Streewise Reports: What is the 2014 development for which you are most grateful?

Marin Katusa: I am grateful for the current correction in the resources area. It is what we’ve been waiting for. We have been saying to stay in cash for a while, be very patient, we’re going to have a correction. If you are a true contrarian investor, you have to buy when there is blood on the streets. I can assure you that in Vancouver, the junior resource hub of the world, there is blood on the streets. It’s going to probably take longer than most people want for the market to turn around. That’s irrelevant to me; I don’t take a quarterly or a monthly perspective. I look at the longer-term perspective. I’m thankful for the correction because it’s providing me opportunities to get into some of the best companies at prices that two years ago would seem unimaginable.

Frank Holmes: I am thankful for the royalty model and the MLP model, because with these you have higher margins along with dividend income. In particular, I was happiest with names such as Virginia Mines Inc. (VGQ:TSX) most recently, along with Franco-Nevada Corp. (FNV:TSX; FNV:NYSE), Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX) and Silver Wheaton Corp. (SLW:TSX; SLW:NYSE).

John Kaiser: The collapse of valuations in the resource sector has widespread negative repercussions, but a positive outcome. What I am thankful for is that we are no longer in an environment where everything is overvalued because of positive momentum in both the market and the key commodity cycle and in gold bug narratives. Instead, now it is possible to find good value adjusted for fundamental and external risks. 2014 killed the last greater fool. Going forward, investors in the resource sector will only look smart for the right reasons.

David Morgan: As I say at the end of The Morgan Report every month, “health above wealth, and wisdom above knowledge.” As always, I am grateful to be alive and surrounded by wonderful people.

Rick Rule: I am thankful for the young individuals I work with at Sprott who are really developing and making an impact at the company. Those are the people who will take the sector to the next level.

Chris Berry: I definitely think we’ve bottomed in the metals. This doesn’t mean that certain metals like iron ore can’t fall further, but generally, metals prices such as copper or lithium seem to have stabilized. The real questions now are how long do we stay at these depressed levels and what will be the catalyst for the next leg up in the cycle? It may be 2016–2017 before we know the answers.

Brent Cook: I am thankful that my daughters are doing well and off the dole, and for some great beach volleyball in Mexico as I celebrated my 60th birthday.

Investment wise, I am also thankful that two of the companies in the Exploration Insightsportfolio—Papillon Resources Inc. (PIR:ASX; PAPQF:GREYS) and Virginia Mines Inc. were bought out at premiums. Both had high quality, legitimate economic deposits that can make money at any foreseeable gold price. Companies like those are few and far between.

I am also grateful that my thesis of declining economic discoveries leading to increasing demand for these very few developable deposits is playing out. It will take time, however. What I don’t think we have seen yet is capitulation. When Rick Rule capitulates, then we have complete capitulation and the market can start to turn.

Kal Kotecha: I am grateful that gold is only down marginally by my calculation. It is actually the U.S. dollar that is rising and making gold look weak.

Chen Lin: I am grateful that I saw the correction of commodities coming during the summer and was able to raise a lot of cash in early September. Otherwise my portfolio would have suffered huge damage.

SWR: What was the biggest turkey of 2014, what are you glad is behind us as we move into 2015?

Rick Rule: I was the biggest turkey. I was really expecting a surge in the retail resource marketplace. I was expecting capitulation. I have been hanging in there and was really surprised at the degree of volatility. Instead of capitulation, we took another leg down. That makes me a turkey. Now we have to see if I will be right in 2015.

John Kaiser: The biggest turkey was the updated feasibility study Goldcorp Inc. (G:TSX; GG:NYSE) published in late March for its Eleonore gold mine in Quebec. Eleonore was the greatest Canadian gold exploration discovery made by a resource junior (Virginia Gold Mines) during the past decade. When Goldcorp bought Virginia in March 2006, gold was at about $550 per ounce ($550/oz), less than half where it is today. After the pre-resource estimate in 2006 for $750 million ($750M), the company outlined 3.8M Proven and Probable ounces and another 4M Inferred ounces at a somewhat higher grade, nearly doubling the projected 9 year mine-life. The 7,500 ton per day underground mine will average 400,000 oz annually, but the feasibility study indicates that at a 5% discount rate using $$1,300/oz gold, the after-tax net present value is negative $172M and the internal rate of return is 3.15%, thanks largely to a capital cost of $1.85 billion.

Eleonore is a symbolic turkey for the exploration sector because it has raised the bar for what counts as an exploration success at $1,200/oz gold to an impossibly high level. If a junior discovers a new deposit in a remote location that looks like Eleonore tomorrow, the market would have to dismiss it as economically insignificant. Eleonore has already been built, so it would benefit from higher gold price and the doubling of mine life when the resource is upgraded to a reserve, but it would not be built today.

Frank Holmes: In 2014 the “turkey country” was Colombia, with Ecuador appearing to be the new dove. The biggest turkey has been Gran Colombia Gold Corp. (GCM:TSX)(GCM:TSX), for a number of reasons. In Colombia, poor government policies hurt mining companies. This risk of socialism, paired and with the price of gold and weak management that was unable to focus on mine development, really hurt the company.

Chris Berry: The biggest turkey was tin. Based on ore export bans in countries like Indonesia and threats to do the same in the Philippines, I expected the tin price to end the year substantially higher. This did not happen, even though we did see higher prices for similar metals like nickel and aluminum.

Brent Cook: The biggest turkey is that a sizable portion of humanity has not mentally advanced much past the Stone Age, with the exception of methods of killing each other. The long list of atrocities committed in the Ukraine, Palestine, Israel, Sudan, Congo, etc. by the likes of ISIS, Boko Haram and others, document that there is nothing kind about mankind.

David Morgan: Colossus Minerals Inc. (CSI:TSX; COLUF:OTCQX) was a big disappointment. I still think it had one of the best assets in the world, but it was a complete disaster. There were structural issues in the underground mine and management, for whatever reason, wasn’t forthright about what was happening. That is a reminder to only invest money you can afford to lose.

Kal Kotecha: The biggest turkey of 2014 was coal. In addition to government pressure, the impact of Australia flooding the market with cheap supply and China’s demand slowing down has taken a toll. However, with a new Republican majority in place in Washington D.C., prospects may improve for coal in 2015.

Chen Lin: Mart Resources Inc. (MMT:TSX.V) is my biggest turkey of 2014. It was supposed to start its new pipeline in the first half, then the beginning of second half of the year. Now we are in November and it is still waiting for the final paper work. Shares dropped to below CA$1, unthinkable a year ago. Fortunately, the dividends I received already covered my original costs. But it still hurt a lot. I hope they will get the final signature soon and let the oil flow.

Chris Berry, with a lifelong interest in geopolitics and the financial issues that emerge from these relationships, founded House Mountain Partners in 2010. The firm focuses on the evolving geopolitical relationship between emerging and developed economies, the commodity space and junior mining and resource stocks positioned to benefit from this phenomenon. Berry holds a Master of Business Administration in finance with an international focus from Fordham University, and a Bachelor of Arts in international studies from the Virginia Military Institute.

Chris Berry, with a lifelong interest in geopolitics and the financial issues that emerge from these relationships, founded House Mountain Partners in 2010. The firm focuses on the evolving geopolitical relationship between emerging and developed economies, the commodity space and junior mining and resource stocks positioned to benefit from this phenomenon. Berry holds a Master of Business Administration in finance with an international focus from Fordham University, and a Bachelor of Arts in international studies from the Virginia Military Institute.

Frank Holmes is CEO and chief investment officer at U.S. Global Investors Inc., which manages a diversified family of mutual funds and hedge funds specializing in natural resources, emerging markets and gold and precious metals. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve global conflict, and is an adviser to the William J. Clinton Foundation on sustainable development in nations with resource-based economies. Holmes is a much sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications.

Frank Holmes is CEO and chief investment officer at U.S. Global Investors Inc., which manages a diversified family of mutual funds and hedge funds specializing in natural resources, emerging markets and gold and precious metals. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve global conflict, and is an adviser to the William J. Clinton Foundation on sustainable development in nations with resource-based economies. Holmes is a much sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications.

Brent Cook brings more than 30 years of experience to his role as a geologist, consultant and investment adviser. His knowledge spans all areas of the mining business, from the conceptual stage through detailed technical and financial modeling related to mine development and production. Cook’s weekly Exploration Insights newsletter focuses on early discovery, high-reward opportunities, primarily among junior mining and exploration companies.

Brent Cook brings more than 30 years of experience to his role as a geologist, consultant and investment adviser. His knowledge spans all areas of the mining business, from the conceptual stage through detailed technical and financial modeling related to mine development and production. Cook’s weekly Exploration Insights newsletter focuses on early discovery, high-reward opportunities, primarily among junior mining and exploration companies.

With a background in mathematics, Marin Katusa left teaching post-secondary mathematics to pursue portfolio management within the resource sector. His hedge fund’s five-year track record has beat the peer TSX-V index by over 600%. He is regularly interviewed on national and local television channels in North America, such as the Business News Network (BNN) and many other radio and newspaper outlets for his opinions and insights regarding the resource sector. Katusa is a director of Canada’s third largest copper producer, Copper Mountain Mining Corp. Katusa is the chief investment strategist for the energy division of Casey Research. A regular part of his due diligence process for Casey Research includes property tours, which has resulted in him visiting hundreds of mining and energy producing and exploration projects all around the world. You can learn more about his book, “The Colder War” here.

With a background in mathematics, Marin Katusa left teaching post-secondary mathematics to pursue portfolio management within the resource sector. His hedge fund’s five-year track record has beat the peer TSX-V index by over 600%. He is regularly interviewed on national and local television channels in North America, such as the Business News Network (BNN) and many other radio and newspaper outlets for his opinions and insights regarding the resource sector. Katusa is a director of Canada’s third largest copper producer, Copper Mountain Mining Corp. Katusa is the chief investment strategist for the energy division of Casey Research. A regular part of his due diligence process for Casey Research includes property tours, which has resulted in him visiting hundreds of mining and energy producing and exploration projects all around the world. You can learn more about his book, “The Colder War” here.

John Kaiser, a mining analyst with 25-plus years of experience, produces Kaiser Research Online. After graduating from the University of British Columbia in 1982, he joined Continental Carlisle Douglas as a research assistant. Six years later, he moved to Pacific International Securities as research director, and also became a registered investment adviser. He moved to the U.S. with his family in 1994.

John Kaiser, a mining analyst with 25-plus years of experience, produces Kaiser Research Online. After graduating from the University of British Columbia in 1982, he joined Continental Carlisle Douglas as a research assistant. Six years later, he moved to Pacific International Securities as research director, and also became a registered investment adviser. He moved to the U.S. with his family in 1994.

Kal Kotecha is the editor and founder of the Junior Gold Report, a publication about small-cap mining stocks. He was the editor and creator of The Moly/Gold Report, which focuses on critical analyses and open journalism of companies profiting from the precious and base metals sector. The scope of his current activities include worldwide onsite analyses and reporting of developing companies. Kotecha has previously held leadership positions with many junior mining companies. Kotecha completed his Master of Business Administration in finance in 2007 and is working on his Ph.D. in business marketing. He also teaches economics at the University of Waterloo.

Kal Kotecha is the editor and founder of the Junior Gold Report, a publication about small-cap mining stocks. He was the editor and creator of The Moly/Gold Report, which focuses on critical analyses and open journalism of companies profiting from the precious and base metals sector. The scope of his current activities include worldwide onsite analyses and reporting of developing companies. Kotecha has previously held leadership positions with many junior mining companies. Kotecha completed his Master of Business Administration in finance in 2007 and is working on his Ph.D. in business marketing. He also teaches economics at the University of Waterloo.

Chen Lin writes the popular stock newsletter What Is Chen Buying? What Is Chen Selling?, published and distributed by Taylor Hard Money Advisors, Inc. While a doctoral candidate in aeronautical engineering at Princeton, Chen found his investment strategies were so profitable that he put his Ph.D. on the back burner. He employs a value-oriented approach and often demonstrates excellent market timing due to his exceptional technical analysis.

Chen Lin writes the popular stock newsletter What Is Chen Buying? What Is Chen Selling?, published and distributed by Taylor Hard Money Advisors, Inc. While a doctoral candidate in aeronautical engineering at Princeton, Chen found his investment strategies were so profitable that he put his Ph.D. on the back burner. He employs a value-oriented approach and often demonstrates excellent market timing due to his exceptional technical analysis.

David Morgan (www.Silver-Investor.com) is a widely recognized analyst in the precious metals industry; he consults for hedge funds, high net-worth investors, mining companies, depositories and bullion dealers. He is the publisher of The Morgan Report on precious metals, the author of “Get the Skinny on Silver Investing” and a featured speaker at investment conferences in North America, Europe and Asia.

David Morgan (www.Silver-Investor.com) is a widely recognized analyst in the precious metals industry; he consults for hedge funds, high net-worth investors, mining companies, depositories and bullion dealers. He is the publisher of The Morgan Report on precious metals, the author of “Get the Skinny on Silver Investing” and a featured speaker at investment conferences in North America, Europe and Asia.

Rick Rule, CEO of Sprott US Holdings Inc., began his career in the securities business in 1974. He is a leading American retail broker specializing in mining, energy, water utilities, forest products and agriculture. His company has built a national reputation on taking advantage of global opportunities in the oil and gas, mining, alternative energy, agriculture, forestry and water industries. Rule writes a free, thrice-weekly e-letter, Sprott’s Thoughts.

Want to read more articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published.

Related Articles

- Rolling with Biotech’s Regulatory Punches: Chen Lin

- Smart Oil is Cheap Oil: Rudolf Hokanson

- Florian Siegfried: Seeking Less Risky Business in Mining M&A

DISCLOSURE:

1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) Brent Cook: I own, or my family owns, shares of the following companies mentioned in my comments: Virginia Mines Inc. I personally am, or my family is, paid by the following companies mentioned in my comments: None. The following companies mentioned in my comments have a financial relationship with my company: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

Frank Holmes: I own, or my family owns, shares of the following companies mentioned in my comments: None. I personally am, or my family is, paid by the following companies mentioned in my comments: None. The following companies mentioned in my comments are held in U.S. Global Investors funds: Franco-Nevada Corp., Royal Gold Inc., Silver Wheaton Corp., Virginia Mines Inc. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

John Kaiser: I own, or my family owns, shares of the following companies mentioned in my comments: None. I personally am, or my family is, paid by the following companies mentioned in my comments: None. The following companies mentioned in my comments have a financial relationship with my company: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

Chen Lin: I own, or my family owns, shares of the following companies mentioned in this interview: Mart Resources Inc. I personally am, or my family is, paid by the following companies mentioned in this interview: None. The following companies mentioned in this interview have a financial relationship with my company: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

David Morgan: I own, or my family owns, shares of the following companies mentioned in my comments: None. I personally am, or my family is, paid by the following companies mentioned in my comments: None. The following companies mentioned in my comments have a financial relationship with my company: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

3) The following companies mentioned in the interview are sponsors of Streetwise Reports: Mart Resources Inc., Pan Orient Energy Corp., Gran Colombia Gold Corp., Virginia Mines Inc. and Silver Wheaton Corp. Franco-Nevada Corp. and Goldcorp Inc. are not affiliated with Streetwise Reports. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

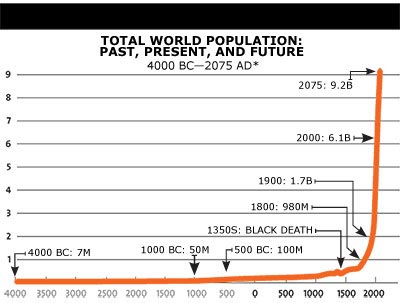

I’d like to share a Demographics trade that is unique for three reasons:

I’d like to share a Demographics trade that is unique for three reasons:

With historic events taking place around the globe, the Godfather of newsletter writers, 90-year old Richard Russell, put out one of his most dire warnings of the year, covering everything from missing U.S. gold, to the complete collapse and destruction of all global fiat currencies and the world monetary system. The 60-year market veteran also warned that if the U.S. gold is in fact gone, it will be the “monetary story of the century.”

With historic events taking place around the globe, the Godfather of newsletter writers, 90-year old Richard Russell, put out one of his most dire warnings of the year, covering everything from missing U.S. gold, to the complete collapse and destruction of all global fiat currencies and the world monetary system. The 60-year market veteran also warned that if the U.S. gold is in fact gone, it will be the “monetary story of the century.”

“Everything will collapse” is the consequence Gloom, Boom, & Doom’s Marc Faber sees from the Fed’s latest ‘stimulus’ (and the fallacy and misconception of how money-printing can help employment).

“Everything will collapse” is the consequence Gloom, Boom, & Doom’s Marc Faber sees from the Fed’s latest ‘stimulus’ (and the fallacy and misconception of how money-printing can help employment). While some contrarian investors thought the 2014 natural resource market was so bad it was good—their are others all too happy to see this this volatile year in the rearview mirror.

While some contrarian investors thought the 2014 natural resource market was so bad it was good—their are others all too happy to see this this volatile year in the rearview mirror.