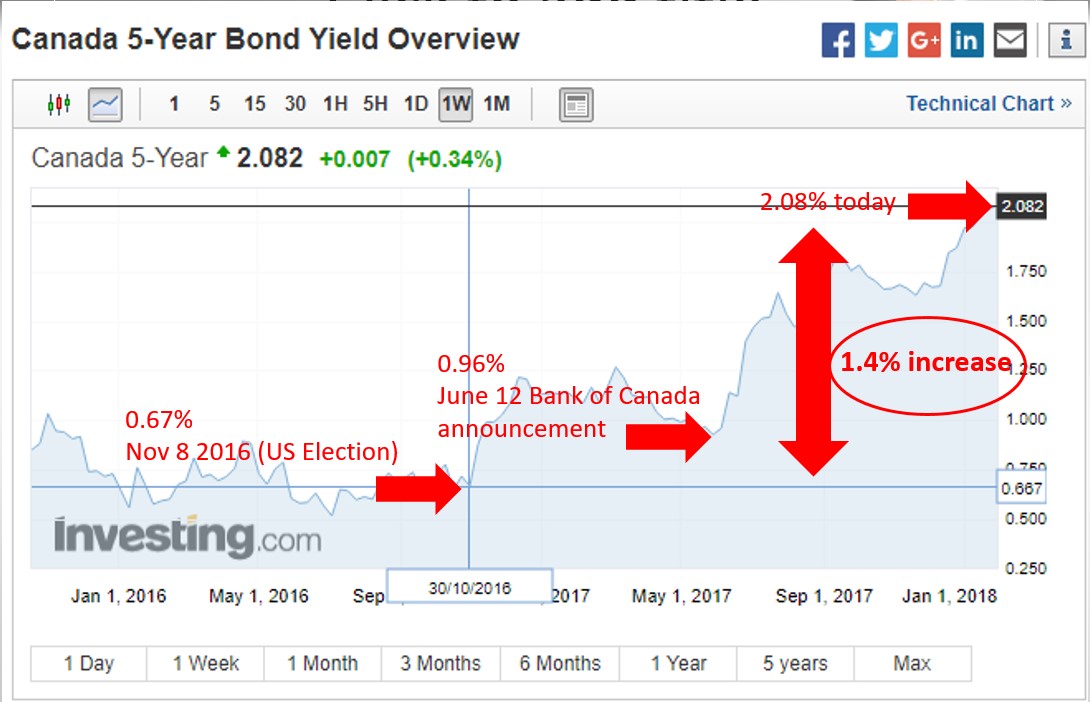

Bond yields, from which the fixed rate mortgages in Canada are derived, have been climbing significantly over the past 14 months.

So the question is, “should I lock in my variable rate”?

Due to many variables, this is a difficult question to answer immediately answer, everyone’s own personal situation is unique. There is no one size fits all…

Well, there are 3 main considerations:

- Your current variable interest rate,

- Your future goals and housing/mortgage plans, and

- Your potential new fixed rate (this is a big one).

If your variable rate has increased to 3% and over, you may want to think about locking in. We suggest you talk to your bank about what they would offer you to lock in, and convey those rates to our team to see if it makes sense to lock in with your existing bank or transfer the mortgage to another lender.

If your mortgage fits a certain qualification box (called insurable), vary attractive rates that are about .4% lower than the banks are available. It may make sense to break your mortgage with your bank and transfer to another lender if the difference in rates is large enough to offset the penalty to move the mortgage. To be qualified for the best rates right now, an insurable mortgage must follow the following criteria:

– Mortgage funded before Oct 2016

– Owner occupied or if a rental, must be 2+ (legal) units

– No refinances allowed, but you can transfer your mortgage as long as you are not adding any more money to your mortgage

Current insurable 5 year fixed rates are around 3.19%. Uninsurable rates are around 3.59%.

However, variable rates may be preferable over the fixed because the variable rate has the lowest prepayment penalties. Variable rate prepayment penalties are below 1% of the mortgage, where fixed rates at big banks can be 4%+ of the outstanding mortgage. Insurable 5 year variable rates are as low as Prime -.95% (2.5%)

If you have a Line of Credit (aka HELOC) and are not using it to its potential or have a balance sitting on it, you should call me to discuss if that is what is best for you. The rates on a HELOC are higher than a mortgage and it may make sense to lock that in.

Call ASAP for more details and don’t miss this window of opportunity!

The BC Government wants to trash the most important industry in the province in the name of affordability. An industry that has a huge workforce. Michael has the numbers and makes the case that Gov’t should leave real estate alone.

….also related from Michael: Your Moral & Intellectual Superiors

Jan 1st has come and gone, and wow was it a busy December. Most in the industry reported Jan 1st when the new stress test arrived (you can read more about the stress test by reading the previous article here). So, now that the new rules are in effect, how may you be impacted?

First off, its important to note that Credit Unions are NOT affected by the new guidelines as they are provincially regulated, not federally regulated. The Credit Unions have confirmed that they will not be following suit with the movement to change qualification criteria. Mortgage Brokers have never before been so important, being able to shop banks but also non-banks and Credit Unions to source loans.

Borrowing power with the bank is now reduced by about 20% for those choosing to take a 5 year fixed rate mortgage. All other terms were already stress tested, but previously choosing a 5 year fixed was a way to get around to tighter qualification guidelines and now that option has disappeared.

Some banks have confirmed that anyone with a contract dated prior to Jan 1, 2018 will be grandfathered under the old rules. This is important for those of you who have presales completing in the next few years. There was no clarity on this rule for many banks until very close to the deadline. In some cases, as late as Dec 29th!

One item that is interesting here is that shorter term rates like variable and 1-3 year fixed terms will now qualify at a lower interest rate, which will incentivize some borrowers to take shorter term rates. This is something that is likely an unintended consequence of the new rules and likely something that the government didn’t quite think through when introducing the new rules. One of the last things the government wants is for borrowers to be assuming short term debts in an environment where interest rates are so low and rates rising too quickly will have many of these borrowers seeing increases to their payments in just 1-2 years instead of ~ 5 years (as many borrowers were previously to maximize borrowing power).

All in all, these rules are intended to make it harder to qualify, yes, but are also here to protect the value of your real estate assets from a collapse like what was seen down in the US in the subprime crisis. If you are seeking financing, it may be wise to jump in sooner rather than later as the Credit Unions may see more volume than they can handle and start to taper their guidelines as well.

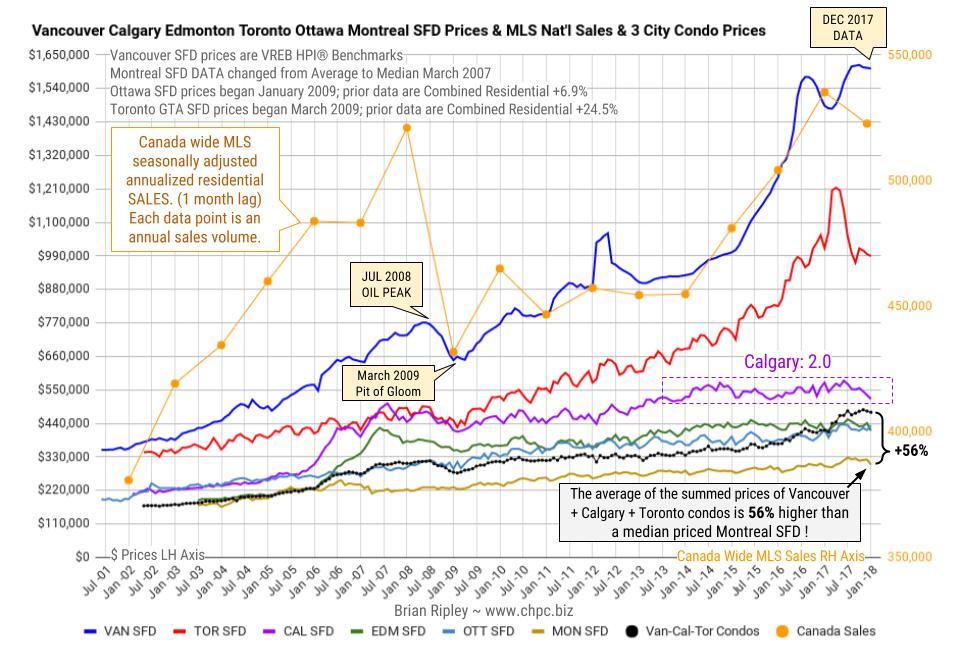

- *Toronto GTA SFD prices began March 2009. Prior data are Combined Residential +24.5%.

- *Ottawa SFD prices began January 2009. Prior data are Combined Residential +6.9%.

- *Montreal SFD DATA changed from Average to Median in March 2007

- *Vancouver SFD data are HPI®, not Average.

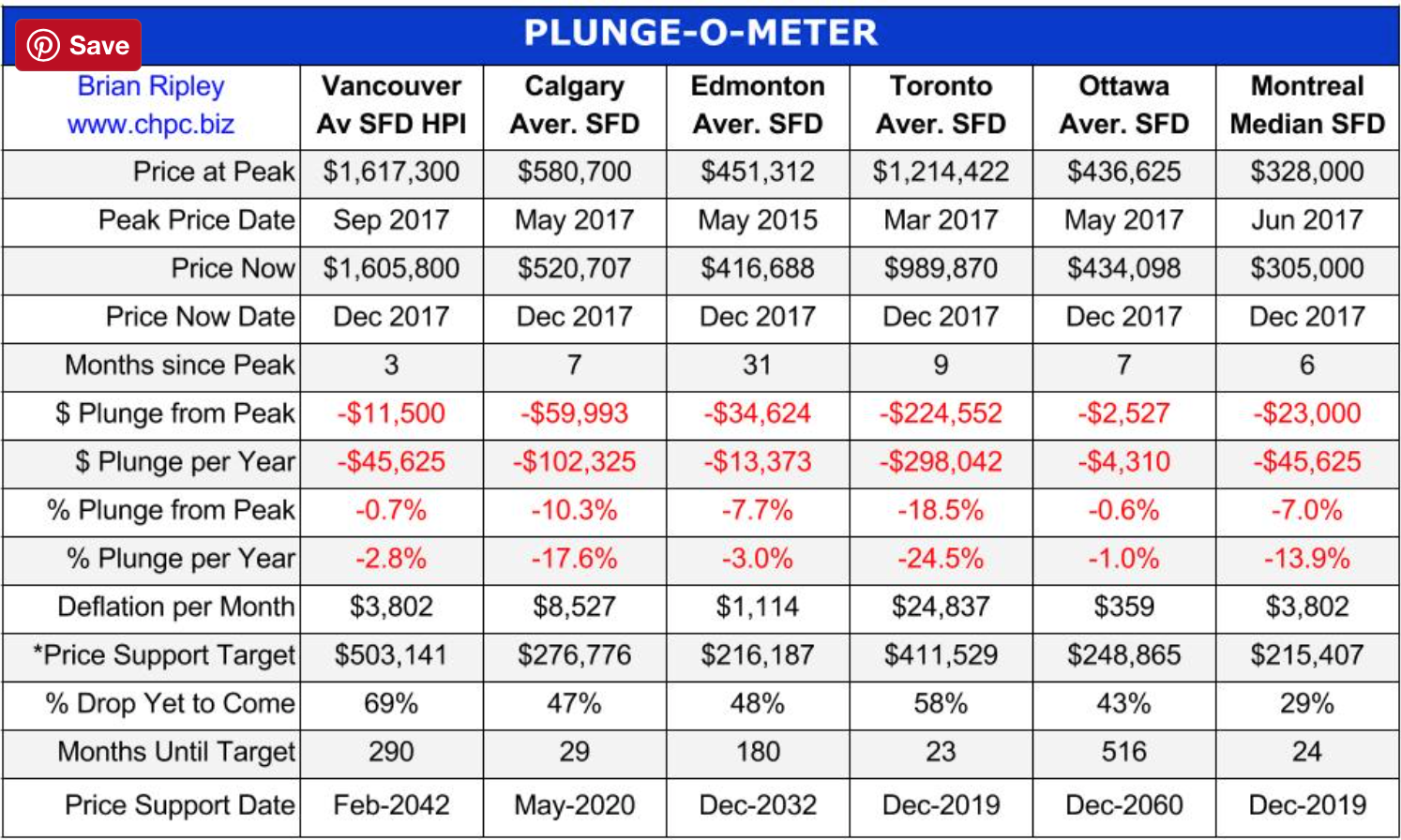

In December 2017 Toronto metro SFD prices continued slipping and 9 months since the March 2017 spike and peak price, they have lost $217,895 or 18% (Plunge-O-Meter). Vancouver prices are still defying gravity; FOMO and speculative pricing is still on. Anyone owning a detached house in the scorching hot Vancouver market is sitting on an unredeemed lottery ticket with time running out as buyers hibernate into the seasonal decline. The Bank of Canada interest rate up-moves are thinning the crowd even more.

It remains interesting to note that the combined average sum price of a Vancouver, Calgary & Toronto condo is currently 56% (no typo) more expensive than a median priced Montreal SFD; it was 52% in OCT 2017; 51% in APR 2017, 49% in FEB 2017 and 41% in July 2016 at the Vancouver peak. Montreal has more listing inventory available for sale than any of the other 5 biggest metros in Canada and the lowest monthly absorption rate based on total listings and sales.

The Plunge-O-Meter tracks the dollar and percentage losses from the peak and projects when prices might find support. On the price chart in the spring of 2005 there was a 4-6 month plateau period while buyers and sellers twitched like a herd. When the credit spreads narrowed and the yield curve began its journey towards inversion, the commodity stampede began.

*The Price Support target represents prices at March 2005; the start of a 40 month period of ardent speculation in all commodities; then a full blown crash into the pit of gloom (March 2009); and then another 39 month rocket ship to the moon but then the crowd suddenly thinned out in April 2012. The revival of spirits erupted in 2013 as global money went short cash and long real estate on an inflation bet. Now we have a major sense of doubt about value in Toronto.

Plunge-O-Nomics

The Pit of Gloom

- ’07-’08 Average Vancouver SFD lost $122,900, or 15.9% in 8 months (2%/mo drop)

- ’07-’08 Average Calgary SFD lost $92,499, or 18.3% in 18 months (1%/mo drop)

- ’07-’08 Average Edmonton SFD lost $78,719, or 18.5% in 21 months (0.9%/mo drop)

- ’07-’08 Average Toronto SFD lost $63,867, or 13% in 13 months (1%/mo drop)

- ’07-’08 Average Ottawa Residence lost $25,664, or 8.6% in 6 months (1.4%/mo drop)

- ’07-’08 Median Montreal SFD lost $6,000, down 2.6% in 6 months (0.4%/mo drop)

Property values are starting to crash hard in Sydney Australia, New Zealand, and London. Politicians are simply idiots. They all targeted foreigners buying property as the leading cause for the rise in housing prices. What they failed to grasp is that people spend more money when they THINK they have equity in their home. Whenever housing starts to decline, so does consumer spending and guess what – you get the economic downturn. Dah!

Property values are starting to crash hard in Sydney Australia, New Zealand, and London. Politicians are simply idiots. They all targeted foreigners buying property as the leading cause for the rise in housing prices. What they failed to grasp is that people spend more money when they THINK they have equity in their home. Whenever housing starts to decline, so does consumer spending and guess what – you get the economic downturn. Dah!

….also from Martin: