Bonds & Interest Rates

As usual the Federal Reserve media reaction machine has fallen for a poorly executed head fake. It has fallen for this move many times in the past, and for its efforts, it has tackled nothing but air. Yet right on cue, it took the bait once more. Somehow the takeaway from Wednesday’s release of the June Fed statement and Chairman Ben Bernanke’s press conference was that the central bank is likely to begin scaling back, or “tapering,” its $85 billion per month quantitative easing program sometime later this year, and that the program may be completely wound down by the middle of next year.

The global economy has changed radically in recent years but most Americans seem to continue to invest as if it hasn’t.

Euro Pacific Capital offers a means for American investors to gain exposure to those areas of the global economy that have largely avoided the crushing debt burden that has swamped many developed economies.

Based on the irresponsible policies of the Federal Reserve and the continued failure of the United States to put our fiscal house in order, we believe that the U.S. dollar is at risk of falling relative to currencies of more economically vibrant nations. Changes in currency valuation, often ignored by many investment consultants, could make significant impact on long term results.

Our firm’s mission, as is widely articulated by our founder and CEO Peter Schiff, is to offer globally diversified investment options to discerning retail investors and forward thinking institutions. Operating from seven offices nationwide, Euro Pacific brokers develop individual relationships with customers to determine their unique investment needs.

Are you a Retail Investor?

Individuals, families, trusts, and corporations can open a variety of investment and retirement accounts with Euro Pacific, including IRAs, and Roth IRAs. Those with $50,000 or more to invest can choose Euro Pacific’s signature managed account portfolios that rely on active management to achieve specific investment goals. While these accounts offer varied asset class allocations, all seek exposure to those nations, currencies and sectors that are favored by Euro Pacific’s global economic outlook.

Find out more about how we work with clients:

Traditional Brokerage Accounts

Are you an Institutional Investor?

Euro Pacific equity analysts provide in-depth research in commodity, energy, transportation, basic materials, manufacturing, and consumer stocks in developed and emerging markets worldwide. We compliment this research with an institutional trading desk that operates in local markets around the globe. Euro Pacific Asset Management offers international portfolio management services to all types of institutional investment funds, including pension funds, endowments, and foundations.

Find out More:

A Potential Financial Disaster That’s Bigger Than Subprime

MacLean’s’ most recent issue gives us 99 reasons why Canada is better than America. It says we’re happier, fitter, and richer – and our kids are smarter too.

While much of it may be true, there are economic factors unraveling that might give every Canadian a reason to be scared.

While our economic numbers have been strong, we need to look at the bigger picture.

Strong Growth or Just Getting Lucky?

Last month, statistics Canada released Q1 data that shows a surprisingly strong 2.5% annualized growth between January and March.

That means growth in the first quarter outperformed every three-month period over the past year and a half. And exports – particularly shipment of oil products to the United States – made a nice 1.5% gain.

It may sound like Canada is doing great, but the numbers don’t tell the whole story.

Most of Q1 growth came from trade with the U.S., and partly due to a one-off rebound in energy exports – also to the U.S. – that are now pretty much recovered after the disruptions to production from last year.

Domestic demand was soft and outlook is weak. If it wasn’t for the contribution from government, which showed the strongest component of domestic demand, the numbers could’ve been a lot worse. Expect the weakening trend to continue as the housing market softens, and consumption spending shrinks as Canadians tackle their highly elevated debt levels

According to TransUnion, the average Canadian’s non-mortgage debt – which includes credit cards, car loans, installment loans and lines of credit – reached a whopping $26,935 in the first quarter. In BC alone, the debt per person has now reached a staggering $38,619, surpassing Alberta’s $36,223.

Factor in housing costs and we’re looking at a country that is living well beyond its means (I’ll talk about the housing situation next week).

Are we living beyond our means? Share your thoughts by CLICKING HERE

You know there are growth issues when government spending is one of the strongest component of domestic demand – especially when the budget balance for Canada has been negative since late 2008 and the government is trying cut back on spending.

……read more HERE

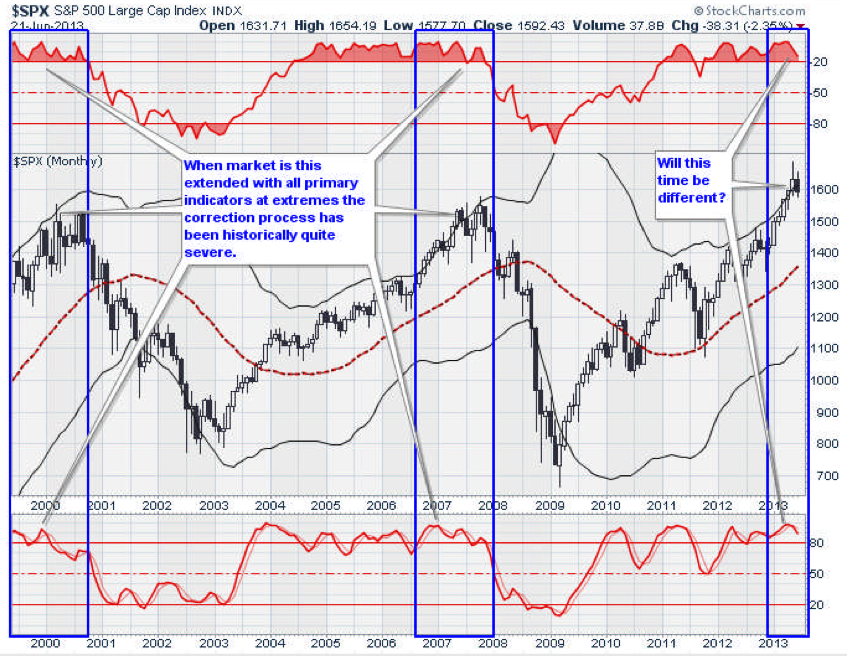

After eight straight months of advance in the markets what the media absolutely believed could not happen finally has – the market quit going up. However, you can’t really blame the media for believing in an “unstoppable” rally, after all, like a “Bigfoot” sighting, they clearly saw evidence of an urban legend.

However, as we have been discussing for many weeks, such market advances that push prices to extreme divergences from their historic norms are ultimately due for a correction. Without such corrections the markets become distorted, unhealthy and subject to severe crashes.

This week we will review our analysis from last week, set targets for the current correction and discuss recommended actions for portfolios currently.

However, before we jump into the analysis I want to give you a few updates to the coming changes to the newsletter and website.

“Streettalklive.com” is merging into “STAWealth.com.” Only the look is changing – all the great features will remain the same.

This weekly newsletter will actually become three different HTML documents that you will be able to print, read on your tablet and phone, share with friends post to your social network. The three pieces will be:

– Portfolio Management: Market analysis & Investing Strategy

– Market/Sector Analysis: Analysis of 15 major sectors /markets

– 401k Plan Manager: Expanded and improved model/analysis

Also, more frequent postings to the daily blog that are short reads, quick analysis or video/audio analysis of investing ideas, economics, strategies or tips.

As we get closer to the rollout of the new site I will keep you informed of all of the changes. I hope you will find the new website to be more useful and informative in the management of your financial future.

……read the 17 page report HERE

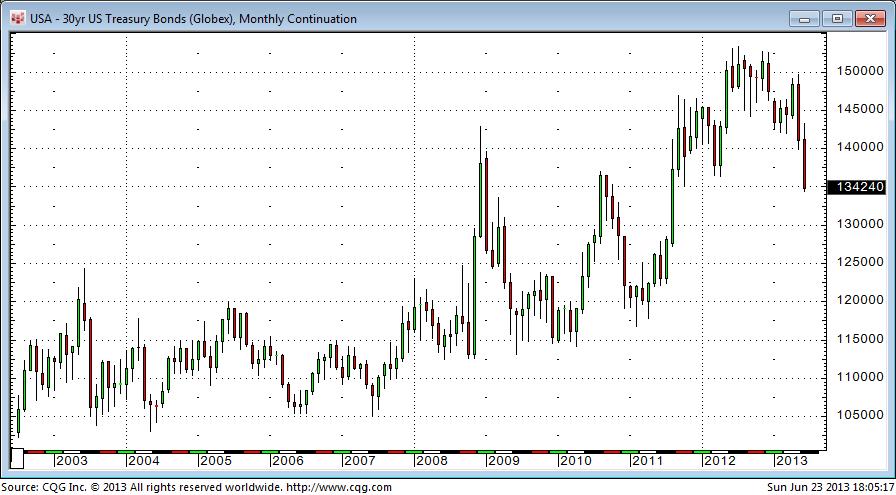

The bond market had its worst week in many years last week as yields soared following the June 19 Fed meeting and Bernanke’s Q+A…and as bond prices tumbled so did stocks, gold, foreign currencies and commodities…while the US Dollar soared. You might ask, “Was anybody really all that surprised by what Bernanke had to say? Don’t you think that the market has over-reacted?” Well, in terms of Rational Expectations, perhaps the market has over-reacted…but…in terms of Market Psychology Bernanke’s June 19 comments, just like his comments on the May 22 Key Turn Date, were not the “Cause” of the market price action…they were just the “Catalyst” for a market that was dangerously “out of balance”…and the price action last week adds to my conviction that the May 22 KTD signaled a Major turn in Market Psychology.

My definition of a Key Turn Date is when a number of different markets reverse course on or around the same date due to a (dramatic) change in Market Psychology. Such a “Reversal” implies that Market Psychology was “overdone” prior to the reversal. For instance, if bullish Market Psychology had become WAY overdone prior to the May 22 KTD…on the back of expectations of more and more easy money…then the slightest hint that the supply of easy money would diminish would catch the market “wrong-footed” and precipitate a scramble to rebalance.

I think the essence of the current “rebalancing” in the markets is leverage reduction…either voluntarily or otherwise. The price action June 19 through 21 when stocks, bonds, gold, commodities and foreign currencies all fell at the same time looks like deleveraging….likely forced in some cases. From the perspective of Rational Expectations the hard sell-offs appear to be over-done…at least in the very short term.

Rational Expectations may have a moderating impact on the “mood swings” of Market Psychology…but it’s the “overdoneness” of Market Psychology that defines the market’s highs and lows. Why did we have a house price boom, and then a bust, in the USA, or Spain, or Ireland or…? Why did APPL or Crude Oil or the 1980’s Nikkei soar and fall? Surely we have answers that come from the “dimension” of Rational Expectations…but just as surely we have answers that come from the “dimension” of Market Psychology.

One aspect of Market Psychology: When a market is rising and a Player is long…using leverage to add to his position…he knows that he is right and he knows that he knows what is going on…when that same market reverses and starts to fall the Player begins to doubt his “knowingness”…and as his losses mount he becomes convinced that “somebody” knows something that he doesn’t…so he either cuts his position or shifts into fear, anger and denial.

I believe that the dominant feature of Market Psychology for the past few years has been that Players assumed that the Fed and other CBs “had their back”…the Bernanke put etc…but if the Last Buyer has been discovered, and a Major Top was made on May 22, then Players may start to doubt their “knowingness” about CB policies and edge closer to the exits.

Players have “added to their positions” through various forms of leverage during the bullish phase of Market Psychology and “edging closer to the exits” may simply mean reducing leverage…pulling back from emerging markets, for instance, or taking a little money off the table…and in these circumstances, Market Psychology may become increasingly bearish.

Trading:

Was the sell-off late last week overdone? It depends on your time frame…you have to keep the time frame of your trading in sync with the time frame of your analysis…for instance, I can imagine that the 6 month leg higher in US and European stock indices…from KTD Nov 16 to KTD May 22…courtesy of the Japanese “cherry on top” liquidity injections into world markets…was the LAST LEG higher and that global stock indices are headed lower over the 6 month time horizon…or more…that interest rates made their lows in 2012 and are headed higher…and so is the USD.

Charts:

The bond market had a very RARE Monthly Key Reversal Down in May…reversing the “hope” that was in the April “buy the dip” rally. Not surprisingly, the bond market has continued down in June…last week was its worst week in at least 10 years.

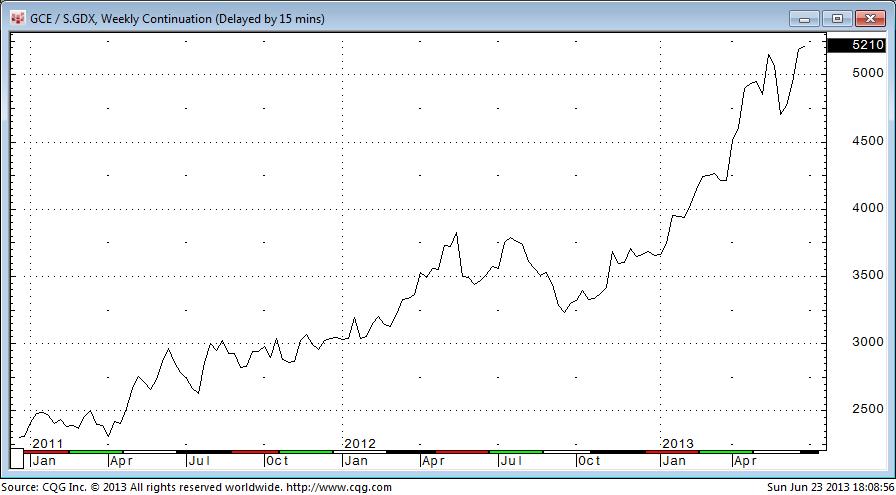

The gold market broke the key $1540 support level in April then took another leg down last week to its lowest levels in nearly 3 years. Gold ETF sales continue. Gold is extremely over-sold (short term.)

The ratio of gold to gold shares rose to a 12 year high…with gold shares falling closer to their 2008 lows. This blog has repeatedly warned against buying “cheap” gold shares.

The S+P registered a Weekly Key Reversal Down last week continuing the downtrend begun on KTD May 22.

The VIX jumped to its highest level in over a year last week (save for 2 days at the very end of 2012) but the VIX rally seemed to peter out late on Friday, June 21…perhaps indicating that the sell-off was overdone. Perhaps.

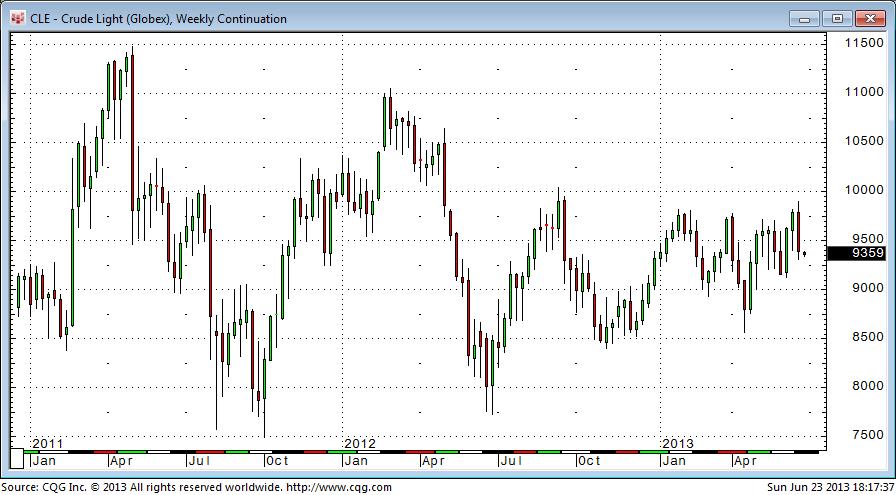

WTI Crude oil had a Weekly Key Reversal Down last week after trading up to its best levels in nearly a year. My view has been that bullish Market Psychology is in an uphill battle with growing supply…and perhaps with a global downturn in demand…and its best “hope” is for Mid-East geo-political risk premiums.

The Euro currency had a Weekly Key Reversal Down last week after trading up to its best levels since February. I’ve been puzzled over “Why” the Euro has rallied since May 22…my best guess is that European banks are badly under-capitalized…that they have been reducing EM loans (EM markets and EM currencies have been weak) and repatriating funds home to Europe…boosting the Euro. The precedent for this “flow of funds” idea driving the Euro higher is similar to Japanese insurance companies selling overseas assets and repatriating capital immediately after the Tsunami in March 2011…driving the Yen higher.

The Canadian Dollar had a RARE Monthly Key Reversal Down in May and has continued lower in June…hitting its lowest levels since November 2011. I’ve decreased my long term holdings of CAD in favor of USD.

The US Dollar Index hit 3 year highs in early May…then fell for 4 consecutive weeks…it had a big reversal higher last week.

The Australian Dollar has tumbled over 14 cents from its early April highs…it’s a “proxy” for commodities and for China…its trading volume in the FX world (4th after the USD, Yen and Euro) is far above its “ranked” place in world GDP…it’s a high “Beta” currency and its decline since early April may have been foreshadowing bearish Market Psychology…on China and commodities.

Emerging Markets stock indices have had 5 consecutive weeks down since the May 22 KTD…a graphic on how money is flowing away from the Periphery and back to the Center.

“HYPERINFLATION has ONLY taken place in minor peripheral economies. It has NEVERtaken place in a major economy. All major economies implode from deflation because as they need money, they attack their citizens destroying their own economies as we are doing right now. So while you wait for HYPERINFLATION, your taxes will rise, your rights will vanish, and you will see tanks on your streets before $30,000 gold that will still be the cost of a men’s suit. Forget this HYPERINFLATION and fiat nonsense. Government began getting involved with money first out of just standardizing the weight to facilitate trade as pictured above. That was it.”

“All money is fiat if you define it incorrectly as intangible money rather than An arbitrary order or decree. As long as money floats in value and it is legal tender meaning government accepts it in return for taxes, then it is not fiat in real terms. The idea that money must be tangible also has no basis in fact. Money has been many things to many people. The entire basis of money is you will accept something as money as long as you have CONFIDENCE that in turn someone else will accept it from you.”

……read the entire article “Forget the Fiat – It’s CONFIDENCE” HERE