Henk Krasenberg, founder of the European Gold Centre, is back from the INDABA Mining Conference in South Africa with plenty to report. He has seen a sea change in mining in Africa over the last few years; countries are growing more confident and have a greater awareness of mining’s potential. In this interview with The Gold Report, Krasenberg provides a European perspective on a whole slew of miners working in Africa, as well as in all corners of the world.

The Gold Report: Where’s the rally for gold?

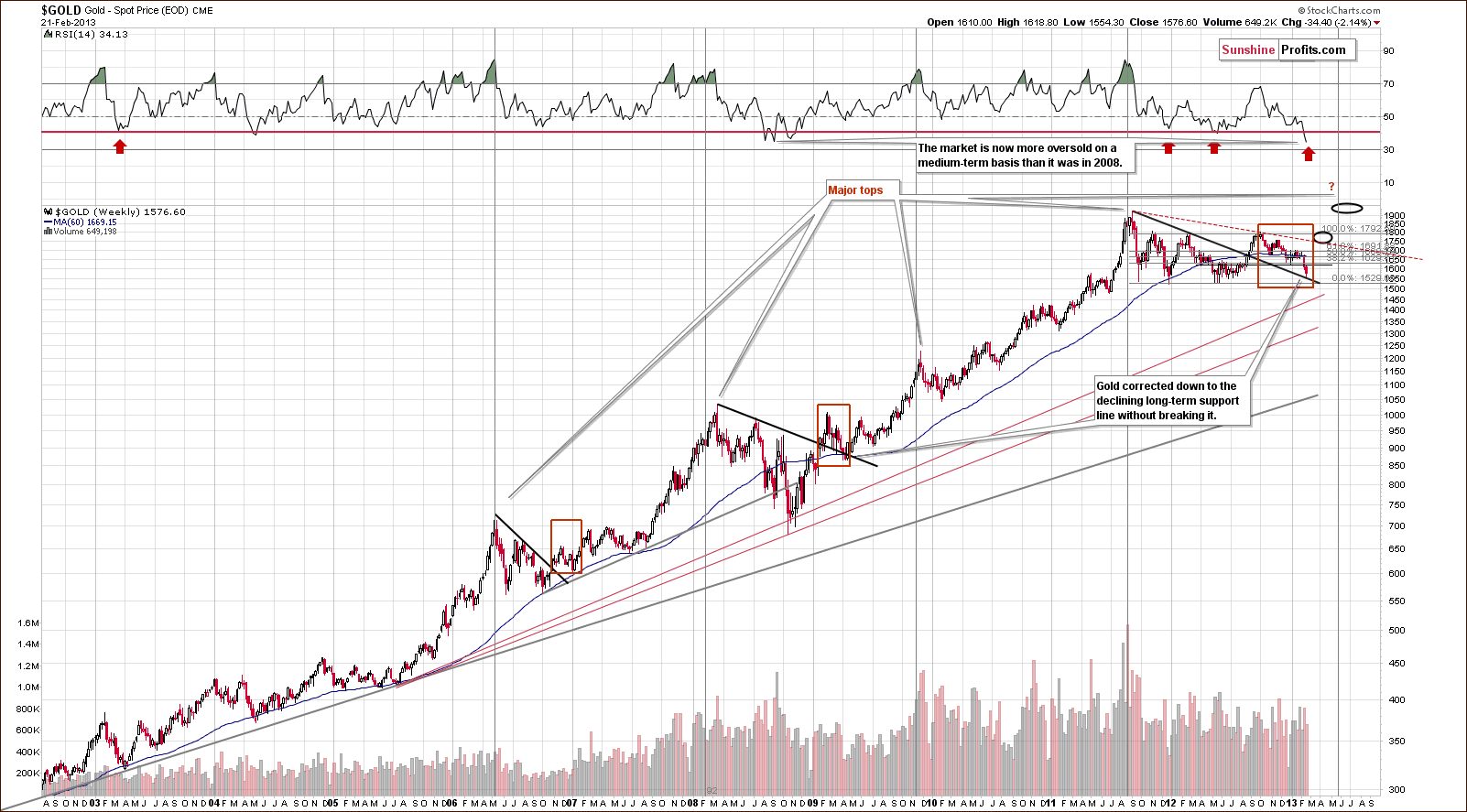

Henk Krasenberg: The general investment public is not in the right mood for resource stocks. Those who own them are not happy with their performance, and those who don’t own them are not convinced that they should own them. Only 2% of all investment capital is in gold, other metals and related vehicles. I believe that gold is not as high as most people think. I relate it to the all-time high of $850/ounce ($850/oz) in 1980 and if you correct that to today’s standards, that would equal $2,400–$2,500/oz. So we are well below the real historical high. Further, the market for resource shares has not been very stimulating. Resource shares are greatly undervalued in my opinion. That surprises me. Several producers are reporting record production and record earnings and project further increases for the next few years. Also, the results that exploration companies report are generally very encouraging.

TGR: A lot of people would say that the market pretty much has these companies right where they should be. Why do you believe they are undervalued?

HK: If you talk about production companies, what is not reflected in their prices is their potential. Of course, that doesn’t count for everybody. It is very difficult for the major companies to achieve substantial increases in their production, but several of the emerging and midtier producers are looking at a great future.

TGR: When the rally does happen, how high could that percentage get?

HK: That depends a lot on the nature of the frenzy that gives reason for a rally and whether the institutions will come in — the regular investment capital of pension funds and insurance companies, regular shareholding companies. If gold investment moves from 2% to 4% of the total investments, we are talking about a lot of new capital coming to the market.

TGR: You recently attended the annual INDABA Mining Conference in Cape Town, South Africa. What were two or three takeaways from that conference?

HK: I was impressed with the confidence that people have in the future. So many things are happening in Africa that are different from even just five years ago. I noticed that the governments of the presenting countries show more dedication and a more realistic and constructive attitude; it seems that they are now viewing mining more as a blessing than as a curse. They seem to be more aware of their potential and the possible benefits. The countries expressed awareness of and willingness about the need to work together with the companies.

Also remarkable were the questions that people asked about the risk of resources being nationalized and about indigenization. Countries want their local investors to have a certain percentage of ownership, but they often do not have money to pay for it. In Zimbabwe, for example, it is all paper deals. Kenya wants to apply a rule that 35% of every company should be owned by national people. If they indeed pay for that, it could also be a positive factor. All the companies need money for their progress, so if they can raise 35% of their requirements within those countries, that would be welcome.

Also remarkable was that newer countries are coming into the game: After Tanzania, Burkina Faso, Mali and Guinea, Eritrea, Ethiopia and Mauritania have joined the ranks of mining countries. Now, former mining nations like Zambia, Liberia, Sierra Leone and Zimbabwe are re-emerging and a new generation of countries that you hardly ever thought of for their resource potential, like Mozambique, Gabon, Senegal, Uganda and Malawi, were at the conference. Some were mainly known for diamonds, but now they are also working on gold, copper and other metals.

TGR: So mostly Central and West Africa?

HK: There weren’t too many countries presenting from the eastern part, but in the second half of last year, I wrote a report on East Africa, and I think that is a much underexplored area. Interesting things are happening there too, but not yet as widely as in West Africa.

TGR: You note in a recent edition of your GOLDVIEW newsletter that developing countries are buying a lot more gold than developed nations. Is that reflective of growing global fear about U.S. and Europe economic stability?

HK: The developing countries never were in a position to be able to buy gold. Now they are doing better and are getting some money, and they see all this turmoil in the world. They finally have reached the point that they can afford to buy gold, so they will. Most of the countries that used to have big gold reserves have sold part of their gold, and in most cases that happened at a time when the gold price had not even started its real rise. If you sold gold at $250–$400/oz in the past, as did the U.K., the Netherlands and Canada, it is not easy to be buying it at $1,600–$1,700/oz. It would take a lot of courage, and I am sure that they would receive push back from the public. Despite the current setback of the gold price, I think there may come a time when they will seriously regret not having bought it back at $1,600/oz. This may very well be the last opportunity to buy it at these levels.

TGR: Germany recently announced that it wanted to repatriate part of the gold that it has in foreign banks. What did you make of that announcement and that it’s not going to fully happen until 2020?

HK: I’m puzzled that not more people are concerned about this because most of the foreign gold is with the Federal Reserve in New York. First there was a 30-year deal, and now it is to take them seven years to deliver that gold to Germany. That scares me because what does that mean? Is the gold not there, as some people believe? But the seven-year stretch most probably suggests or indicates that they used the gold, which was deposited by the central banks, to lend it out and/or to secure loans. Some people say gold is the only asset without a liability. True, if you buy gold with your own money, but not with a loan. If it indeed turns out that the Fed has put all kinds of obligations on the foreign gold, we have a serious problem. If this scenario is true, the Fed has every reason not to let the gold price move up to over $2,000/oz because sooner or later it has to cover its possible shortfall.

TGR: What about some of the recent rhetoric from Mario Draghi, the head of the European Central Bank?

HK: People like him cannot say what they think. They are in a political function. They have a responsibility toward the nations, to the public. They have to lie, to put it bluntly, and they do. They will never say they don’t have the gold or they don’t have enough gold or they used it. If it ever comes out that not all the gold is where we think it is, we could see crazy days with gold prices of $10,000/oz, $20,000/oz or whatever.

TGR: What are you seeing for a trading range for gold in 2013?

HK: I’m confident that we will see higher prices. It does not take that much to get it over $1,700/oz, although what happened in the last two weeks with the gold price may make us wonder. But if you ask me whether it will be $2,000/oz, $3,000/oz or $5,000/oz, that will largely depend on the situations that arise. There are enough ghosts in the closet.

TGR: Gold went up 6.2% in 2012. Do you think it will beat that percentage in 2013?

HK: It doesn’t take much to beat that.

TGR: Where does that leave silver?

HK: The fact that there is already not enough silver to make the coins that people want tells me a lot. On the other hand, nobody seems to panic. I think silver has extra potential because there is an actual shortage looming while the demand for silver coins and other uses is strong. But the old dogma is still valid: If and when gold jumps, silver will jump too.

TGR: Were people particularly bullish on platinum, perhaps copper?

HK: Not surprisingly, copper was widely mentioned at the conference because China has a large appetite for it. Copper is not a glamorous metal but a daily necessity.

One presenter on platinum said mining platinum is tough. It’s so different from gold. It is a hard business to be in. At the moment, platinum is struggling. There may be a very significant shortage in platinum, in particular because of lower output of the mines in South Africa. Zimbabwe could benefit from that situation.

TGR: Tell us the difference between the average European precious metals investor and one from North America.

HK: North American investors are much more opportunistic. They have a better and longer history of metals and even more of mining than Europeans have. In North America it is easier to meet people who have invested in resources. When North American investors have gold shares and they hear that uranium is hot, they jump easily into uranium and then into tantalum, graphite, graphene, and so on. They follow the trend. Here in Europe only the fairly sophisticated or adventurous investors will do so. Once we commit, we tend to stick with it. We take a longer-term approach.

TGR: What are some European mining stories?

HK: We have over 300 companies that are active in the European resources, and we never hear about them. The media hardly ever talk about them. Most people don’t even know we have an industry like that. Even in investment circles information is scarce. When the European Union is talking about resources, about mining, they are talking about industrial minerals like cement and stone; that is what they call their mining industry. If the industry will move forward and we will have more production stories, they will be more appealing to the people.

There are a few companies now producing gold in Sweden. Nordic Mines AB (NOMI:ST; NOM:OSLO) is producing nicely. In Spain we have Orvana Minerals Corp. (ORV:TSX), which just became a client of mine. Astur Gold Corp. (AST:TSX.V) is relaunching its mine in Asturias, Spain.Global Minerals Ltd. (CTG:TSX.V; DPF:FSE) is reviving a former copper-silver producer in Slovakia and aims to become the first real silver producer in Europe.

TGR: AsturGold is trying to bring the Salave gold project back into production. Where is it on that path?

HK: It has had some hurdles. There are environmental protests. The company recently made some changes in its plans because it is pretty close to the sea. Rather than producing the gold itself with the use of cyanide, it has decided to make a concentrate and send it to a smelter. That has taken the wind out of the sails of the environmentalists and the government officials. Now the government has issued its latest list of requirements, which is still an extensive list. The company has to comply with about 30 points, and CEO Cary Pinkowski is confident that he can meet those.

A good example of how the production of crushed ore and concentrates could work is Excellon Resources Inc. (EXN:TSX) in Mexico. I have always said that it was the most profitable trucking company because it crushed the ore and shipped it to a smelter, and it got the money back. That was a fairly nice and clean operation. Now Excellon is adding its own mill.

TGR: As far as Global Minerals goes, do you think the share price will get an uptick with the recent increase in copper prices?

HK: It will be a contributing factor but I think Global Mineral’s share price will be more dependent on the company’s continuous drilling and testing and coming closer to a production decision. The impact of the silver prices will be greater than that of copper.

TGR: Is the financing in place now to bring Strieborná into production?

HK: It is on its way. I think that there are good possibilities to get the financing in Europe.

TGR: What’s happening with Orvana?

HK: Orvana is an interesting company. Its CEO, Bill Williams, is also producing in Bolivia. He says, “I don’t explore; I only find mines.” It’s different from the typical exploration company that turns into a production company after a long period of exploration.

TGR: France has joined with the Malian army to drive Muslim extremists out of the country’s northern territory. Has this changed your view of Mali or perhaps even West Africa as a jurisdiction in which to invest?

HK: Not really, because there’s always a basis for conflict within African countries. But in Mali, when forces both from outside Africa and inside Africa teamed up, things started to be solved. Mali was at INDABA. When I asked, the representatives shrugged their shoulders and said they will solve it. Mining and exploration in the artisanal way is a mode of daily life more than anywhere else, so I’m not concerned that much.

TGR: Are there any West African plays that remain compelling to you?

HK: Gold Fields Ltd. (GFI:NYSE), African Rainbow Minerals Ltd. (ARI:JSE), Randgold Resources Ltd. (GOLD:NASDAQ; RRS:LSE), Resolute Mining Ltd. (RSG:ASX) and Endeavour Mining Corp. (EDV:TSX; EVR:ASX) made excellent presentations at the conference. Tembo Gold Corp. (TEM:TSX.V; TBGPF:OTCQX) has been achieving very nice drill results recently. CEO David Scott was walking around with a big smile on his face. It had almost 23 grams per ton (g/t) gold over 15 meters (15m) from 299m down hole.

TGR: How would you compare that to similar plays, such as when Barrick Gold Corp. (ABX:TSX; ABX:NYSE) discovered Bulyanhulu?

HK: David Scott is convinced that Tembo Gold is on to something similar, and it is pretty much adjacent to African Barrick Gold Plc’s (ABG:LSE) Bulyanhulu.

TGR: Any others?

HK: I like my client New Dawn Mining Corp. (ND:TSX) in Zimbabwe. It is busy with indigenization and is producing 35,000 oz (35 Koz) and expecting to bring it up to over 100 Koz in the next two years provided that a better sentiment toward Zimbabwe develops, which would make raising money easier.

Centamin Plc (CEE:TSX; CNT:ASX, CEY:LSE) is successfully producing gold in Egypt. I was impressed with the management. I met my former client Helio Resource Corp. (HRC:TSX.V) when I was in Tanzania and Namibia. It has open-pit and underground potential. Another company that I like is in Burkina Faso. It’s an Australian company, Ampella Mining Ltd. (AMX:ASX). The man in charge of that project is very knowledgeable, has a lot of experience in Africa and only has the responsibility of bringing the project forward and into production. Other corporate duties are being taken care of at the company’s head office in Australia.

African Gold Group Inc. (AGG:TSX.V) is also a former client. It is selling off its interest in Ghana to Newmont Mining Corp. (NEM:NYSE), so it gets a nice amount of cash and will continue to focus on Mali. Merrex Gold Inc. (MXI:TSX.V; MXGIF:OTCQX) is also in Mali and has a joint venture with IAMGOLD Corp. (IMG:TSX; IAG:NYSE). It has been doing well. Castle Peak Mining Ltd. (CAP:TSX.V) is a typical example of a company that had good drill results, and it became public at $0.35/share not too long ago. Shares are selling at $0.06/share despite good results and good management. I’ve always liked Sunridge Gold Corp. (SGC:TSX.V); it used to have a connection with Nevsun Resources Ltd. (NSU:TSX; NSU:NYSE.MKT). Teranga Gold Corp. (TGZ:TSX; TGZ:ASX) looks very interesting.

Premier African Minerals Ltd. (PREM:LSE) is in Zimbabwe and Togo. I didn’t even know Togo had any minerals, but there’s quite some mineralization there, so I’m looking into those new areas. For instance, Liberia used to have political problems, but it’s quiet now. It used to be famous for its diamonds. Now it’s looking into gold and other minerals, and there are several companies active in Liberia. I am looking at Amlib Holdings Plc (privately held), a very interesting situation, and some other companies.

TGR: Why haven’t those companies that have had solid, if not record, years had better share price performance?

HK: In a market that is struggling and depressed, it’s not easy to do well despite good results, but if you look at their share prices, they haven’t done badly. They are all selling at levels not too far below their former highs. Argonaut Gold Inc. (AR:TSX), Aurcana Corporation (AUN:TSX.V; AUNFF:OTCQX), Great Panther Silver Ltd. (GPR:TSX; GPL:NYSE.MKT), Scorpio Gold Corp. (SGN:TSX.V), SilverCrest Mines Inc. (SVL:TSX.V; SVLC:NYSE.MKT) and Timmins Gold Corp. (TMM:TSX; TGD:NYSE.MKT) are all doing great and are looking at even better results in the next few years.

SilverCrest has remarkable growth potential; it will be doubling its production in the next three years.

Argonaut Gold is digesting the recent takeover of the Magino mine in Ontario, which upon coming to production can double its current output. Argonaut Gold just had warrants converted, and has over $117 million ($117M) in the treasury, so it is well financed.

Timmins Gold is on the right track. The potential at its one project is great and it has the cash flow to do it. Also Great Panther, which was struggling a little bit, had a great fourth quarter last year.

TGR: Argonaut’s stated goal on the website is to produce 300–500 Koz gold over the next few years, but it’s currently producing about 120–140 Koz. Magino is going to add to the production profile, but it’s not going to get Argonaut there on its own.

HK: Argonaut has more than Magino—such as San Antonio, El Castillo and La Colorado. It is undertaking to define the potential of the Magino because it would like to see the mine happen first—the company just acquired it. It would like to find out whether it is as big as the former management said it was. Do not underestimate Argonaut’s management; it is a pretty serious and determined team. I like the team and I think it will succeed in reaching its goal.

TGR: Great Panther produced 454 Koz in Q4/12 versus 371 Koz in Q3/12. Can investors realistically expect it to continue that kind of growth?

HK: Great Panther has been having some problems with maintaining its cost and production levels. However, the fourth quarter was a nice sign. I have great admiration for Great Panther. Bob Archer is a great entrepreneur and a very intelligent operator. He’s the kind of CEO that investors like to see.

TGR: And Scorpio Gold?

HK: CEO Peter Hawley is a modest but very intelligent and reliable person. I believe that Nevada will be one of the great mining areas sometime in the next few years. I would not be surprised if we see Scorpio Gold strengthening its position in Nevada.

TGR: What are your parting thoughts on this space?

HK: There is a new generation of companies coming in general but also in Mexico, one of my favorite mining countries. Argonaut, SilverCrest and Timmins Gold—my top three picks—were not in production five years ago, not even three years ago. But there are still some good old ones;MAG Silver Corp. (MAG:TSX; MVG:NYSE) and Canasil Resources Inc. (CLZ:TSX.V) are old favorites.

Other companies that I know from the past are finally coming to the limelight: Northair, nowInternational Northair Mines Ltd. (INM:TSX.V), is reporting excellent results from its La Cigarra silver project in Mexico. The same is true for Kimber Resources Inc. (KBR:TSX; KBX:NYSE.MKT)with its Monterde project in Mexico. Paramount Gold and Silver Corp. (PZG:NYSE.MKT; PZG:TSX) is progressing at its San Miguel project and at its Sleeper mine in Nevada. All these companies are potential production candidates.

TGR: Thank you for your time.

Henk J. Krasenberg is the founder of the European Gold Centre, which analyzes and comments on gold, other metals and minerals and international mining and exploration companies in perspective to the rapidly changing world of economics, finance and investments. The organization publishes GOLDVIEW, Mining in Africa, Mining in Europe and Mining in Mexico, allavailable at no cost to investors. Krasenberg’s career has included security analysis, investment advisory, portfolio management and investment banking.

DISCLOSURE:

1) Brian Sylvester conducted this interview for The Gold Report and provides services to The Gold Report as an employee or as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Orvana Minerals Corp., Global Minerals Ltd., Sunridge Gold Corp., Teranga Gold Corp., Argonaut Gold Inc., Great Panther Silver Ltd., SilverCrest Mines Inc., Timmins Gold Corp. and MAG Silver Corp. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Henk Krasenberg: I or my family own shares of the following companies mentioned in this interview: None. I personally or my family am paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: Argonaut Gold Inc., Aurcana Corporation, Great Panther Silver Inc., New Dawn Mining Corp., Orvana Minerals Corp., Scorpio Gold Corp., SilverCrest Mines Inc., Timmins Gold Corp., Canasil Resources Inc., Tembo Gold Corp., Astur Gold Corp. and Paramount Gold and Silver Corp. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.