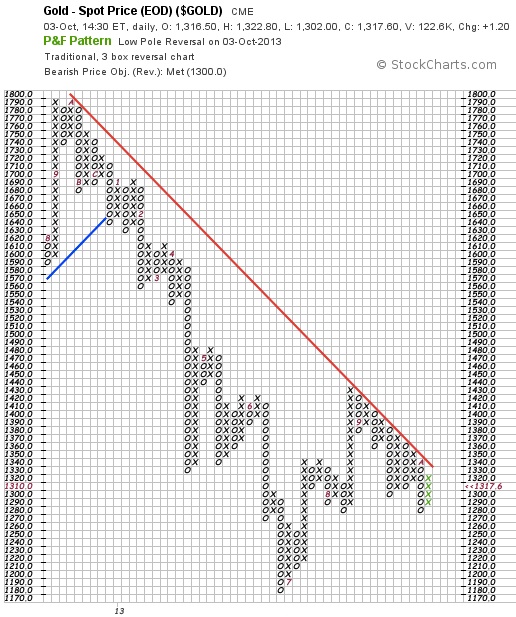

The wholesale price of gold gave back this week’s 1.4% gains Wednesday morning in London, dropping below $1.310 per ounce as European shares recovered earlier losses.

Commodities ticked lower, as did non-U.S. government bonds, while silver followed gold lower, but retained a 1.0% gain for the week so far.

U.S. stock futures pointed higher despite Washington’s current impasse over the debt ceiling moving within eight days of a possible debt default.

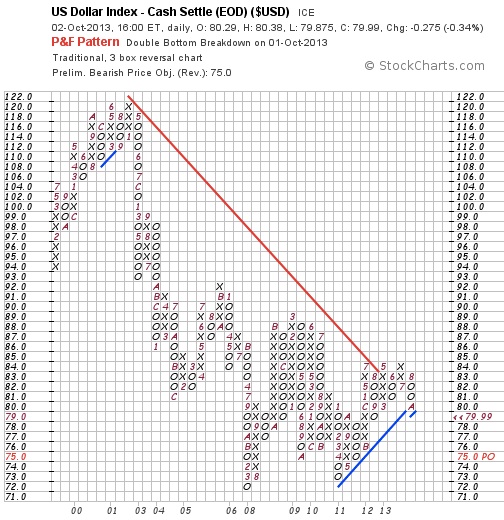

The U.S. dollar meantime rose sharply after the New York Times reported that current Federal Reserve vice-chair Janet Yellen – a renowned “dove” on low interest rates and stronger quantitative easing – will today be confirmed as President Obama’s choice to succeed Ben Bernanke as the central bank’s chief.

“Sentiment has changed. People don’t seem to be flocking to gold, even in times of distress,” said Jim Iuorio, managing director of TJM Institutional Services in Chicago to CNBC on Tuesday.

“[Gold prices] continue to hang in limbo,” says a Singapore trading desk, “unable to rally yet does not want to give up $1,300 handle.”

“The closer the U.S. comes to reaching its debt ceiling,” say commodity analysts at Commerzbank in Germany, “and the more the risk of insolvency grows as a result, the more gold should be in demand as a safe haven in the west…which should be reflected in a climbing gold price.

“Perhaps gold will be shaken out of its lethargy when the Fed minutes are published this evening,” says the bank, asking if the delay in ‘QE tapering’ last month was due to the U.S. central bank’s fears over a drop in government spending.

But “once we get past this stalemate in Washington, precious metals are a slam dunk to sell,” reckoned investment bank Goldman Sach’s head of commodities research Jeffery Currie, speaking Tuesday at Commodities Week here in London.

Selling gold is his top raw materials trade for 2014, a view agreed Tuesday by Swiss investment and bullion bank Credit Suisse’s research chief Ric Deverell.

“You have to argue that with significant recovery in the U.S.,” said Currie, “tapering of QE should put downward pressure on gold.”

Economic growth in the U.K. is set to outstrip the U.S. in 2013, the International Monetary Fund said Tuesday, adding that it was “pleasantly surprised” by Britain’s ‘austerity’ policies failing to hurt growth as the IMF warned in April.

U.K. manufacturing and industrial output today showed a sharp drop for August, defying analyst forecasts of strong growth.

The Pound fell hard after the news, dropping to a 2-week low beneath $1.60. That buoyed gold for U.K. investors above £820 per ounce, some 0.8% below an earlier spike to one-week highs.

Gold priced in Euros also eased back, touching last week’s closing level at €967 per ounce as the single currency fell despite much stronger-than-expected German industrial output data for August.

Currie at Goldman Sachs now sees his target for year-end 2014 at $1,050 per ounce – a “key gold level” according to panellists speaking last week at the London Bullion Market Association’s conference in Rome.