The Mining Report: What effect is the strong U.S. dollar having on base metal prices and base metal equities?

Stefan Ioannou: Base metals are priced in U.S. dollars, so as the dollar rises in value, base metals fall in value. Right now, copper is testing the $3 per pound ($3/lb) level, and zinc is drifting down toward $1/lb. And, of course, lower base metal prices are reflected in lower valuations of base metal equities.

TMR: Why is the U.S. dollar becoming stronger?

SI: Because of a strengthening U.S. economy or at least the perception of one. To give one example, the job creation figure for September was expected to be 215,000, but the number came in at 248,000.

TMR: How long will this U.S. dollar trend last?

SI: With quantitative easing seemingly over, which is still arguable, the big question for the U.S. economy is when and by how much will interest rates be increased. Elsewhere in the world, the other major economies seem to be, if not slipping, not really growing significantly. Europe is kind of flat. China is still growing but not nearly as fast as people had hoped for or expected. As a result, most world currencies are down relative to the U.S. dollar.

SI: With quantitative easing seemingly over, which is still arguable, the big question for the U.S. economy is when and by how much will interest rates be increased. Elsewhere in the world, the other major economies seem to be, if not slipping, not really growing significantly. Europe is kind of flat. China is still growing but not nearly as fast as people had hoped for or expected. As a result, most world currencies are down relative to the U.S. dollar.

TMR: What are your forecasts for base metal prices?

SI: Our metal price forecasts for 2015 forward include $3.25/lb copper, $8.50/lb nickel and $1.15/lb zinc.

TMR: What are the economic assumptions underlying these forecasts?

SI: We try to pick metal prices that are arguably conservative, but we do take into account some of the major supply-demand fundamentals coming down the pipe. For example, zinc is facing a significant supply deficit into 2016, so we could see zinc rise above $1.50/lb fairly quickly. Would it stay there for more than two or three years? Probably not, given the anticipated increase in higher-cost Chinese production that higher zinc prices would trigger. Nevertheless, we see a medium-term investment opportunity emerging.

TMR: Given how important China is to world economic growth, how much do we really know about the Chinese economy?

SI: China has always been a bit of a mystery. The September Purchasing Managers Index (PMI) number was the same as August: 51.1. Anything over 50 indicates expanding growth, but it is subdued growth. The market has been looking to 7.5% GDP growth in China this year, but it looks as if it won’t make that.

The worrisome aspects to the Chinese economy are an ailing property market, industrial overcapacity and high levels of corporate debt. Housing is about 25% of the Chinese economy, so policymakers are now considering loosening mortgage restrictions.

TMR: Why do you believe the world faces a copper deficit in the near future?

TMR: Why do you believe the world faces a copper deficit in the near future?

SI: On the supply side, the majors have in the last few years focused on cutting costs at existing operations. That’s obviously great for their bottom lines today. However, it also means new mines and greenfield developments are being deferred. So by 2017–2018 we will face the consequence of a lack of new supply, which is demand outweighing supply.

TMR: Does the world face a near-term nickel deficit as well?

SI: A big driver for nickel is the steel market, and this has been relatively bearish. This year, however, Indonesia, which provides 25% of world supply, banned the export of nickel ore. Indonesia wants the economic benefits of processing its ore in country, but it will take a couple of years to build its infrastructure so that this lost supply will re-enter the global market.

The Philippines is also now considering an export ban of its own. This country supplies less than 10% of the world market, but it’s still a significant number. Nickel ore stockpiles in China and elsewhere are still high, but are now being drawn down toward potentially critical levels. There is a bullish argument that we could see the nickel market slip into deficit by as early as mid-2015.

TMR: What’s your view of the junior copper space?

SI: Everything I cover has come down in valuation. I think there is opportunity here. The best place to start is with the producers because they are generating cash flow and have positive balance sheets. One such company is Copper Mountain Mining Corp. (CUM:TSX). Its Copper Mountain mine in British Columbia—owned 25% by Mitsubishi Corp. (8058:JP)—has had a long start-up. The company has just installed a new secondary crusher, which is finally going to bring it to nameplate capacity: 35,000 tonnes per day (35 Kt/day) of throughput. This is the turning point, and I think Copper Mountain Mining is poised for a rerating.

TMR: You just raised your target price, correct?

SI: Yes, from $3 to $3.50. We just saw the company’s Q3/14 production numbers. The crusher integration went smoothly over the latter half of the period and was handling over 35 Kt/day in late September, which should set the stage for a strong Q4/14.

TMR: What other producers did you want to discuss?

SI: Capstone Mining Corp. (CS:TSX) and Nevsun Resources Ltd. (NSU:TSX; NSU:NYSE.MKT). Capstone has three mines which, for the most part, are operating well: Pinto Valley in Arizona, Cozamin in Mexico and Minto in the Yukon. Pinto Valley was bought from BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK) last year for $650 million ($650M). The market was skeptical at the time, but the company immediately drilled and expanded the project’s five-year reserve, which now supports a mine plan through 2026. This has been a game changer for Capstone’s capacity.

TMR: As a result, you wrote in August that Minto’s position as a “core asset” has been diminished.

TMR: As a result, you wrote in August that Minto’s position as a “core asset” has been diminished.

SI: Minto has been a very successful mine over the years. But it’s getting to the point now where the remaining resource is for the most part lower grade and higher cost to produce. Cozamin, Capstone’s third mine, is also smaller than Pinto Valley, but it’s got very good grade and a lot of exploration potential. It’s an underground mine, so Capstone is going to continue to add reserves over time. Plus, there’s a fair bit of zinc coming out of it.

TMR: Is Nevsun an example of the perils of overstating political risk? The Bisha mine is in Eritrea, but it is nonetheless a success story, right?

SI: Very much so. I give the Eritrean government a lot of credit. It established a well-defined and well-considered mining code that lays out exactly how the government will participate and the steps that need to be taken to move a project into production. Bisha is now 60% owned by Nevsun and 40% by the government. The government got 10% for free, which is pretty standard across Africa, and proceeded to pay fair value for the other 30%.

Nevsun has close to $400M in cash and no debt. That works out to $2/share, and so half of the company’s share price is actually cash. Nevsun’s biggest issue going forward is what its next acquisition is going to be.

TMR: Bisha began with gold mining and then with copper. What is its future?

SI: Bisha is a 40 million ton (40 Mt) volcanogenic massive sulfide (VMS) deposit, world-class in size and high grade. For the first few years Nevsun mined 8 grams per ton (8 g/t) gold from an open pit that had basically no strip ratio to it. Now the company is into the second layer of the VMS cake: supergene copper. It is mining grades well north of 5% now in an open pit. As Nevsun moves into the third layer, toward 2016, there will be zinc and copper, hopefully just as the zinc price really starts to pick up.

TMR: What are the prospects for resource growth at Bisha?

SI: Bisha has always been a very prospective land package, but this is the first year Nevsun has spent significant money on regional exploration. VMS deposits typically occur in clusters, and Nevsun has already found a few smaller ones outside Bisha: one called Harena is 10 kilometers south. Assays released September 23 included 0.85% copper, 3.96% zinc, 0.4 g/t gold and 43.6 g/t silver over 41.6 meters. Nevsun has already outlined a 1.2 Mt reserve that remains open for expansion. Ore from the deposit will be trucked to the Bisha plant for processing.

TMR: Which copper project most interests you?

SI: Highland Copper Company Inc. (HI:TSX.V), which is in Michigan’s Upper Peninsula, an area with a really productive copper mining history. The company originally had two smaller, high-grade deposits: 543S and G2. Then in February, the company bought the Copperwood mine from Orvana Minerals Corp. (ORV:TSX) for $25M. This is an advanced-stage project: feasibility done, essentially permitted, ready to go. And then Highland bought the historic White Pine mine and surrounding property. The idea now is to consolidate those deposits and build a centralized facility. Highland could produce upward of 200 million pounds (200 Mlb) a year, a number that will attract the interest of midtier producers.

TMR: After consolidation, how much will this project cost?

SI: My ballpark number would be $650M for a 16 Kt/day operation.

TMR: But Highland wouldn’t be doing this on its own.

SI: It’s going to be a 50/50 joint venture (JV) with AMCI Group. Highland’s bringing the project to the table, and AMCI’s bringing the money: $45M by December 15, which is basically all the funding required to take the project through feasibility, which is expected by early 2016.

TMR: Which nickel project most interests you?

SI: Talon Metals Corp. (TLO:TSX) and its Tamarack nickel-copper-platinum project in Minnesota. This is a JV with Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK). Talon has the option to spend $37M over the next three years to own 30%. At that point Rio Tinto has a decision to make. If a resource gets defined to the point where it’s big enough, Rio Tinto will build the mine as a 70/30 JV. Or if Rio Tinto decides it’s not big enough, Talon can buy out Rio Tinto for $107M.

TMR: The company announced an initial resource estimate September 2.

SI: This is a high-grade nickel-sulfide deposit of about 6 Mt now, with more than 2% nickel equivalent. It’s close to infrastructure. From a geological perspective, it’s similar to Voisey’s Bay. The deposit is shaped like a tadpole. The 6 Mt is located in the tail, which is wide open and could contain 10–20 Mt. The head, which hasn’t been drilled, holds the real blue-sky potential for a very large discovery. I think that’s why Rio Tinto has kept an interest in it. Even if the deposit turns out not to be large enough for Rio Tinto, it’s already looking as if it could be one heck of a deposit for a junior to midtier producer.

I should mention that Rio Tinto had another nickel deposit in the northern U.S.: Eagle, which it sold to Lundin Mining Corp. (LUN:TSX) last year for $325M. Eagle is going to be a mine, but Rio Tinto sold that one and kept Tamarack. That should tell you something.

TMR: Are there other projects similar to Voisey’s Bay?

SI: North American Nickel Inc.’s (NAN:TSX.V) Maniitsoq project in Greenland has a similar type of geology. One of the things the market really likes to see in the nickel space is sulfide-nickel projects, like Maniitsoq, instead of laterite nickel. Processing is just a lot simpler and good grades are common. Maniitsoq hit some very high grades right off the bat in 2013. It didn’t get those barnburner grades this year, but I don’t think this story is over.

North American Nickel is owned 30% by VMS Ventures Inc. (VMS:TSX.V), whose primary asset is a VMS deposit in Manitoba called Reed, itself a JV with HudBay Minerals Inc. (HBM:TSX; HBM:NYSE). VMS Ventures is getting cash flow out of that. One way to play the Maniitsoq story is to buy VMS shares. Then you get cash flow, plus the potential benefits from Greenland.

TMR: What about other nickel-sulfide projects?

SI: Balmoral Resources Ltd. (BAR:TSX; BAMLF:OTCQX) has made a high-grade nickel sulfide discovery at its Grasset project in Quebec, which has garnered a lot of attention. There is also Royal Nickel Corp.’s (RNX:TSX) Dumont project in Quebec. Production start-up is targeted in 2016. On the one hand, it’s low grade at ~0.3% nickel. On the other, it contains billions of tonnes, which translates into a long mine life and a pretty significant production profile. The company’s in the midst of permitting and shoring up project financing, which will likely entail a partnership.

TMR: According to Royal’s website, this would be the fifth-largest nickel sulfide operation in the world. When you add low grade to that, you’re talking a big capital expenditure (capex).

SI: $1.2B is the feasibility study number.

TMR: Is Dumont dependent on a rise in the price of nickel?

SI: Considering its capex, to generate an 18% internal rate of return, Dumont would probably require a nickel price of at least $9.00/lb. That said, the deposit’s size underpins a mine plan that would span multiple metal price cycles.

TMR: Which zinc producer stands out?

SI: We believe that Trevali Mining Corp. (TV:TSX; TREVF:OTCQX; TV:BVL) is poised to become the marquee name in the zinc space. Zinc is facing a significant medium-term supply issue because of mine closures. Last year, the Brunswick #12 mine in New Brunswick, an Xstrata Plc (XTA:LSE) operation, was depleted. Soon, China Minmetals Corp.’s (CMIN:CH) Century mine in Australia and Vedanta Resources Plc’s (VED:LSE) Lisheen mine in Ireland will close, too. Within the next two years, something on the order of 10–12% of world production will be lost.

The flip side is that there are no significant advanced-stage projects in line to make up this deficit. Almost by default, anyone who has zinc in its name or has a zinc association is poised to do well. Trevali is the leader of that pack. It is in production now at Santander in Peru, about 40 Mlb a year currently. Caribou in New Brunswick is slated to begin commissioning in the second quarter of next year. When it is up and running at full scale capacity, it will add about 90 Mlb a year. Santander is scheduled for an expansion, probably in 2016–2017, to 80 Mlb. At the end of the day, we are looking at a zinc company with over 170 Mlb of annual zinc production on its books.

TMR: Which other North American zinc projects interest you?

SI: Foran Mining Corp.’s (FOM:TSX.V) McIlvenna Bay project began its preliminary economic assessment last month. It’s a VMS deposit with zinc, copper and other metals. It’s in Saskatchewan, just over the border from Manitoba. Geologically, it’s within the Flin Flon Greenstone Belt and at 25 Mt is the third-biggest discovery in the world-class mining camp. It has proximity to HudBay’s infrastructure, and it could be strategic to HudBay at some point in the future.

TMR: HudBay’s share price rose from $8 in the spring to about $11.50 and then fell to $9.25. Was its takeover of Augusta Resource Corp. and its Rosemont copper project in Arizona a mistake?

SI: I would argue that it was a pretty strategic move for HudBay. The company put in an early bid, before Rosemont’s permitting was completed. It took a chance, but got Rosemont at a discounted valuation. HudBay already has its development plate full with Lalor in Manitoba and probably even more so with Constancia in Peru. So it is taking a longer-term view on Rosemont’s development timeline relative to the project’s previous owner.

TMR: HudBay completed a $170M debt financing in August. How do you rate its expansion versus its bottom line?

SI: Well, HudBay has to be careful. The company is currently spending a lot of money to grow its production profile at multiple operations. Constancia is a $1.7B project. But the good news is that we were down at the site in September, and it is tracking on schedule and on budget. It’s 92% complete as we speak.

TMR: What about any projects in Alaska?

SI: There is Zazu Metals Corp.’s (ZAZ:TSX) LIK project. It has silver, as well as zinc. And some lead, as well, but zinc is its main focus. LIK is very close to Teck Resources Ltd.’s (TCK:TSX; TCK:NYSE) Red Dog zinc mine, the world’s largest, with about 5% of world production.

TMR: LIK is a JV with Teck, is it not?

SI: Yes, but it’s slightly different than your typical junior-major JV. In this case, Zazu is spending $18M to own 80% and Teck will not have a subsequent back-in right.

TMR: What do you think of the project?

SI: There’s very good established infrastructure, and just across the project boundary Teck has a deposit called Su. The area is basically one big deposit. If and when Teck puts Su into production, it would make almost no sense to do it without a combined Su/LIK open pit. Furthermore, Red Dog is very high grade, but it’s also underpinned by an onerous royalty structure with a First Nations company called NANA Regional Corp. Eventually, NANA will get a 50% net proceeds interest (NPI) royalty from Red Dog. LIK and Su have lower grades, but there NANA does not hold an NPI royalty on potential production from the deposits.

The other consideration is that two years ago Zebra Holdings, which is the Lundin family’s affiliated trust, bought 20% of Zazu, arguably bringing Lundin Mining into the picture. And we expect that with the zinc price rising, established producers are going to be looking for assets.

TMR: It has been said that the low-hanging fruit in base metals has all been picked. Thus, future projects will be more difficult and expensive, so people are just going to have to get used to permanently higher base metals prices. Do you agree?

SI: As the majors have gotten bigger, the size of the deposits they require to actually make a difference to their bottom lines needs to be bigger. Unfortunately, grade and tonnage are inversely proportional. Generally speaking, big deposits are going to be low grade. And so costs will be higher. Right now, the middle of the cost curve for copper is on the order of $1.50–1.75/lb. As we mine more and more lower-grade deposits, I wouldn’t be surprised if that position on the cost curve reached $2/lb.

TMR: Doesn’t this suggest a particular opportunity for what we might call high-grade boutique projects?

SI: For sure. At the end of the day grade is king. I think it always will be. If you can find something that has a reasonable tonnage and a good grade, you could be off to the races. Such projects can be company makers. For instance, Talon has the potential to mine a modest-sized nickel deposit with very good grade. Again, probably not big enough for Rio Tinto but very lucrative for Talon. That’s where the opportunity lies for some of these smaller companies.

TMR: Stefan, thank you for your time and your insights.

Stefan Ioannou has spent the last eight years as a mining analyst covering mid-cap base metal companies at Haywood Securities. Prior to joining Haywood, he worked with a number of exploration and mining companies, as well as government agencies as a field geologist in Nevada and throughout the Canadian Shield in both the gold and base metal sectors.

Read what other experts are saying about:

Want to read more Mining Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit The Mining Report home page.

Related Articles

- Stefan Ioannou’s Three Things to Look for in Three Base Metal Plays

- John Kaiser’s Tips for Escaping the Resource Sector Swamp Alive

- The Best Offense Remains a Good Defense: M Partners’ Derek Macpherson

DISCLOSURE:

1) Kevin Michael Grace conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an independent contractor. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) Stefan Ioannou: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: Highland Copper Company Inc., Royal Nickel Corp., and Trevali Resources Corp. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over what companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

3) The following companies mentioned in the interview are sponsors of Streetwise Reports: North American Nickel Inc., Balmoral Resources Ltd. and Trevali Mining Corp. Streetwise Reports does not accept stock in exchange for its services. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert can speak independently about the sector.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

s

s

The all-powerful U.S. dollar is currently hammering base metals and base metal equities. Haywood Securities Mining Analyst Stefan Ioannou says that increasing demand and near-term supply shortages make base metals a bargain that won’t last. In this interview with

The all-powerful U.S. dollar is currently hammering base metals and base metal equities. Haywood Securities Mining Analyst Stefan Ioannou says that increasing demand and near-term supply shortages make base metals a bargain that won’t last. In this interview with

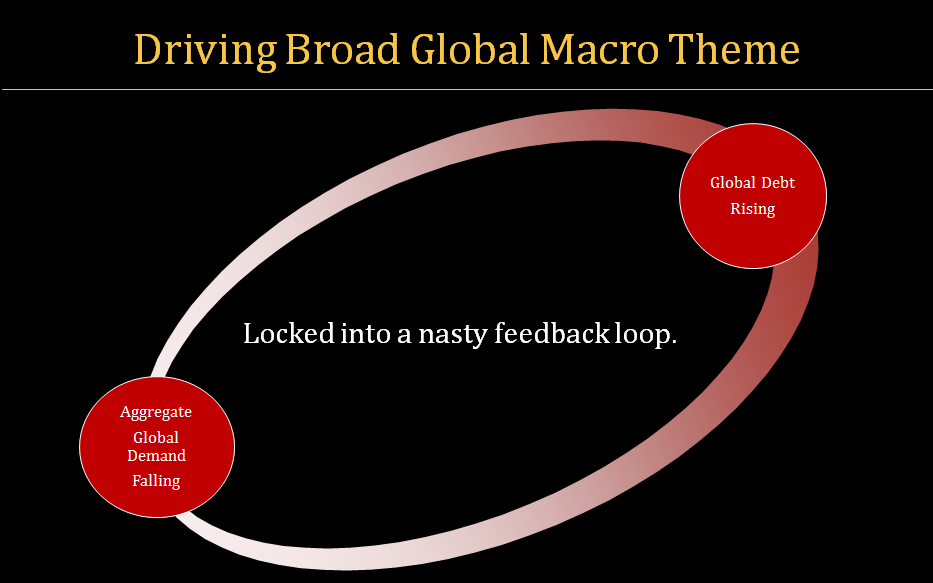

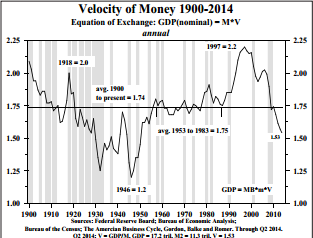

If we assume the equation: Nominal GDP = Monetary Base x Monetary Velocity; then we how can we expect growth to be strong when money supply numbers globally are flat at best and monetary velocity is crashing through the floor? [This is a global phenomenon, not just a US problem.]

If we assume the equation: Nominal GDP = Monetary Base x Monetary Velocity; then we how can we expect growth to be strong when money supply numbers globally are flat at best and monetary velocity is crashing through the floor? [This is a global phenomenon, not just a US problem.]