Gold & Precious Metals

Douglas McIntyre, of 24/7 Wall Street, recently wrote an article discussing the 10 reasons why the market will, or won’t, crash. The problem is that the view presented is terribly myopic which creates a misleading discussion of the current market environment. My notations are in blue in order to balance the discussion accordingly:

Like clockwork, every time the American stock market makes new highs, some people insist it cannot go higher. A subset of those believe the market will crash. Others even believe it will reset like it did when the S&P 500 dropped from more than 1,500 in October 2007 to just above 600 in March 2009. A review of the most widely held beliefs about why a new crash is coming shows that some are bogus, while others almost certainly are likely to be right.

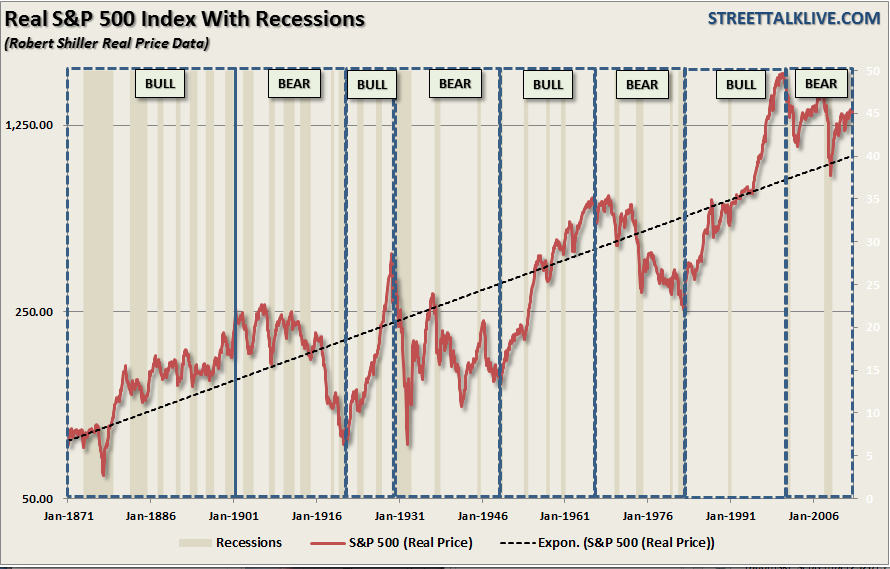

The reason that when markets push to new highs that analysts begin to discuss the potential for the next crash is simply because every crash in history has occurred from market highs. The chart below shows the history of the S&P 500 going back to 1871. Each major “crash”has occurred from market peaks when valuations, based on trailing 12 months reported earnings, exceeded 20x earnings.

….much more HERE

We Drill Down Into The Facts To Find Out.

The Canadian condo market is running into a precarious over-supply situation with large inventories slated to be entering the market in 2014 and 2015. Major centers such as Vancouver, Montreal and Toronto are witnessing a rapid pace of condo construction, despite falling sales. The demand for housing overall is slowing down, with sales in the last few months of 2013 falling on y-on-y basis. In most major Canadian markets there is an increase in listings and decrease in sales (even though prices are still somehow rising, which should in and of itself be indicative of a problem).

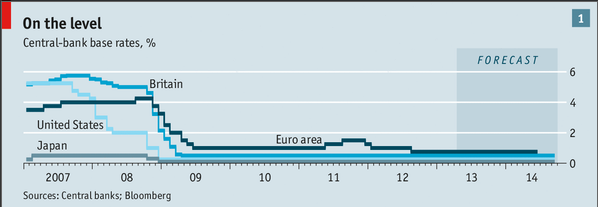

However, what is holding the housing market from the “steep and prolonged fall” that the American and periphery EU markets experienced is the extremely low interest rate offered by the banks in a bid to maintain their top line and bottom line. (Note: ~>70% of the mortgages in Canada are insured by Canada Mortgage and Housing Corporation. The banks therefore are more than motivated to lend for home mortgages). This “ZIRP” (Zero Interest Rate Policy) environment portends material volatility when it comes to an end, either voluntarily through the prospect of organic economic growth, or involuntarily through natural market forces coming to bear. The reason is that at no time in the history of the developed world has interest rates been this low for this long.

…..read more HERE

The USTreasury Bond market breakdown is in progress, all part of the general USDollar global rejection that is taking the world by storm. Of course, residents inside the US Dome do not notice, since they only perceive it as the native currency. From conversations with common folk, discussions with investor types, and general observations for over 20 years, the Jackass belief is that only 5% to 10% of Americans are aware that the USDollar serves as a global financial instrument in contracts, the basis for trade settlement (mostly crude oil), with some extremely important consequences. A major development has begun, much like a metabolic life support system in concert with the Interest Rate Swap derivative contract. For two years or more, the USTreasury Bond market has been deeply dependent upon artificial demand derived from the derivatives. Entire bond rallies have been fabricated with 50:1 leverage, fully supported by the financial network propaganda. Without derivative flying buttress support, the giant USTBond Tower would have collapsed a couple of years ago. Now a new support system has been begun, a dangerous musical chairs long entrenched in the stock market. It has entered the bond market finally. Flash Trading!!

….read more HERE

Jobless claims beat expectations with a prints 305k vs the expectation of 325k. The fourth straight week of gains and increaslingly important number as jobs are tied to central bank policy.

Drew Zimmerman

Investment & Commodities/Futures Advisor

604-664-2842 – Direct

604 664 2900 – Main

604 664 2666 – Fax

800 810 7022 – Toll Free

CAUTION! Before you continue…

CAUTION! Before you continue…