Douglas McIntyre, of 24/7 Wall Street, recently wrote an article discussing the 10 reasons why the market will, or won’t, crash. The problem is that the view presented is terribly myopic which creates a misleading discussion of the current market environment. My notations are in blue in order to balance the discussion accordingly:

Like clockwork, every time the American stock market makes new highs, some people insist it cannot go higher. A subset of those believe the market will crash. Others even believe it will reset like it did when the S&P 500 dropped from more than 1,500 in October 2007 to just above 600 in March 2009. A review of the most widely held beliefs about why a new crash is coming shows that some are bogus, while others almost certainly are likely to be right.

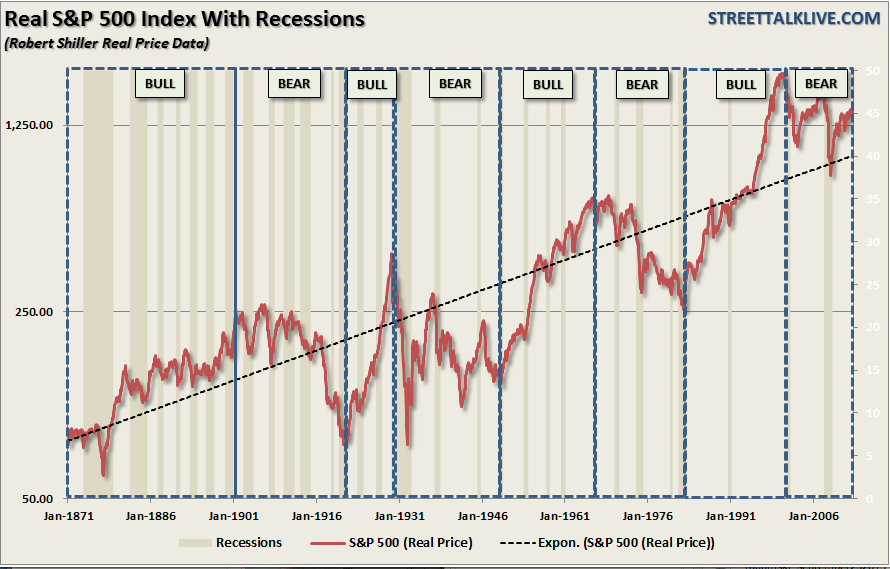

The reason that when markets push to new highs that analysts begin to discuss the potential for the next crash is simply because every crash in history has occurred from market highs. The chart below shows the history of the S&P 500 going back to 1871. Each major “crash”has occurred from market peaks when valuations, based on trailing 12 months reported earnings, exceeded 20x earnings.

….much more HERE