Gold & Precious Metals

“Since 2007 savings have climbed from 50% of GDP to nearly 53% in 2010. During this time investment has climbed from just over 40% of GDP to nearly 49%. The difference between the two has declined from just over 10% of GDP to just under 4%, and this of course is just another way to say that China’s current account surplus has dropped from just over 10% of GDP to just under 4%.” – Jack Crooks

CHINA REBALANCING: IS IT AN OXYMORON?

“The department [China’s Organization Department] is plagued by constant tension that bedevils most political systems. The Politburo has striven to professionalize the selection of top officials through the department, while undermining the process at the same time by fixing appointments in favor of loyalist and relatives. Powerful officials presiding over local fiefdoms have swept aside the rules even more crudely, establishing marketplaces in which government positions are bought and sold for huge financial gain.”

– Richard McGregor, The Party: The secret world of China’s communist rulers

I got a bit of a chuckle out of IMF Chief Christine Lagarde. She recently praised China for its “rebalancing efforts.” What a pain it must be to have to lie publicly on a regular basis in an effort to keep the key players agreeable so you can attempt to conduct coordinated global policy.

There is a big gap between Ms. Lagarde’s public PR and reality when it comes to China’s “rebalancing.” This if from Professor Michael Pettis’ latest missive [my emphasis]:

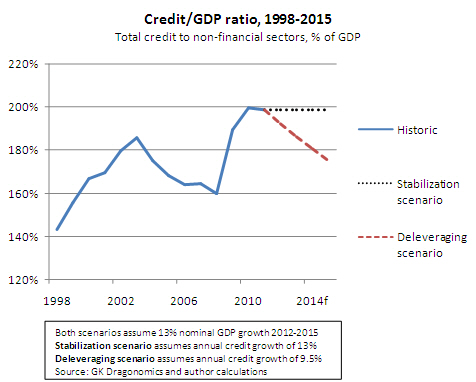

China is not rebalancing and the decline in the surplus was driven wholly by external conditions. In fact until 2010, and probably also in 2011, the imbalances have gotten worse, not better.

For proof consider China’s total savings rate as a share of GDP relative to China’s total investment rate. The current account surplus, of course, is equal to the excess of savings over investment – any excess savings must be exported, and by definition the current account surplus is exactly equal to the capital account deficit. This is the standard accounting identity to which I have referred many times in my newsletters.

The savings and investment numbers show that the last time investment exceeded savings was in 1993-94, and during that time China of course ran a current account deficit. This was just before Beijing sharply devalued the RMB, after which it immediately began running a surplus, which has persisted for 17 years. Since 2007 savings have climbed from 50% of GDP to nearly 53% in 2010. During this time investment has climbed from just over 40% of GDP to nearly 49%. The difference between the two has declined from just over 10% of GDP to just under 4%, and this of course is just another way to say that China’s current account surplus has dropped from just over 10% of GDP to just under 4%.

According to Dr. Pettis:

-

A declining savings rate in China would indicate consumption was rising; which is what everyone seems to want and Ms. Lagarde was likely hinting at. A falling savings rate would indicate China would not be so highly dependent on investment and export growth. This process would effectively represent a transfer of wealth back to the household sector i.e. Chinese consumers.

Guess what Ms. Largarde? China’s savings rate is increasing, not declining. This is the opposite of rebalancing.

But many analysts point to the fact that China is pursuing policies to stimulate consumption. Oh really? Back to Dr. Pettis:

Beijing is trying to increase the consumption share of GDP by subsidizing certain types of household consumption (white goods, cars), but since the subsidies are paid for indirectly by the household sector, the net effect is to take away with one hand what it offers with the other. This is no way to increase consumption.

Meanwhile investment continues to grow and, with it, debt continues to grow, and since the only way to manage all this debt is to continue repressing interest rates at the expense of household depositors, households have to increase their savings rates to make up the difference. So national savings continue to rise.

So why is the current account surplus declining if China’s consumption isn’t taking its place? Investment continues to increase. State Owned Industries (SOEs) still enjoy access to cheap credit (this is an effective subsidy by the household sector, i.e. transfer of wealth due to below-market interest rates on deposits; same thing happening in the US in order to subsidize the banking system). But because SOEs have increased capacity so much in key industries, and profitability has vanished, they are using this cheap credit to move beyond their core businesses, i.e. increasing investment. This is why many, including us, continue to warn about malinvestment and the hidden ticking debt bomb inside China’s financial system that will be a key reason why Chinese GDP numbers will continue to disappoint in the quarters ahead.

Sure, we all got excited when Wen Jiabao (considered by the West to be in the “reform” camp) and his eight other pals, who run China through the Politburo Standing Committee, jettisoned rising star princeling Bo Xilai, a ruthless climber who was quite happy with the current Chinese growth model. To many, this very public purging indicates the reformers are in charge and a swift change in the Chinese model of export and investment dependence is now in play.

Well, even if the so-called reformers are in charge, the transition to a consumption model, which by its very nature will require increased individual freedoms, will likely be a much slower process than we would wish for. Any transition will produce a lot of political blowback as the existing order protects its turf, and the Party itself has to worry about being marginalized if it allows its citizens to make their own decisions across the economic sphere.

The point is this: we can’t expect China to be the engine of global growth given the export-cum-investment model is running out of gas. And we can’t expect some type of overnight smooth transition to a domestic consumption-driven growth model to save the world.

China may soon be heading down the right path. It seems they are; and I think that path will be to the economic benefit of all concerned. But as always, the proof is in the pudding.

British investors have a bit of a blind spot for American funds, with the US accounting for only 5pc of all the shares we hold in unit trusts, according to the Investment Management Association. Now enthusiasts claim there are several good reasons to reconsider the sector.

Winning the Rare Earth Economic War

China’s sudden cuts to rare earth export quotas and domestic production marked the beginning of a Rare Earth Economic War, proposes Jacob Securities’ Senior Mining and Metals Analyst Luisa Moreno. The good news is that partnerships between end-users and mining companies may just be the secret weapon to level the playing field for critical metals producers operating beyond China’s borders. In this exclusive interview with The Critical Metals Report, Moreno points to the companies that are closest to delivering high-quality goods for the benefit of manufacturers and investors alike.

COMPANIES MENTIONED: AVALON RARE METALS INC. – FRONTIER RARE EARTHS LTD. – LYNAS CORP. –MATAMEC EXPLORATIONS INC. – MEDALLION RESOURCES LTD. – MOLYCORP INC. – MONTERO MINING AND EXPLORATION LTD. – NEO MATERIAL TECHNOLOGIES – RARE ELEMENT RESOURCES LTD. –TASMAN METALS LTD. – UCORE RARE METALS INC.

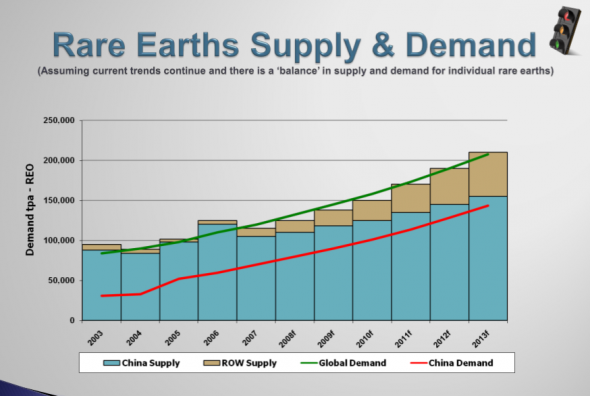

The Critical Metals Report: Last year you published a research report called the Rare Earth Economic War. When we talked last time, you said that China was on one side and industrialized nations were on the other, with China winning. Does China’s new five-year plan with an emphasis on consumer consumption change that balance?

Luisa Moreno: China’s new five-year plan as it concerns raw materials suggests that China wants to better utilize its resources primarily for its own economic development, which in part supports the concept of a raw materials economic war. China, just as most nations, would like to be self-sufficient in key mineral resources. The country has about one-third of all the total rare earth element (REE) resources, but it supplies the world with more than 95% of its rare earth needs. I believe China is in a resource-preservation mode. However, what is not so fair are the differences between China’s domestic rare earths prices and international prices, which are usually much higher, and China’s dramatic decrease in production and export quotas in such a short period of time. China is well aware of the critical uses of some of the rare earths and it seems that it is determined to allocate a limited amount to the world and increasingly consume most of it by attracting REE-dependent manufacturing into China. The leaders plan to manage sustainable growth of the Chinese REE sector by attracting companies that utilize these resources. That would bring jobs while developing advanced rare earth-based technologies. It is no different from what other nations would like to do. Of course, China is at an advantage because it has the largest capacity in the world for the production of these elements and the know-how to refine them. The rest of the world is left with the option of moving manufacturing to China for better access to these materials.

TCMR: So you are saying that China is still winning?

LM: I believe so. Actually, the recent move by the U.S., EU and Japan to file a law suit against China may end up supporting that conclusion, if they are unable to persuade it to change its rare earth policies. It seems that China is increasingly consuming most of these elements and it is trying to control supply and prices.

TCMR: Can lawsuits and political pressure really make China change its export habits?

LM: Potentially. I think a negative ruling could make leaders think twice before deciding on export quotas or other related trading policies. But China will put Chinese interests first, obviously. I don’t think that the rest of the world has much leverage with what is now the second-largest world economy. I think the lawsuits bring attention to how other nations may feel, but might not necessarily be sufficient to change China’s policies regarding rare earths or other critical materials.

TCMR: China’s Ministry of Commerce recently announced that the export quotas would remain essentially the same—30,184 tons (t) in 2012—but only 50% of the quota was used last year. Is that quota meaningful?

LM: 2011 was an exceptionally bad year, the tsunami in Japan, the second-largest REE consumer, having caused a slowdown in demand, not to mention the global economic slowdown in the second half of the year, which was marked by poor economic conditions in Europe and negative economic politics in the U.S. The second half of 2011 was clearly not a favorable one for rare earths and many other commodities. Now that the rare earth element export quotas are separated into lights, mediums and heavies, I think it will become more evident where the real demand is and how tight the export quotas really are, assuming that we see some economic recovery.

I think the new invoicing system that China is implementing to better control production and exports may decrease illegal exports of rare earths as well. Right now, official export numbers are not the total picture because so much is illegally produced and exported. I’m not sure China will be able to control all of the illegal exports, but at least reining it in a little bit will impact the supply-demand equation.

If Lynas Corp. (LYC:ASX) comes into production and Molycorp Inc. (MCP:NYSE) ramps up production, we should see an increase in production of light rare earth elements (LREEs). That may make export quotas for LREEs less meaningful. However, China will probably maintain export quotas for some of the most critical REEs, including the light element neodymium and some of the heavy rare earths (HREEs) like dysprosium and yttrium. For the next five to 10 years, as long as there is a risk that some of these elements might be in shortfall, we may still see an REE export quota of some sort.

TCMR: You called 2011 an exceptional year in terms of bad economic news, but could the drop in rare earths prices indicate that it had been in a bubble? Have companies’ efforts to re-engineer products and eliminate their needs for rare earths been successful? Or was it just the economy in general that accounted for the price drops?

LM: Likely it was a combination of all those things. I think the current and future demand for materials such as dysprosium should be healthy, but I’m not sure if $3,000/kilogram (kg) was justifiable. Similarly, the prices of lanthanum and cerium, which are fairly common elements historically below $10/kg , were above $100/kg back in August, a level we now know is not really sustainable. Prices seem to have been in a bubble and when demand decreased, REE prices also fell significantly. Chinese officials may have wanted prices to stay high and some Chinese refiners even suspended production for a few months when prices were falling and demand was weak.

TCMR: Considering that not all REEs are created equal in terms of market value, what are some of the most in-demand elements, and could those prices break out this year?

LM: I think the critical elements identified by the U.S. Department of Energy—neodymium, praseodymium, terbium, dysprosium and yttrium—could experience a significant increase in demand; some may even be in shortfall right now. It is possible that the prices of these elements may rise, but in the short term, we might see continued decreasing prices until they stabilize. I have already seen signs that they are starting to stabilize. If there is stability, or better yet growth in the global economy, the prices for some of these elements could potentially increase this year.

TCMR: You mentioned Molycorp and Lynas. Molycorp just announced the start-up of its manufacturing facility in Mountain Pass, California. Will that produce mostly LREEs? Could those two companies make a difference in global supply in the next couple of years?

LM: Absolutely. Light rare earths are the most sold or consumed elements—particularly lanthanum and cerium. They are the cheapest, but they are the ones that are sold in the highest volume. Lynas and Molycorp could also produce significant amounts of neodymium, which is very important for the production of super magnets used in hybrid cars, computers and wind turbines. Molycorp really does not have much of the heavies like dysprosium and terbium at Mountain Pass. Lynas might be able to produce some of the most critical heavies from its plant in Malaysia, but it would be rather expensive given that it only has small percentages of heavy lanthanides. In any case, even if both companies ramp up production, it won’t completely close the gap in demand that exists for some of these critical elements outside China.

TCMR: When do you see each of those companies going into production?

LM: There have been delays with the Lynas project because of permitting issues, but I think it hopes to start production in Malaysia before the end of the year. Molycorp expects to reach its phase one annualized production of 19,050t of mixed rare earth oxides by Q312 and separated products perhaps before the end of the year. It’s hard to say exactly when these companies will be able to reach their target production. As you know, with mining projects delays are not unusual, but both companies are working very hard to deliver on their promises.

TCMR: What are your top picks for non-Chinese companies that could supply some of the heavy elements in the future?

LM: My top picks include Matamec Explorations Inc. (MAT:TSX.V; MRHEF:OTCQX) and Ucore Rare Metals Inc. (UCU:TSX.V; UURAF:OTCQX). I cover both companies and they both have a favorable REE distribution with high percentages of the critical elements. I think Matamec has made significant progress with its metallurgy and its partnerships. The company just announced that Toyota Tsusho Corp. (TYHOF:OTC; 8015:JP) has signed a binding memo of understanding with Matamec, which means it has priority over the development of the Kipawa. That is very good for Matamec.

Ucore should come out with a preliminary economic assessment (PEA) in the next few weeks, and we should be able to better assess if it is an economically viable project. The project is in Alaska and we believe it is the most significant HREE deposit in the U.S. It’s very interesting.

TCMR: Could either of these companies be takeover targets for a Molycorp looking to cover the HREE space?

LM: If Molycorp wants to become the leading rare earths company, it will have to find a solution for the heavy rare earths. I think Matamec could have filled that role, but because Toyota has now the binding agreement, it will be difficult for Molycorp to approach Matamec. Besides, it seems that Toyota is interested in a 100% offtake deal with Matamec. Ucore, on the other hand, continues to be another good option for Molycorp, although the company is still working on its metallurgy and may be seen as too early stage. When the PEA comes out, hopefully we’ll have a much better idea of the progress of the project.

Another company that would also be of interest is Tasman Metals Ltd. (TSM:TSX.V; TAS:NYSE.A; TASXF:OTCPK; T61:FSE), which has the Norra Karr deposit in Sweden. It is close to Molycorp’s Silmet refinery in Europe. Tasman has one of the highest percentages of heavies. Contrary to Ucore and Matamec, it actually has a very large resource. My understanding is that in terms of the metallurgy, it made significant progress but it is not as advanced as Matamec or Rare Element Resources Ltd. (RES:TSX; REE:NYSE.A). Hopefully, it will file a PEA this year as well.

TCMR: Matamec is trading at $0.32 today and Ucore at $0.41. Could the recent news be catalysts for both of those companies?

LM: I think so. As the market looks around for HREE alternatives to Molycorp, I think there is great potential for Ucore and Tasman to be recognized by the market as potential targets. Matamec is currently working on the details of a definitive agreement with Toyota Tsusho, to be completed by July.

TCMR: You have commented on the importance of metallurgy and the refining process for extracting and efficiently delivering high-quality oxides for each individual mineral source because each one is very different. What companies are well on their way to doing this?

LM: Like I said, Matamec is well underway in doing this. Now, it has a fantastic partner, which is Toyota Tsusho and all the associated companies and likely universities that will be involved in developing that project.

I think another company that has made significant progress is Montero Mining and Exploration Ltd. (MON:TSX.V). It has a deposit in Tanzania and it just announced that it has produced an oxide concentrate. That’s really good.

Rare Element Resources Ltd. is another. I visited its pilot plant last year. It has also made significant progress. The resource is mainly comprised of bastnasite mineral, which, relative to other deposits, might mean that it will have fewer processing challenges. It has been able to produce a mixed oxide concentrate and is moving towards separating the elements and producing individual elements oxides. As I said, it’s already at the pilot level and completed a prefeasibility study. Rare Element is one of the most advanced projects; we believe however that the company needs to secure offtake agreements and a JV partner capable of co-financing the $375 million project.

Another one that I like is Frontier Rare Earths Ltd. (FRO:TSX). It just published a comprehensive PEA, which included a separation plant. No other company has done that yet. Frontier has a partnership and partial offtake agreement with Korea Resource Corporation and the support of a consortium of Korean companies.

TCMR: Could other REE companies that you’re following break out in the next few years, either because of agreements with partners or as takeout candidates or because they might actually start producing?

LM: I think we should perhaps pay more attention to what is going on in Brazil. We believe that Neo Material Technologies (NEM:TSX) spent some time there before being acquired by Molycorp. It seems that the company may have been looking at recovering xenotime from tailings at the Pitinga mine in Brazil.

Another private project is owned by Mining Ventures Brasil. It seems to have a colluvial deposit with high percentages of xenotime and monazite. The distribution for the heavies may be quite favorable. It’s an early-stage project; the company is moving forward with the metallurgy now. There is a possibility that things could work out pretty fast for them.

Another private project still in Brazil is the one that it is ongoing at Companhia Brasileira de Metalurgia e Mineração (CBMM). It is the largest producer of niobium but it also has rare earths in its deposit.

Medallion Resources Ltd. (MDL:TSX.V; MLLOF:OTCQX; MRD:FSE) is a public company targeting monazite deposits around the world. Monazite, just like xenotime, has been used in the past to recover rare earths. The model is to find these monazite deposits because they represent a far easier metallurgic process than other sources. That could allow Medallion to fast-track its project.

A lot of folks are trying to find solutions for these metals.

TCMR: The sheer number of early-stage projects presents a challenge for potential investors. How can investors pick which companies might be successful? What should they focus on when there are so many moving parts—the management, the location, the metallurgy and the different elements themselves?

LM: To start, investors should be looking at the same factors they usually use to assess mining companies. Beyond that, the most important factors for REE projects specifically are metallurgy and industry partnerships. However, it depends what investors are looking for. Essentially, there are some names in the rare earths space that are well known and respected. Examples of that are Avalon Rare Metals Inc. (AVL:TSX; AVL:NYSE; AVARF:OTCQX) and Rare Element Resources Ltd. They were the first ones to publish PEAs and are still perceived by some as the frontrunners. There are, however, lesser-known companies that have received far less love from the market, despite having made significant advances. That includes Matamec and Frontier, which I still feel are somewhat under the radar.

If investors are anticipating a bounce in rare earths stocks and would like to hold rare earths companies that have made major progress in metallurgy, with solid industry partnerships and have great potential for significant long-term upside, I think names like Matamec and Frontier might be good. They’re relatively more advanced, particularly in metallurgy, which is very important because you can have 100 million tons at high grades, but if the metallurgy is complex and you are five years away from solving the processing to a level where it’s economic to recover these elements, that might not be so competitive in this market. Those that are more advanced will be better positioned to secure development partners. That’s very important because the PEAs coming out show that projects are capital expenditure intensive and industry partners can help finance these projects.

Rare earths are not commodities; end users, usually through joint ventures, guide companies toward production of appropriate materials. It’s a very complex space. As I said, although Matamec and Frontier have made significant progress, they consistently have underperformed some of their peers. So investors who are interested in those names will have to be really patient. We believe, however, that Molycorp is the undisputable leading non-Chinese rare earth listed company at the moment and investor interest in this space should follow and analyze this company to determine a good entry point.

TCMR: You’re going to be speaking at the International Rare Earths Summit in San Francisco in May. What message will you be delivering?

LM: Seeing as a significant part of the audience is expected to be end users who are extremely concerned about the long-term availability of these elements, I’ll be talking about the challenges that rare earth miners and future producers face, focusing on how end-users may better participate in the development of a global rare earths supply industry. They could surely help fast track the development of the rare earths industry outside China.

TCMR: Thank you very much for your time, Luisa.

Luisa Moreno is a senior mining and metals analyst at Jacob Securities Inc. in Toronto. She covers industrial materials with a major focus on technology and energy metal companies. She has been a guest speaker on television and at international conferences. Moreno has published reports on rare earths and other critical materials and has been quoted in newspapers and industry blogs. She holds a bachelor’s and master’s in physics engineering as well as a Ph.D. in materials and mechanics from Imperial College, London.

Want to read more exclusive Critical Metals Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators and learn more about critical metals companies, visit our Critical Metals Report page.

DISCLOSURE:

1) JT Long conducted this interview. She personally and/or her family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Critical Metals Report: Rare Element Resources Ltd., Medallion Resources Ltd., Frontier Rare Earths Ltd., Tasman Metals Ltd., Matamec Explorations Inc. and Ucore Rare MetalsInc. Streetwise Reports does not accept stock in exchange for services.

3) Luisa Moreno: I personally and/or my family own shares of the following companies mentioned in this interview: None. I was not paid to do this interview.

These stable businesses offer some of the most reliable dividends on the market today.

When gold was first discovered at Sutter’s Mill in the foothills of California’s Sierra Nevada mountains in 1848, thousands of people dropped everything and headed west with dreams of striking it rich.

Within a year, San Francisco was transformed from a sleepy outpost with a few dozen shacks into a bustling mining hub. As gold fever spread, would-be prospectors poured in by the boatload from as far away as Chile and Hawaii.

There was plenty of gold to be had in rivers and streams, particularly in the early days. But much of it went to larger operations that utilized high-volume hydraulic recovery techniques. The average miner sifting with a simple pan or other crude device was lucky to break even and recoup expenses. Thousands went home disillusioned and broke.

However, while the great gold rush was a bust for many, the huge population influx was a boon for gaming houses, saloons and brothels. And several entrepreneurs made a fortune, among them a peddler of denim pants named Levi Strauss.

In fact, the first millionaire to emerge from all of this was an enterprising retailer named Sam Brannan. Brannan famously cornered the market and bought nearly all of the available supplies of picks, shovels and pans. Then to drum up business, he ran through the streets showing everyone the newfound gold dust.

Brannan was clever. He knew that some would find gold and others wouldn’t — but they would all need tools. And he was happy to supply them, at a substantial mark-up, of course. At the peak, Brannan was reportedly raking in $5,000 a day in sales, more than $140,000 in today’s dollars.

What does any of this have to do with income investing? Plenty…

As the Chief Strategist behind StreetAuthority’s Energy & Income advisory, I think the easiest way to explain this is using the energy field as an example.

From small independent explorers to integrated global giants, companies that find and produce oil and gas can make a ton of money for their shareholders.

And many of these companies pay out steady dividends. For example, ExxonMobil (NYSE: XOM) has raised dividends nearly 6% annually for the past three decades.

But these companies are also exposed to fluctuating commodity markets. And as we all know, energy prices can be notoriously volatile.

For example, Exxon shares are still well below their highs from before the recession on the heels of lower energy prices.

By contrast, companies that provide necessary equipment and services to these exploration companies aren’t in the business of selling oil and gas. So they don’t directly feel those day-to-day price swings. As long as prices are strong enough to support continued exploration and development activity, they stay happy.

It’s the same situation that the “pick and shovel” companies during the Gold Rush were able to use to their advantage.

In the income and energy field, there are a number of these types of companies… and many pay high yields.

Perhaps the best known group is master limited partnerships (MLPs). These aren’t your traditional equipment and service companies that make pumps or drill bits… but they are every bit as important.

Without MLPs, the energy pumped out of the ground by energy companies would be useless. That’s because these companies own the pipeline and storage assets — so called “midstream” assets — that help get energy from the field to the end user.

MLPs typically aren’t concerned with energy prices. They get paid for the volume shipped through their pipelines and storage terminals. They usually earn the same amount whether a barrel of oil is $150 or $50.

Of course, when you make money from simply transporting commodities (which are in constant demand) and don’t have to worry about swings in their prices, you’d expect to see steady cash flow. This is the case with many MLPs, which pass along the bulk of that money to their investors in the form of steady yields. Most MLPs have yields averaging 5-6%, and it’s not uncommon for some MLPs yield in the double-digits.

But this same principal can be applied across the entire income universe. There are plenty of yields that come from companies doing the “exploring” — whether it be actual exploration for energy, delivering the next breakthrough drug, or building a new airplane.

If you want to invest in the most stable businesses, however, look to the companies that will make money supplying the “picks, shovels and pans”… even if other companies don’t strike gold.

[Note: For more about the income opportunities in the energy field, don’t miss my recent presentation about energy royalty trusts. This field is small — only about two dozen trade on the market. But we’ve found one trust yielding up to 17.1%. For more information — including names and ticker symbols — visit this link.]

Good investing!

Nathan Slaughter

Chief Investment Strategist, Energy & Income

Disclosure: Neither Nathan Slaughter not StreetAuthority own shares of the securities mentioned. In accordance with company policies, StreetAuthority always provides readers with at least 48 hours advance notice before buying or selling any securities in any “real money” model portfolio. Members of our staff are restricted from buying or selling any securities for two weeks after being featured in our advisories or on our website, as monitored by our compliance officer.